686d6ef569db49bb7e01bf46a5863b5b.ppt

- Количество слайдов: 25

Understanding Agricultural Options John Hobert Farm Business Management Program Riverland Community College

Why are Agricultural Options Popular? Options are basically easy to understand as compared to the Futures Hedge. n An options hedger is protected against any “unfavorable price change. ” n A hedger does not have to deposit any margin money or worry about margin calls. n

Why are Agricultural Options Popular? Options allow buyers of agricultural products to set “ceiling” prices to protect against price increases. n Options allow the opportunity to gain from rising markets. (puts) n Options allow the opportunity to gain from price decreases in the market. (calls) n

Why are Agricultural Options Popular? n Options permit producers to establish “floor” prices for protection against falling markets.

What is an Option? n An Option is simply the right, but not the obligation, to buy or sell a futures contract at some predetermined price at anytime within a specified time period.

Option terminology: An option to buy a futures contract is known as a “call option. ” n An option to sell a futures contract is known as a “put option. ” n The predetermined futures price at which the future contract may be bought or sold is called the “strike or exercise price, ” strike price being most commonly used. n

More Option Terminology: The “premium” is the amount paid for an option. n The individual purchasing an options contract is referred to as the “options buyer” or “holder. ” n An options contract is said to be “in the money” when it has intrinsic value. n

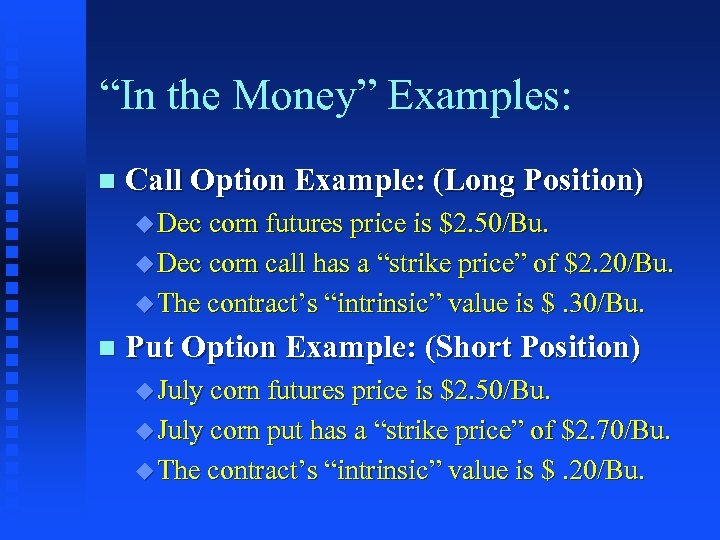

Intrinsic values in a nut shell: n An option has an intrinsic value if it would be profitable to exercise the option. u Call Options have intrinsic value when the strike price is below the futures price. u Put Options have intrinsic value when the strike price is above the futures price.

“In the Money” Examples: n Call Option Example: (Long Position) u Dec corn futures price is $2. 50/Bu. u Dec corn call has a “strike price” of $2. 20/Bu. u The contract’s “intrinsic” value is $. 30/Bu. n Put Option Example: (Short Position) u July corn futures price is $2. 50/Bu. u July corn put has a “strike price” of $2. 70/Bu. u The contract’s “intrinsic” value is $. 20/Bu.

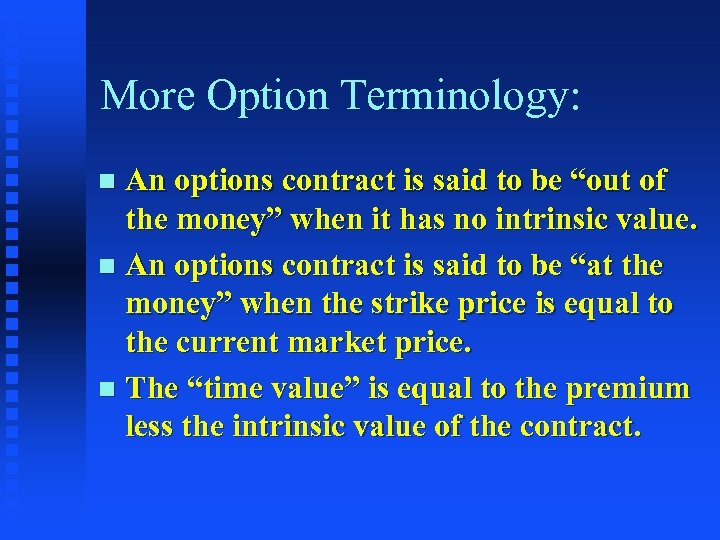

More Option Terminology: An options contract is said to be “out of the money” when it has no intrinsic value. n An options contract is said to be “at the money” when the strike price is equal to the current market price. n The “time value” is equal to the premium less the intrinsic value of the contract. n

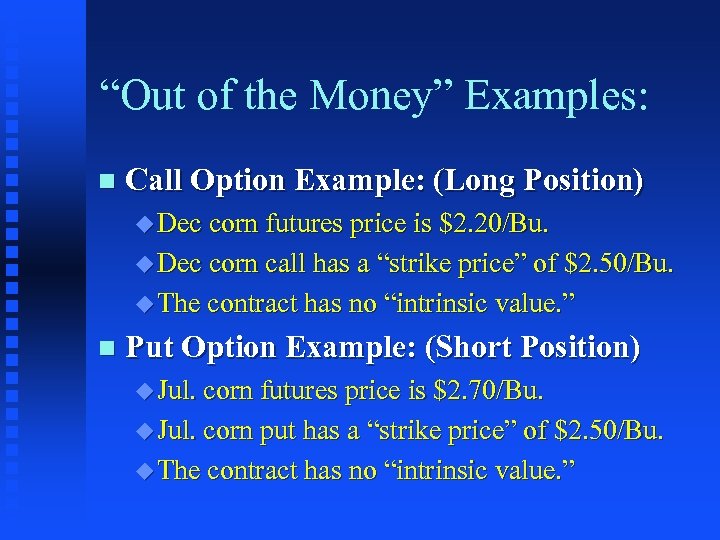

“Out of the Money” Examples: n Call Option Example: (Long Position) u Dec corn futures price is $2. 20/Bu. u Dec corn call has a “strike price” of $2. 50/Bu. u The contract has no “intrinsic value. ” n Put Option Example: (Short Position) u Jul. corn futures price is $2. 70/Bu. u Jul. corn put has a “strike price” of $2. 50/Bu. u The contract has no “intrinsic value. ”

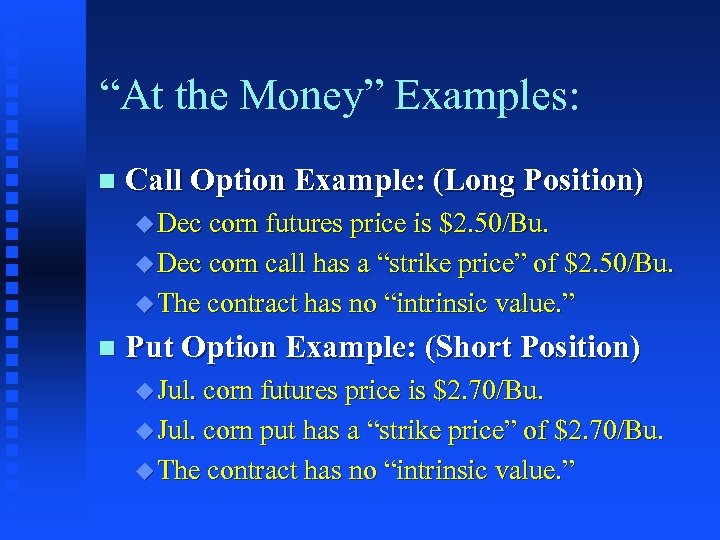

“At the Money” Examples: n Call Option Example: (Long Position) u Dec corn futures price is $2. 50/Bu. u Dec corn call has a “strike price” of $2. 50/Bu. u The contract has no “intrinsic value. ” n Put Option Example: (Short Position) u Jul. corn futures price is $2. 70/Bu. u Jul. corn put has a “strike price” of $2. 70/Bu. u The contract has no “intrinsic value. ”

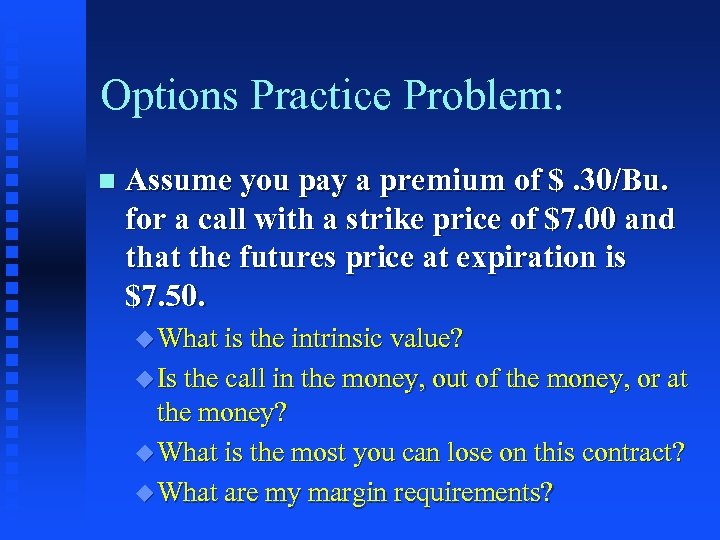

Options Practice Problem: n Assume you pay a premium of $. 30/Bu. for a call with a strike price of $7. 00 and that the futures price at expiration is $7. 50. u What is the intrinsic value? u Is the call in the money, out of the money, or at the money? u What is the most you can lose on this contract? u What are my margin requirements?

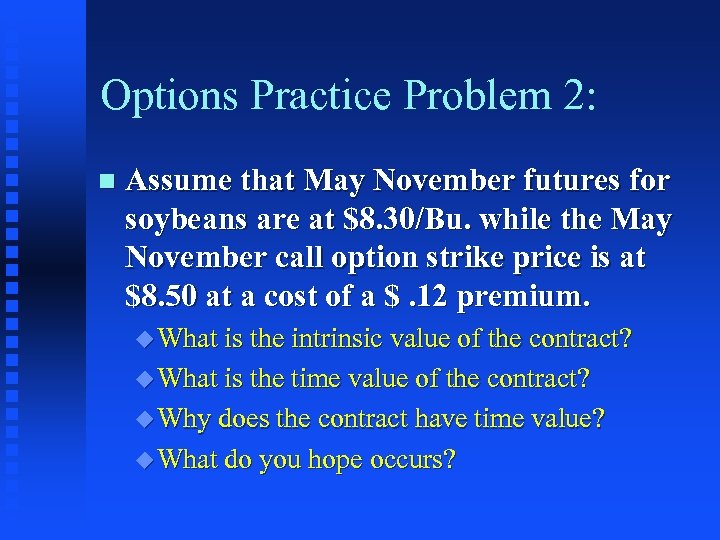

Options Practice Problem 2: n Assume that May November futures for soybeans are at $8. 30/Bu. while the May November call option strike price is at $8. 50 at a cost of a $. 12 premium. u What is the intrinsic value of the contract? u What is the time value of the contract? u Why does the contract have time value? u What do you hope occurs?

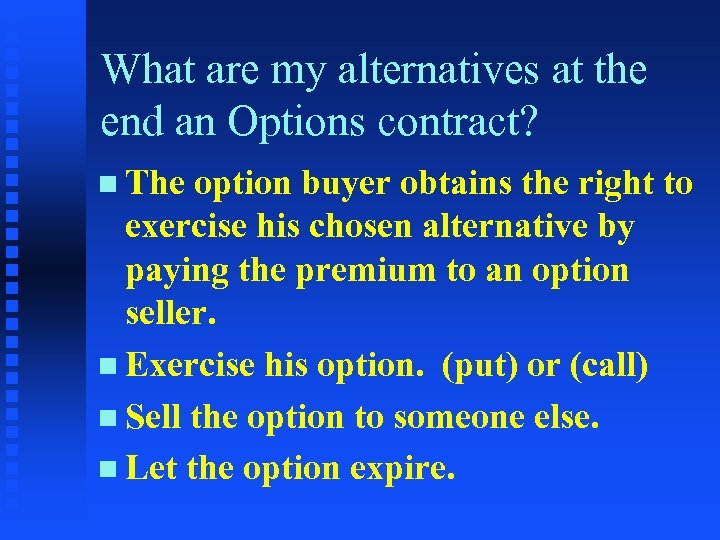

What are my alternatives at the end an Options contract? n The option buyer obtains the right to exercise his chosen alternative by paying the premium to an option seller. n Exercise his option. (put) or (call) n Sell the option to someone else. n Let the option expire.

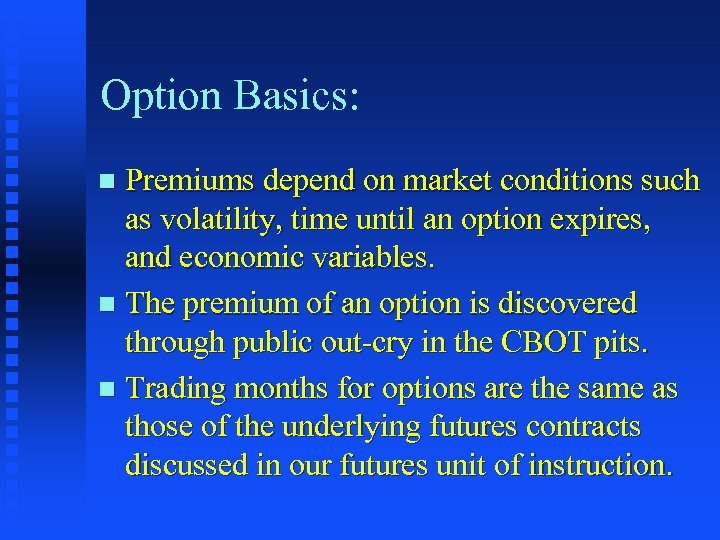

Option Basics: Premiums depend on market conditions such as volatility, time until an option expires, and economic variables. n The premium of an option is discovered through public out-cry in the CBOT pits. n Trading months for options are the same as those of the underlying futures contracts discussed in our futures unit of instruction. n

More Option Basics: As futures prices increase or decrease, additional higher and lower strike prices are listed. n Option strike prices can be found in daily newspapers, through on-line quotation services (DTN), internet, local grain elevators or brokers. n Commission fees are charged by brokers. n

Strike Price Basics: n Strike prices are listed in predetermined multiples for each commodity: u $. 25 per bushel for soybeans u $. 10 per bushel for corn u $. 10 per bushel for wheat u $. 10 per bushel for oats u $5. 00 per ton for SBOM below $200/ton u $10. 00 per ton for SBOM above $200/ton

Strike Price Basics Continued: The listed strike prices will include an ator near-the-money option, at least five strikes below and at least nine strikes above the at-the-money options. n This applies to both puts and calls. n The five lower strikes would follow normal commodity intervals. n

Strike Price Basics Continued: n The nine higher strikes would include five at normal intervals above the at-themoneys, plus an additional four strikes listed in even strikes that are double the normal intervals discussed previously.

Five Strategies for Buying and Selling Agricultural Options: Buying put options for protection against lower prices. n Buying put options for “price insurance” when you store your crop. n Writing call options to achieve a higher effective selling price for a crop you are storing. n

Five Strategies for Buying and Selling Agricultural Options: Buying call options at harvest to profit from a winter/spring price increase. n Buying call options for short-term protection against rising prices. n

Options offer “versatility: ” They can be used for protection against declining prices or against rising prices. n They can be used to achieve short-term objectives or long-term objectives. n They can be used conservatively or aggressively. n You hold the right to exercise your option when you feel it is the right time. n

Take Home Review Test: Free Breakfast at the June Meeting for the individual scoring the highest on the review test courtesy of JCH. n In case of tie, we will draw for the winner. n This format will be continued in the future to encourage you to review each meeting for your benefit. n

Next Month: n. Strategy Examples for Buying and Selling Agricultural Options.

686d6ef569db49bb7e01bf46a5863b5b.ppt