b4dc189e34e23cc78a24a6af00f51f67.ppt

- Количество слайдов: 84

Under Pressure: P/C Insurance in 2003 An Overview & Outlook for the US & New Mexico Insurance Issues Legislative Luncheon Independent Insurance Agents of New Mexico Santa Fe, NM February 7, 2003 Robert P. Hartwig, Ph. D. , CPCU, Senior Vice President & Chief Economist Insurance Information Institute 110 William Street New York, NY 10038 Tel: (212) 346 -5520 Fax: (212) 732 -1916 bobh@iii. org www. iii. org

Under Pressure: P/C Insurance in 2003 An Overview & Outlook for the US & New Mexico Insurance Issues Legislative Luncheon Independent Insurance Agents of New Mexico Santa Fe, NM February 7, 2003 Robert P. Hartwig, Ph. D. , CPCU, Senior Vice President & Chief Economist Insurance Information Institute 110 William Street New York, NY 10038 Tel: (212) 346 -5520 Fax: (212) 732 -1916 bobh@iii. org www. iii. org

Presentation Outline • Pressure to Improve Performance: Ø Profitability ØUnderwriting ØPricing • • • Capacity Crunch Investment Overview The Challenge of Terrorism Credit in Personal Lines Underwriting Q&A

Presentation Outline • Pressure to Improve Performance: Ø Profitability ØUnderwriting ØPricing • • • Capacity Crunch Investment Overview The Challenge of Terrorism Credit in Personal Lines Underwriting Q&A

PRESSURE TO IMPROVE PROFITABILITY

PRESSURE TO IMPROVE PROFITABILITY

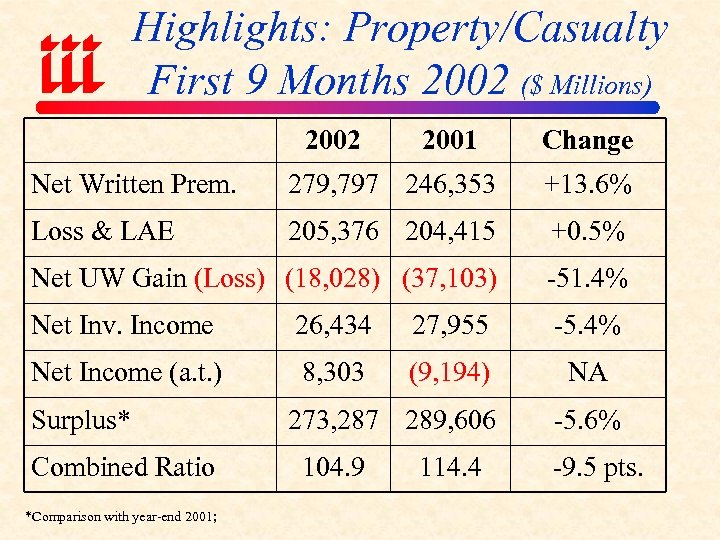

Highlights: Property/Casualty First 9 Months 2002 ($ Millions) 2002 2001 Change Net Written Prem. 279, 797 246, 353 +13. 6% Loss & LAE 205, 376 204, 415 +0. 5% Net UW Gain (Loss) (18, 028) (37, 103) -51. 4% Net Inv. Income 26, 434 27, 955 -5. 4% Net Income (a. t. ) 8, 303 (9, 194) NA Surplus* Combined Ratio *Comparison with year-end 2001; 273, 287 289, 606 104. 9 114. 4 -5. 6% -9. 5 pts.

Highlights: Property/Casualty First 9 Months 2002 ($ Millions) 2002 2001 Change Net Written Prem. 279, 797 246, 353 +13. 6% Loss & LAE 205, 376 204, 415 +0. 5% Net UW Gain (Loss) (18, 028) (37, 103) -51. 4% Net Inv. Income 26, 434 27, 955 -5. 4% Net Income (a. t. ) 8, 303 (9, 194) NA Surplus* Combined Ratio *Comparison with year-end 2001; 273, 287 289, 606 104. 9 114. 4 -5. 6% -9. 5 pts.

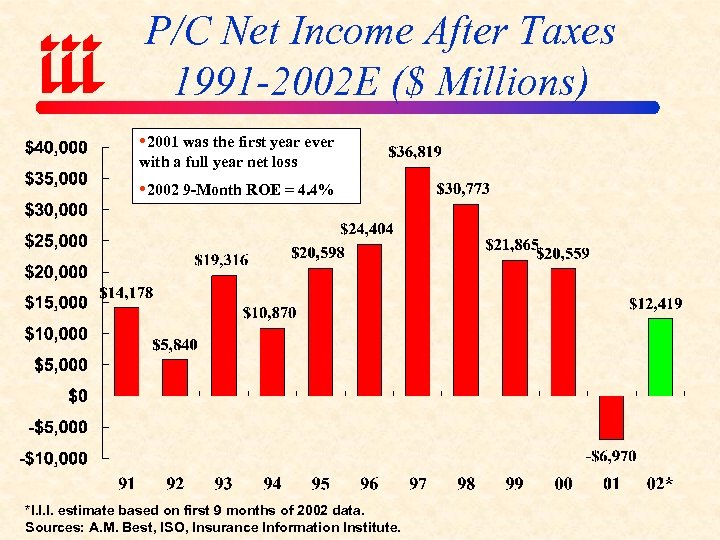

P/C Net Income After Taxes 1991 -2002 E ($ Millions) 2001 was the first year ever with a full year net loss 2002 9 -Month ROE = 4. 4% *I. I. I. estimate based on first 9 months of 2002 data. Sources: A. M. Best, ISO, Insurance Information Institute.

P/C Net Income After Taxes 1991 -2002 E ($ Millions) 2001 was the first year ever with a full year net loss 2002 9 -Month ROE = 4. 4% *I. I. I. estimate based on first 9 months of 2002 data. Sources: A. M. Best, ISO, Insurance Information Institute.

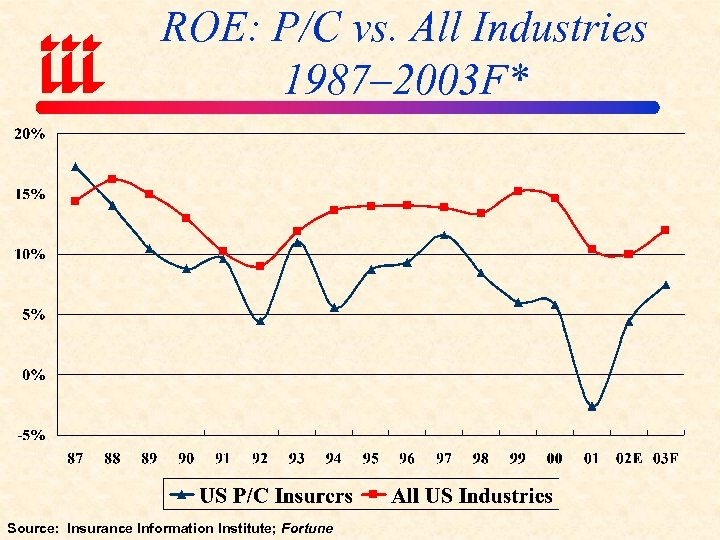

ROE: P/C vs. All Industries 1987– 2003 F* Source: Insurance Information Institute; Fortune

ROE: P/C vs. All Industries 1987– 2003 F* Source: Insurance Information Institute; Fortune

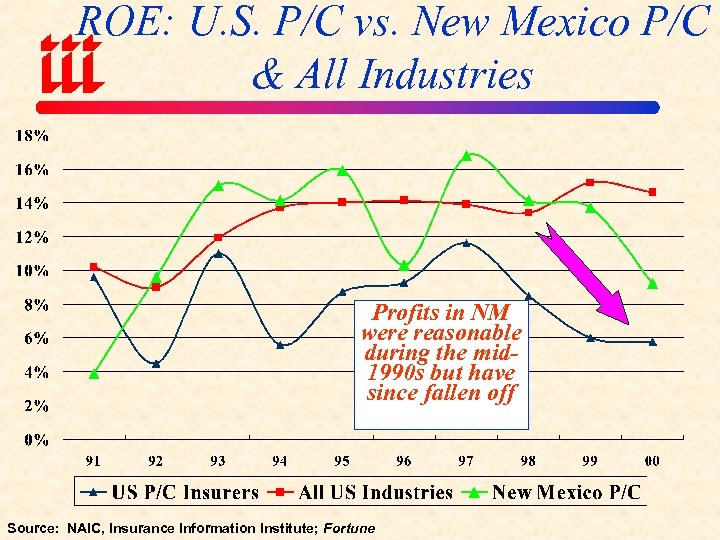

ROE: U. S. P/C vs. New Mexico P/C & All Industries Profits in NM were reasonable during the mid 1990 s but have since fallen off Source: NAIC, Insurance Information Institute; Fortune

ROE: U. S. P/C vs. New Mexico P/C & All Industries Profits in NM were reasonable during the mid 1990 s but have since fallen off Source: NAIC, Insurance Information Institute; Fortune

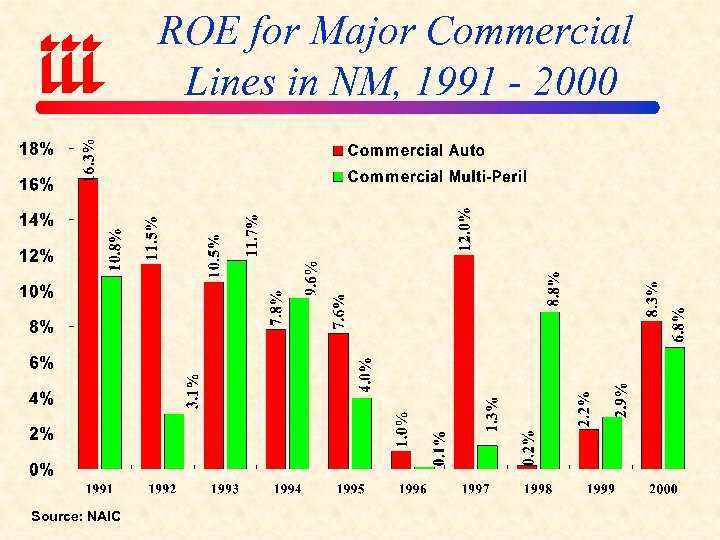

ROE for Major Commercial Lines in NM, 1991 - 2000 Source: NAIC

ROE for Major Commercial Lines in NM, 1991 - 2000 Source: NAIC

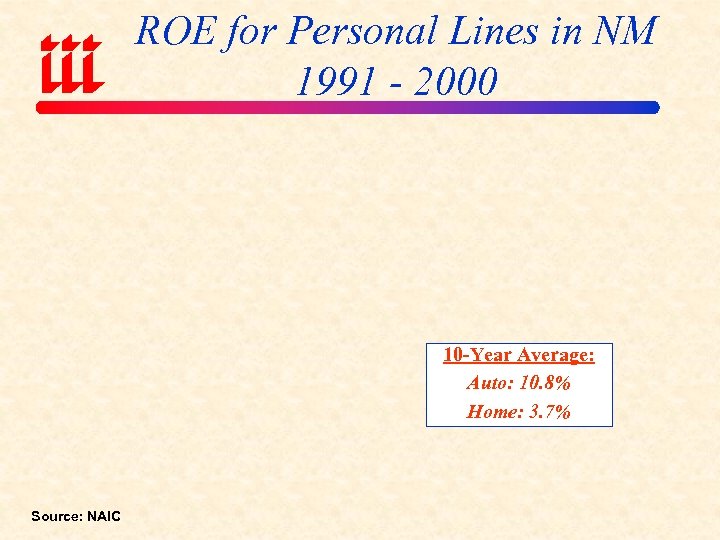

ROE for Personal Lines in NM 1991 - 2000 10 -Year Average: Auto: 10. 8% Home: 3. 7% Source: NAIC

ROE for Personal Lines in NM 1991 - 2000 10 -Year Average: Auto: 10. 8% Home: 3. 7% Source: NAIC

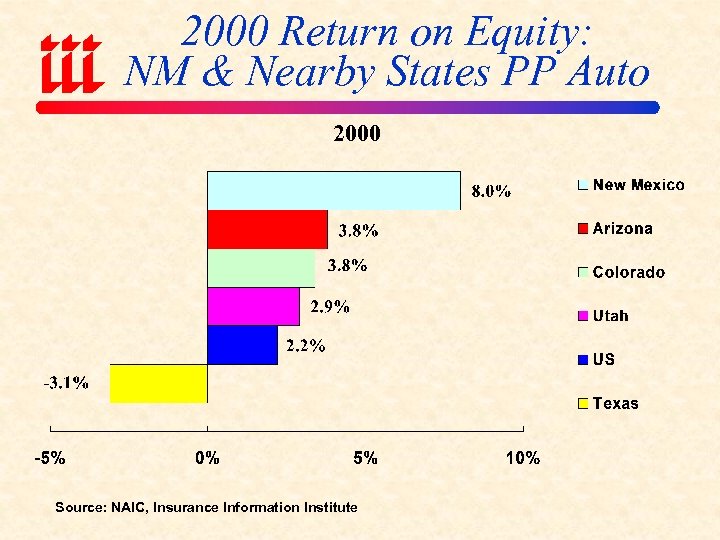

2000 Return on Equity: NM & Nearby States PP Auto 2000 Source: NAIC, Insurance Information Institute

2000 Return on Equity: NM & Nearby States PP Auto 2000 Source: NAIC, Insurance Information Institute

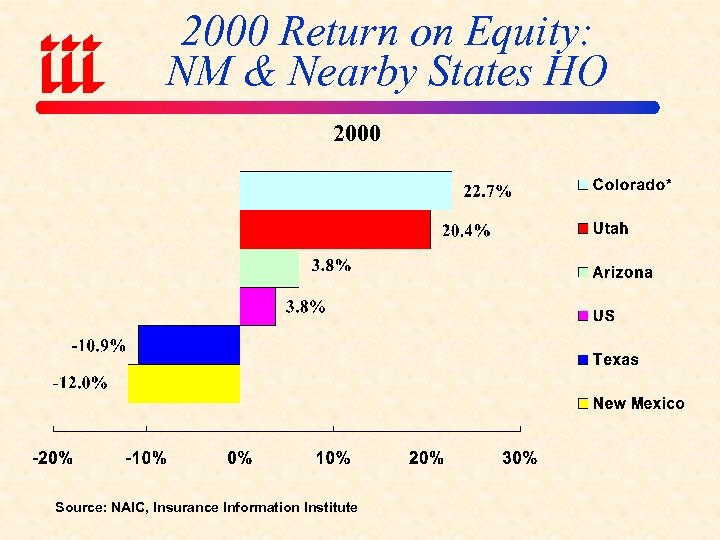

2000 Return on Equity: NM & Nearby States HO 2000 Source: NAIC, Insurance Information Institute

2000 Return on Equity: NM & Nearby States HO 2000 Source: NAIC, Insurance Information Institute

PRESSURE TO IMPROVE UNDERWRITING

PRESSURE TO IMPROVE UNDERWRITING

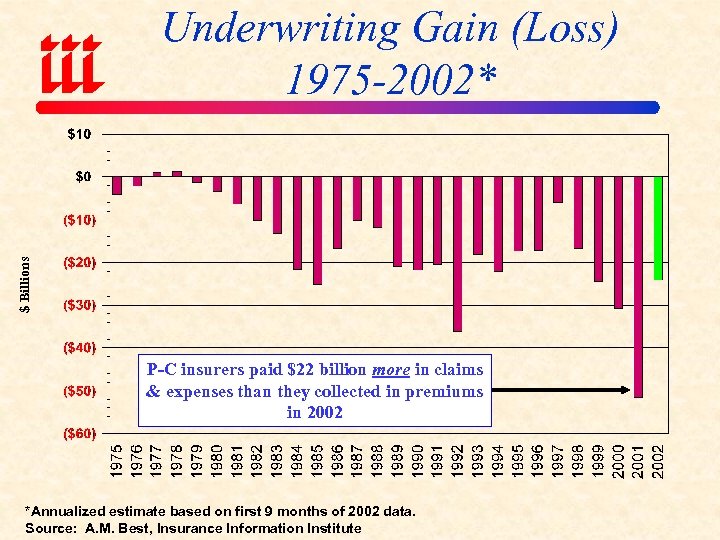

$ Billions Underwriting Gain (Loss) 1975 -2002* P-C insurers paid $22 billion more in claims & expenses than they collected in premiums in 2002 *Annualized estimate based on first 9 months of 2002 data. Source: A. M. Best, Insurance Information Institute

$ Billions Underwriting Gain (Loss) 1975 -2002* P-C insurers paid $22 billion more in claims & expenses than they collected in premiums in 2002 *Annualized estimate based on first 9 months of 2002 data. Source: A. M. Best, Insurance Information Institute

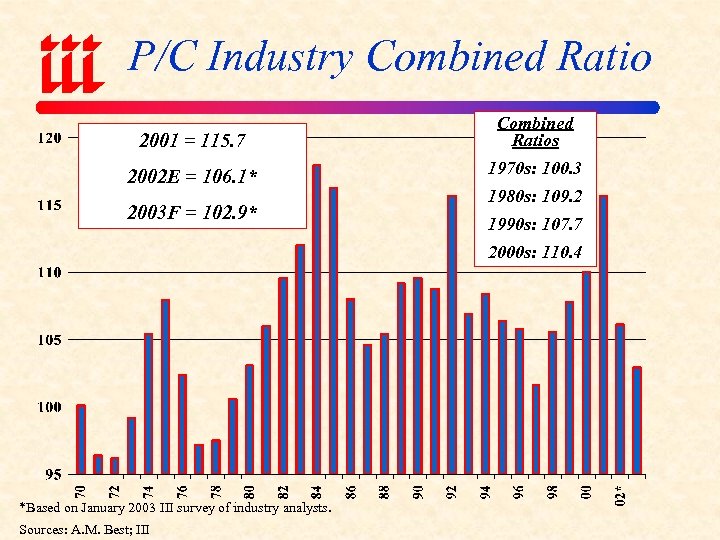

P/C Industry Combined Ratio 2001 = 115. 7 Combined Ratios 2002 E = 106. 1* 1970 s: 100. 3 2003 F = 102. 9* 1980 s: 109. 2 1990 s: 107. 7 2000 s: 110. 4 *Based on January 2003 III survey of industry analysts. Sources: A. M. Best; III

P/C Industry Combined Ratio 2001 = 115. 7 Combined Ratios 2002 E = 106. 1* 1970 s: 100. 3 2003 F = 102. 9* 1980 s: 109. 2 1990 s: 107. 7 2000 s: 110. 4 *Based on January 2003 III survey of industry analysts. Sources: A. M. Best; III

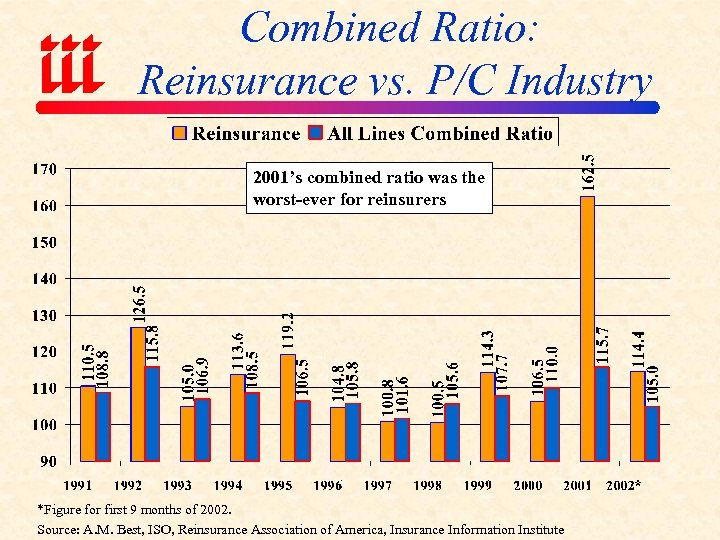

Combined Ratio: Reinsurance vs. P/C Industry 2001’s combined ratio was the worst-ever for reinsurers *Figure for first 9 months of 2002. Source: A. M. Best, ISO, Reinsurance Association of America, Insurance Information Institute

Combined Ratio: Reinsurance vs. P/C Industry 2001’s combined ratio was the worst-ever for reinsurers *Figure for first 9 months of 2002. Source: A. M. Best, ISO, Reinsurance Association of America, Insurance Information Institute

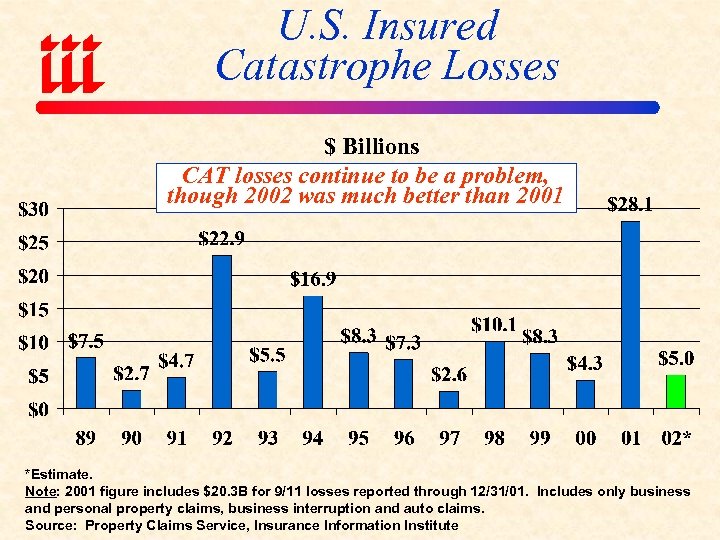

U. S. Insured Catastrophe Losses $ Billions CAT losses continue to be a problem, though 2002 was much better than 2001 *Estimate. Note: 2001 figure includes $20. 3 B for 9/11 losses reported through 12/31/01. Includes only business and personal property claims, business interruption and auto claims. Source: Property Claims Service, Insurance Information Institute

U. S. Insured Catastrophe Losses $ Billions CAT losses continue to be a problem, though 2002 was much better than 2001 *Estimate. Note: 2001 figure includes $20. 3 B for 9/11 losses reported through 12/31/01. Includes only business and personal property claims, business interruption and auto claims. Source: Property Claims Service, Insurance Information Institute

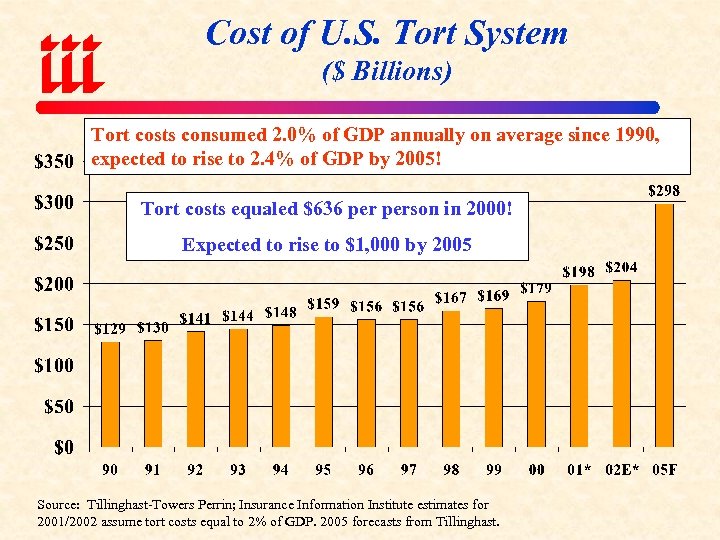

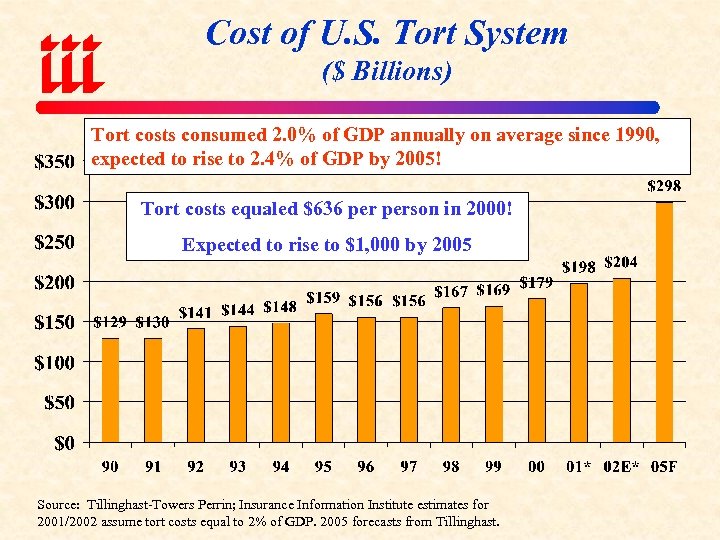

Cost of U. S. Tort System ($ Billions) Tort costs consumed 2. 0% of GDP annually on average since 1990, expected to rise to 2. 4% of GDP by 2005! Tort costs equaled $636 person in 2000! Expected to rise to $1, 000 by 2005 Source: Tillinghast-Towers Perrin; Insurance Information Institute estimates for 2001/2002 assume tort costs equal to 2% of GDP. 2005 forecasts from Tillinghast.

Cost of U. S. Tort System ($ Billions) Tort costs consumed 2. 0% of GDP annually on average since 1990, expected to rise to 2. 4% of GDP by 2005! Tort costs equaled $636 person in 2000! Expected to rise to $1, 000 by 2005 Source: Tillinghast-Towers Perrin; Insurance Information Institute estimates for 2001/2002 assume tort costs equal to 2% of GDP. 2005 forecasts from Tillinghast.

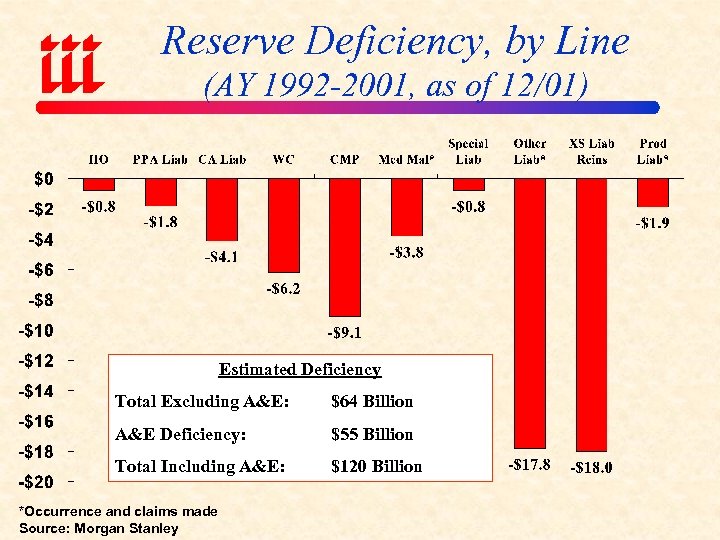

Reserve Deficiency, by Line (AY 1992 -2001, as of 12/01) Estimated Deficiency Total Excluding A&E: $64 Billion A&E Deficiency: $55 Billion Total Including A&E: $120 Billion *Occurrence and claims made Source: Morgan Stanley

Reserve Deficiency, by Line (AY 1992 -2001, as of 12/01) Estimated Deficiency Total Excluding A&E: $64 Billion A&E Deficiency: $55 Billion Total Including A&E: $120 Billion *Occurrence and claims made Source: Morgan Stanley

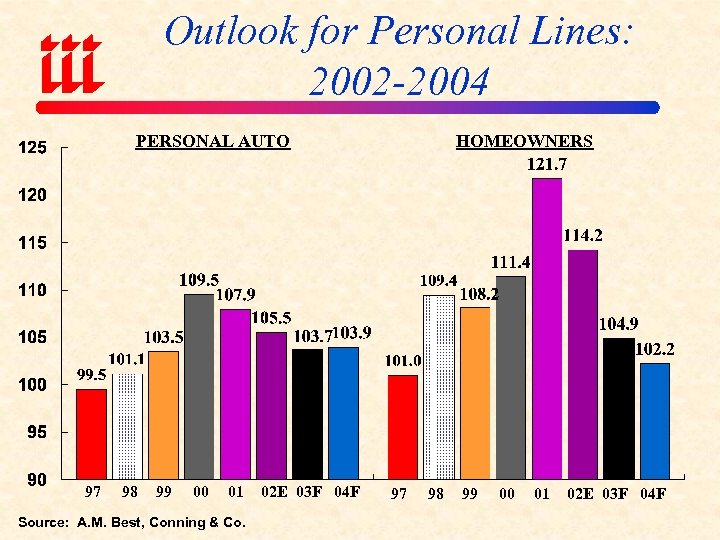

Outlook for Personal Lines: 2002 -2004 PERSONAL AUTO 97 98 99 00 01 Source: A. M. Best, Conning & Co. 02 E 03 F 04 F HOMEOWNERS 97 98 99 00 01 02 E 03 F 04 F

Outlook for Personal Lines: 2002 -2004 PERSONAL AUTO 97 98 99 00 01 Source: A. M. Best, Conning & Co. 02 E 03 F 04 F HOMEOWNERS 97 98 99 00 01 02 E 03 F 04 F

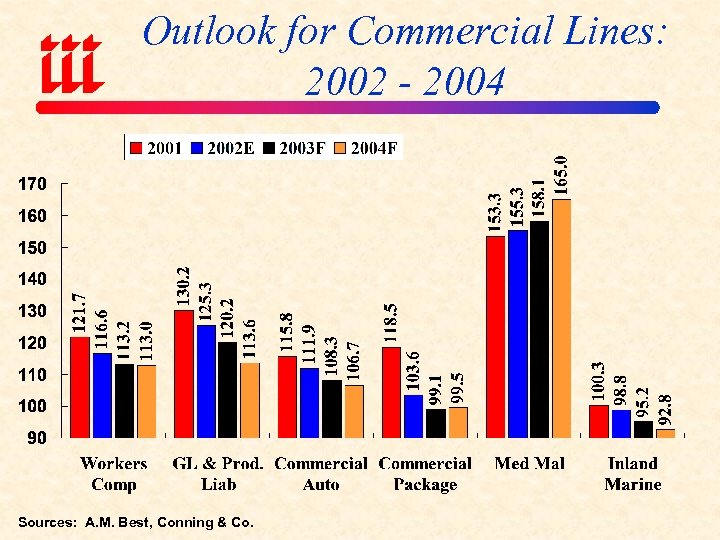

Outlook for Commercial Lines: 2002 - 2004 Sources: A. M. Best, Conning & Co.

Outlook for Commercial Lines: 2002 - 2004 Sources: A. M. Best, Conning & Co.

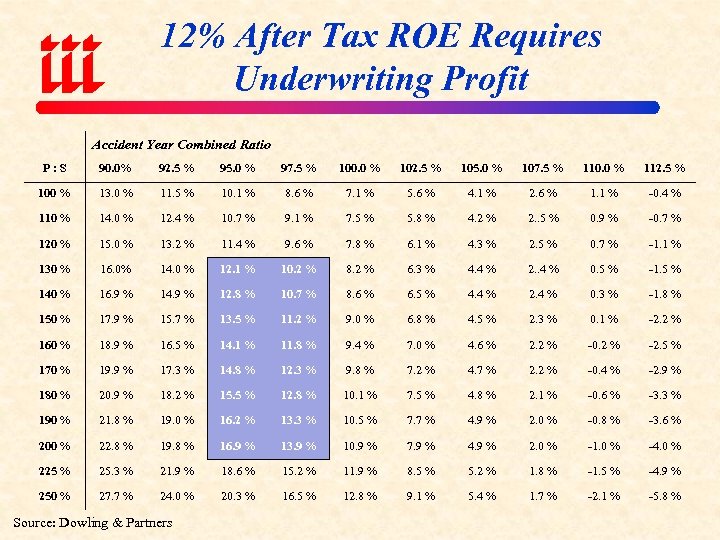

12% After Tax ROE Requires Underwriting Profit Accident Year Combined Ratio P: S 90. 0% 92. 5 % 95. 0 % 97. 5 % 100. 0 % 102. 5 % 105. 0 % 107. 5 % 110. 0 % 112. 5 % 100 % 13. 0 % 11. 5 % 10. 1 % 8. 6 % 7. 1 % 5. 6 % 4. 1 % 2. 6 % 1. 1 % -0. 4 % 110 % 14. 0 % 12. 4 % 10. 7 % 9. 1 % 7. 5 % 5. 8 % 4. 2 % 2. . 5 % 0. 9 % -0. 7 % 120 % 15. 0 % 13. 2 % 11. 4 % 9. 6 % 7. 8 % 6. 1 % 4. 3 % 2. 5 % 0. 7 % -1. 1 % 130 % 16. 0% 14. 0 % 12. 1 % 10. 2 % 8. 2 % 6. 3 % 4. 4 % 2. . 4 % 0. 5 % -1. 5 % 140 % 16. 9 % 14. 9 % 12. 8 % 10. 7 % 8. 6 % 6. 5 % 4. 4 % 2. 4 % 0. 3 % -1. 8 % 150 % 17. 9 % 15. 7 % 13. 5 % 11. 2 % 9. 0 % 6. 8 % 4. 5 % 2. 3 % 0. 1 % -2. 2 % 160 % 18. 9 % 16. 5 % 14. 1 % 11. 8 % 9. 4 % 7. 0 % 4. 6 % 2. 2 % -0. 2 % -2. 5 % 170 % 19. 9 % 17. 3 % 14. 8 % 12. 3 % 9. 8 % 7. 2 % 4. 7 % 2. 2 % -0. 4 % -2. 9 % 180 % 20. 9 % 18. 2 % 15. 5 % 12. 8 % 10. 1 % 7. 5 % 4. 8 % 2. 1 % -0. 6 % -3. 3 % 190 % 21. 8 % 19. 0 % 16. 2 % 13. 3 % 10. 5 % 7. 7 % 4. 9 % 2. 0 % -0. 8 % -3. 6 % 200 % 22. 8 % 19. 8 % 16. 9 % 13. 9 % 10. 9 % 7. 9 % 4. 9 % 2. 0 % -1. 0 % -4. 0 % 225 % 25. 3 % 21. 9 % 18. 6 % 15. 2 % 11. 9 % 8. 5 % 5. 2 % 1. 8 % -1. 5 % -4. 9 % 250 % 27. 7 % 24. 0 % 20. 3 % 16. 5 % 12. 8 % 9. 1 % 5. 4 % 1. 7 % -2. 1 % -5. 8 % Source: Dowling & Partners

12% After Tax ROE Requires Underwriting Profit Accident Year Combined Ratio P: S 90. 0% 92. 5 % 95. 0 % 97. 5 % 100. 0 % 102. 5 % 105. 0 % 107. 5 % 110. 0 % 112. 5 % 100 % 13. 0 % 11. 5 % 10. 1 % 8. 6 % 7. 1 % 5. 6 % 4. 1 % 2. 6 % 1. 1 % -0. 4 % 110 % 14. 0 % 12. 4 % 10. 7 % 9. 1 % 7. 5 % 5. 8 % 4. 2 % 2. . 5 % 0. 9 % -0. 7 % 120 % 15. 0 % 13. 2 % 11. 4 % 9. 6 % 7. 8 % 6. 1 % 4. 3 % 2. 5 % 0. 7 % -1. 1 % 130 % 16. 0% 14. 0 % 12. 1 % 10. 2 % 8. 2 % 6. 3 % 4. 4 % 2. . 4 % 0. 5 % -1. 5 % 140 % 16. 9 % 14. 9 % 12. 8 % 10. 7 % 8. 6 % 6. 5 % 4. 4 % 2. 4 % 0. 3 % -1. 8 % 150 % 17. 9 % 15. 7 % 13. 5 % 11. 2 % 9. 0 % 6. 8 % 4. 5 % 2. 3 % 0. 1 % -2. 2 % 160 % 18. 9 % 16. 5 % 14. 1 % 11. 8 % 9. 4 % 7. 0 % 4. 6 % 2. 2 % -0. 2 % -2. 5 % 170 % 19. 9 % 17. 3 % 14. 8 % 12. 3 % 9. 8 % 7. 2 % 4. 7 % 2. 2 % -0. 4 % -2. 9 % 180 % 20. 9 % 18. 2 % 15. 5 % 12. 8 % 10. 1 % 7. 5 % 4. 8 % 2. 1 % -0. 6 % -3. 3 % 190 % 21. 8 % 19. 0 % 16. 2 % 13. 3 % 10. 5 % 7. 7 % 4. 9 % 2. 0 % -0. 8 % -3. 6 % 200 % 22. 8 % 19. 8 % 16. 9 % 13. 9 % 10. 9 % 7. 9 % 4. 9 % 2. 0 % -1. 0 % -4. 0 % 225 % 25. 3 % 21. 9 % 18. 6 % 15. 2 % 11. 9 % 8. 5 % 5. 2 % 1. 8 % -1. 5 % -4. 9 % 250 % 27. 7 % 24. 0 % 20. 3 % 16. 5 % 12. 8 % 9. 1 % 5. 4 % 1. 7 % -2. 1 % -5. 8 % Source: Dowling & Partners

HOW DOES THIS HARD MARKET STACK UP TO PREVIOUS HARD MARKETS?

HOW DOES THIS HARD MARKET STACK UP TO PREVIOUS HARD MARKETS?

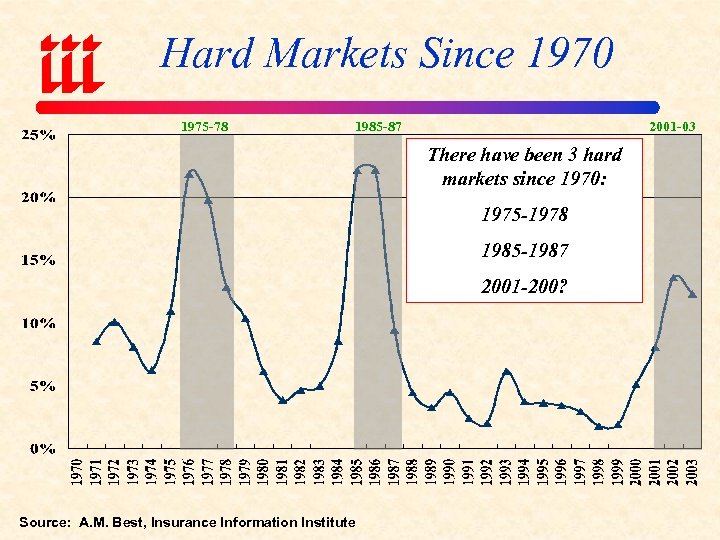

Hard Markets Since 1970 1975 -78 1985 -87 2001 -03 There have been 3 hard markets since 1970: 1975 -1978 1985 -1987 2001 -200? Source: A. M. Best, Insurance Information Institute

Hard Markets Since 1970 1975 -78 1985 -87 2001 -03 There have been 3 hard markets since 1970: 1975 -1978 1985 -1987 2001 -200? Source: A. M. Best, Insurance Information Institute

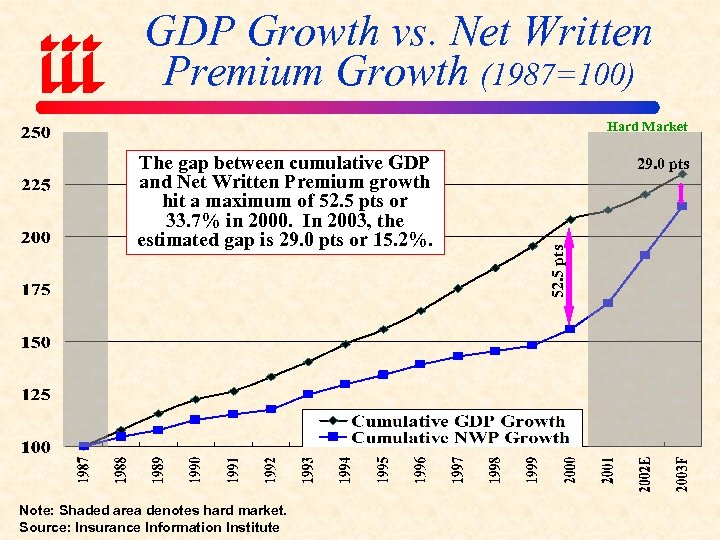

GDP Growth vs. Net Written Premium Growth (1987=100) Hard Market Note: Shaded area denotes hard market. Source: Insurance Information Institute 29. 0 pts 52. 5 pts The gap between cumulative GDP and Net Written Premium growth hit a maximum of 52. 5 pts or 33. 7% in 2000. In 2003, the estimated gap is 29. 0 pts or 15. 2%.

GDP Growth vs. Net Written Premium Growth (1987=100) Hard Market Note: Shaded area denotes hard market. Source: Insurance Information Institute 29. 0 pts 52. 5 pts The gap between cumulative GDP and Net Written Premium growth hit a maximum of 52. 5 pts or 33. 7% in 2000. In 2003, the estimated gap is 29. 0 pts or 15. 2%.

THE U. S. LEGAL SYSTEM IS OUT OF CONTROL: U. S. CIVIL JUSTICE SYSTEM RULED BY THEORY OF “JACKPOT JUSTICE”

THE U. S. LEGAL SYSTEM IS OUT OF CONTROL: U. S. CIVIL JUSTICE SYSTEM RULED BY THEORY OF “JACKPOT JUSTICE”

TORT-ure • • • • Asbestos “Toxic” Mold Medical Malpractice Construction Defects Lead Fast Food Arsenic Treated Lumber Guns Genetically Modified Foods (Corn) Pharmaceuticals & Medical Devices Security exposures (workplace violence, post-9/11 issues) What’s Next? Slavery Sept. 11? ?

TORT-ure • • • • Asbestos “Toxic” Mold Medical Malpractice Construction Defects Lead Fast Food Arsenic Treated Lumber Guns Genetically Modified Foods (Corn) Pharmaceuticals & Medical Devices Security exposures (workplace violence, post-9/11 issues) What’s Next? Slavery Sept. 11? ?

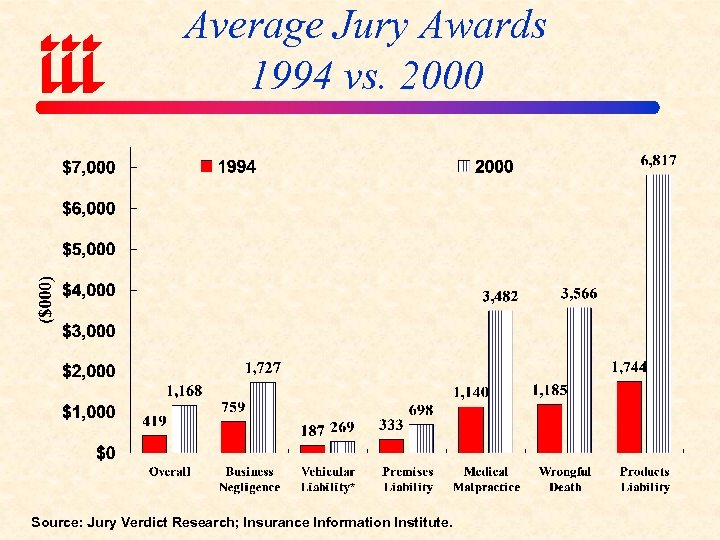

Average Jury Awards 1994 vs. 2000 Source: Jury Verdict Research; Insurance Information Institute.

Average Jury Awards 1994 vs. 2000 Source: Jury Verdict Research; Insurance Information Institute.

Cost of U. S. Tort System ($ Billions) Tort costs consumed 2. 0% of GDP annually on average since 1990, expected to rise to 2. 4% of GDP by 2005! Tort costs equaled $636 person in 2000! Expected to rise to $1, 000 by 2005 Source: Tillinghast-Towers Perrin; Insurance Information Institute estimates for 2001/2002 assume tort costs equal to 2% of GDP. 2005 forecasts from Tillinghast.

Cost of U. S. Tort System ($ Billions) Tort costs consumed 2. 0% of GDP annually on average since 1990, expected to rise to 2. 4% of GDP by 2005! Tort costs equaled $636 person in 2000! Expected to rise to $1, 000 by 2005 Source: Tillinghast-Towers Perrin; Insurance Information Institute estimates for 2001/2002 assume tort costs equal to 2% of GDP. 2005 forecasts from Tillinghast.

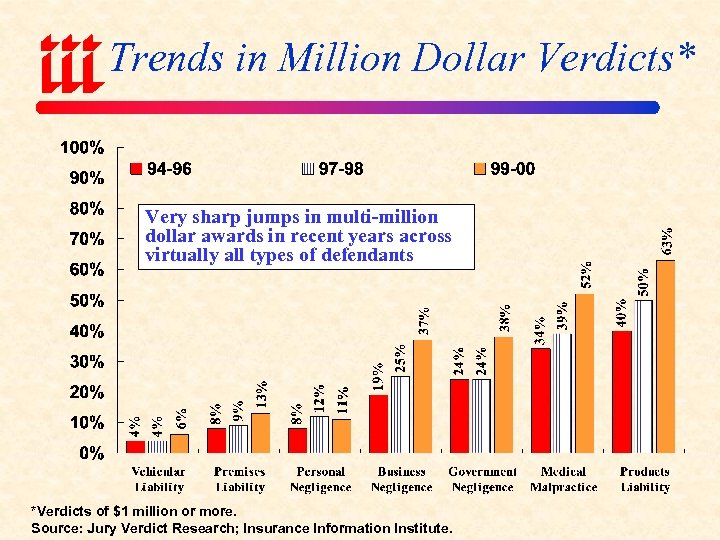

Trends in Million Dollar Verdicts* Very sharp jumps in multi-million dollar awards in recent years across virtually all types of defendants *Verdicts of $1 million or more. Source: Jury Verdict Research; Insurance Information Institute.

Trends in Million Dollar Verdicts* Very sharp jumps in multi-million dollar awards in recent years across virtually all types of defendants *Verdicts of $1 million or more. Source: Jury Verdict Research; Insurance Information Institute.

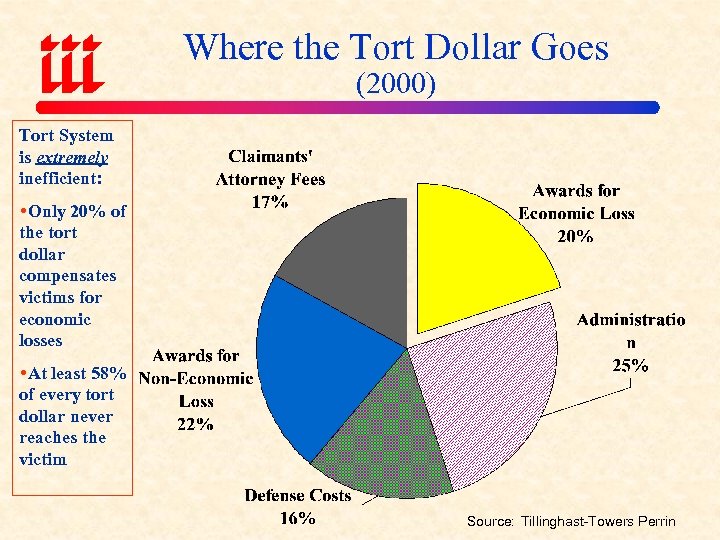

Where the Tort Dollar Goes (2000) Tort System is extremely inefficient: Only 20% of the tort dollar compensates victims for economic losses At least 58% of every tort dollar never reaches the victim Source: Tillinghast-Towers Perrin

Where the Tort Dollar Goes (2000) Tort System is extremely inefficient: Only 20% of the tort dollar compensates victims for economic losses At least 58% of every tort dollar never reaches the victim Source: Tillinghast-Towers Perrin

PRESSURE TO IMPROVE PRICING

PRESSURE TO IMPROVE PRICING

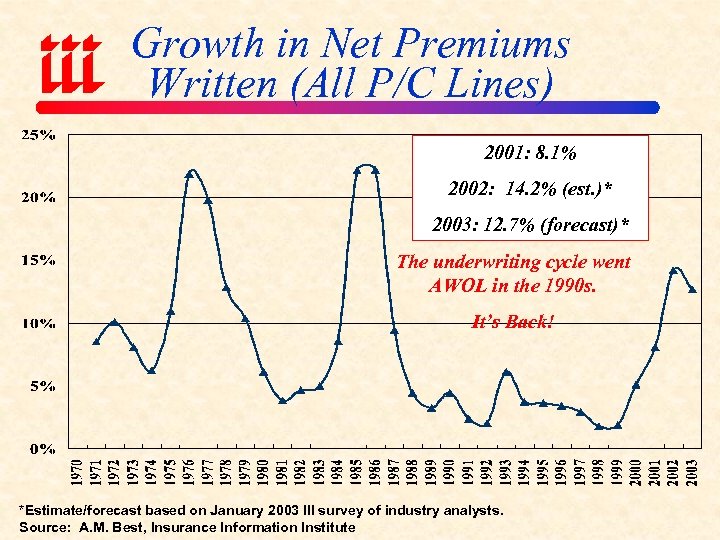

Growth in Net Premiums Written (All P/C Lines) 2001: 8. 1% 2002: 14. 2% (est. )* 2003: 12. 7% (forecast)* The underwriting cycle went AWOL in the 1990 s. It’s Back! *Estimate/forecast based on January 2003 III survey of industry analysts. Source: A. M. Best, Insurance Information Institute

Growth in Net Premiums Written (All P/C Lines) 2001: 8. 1% 2002: 14. 2% (est. )* 2003: 12. 7% (forecast)* The underwriting cycle went AWOL in the 1990 s. It’s Back! *Estimate/forecast based on January 2003 III survey of industry analysts. Source: A. M. Best, Insurance Information Institute

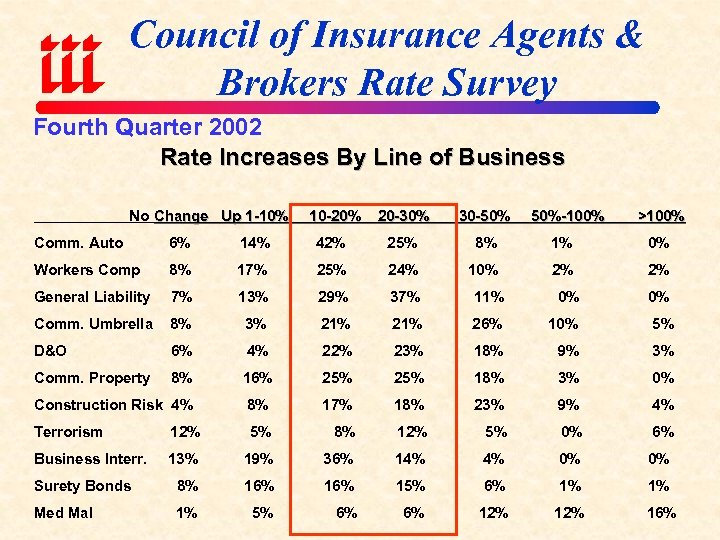

Council of Insurance Agents & Brokers Rate Survey Fourth Quarter 2002 Rate Increases By Line of Business No Change Up 1 -10% 10 -20% 20 -30% 30 -50% 50%-100% >100% Comm. Auto 6% 14% 42% 25% 8% 1% 0% Workers Comp 8% 17% 25% 24% 10% 2% 2% General Liability 7% 13% 29% 37% 11% 0% 0% Comm. Umbrella 8% 3% 21% 26% 10% 5% D&O 6% 4% 22% 23% 18% 9% 3% Comm. Property 8% 16% 25% 18% 3% 0% Construction Risk 4% 8% 17% 18% 23% 9% 4% Terrorism 12% 5% 8% 12% 5% 0% 6% Business Interr. 13% 19% 36% 14% 4% 0% 0% Surety Bonds 8% 16% 15% 6% 1% 1% Med Mal 1% 5% 6% 6% 12% 16%

Council of Insurance Agents & Brokers Rate Survey Fourth Quarter 2002 Rate Increases By Line of Business No Change Up 1 -10% 10 -20% 20 -30% 30 -50% 50%-100% >100% Comm. Auto 6% 14% 42% 25% 8% 1% 0% Workers Comp 8% 17% 25% 24% 10% 2% 2% General Liability 7% 13% 29% 37% 11% 0% 0% Comm. Umbrella 8% 3% 21% 26% 10% 5% D&O 6% 4% 22% 23% 18% 9% 3% Comm. Property 8% 16% 25% 18% 3% 0% Construction Risk 4% 8% 17% 18% 23% 9% 4% Terrorism 12% 5% 8% 12% 5% 0% 6% Business Interr. 13% 19% 36% 14% 4% 0% 0% Surety Bonds 8% 16% 15% 6% 1% 1% Med Mal 1% 5% 6% 6% 12% 16%

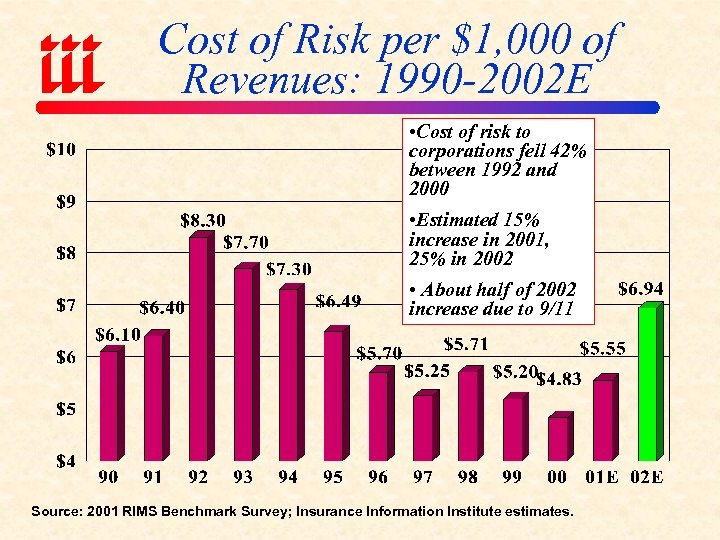

Cost of Risk per $1, 000 of Revenues: 1990 -2002 E • Cost of risk to corporations fell 42% between 1992 and 2000 • Estimated 15% increase in 2001, 25% in 2002 • About half of 2002 increase due to 9/11 Source: 2001 RIMS Benchmark Survey; Insurance Information Institute estimates.

Cost of Risk per $1, 000 of Revenues: 1990 -2002 E • Cost of risk to corporations fell 42% between 1992 and 2000 • Estimated 15% increase in 2001, 25% in 2002 • About half of 2002 increase due to 9/11 Source: 2001 RIMS Benchmark Survey; Insurance Information Institute estimates.

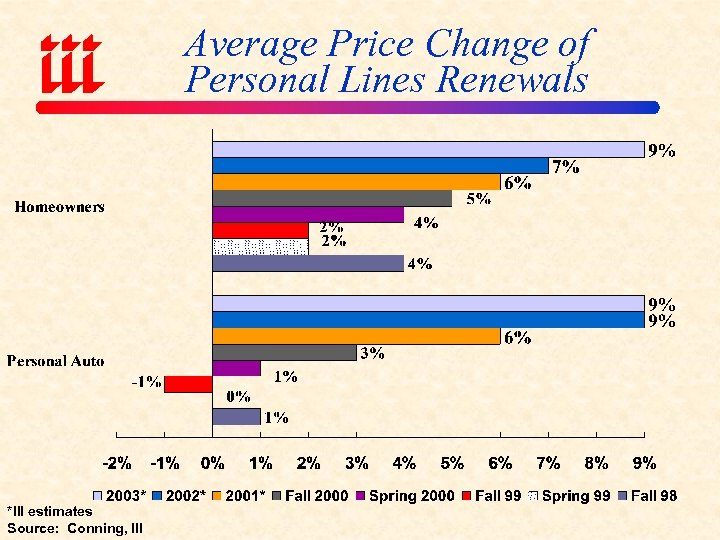

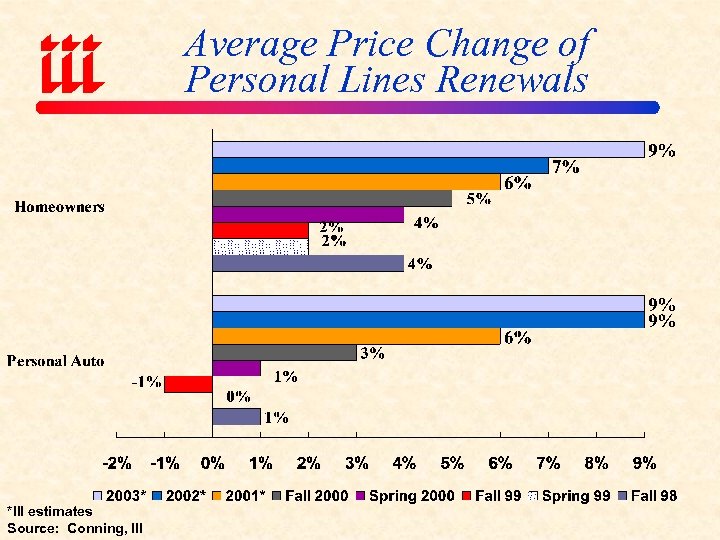

Average Price Change of Personal Lines Renewals *III estimates Source: Conning, III

Average Price Change of Personal Lines Renewals *III estimates Source: Conning, III

Average Price Change of Personal Lines Renewals *III estimates Source: Conning, III

Average Price Change of Personal Lines Renewals *III estimates Source: Conning, III

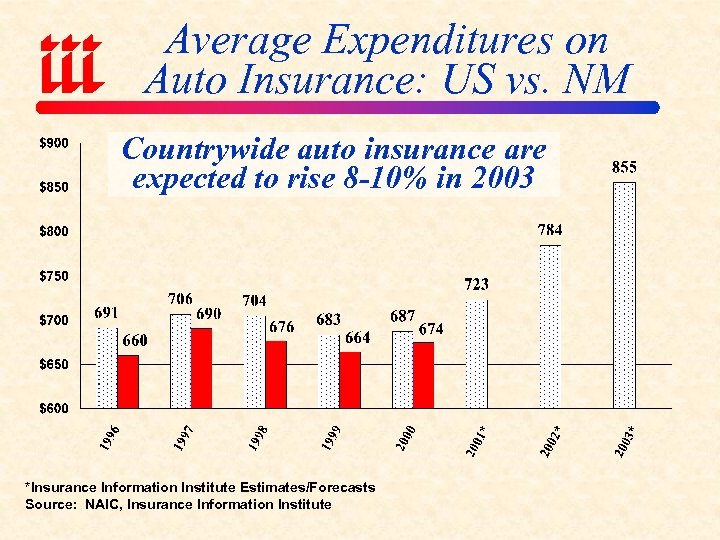

Average Expenditures on Auto Insurance: US vs. NM Countrywide auto insurance are expected to rise 8 -10% in 2003 *Insurance Information Institute Estimates/Forecasts Source: NAIC, Insurance Information Institute

Average Expenditures on Auto Insurance: US vs. NM Countrywide auto insurance are expected to rise 8 -10% in 2003 *Insurance Information Institute Estimates/Forecasts Source: NAIC, Insurance Information Institute

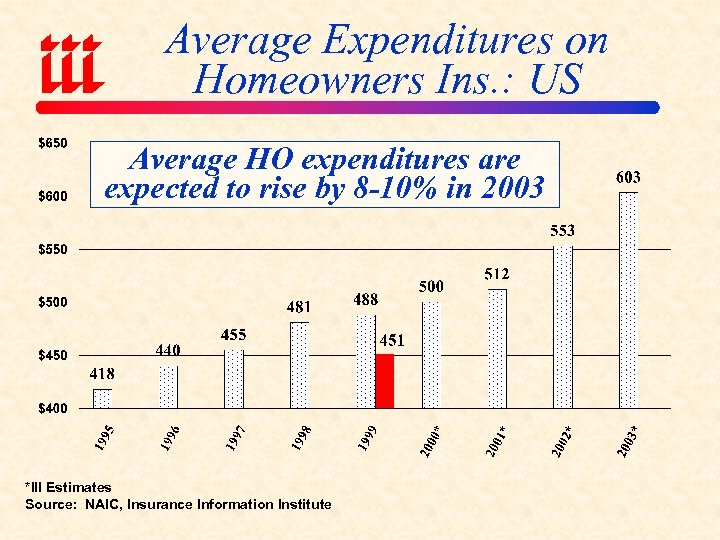

Average Expenditures on Homeowners Ins. : US Average HO expenditures are expected to rise by 8 -10% in 2003 *III Estimates Source: NAIC, Insurance Information Institute

Average Expenditures on Homeowners Ins. : US Average HO expenditures are expected to rise by 8 -10% in 2003 *III Estimates Source: NAIC, Insurance Information Institute

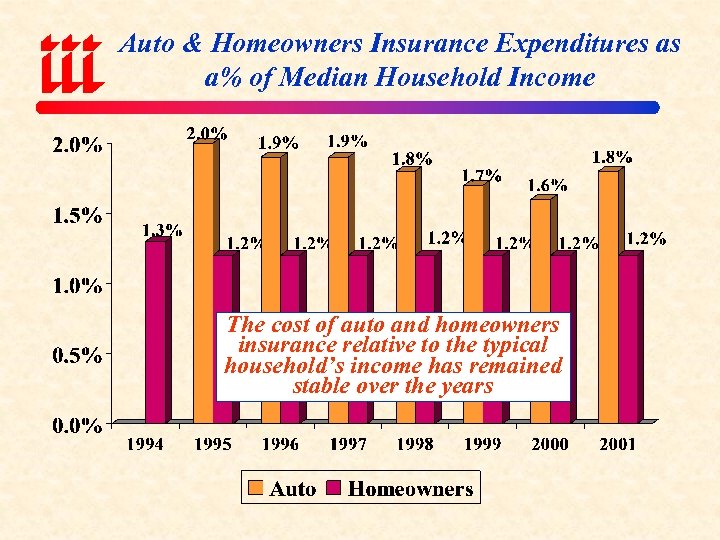

Auto & Homeowners Insurance Expenditures as a% of Median Household Income The cost of auto and homeowners insurance relative to the typical household’s income has remained stable over the years

Auto & Homeowners Insurance Expenditures as a% of Median Household Income The cost of auto and homeowners insurance relative to the typical household’s income has remained stable over the years

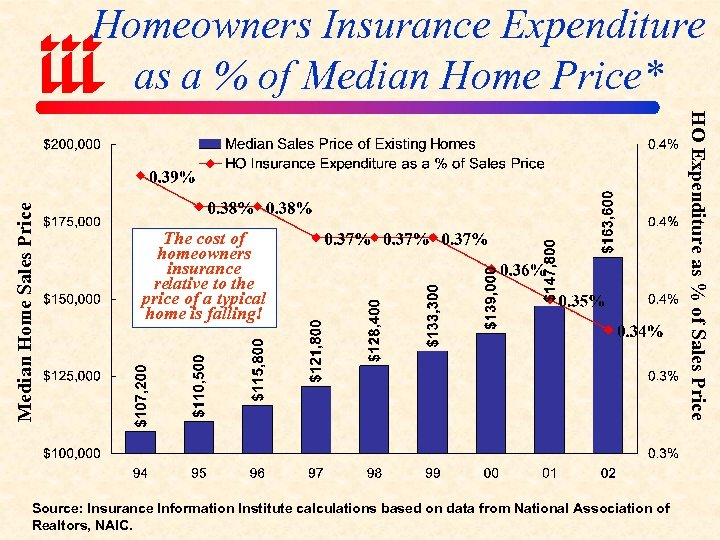

The cost of homeowners insurance relative to the price of a typical home is falling! Source: Insurance Information Institute calculations based on data from National Association of Realtors, NAIC. HO Expenditure as % of Sales Price Median Home Sales Price Homeowners Insurance Expenditure as a % of Median Home Price*

The cost of homeowners insurance relative to the price of a typical home is falling! Source: Insurance Information Institute calculations based on data from National Association of Realtors, NAIC. HO Expenditure as % of Sales Price Median Home Sales Price Homeowners Insurance Expenditure as a % of Median Home Price*

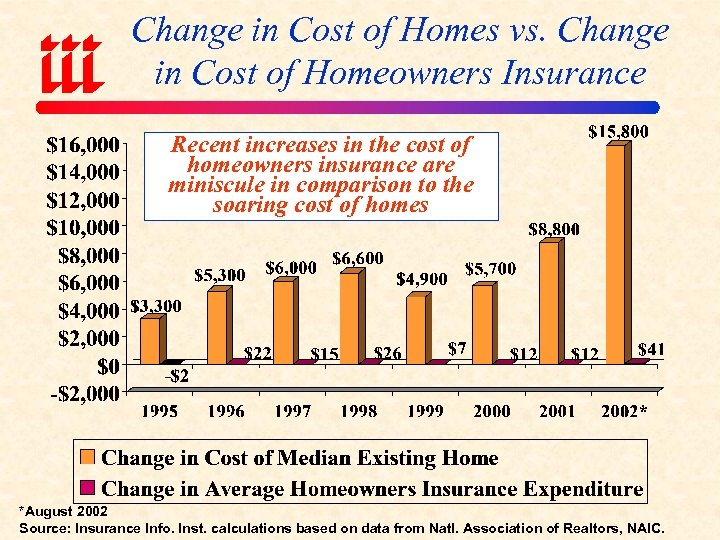

Change in Cost of Homes vs. Change in Cost of Homeowners Insurance Recent increases in the cost of homeowners insurance are miniscule in comparison to the soaring cost of homes *August 2002 Source: Insurance Info. Inst. calculations based on data from Natl. Association of Realtors, NAIC.

Change in Cost of Homes vs. Change in Cost of Homeowners Insurance Recent increases in the cost of homeowners insurance are miniscule in comparison to the soaring cost of homes *August 2002 Source: Insurance Info. Inst. calculations based on data from Natl. Association of Realtors, NAIC.

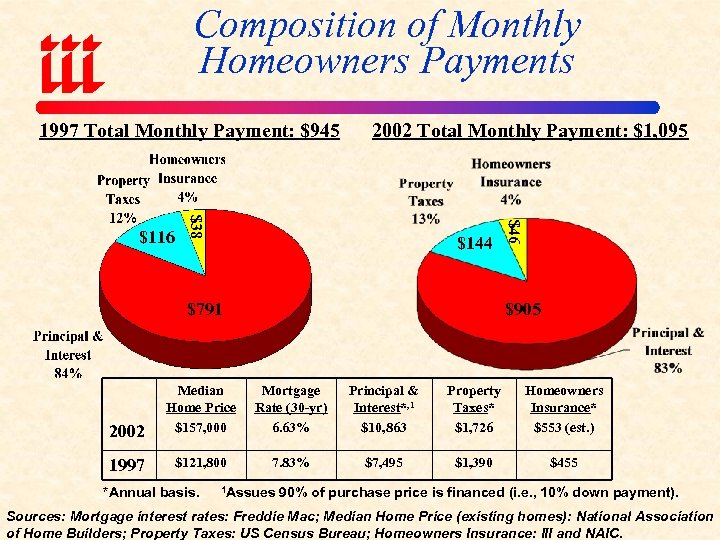

Composition of Monthly Homeowners Payments 1997 Total Monthly Payment: $945 $144 $791 $46 $38 $116 2002 Total Monthly Payment: $1, 095 $905 2002 Median Home Price $157, 000 Mortgage Rate (30 -yr) 6. 63% Principal & Interest*, 1 $10, 863 Property Taxes* $1, 726 Homeowners Insurance* $553 (est. ) 1997 $121, 800 7. 83% $7, 495 $1, 390 $455 *Annual basis. 1 Assues 90% of purchase price is financed (i. e. , 10% down payment). Sources: Mortgage interest rates: Freddie Mac; Median Home Price (existing homes): National Association of Home Builders; Property Taxes: US Census Bureau; Homeowners Insurance: III and NAIC.

Composition of Monthly Homeowners Payments 1997 Total Monthly Payment: $945 $144 $791 $46 $38 $116 2002 Total Monthly Payment: $1, 095 $905 2002 Median Home Price $157, 000 Mortgage Rate (30 -yr) 6. 63% Principal & Interest*, 1 $10, 863 Property Taxes* $1, 726 Homeowners Insurance* $553 (est. ) 1997 $121, 800 7. 83% $7, 495 $1, 390 $455 *Annual basis. 1 Assues 90% of purchase price is financed (i. e. , 10% down payment). Sources: Mortgage interest rates: Freddie Mac; Median Home Price (existing homes): National Association of Home Builders; Property Taxes: US Census Bureau; Homeowners Insurance: III and NAIC.

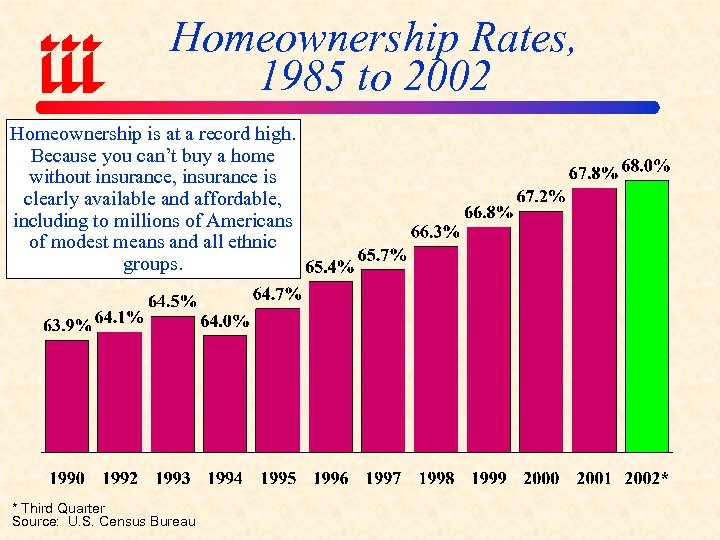

Homeownership Rates, 1985 to 2002 Homeownership is at a record high. Because you can’t buy a home without insurance, insurance is clearly available and affordable, including to millions of Americans of modest means and all ethnic groups. * Third Quarter Source: U. S. Census Bureau

Homeownership Rates, 1985 to 2002 Homeownership is at a record high. Because you can’t buy a home without insurance, insurance is clearly available and affordable, including to millions of Americans of modest means and all ethnic groups. * Third Quarter Source: U. S. Census Bureau

CAPACITY CRUNCH

CAPACITY CRUNCH

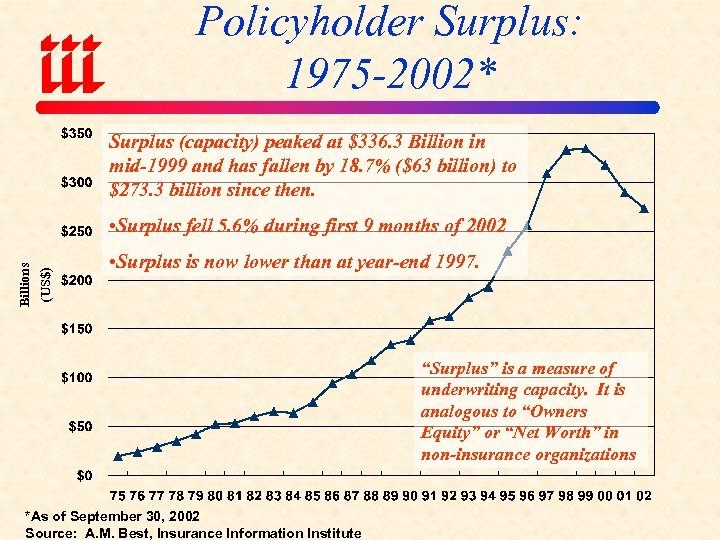

Policyholder Surplus: 1975 -2002* Surplus (capacity) peaked at $336. 3 Billion in mid-1999 and has fallen by 18. 7% ($63 billion) to $273. 3 billion since then. (US$) Billions • Surplus fell 5. 6% during first 9 months of 2002 • Surplus is now lower than at year-end 1997. “Surplus” is a measure of underwriting capacity. It is analogous to “Owners Equity” or “Net Worth” in non-insurance organizations *As of September 30, 2002 Source: A. M. Best, Insurance Information Institute

Policyholder Surplus: 1975 -2002* Surplus (capacity) peaked at $336. 3 Billion in mid-1999 and has fallen by 18. 7% ($63 billion) to $273. 3 billion since then. (US$) Billions • Surplus fell 5. 6% during first 9 months of 2002 • Surplus is now lower than at year-end 1997. “Surplus” is a measure of underwriting capacity. It is analogous to “Owners Equity” or “Net Worth” in non-insurance organizations *As of September 30, 2002 Source: A. M. Best, Insurance Information Institute

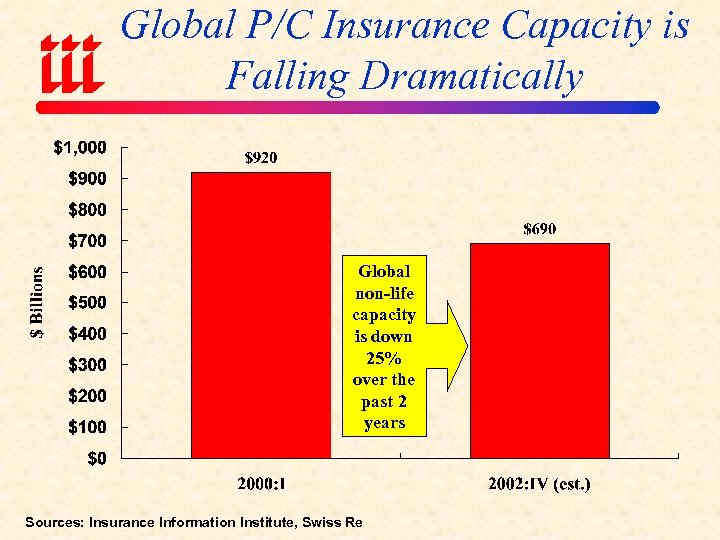

Global P/C Insurance Capacity is Falling Dramatically Global non-life capacity is down 25% over the past 2 years Sources: Insurance Information Institute, Swiss Re

Global P/C Insurance Capacity is Falling Dramatically Global non-life capacity is down 25% over the past 2 years Sources: Insurance Information Institute, Swiss Re

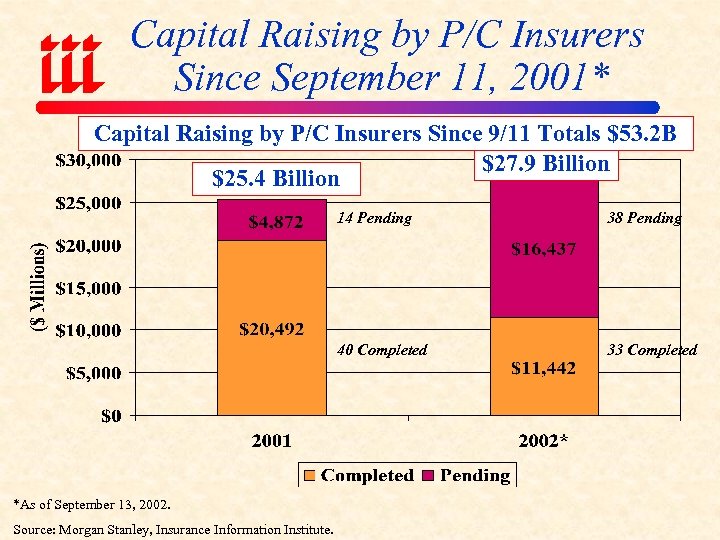

Capital Raising by P/C Insurers Since September 11, 2001* Capital Raising by P/C Insurers Since 9/11 Totals $53. 2 B $27. 9 Billion $25. 4 Billion 14 Pending 40 Completed *As of September 13, 2002. Source: Morgan Stanley, Insurance Information Institute. 38 Pending 33 Completed

Capital Raising by P/C Insurers Since September 11, 2001* Capital Raising by P/C Insurers Since 9/11 Totals $53. 2 B $27. 9 Billion $25. 4 Billion 14 Pending 40 Completed *As of September 13, 2002. Source: Morgan Stanley, Insurance Information Institute. 38 Pending 33 Completed

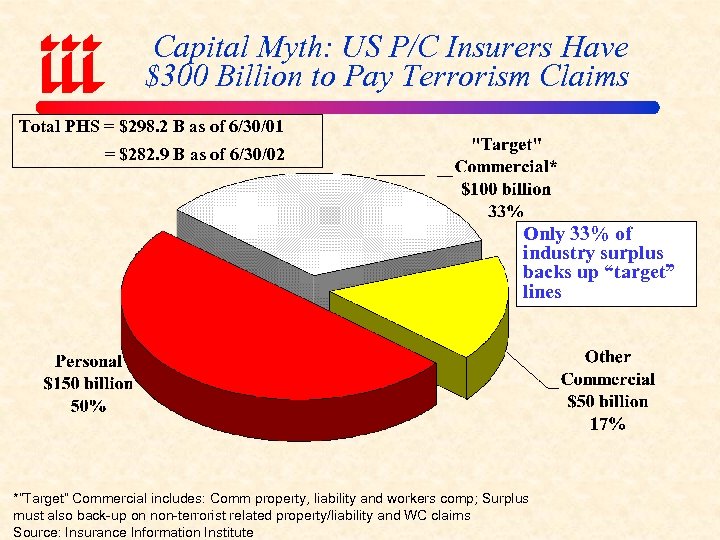

Capital Myth: US P/C Insurers Have $300 Billion to Pay Terrorism Claims Total PHS = $298. 2 B as of 6/30/01 = $282. 9 B as of 6/30/02 Only 33% of industry surplus backs up “target” lines *”Target” Commercial includes: Comm property, liability and workers comp; Surplus must also back-up on non-terrorist related property/liability and WC claims Source: Insurance Information Institute

Capital Myth: US P/C Insurers Have $300 Billion to Pay Terrorism Claims Total PHS = $298. 2 B as of 6/30/01 = $282. 9 B as of 6/30/02 Only 33% of industry surplus backs up “target” lines *”Target” Commercial includes: Comm property, liability and workers comp; Surplus must also back-up on non-terrorist related property/liability and WC claims Source: Insurance Information Institute

INVESTMENT OVERVIEW

INVESTMENT OVERVIEW

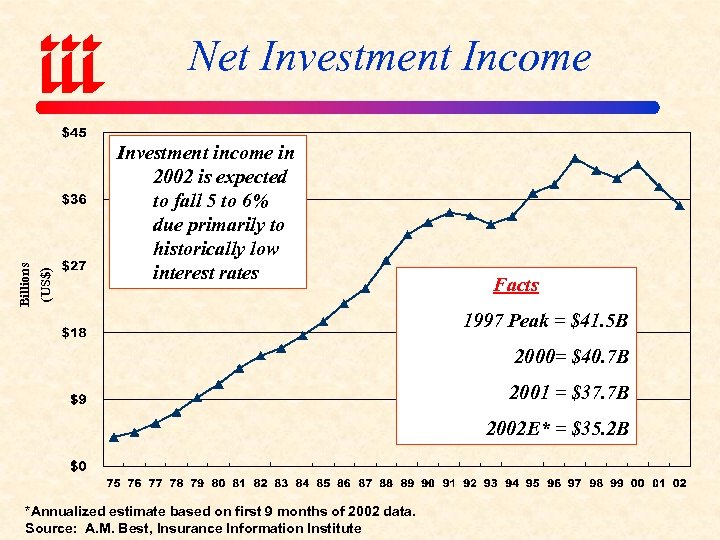

(US$) Billions Net Investment Income Investment income in 2002 is expected to fall 5 to 6% due primarily to historically low interest rates Facts 1997 Peak = $41. 5 B 2000= $40. 7 B 2001 = $37. 7 B 2002 E* = $35. 2 B *Annualized estimate based on first 9 months of 2002 data. Source: A. M. Best, Insurance Information Institute

(US$) Billions Net Investment Income Investment income in 2002 is expected to fall 5 to 6% due primarily to historically low interest rates Facts 1997 Peak = $41. 5 B 2000= $40. 7 B 2001 = $37. 7 B 2002 E* = $35. 2 B *Annualized estimate based on first 9 months of 2002 data. Source: A. M. Best, Insurance Information Institute

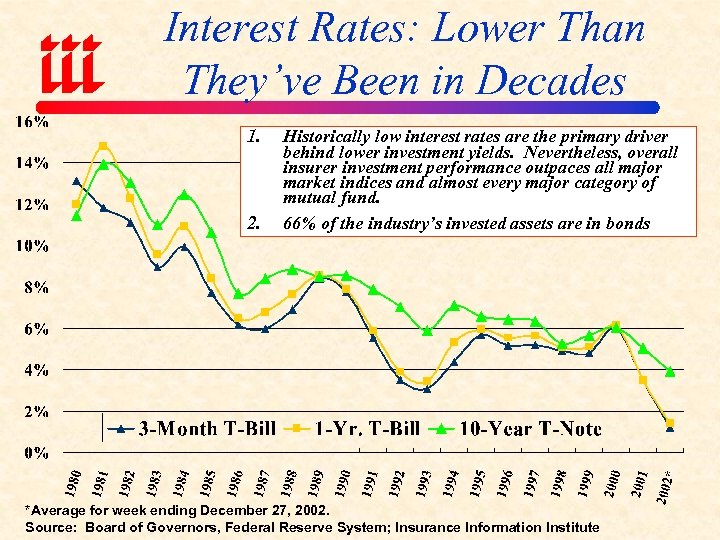

Interest Rates: Lower Than They’ve Been in Decades 1. 2. Historically low interest rates are the primary driver behind lower investment yields. Nevertheless, overall insurer investment performance outpaces all major market indices and almost every major category of mutual fund. 66% of the industry’s invested assets are in bonds *Average for week ending December 27, 2002. Source: Board of Governors, Federal Reserve System; Insurance Information Institute

Interest Rates: Lower Than They’ve Been in Decades 1. 2. Historically low interest rates are the primary driver behind lower investment yields. Nevertheless, overall insurer investment performance outpaces all major market indices and almost every major category of mutual fund. 66% of the industry’s invested assets are in bonds *Average for week ending December 27, 2002. Source: Board of Governors, Federal Reserve System; Insurance Information Institute

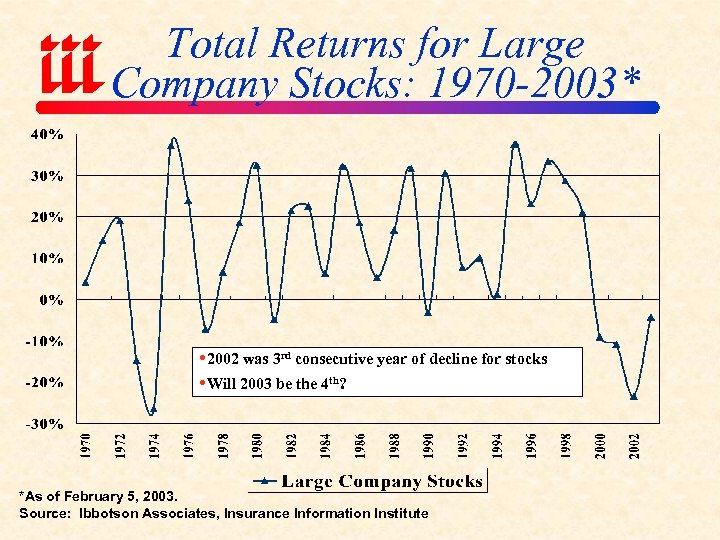

Total Returns for Large Company Stocks: 1970 -2003* 2002 was 3 rd consecutive year of decline for stocks Will 2003 be the 4 th? *As of February 5, 2003. Source: Ibbotson Associates, Insurance Information Institute

Total Returns for Large Company Stocks: 1970 -2003* 2002 was 3 rd consecutive year of decline for stocks Will 2003 be the 4 th? *As of February 5, 2003. Source: Ibbotson Associates, Insurance Information Institute

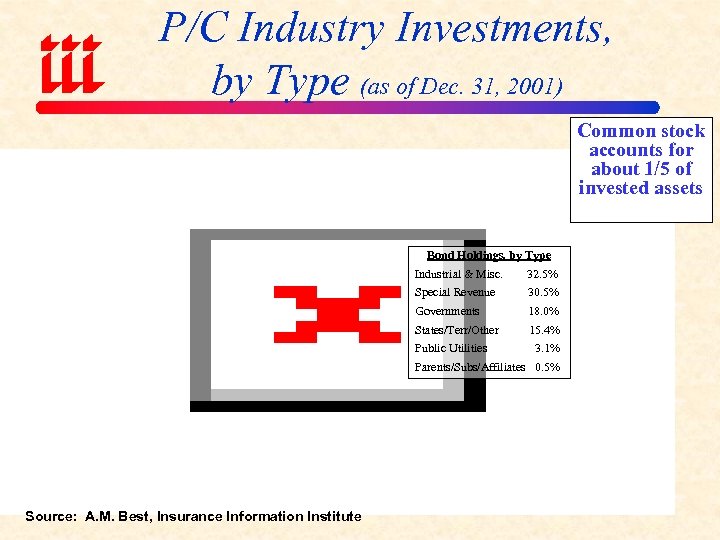

P/C Industry Investments, by Type (as of Dec. 31, 2001) Common stock accounts for about 1/5 of invested assets Bond Holdings, by Type Industrial & Misc. 32. 5% Special Revenue 30. 5% Governments 18. 0% States/Terr/Other 15. 4% Public Utilities 3. 1% Parents/Subs/Affiliates 0. 5% Source: A. M. Best, Insurance Information Institute

P/C Industry Investments, by Type (as of Dec. 31, 2001) Common stock accounts for about 1/5 of invested assets Bond Holdings, by Type Industrial & Misc. 32. 5% Special Revenue 30. 5% Governments 18. 0% States/Terr/Other 15. 4% Public Utilities 3. 1% Parents/Subs/Affiliates 0. 5% Source: A. M. Best, Insurance Information Institute

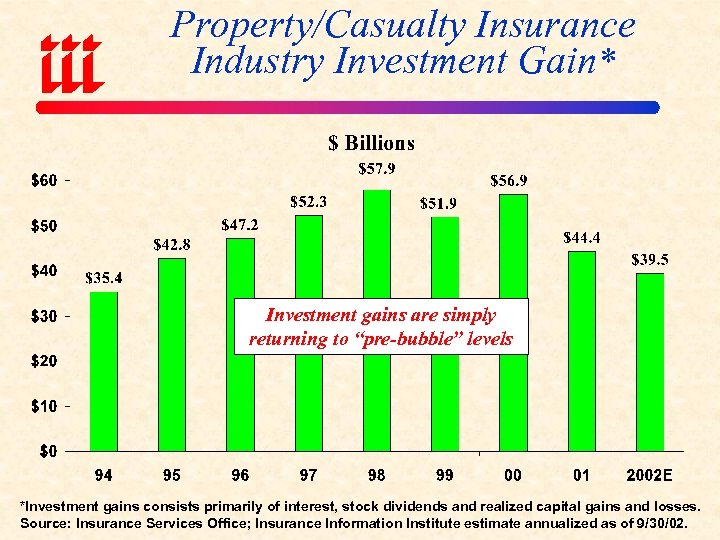

Property/Casualty Insurance Industry Investment Gain* Investment gains are simply returning to “pre-bubble” levels *Investment gains consists primarily of interest, stock dividends and realized capital gains and losses. Source: Insurance Services Office; Insurance Information Institute estimate annualized as of 9/30/02.

Property/Casualty Insurance Industry Investment Gain* Investment gains are simply returning to “pre-bubble” levels *Investment gains consists primarily of interest, stock dividends and realized capital gains and losses. Source: Insurance Services Office; Insurance Information Institute estimate annualized as of 9/30/02.

Geopolitical Instability Increased in 2002, Boiling Over in 2003 Terrorists & Terrorism War on Terrorism North Korea: Nukes & Kooks Iraq: War Jitters

Geopolitical Instability Increased in 2002, Boiling Over in 2003 Terrorists & Terrorism War on Terrorism North Korea: Nukes & Kooks Iraq: War Jitters

THE CHALLENGE OF TERRORISM

THE CHALLENGE OF TERRORISM

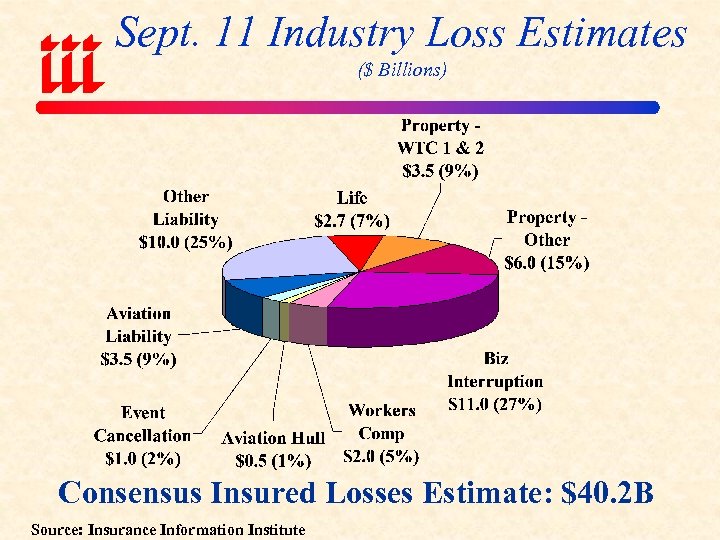

Sept. 11 Industry Loss Estimates ($ Billions) Consensus Insured Losses Estimate: $40. 2 B Source: Insurance Information Institute

Sept. 11 Industry Loss Estimates ($ Billions) Consensus Insured Losses Estimate: $40. 2 B Source: Insurance Information Institute

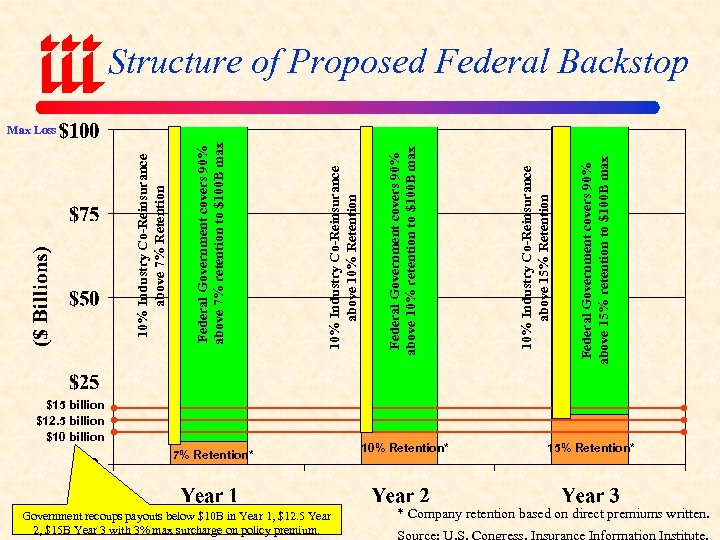

Structure of Proposed Federal Backstop $15 billion $12. 5 billion $10 billion 7% Retention* Government recoups payouts below $10 B in Year 1, $12. 5 Year 2, $15 B Year 3 with 3% max surcharge on policy premium. 10% Retention* Federal Government covers 90% above 15% retention to $100 B max 10% Industry Co-Reinsurance above 15% Retention Federal Government covers 90% above 10% retention to $100 B max 10% Industry Co-Reinsurance above 10% Retention Federal Government covers 90% above 7% retention to $100 B max 10% Industry Co-Reinsurance above 7% Retention Max Loss 15% Retention* * Company retention based on direct premiums written. Source: U. S. Congress, Insurance Information Institute.

Structure of Proposed Federal Backstop $15 billion $12. 5 billion $10 billion 7% Retention* Government recoups payouts below $10 B in Year 1, $12. 5 Year 2, $15 B Year 3 with 3% max surcharge on policy premium. 10% Retention* Federal Government covers 90% above 15% retention to $100 B max 10% Industry Co-Reinsurance above 15% Retention Federal Government covers 90% above 10% retention to $100 B max 10% Industry Co-Reinsurance above 10% Retention Federal Government covers 90% above 7% retention to $100 B max 10% Industry Co-Reinsurance above 7% Retention Max Loss 15% Retention* * Company retention based on direct premiums written. Source: U. S. Congress, Insurance Information Institute.

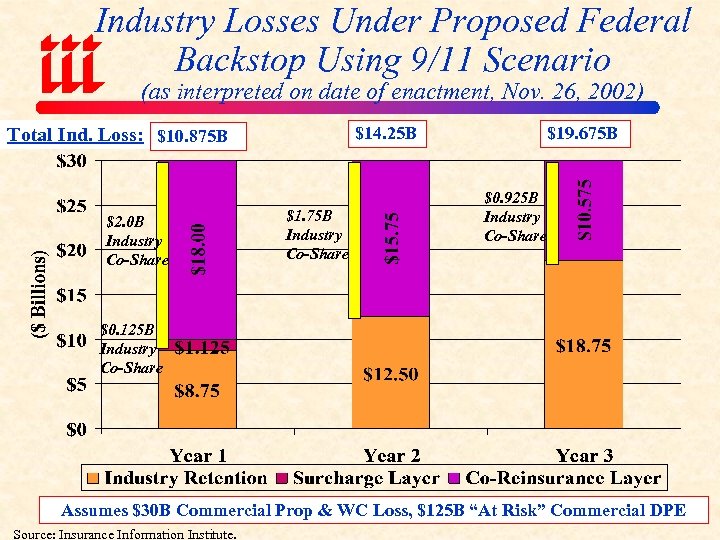

Industry Losses Under Proposed Federal Backstop Using 9/11 Scenario (as interpreted on date of enactment, Nov. 26, 2002) Total Ind. Loss: $10. 875 B $2. 0 B Industry Co-Share $14. 25 B $1. 75 B Industry Co-Share $19. 675 B $0. 925 B Industry Co-Share $0. 125 B Industry Co-Share Assumes $30 B Commercial Prop & WC Loss, $125 B “At Risk” Commercial DPE Source: Insurance Information Institute.

Industry Losses Under Proposed Federal Backstop Using 9/11 Scenario (as interpreted on date of enactment, Nov. 26, 2002) Total Ind. Loss: $10. 875 B $2. 0 B Industry Co-Share $14. 25 B $1. 75 B Industry Co-Share $19. 675 B $0. 925 B Industry Co-Share $0. 125 B Industry Co-Share Assumes $30 B Commercial Prop & WC Loss, $125 B “At Risk” Commercial DPE Source: Insurance Information Institute.

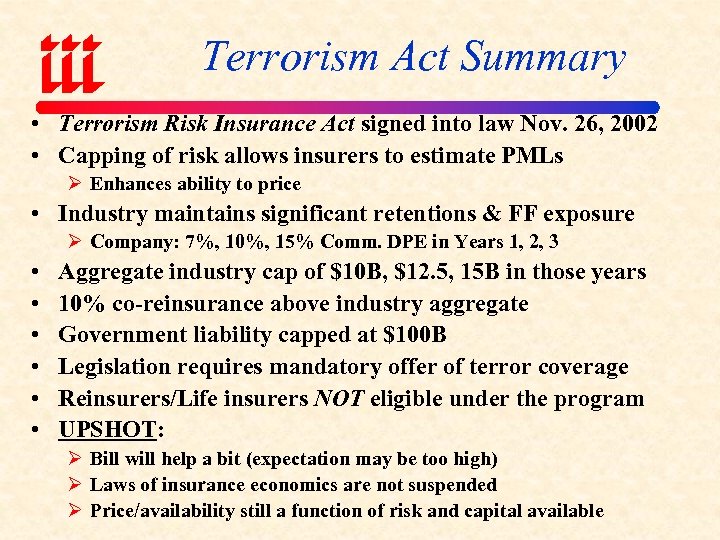

Terrorism Act Summary • Terrorism Risk Insurance Act signed into law Nov. 26, 2002 • Capping of risk allows insurers to estimate PMLs Ø Enhances ability to price • Industry maintains significant retentions & FF exposure Ø Company: 7%, 10%, 15% Comm. DPE in Years 1, 2, 3 • • • Aggregate industry cap of $10 B, $12. 5, 15 B in those years 10% co-reinsurance above industry aggregate Government liability capped at $100 B Legislation requires mandatory offer of terror coverage Reinsurers/Life insurers NOT eligible under the program UPSHOT: Ø Bill will help a bit (expectation may be too high) Ø Laws of insurance economics are not suspended Ø Price/availability still a function of risk and capital available

Terrorism Act Summary • Terrorism Risk Insurance Act signed into law Nov. 26, 2002 • Capping of risk allows insurers to estimate PMLs Ø Enhances ability to price • Industry maintains significant retentions & FF exposure Ø Company: 7%, 10%, 15% Comm. DPE in Years 1, 2, 3 • • • Aggregate industry cap of $10 B, $12. 5, 15 B in those years 10% co-reinsurance above industry aggregate Government liability capped at $100 B Legislation requires mandatory offer of terror coverage Reinsurers/Life insurers NOT eligible under the program UPSHOT: Ø Bill will help a bit (expectation may be too high) Ø Laws of insurance economics are not suspended Ø Price/availability still a function of risk and capital available

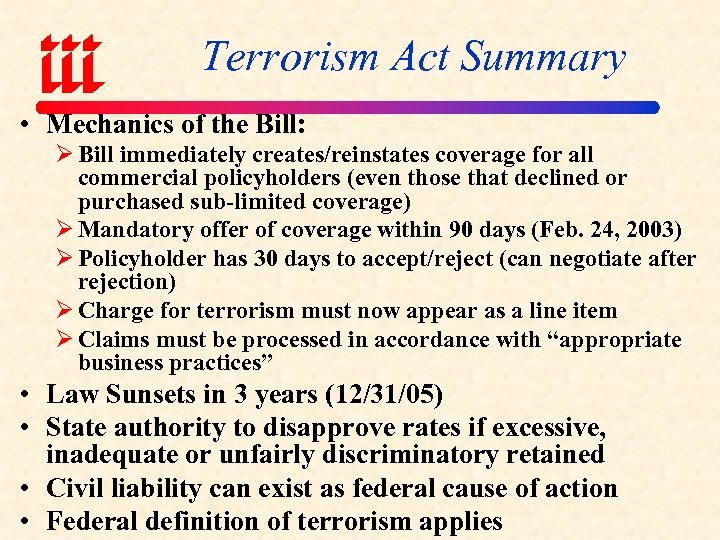

Terrorism Act Summary • Mechanics of the Bill: Ø Bill immediately creates/reinstates coverage for all commercial policyholders (even those that declined or purchased sub-limited coverage) Ø Mandatory offer of coverage within 90 days (Feb. 24, 2003) Ø Policyholder has 30 days to accept/reject (can negotiate after rejection) Ø Charge for terrorism must now appear as a line item Ø Claims must be processed in accordance with “appropriate business practices” • Law Sunsets in 3 years (12/31/05) • State authority to disapprove rates if excessive, inadequate or unfairly discriminatory retained • Civil liability can exist as federal cause of action • Federal definition of terrorism applies

Terrorism Act Summary • Mechanics of the Bill: Ø Bill immediately creates/reinstates coverage for all commercial policyholders (even those that declined or purchased sub-limited coverage) Ø Mandatory offer of coverage within 90 days (Feb. 24, 2003) Ø Policyholder has 30 days to accept/reject (can negotiate after rejection) Ø Charge for terrorism must now appear as a line item Ø Claims must be processed in accordance with “appropriate business practices” • Law Sunsets in 3 years (12/31/05) • State authority to disapprove rates if excessive, inadequate or unfairly discriminatory retained • Civil liability can exist as federal cause of action • Federal definition of terrorism applies

CREDIT IN PERSONAL LINES UNDERWRITING

CREDIT IN PERSONAL LINES UNDERWRITING

Why Do Insurers Use Credit Information?

Why Do Insurers Use Credit Information?

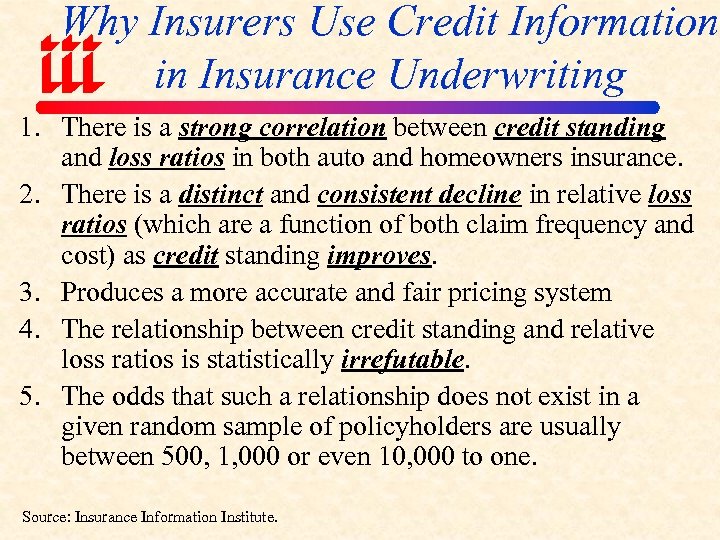

Why Insurers Use Credit Information in Insurance Underwriting 1. There is a strong correlation between credit standing and loss ratios in both auto and homeowners insurance. 2. There is a distinct and consistent decline in relative loss ratios (which are a function of both claim frequency and cost) as credit standing improves. 3. Produces a more accurate and fair pricing system 4. The relationship between credit standing and relative loss ratios is statistically irrefutable. 5. The odds that such a relationship does not exist in a given random sample of policyholders are usually between 500, 1, 000 or even 10, 000 to one. Source: Insurance Information Institute.

Why Insurers Use Credit Information in Insurance Underwriting 1. There is a strong correlation between credit standing and loss ratios in both auto and homeowners insurance. 2. There is a distinct and consistent decline in relative loss ratios (which are a function of both claim frequency and cost) as credit standing improves. 3. Produces a more accurate and fair pricing system 4. The relationship between credit standing and relative loss ratios is statistically irrefutable. 5. The odds that such a relationship does not exist in a given random sample of policyholders are usually between 500, 1, 000 or even 10, 000 to one. Source: Insurance Information Institute.

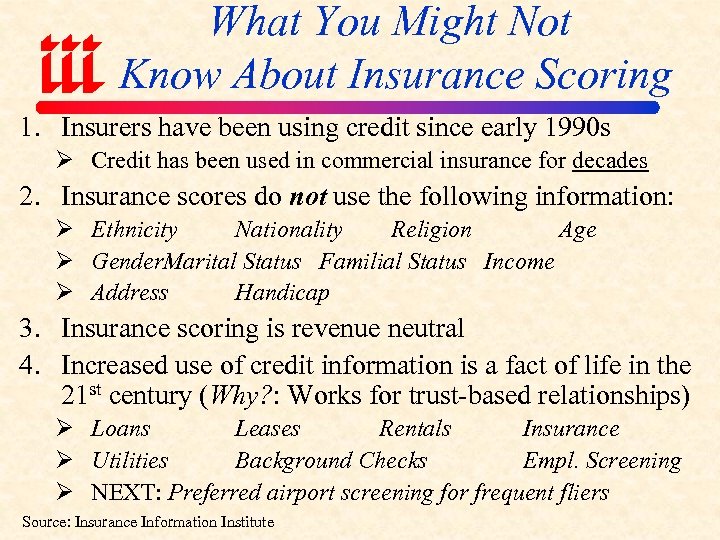

What You Might Not Know About Insurance Scoring 1. Insurers have been using credit since early 1990 s Ø Credit has been used in commercial insurance for decades 2. Insurance scores do not use the following information: Ø Ethnicity Nationality Religion Age Ø Gender. Marital Status Familial Status Income Ø Address Handicap 3. Insurance scoring is revenue neutral 4. Increased use of credit information is a fact of life in the 21 st century (Why? : Works for trust-based relationships) Ø Loans Leases Rentals Insurance Ø Utilities Background Checks Empl. Screening Ø NEXT: Preferred airport screening for frequent fliers Source: Insurance Information Institute

What You Might Not Know About Insurance Scoring 1. Insurers have been using credit since early 1990 s Ø Credit has been used in commercial insurance for decades 2. Insurance scores do not use the following information: Ø Ethnicity Nationality Religion Age Ø Gender. Marital Status Familial Status Income Ø Address Handicap 3. Insurance scoring is revenue neutral 4. Increased use of credit information is a fact of life in the 21 st century (Why? : Works for trust-based relationships) Ø Loans Leases Rentals Insurance Ø Utilities Background Checks Empl. Screening Ø NEXT: Preferred airport screening for frequent fliers Source: Insurance Information Institute

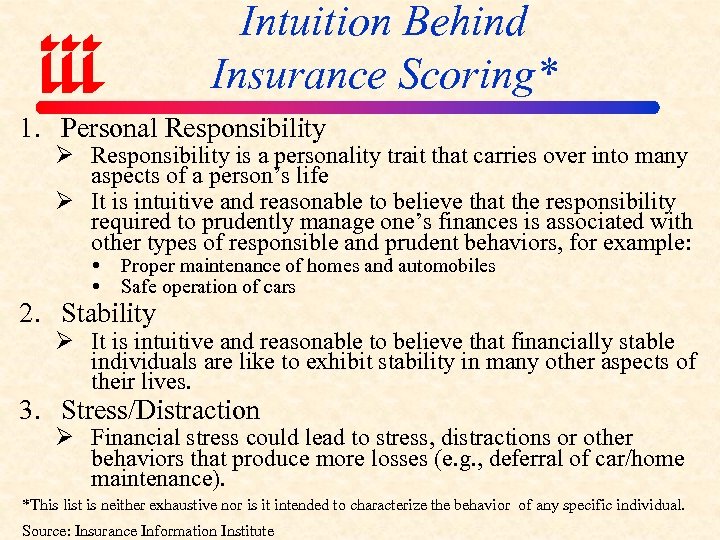

Intuition Behind Insurance Scoring* 1. Personal Responsibility Ø Responsibility is a personality trait that carries over into many aspects of a person’s life Ø It is intuitive and reasonable to believe that the responsibility required to prudently manage one’s finances is associated with other types of responsible and prudent behaviors, for example: Proper maintenance of homes and automobiles Safe operation of cars 2. Stability Ø It is intuitive and reasonable to believe that financially stable individuals are like to exhibit stability in many other aspects of their lives. 3. Stress/Distraction Ø Financial stress could lead to stress, distractions or other behaviors that produce more losses (e. g. , deferral of car/home maintenance). *This list is neither exhaustive nor is it intended to characterize the behavior of any specific individual. Source: Insurance Information Institute

Intuition Behind Insurance Scoring* 1. Personal Responsibility Ø Responsibility is a personality trait that carries over into many aspects of a person’s life Ø It is intuitive and reasonable to believe that the responsibility required to prudently manage one’s finances is associated with other types of responsible and prudent behaviors, for example: Proper maintenance of homes and automobiles Safe operation of cars 2. Stability Ø It is intuitive and reasonable to believe that financially stable individuals are like to exhibit stability in many other aspects of their lives. 3. Stress/Distraction Ø Financial stress could lead to stress, distractions or other behaviors that produce more losses (e. g. , deferral of car/home maintenance). *This list is neither exhaustive nor is it intended to characterize the behavior of any specific individual. Source: Insurance Information Institute

Risk & Loss Accounting for Differences in Losses by Risk Characteristics Makes Insurance Pricing More Equitable

Risk & Loss Accounting for Differences in Losses by Risk Characteristics Makes Insurance Pricing More Equitable

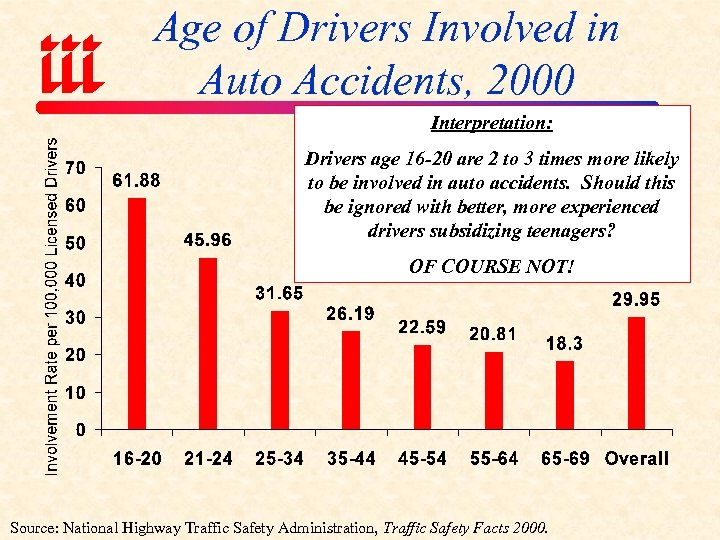

Age of Drivers Involved in Auto Accidents, 2000 Interpretation: Drivers age 16 -20 are 2 to 3 times more likely to be involved in auto accidents. Should this be ignored with better, more experienced drivers subsidizing teenagers? OF COURSE NOT! Source: National Highway Traffic Safety Administration, Traffic Safety Facts 2000.

Age of Drivers Involved in Auto Accidents, 2000 Interpretation: Drivers age 16 -20 are 2 to 3 times more likely to be involved in auto accidents. Should this be ignored with better, more experienced drivers subsidizing teenagers? OF COURSE NOT! Source: National Highway Traffic Safety Administration, Traffic Safety Facts 2000.

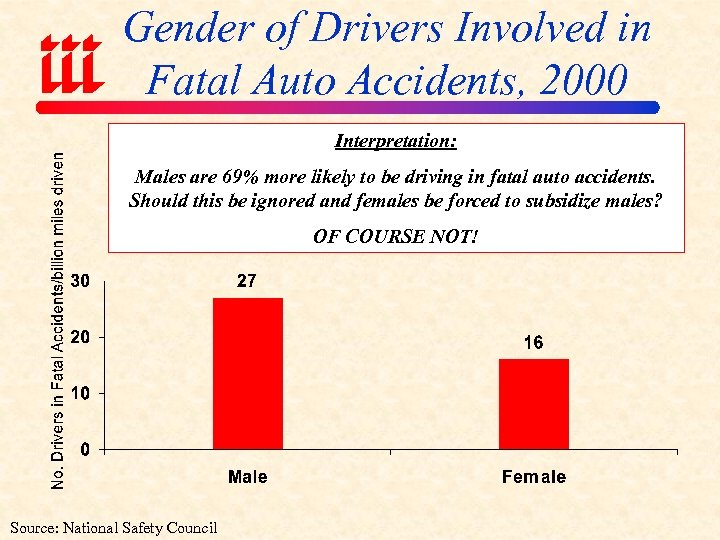

Gender of Drivers Involved in Fatal Auto Accidents, 2000 Interpretation: Males are 69% more likely to be driving in fatal auto accidents. Should this be ignored and females be forced to subsidize males? OF COURSE NOT! Source: National Safety Council

Gender of Drivers Involved in Fatal Auto Accidents, 2000 Interpretation: Males are 69% more likely to be driving in fatal auto accidents. Should this be ignored and females be forced to subsidize males? OF COURSE NOT! Source: National Safety Council

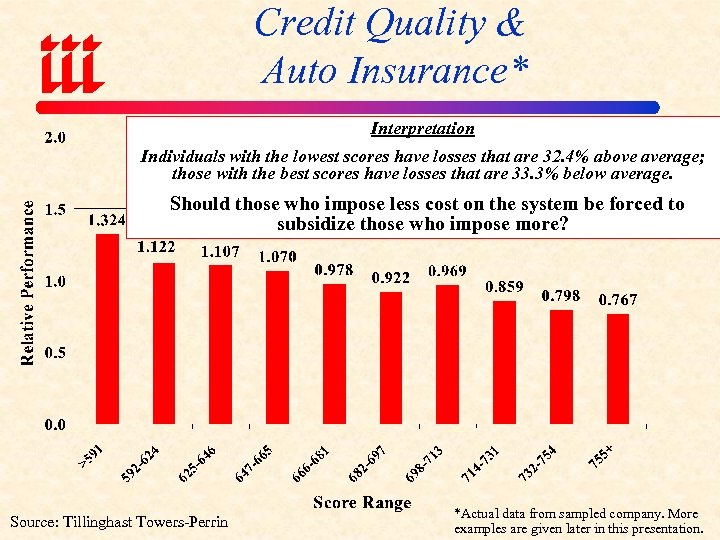

Credit Quality & Auto Insurance* Interpretation Individuals with the lowest scores have losses that are 32. 4% above average; those with the best scores have losses that are 33. 3% below average. Should those who impose less cost on the system be forced to subsidize those who impose more? Source: Tillinghast Towers-Perrin *Actual data from sampled company. More examples are given later in this presentation.

Credit Quality & Auto Insurance* Interpretation Individuals with the lowest scores have losses that are 32. 4% above average; those with the best scores have losses that are 33. 3% below average. Should those who impose less cost on the system be forced to subsidize those who impose more? Source: Tillinghast Towers-Perrin *Actual data from sampled company. More examples are given later in this presentation.

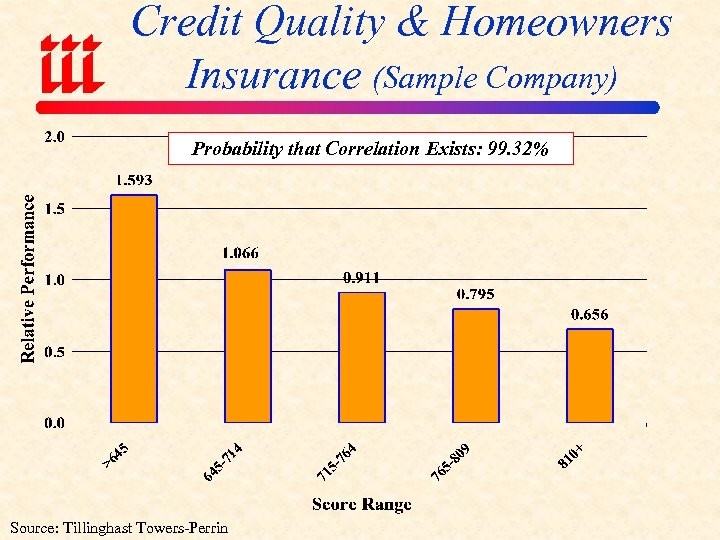

Credit Quality & Homeowners Insurance (Sample Company) Probability that Correlation Exists: 99. 32% Source: Tillinghast Towers-Perrin

Credit Quality & Homeowners Insurance (Sample Company) Probability that Correlation Exists: 99. 32% Source: Tillinghast Towers-Perrin

Actual Example: How Insurer Use of Credit Benefits Consumers & What Consumers Stand to Lose

Actual Example: How Insurer Use of Credit Benefits Consumers & What Consumers Stand to Lose

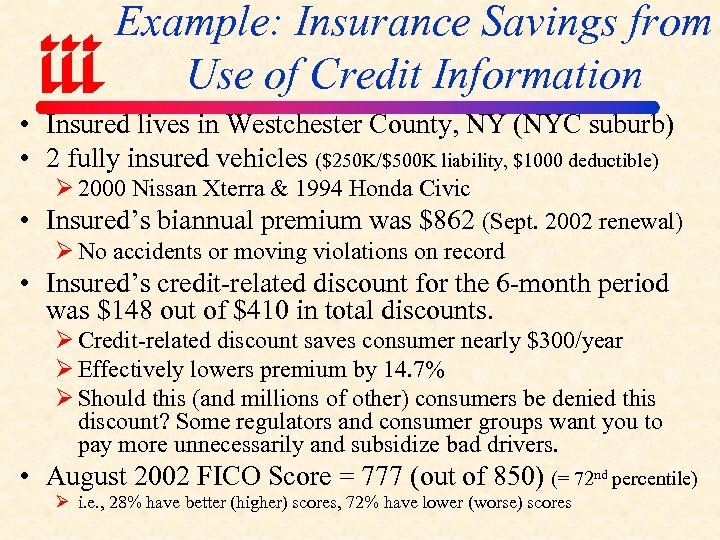

Example: Insurance Savings from Use of Credit Information • Insured lives in Westchester County, NY (NYC suburb) • 2 fully insured vehicles ($250 K/$500 K liability, $1000 deductible) Ø 2000 Nissan Xterra & 1994 Honda Civic • Insured’s biannual premium was $862 (Sept. 2002 renewal) Ø No accidents or moving violations on record • Insured’s credit-related discount for the 6 -month period was $148 out of $410 in total discounts. Ø Credit-related discount saves consumer nearly $300/year Ø Effectively lowers premium by 14. 7% Ø Should this (and millions of other) consumers be denied this discount? Some regulators and consumer groups want you to pay more unnecessarily and subsidize bad drivers. • August 2002 FICO Score = 777 (out of 850) (= 72 nd percentile) Ø i. e. , 28% have better (higher) scores, 72% have lower (worse) scores

Example: Insurance Savings from Use of Credit Information • Insured lives in Westchester County, NY (NYC suburb) • 2 fully insured vehicles ($250 K/$500 K liability, $1000 deductible) Ø 2000 Nissan Xterra & 1994 Honda Civic • Insured’s biannual premium was $862 (Sept. 2002 renewal) Ø No accidents or moving violations on record • Insured’s credit-related discount for the 6 -month period was $148 out of $410 in total discounts. Ø Credit-related discount saves consumer nearly $300/year Ø Effectively lowers premium by 14. 7% Ø Should this (and millions of other) consumers be denied this discount? Some regulators and consumer groups want you to pay more unnecessarily and subsidize bad drivers. • August 2002 FICO Score = 777 (out of 850) (= 72 nd percentile) Ø i. e. , 28% have better (higher) scores, 72% have lower (worse) scores

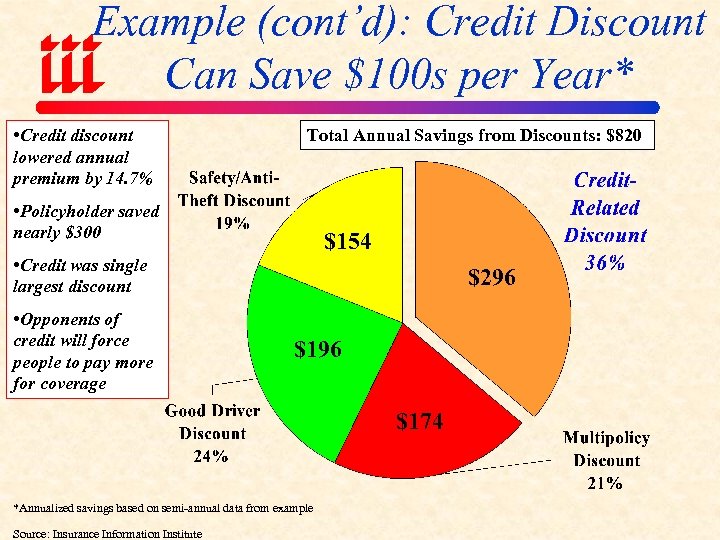

Example (cont’d): Credit Discount Can Save $100 s per Year* • Credit discount lowered annual premium by 14. 7% Total Annual Savings from Discounts: $820 • Policyholder saved nearly $300 $154 • Credit was single largest discount • Opponents of credit will force people to pay more for coverage $296 $174 *Annualized savings based on semi-annual data from example Source: Insurance Information Institute

Example (cont’d): Credit Discount Can Save $100 s per Year* • Credit discount lowered annual premium by 14. 7% Total Annual Savings from Discounts: $820 • Policyholder saved nearly $300 $154 • Credit was single largest discount • Opponents of credit will force people to pay more for coverage $296 $174 *Annualized savings based on semi-annual data from example Source: Insurance Information Institute

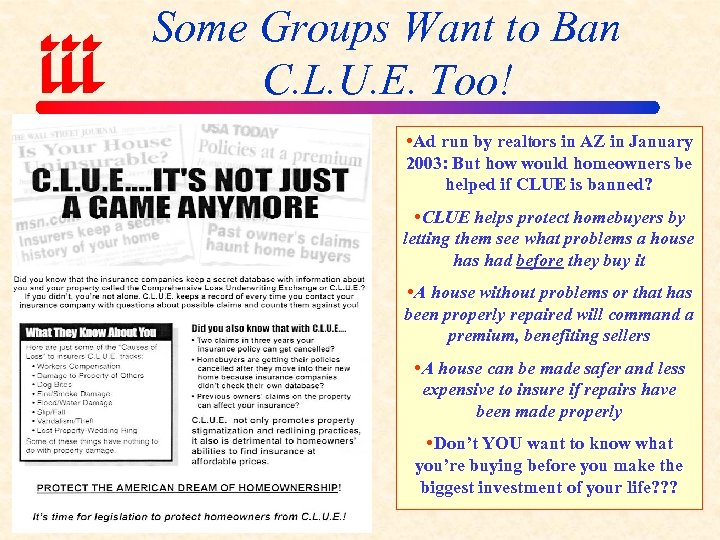

Some Groups Want to Ban C. L. U. E. Too! Ad run by realtors in AZ in January 2003: But how would homeowners be helped if CLUE is banned? CLUE helps protect homebuyers by letting them see what problems a house has had before they buy it A house without problems or that has been properly repaired will command a premium, benefiting sellers A house can be made safer and less expensive to insure if repairs have been made properly Don’t YOU want to know what you’re buying before you make the biggest investment of your life? ? ?

Some Groups Want to Ban C. L. U. E. Too! Ad run by realtors in AZ in January 2003: But how would homeowners be helped if CLUE is banned? CLUE helps protect homebuyers by letting them see what problems a house has had before they buy it A house without problems or that has been properly repaired will command a premium, benefiting sellers A house can be made safer and less expensive to insure if repairs have been made properly Don’t YOU want to know what you’re buying before you make the biggest investment of your life? ? ?

Insurers Support Good Public Policy in the Use of Credit Information in Insurance

Insurers Support Good Public Policy in the Use of Credit Information in Insurance

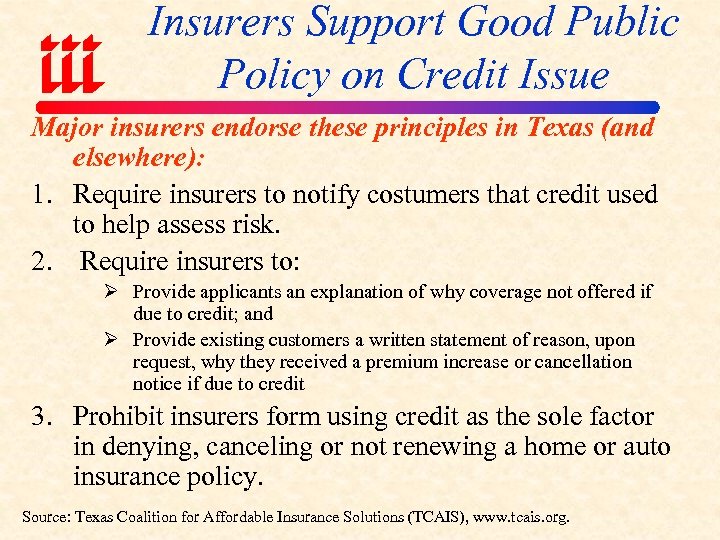

Insurers Support Good Public Policy on Credit Issue Major insurers endorse these principles in Texas (and elsewhere): 1. Require insurers to notify costumers that credit used to help assess risk. 2. Require insurers to: Ø Provide applicants an explanation of why coverage not offered if due to credit; and Ø Provide existing customers a written statement of reason, upon request, why they received a premium increase or cancellation notice if due to credit 3. Prohibit insurers form using credit as the sole factor in denying, canceling or not renewing a home or auto insurance policy. Source: Texas Coalition for Affordable Insurance Solutions (TCAIS), www. tcais. org.

Insurers Support Good Public Policy on Credit Issue Major insurers endorse these principles in Texas (and elsewhere): 1. Require insurers to notify costumers that credit used to help assess risk. 2. Require insurers to: Ø Provide applicants an explanation of why coverage not offered if due to credit; and Ø Provide existing customers a written statement of reason, upon request, why they received a premium increase or cancellation notice if due to credit 3. Prohibit insurers form using credit as the sole factor in denying, canceling or not renewing a home or auto insurance policy. Source: Texas Coalition for Affordable Insurance Solutions (TCAIS), www. tcais. org.

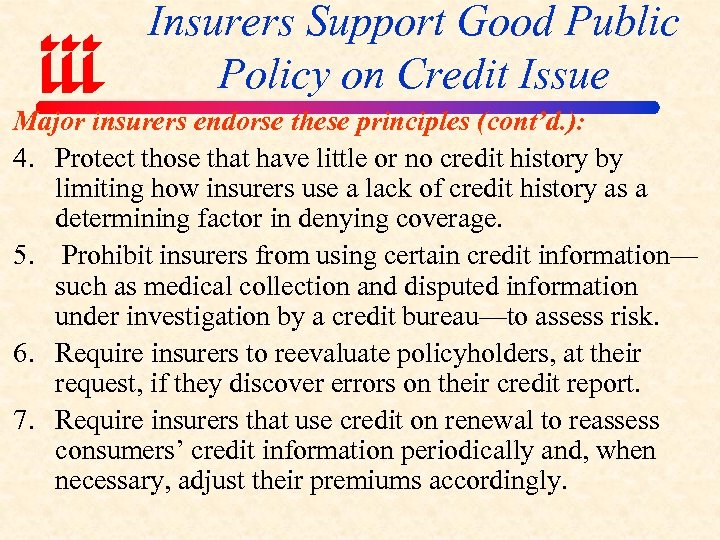

Insurers Support Good Public Policy on Credit Issue Major insurers endorse these principles (cont’d. ): 4. Protect those that have little or no credit history by limiting how insurers use a lack of credit history as a determining factor in denying coverage. 5. Prohibit insurers from using certain credit information— such as medical collection and disputed information under investigation by a credit bureau—to assess risk. 6. Require insurers to reevaluate policyholders, at their request, if they discover errors on their credit report. 7. Require insurers that use credit on renewal to reassess consumers’ credit information periodically and, when necessary, adjust their premiums accordingly.

Insurers Support Good Public Policy on Credit Issue Major insurers endorse these principles (cont’d. ): 4. Protect those that have little or no credit history by limiting how insurers use a lack of credit history as a determining factor in denying coverage. 5. Prohibit insurers from using certain credit information— such as medical collection and disputed information under investigation by a credit bureau—to assess risk. 6. Require insurers to reevaluate policyholders, at their request, if they discover errors on their credit report. 7. Require insurers that use credit on renewal to reassess consumers’ credit information periodically and, when necessary, adjust their premiums accordingly.

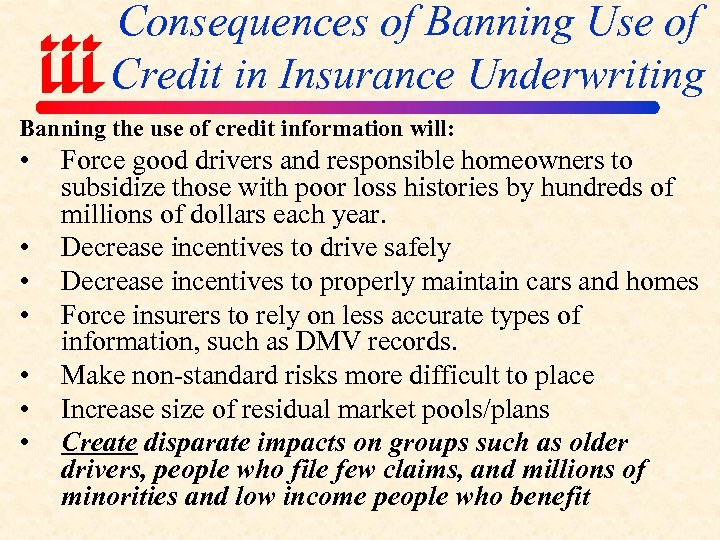

Consequences of Banning Use of Credit in Insurance Underwriting Banning the use of credit information will: • • Force good drivers and responsible homeowners to subsidize those with poor loss histories by hundreds of millions of dollars each year. Decrease incentives to drive safely Decrease incentives to properly maintain cars and homes Force insurers to rely on less accurate types of information, such as DMV records. Make non-standard risks more difficult to place Increase size of residual market pools/plans Create disparate impacts on groups such as older drivers, people who file few claims, and millions of minorities and low income people who benefit

Consequences of Banning Use of Credit in Insurance Underwriting Banning the use of credit information will: • • Force good drivers and responsible homeowners to subsidize those with poor loss histories by hundreds of millions of dollars each year. Decrease incentives to drive safely Decrease incentives to properly maintain cars and homes Force insurers to rely on less accurate types of information, such as DMV records. Make non-standard risks more difficult to place Increase size of residual market pools/plans Create disparate impacts on groups such as older drivers, people who file few claims, and millions of minorities and low income people who benefit

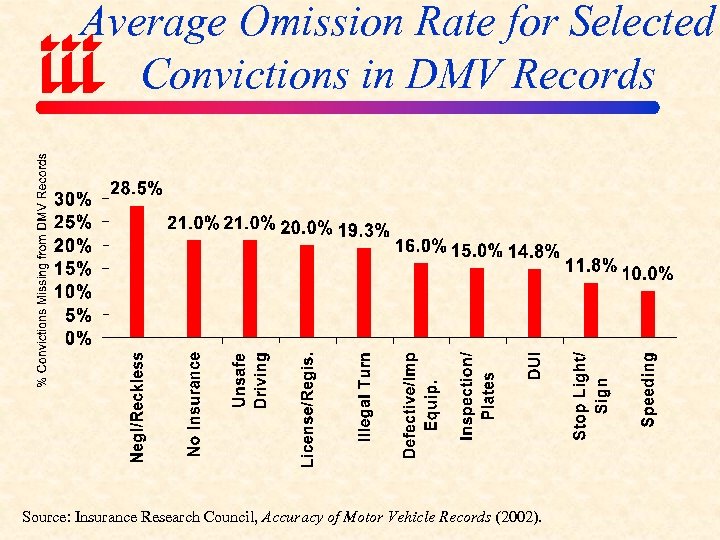

Average Omission Rate for Selected Convictions in DMV Records Source: Insurance Research Council, Accuracy of Motor Vehicle Records (2002).

Average Omission Rate for Selected Convictions in DMV Records Source: Insurance Research Council, Accuracy of Motor Vehicle Records (2002).

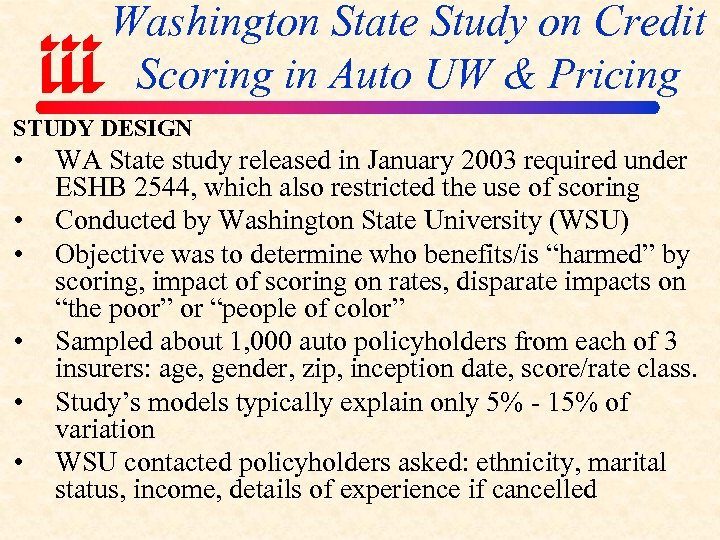

Washington State Study on Credit Scoring in Auto UW & Pricing STUDY DESIGN • • • WA State study released in January 2003 required under ESHB 2544, which also restricted the use of scoring Conducted by Washington State University (WSU) Objective was to determine who benefits/is “harmed” by scoring, impact of scoring on rates, disparate impacts on “the poor” or “people of color” Sampled about 1, 000 auto policyholders from each of 3 insurers: age, gender, zip, inception date, score/rate class. Study’s models typically explain only 5% - 15% of variation WSU contacted policyholders asked: ethnicity, marital status, income, details of experience if cancelled

Washington State Study on Credit Scoring in Auto UW & Pricing STUDY DESIGN • • • WA State study released in January 2003 required under ESHB 2544, which also restricted the use of scoring Conducted by Washington State University (WSU) Objective was to determine who benefits/is “harmed” by scoring, impact of scoring on rates, disparate impacts on “the poor” or “people of color” Sampled about 1, 000 auto policyholders from each of 3 insurers: age, gender, zip, inception date, score/rate class. Study’s models typically explain only 5% - 15% of variation WSU contacted policyholders asked: ethnicity, marital status, income, details of experience if cancelled

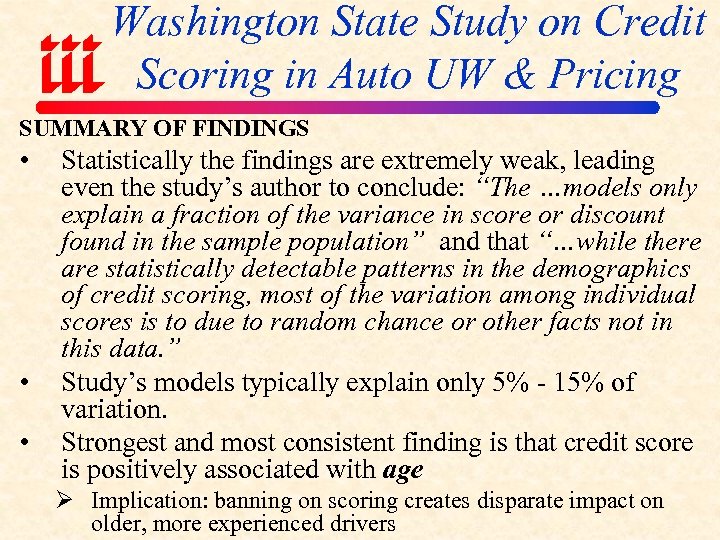

Washington State Study on Credit Scoring in Auto UW & Pricing SUMMARY OF FINDINGS • • • Statistically the findings are extremely weak, leading even the study’s author to conclude: “The …models only explain a fraction of the variance in score or discount found in the sample population” and that “…while there are statistically detectable patterns in the demographics of credit scoring, most of the variation among individual scores is to due to random chance or other facts not in this data. ” Study’s models typically explain only 5% - 15% of variation. Strongest and most consistent finding is that credit score is positively associated with age Ø Implication: banning on scoring creates disparate impact on older, more experienced drivers

Washington State Study on Credit Scoring in Auto UW & Pricing SUMMARY OF FINDINGS • • • Statistically the findings are extremely weak, leading even the study’s author to conclude: “The …models only explain a fraction of the variance in score or discount found in the sample population” and that “…while there are statistically detectable patterns in the demographics of credit scoring, most of the variation among individual scores is to due to random chance or other facts not in this data. ” Study’s models typically explain only 5% - 15% of variation. Strongest and most consistent finding is that credit score is positively associated with age Ø Implication: banning on scoring creates disparate impact on older, more experienced drivers

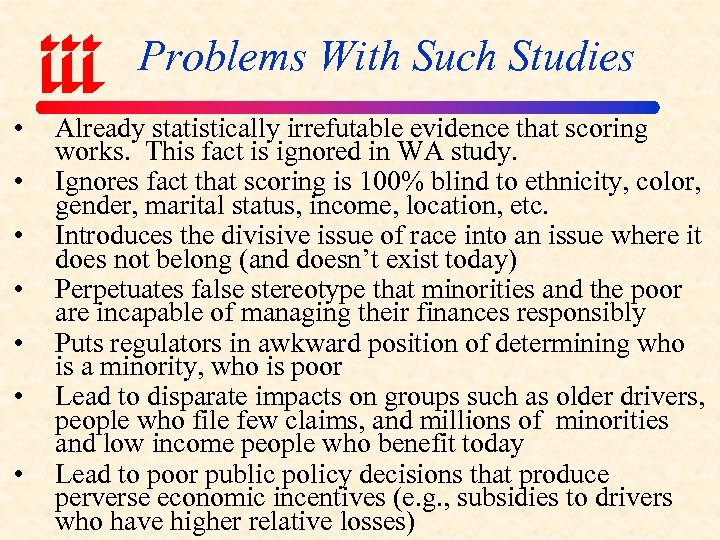

Problems With Such Studies • • Already statistically irrefutable evidence that scoring works. This fact is ignored in WA study. Ignores fact that scoring is 100% blind to ethnicity, color, gender, marital status, income, location, etc. Introduces the divisive issue of race into an issue where it does not belong (and doesn’t exist today) Perpetuates false stereotype that minorities and the poor are incapable of managing their finances responsibly Puts regulators in awkward position of determining who is a minority, who is poor Lead to disparate impacts on groups such as older drivers, people who file few claims, and millions of minorities and low income people who benefit today Lead to poor public policy decisions that produce perverse economic incentives (e. g. , subsidies to drivers who have higher relative losses)

Problems With Such Studies • • Already statistically irrefutable evidence that scoring works. This fact is ignored in WA study. Ignores fact that scoring is 100% blind to ethnicity, color, gender, marital status, income, location, etc. Introduces the divisive issue of race into an issue where it does not belong (and doesn’t exist today) Perpetuates false stereotype that minorities and the poor are incapable of managing their finances responsibly Puts regulators in awkward position of determining who is a minority, who is poor Lead to disparate impacts on groups such as older drivers, people who file few claims, and millions of minorities and low income people who benefit today Lead to poor public policy decisions that produce perverse economic incentives (e. g. , subsidies to drivers who have higher relative losses)

Insurance Information Institute On-Line If you would like a copy of this presentation, please give me your business card with e-mail address

Insurance Information Institute On-Line If you would like a copy of this presentation, please give me your business card with e-mail address