84fe9f46d3909072390c8b2b39e832b9.ppt

- Количество слайдов: 10

Uncertainty and Exclusive Dealing Work in early stages Eric B. Rasmusen, Dan R. and Catherine M. Dalton Professor, Kelley School of Business, Indiana University. Ralph Winter, Canada Research Chair in Business Economics and Policy, Sauder School of Business, U. of British Columbia. http: //www. sauder. ubc. ca/Faculty/People/Faculty_Members/Winter _Ralph No paper yet. December 10, 2013 1

Uncertainty and Exclusive Dealing Work in early stages Eric B. Rasmusen, Dan R. and Catherine M. Dalton Professor, Kelley School of Business, Indiana University. Ralph Winter, Canada Research Chair in Business Economics and Policy, Sauder School of Business, U. of British Columbia. http: //www. sauder. ubc. ca/Faculty/People/Faculty_Members/Winter _Ralph No paper yet. December 10, 2013 1

ZERO RISK AVERSION, BUT BANKRUPTCY COSTS MODEL 2 Two suppliers make widgets at constant marginal cost 5, zero fixed cost. One retailer has market power in the consumer market. He incurs fixed cost 200 and a constant marginal cost of 2, and charges R to consumers.

ZERO RISK AVERSION, BUT BANKRUPTCY COSTS MODEL 2 Two suppliers make widgets at constant marginal cost 5, zero fixed cost. One retailer has market power in the consumer market. He incurs fixed cost 200 and a constant marginal cost of 2, and charges R to consumers.

Order of Play 1. The suppliers each offer the retailer any contract they wish, simultaneously. It will be of the form (Q 1 a, P 1 a) vs. (Q 1 b, P 1 b), and may require exclusive dealing or not. 2. The retailer accepts or rejects. 3. Nature chooses Strong consumer demand with probability. 5, Weak otherwise. If it strong, 100 units can be sold at price 10 or lower, 0 at higher prices. If it is weak, 50 units can be sold at price 10 or lower, 0 at higher prices. 4. The producers simultaneously choose spot prices S 1 and S 2. 5. The retailer decides how many widgets to buy, and resells them at price R. 6. If the retailer’s profit would be negative, it goes bankrupt and must quickly sell its shop at 800 below its longterm value. 3

Order of Play 1. The suppliers each offer the retailer any contract they wish, simultaneously. It will be of the form (Q 1 a, P 1 a) vs. (Q 1 b, P 1 b), and may require exclusive dealing or not. 2. The retailer accepts or rejects. 3. Nature chooses Strong consumer demand with probability. 5, Weak otherwise. If it strong, 100 units can be sold at price 10 or lower, 0 at higher prices. If it is weak, 50 units can be sold at price 10 or lower, 0 at higher prices. 4. The producers simultaneously choose spot prices S 1 and S 2. 5. The retailer decides how many widgets to buy, and resells them at price R. 6. If the retailer’s profit would be negative, it goes bankrupt and must quickly sell its shop at 800 below its longterm value. 3

Equilibrium The resale price will be R=10 and the spot price for inputs will be S 1=S 2 =5. The two suppliers will offer only exclusive-dealing contracts, and they will offer the identical contract. The quantity choices will be Qa= 100 and Qb =50. The profit must be zero overall when they compete against each other, so. 5*100(Pa-5) +. 5*50(Pb-5) =0 or 2 Pa+Pb =15 This allows for a lot of price combinations, since it’s one equation in two unknowns. But the retailer will not accept a contract that might result in bankruptcy, so it requires that 100(10 -Pa-2) – 200 >= 0, so Pa <= 6. and 50(10 -Pb-2) – 200 >= 0, so Pb <= 4. 4

Equilibrium The resale price will be R=10 and the spot price for inputs will be S 1=S 2 =5. The two suppliers will offer only exclusive-dealing contracts, and they will offer the identical contract. The quantity choices will be Qa= 100 and Qb =50. The profit must be zero overall when they compete against each other, so. 5*100(Pa-5) +. 5*50(Pb-5) =0 or 2 Pa+Pb =15 This allows for a lot of price combinations, since it’s one equation in two unknowns. But the retailer will not accept a contract that might result in bankruptcy, so it requires that 100(10 -Pa-2) – 200 >= 0, so Pa <= 6. and 50(10 -Pb-2) – 200 >= 0, so Pb <= 4. 4

Pb=4, Pa = 5. 5 Try Pb=4, Pa = 5. 5. Is this incentive compatible? We need for the retailer to choose the right contract when demand is strong, so we need: 100(10 -Pa-2) – 200 >= 50(10 -Pb-2) – 200 so 8 +Pb >= 2 Pa. That is OK because 8 + 4 >= 2*5. 5. A spot contract would be no good because the retailer would have a. 5 chance of going bankrupt. A non-exclusive contract would be no good, because in BOOM times the retailer would pretend it 5 was BUST and purchase as much extra as needed from the other supplier.

Pb=4, Pa = 5. 5 Try Pb=4, Pa = 5. 5. Is this incentive compatible? We need for the retailer to choose the right contract when demand is strong, so we need: 100(10 -Pa-2) – 200 >= 50(10 -Pb-2) – 200 so 8 +Pb >= 2 Pa. That is OK because 8 + 4 >= 2*5. 5. A spot contract would be no good because the retailer would have a. 5 chance of going bankrupt. A non-exclusive contract would be no good, because in BOOM times the retailer would pretend it 5 was BUST and purchase as much extra as needed from the other supplier.

Risk Aversion Instead It is easy to make a version of this with no bankruptcy costs, but with a risk-averse retailer and risk-neutral suppliers. (or, keep the bankruptcy cost– it doesn’t matter) The optimal contract would be constructed to yield the retailer the same profit in both BOOM and BUST. 6

Risk Aversion Instead It is easy to make a version of this with no bankruptcy costs, but with a risk-averse retailer and risk-neutral suppliers. (or, keep the bankruptcy cost– it doesn’t matter) The optimal contract would be constructed to yield the retailer the same profit in both BOOM and BUST. 6

What about Unspecified Price? Some price has to be specified in the contract. Otherwise, there’s no possible efficiency gain. The supplier would supply in the bust at a low enough price. But the model will work with just a “minimum guaranteed deal” I think: e. g. , in the bankrtupcymodel, the retailer is guaranteed the possibiltiy of Qb=50, Pb=4. 7

What about Unspecified Price? Some price has to be specified in the contract. Otherwise, there’s no possible efficiency gain. The supplier would supply in the bust at a low enough price. But the model will work with just a “minimum guaranteed deal” I think: e. g. , in the bankrtupcymodel, the retailer is guaranteed the possibiltiy of Qb=50, Pb=4. 7

The Floor Deal Model Go back to the bankruptcy model with zero risk aversion. But now suppose the supplier will only offer a minimum deal (reason: it’s hard to know in advance what P, Q terms to set, but it’s possible to set a floor— suboptimal probably--- without much trouble) 8

The Floor Deal Model Go back to the bankruptcy model with zero risk aversion. But now suppose the supplier will only offer a minimum deal (reason: it’s hard to know in advance what P, Q terms to set, but it’s possible to set a floor— suboptimal probably--- without much trouble) 8

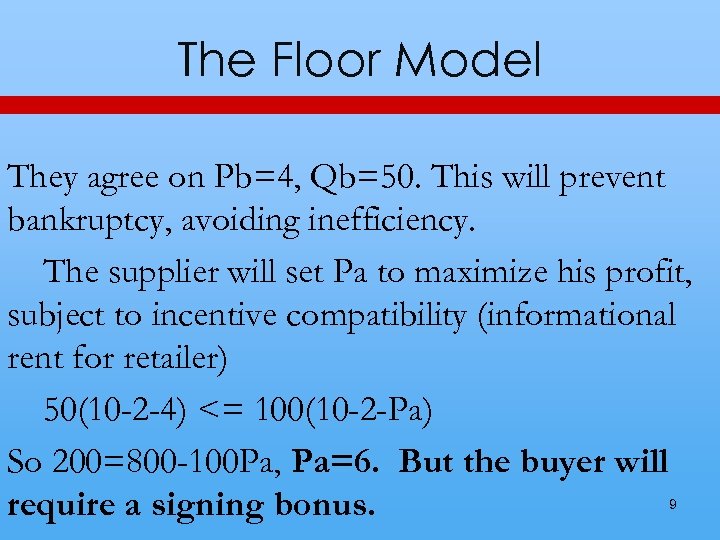

The Floor Model They agree on Pb=4, Qb=50. This will prevent bankruptcy, avoiding inefficiency. The supplier will set Pa to maximize his profit, subject to incentive compatibility (informational rent for retailer) 50(10 -2 -4) <= 100(10 -2 -Pa) So 200=800 -100 Pa, Pa=6. But the buyer will require a signing bonus. 9

The Floor Model They agree on Pb=4, Qb=50. This will prevent bankruptcy, avoiding inefficiency. The supplier will set Pa to maximize his profit, subject to incentive compatibility (informational rent for retailer) 50(10 -2 -4) <= 100(10 -2 -Pa) So 200=800 -100 Pa, Pa=6. But the buyer will require a signing bonus. 9

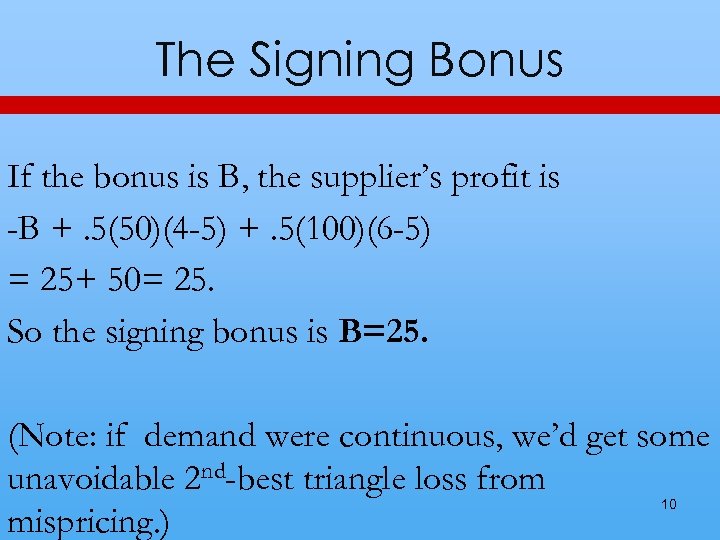

The Signing Bonus If the bonus is B, the supplier’s profit is -B +. 5(50)(4 -5) +. 5(100)(6 -5) = 25+ 50= 25. So the signing bonus is B=25. (Note: if demand were continuous, we’d get some unavoidable 2 nd-best triangle loss from mispricing. ) 10

The Signing Bonus If the bonus is B, the supplier’s profit is -B +. 5(50)(4 -5) +. 5(100)(6 -5) = 25+ 50= 25. So the signing bonus is B=25. (Note: if demand were continuous, we’d get some unavoidable 2 nd-best triangle loss from mispricing. ) 10