ebc56ac39af6d091a4bb1e8bacb3c48b.ppt

- Количество слайдов: 13

UN General Assembly – Thematic Debate 31 July 2007 Michael Liebreich, Chairman & CEO © New Energy Finance, 2007

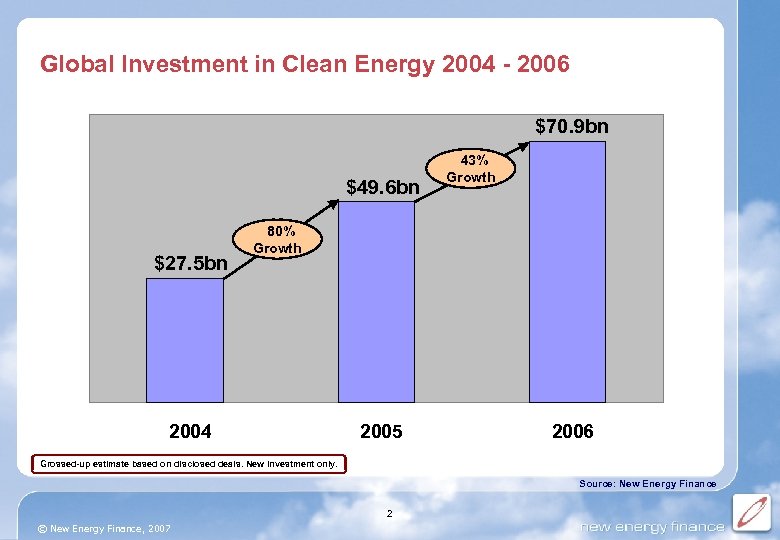

Global Investment in Clean Energy 2004 - 2006 $70. 9 bn $49. 6 bn $27. 5 bn 43% Growth 80% Growth 2004 2005 2006 Grossed-up estimate based on disclosed deals. New investment only. Source: New Energy Finance 2 © New Energy Finance, 2007

UN Report: Global Trends in Sustainable Energy Investment 2007 “Transactions leap to record $100 billion in 2006; Renewables Shed Fringe Image” Press Release, United Nations Environment Programme Sustainable Energy Finance Initiative “The report clearly shows that […] the finance sector believes the existing technologies of today will ‘decarbonise’ the energy mix” Yvo de Boer, Executive Secretary United Nations Convention on Climate Change Source: United Nations 3 © New Energy Finance, 2007

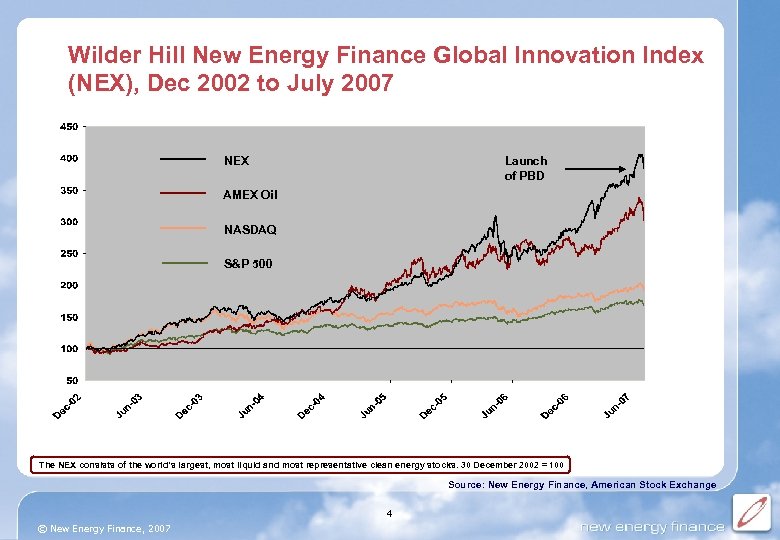

Wilder Hill New Energy Finance Global Innovation Index (NEX), Dec 2002 to July 2007 NEX Launch of PBD AMEX Oil NASDAQ S&P 500 The NEX consists of the world’s largest, most liquid and most representative clean energy stocks. 30 December 2002 = 100 Source: New Energy Finance, American Stock Exchange 4 © New Energy Finance, 2007

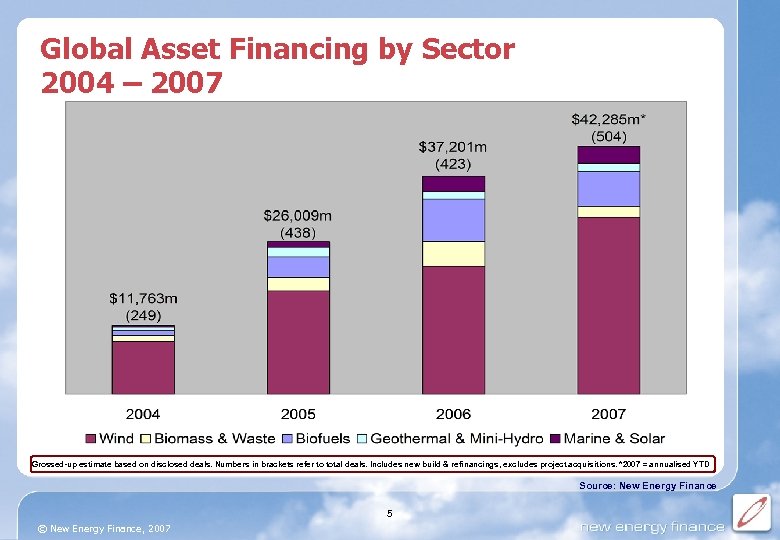

Global Asset Financing by Sector 2004 – 2007 Grossed-up estimate based on disclosed deals. Numbers in brackets refer to total deals. Includes new build & refinancings, excludes project acquisitions. *2007 = annualised YTD Source: New Energy Finance 5 © New Energy Finance, 2007

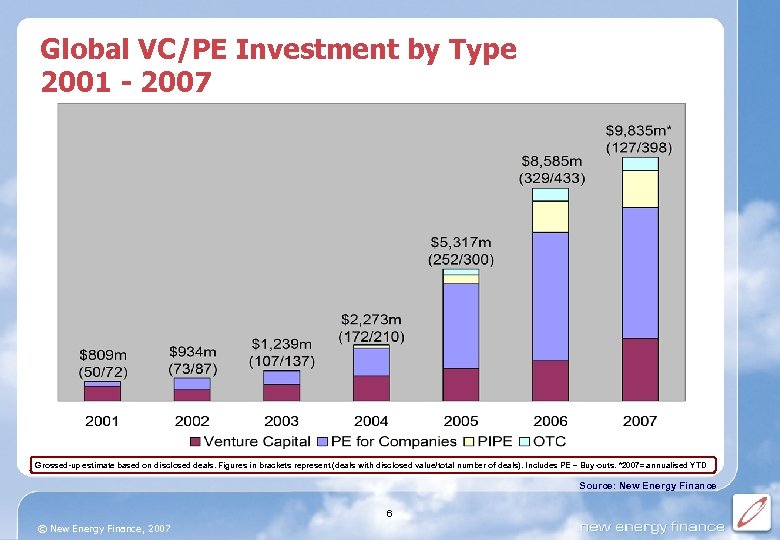

Global VC/PE Investment by Type 2001 - 2007 Grossed-up estimate based on disclosed deals. Figures in brackets represent (deals with disclosed value/total number of deals). Includes PE – Buy-outs. *2007= annualised YTD Source: New Energy Finance 6 © New Energy Finance, 2007

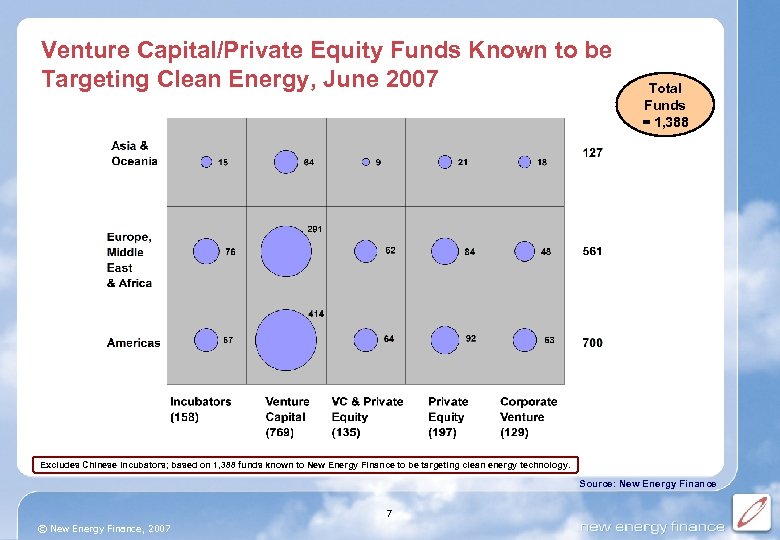

Venture Capital/Private Equity Funds Known to be Targeting Clean Energy, June 2007 Total Funds = 1, 388 Excludes Chinese incubators; based on 1, 388 funds known to New Energy Finance to be targeting clean energy technology. Source: New Energy Finance 7 © New Energy Finance, 2007

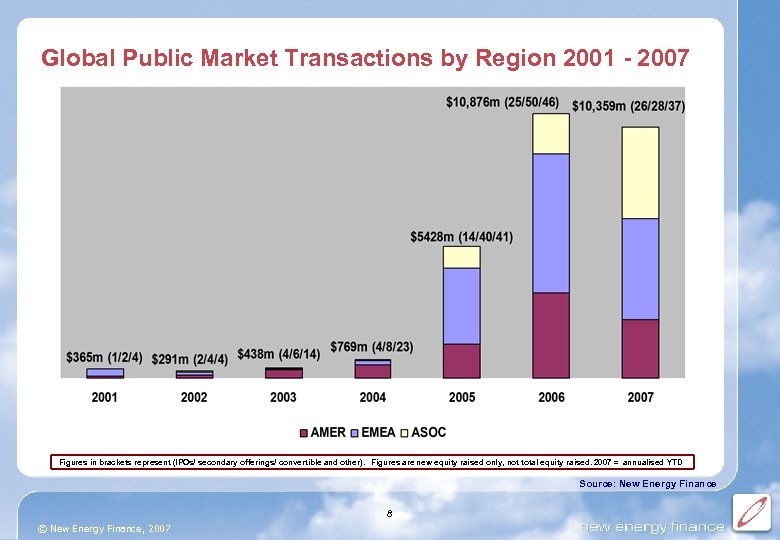

Global Public Market Transactions by Region 2001 - 2007 Figures in brackets represent (IPOs/ secondary offerings/ convertible and other). Figures are new equity raised only, not total equity raised. 2007 = annualised YTD Source: New Energy Finance 8 © New Energy Finance, 2007

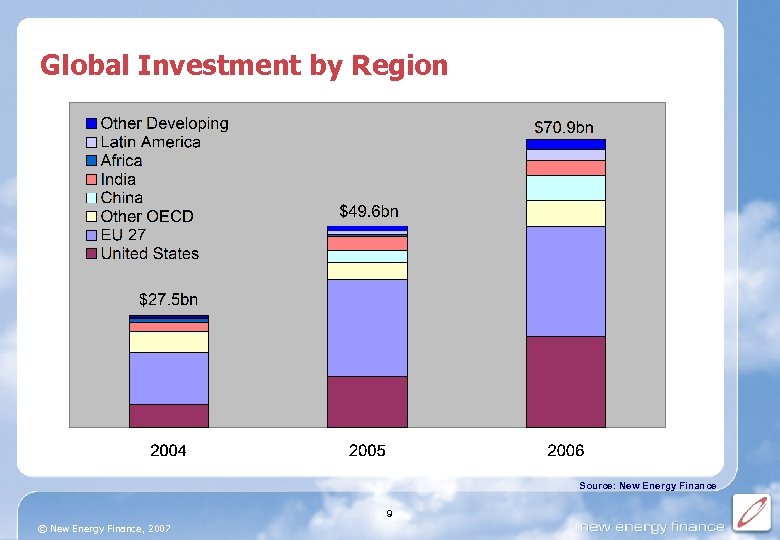

Global Investment by Region Source: New Energy Finance 9 © New Energy Finance, 2007

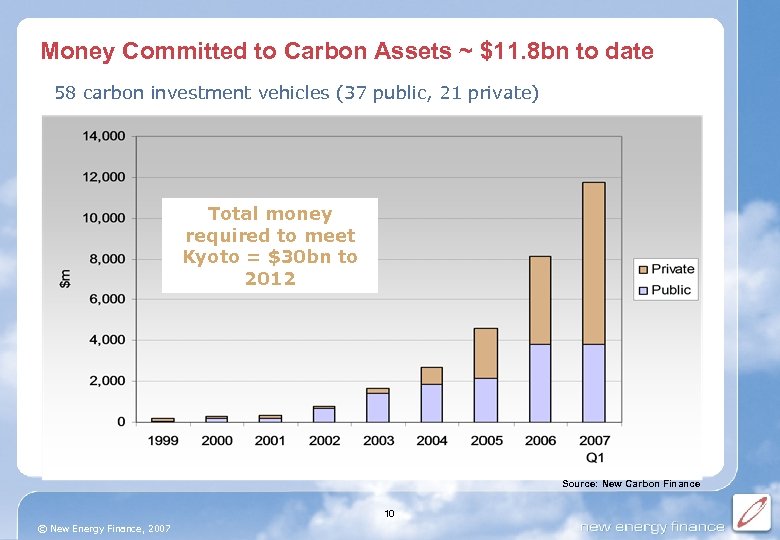

Money Committed to Carbon Assets ~ $11. 8 bn to date 58 carbon investment vehicles (37 public, 21 private) Total money required to meet Kyoto = $30 bn to 2012 Source: New Carbon Finance 10 © New Energy Finance, 2007

In summary There is no shortage of capital for clean energy companies and projects We are seeing very rapid growth rates in investment in all asset classes and countries Investment is diversifying: – From Europe to global – From wind to multi-sector – From power generation to energy efficiency and infrastructure Wind industry in particular has reached scale and is maturing and consolidating rapidly 11 © New Energy Finance, 2007

Issues and Challenges… Although capital is abundant, not enough is flowing to the developing world – particularly slower developing countries Valuations are currently in risky territory, particularly in the light of recent capital market instability Solar PV sector is being held back by silicon bottleneck, and when this eases, prices and margins are likely to collapse Biofuels will be more about global trade than about technology US carbon markets will be minor players unless there is a federal system 12 © New Energy Finance, 2007

About the company New Energy Finance New Carbon Finance www. newenergyfinance. com www. newcarbonfinance. com tel: +44 20 7467 6760 email: sales@newenergyfinance. com News service Newsletters Deal & investor databases Research Analysis Consulting Carbon price forecasting Advisory support 13 © New Energy Finance, 2007

ebc56ac39af6d091a4bb1e8bacb3c48b.ppt