17e93280517898baed8907d93eb4402d.ppt

- Количество слайдов: 19

UECM 2433 – Introduction to Risk Management and Insurance. Tutorial: Group 5 Prepared by: ü Chay Pui Yinn(0900864) ü Soh Wei Yen(0802727) ü Teo Ai Lee(0900210)

UECM 2433 – Introduction to Risk Management and Insurance. Tutorial: Group 5 Prepared by: ü Chay Pui Yinn(0900864) ü Soh Wei Yen(0802727) ü Teo Ai Lee(0900210)

Insurance products: Life insurance: Ø Great Eastern (Great Enhance Living Care) Ø Uni Asia (Uni. CI Protector Plus) Ø Allianz (Power. Link) Medical insurance: Ø Allianz (Care -Individual) Ø OCBC (Medic - Pac) Ø Prudential (Pru. Health)

Insurance products: Life insurance: Ø Great Eastern (Great Enhance Living Care) Ø Uni Asia (Uni. CI Protector Plus) Ø Allianz (Power. Link) Medical insurance: Ø Allianz (Care -Individual) Ø OCBC (Medic - Pac) Ø Prudential (Pru. Health)

Life Insurance

Life Insurance

Allianz Power. Link One regular premium investment-linked plan Coverage: Ø Critical illness Ø Medical and Health Ø Regular Saving, Ø Waiver of Premium Ø Death or Total and Permanent Disability (TPD)

Allianz Power. Link One regular premium investment-linked plan Coverage: Ø Critical illness Ø Medical and Health Ø Regular Saving, Ø Waiver of Premium Ø Death or Total and Permanent Disability (TPD)

Great Eastern Great Enhance Living Care Whole life and deferred whole life insurance plan Coverage: Ø Critical illness Ø Death or Total and Permanent Disability (TPD)

Great Eastern Great Enhance Living Care Whole life and deferred whole life insurance plan Coverage: Ø Critical illness Ø Death or Total and Permanent Disability (TPD)

Uni Asia Uni. CI Protector Plus Whole life plan Coverage: Ø Critical illness Ø Death or Total and Permanent Disability (TPD) Ø Accidental TPD Ø Accidental Death Ø Funeral expenses Ø Terminal illness

Uni Asia Uni. CI Protector Plus Whole life plan Coverage: Ø Critical illness Ø Death or Total and Permanent Disability (TPD) Ø Accidental TPD Ø Accidental Death Ø Funeral expenses Ø Terminal illness

Differences between this 3 life product

Differences between this 3 life product

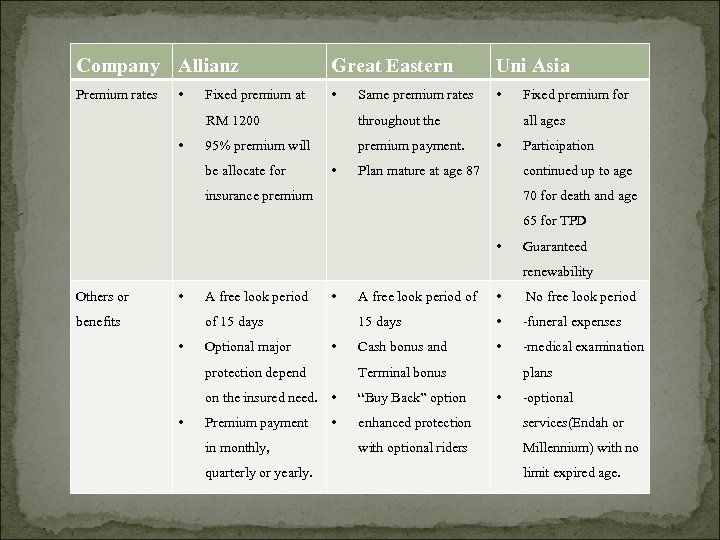

Company Allianz Premium rates • Fixed premium at Great Eastern Uni Asia • • Same premium rates RM 1200 • throughout the 95% premium will premium payment. be allocate for • Fixed premium for all ages • Plan mature at age 87 Participation continued up to age insurance premium 70 for death and age 65 for TPD • Guaranteed renewability Others or • benefits A free look period • • Optional major • • No free look period 15 days of 15 days A free look period of • -funeral expenses Cash bonus and • -medical examination protection depend on the insured need. • • Terminal bonus “Buy Back” option Premium payment in monthly, quarterly or yearly. • plans • -optional enhanced protection services(Endah or with optional riders Millennium) with no limit expired age.

Company Allianz Premium rates • Fixed premium at Great Eastern Uni Asia • • Same premium rates RM 1200 • throughout the 95% premium will premium payment. be allocate for • Fixed premium for all ages • Plan mature at age 87 Participation continued up to age insurance premium 70 for death and age 65 for TPD • Guaranteed renewability Others or • benefits A free look period • • Optional major • • No free look period 15 days of 15 days A free look period of • -funeral expenses Cash bonus and • -medical examination protection depend on the insured need. • • Terminal bonus “Buy Back” option Premium payment in monthly, quarterly or yearly. • plans • -optional enhanced protection services(Endah or with optional riders Millennium) with no limit expired age.

Medical Insurance

Medical Insurance

Allianz Care –Individual Hospital and Surgical Insurance Ø surgical fees, Ø hospital supplies & services, Ø pre-hospital diagnosis test Major medical insurance Ø monthly outpatient cancer treatment Ø emergency accidental outpatient treatment Long-term Healthcare Ø Home nursing care

Allianz Care –Individual Hospital and Surgical Insurance Ø surgical fees, Ø hospital supplies & services, Ø pre-hospital diagnosis test Major medical insurance Ø monthly outpatient cancer treatment Ø emergency accidental outpatient treatment Long-term Healthcare Ø Home nursing care

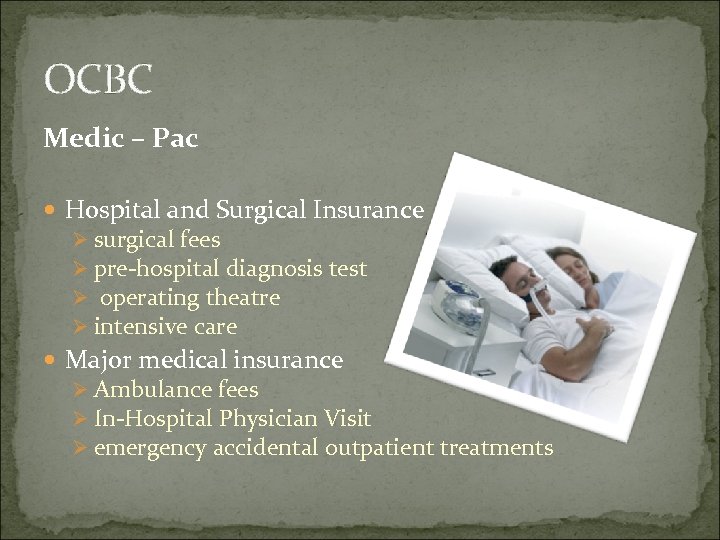

OCBC Medic – Pac Hospital and Surgical Insurance Ø surgical fees Ø pre-hospital diagnosis test Ø operating theatre Ø intensive care Major medical insurance Ø Ambulance fees Ø In-Hospital Physician Visit Ø emergency accidental outpatient treatments

OCBC Medic – Pac Hospital and Surgical Insurance Ø surgical fees Ø pre-hospital diagnosis test Ø operating theatre Ø intensive care Major medical insurance Ø Ambulance fees Ø In-Hospital Physician Visit Ø emergency accidental outpatient treatments

Long-term Healthcare Ø nursing at home Ø daily maximum up to 60 days Home Savings Accounts Ø Government service tax is insured

Long-term Healthcare Ø nursing at home Ø daily maximum up to 60 days Home Savings Accounts Ø Government service tax is insured

Prudential Pru. Health Hospital and Surgical Insurance Ø hospital daily room& board(120 days a year) Ø pre and post-hospitalization treatment Ø surgical in hospital related services. Ø day surgery Ø intensive care

Prudential Pru. Health Hospital and Surgical Insurance Ø hospital daily room& board(120 days a year) Ø pre and post-hospitalization treatment Ø surgical in hospital related services. Ø day surgery Ø intensive care

Major medical insurance Ø cancer treatment Ø kidney dialysis Ø emergency treatment for accidental injury (annual limit) Long-term Healthcare Ø Home nursing care(180 days per lifetime)

Major medical insurance Ø cancer treatment Ø kidney dialysis Ø emergency treatment for accidental injury (annual limit) Long-term Healthcare Ø Home nursing care(180 days per lifetime)

Differences between this 3 medical product

Differences between this 3 medical product

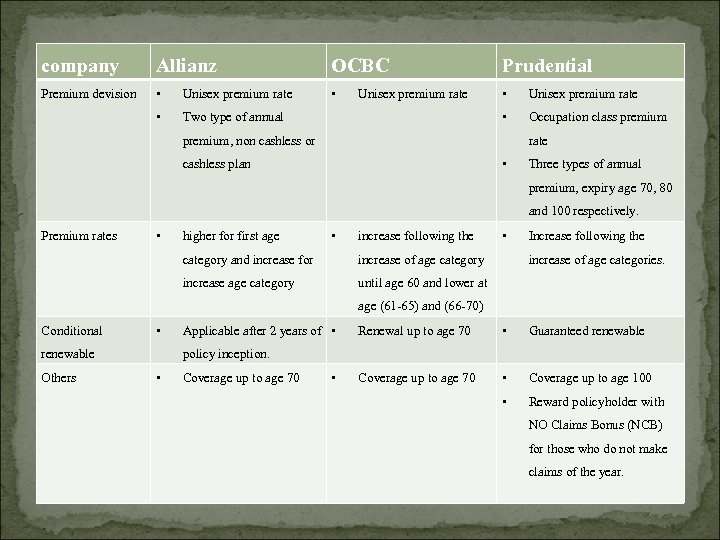

company Allianz OCBC Prudential Premium devision • Unisex premium rate • Two type of annual • Occupation class premium Unisex premium rate premium, non cashless or rate • cashless plan Three types of annual premium, expiry age 70, 80 and 100 respectively. Premium rates • higher for first age • increase following the category and increase for increase of age category increase age category • Increase following the increase of age categories. until age 60 and lower at age (61 -65) and (66 -70) Conditional • renewable Others Applicable after 2 years of • Renewal up to age 70 • Guaranteed renewable Coverage up to age 70 • Coverage up to age 100 • Reward policyholder with policy inception. • Coverage up to age 70 • NO Claims Bonus (NCB) for those who do not make claims of the year.

company Allianz OCBC Prudential Premium devision • Unisex premium rate • Two type of annual • Occupation class premium Unisex premium rate premium, non cashless or rate • cashless plan Three types of annual premium, expiry age 70, 80 and 100 respectively. Premium rates • higher for first age • increase following the category and increase for increase of age category increase age category • Increase following the increase of age categories. until age 60 and lower at age (61 -65) and (66 -70) Conditional • renewable Others Applicable after 2 years of • Renewal up to age 70 • Guaranteed renewable Coverage up to age 70 • Coverage up to age 100 • Reward policyholder with policy inception. • Coverage up to age 70 • NO Claims Bonus (NCB) for those who do not make claims of the year.

The Underwriting Consideration the insurable interest should be valid The premiums payable under the policy is the amount that is affordable by the insured the plan serves the needs to the insured. most of the medical insurance set few plan(at least four) with different premiums amount according to different occupation group. a waiting period of 30 days from the commencement date of insurance for medical examination of the insured to examine whether the insured suit the term and condition of the policy.

The Underwriting Consideration the insurable interest should be valid The premiums payable under the policy is the amount that is affordable by the insured the plan serves the needs to the insured. most of the medical insurance set few plan(at least four) with different premiums amount according to different occupation group. a waiting period of 30 days from the commencement date of insurance for medical examination of the insured to examine whether the insured suit the term and condition of the policy.

The Most Interesting Product Life insurance: Great Enhanced Living Care (Great Eastern) Ø the unique of “Buy Back” option Ø when critical illness claim is made, the chance of getting insurance is decrease. Ø able to “Buy Back” the death benefit portion of the policy up to the maximum of the basic sum assured Ø payments pay by cash, GIRO, banker’s order, cheque or credit card annually, half yearly, quarterly or monthly Ø cash bonus and terminal bonus depend on the operating and investments results.

The Most Interesting Product Life insurance: Great Enhanced Living Care (Great Eastern) Ø the unique of “Buy Back” option Ø when critical illness claim is made, the chance of getting insurance is decrease. Ø able to “Buy Back” the death benefit portion of the policy up to the maximum of the basic sum assured Ø payments pay by cash, GIRO, banker’s order, cheque or credit card annually, half yearly, quarterly or monthly Ø cash bonus and terminal bonus depend on the operating and investments results.

The Most Interesting Product Health Insurance: Pru. Health (Prudential) Ø rewards No Claims Bonus(NCB) plan to the insured with yearly bonuses of up to RM 500 when the insured do not make a claim while continue enjoy medical coverage Ø a regular premium medical rider that gives bonuses when the insured are healthy Ø covering the medical bills even up to age 100

The Most Interesting Product Health Insurance: Pru. Health (Prudential) Ø rewards No Claims Bonus(NCB) plan to the insured with yearly bonuses of up to RM 500 when the insured do not make a claim while continue enjoy medical coverage Ø a regular premium medical rider that gives bonuses when the insured are healthy Ø covering the medical bills even up to age 100