a16b596946a080502e367da124773a4c.ppt

- Количество слайдов: 33

UCL Pension Services Changes to Pension Tax Relief Limits Annual Allowance from 6 th April 2011 Life Time Allowance from 6 th April 2012 February 2012 workshops UCL Pension Services

UCL Pension Services Changes to Pension Tax Relief Limits Annual Allowance from 6 th April 2011 Life Time Allowance from 6 th April 2012 February 2012 workshops UCL Pension Services

Changes to the Annual Allowance and Life Time Allowance – reduced limits Today’s presenters: Fenella Needham – Pensions Manager UCL • Annual Allowance and Life Time Allowance Gary O’Neill – Austin Chapel Independent Financial Advisers • Will you need financial advice? In attendance Colleagues from UCL Pension Services

Changes to the Annual Allowance and Life Time Allowance – reduced limits Today’s presenters: Fenella Needham – Pensions Manager UCL • Annual Allowance and Life Time Allowance Gary O’Neill – Austin Chapel Independent Financial Advisers • Will you need financial advice? In attendance Colleagues from UCL Pension Services

Overview for today • What is the Annual Allowance (AA) and Life Time Allowance (LTA)? • Why have they changed? • How are the AA and LTA calculated and what might be the potential tax implications for you • Impact of any future pay increase or payment of any future AVC’s • Actions you need to consider going forward • Consider independent financial advice

Overview for today • What is the Annual Allowance (AA) and Life Time Allowance (LTA)? • Why have they changed? • How are the AA and LTA calculated and what might be the potential tax implications for you • Impact of any future pay increase or payment of any future AVC’s • Actions you need to consider going forward • Consider independent financial advice

Outcomes for today • You have a good understanding of the AA tax changes implemented in April 2011 – Finance Act 2011 • You are aware of the potential tax impact caused by future pay increases, continued accrual of pension benefits whilst in any (but especially a final salary) pension scheme and/or paying AVCs • You know when & from whom to get the required information necessary for you to calculate the AA and assess whether any tax charge may be due • You are aware of the possibility of applying for Fixed Protection before 5 th April 2012 due to the reduced LTA limit • You know where to get pensions information and independent financial advice

Outcomes for today • You have a good understanding of the AA tax changes implemented in April 2011 – Finance Act 2011 • You are aware of the potential tax impact caused by future pay increases, continued accrual of pension benefits whilst in any (but especially a final salary) pension scheme and/or paying AVCs • You know when & from whom to get the required information necessary for you to calculate the AA and assess whether any tax charge may be due • You are aware of the possibility of applying for Fixed Protection before 5 th April 2012 due to the reduced LTA limit • You know where to get pensions information and independent financial advice

Why have the AA and LTA changed? • • • AA and LTA were first introduced April 2006 – Finance Act 2004 AA (2006 - pre April 2011) was £ 255, 000 per annum and LTA was £ 1. 5 m in 2006, rising to £ 1. 8 m for tax year 2010/11 Limits sufficiently high to not affect many people at UCL • Finance Act 2011 made significant changes to the regime and its operation. • Labour government brought in changes in 2009 which aimed to bring an additional £ 3. 4 Bn of tax revenue. New government simplified the methodology but have same income target. • From 6 April 2011 - AA reduced to £ 50, 000 • From 6 April 2012 – LTA reduced to £ 1, 5 m

Why have the AA and LTA changed? • • • AA and LTA were first introduced April 2006 – Finance Act 2004 AA (2006 - pre April 2011) was £ 255, 000 per annum and LTA was £ 1. 5 m in 2006, rising to £ 1. 8 m for tax year 2010/11 Limits sufficiently high to not affect many people at UCL • Finance Act 2011 made significant changes to the regime and its operation. • Labour government brought in changes in 2009 which aimed to bring an additional £ 3. 4 Bn of tax revenue. New government simplified the methodology but have same income target. • From 6 April 2011 - AA reduced to £ 50, 000 • From 6 April 2012 – LTA reduced to £ 1, 5 m

Annual Allowance – what is it? • An annual threshold or value by which your pension benefits may increase without any personal tax liability • Any excess over the AA of £ 50, 000 pa is subject to tax at your marginal (highest) rate of tax • Ability to use any unused AA from previous three tax years to offset any excess of AA in a Pension Input Period (PIP) previous 3 years using an AA value of £ 50 k • Carry Forward - mechanism for previous 3 years unused allowance

Annual Allowance – what is it? • An annual threshold or value by which your pension benefits may increase without any personal tax liability • Any excess over the AA of £ 50, 000 pa is subject to tax at your marginal (highest) rate of tax • Ability to use any unused AA from previous three tax years to offset any excess of AA in a Pension Input Period (PIP) previous 3 years using an AA value of £ 50 k • Carry Forward - mechanism for previous 3 years unused allowance

Annual Allowance – how is it calculated? • Pension Input Period (PIP) - USS and NHS schemes both 1 st April to 31 st March • Capital Value of pension, lump sum, AVCs at end of PIP • Factor of 16 (was 10) • Consumer Price Index (CPI) • Aim is to achieve additional tax revenue by multiple means; • Lower limits will bring in more AA tax charges • Employees limiting benefit accrual to new AA limit will pay higher PAYE through reduced tax relief on pension contributions

Annual Allowance – how is it calculated? • Pension Input Period (PIP) - USS and NHS schemes both 1 st April to 31 st March • Capital Value of pension, lump sum, AVCs at end of PIP • Factor of 16 (was 10) • Consumer Price Index (CPI) • Aim is to achieve additional tax revenue by multiple means; • Lower limits will bring in more AA tax charges • Employees limiting benefit accrual to new AA limit will pay higher PAYE through reduced tax relief on pension contributions

Who could be affected? - Annual Allowance • • • Promotion (becoming Director, Dean, Vice Provost or Provost!) and remaining in the same pension scheme Annual professorial, clinical and appraisal pay awards Pay awards in excess of CPI Receiving a regrading or regrading a member of your staff Employing someone/moving jobs within the sector and remaining in same pension scheme Paying AVCs or contributions into another scheme Accruing pension at a higher rate than scheme accrual, paying Added Years AVCs Redundancy / Purchase of additional service (augmentation) by employer Combination of high salary / long service Limited scope to use previous unused allowances Note: Deferred benefits NOT included in AA calculations

Who could be affected? - Annual Allowance • • • Promotion (becoming Director, Dean, Vice Provost or Provost!) and remaining in the same pension scheme Annual professorial, clinical and appraisal pay awards Pay awards in excess of CPI Receiving a regrading or regrading a member of your staff Employing someone/moving jobs within the sector and remaining in same pension scheme Paying AVCs or contributions into another scheme Accruing pension at a higher rate than scheme accrual, paying Added Years AVCs Redundancy / Purchase of additional service (augmentation) by employer Combination of high salary / long service Limited scope to use previous unused allowances Note: Deferred benefits NOT included in AA calculations

Annual Allowance – Example 1 No AVCs paid, no large increase in salary • Earnings increase from £ 100, 000 to £ 115, 000 on 1 st August 2011 • PIP pay figure for 2011/12 = ((4/12 x £ 100 k)+(8/12 x £ 115 k)) = £ 110, 000 • 28 years service at 31/3/2011 – 29 years service at 31/3/2012 • CPI (at September prior) = 3. 1% • Factor of 16

Annual Allowance – Example 1 No AVCs paid, no large increase in salary • Earnings increase from £ 100, 000 to £ 115, 000 on 1 st August 2011 • PIP pay figure for 2011/12 = ((4/12 x £ 100 k)+(8/12 x £ 115 k)) = £ 110, 000 • 28 years service at 31/3/2011 – 29 years service at 31/3/2012 • CPI (at September prior) = 3. 1% • Factor of 16

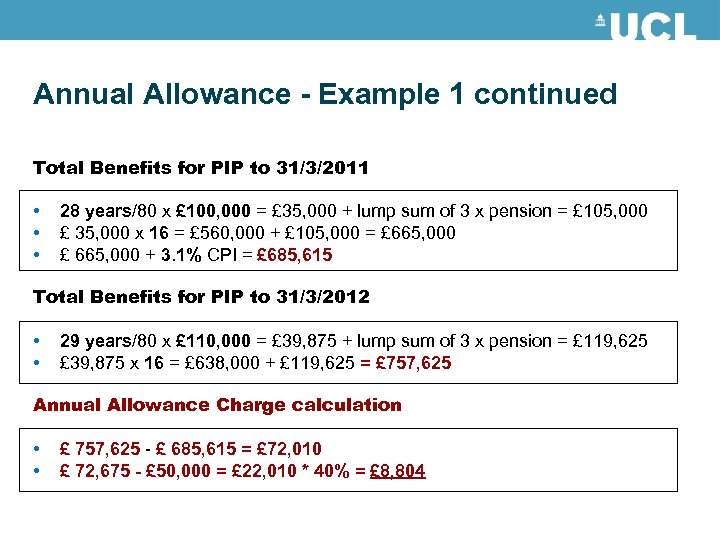

Annual Allowance - Example 1 continued Total Benefits for PIP to 31/3/2011 • • • 28 years/80 x £ 100, 000 = £ 35, 000 + lump sum of 3 x pension = £ 105, 000 £ 35, 000 x 16 = £ 560, 000 + £ 105, 000 = £ 665, 000 + 3. 1% CPI = £ 685, 615 Total Benefits for PIP to 31/3/2012 • • 29 years/80 x £ 110, 000 = £ 39, 875 + lump sum of 3 x pension = £ 119, 625 £ 39, 875 x 16 = £ 638, 000 + £ 119, 625 = £ 757, 625 Annual Allowance Charge calculation • • £ 757, 625 - £ 685, 615 = £ 72, 010 £ 72, 675 - £ 50, 000 = £ 22, 010 * 40% = £ 8, 804

Annual Allowance - Example 1 continued Total Benefits for PIP to 31/3/2011 • • • 28 years/80 x £ 100, 000 = £ 35, 000 + lump sum of 3 x pension = £ 105, 000 £ 35, 000 x 16 = £ 560, 000 + £ 105, 000 = £ 665, 000 + 3. 1% CPI = £ 685, 615 Total Benefits for PIP to 31/3/2012 • • 29 years/80 x £ 110, 000 = £ 39, 875 + lump sum of 3 x pension = £ 119, 625 £ 39, 875 x 16 = £ 638, 000 + £ 119, 625 = £ 757, 625 Annual Allowance Charge calculation • • £ 757, 625 - £ 685, 615 = £ 72, 010 £ 72, 675 - £ 50, 000 = £ 22, 010 * 40% = £ 8, 804

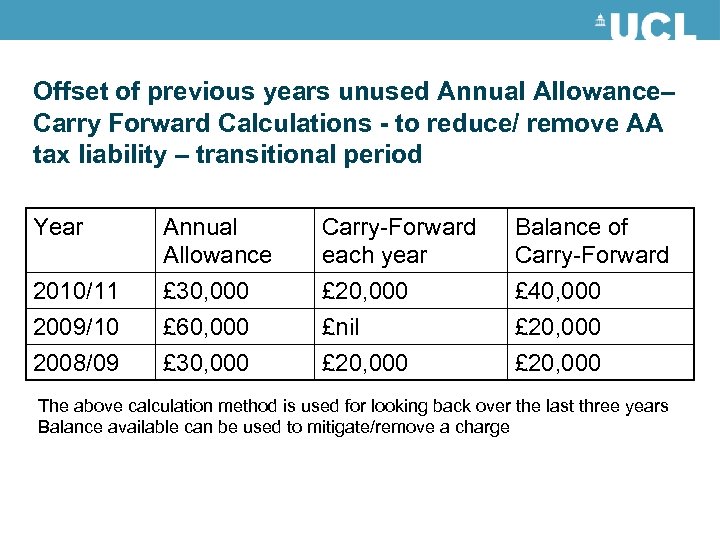

Offset of previous years unused Annual Allowance– Carry Forward Calculations - to reduce/ remove AA tax liability – transitional period Year Annual Allowance Carry-Forward each year Balance of Carry-Forward 2010/11 2009/10 2008/09 £ 30, 000 £ 60, 000 £ 30, 000 £ 20, 000 £nil £ 20, 000 £ 40, 000 £ 20, 000 The above calculation method is used for looking back over the last three years Balance available can be used to mitigate/remove a charge

Offset of previous years unused Annual Allowance– Carry Forward Calculations - to reduce/ remove AA tax liability – transitional period Year Annual Allowance Carry-Forward each year Balance of Carry-Forward 2010/11 2009/10 2008/09 £ 30, 000 £ 60, 000 £ 30, 000 £ 20, 000 £nil £ 20, 000 £ 40, 000 £ 20, 000 The above calculation method is used for looking back over the last three years Balance available can be used to mitigate/remove a charge

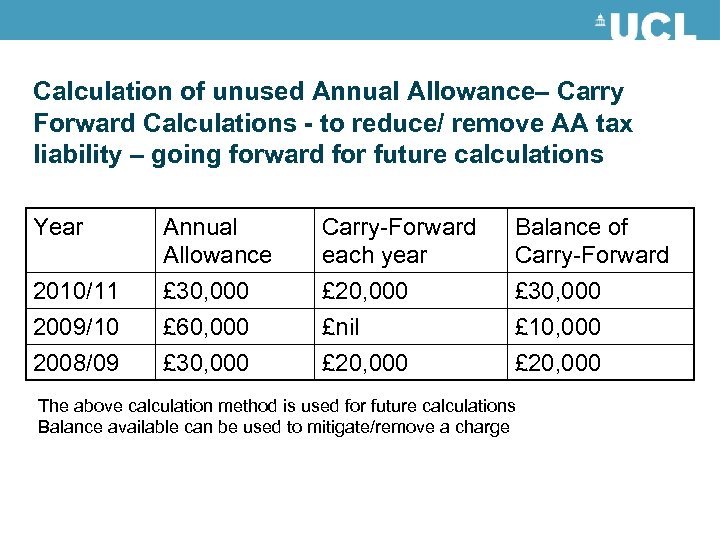

Calculation of unused Annual Allowance– Carry Forward Calculations - to reduce/ remove AA tax liability – going forward for future calculations Year Annual Allowance Carry-Forward each year Balance of Carry-Forward 2010/11 2009/10 2008/09 £ 30, 000 £ 60, 000 £ 30, 000 £ 20, 000 £nil £ 20, 000 £ 30, 000 £ 10, 000 £ 20, 000 The above calculation method is used for future calculations Balance available can be used to mitigate/remove a charge

Calculation of unused Annual Allowance– Carry Forward Calculations - to reduce/ remove AA tax liability – going forward for future calculations Year Annual Allowance Carry-Forward each year Balance of Carry-Forward 2010/11 2009/10 2008/09 £ 30, 000 £ 60, 000 £ 30, 000 £ 20, 000 £nil £ 20, 000 £ 30, 000 £ 10, 000 £ 20, 000 The above calculation method is used for future calculations Balance available can be used to mitigate/remove a charge

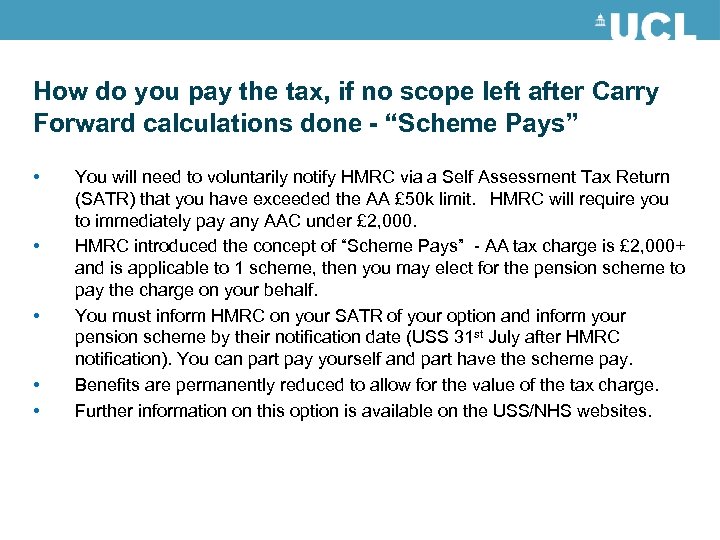

How do you pay the tax, if no scope left after Carry Forward calculations done - “Scheme Pays” • • • You will need to voluntarily notify HMRC via a Self Assessment Tax Return (SATR) that you have exceeded the AA £ 50 k limit. HMRC will require you to immediately pay any AAC under £ 2, 000. HMRC introduced the concept of “Scheme Pays” - AA tax charge is £ 2, 000+ and is applicable to 1 scheme, then you may elect for the pension scheme to pay the charge on your behalf. You must inform HMRC on your SATR of your option and inform your pension scheme by their notification date (USS 31 st July after HMRC notification). You can part pay yourself and part have the scheme pay. Benefits are permanently reduced to allow for the value of the tax charge. Further information on this option is available on the USS/NHS websites.

How do you pay the tax, if no scope left after Carry Forward calculations done - “Scheme Pays” • • • You will need to voluntarily notify HMRC via a Self Assessment Tax Return (SATR) that you have exceeded the AA £ 50 k limit. HMRC will require you to immediately pay any AAC under £ 2, 000. HMRC introduced the concept of “Scheme Pays” - AA tax charge is £ 2, 000+ and is applicable to 1 scheme, then you may elect for the pension scheme to pay the charge on your behalf. You must inform HMRC on your SATR of your option and inform your pension scheme by their notification date (USS 31 st July after HMRC notification). You can part pay yourself and part have the scheme pay. Benefits are permanently reduced to allow for the value of the tax charge. Further information on this option is available on the USS/NHS websites.

Informing HMRC via SATR • Inform HMRC through their online assessment portal or via form SA 101 of your option • ‘How to fill in your tax return’ guide http: //www. hmrc. gov. uk/workshe ets/sa 150. pdf • Important - Ask scheme for an reduction affect of your benefits before completing SATR – otherwise how will you know which option you want to do • Must pay AAC if less than £ 2, 000 • Ignorance is no excuse!

Informing HMRC via SATR • Inform HMRC through their online assessment portal or via form SA 101 of your option • ‘How to fill in your tax return’ guide http: //www. hmrc. gov. uk/workshe ets/sa 150. pdf • Important - Ask scheme for an reduction affect of your benefits before completing SATR – otherwise how will you know which option you want to do • Must pay AAC if less than £ 2, 000 • Ignorance is no excuse!

How do you know the best option to pay the AAC? • From July 2013 pension schemes must provide you on request, by no later than the 6 th October proceeding the PIP year, the AA calculation for their schemes PIP, if you have exceeded the AA. If you exceed the AA, the scheme will also be required to provide three previous years calculations • If the AAC is greater than £ 2, 000 and you want to consider asking the scheme to pay, you will need to, between October and 31 st January, liaise with them to identify the permanent reduction in your pension benefits. • Once you make a decision you will need to advise HMRC via your SATR. This election is irrevocable. Your scheme will set a deadline by which they need to be advised of your election. If the scheme are not advised by this deadline you could be liable to pay the AAC in full direct to HMRC. • Important – If AAC is under £ 2, 000, you will have to pay the charge to HMRC

How do you know the best option to pay the AAC? • From July 2013 pension schemes must provide you on request, by no later than the 6 th October proceeding the PIP year, the AA calculation for their schemes PIP, if you have exceeded the AA. If you exceed the AA, the scheme will also be required to provide three previous years calculations • If the AAC is greater than £ 2, 000 and you want to consider asking the scheme to pay, you will need to, between October and 31 st January, liaise with them to identify the permanent reduction in your pension benefits. • Once you make a decision you will need to advise HMRC via your SATR. This election is irrevocable. Your scheme will set a deadline by which they need to be advised of your election. If the scheme are not advised by this deadline you could be liable to pay the AAC in full direct to HMRC. • Important – If AAC is under £ 2, 000, you will have to pay the charge to HMRC

Permanent reduction to benefits “Scheme Pays” • USS - have published indicative factors (available on the USS web) of the permanent reduction to pension/cash if they are asked to pay an AAC on the members behalf. • NHS – “scheme pays” may be elected where the overall tax charge is £ 2000+ but no factors published.

Permanent reduction to benefits “Scheme Pays” • USS - have published indicative factors (available on the USS web) of the permanent reduction to pension/cash if they are asked to pay an AAC on the members behalf. • NHS – “scheme pays” may be elected where the overall tax charge is £ 2000+ but no factors published.

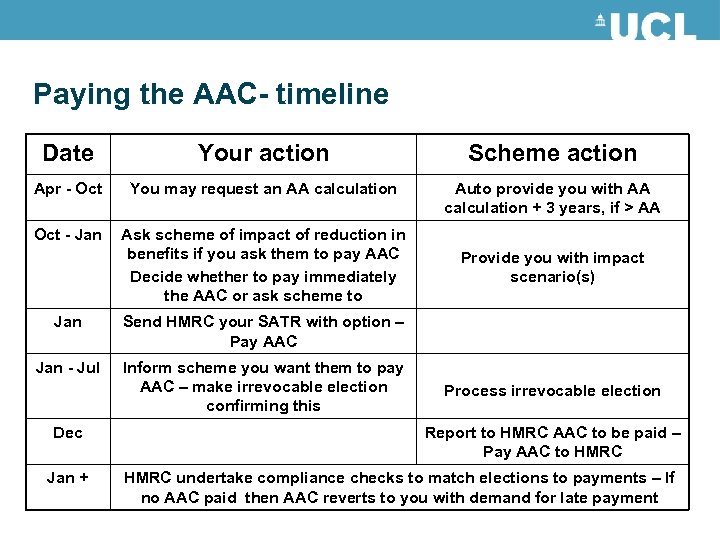

Paying the AAC- timeline Date Your action Scheme action Apr - Oct You may request an AA calculation Auto provide you with AA calculation + 3 years, if > AA Oct - Jan Ask scheme of impact of reduction in benefits if you ask them to pay AAC Decide whether to pay immediately the AAC or ask scheme to Jan Send HMRC your SATR with option – Pay AAC Jan - Jul Inform scheme you want them to pay AAC – make irrevocable election confirming this Provide you with impact scenario(s) Dec Jan + Process irrevocable election Report to HMRC AAC to be paid – Pay AAC to HMRC undertake compliance checks to match elections to payments – If no AAC paid then AAC reverts to you with demand for late payment

Paying the AAC- timeline Date Your action Scheme action Apr - Oct You may request an AA calculation Auto provide you with AA calculation + 3 years, if > AA Oct - Jan Ask scheme of impact of reduction in benefits if you ask them to pay AAC Decide whether to pay immediately the AAC or ask scheme to Jan Send HMRC your SATR with option – Pay AAC Jan - Jul Inform scheme you want them to pay AAC – make irrevocable election confirming this Provide you with impact scenario(s) Dec Jan + Process irrevocable election Report to HMRC AAC to be paid – Pay AAC to HMRC undertake compliance checks to match elections to payments – If no AAC paid then AAC reverts to you with demand for late payment

Ways to reduce your AA tax liability • AA tax is a reality but might not be a bad thing – a one off cost for long term increase/return in pension benefit • Carry Forward mechanisms • Amendments to scheme rules to help mitigate/remove impact of any AA charge • Remember HMRC are banking on getting more PAYE tax as individuals and schemes identify mitigation methods to pay AA tax – both are at your marginal rate!

Ways to reduce your AA tax liability • AA tax is a reality but might not be a bad thing – a one off cost for long term increase/return in pension benefit • Carry Forward mechanisms • Amendments to scheme rules to help mitigate/remove impact of any AA charge • Remember HMRC are banking on getting more PAYE tax as individuals and schemes identify mitigation methods to pay AA tax – both are at your marginal rate!

Part Two Changes to Life Time Allowance from 6 th April 2012

Part Two Changes to Life Time Allowance from 6 th April 2012

Life Time Allowance (LTA) – what is it? • A threshold on the total value of all your pension benefits before any tax liability - Value determined on a Benefit Crystallisation Event (BCE) (i. e. Retirement) • Around since 2006 and has increased each year from £ 1. 5 m to £ 1. 8 m in tax year 2010/2011 (equal to a pension of £ 74 k and a lump sum of £ 450 k) • Reduces to £ 1. 5 m from 2012/2013 (£ 0. 5 B pa new revenue expected on top of current £ 4 B) • Any excess over the LTA of £ 1. 5 m is subject to tax recovery charge of 55% if taken as a lump sum, 25% (in addition to the ordinary marginal income tax rate) if taken as pension • Fixed Protection for those who have or may exceed £ 1. 5 m by 5 th April 2012

Life Time Allowance (LTA) – what is it? • A threshold on the total value of all your pension benefits before any tax liability - Value determined on a Benefit Crystallisation Event (BCE) (i. e. Retirement) • Around since 2006 and has increased each year from £ 1. 5 m to £ 1. 8 m in tax year 2010/2011 (equal to a pension of £ 74 k and a lump sum of £ 450 k) • Reduces to £ 1. 5 m from 2012/2013 (£ 0. 5 B pa new revenue expected on top of current £ 4 B) • Any excess over the LTA of £ 1. 5 m is subject to tax recovery charge of 55% if taken as a lump sum, 25% (in addition to the ordinary marginal income tax rate) if taken as pension • Fixed Protection for those who have or may exceed £ 1. 5 m by 5 th April 2012

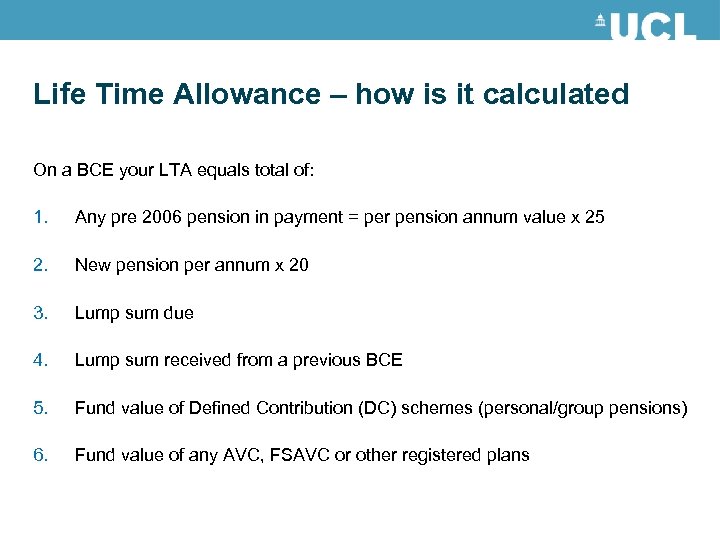

Life Time Allowance – how is it calculated On a BCE your LTA equals total of: 1. Any pre 2006 pension in payment = per pension annum value x 25 2. New pension per annum x 20 3. Lump sum due 4. Lump sum received from a previous BCE 5. Fund value of Defined Contribution (DC) schemes (personal/group pensions) 6. Fund value of any AVC, FSAVC or other registered plans

Life Time Allowance – how is it calculated On a BCE your LTA equals total of: 1. Any pre 2006 pension in payment = per pension annum value x 25 2. New pension per annum x 20 3. Lump sum due 4. Lump sum received from a previous BCE 5. Fund value of Defined Contribution (DC) schemes (personal/group pensions) 6. Fund value of any AVC, FSAVC or other registered plans

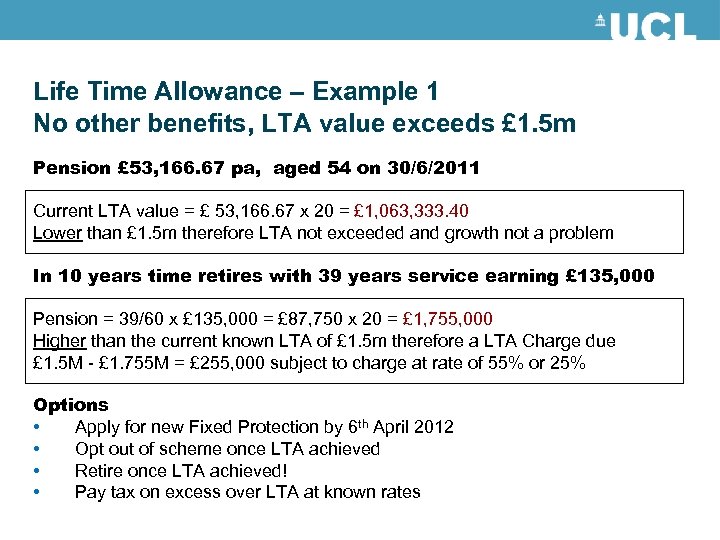

Life Time Allowance – Example 1 No other benefits, LTA value exceeds £ 1. 5 m Pension £ 53, 166. 67 pa, aged 54 on 30/6/2011 Current LTA value = £ 53, 166. 67 x 20 = £ 1, 063, 333. 40 Lower than £ 1. 5 m therefore LTA not exceeded and growth not a problem In 10 years time retires with 39 years service earning £ 135, 000 Pension = 39/60 x £ 135, 000 = £ 87, 750 x 20 = £ 1, 755, 000 Higher than the current known LTA of £ 1. 5 m therefore a LTA Charge due £ 1. 5 M - £ 1. 755 M = £ 255, 000 subject to charge at rate of 55% or 25% Options • Apply for new Fixed Protection by 6 th April 2012 • Opt out of scheme once LTA achieved • Retire once LTA achieved! • Pay tax on excess over LTA at known rates

Life Time Allowance – Example 1 No other benefits, LTA value exceeds £ 1. 5 m Pension £ 53, 166. 67 pa, aged 54 on 30/6/2011 Current LTA value = £ 53, 166. 67 x 20 = £ 1, 063, 333. 40 Lower than £ 1. 5 m therefore LTA not exceeded and growth not a problem In 10 years time retires with 39 years service earning £ 135, 000 Pension = 39/60 x £ 135, 000 = £ 87, 750 x 20 = £ 1, 755, 000 Higher than the current known LTA of £ 1. 5 m therefore a LTA Charge due £ 1. 5 M - £ 1. 755 M = £ 255, 000 subject to charge at rate of 55% or 25% Options • Apply for new Fixed Protection by 6 th April 2012 • Opt out of scheme once LTA achieved • Retire once LTA achieved! • Pay tax on excess over LTA at known rates

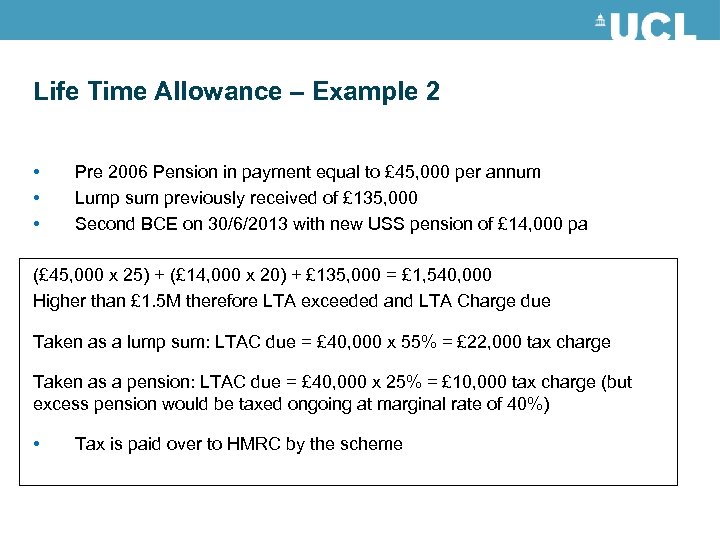

Life Time Allowance – Example 2 • • • Pre 2006 Pension in payment equal to £ 45, 000 per annum Lump sum previously received of £ 135, 000 Second BCE on 30/6/2013 with new USS pension of £ 14, 000 pa (£ 45, 000 x 25) + (£ 14, 000 x 20) + £ 135, 000 = £ 1, 540, 000 Higher than £ 1. 5 M therefore LTA exceeded and LTA Charge due Taken as a lump sum: LTAC due = £ 40, 000 x 55% = £ 22, 000 tax charge Taken as a pension: LTAC due = £ 40, 000 x 25% = £ 10, 000 tax charge (but excess pension would be taxed ongoing at marginal rate of 40%) • Tax is paid over to HMRC by the scheme

Life Time Allowance – Example 2 • • • Pre 2006 Pension in payment equal to £ 45, 000 per annum Lump sum previously received of £ 135, 000 Second BCE on 30/6/2013 with new USS pension of £ 14, 000 pa (£ 45, 000 x 25) + (£ 14, 000 x 20) + £ 135, 000 = £ 1, 540, 000 Higher than £ 1. 5 M therefore LTA exceeded and LTA Charge due Taken as a lump sum: LTAC due = £ 40, 000 x 55% = £ 22, 000 tax charge Taken as a pension: LTAC due = £ 40, 000 x 25% = £ 10, 000 tax charge (but excess pension would be taxed ongoing at marginal rate of 40%) • Tax is paid over to HMRC by the scheme

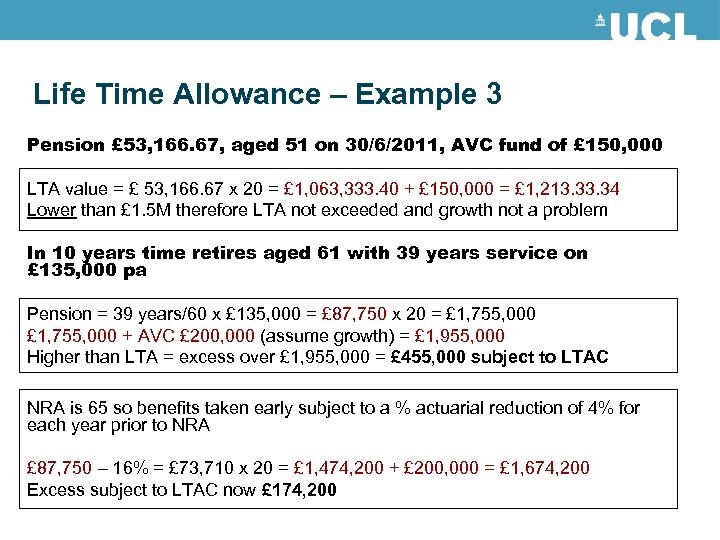

Life Time Allowance – Example 3 Pension £ 53, 166. 67, aged 51 on 30/6/2011, AVC fund of £ 150, 000 LTA value = £ 53, 166. 67 x 20 = £ 1, 063, 333. 40 + £ 150, 000 = £ 1, 213. 34 Lower than £ 1. 5 M therefore LTA not exceeded and growth not a problem In 10 years time retires aged 61 with 39 years service on £ 135, 000 pa Pension = 39 years/60 x £ 135, 000 = £ 87, 750 x 20 = £ 1, 755, 000 + AVC £ 200, 000 (assume growth) = £ 1, 955, 000 Higher than LTA = excess over £ 1, 955, 000 = £ 455, 000 subject to LTAC NRA is 65 so benefits taken early subject to a % actuarial reduction of 4% for each year prior to NRA £ 87, 750 – 16% = £ 73, 710 x 20 = £ 1, 474, 200 + £ 200, 000 = £ 1, 674, 200 Excess subject to LTAC now £ 174, 200

Life Time Allowance – Example 3 Pension £ 53, 166. 67, aged 51 on 30/6/2011, AVC fund of £ 150, 000 LTA value = £ 53, 166. 67 x 20 = £ 1, 063, 333. 40 + £ 150, 000 = £ 1, 213. 34 Lower than £ 1. 5 M therefore LTA not exceeded and growth not a problem In 10 years time retires aged 61 with 39 years service on £ 135, 000 pa Pension = 39 years/60 x £ 135, 000 = £ 87, 750 x 20 = £ 1, 755, 000 + AVC £ 200, 000 (assume growth) = £ 1, 955, 000 Higher than LTA = excess over £ 1, 955, 000 = £ 455, 000 subject to LTAC NRA is 65 so benefits taken early subject to a % actuarial reduction of 4% for each year prior to NRA £ 87, 750 – 16% = £ 73, 710 x 20 = £ 1, 474, 200 + £ 200, 000 = £ 1, 674, 200 Excess subject to LTAC now £ 174, 200

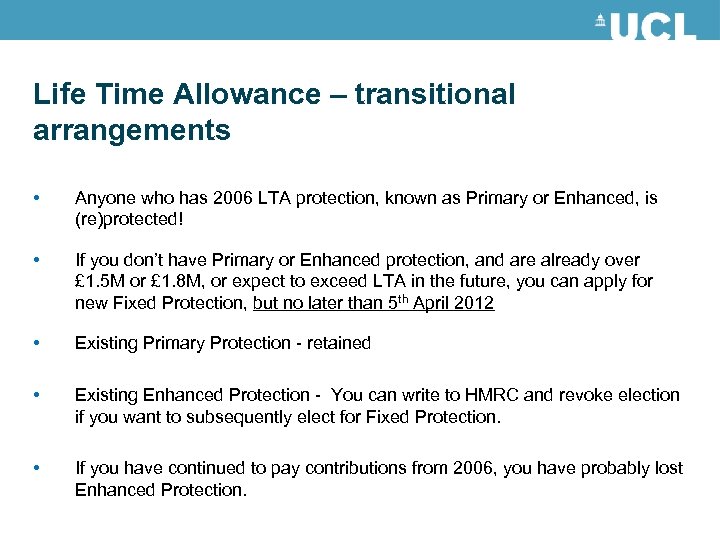

Life Time Allowance – transitional arrangements • Anyone who has 2006 LTA protection, known as Primary or Enhanced, is (re)protected! • If you don’t have Primary or Enhanced protection, and are already over £ 1. 5 M or £ 1. 8 M, or expect to exceed LTA in the future, you can apply for new Fixed Protection, but no later than 5 th April 2012 • Existing Primary Protection - retained • Existing Enhanced Protection - You can write to HMRC and revoke election if you want to subsequently elect for Fixed Protection. • If you have continued to pay contributions from 2006, you have probably lost Enhanced Protection.

Life Time Allowance – transitional arrangements • Anyone who has 2006 LTA protection, known as Primary or Enhanced, is (re)protected! • If you don’t have Primary or Enhanced protection, and are already over £ 1. 5 M or £ 1. 8 M, or expect to exceed LTA in the future, you can apply for new Fixed Protection, but no later than 5 th April 2012 • Existing Primary Protection - retained • Existing Enhanced Protection - You can write to HMRC and revoke election if you want to subsequently elect for Fixed Protection. • If you have continued to pay contributions from 2006, you have probably lost Enhanced Protection.

What is the new Fixed Protection and how do you apply for it • • http: //www. hmrc. gov. uk/pensions chemes/apss 227. pdf http: //www. hmrc. gov. uk/pensions chemes/apss 227 -notes. pdf Must be with HMRC by 5 th April 2012 – no online application You may lose your Fixed Protection status if you continue to accrue pensionable service in a defined benefit scheme. You must cease contributing to any Money Purchase AVCs You lose Fixed Protection if you later rejoin a pension scheme. Note - Be careful of auto enrolment from 2013

What is the new Fixed Protection and how do you apply for it • • http: //www. hmrc. gov. uk/pensions chemes/apss 227. pdf http: //www. hmrc. gov. uk/pensions chemes/apss 227 -notes. pdf Must be with HMRC by 5 th April 2012 – no online application You may lose your Fixed Protection status if you continue to accrue pensionable service in a defined benefit scheme. You must cease contributing to any Money Purchase AVCs You lose Fixed Protection if you later rejoin a pension scheme. Note - Be careful of auto enrolment from 2013

Things to consider – Life Time Allowance • • • What is my current notional LTA? What are the values of my other pension scheme pots? Have I exceeded current LTA of £ 1. 8 m? Have I exceeded new £ 1. 5 m LTA ? Do I need to apply for Fixed Protection? If I’ve not exceeded the LTA, when might I? Review levels of any Money Purchase AVCs? Is exceeding the LTA OK? Impact of a new post in the sector = increased pay = AA impact and LTA impact Financial advice?

Things to consider – Life Time Allowance • • • What is my current notional LTA? What are the values of my other pension scheme pots? Have I exceeded current LTA of £ 1. 8 m? Have I exceeded new £ 1. 5 m LTA ? Do I need to apply for Fixed Protection? If I’ve not exceeded the LTA, when might I? Review levels of any Money Purchase AVCs? Is exceeding the LTA OK? Impact of a new post in the sector = increased pay = AA impact and LTA impact Financial advice?

Going forward - AA or LTA • • • Watch out for further news on your schemes changes which may impact AA and LTA - communications to members considered to be at risk of exceeding tax limits levels. USS, NHS, HMRC web constantly updated – supporting resources Find out what your notional LTA value is - if over £ 1 m then look to get financial advice on future impact of pay increases, continued accrual, value of other pension pots, probable retirement date. If you are considering taking any of the scheme options, it is important to consider the effects carefully as they will have an impact upon the amount of pension at retirement. If scheme sends you a statement, PIP calculations, check it. Correct salary used? Does it mention LTA or AA value? If so, act on it. May need to act quickly – some elections need to be made before 6 April 2012

Going forward - AA or LTA • • • Watch out for further news on your schemes changes which may impact AA and LTA - communications to members considered to be at risk of exceeding tax limits levels. USS, NHS, HMRC web constantly updated – supporting resources Find out what your notional LTA value is - if over £ 1 m then look to get financial advice on future impact of pay increases, continued accrual, value of other pension pots, probable retirement date. If you are considering taking any of the scheme options, it is important to consider the effects carefully as they will have an impact upon the amount of pension at retirement. If scheme sends you a statement, PIP calculations, check it. Correct salary used? Does it mention LTA or AA value? If so, act on it. May need to act quickly – some elections need to be made before 6 April 2012

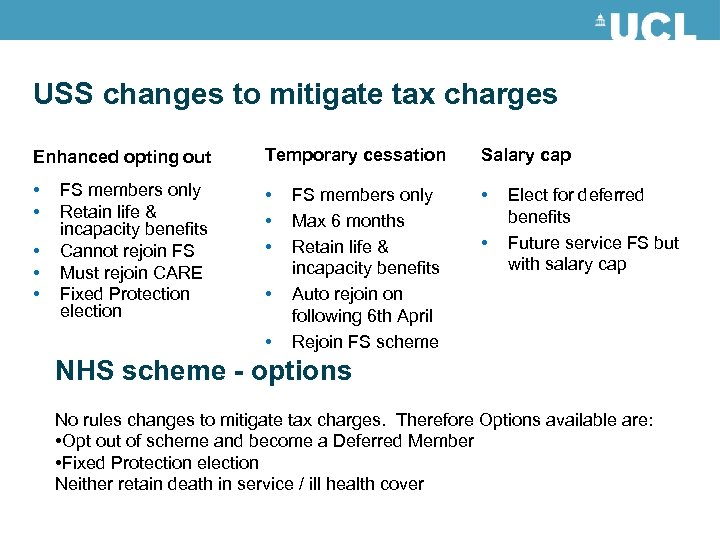

USS changes to mitigate tax charges Enhanced opting out Temporary cessation Salary cap • • • FS members only Retain life & incapacity benefits Cannot rejoin FS Must rejoin CARE Fixed Protection election • • FS members only Max 6 months Retain life & incapacity benefits Auto rejoin on following 6 th April Rejoin FS scheme • Elect for deferred benefits Future service FS but with salary cap NHS scheme - options No rules changes to mitigate tax charges. Therefore Options available are: • Opt out of scheme and become a Deferred Member • Fixed Protection election Neither retain death in service / ill health cover

USS changes to mitigate tax charges Enhanced opting out Temporary cessation Salary cap • • • FS members only Retain life & incapacity benefits Cannot rejoin FS Must rejoin CARE Fixed Protection election • • FS members only Max 6 months Retain life & incapacity benefits Auto rejoin on following 6 th April Rejoin FS scheme • Elect for deferred benefits Future service FS but with salary cap NHS scheme - options No rules changes to mitigate tax charges. Therefore Options available are: • Opt out of scheme and become a Deferred Member • Fixed Protection election Neither retain death in service / ill health cover

Financial Advice • These matters are complex, difficult decisions to make, natural you will want help in making the decision which is best for you. • UCL Pension Services and staff at the schemes can provide information about the scheme and the options available but cannot give financial advice. • USS – list of contacts able to assist members with further queries / benefit calculations & list of Independent Financial Advisors (IFA) • Help from other organisations; BMA etc.

Financial Advice • These matters are complex, difficult decisions to make, natural you will want help in making the decision which is best for you. • UCL Pension Services and staff at the schemes can provide information about the scheme and the options available but cannot give financial advice. • USS – list of contacts able to assist members with further queries / benefit calculations & list of Independent Financial Advisors (IFA) • Help from other organisations; BMA etc.

Things to consider – Financial advice • Over 16 years experience of advising higher education professionals. • Provide a ‘financial advice in the workplace programme’ for UCL, Queen Mary, University of London, and The University of Northampton • Pre and post retirement advice for individuals in order to maximise pension benefits and mitigate taxation. • Investment advice and management service which includes a review of existing investments held and also recommendation of suitable future investments. • Individual meetings can be held at the work place or at your home. Austin-Chapel Independent Financial Advisers LLP

Things to consider – Financial advice • Over 16 years experience of advising higher education professionals. • Provide a ‘financial advice in the workplace programme’ for UCL, Queen Mary, University of London, and The University of Northampton • Pre and post retirement advice for individuals in order to maximise pension benefits and mitigate taxation. • Investment advice and management service which includes a review of existing investments held and also recommendation of suitable future investments. • Individual meetings can be held at the work place or at your home. Austin-Chapel Independent Financial Advisers LLP

Further information • Pension Services website www. ucl. ac. uk/hr/pensions Dedicated page – Tax Relief Limits • USS website – www. uss. co. uk Various dedicated pages • • NHS website – www. nhsbsa. nhs. uk/pensions Various dedicated pages • HMRC – Self Assessment Tax Return www. hmrc. gov. uk/forms/sa 101. pdf • BMA website – www. bma. org. uk • Austin Chapel Independent Financial Advisers gary. oneill@austinchapel. co. uk – Mobile 07860 240855

Further information • Pension Services website www. ucl. ac. uk/hr/pensions Dedicated page – Tax Relief Limits • USS website – www. uss. co. uk Various dedicated pages • • NHS website – www. nhsbsa. nhs. uk/pensions Various dedicated pages • HMRC – Self Assessment Tax Return www. hmrc. gov. uk/forms/sa 101. pdf • BMA website – www. bma. org. uk • Austin Chapel Independent Financial Advisers gary. oneill@austinchapel. co. uk – Mobile 07860 240855

Questions

Questions