dd0c6238573f7a936da7f2e69eeb465d.ppt

- Количество слайдов: 19

UBSW Emerging Companies Conference Andrew Lindberg, Managing Director 23 rd October 2002

Overview • Financial objectives • Strategy • Capital management • Current issues

Our financial objectives are clear Target: • 15% ROE • Consistent trend EPS growth • Stable dividend payment • Improve quality of earnings • Efficient capital management

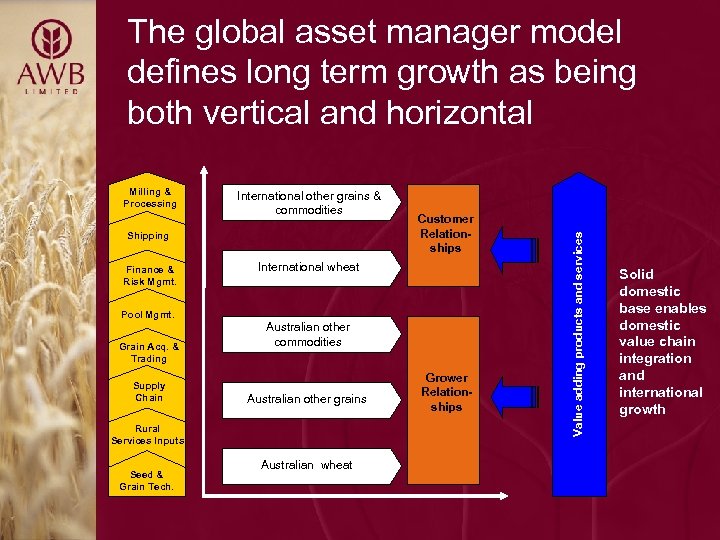

Milling & Processing International other grains & commodities Shipping Finance & Risk Mgmt. Pool Mgmt. Grain Acq. & Trading Supply Chain International wheat Australian other commodities Australian other grains Rural Services Inputs Seed & Grain Tech. Customer Relationships Australian wheat Grower Relationships Value adding products and services The global asset manager model defines long term growth as being both vertical and horizontal Solid domestic base enables domestic value chain integration and international growth

In order to achieve our objectives, AWB has clearly defined strategies Maximise value for growers, customers & shareholders • Win grower mandates • Create value through supply chain efficiencies • Sustain trading out performance • Lead in grain technology • Maintain growth and diversify revenue streams • Strengthen stakeholder support • Secure end user demand • Strengthen organisational capability and performance

Specific near term initiatives will support our strategies • Diversify domestically and offshore – Expand finance & risk management offerings – Strengthen position in Asia and Middle East and develop global trading business (Geneva) – State deregulation of other grains – Step up investigation of M&A opportunities • Increase grains under management • Strengthen our rural services base • Supply chain investments that provide commercial returns • Active capital management • Ensure effective cost control

In 2001/02 AWB strengthened its core business … Strengthen core business to sustain performance • Further improvement to a key under-performing business area Chartering • Strengthening of the performance of the Single Desk and implementation of new performance based remuneration model • Broaden financial and risk services to growers and customers • Strengthen grower/rural services and financial advisory networks • Development of AWB supply chain network with capacity of around 3 mt • Development of superior grain varieties through a JV with Syngenta • Establishment of new business processes, systems and product development capability

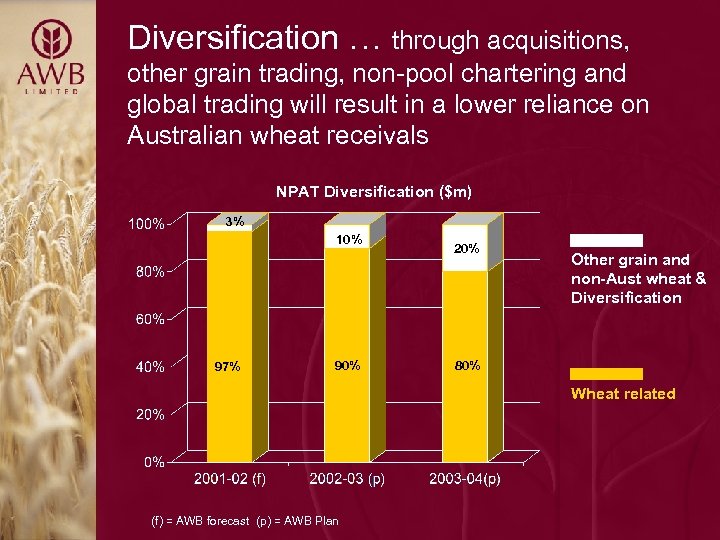

Diversification … through acquisitions, other grain trading, non-pool chartering and global trading will result in a lower reliance on Australian wheat receivals NPAT Diversification ($m) 3% 10% 97% 90% 20% Other grain and non-Aust wheat & Diversification 80% Wheat related (f) = AWB forecast (p) = AWB Plan

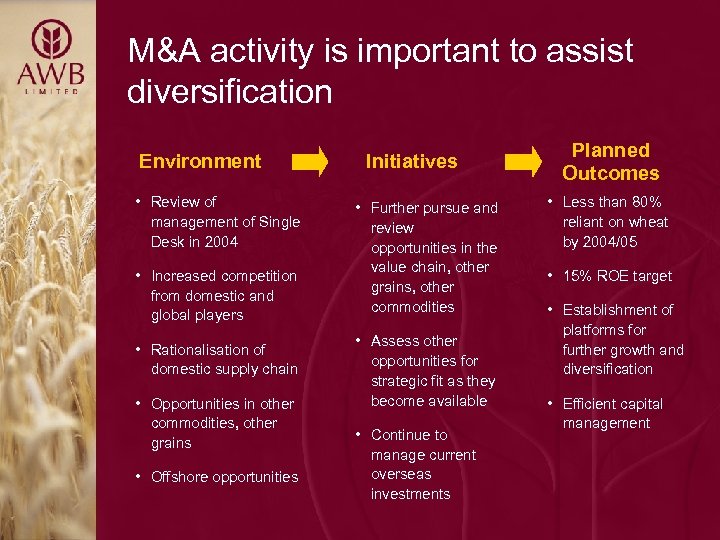

M&A activity is important to assist diversification Environment • Review of management of Single Desk in 2004 • Increased competition from domestic and global players • Rationalisation of domestic supply chain • Opportunities in other commodities, other grains • Offshore opportunities Initiatives • Further pursue and review opportunities in the value chain, other grains, other commodities • Assess other opportunities for strategic fit as they become available • Continue to manage current overseas investments Planned Outcomes • Less than 80% reliant on wheat by 2004/05 • 15% ROE target • Establishment of platforms for further growth and diversification • Efficient capital management

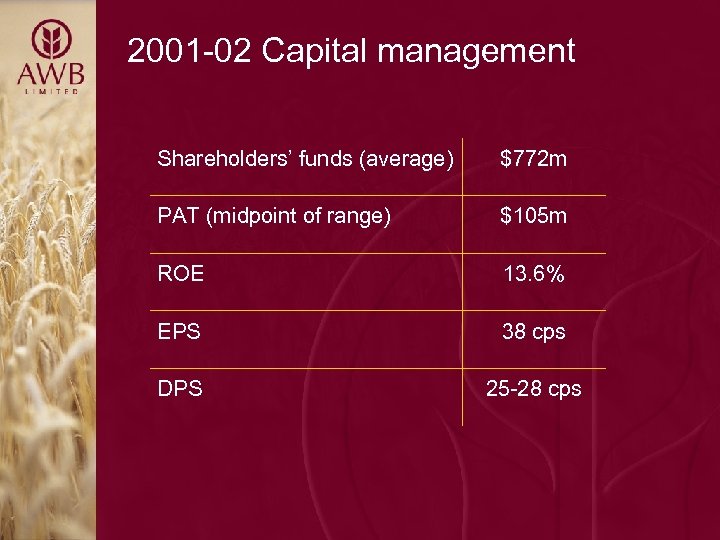

2001 -02 Capital management Shareholders’ funds (average) $772 m PAT (midpoint of range) $105 m ROE 13. 6% EPS 38 cps DPS 25 -28 cps

Capital is allocated notionally to businesses • Main businesses that use capital are: - Finance & Risk Management Products - Grain Acquisition & Trading - Supply Chain & Other Investments • Other business streams include: - Grain Technology - Pool Management Services

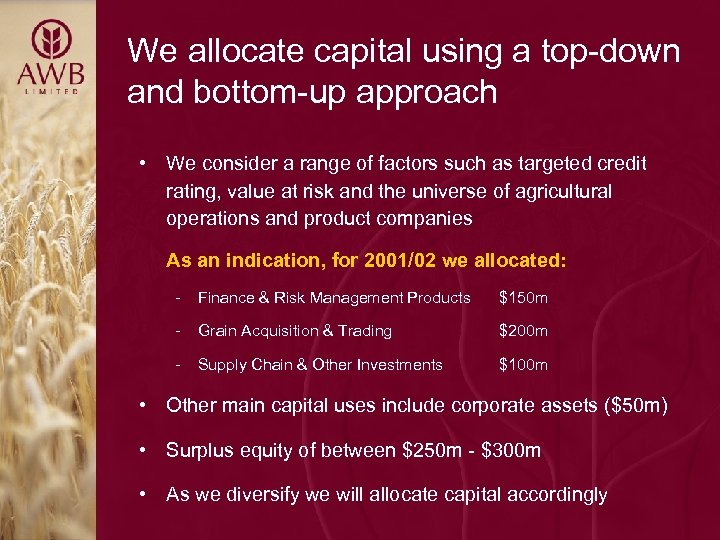

We allocate capital using a top-down and bottom-up approach • We consider a range of factors such as targeted credit rating, value at risk and the universe of agricultural operations and product companies As an indication, for 2001/02 we allocated: - Finance & Risk Management Products $150 m - Grain Acquisition & Trading $200 m - Supply Chain & Other Investments $100 m • Other main capital uses include corporate assets ($50 m) • Surplus equity of between $250 m - $300 m • As we diversify we will allocate capital accordingly

The company is funded through commercial paper • We fund the company and therefore businesses through 3 commercial paper (CP) programs – AUD, US & EURO • We have a relationship bank panel of 16 throughout the world. These banks provide liquidity support i. e. ability to fund company at all times even when markets are tight • Last year AWB issued over $US 5 b in CP • We are an active participant in the FX, Options and Swaps markets

We are constantly looking at the mix of capital and debt in relation to the opportunities available to us • Depending on the range and size of these opportunities we will consider the structure of the balance sheet for maximum value to shareholders • This will include raising some long term debt (none currently) which could take the form of medium term notes, private placement, or hybrid securities. • We will consider a share buy back if this makes sense for shareholder value

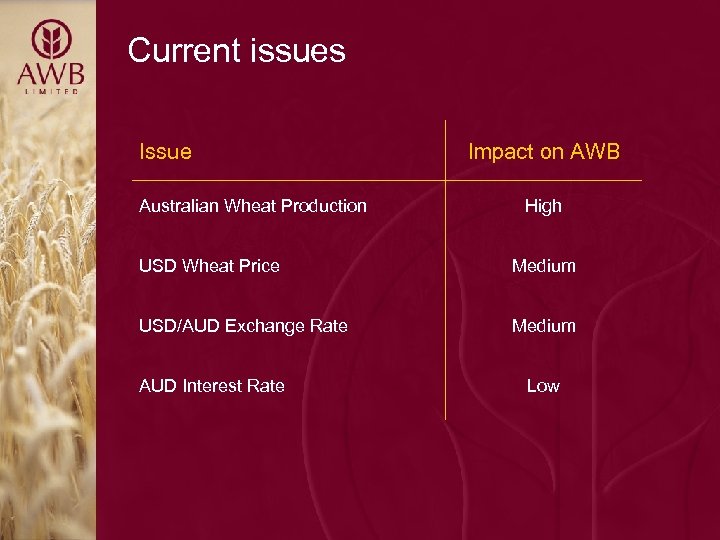

Current issues Issue Australian Wheat Production Impact on AWB High USD Wheat Price Medium USD/AUD Exchange Rate Medium AUD Interest Rate Low

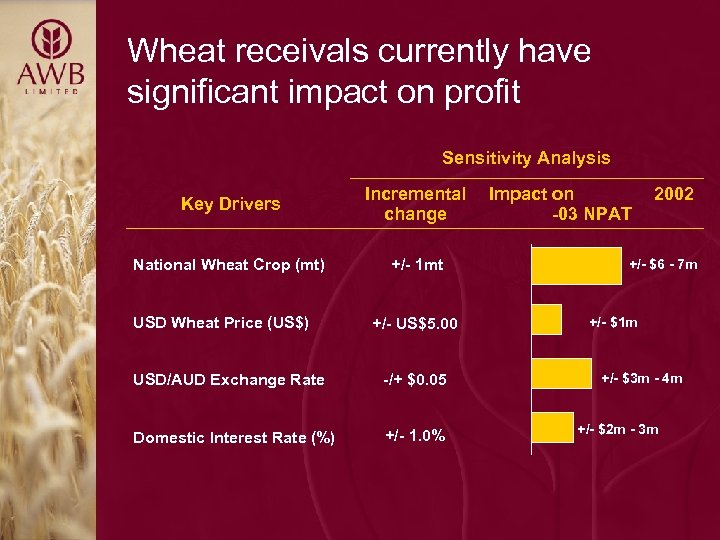

Wheat receivals currently have significant impact on profit Sensitivity Analysis Key Drivers Incremental change National Wheat Crop (mt) +/- 1 mt USD Wheat Price (US$) +/- US$5. 00 USD/AUD Exchange Rate -/+ $0. 05 Domestic Interest Rate (%) +/- 1. 0% Impact on -03 NPAT 2002 +/- $6 - 7 m +/- $1 m +/- $3 m - 4 m +/- $2 m - 3 m

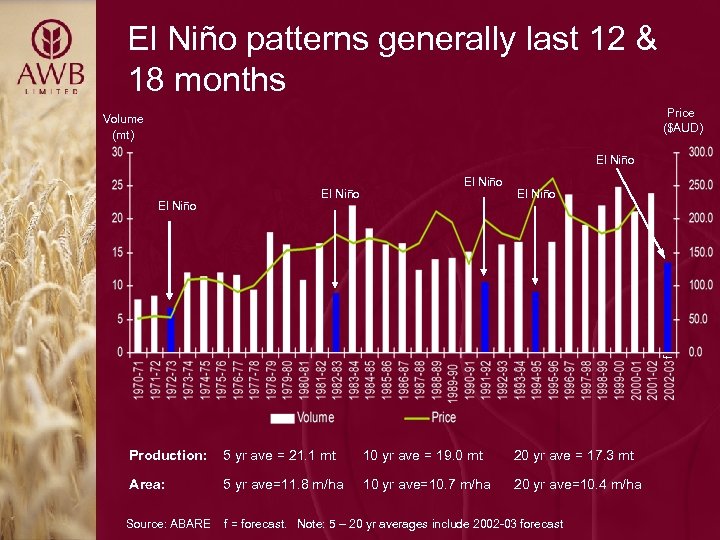

El Niño patterns generally last 12 & 18 months Price ($AUD) Volume (mt) El Niño f El Niño Production: 5 yr ave = 21. 1 mt 10 yr ave = 19. 0 mt 20 yr ave = 17. 3 mt Area: 5 yr ave=11. 8 m/ha 10 yr ave=10. 7 m/ha 20 yr ave=10. 4 m/ha Source: ABARE f = forecast. Note: 5 – 20 yr averages include 2002 -03 forecast

AWB is well positioned • Significant expertise and scale in global wheat marketing • One of the largest integrated global wheat managers • Large existing customer base • Manager of the Single Desk • Potential to broaden range of products, services and customers in Australia and overseas • Strong balance sheet and dividend paying capacity

Full year results 2002 -03 • Released Wednesday 20 November • Analyst briefing at 2: 30 pm Wednesday 20 November • Briefings in Sydney Thursday 21 November • Briefings in Melbourne Friday 22 November

dd0c6238573f7a936da7f2e69eeb465d.ppt