edf8db72c351ea01ed207ac154401928.ppt

- Количество слайдов: 92

U. S. Subprime Mortgage Market Meltdown James R. Barth Auburn University and Milken Institute jbarth@milkeninstitute. org 14 th Dubrovnik Economic Conference The Croatian National Bank Dubrovnik, Croatia June 25– 28, 2008

“Any real-estate investment is a good investment … ”

“Any real-estate investment is a good investment … ” … NOT!

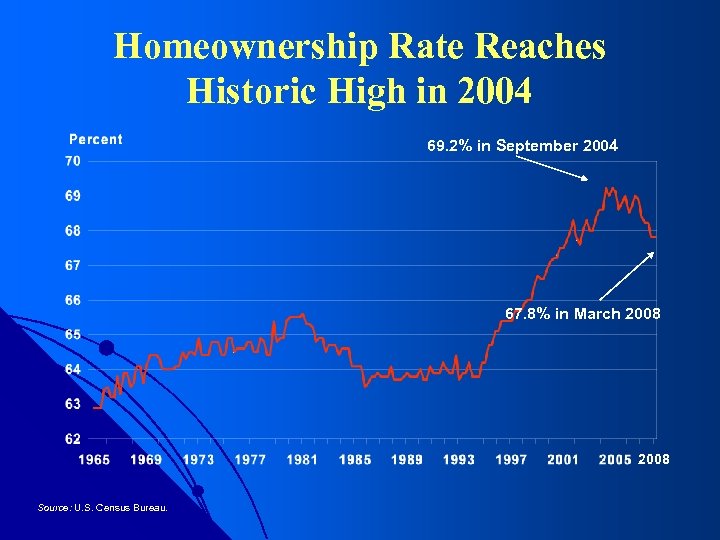

Homeownership Rate Reaches Historic High in 2004 69. 2% in September 2004 67. 8% in March 2008 Source: U. S. Census Bureau.

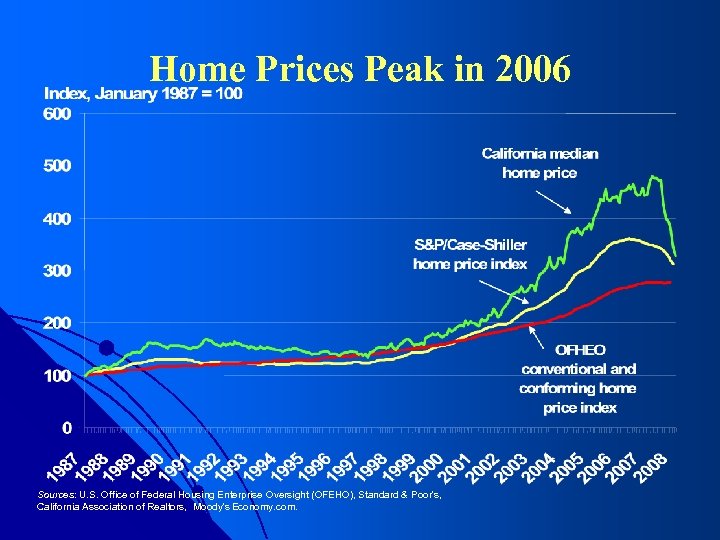

Home Prices Peak in 2006 Sources: U. S. Office of Federal Housing Enterprise Oversight (OFEHO), Standard & Poor's, California Association of Realtors, Moody's Economy. com.

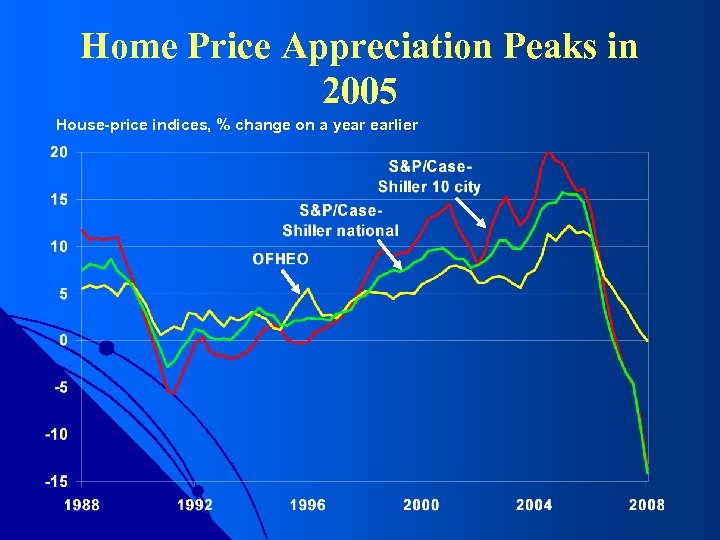

Home Price Appreciation Peaks in 2005 House-price indices, % change on a year earlier

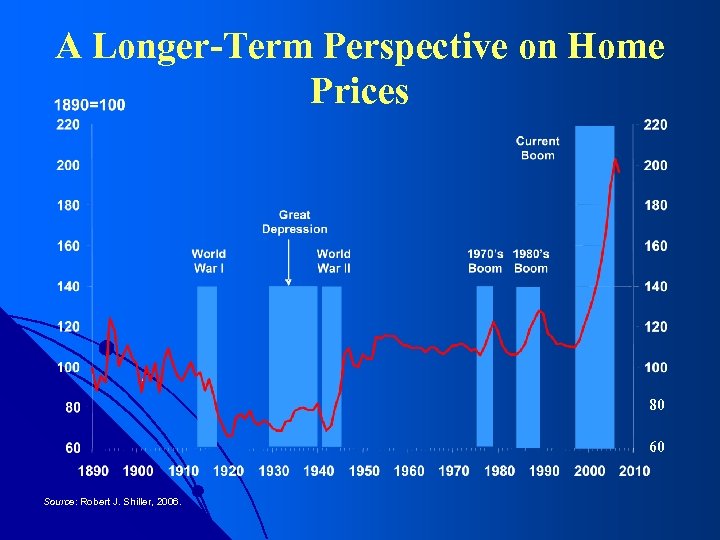

A Longer-Term Perspective on Home Prices 80 60 Source: Robert J. Shiller, 2006.

History Repeats Itself: Home Prices Don’t Just Go Up Change in Home Prices in 100 plus years Percentage change, year ago World War I Source: Robert J. Shiller, 2006. Great World Depression War II 1970’s 1980’s Boom Current Boom

Homes for Sale Take Off Millions Source: U. S. Census Bureau. Millions

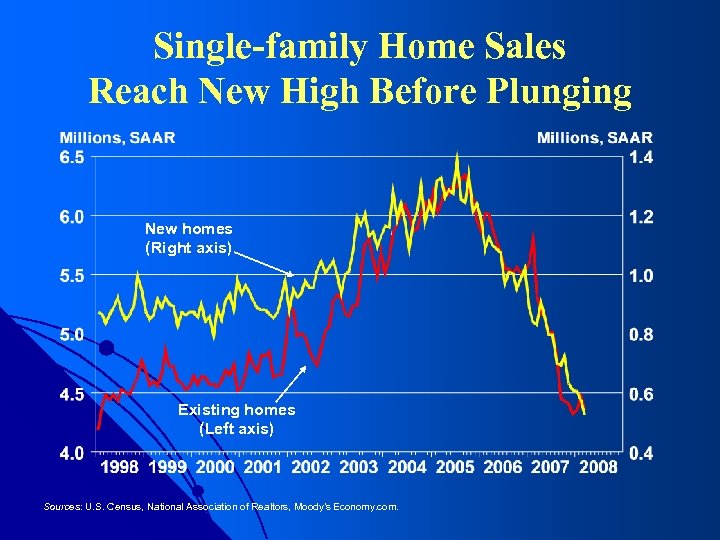

Single-family Home Sales Reach New High Before Plunging New homes (Right axis) Existing homes (Left axis) Sources: U. S. Census, National Association of Realtors, Moody’s Economy. com.

Existing Home Sales Are Down Everywhere Over the Past Two Years Percent change in existing home sales Fourth-quarter 2005 through fourth-quarter 2007 Existing home sales nationwide down 29% Source: Freddie Mac.

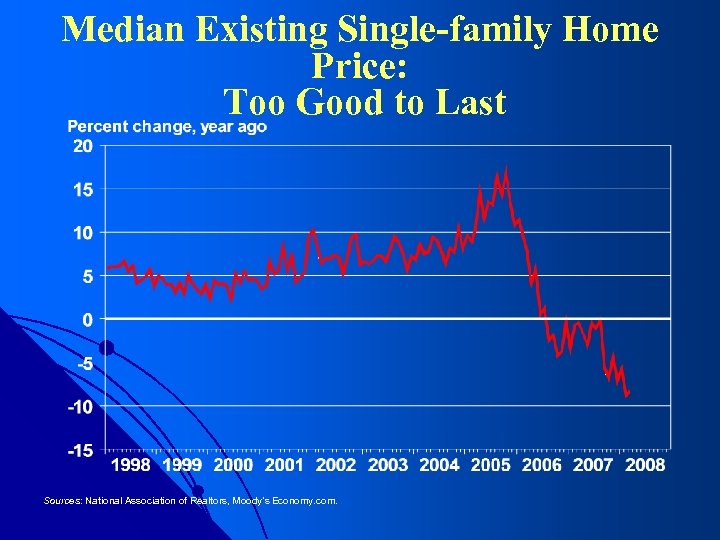

Median Existing Single-family Home Price: Too Good to Last Sources: National Association of Realtors, Moody’s Economy. com.

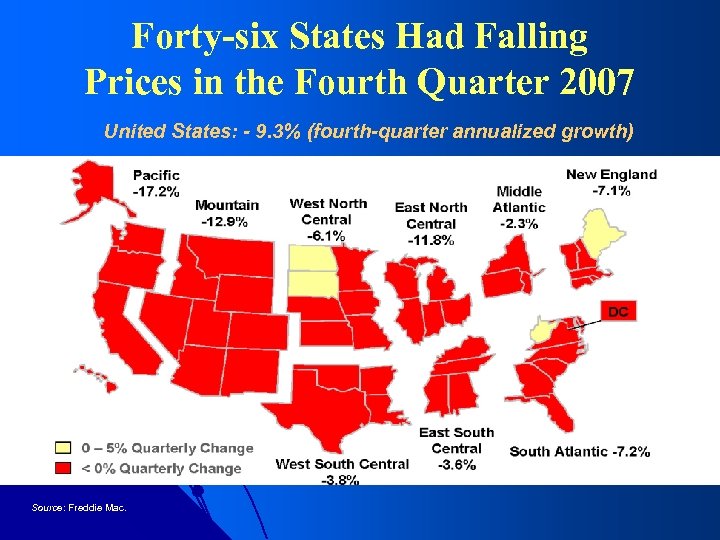

Forty-six States Had Falling Prices in the Fourth Quarter 2007 United States: - 9. 3% (fourth-quarter annualized growth) Source: Freddie Mac.

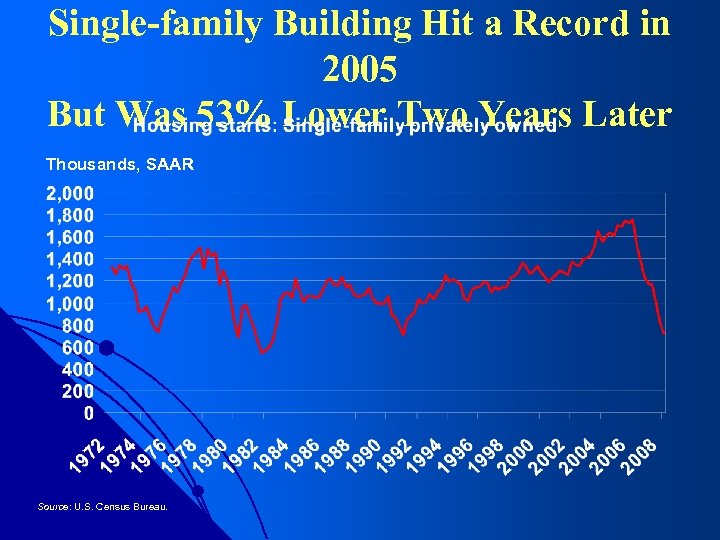

Single-family Housing Starts Sources: U. S. Census Bureau, Global Insight.

Single-family Building Hit a Record in 2005 But Was 53% Lower Two Years Later Thousands, SAAR Source: U. S. Census Bureau.

Homes Sit Longer on the Market Homes available for sale (Left axis) Months supply (Right axis) Sources: National Association of Realtors, Moody’s Economy. com.

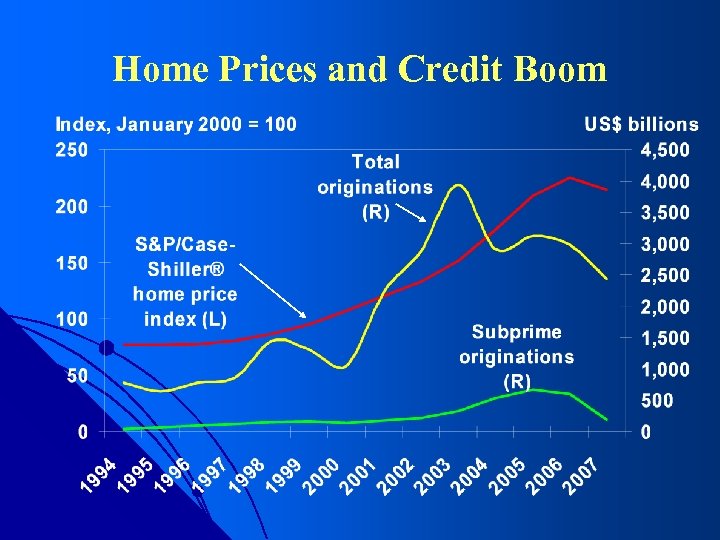

Home Prices and Credit Boom

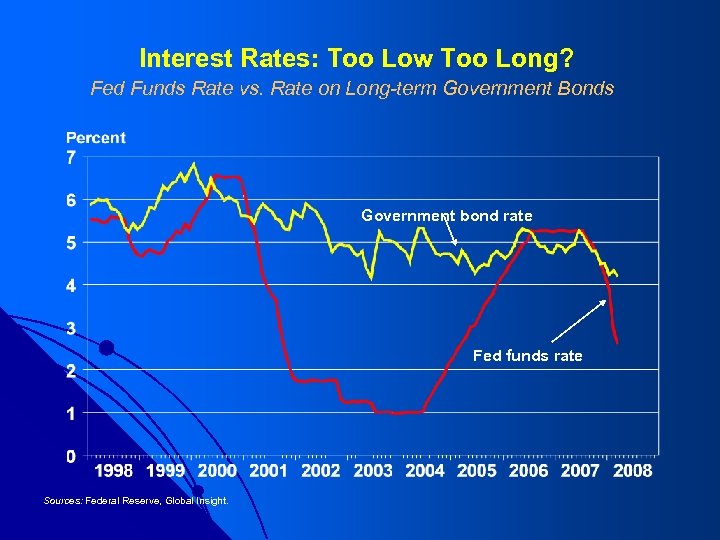

Interest Rates: Too Low Too Long? Fed Funds Rate vs. Rate on Long-term Government Bonds Government bond rate Fed funds rate Sources: Federal Reserve, Global Insight.

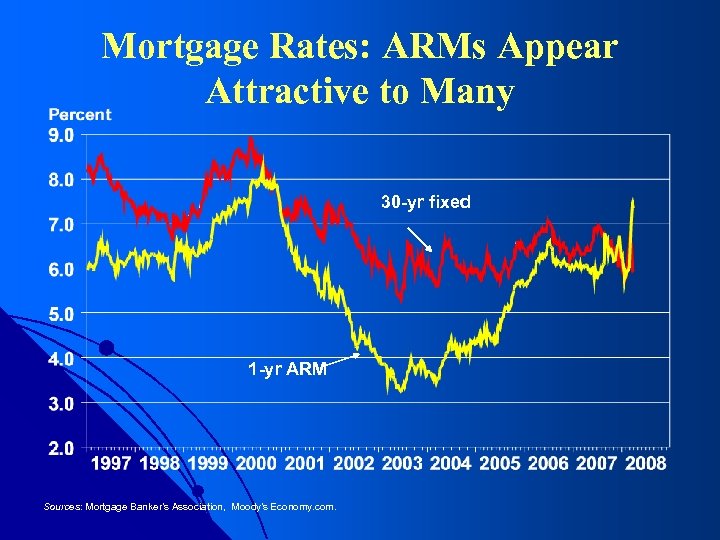

Mortgage Rates: ARMs Appear Attractive to Many 30 -yr fixed 1 -yr ARM Sources: Mortgage Banker’s Association, Moody’s Economy. com.

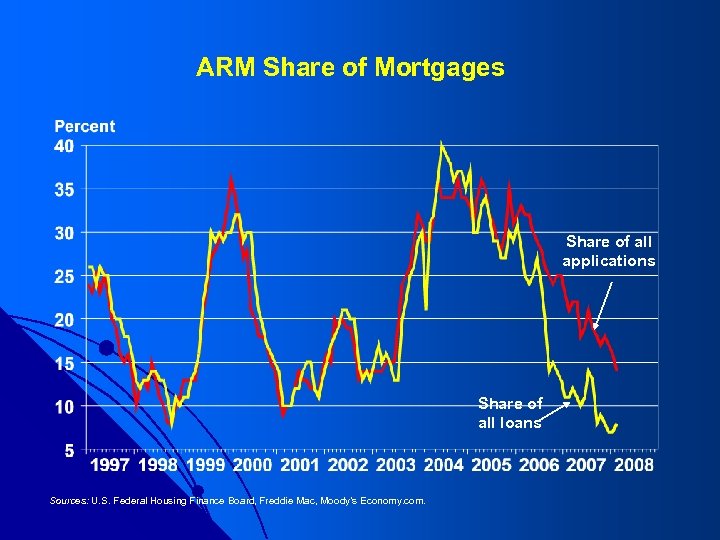

ARM Share of Mortgages Share of all applications Share of all loans Sources: U. S. Federal Housing Finance Board, Freddie Mac, Moody’s Economy. com.

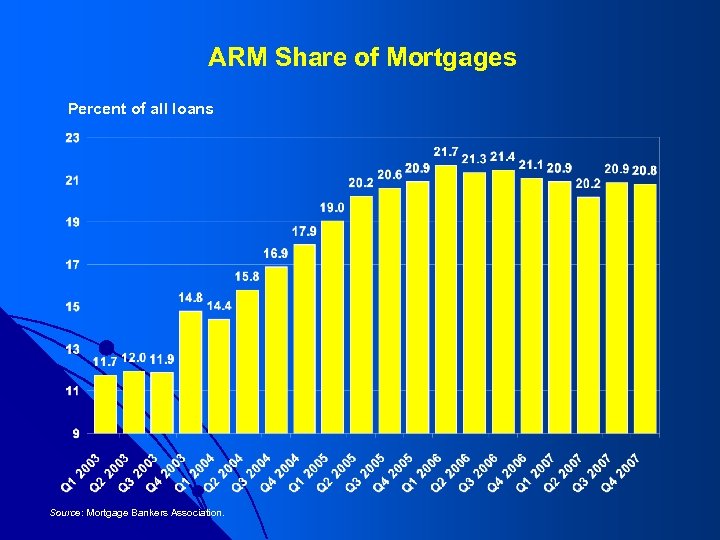

ARM Share of Mortgages Percent of all loans Source: Mortgage Bankers Association.

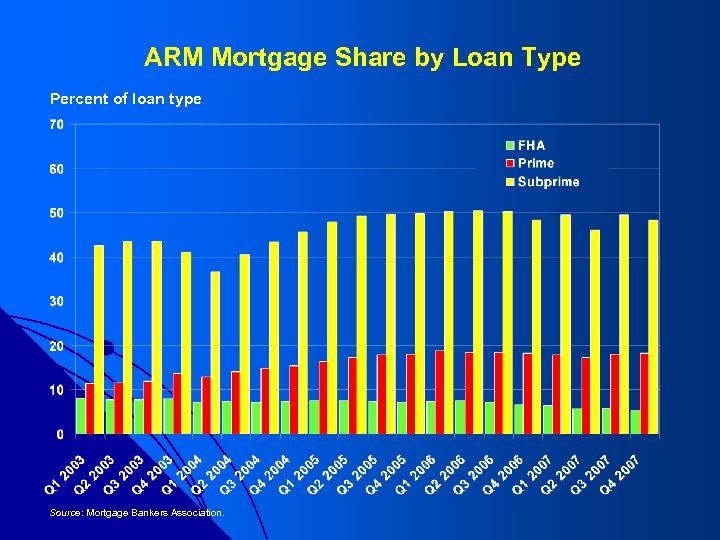

ARM Mortgage Share by Loan Type Percent of loan type Source: Mortgage Bankers Association.

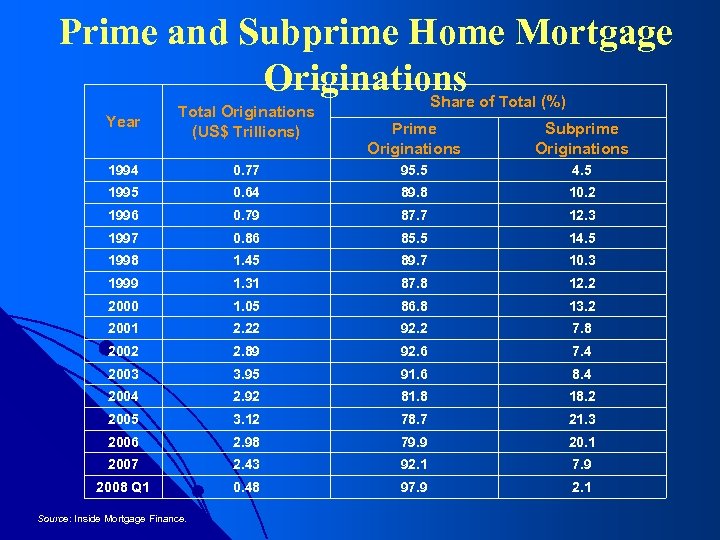

Prime and Subprime Home Mortgage Originations Share of Total (%) Year Total Originations (US$ Trillions) 1994 Prime Originations Subprime Originations 0. 77 95. 5 4. 5 1995 0. 64 89. 8 10. 2 1996 0. 79 87. 7 12. 3 1997 0. 86 85. 5 14. 5 1998 1. 45 89. 7 10. 3 1999 1. 31 87. 8 12. 2 2000 1. 05 86. 8 13. 2 2001 2. 22 92. 2 7. 8 2002 2. 89 92. 6 7. 4 2003 3. 95 91. 6 8. 4 2004 2. 92 81. 8 18. 2 2005 3. 12 78. 7 21. 3 2006 2. 98 79. 9 20. 1 2007 2. 43 92. 1 7. 9 2008 Q 1 0. 48 97. 9 2. 1 Source: Inside Mortgage Finance.

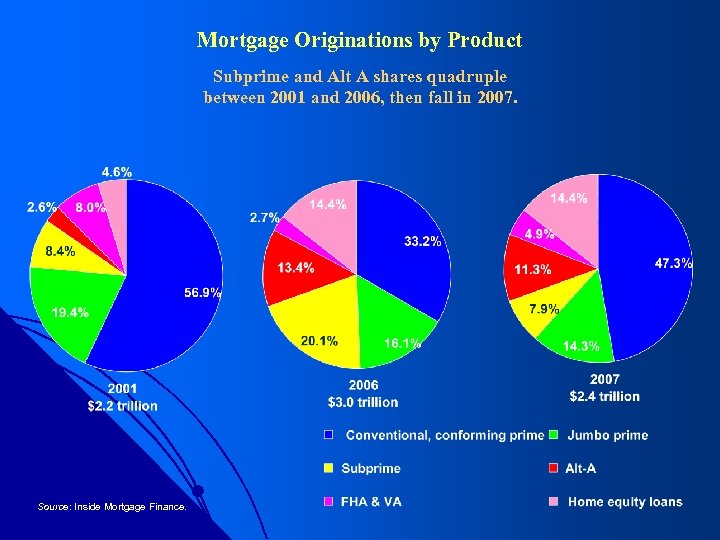

Mortgage Originations by Product Subprime and Alt A shares quadruple between 2001 and 2006, then fall in 2007. Source: Inside Mortgage Finance.

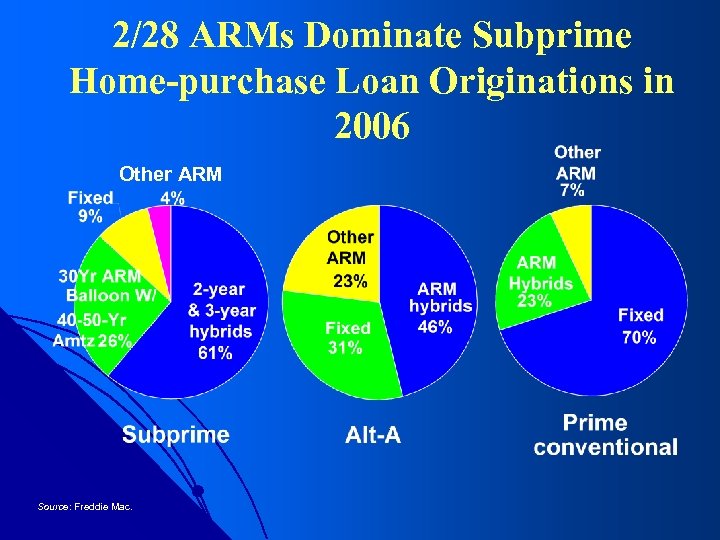

2/28 ARMs Dominate Subprime Home-purchase Loan Originations in 2006 Other ARM Source: Freddie Mac.

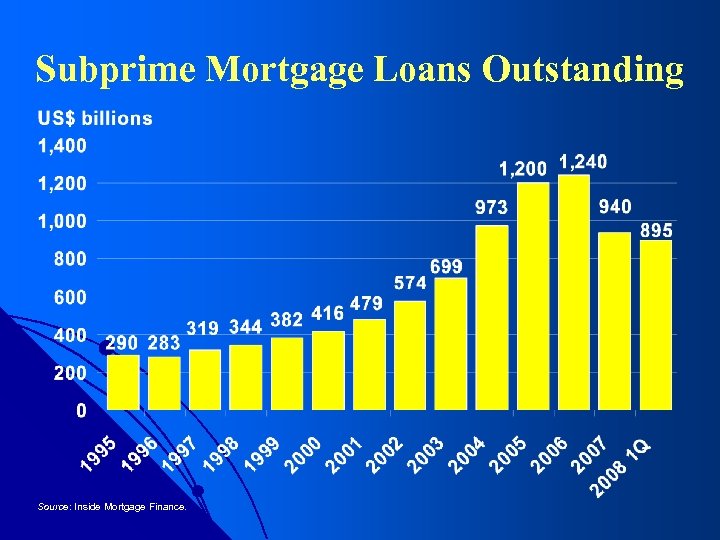

Subprime Mortgage Loans Outstanding Source: Inside Mortgage Finance.

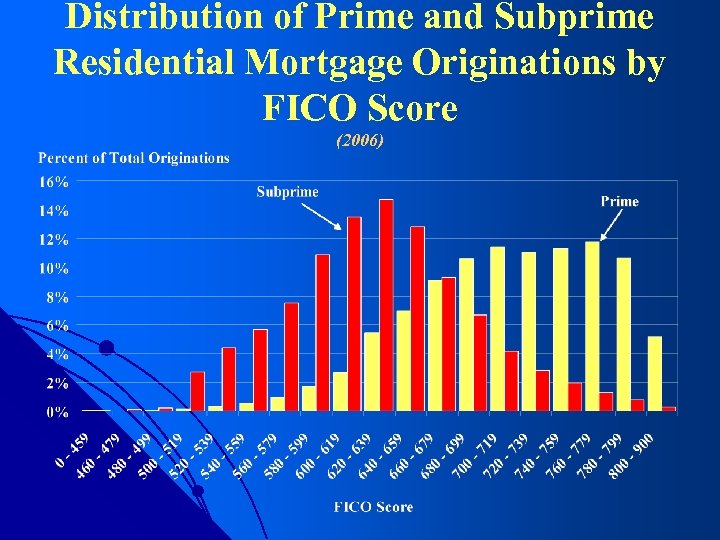

Distribution of Prime and Subprime Residential Mortgage Originations by FICO Score (2006)

National Distribution of FICO Scores

Origin of “Securitization” “But I don’t know any other word to describe what we are doing. You will have to use it (securitization). ” Lewis Ranieri “The Origins of Securitization, Sources of Its Growth, and Its Future Potential, ” A Primer on Securitization

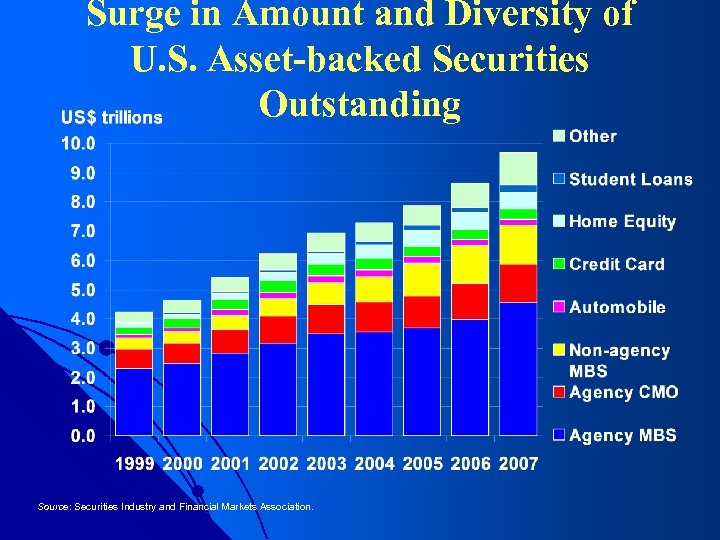

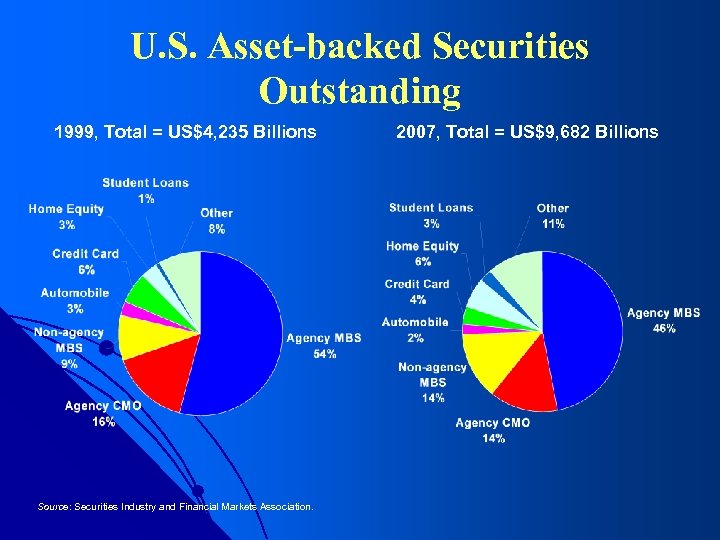

Surge in Amount and Diversity of U. S. Asset-backed Securities Outstanding Source: Securities Industry and Financial Markets Association.

U. S. Asset-backed Securities Outstanding 1999, Total = US$4, 235 Billions Source: Securities Industry and Financial Markets Association. 2007, Total = US$9, 682 Billions

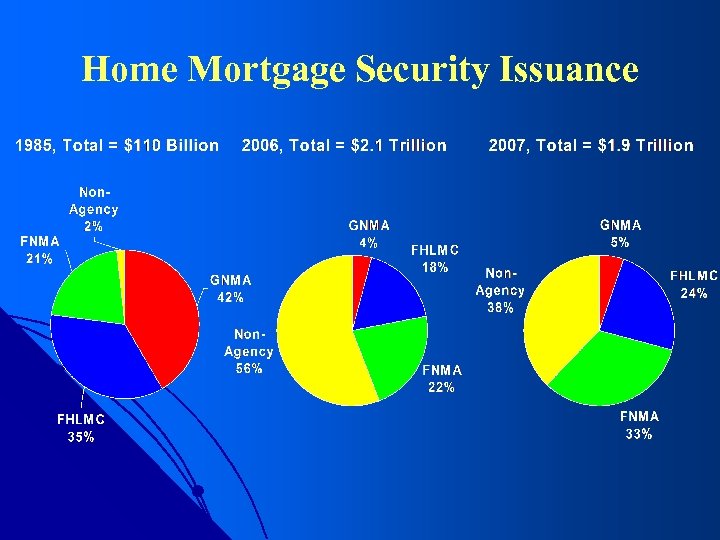

Home Mortgage Security Issuance

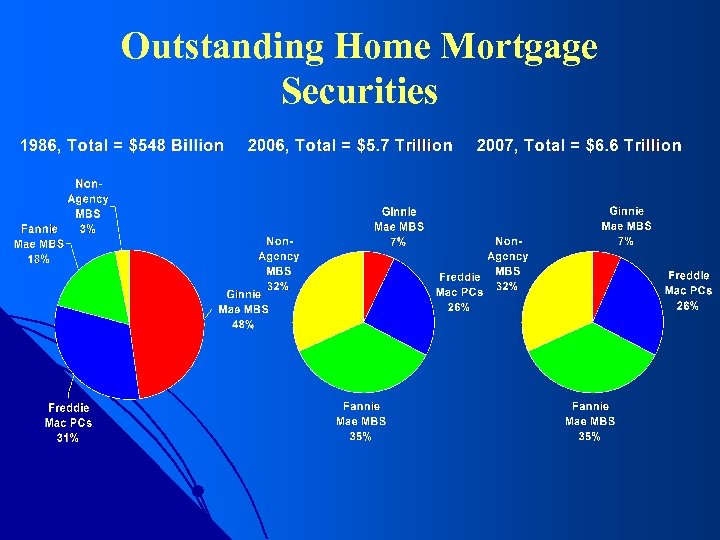

Outstanding Home Mortgage Securities

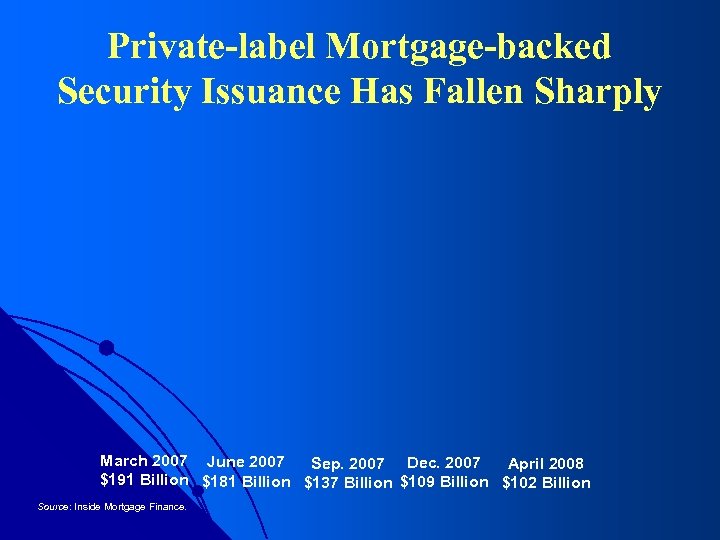

Private-label Mortgage-backed Security Issuance Has Fallen Sharply March 2007 June 2007 Sep. 2007 Dec. 2007 April 2008 $191 Billion $181 Billion $137 Billion $109 Billion $102 Billion Source: Inside Mortgage Finance.

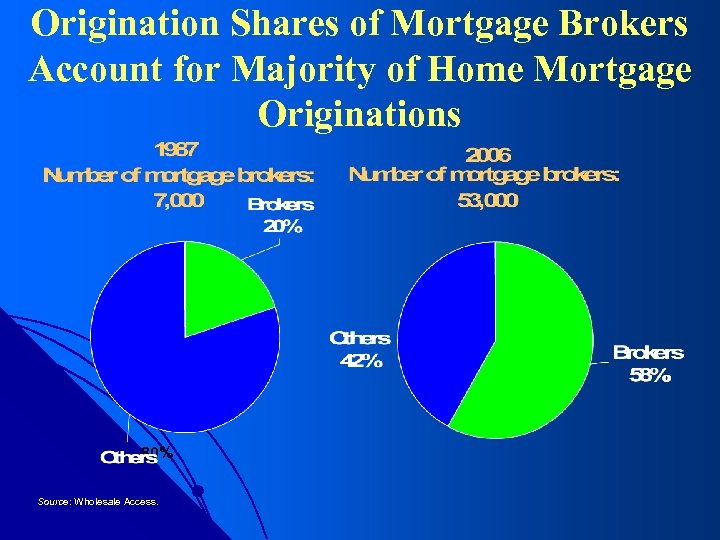

Origination Shares of Mortgage Brokers Account for Majority of Home Mortgage Originations 80% Source: Wholesale Access.

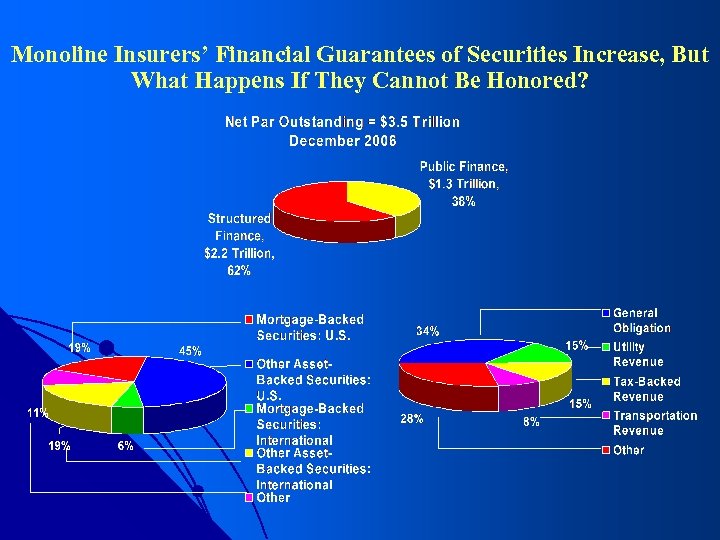

Monoline Insurers’ Financial Guarantees of Securities Increase, But What Happens If They Cannot Be Honored?

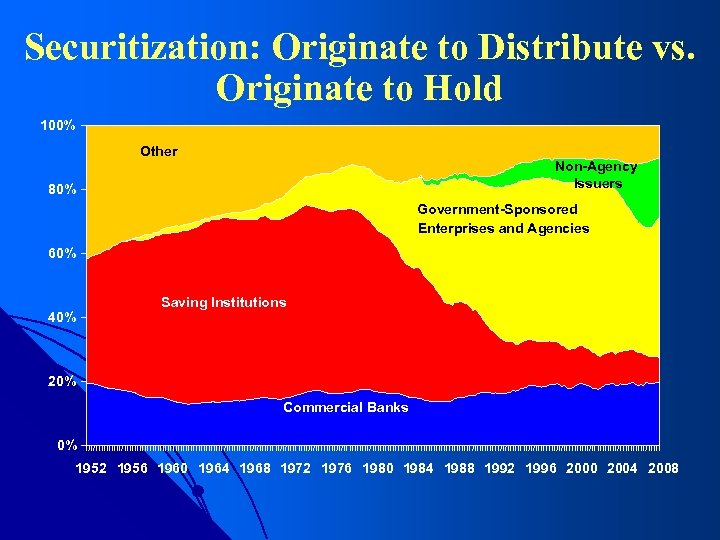

Securitization: Originate to Distribute vs. Originate to Hold 100% Other Non-Agency Issuers 80% Government-Sponsored Enterprises and Agencies 60% 40% Saving Institutions 20% Commercial Banks 0% 1952 1956 1960 1964 1968 1972 1976 1980 1984 1988 1992 1996 2000 2004 2008

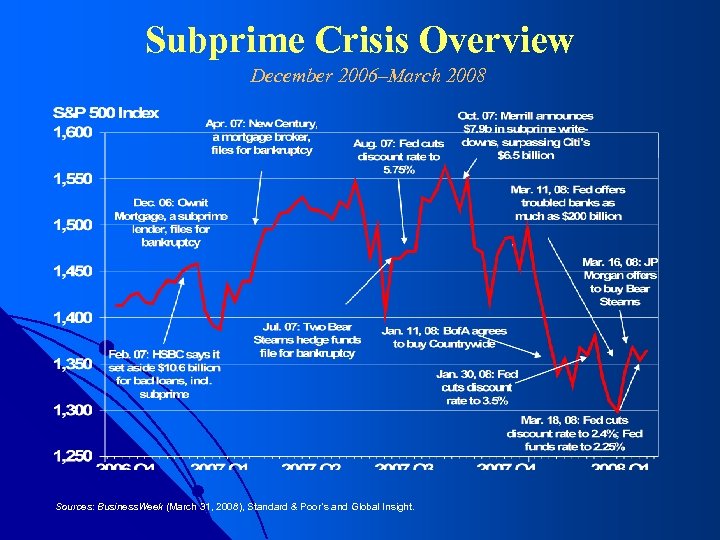

Subprime Crisis Overview December 2006–March 2008 Sources: Business. Week (March 31, 2008), Standard & Poor’s and Global Insight.

Ratio of Median Home Price to Median Household Income Surges

Home Mortgage Share of Household Liabilities Reaches a New High in 2007 Source: Federal Reserve.

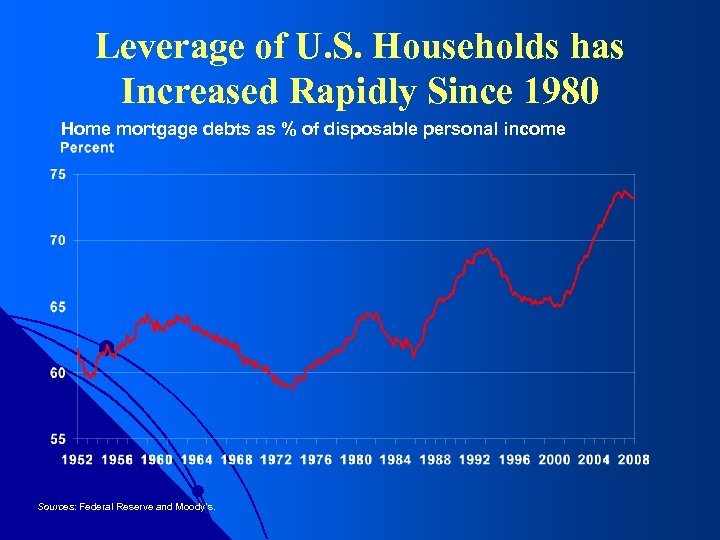

Leverage of U. S. Households has Increased Rapidly Since 1980 Home mortgage debts as % of disposable personal income Sources: Federal Reserve and Moody’s.

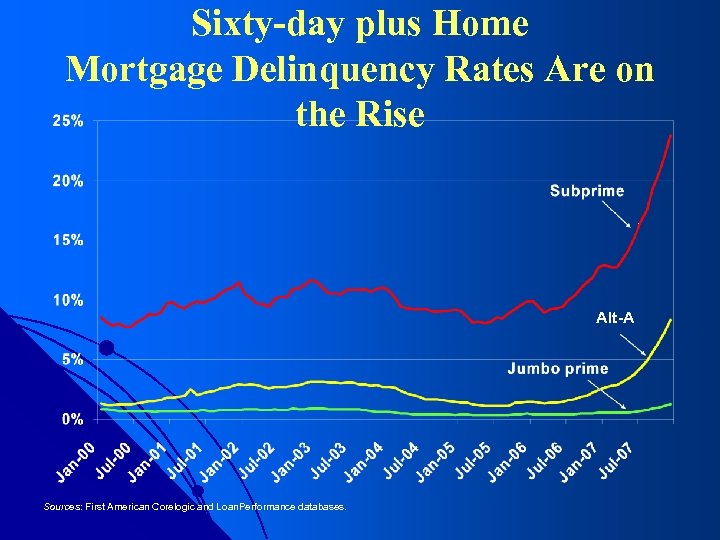

Sixty-day plus Home Mortgage Delinquency Rates Are on the Rise Alt-A Sources: First American Corelogic and Loan. Performance databases.

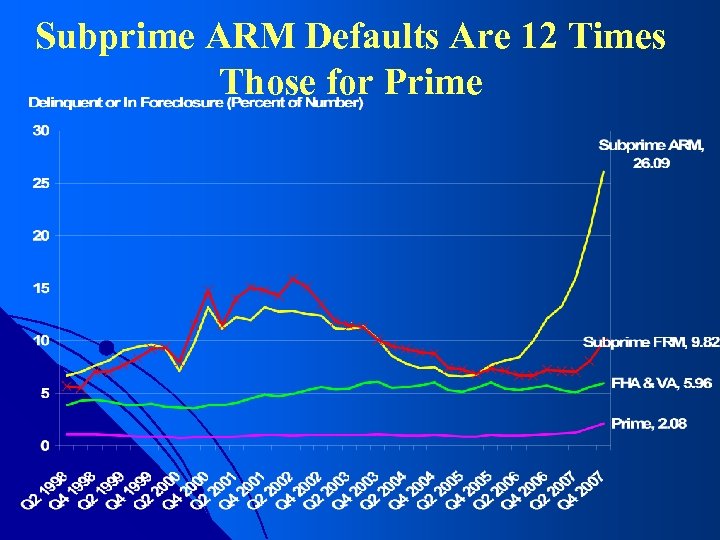

Subprime ARM Defaults Are 12 Times Those for Prime

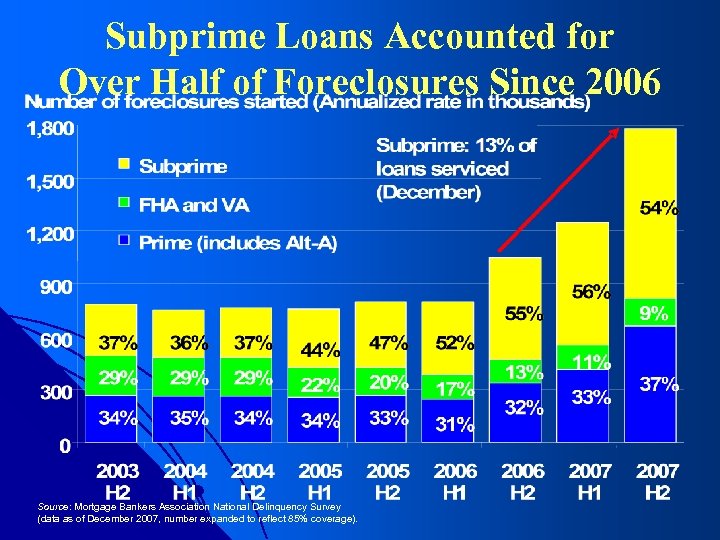

Subprime Loans Accounted for Over Half of Foreclosures Since 2006 Source: Mortgage Bankers Association National Delinquency Survey (data as of December 2007, number expanded to reflect 85% coverage).

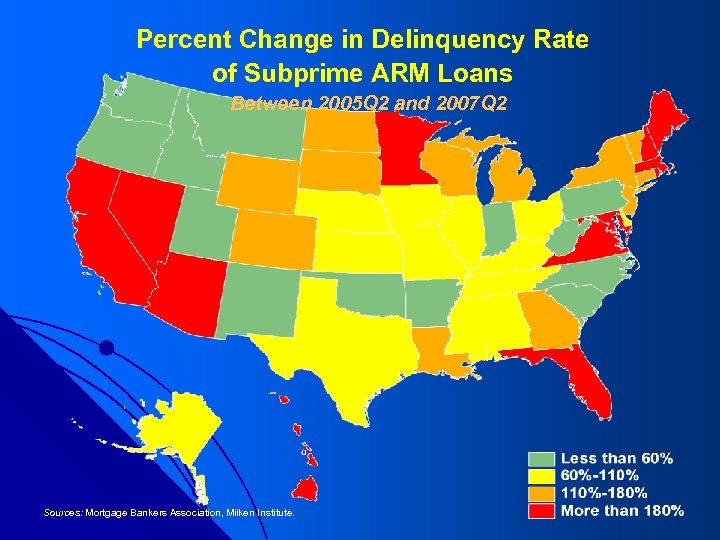

Percent Change in Delinquency Rate of Subprime ARM Loans Between 2005 Q 2 and 2007 Q 2 Sources: Mortgage Bankers Association, Milken Institute.

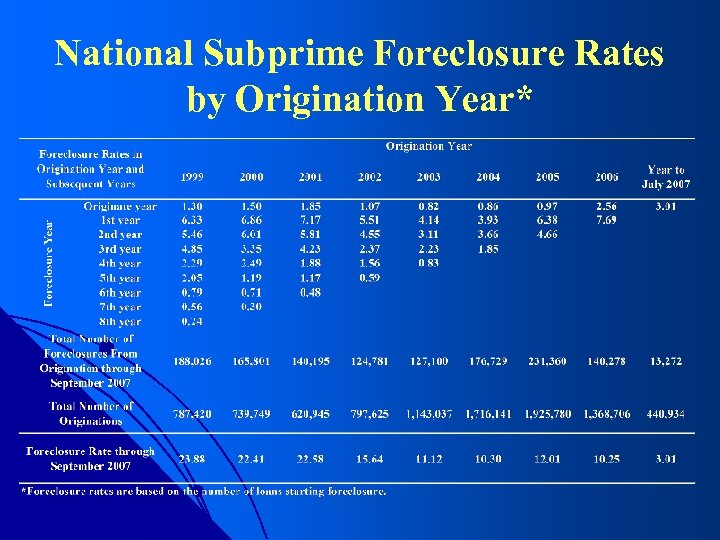

National Subprime Foreclosure Rates by Origination Year*

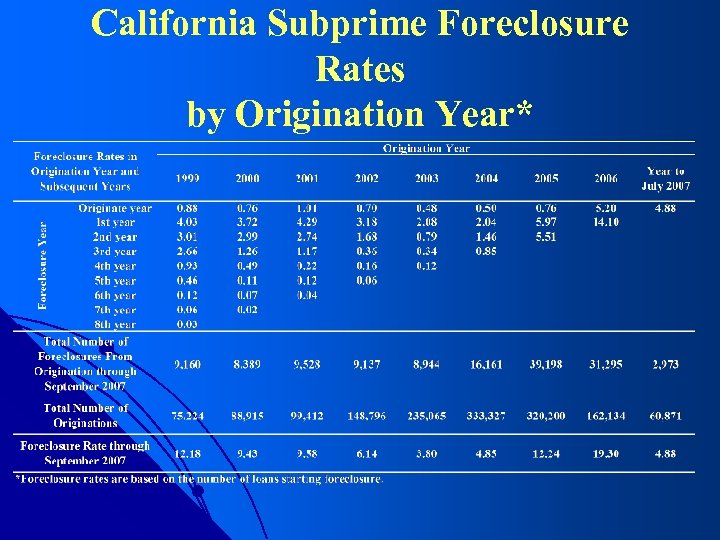

California Subprime Foreclosure Rates by Origination Year*

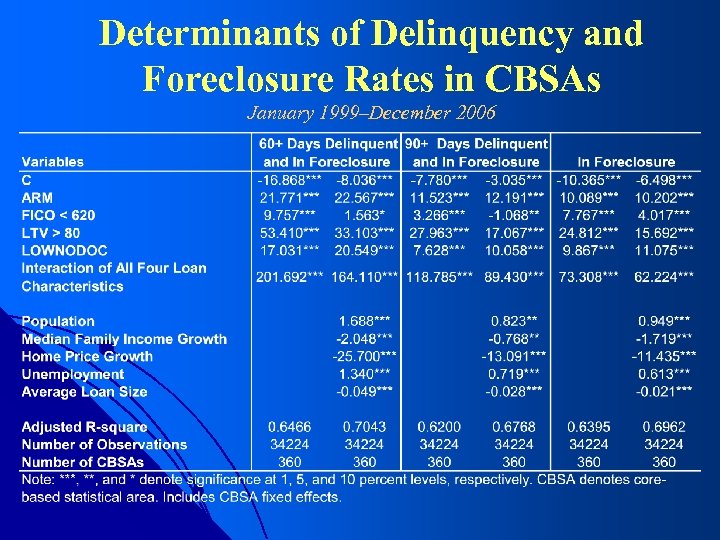

Determinants of Delinquency and Foreclosure Rates in CBSAs January 1999–December 2006

Determinants of Delinquency and Foreclosure Rates in CBSAs January 1999–December 2005

Determinants of Delinquency and Foreclosure Rates in CBSAs January 1999–December 2004

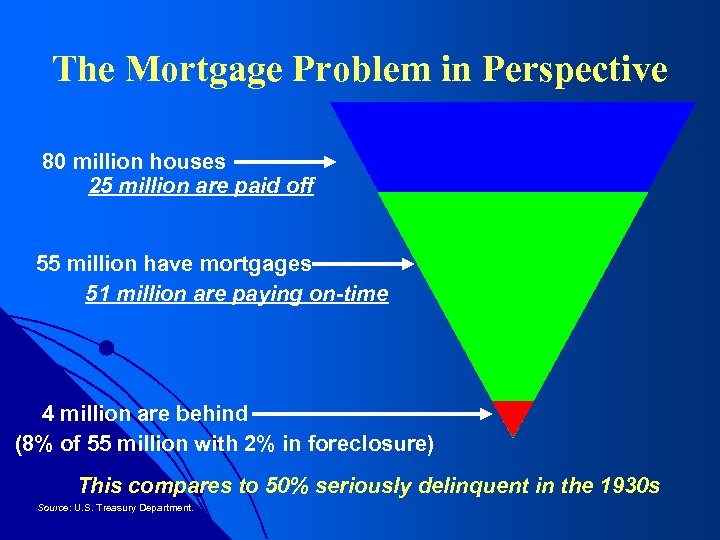

The Mortgage Problem in Perspective 80 million houses 25 million are paid off 55 million have mortgages 51 million are paying on-time 4 million are behind (8% of 55 million with 2% in foreclosure) This compares to 50% seriously delinquent in the 1930 s Source: U. S. Treasury Department.

“A billion here, a billion there, and pretty soon you’re talking real money. ” -- U. S. Senator Everett Dirksen, 1961

“A billion^here, a billion^there, and pretty soon you’re talking real money. ” -- U. S. Senator Everett Dirksen, 1961

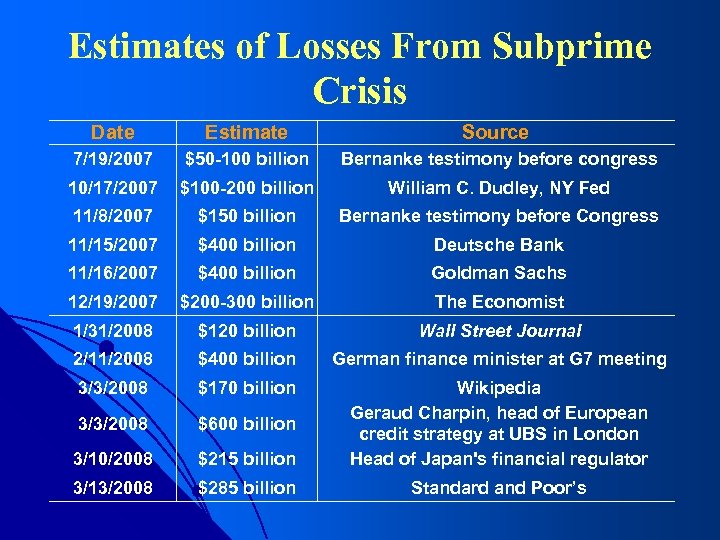

Estimates of Losses From Subprime Crisis Date Estimate Source 7/19/2007 $50 -100 billion Bernanke testimony before congress 10/17/2007 $100 -200 billion William C. Dudley, NY Fed 11/8/2007 $150 billion Bernanke testimony before Congress 11/15/2007 $400 billion Deutsche Bank 11/16/2007 $400 billion Goldman Sachs 12/19/2007 $200 -300 billion The Economist 1/31/2008 $120 billion Wall Street Journal 2/11/2008 $400 billion German finance minister at G 7 meeting 3/3/2008 $170 billion 3/3/2008 $600 billion 3/10/2008 $215 billion Wikipedia Geraud Charpin, head of European credit strategy at UBS in London Head of Japan's financial regulator 3/13/2008 $285 billion Standard and Poor’s

Supbrime’s Biggest Losers The collapse of credit markets in the United States, driven by the subprime loan crisis, has led to major losses for banks worldwide. Source: Bloomberg.

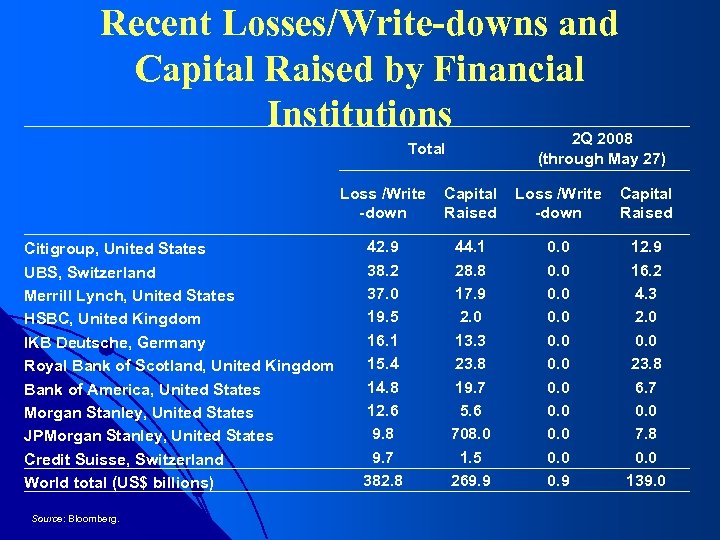

Recent Losses/Write-downs and Capital Raised by Financial Institutions 2 Q 2008 Total Citigroup, United States UBS, Switzerland Merrill Lynch, United States HSBC, United Kingdom IKB Deutsche, Germany Royal Bank of Scotland, United Kingdom Bank of America, United States Morgan Stanley, United States JPMorgan Stanley, United States Credit Suisse, Switzerland World total (US$ billions) Source: Bloomberg. Loss /Write -down 42. 9 38. 2 37. 0 19. 5 16. 1 15. 4 14. 8 12. 6 9. 8 9. 7 382. 8 (through May 27) Capital Loss /Write Raised -down 44. 1 28. 8 17. 9 2. 0 13. 3 23. 8 19. 7 5. 6 708. 0 1. 5 269. 9 0. 0 0. 9 Capital Raised 12. 9 16. 2 4. 3 2. 0 0. 0 23. 8 6. 7 0. 0 7. 8 0. 0 139. 0

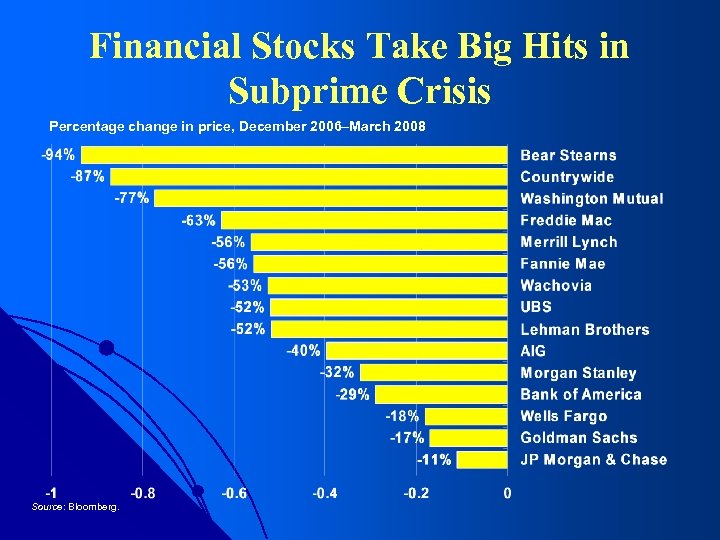

Financial Stocks Take Big Hits in Subprime Crisis Percentage change in price, December 2006–March 2008 Source: Bloomberg.

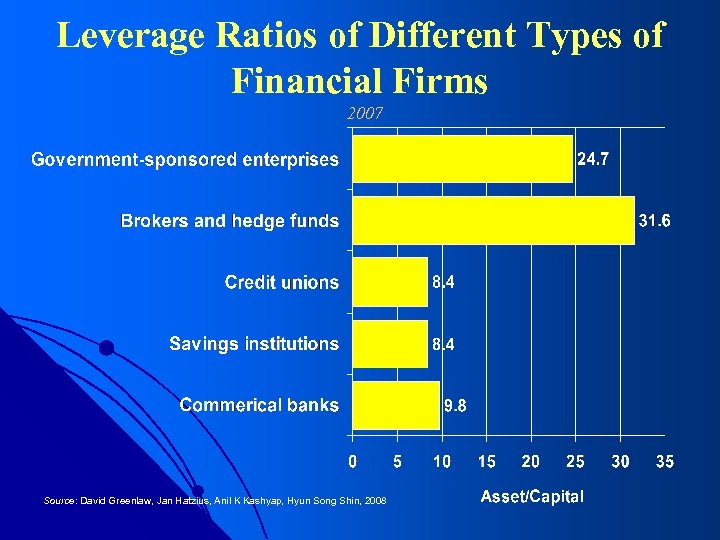

Leverage Ratios of Different Types of Financial Firms 2007 Source: David Greenlaw, Jan Hatzius, Anil K Kashyap, Hyun Song Shin, 2008

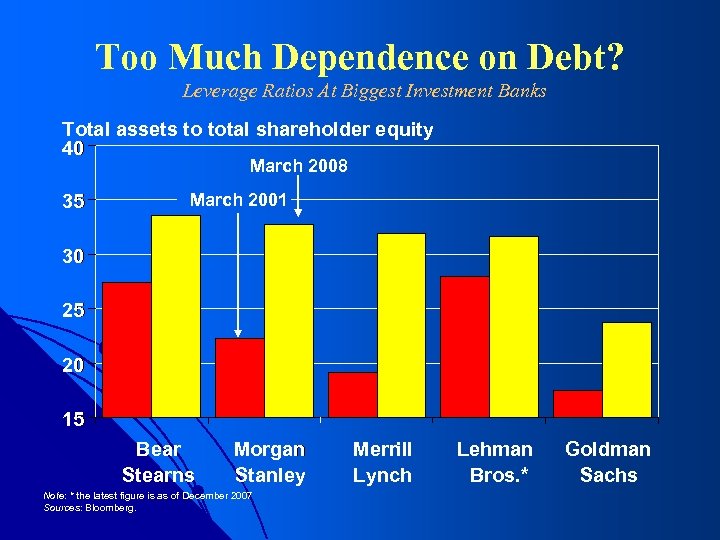

Too Much Dependence on Debt? Leverage Ratios At Biggest Investment Banks Total assets to total shareholder equity 40 March 2008 35 March 2001 30 25 20 15 Bear Stearns Morgan Stanley Note: * the latest figure is as of December 2007 Sources: Bloomberg. Merrill Lynch Lehman Bros. * Goldman Sachs

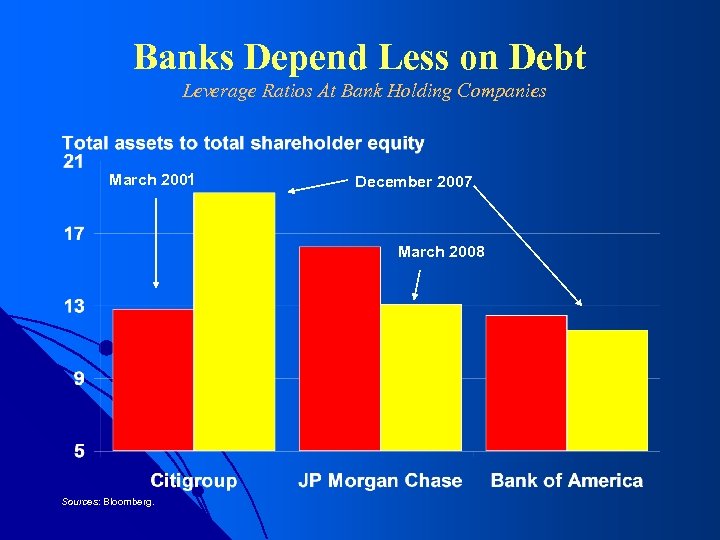

Banks Depend Less on Debt Leverage Ratios At Bank Holding Companies March 2001 December 2007 March 2008 Sources: Bloomberg.

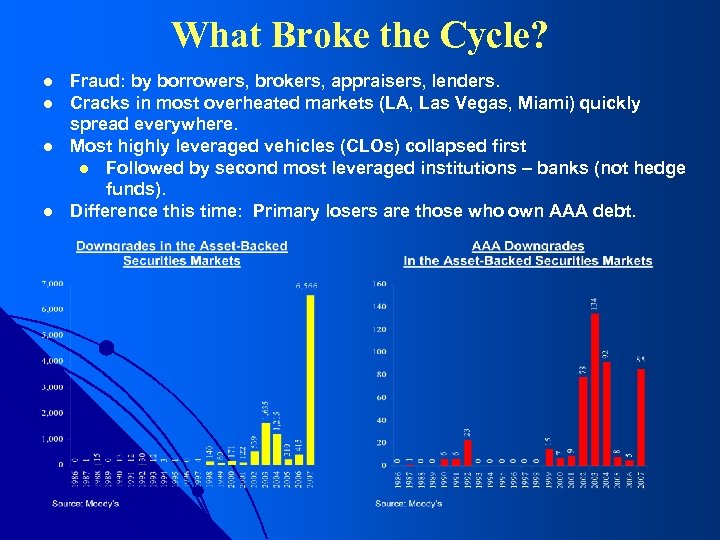

What Broke the Cycle? l l Fraud: by borrowers, brokers, appraisers, lenders. Cracks in most overheated markets (LA, Las Vegas, Miami) quickly spread everywhere. Most highly leveraged vehicles (CLOs) collapsed first l Followed by second most leveraged institutions – banks (not hedge funds). Difference this time: Primary losers are those who own AAA debt.

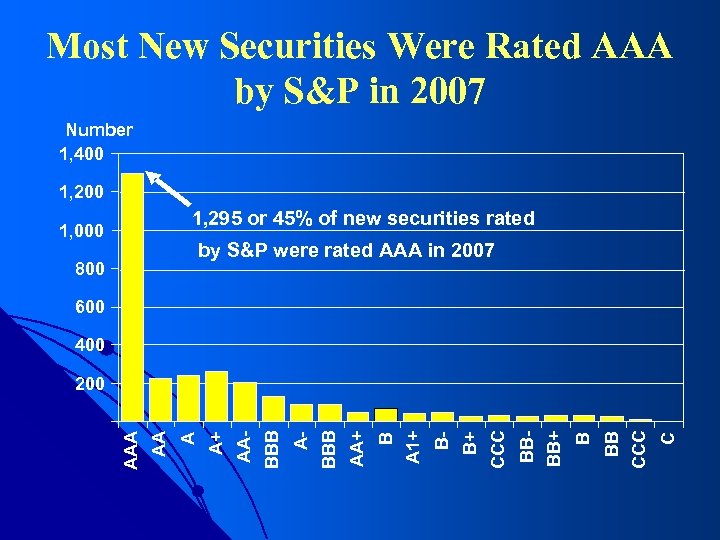

Most New Securities Were Rated AAA by S&P in 2007 Number 1, 400 1, 295 or 45% of new securities rated 1, 000 by S&P were rated AAA in 2007 800 600 400 C CCC BB B BB+ BB- CCC B+ B- A 1+ B AA+ BBB A- BBB AA- A+ A AA AAA 200

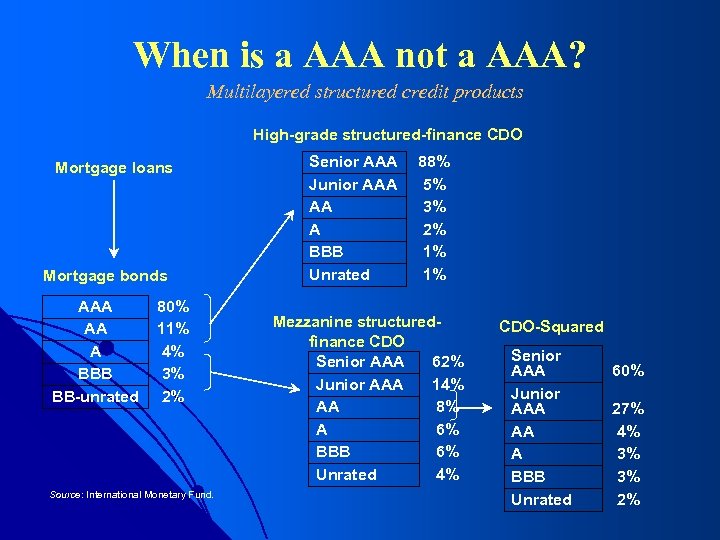

When is a AAA not a AAA? Multilayered structured credit products High-grade structured-finance CDO Mortgage loans Mortgage bonds AAA AA A BBB BB-unrated 80% 11% 4% 3% 2% Source: International Monetary Fund. Senior AAA Junior AAA AA A BBB Unrated 88% 5% 3% 2% 1% 1% Mezzanine structuredfinance CDO Senior AAA 62% Junior AAA 14% AA 8% A 6% BBB 6% Unrated 4% CDO-Squared Senior AAA Junior AAA AA A BBB Unrated 60% 27% 4% 3% 3% 2%

Most Texas Banks Were AAA in the 1980 s First Republic. Bank Corporation

Foreclosures in Houston 30, 000 20, 000 1, 000 1980 Source: Harris County Foreclosure Listing Service. 1986 1992

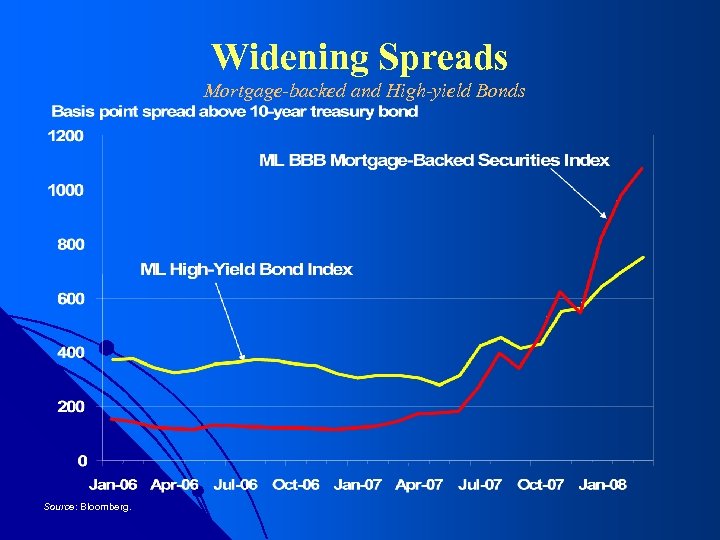

Widening Spreads Mortgage-backed and High-yield Bonds Source: Bloomberg.

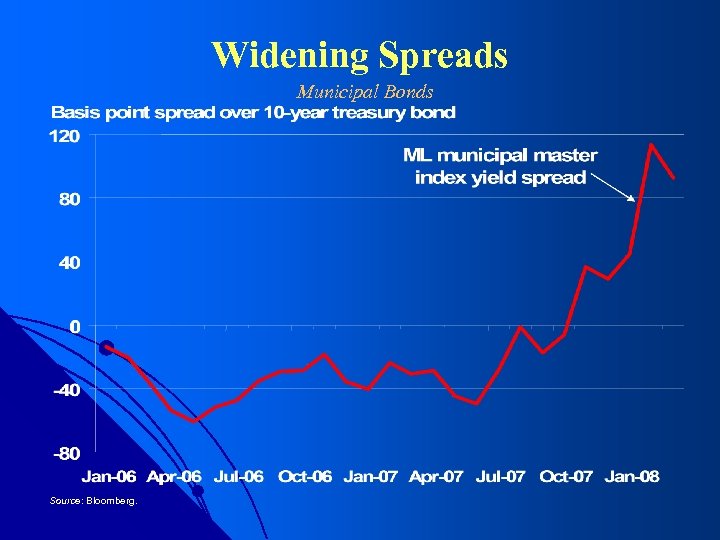

Widening Spreads Municipal Bonds Source: Bloomberg.

Market for Liquidity Freezes Percent Source: Federal Reserve.

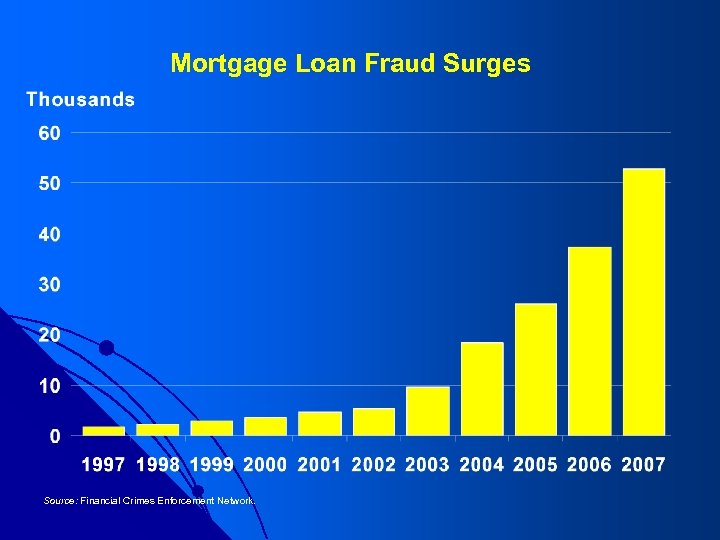

Mortgage Loan Fraud Surges Source: Financial Crimes Enforcement Network.

Dollar Losses in Reported Cases of Mortgage Fraud Source: Federal Bureau of Investigation.

Tightened Standards For Real Estate Loans Net percentage of domestic respondents tightening standards for commercial real estate loans Source: Federal Reserve.

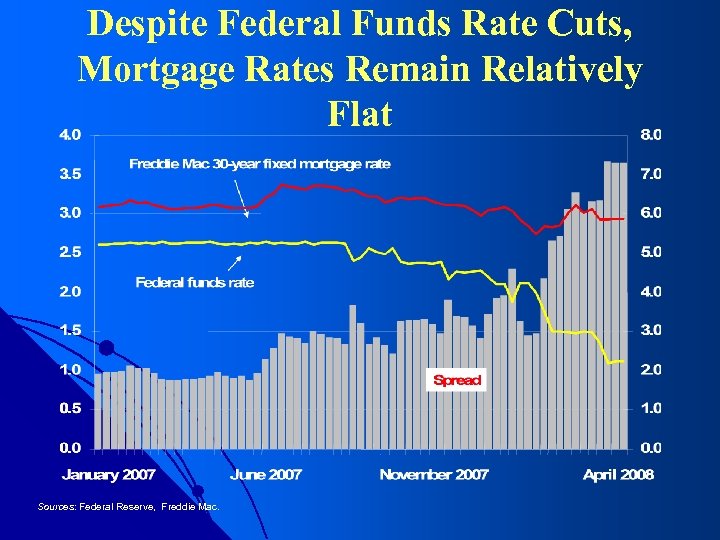

Despite Federal Funds Rate Cuts, Mortgage Rates Remain Relatively Flat Sources: Federal Reserve, Freddie Mac.

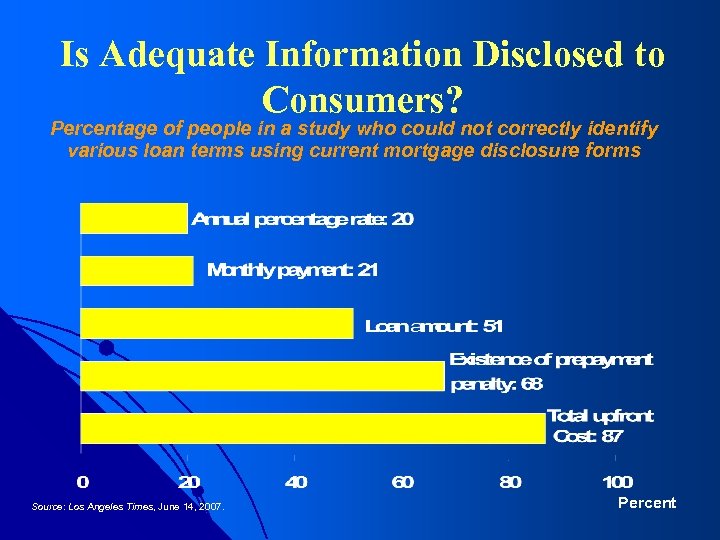

Is Adequate Information Disclosed to Consumers? Percentage of people in a study who could not correctly identify various loan terms using current mortgage disclosure forms Source: Los Angeles Times, June 14, 2007. Percent

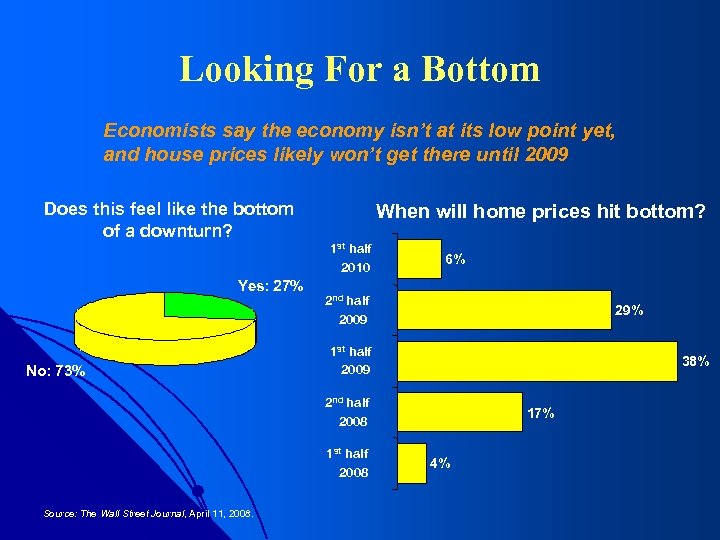

Looking For a Bottom Economists say the economy isn’t at its low point yet, and house prices likely won’t get there until 2009 Does this feel like the bottom of a downturn? When will home prices hit bottom? 1 st half 2010 Yes: 27% No: 73% 6% 2 nd half 2009 29% 1 st half 2009 38% 2 nd half 2008 1 st half 2008 Source: The Wall Street Journal, April 11, 2008. 17% 4%

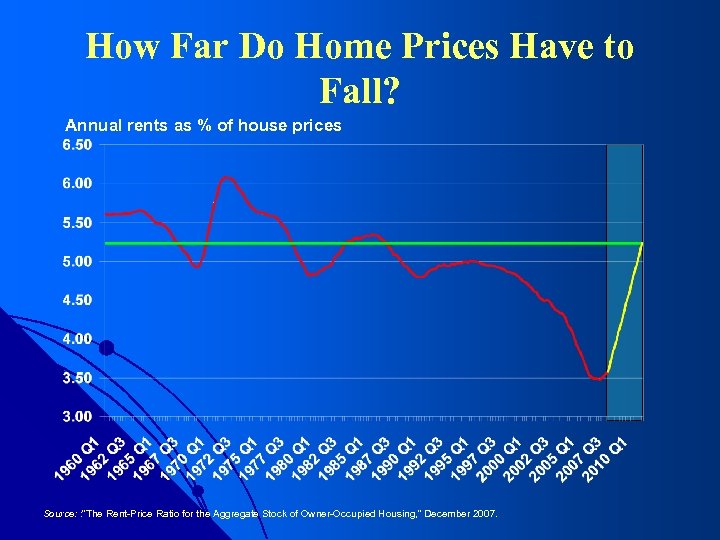

How Far Do Home Prices Have to Fall? Annual rents as % of house prices Source: : ”The Rent-Price Ratio for the Aggregate Stock of Owner-Occupied Housing, ” December 2007.

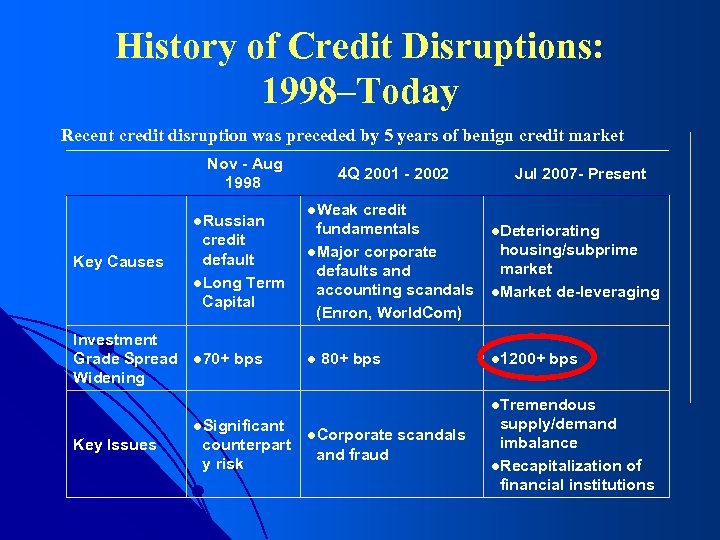

History of Credit Disruptions: 1998–Today Recent credit disruption was preceded by 5 years of benign credit market Nov - Aug 1998 l. Russian Key Causes Investment Grade Spread Widening 4 Q 2001 - 2002 Jul 2007 - Present l. Weak credit default l. Long Term Capital fundamentals l. Major corporate defaults and accounting scandals (Enron, World. Com) l. Deteriorating l 70+ bps l 80+ bps l 1200+ bps housing/subprime market l. Market de-leveraging l. Tremendous l. Significant Key Issues counterpart y risk l. Corporate scandals and fraud supply/demand imbalance l. Recapitalization of financial institutions

What Went Wrong: 1960 s 1980 s Today 2020 s?

Enough Blame to Go Around l Nonresident speculators l Regulators/central bankers l Brokers/other intermediaries l Rating agencies l Institutional investors l Home buyers l Appraisers

$1 Trillion Losses l The “Nifty Fifty” stocks - early 1970 s l Sovereign debt: 1980 s l Texas banks/Southwest real estate: 1980 s l Japanese real estate/equities: 1980 s-90 s l Technology: 2000 l Housing-related investments: 2007 -8

Credit Issues l Ratings consistency l Business volatility l Real estate price fluctuation l Liquidity risk l Counterparty risk Interest rate volatility l Currency risk l Unexpected regulatory requirements l Complexity l l l Sovereign debt risk Leverage

1974: The most important year in financial history since World War II.

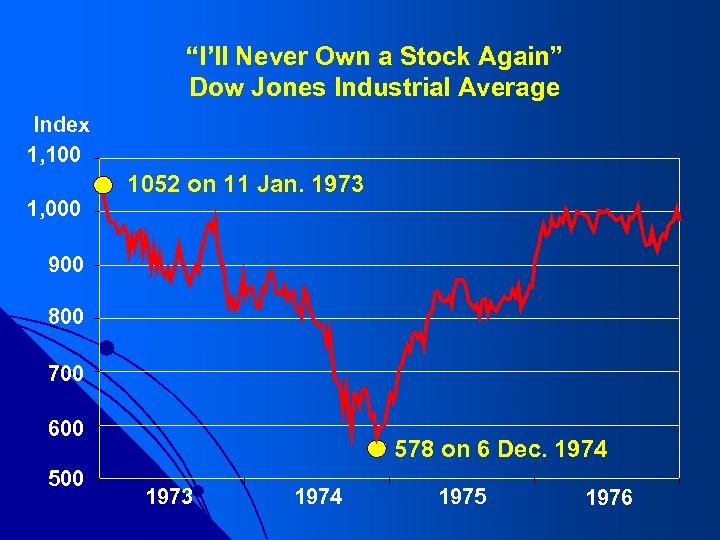

1974: l Interest rates double in one year; highest level in recent recorded U. S. history l Regulation restricts lending l Energy prices skyrocket l U. S. stock market plunges 50%

1974: RESULT Companies with the highest returns on capital, fastest rates of market share and employment growth, greatest contributions to technological and new- product innovation were denied access to equity and debt capital.

For 1975 through 1976, the return on investment non-investment debt-grade portfolios to investors was 100% unleveraged. Fewer than 1 percent of those companies projected to be candidates for bankruptcies actually defaulted.

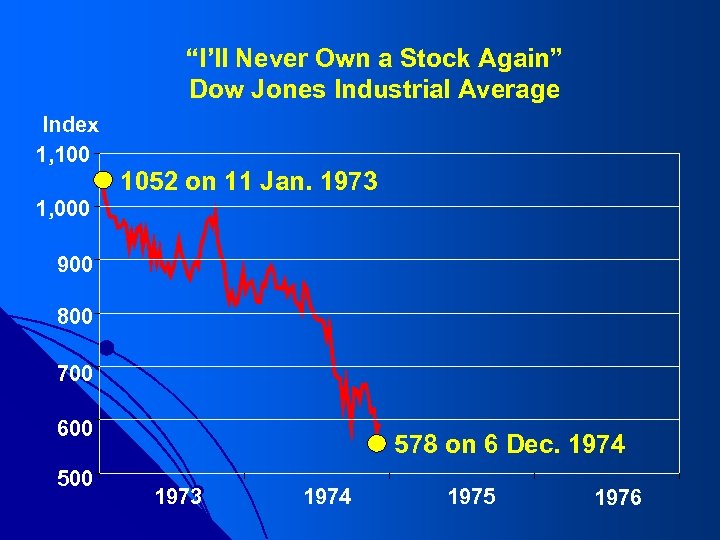

“I’ll Never Own a Stock Again” Dow Jones Industrial Average Index 1, 100 1052 on 11 Jan. 1973 1, 000 900 800 700 600 578 on 6 Dec. 1974 1973 1974 1975 1976

“I’ll Never Own a Stock Again” Dow Jones Industrial Average Index 1, 100 1, 000 1052 on 11 Jan. 1973 900 800 700 600 578 on 6 Dec. 1974 1973 1974 1975 1976

The $55 Billion Misunderstanding Investing in the Nifty Fifty 12/31/72 – 12/31/81 90% of the “Nifty Fifty” showed a negative return over nine years. The average inflation -adjusted rate of return was -46%.

The $55 Billion Misunderstanding Investing in the Nifty Fifty 12/31/72 – 12/31/81 The average P/E ratio of these 16 companies dropped from 66 to 11. Avon ADP Coke Disney Kodak H-P J&J Eli Lilly Marriott Mc. Donald’s Merck Polaroid Rite-Aid Wal-Mart Xerox Dr. Pepper

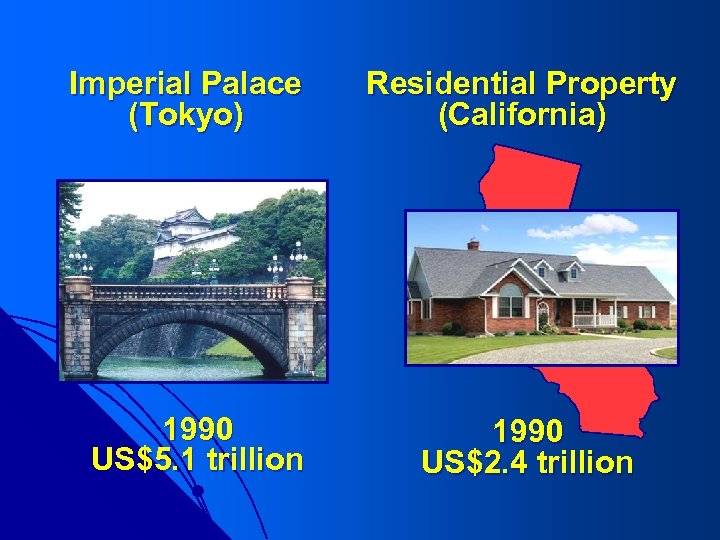

Imperial Palace (Tokyo) Residential Property (California) 1990 US$5. 1 trillion 1990 US$2. 4 trillion

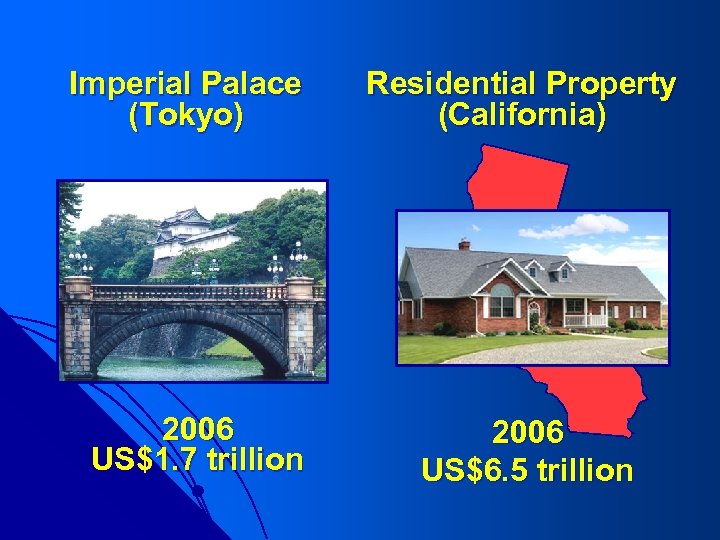

Imperial Palace (Tokyo) Residential Property (California) 2006 US$1. 7 trillion 2006 US$6. 5 trillion

“Real estate prices collapsed, credit dried up, house building stopped. . .

“Real estate prices collapsed, credit dried up, house building stopped. . . in 1792. ”

edf8db72c351ea01ed207ac154401928.ppt