b00ee0d168ac33c7b835b963de28603d.ppt

- Количество слайдов: 35

U. S. RMBS Rating Update Glenn Costello Managing Director August 2007

Agenda New Surveillance Criteria And The ‘Under Analysis’ List Revised Criteria For Rating New Issue RMBS

Agenda New Surveillance Criteria And The ‘Under Analysis’ List Revised Criteria For Rating New Issue RMBS

Understanding Fitch SMARTView > Each month, monitoring criteria determines deals that are selected for review > The ‘Under Analysis’ deals are posted on the website and a press release is issued. All other deals are marked as not being selected for review that month > ‘Under Analysis’ is not the same as ‘Rating Watch’. Whole deals are placed under analysis, and only after analysis is completed are individual tranches upgraded/downgraded/put on ‘Watch’, or affirmed > Separate lists are posted for subprime and Alt-A/prime > Fitch’s goal is to process all deals under review within 30 days www. derivativefitch. com 3

The July 2007 Subprime ‘Under Analysis’ List 170 Transactions > Vintage Distribution: 2006 – 106; 2005 – 27; Older - 37 > Ratings Distribution by # Tranches (2005 and 2006 Deals): – – AAA: 611 AA/A: 812 BBB: 339 BB/B: 126 ‘Stressed’ Vintage Selection Criteria > Deals from 2 H 2005 and 2006 > Estimated loss expectation of 8% or greater; Estimated ‘BBB’ Loss Coverage less than 1. 25 www. derivativefitch. com 4

Fitch’s Approach On ‘Under Analysis’ List > Develop enhanced criteria for evaluating stressed vintages > Conduct rating committees for each transaction > Publish Rating Action Commentaries with detailed information on analysis of each rated security. www. derivativefitch. com 5

Risk Factors For Stressed Vintages > High Combined Loan-To-Value Ratios > Limited/No Borrower Documentation > Payment Shock At ARM Reset > Declining Home Prices – Fitch RMBS model estimates 6%-8% from peak prices www. derivativefitch. com 6

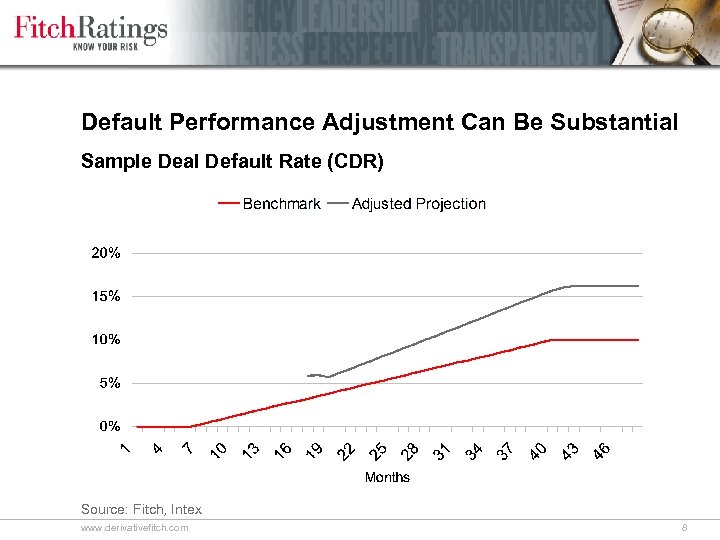

Criteria Changes For Expected Loss Projection > Greater weight to early performance in projecting lifetime performance. This can add several points of pool balance expected to default. – e. g. Prior expectation of 15%, New Expectation of 20% > Increased default expectations for 2/28 hybrid ARM loans. – 1. 2 x prior default expectation if the ARM does not have a ‘piggyback’ second-lien – 1. 5 x prior default expectation if the ARM does have a ‘piggy-back’ second-lien – Combined multiples for analyzed pools range from around 1. 15 x to around 1. 35 x – Results in 2% to 4. 5% of additional pool balance expected to default www. derivativefitch. com 7

Default Performance Adjustment Can Be Substantial Sample Deal Default Rate (CDR) Source: Fitch, Intex www. derivativefitch. com 8

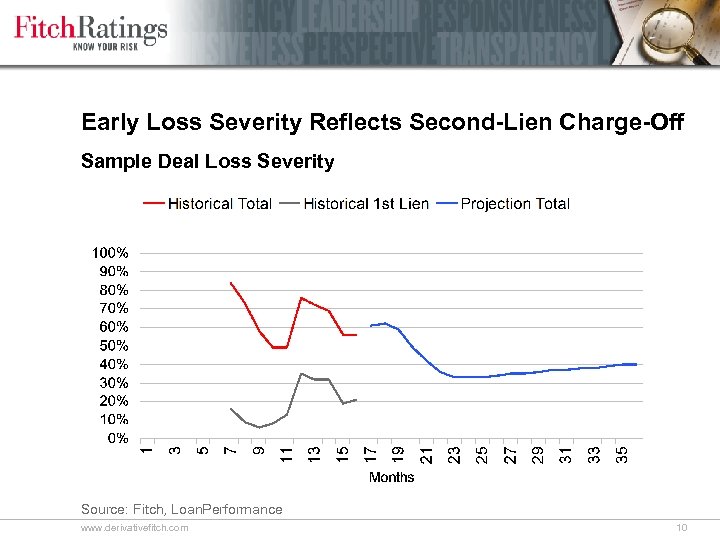

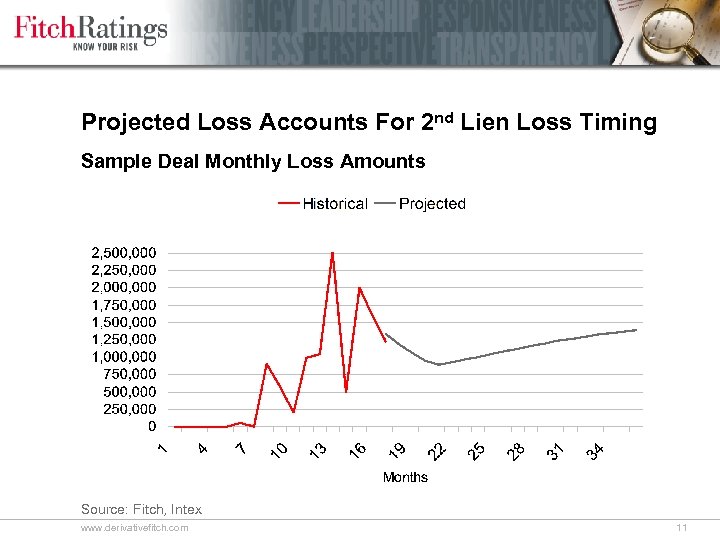

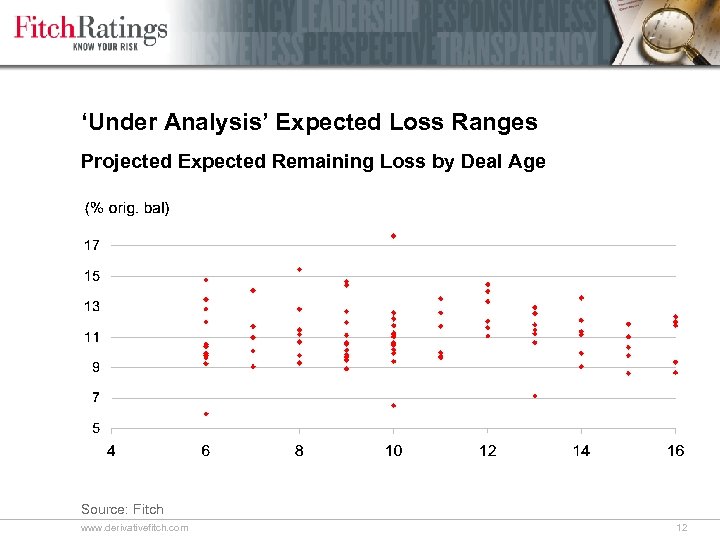

Criteria Changes For Expected Loss Projection (cont. ) > Capture impact of second liens – The worst performing ‘first-lien’ RMBS contain substantial percentages of second liens, 5%-10%. – Loss severity estimates reflect the impact of second-liens over time > The net impact of the changes described above generated expected lifetime losses for the ‘Under Analysis’ stress vintage transactions ranging from 6% to 17% of the original pool balance. www. derivativefitch. com 9

Early Loss Severity Reflects Second-Lien Charge-Off Sample Deal Loss Severity Source: Fitch, Loan. Performance www. derivativefitch. com 10

Projected Loss Accounts For 2 nd Lien Loss Timing Sample Deal Monthly Loss Amounts Source: Fitch, Intex www. derivativefitch. com 11

‘Under Analysis’ Expected Loss Ranges Projected Expected Remaining Loss by Deal Age Source: Fitch www. derivativefitch. com 12

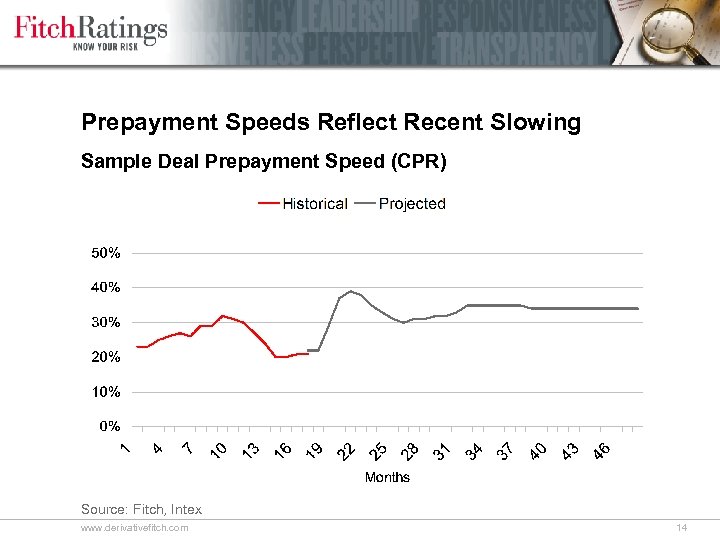

Cash Flow Modeling: Prepayment Assumptions > Fitch’s cash flow model employs standard prepayment assumptions for various mortgage products > Stressed vintage analysis incorporates the slow observed speeds, but reverts to the faster standard speeds over time > This approach avoids undue credit to excess spread during peak loss periods www. derivativefitch. com 13

Prepayment Speeds Reflect Recent Slowing Sample Deal Prepayment Speed (CPR) Source: Fitch, Intex www. derivativefitch. com 14

Minimum Loss Coverage Ratios > The Fitch surveillance model indicates recommended actions based on Break Loss (BL) and Loss Coverage Ratio (LCRs) analysis. > The BL is the amount of mortgage pool loss a bond can sustain without incurring a principal loss. – Example: Class A BL = 32% (% of outstanding pool balance) > The LCR is the ratio of the Break Loss to the Expected Loss. – Example: EL = 12%, Class A BL = 32%, Class A LCR = 2. 67 > To maintain a rating, each class must meet minimum LCR requirements > Specific minimum LCRs have been established for the stressed vintages www. derivativefitch. com 15

Minimum Loss Coverage Ratios Rating Minimum Loss Coverage AAA 2. 50 AA+ 2. 25 AA 2. 00 AA- 1. 75 A+ 1. 60 A 1. 50 A- 1. 40 BBB+ 1. 30 BBB 1. 20 BBB- 1. 10 BB 0. 95 B 0. 75 CCC 0. 00 www. derivativefitch. com 16

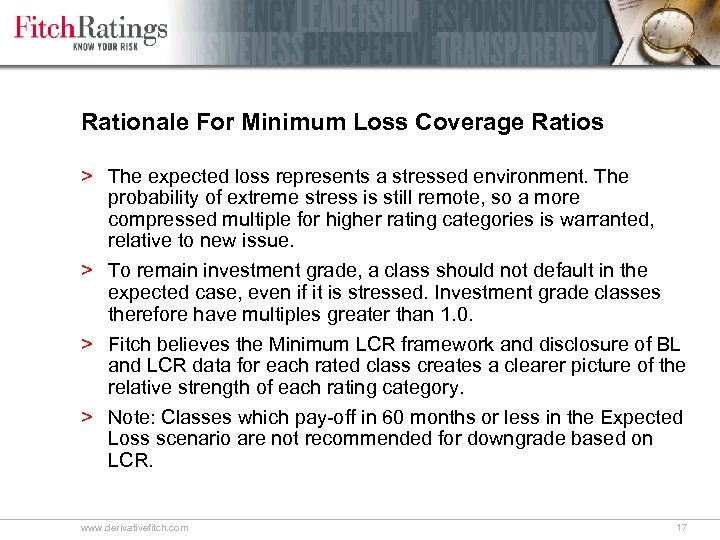

Rationale For Minimum Loss Coverage Ratios > The expected loss represents a stressed environment. The probability of extreme stress is still remote, so a more compressed multiple for higher rating categories is warranted, relative to new issue. > To remain investment grade, a class should not default in the expected case, even if it is stressed. Investment grade classes therefore have multiples greater than 1. 0. > Fitch believes the Minimum LCR framework and disclosure of BL and LCR data for each rated class creates a clearer picture of the relative strength of each rating category. > Note: Classes which pay-off in 60 months or less in the Expected Loss scenario are not recommended for downgrade based on LCR. www. derivativefitch. com 17

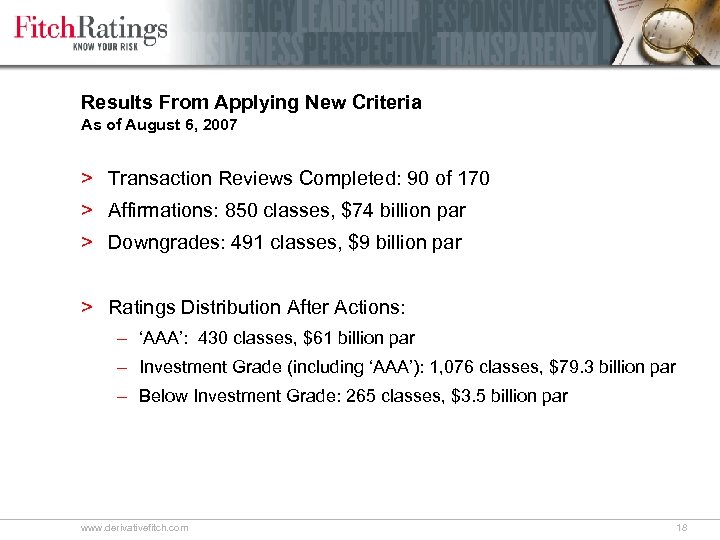

Results From Applying New Criteria As of August 6, 2007 > Transaction Reviews Completed: 90 of 170 > Affirmations: 850 classes, $74 billion par > Downgrades: 491 classes, $9 billion par > Ratings Distribution After Actions: – ‘AAA’: 430 classes, $61 billion par – Investment Grade (including ‘AAA’): 1, 076 classes, $79. 3 billion par – Below Investment Grade: 265 classes, $3. 5 billion par www. derivativefitch. com 18

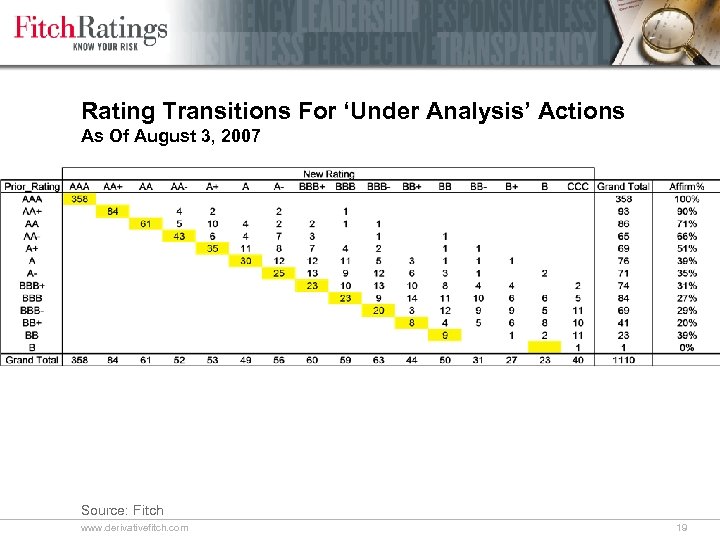

Rating Transitions For ‘Under Analysis’ Actions As Of August 3, 2007 Source: Fitch www. derivativefitch. com 19

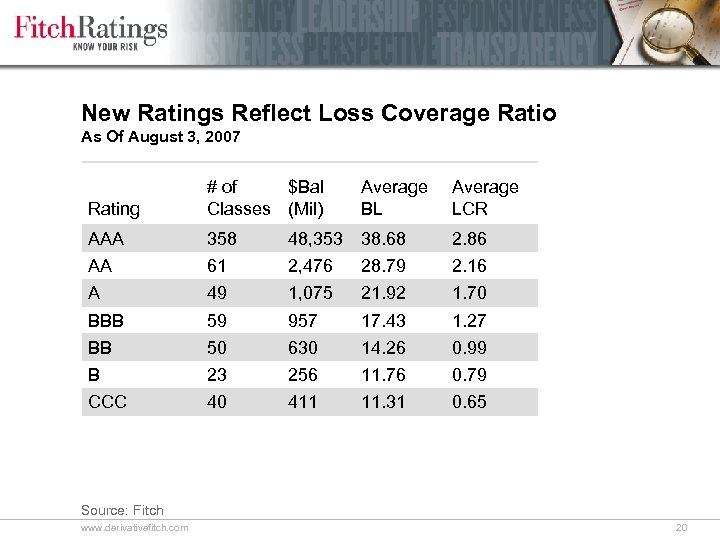

New Ratings Reflect Loss Coverage Ratio As Of August 3, 2007 Rating # of $Bal Classes (Mil) Average BL Average LCR AAA 358 48, 353 38. 68 2. 86 AA 61 2, 476 28. 79 2. 16 A 49 1, 075 21. 92 1. 70 BBB 59 957 17. 43 1. 27 BB 50 630 14. 26 0. 99 B 23 256 11. 76 0. 79 CCC 40 411 11. 31 0. 65 Source: Fitch www. derivativefitch. com 20

Conclusions and Next Steps > The average loss expectations for the poor performing deals on the ‘Under Analysis’ list is around 11% of original balance. Analysis of all deals in these vintages should yield lower average losses > Highly-rated ‘AAA’ and ‘AA’ RMBS demonstrate ability to withstand high multiples to expected loss > The expected case will be monitored closely against actual performance, and additional action will be taken if warranted > We will apply the methodology against all 2005, 2006 and 2007 YTD ratings www. derivativefitch. com 21

Agenda New Surveillance Criteria And The ‘Under Analysis’ List Revised Criteria For Rating New Issue RMBS

The Fitch Resi. Logic Default and Loss Model > Resi. Logic is a loan-level model used to project expected case losses for mortgage pools, as well as Loss Coverage levels for each rating category. > The Resi. Logic model was introduced late in 2006. > Resi. Logic is designed to analyze prime, Alt-A and subprime pools. > The changes announced yesterday represent the first major revision to Resi. Logic www. derivativefitch. com 23

Enhancements/Revisions To Resi. Logic > Greater weight to regional economic indicators – increases default expectations around 20% > Increased default expectations for Hybrid ARM mortgages – 22% increase for 2 -year hybrid ARMs > Greater differentiation among documentation programs through a new ‘Low’ documentation category. Impact varies by program > Use back-end versus front-end DTI ratios with a missing value default of 50% DTI for subprime. Generally minor impact, varies based on data quality > No benefit for recent vintage loans that are 2 or more months seasoned. Minor impact. www. derivativefitch. com 24

Increased Regional Risk Weighting > Fitch started using University Financial Associates (UFA) statelevel default multipliers with the introduction of Resi. Logic > Observing the UFA forecasts through the current downturn has supported their effectiveness > Fitch believes that continued home-price weakness is the greatest risk to new RMBS. A more dynamic approach to regional risk can help mitigate that risk. > Greater weighting to the UFA multipliers supports this goal. www. derivativefitch. com 25

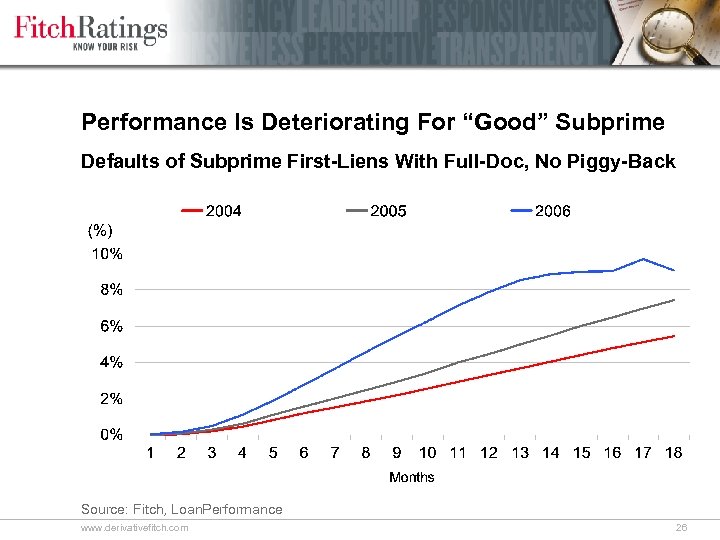

Performance Is Deteriorating For “Good” Subprime Defaults of Subprime First-Liens With Full-Doc, No Piggy-Back Source: Fitch, Loan. Performance www. derivativefitch. com 26

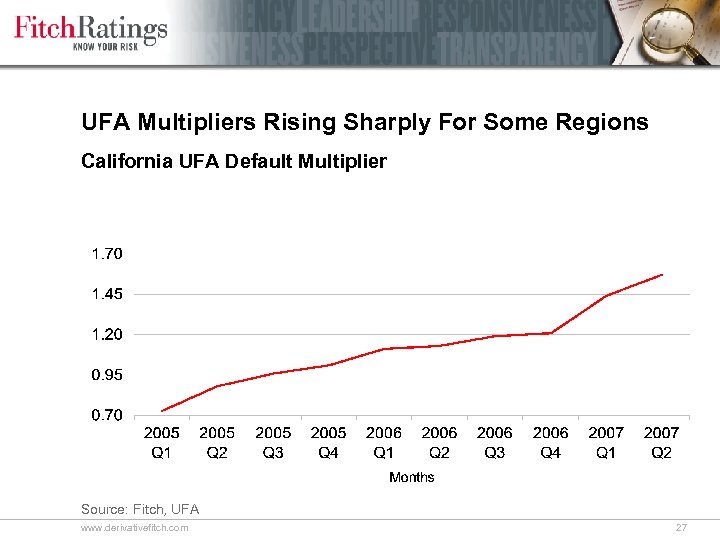

UFA Multipliers Rising Sharply For Some Regions California UFA Default Multiplier Source: Fitch, UFA www. derivativefitch. com 27

Increased Regional Risk Weighting: Implications > Resi. Logic will be updated quarterly with new UFA multipliers > Expected Loss rates will rise or fall accordingly > Fitch will publish the updated multipliers with an impact analysis > Impacts Alt-A and Prime, not just Subprime www. derivativefitch. com 28

ARM Default Rate Adjustments > Many large lenders have abandoned 2/28 and other 2 -year ARM products. > Interagency guidance requires qualification at the fully indexed rate > Existing hybrid ARM borrowers with teaser rates may have severely curtailed refinancing options > A mass of existing hybrid ARM originations is yet to be securitized > Fitch’s adjustment reflects the increased payment shock risk to these products. 2/28 default rate expectations are increased 22%. www. derivativefitch. com 29

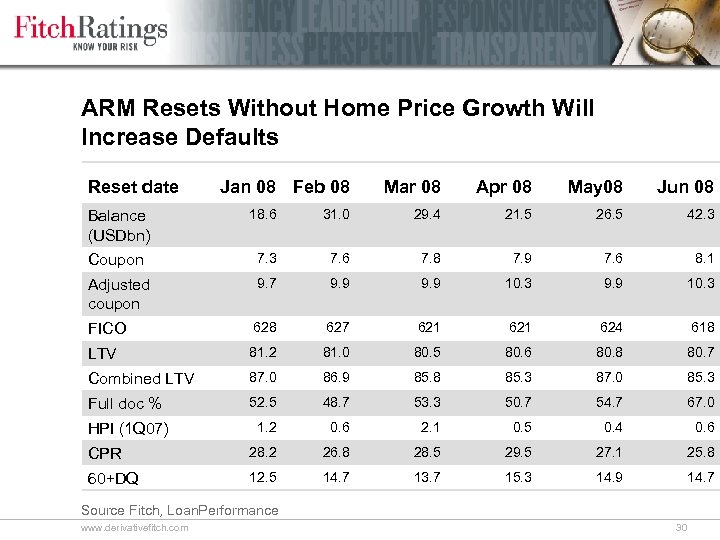

ARM Resets Without Home Price Growth Will Increase Defaults Reset date Jan 08 Feb 08 Mar 08 Apr 08 May 08 Jun 08 Balance (USDbn) 18. 6 31. 0 29. 4 21. 5 26. 5 42. 3 Coupon 7. 3 7. 6 7. 8 7. 9 7. 6 8. 1 Adjusted coupon 9. 7 9. 9 10. 3 FICO 628 627 621 624 618 LTV 81. 2 81. 0 80. 5 80. 6 80. 8 80. 7 Combined LTV 87. 0 86. 9 85. 8 85. 3 87. 0 85. 3 Full doc % 52. 5 48. 7 53. 3 50. 7 54. 7 67. 0 HPI (1 Q 07) 1. 2 0. 6 2. 1 0. 5 0. 4 0. 6 CPR 28. 2 26. 8 28. 5 29. 5 27. 1 25. 8 60+DQ 12. 5 14. 7 13. 7 15. 3 14. 9 14. 7 Source Fitch, Loan. Performance www. derivativefitch. com 30

Impact Of Revisions: ABX. HE 07 -1 Example > Estimated Initial Expected Losses For ABX. HE 07. 1 Collateral Pool – Prior Model: 5. 65% – New Model: 8. 23% – Difference: 2. 58% > Components of Change: UFA: 1. 20%, ARM: ~1. 10%, Other: ~0. 30% > Notes: – Fitch did not rate 10 of the 20 reference entities – Actual ratings did not utilize Resi. Logic – Based on current UFA multipliers, not those prevailing when deals were originated. www. derivativefitch. com 31

What Is Not Changing: Cash Flow Analysis > Dynamic interest-rate risk methodology introduced in 2006. Noarbitrage approach to swap analysis. > New loss timing and prepayment curves introduced in 2006 in conjunction with Intex-based cash flow modeling. > Updated (slower) prepayment curves in early 2007. > We remain very comfortable with our approach. All curves are published on our website. > Further commentary coming on impact of modifications www. derivativefitch. com 32

What’s Next: Additional Enhancements To Resi. Logic > Expansion to MSA-level UFA forecasts > Application of UFA forecasts to expected case Loss Severity www. derivativefitch. com 33

Q&A www. derivativefitch. com 34

b00ee0d168ac33c7b835b963de28603d.ppt