77bd53ac0b683d18bbaf0b66f7ab63f9.ppt

- Количество слайдов: 38

U. S. General Services Administration Office Supplies 3 rd Generation (OS 3) Industry Engagement Event December 10, 2013

U. S. General Services Administration Office Supplies 3 rd Generation (OS 3) Industry Engagement Event December 10, 2013

Robert Woodside, FSSI Program Director, Region 2 1

Robert Woodside, FSSI Program Director, Region 2 1

Office Supplies Second Generation (OS 2) Summary • OS 2, developed in 2010, was a great success resulting in: • Sales exceeding $800 M • Cumulative government savings of $350 M • Increased small business spend from 67% to 76% • Improved ease of use for customers with standardized product descriptions for more efficient comparison shopping • Lower prices through increased competition and a dynamic pricing model, which reduces price variances • Increased the visibility of how much the government spends on office supplies. 2

Office Supplies Second Generation (OS 2) Summary • OS 2, developed in 2010, was a great success resulting in: • Sales exceeding $800 M • Cumulative government savings of $350 M • Increased small business spend from 67% to 76% • Improved ease of use for customers with standardized product descriptions for more efficient comparison shopping • Lower prices through increased competition and a dynamic pricing model, which reduces price variances • Increased the visibility of how much the government spends on office supplies. 2

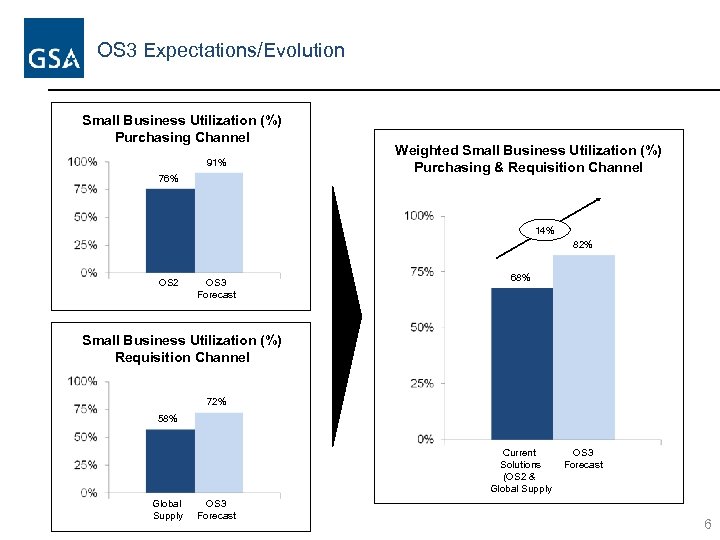

OS 3 Expectations/Requirements • With our proposed acquisition strategy in the purchasing channel, we anticipate a full increase of 15% of small business spend from 76% to an anticipated 91 %. • With our proposed acquisition strategy in the requisition channel, we anticipate a full increase of 14% of small business spend from 58% to an anticipated 72 %. • Combined (purchasing + requisition), we anticipate a full increase of 14% of small business spend from 68% to an anticipated 82 %. • Increase our data care abilities by requiring a UPC-A code which will give agencies further visibility into their office supply spend • Increasing our savings through more precise product comparison using UPC-A code and also through some innovative strategies such as delivery order tier thresholds. 3

OS 3 Expectations/Requirements • With our proposed acquisition strategy in the purchasing channel, we anticipate a full increase of 15% of small business spend from 76% to an anticipated 91 %. • With our proposed acquisition strategy in the requisition channel, we anticipate a full increase of 14% of small business spend from 58% to an anticipated 72 %. • Combined (purchasing + requisition), we anticipate a full increase of 14% of small business spend from 68% to an anticipated 82 %. • Increase our data care abilities by requiring a UPC-A code which will give agencies further visibility into their office supply spend • Increasing our savings through more precise product comparison using UPC-A code and also through some innovative strategies such as delivery order tier thresholds. 3

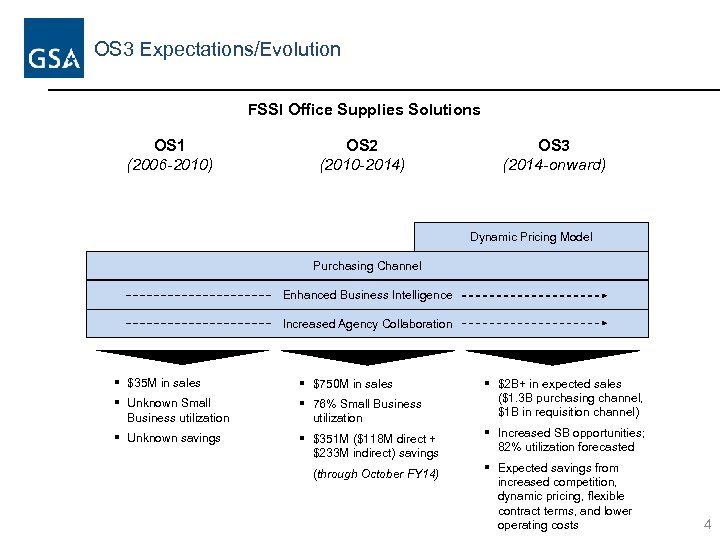

OS 3 Expectations/Evolution FSSI Office Supplies Solutions OS 1 (2006 -2010) OS 2 (2010 -2014) OS 3 (2014 -onward) Dynamic Pricing Model Purchasing Channel Enhanced Business Intelligence Increased Agency Collaboration § $35 M in sales § $750 M in sales § Unknown Small Business utilization § 76% Small Business utilization § $2 B+ in expected sales ($1. 3 B purchasing channel, $1 B in requisition channel) § Unknown savings § $351 M ($118 M direct + $233 M indirect) savings § Increased SB opportunities; 82% utilization forecasted (through October FY 14) § Expected savings from increased competition, dynamic pricing, flexible contract terms, and lower operating costs 4

OS 3 Expectations/Evolution FSSI Office Supplies Solutions OS 1 (2006 -2010) OS 2 (2010 -2014) OS 3 (2014 -onward) Dynamic Pricing Model Purchasing Channel Enhanced Business Intelligence Increased Agency Collaboration § $35 M in sales § $750 M in sales § Unknown Small Business utilization § 76% Small Business utilization § $2 B+ in expected sales ($1. 3 B purchasing channel, $1 B in requisition channel) § Unknown savings § $351 M ($118 M direct + $233 M indirect) savings § Increased SB opportunities; 82% utilization forecasted (through October FY 14) § Expected savings from increased competition, dynamic pricing, flexible contract terms, and lower operating costs 4

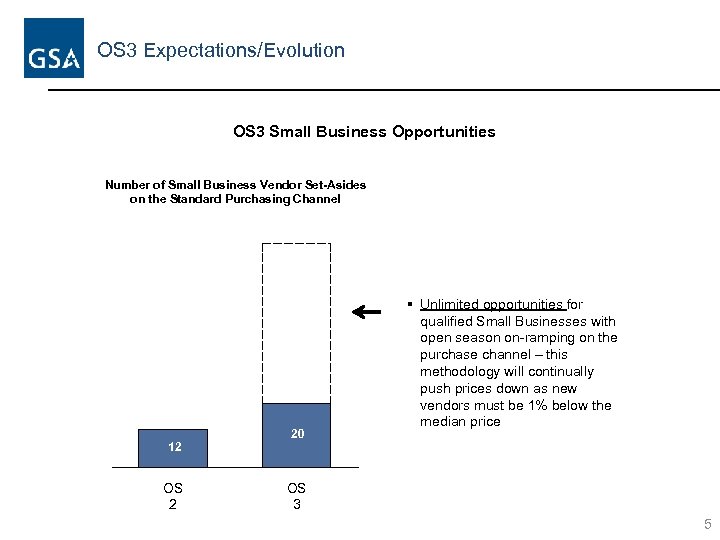

OS 3 Expectations/Evolution OS 3 Small Business Opportunities Number of Small Business Vendor Set-Asides on the Standard Purchasing Channel 12 OS 2 20 § Unlimited opportunities for qualified Small Businesses with open season on-ramping on the purchase channel – this methodology will continually push prices down as new vendors must be 1% below the median price OS 3 5

OS 3 Expectations/Evolution OS 3 Small Business Opportunities Number of Small Business Vendor Set-Asides on the Standard Purchasing Channel 12 OS 2 20 § Unlimited opportunities for qualified Small Businesses with open season on-ramping on the purchase channel – this methodology will continually push prices down as new vendors must be 1% below the median price OS 3 5

OS 3 Expectations/Evolution Small Business Utilization (%) Purchasing Channel 91% 76% Weighted Small Business Utilization (%) Purchasing & Requisition Channel 14% 82% OS 2 OS 3 Forecast 68% Small Business Utilization (%) Requisition Channel 72% 58% Current Solutions (OS 2 & Global Supply OS 3 Forecast 6

OS 3 Expectations/Evolution Small Business Utilization (%) Purchasing Channel 91% 76% Weighted Small Business Utilization (%) Purchasing & Requisition Channel 14% 82% OS 2 OS 3 Forecast 68% Small Business Utilization (%) Requisition Channel 72% 58% Current Solutions (OS 2 & Global Supply OS 3 Forecast 6

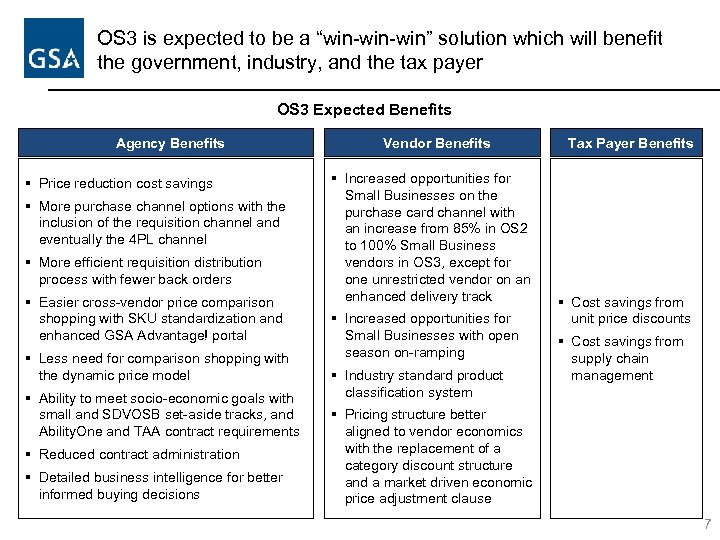

OS 3 is expected to be a “win-win” solution which will benefit the government, industry, and the tax payer OS 3 Expected Benefits Agency Benefits § Price reduction cost savings § More purchase channel options with the inclusion of the requisition channel and eventually the 4 PL channel § More efficient requisition distribution process with fewer back orders § Easier cross-vendor price comparison shopping with SKU standardization and enhanced GSA Advantage! portal § Less need for comparison shopping with the dynamic price model § Ability to meet socio-economic goals with small and SDVOSB set-aside tracks, and Ability. One and TAA contract requirements § Reduced contract administration § Detailed business intelligence for better informed buying decisions Vendor Benefits § Increased opportunities for Small Businesses on the purchase card channel with an increase from 85% in OS 2 to 100% Small Business vendors in OS 3, except for one unrestricted vendor on an enhanced delivery track § Increased opportunities for Small Businesses with open season on-ramping § Industry standard product classification system Tax Payer Benefits § Cost savings from unit price discounts § Cost savings from supply chain management § Pricing structure better aligned to vendor economics with the replacement of a category discount structure and a market driven economic price adjustment clause 7

OS 3 is expected to be a “win-win” solution which will benefit the government, industry, and the tax payer OS 3 Expected Benefits Agency Benefits § Price reduction cost savings § More purchase channel options with the inclusion of the requisition channel and eventually the 4 PL channel § More efficient requisition distribution process with fewer back orders § Easier cross-vendor price comparison shopping with SKU standardization and enhanced GSA Advantage! portal § Less need for comparison shopping with the dynamic price model § Ability to meet socio-economic goals with small and SDVOSB set-aside tracks, and Ability. One and TAA contract requirements § Reduced contract administration § Detailed business intelligence for better informed buying decisions Vendor Benefits § Increased opportunities for Small Businesses on the purchase card channel with an increase from 85% in OS 2 to 100% Small Business vendors in OS 3, except for one unrestricted vendor on an enhanced delivery track § Increased opportunities for Small Businesses with open season on-ramping § Industry standard product classification system Tax Payer Benefits § Cost savings from unit price discounts § Cost savings from supply chain management § Pricing structure better aligned to vendor economics with the replacement of a category discount structure and a market driven economic price adjustment clause 7

OS 3 Scope • OS 3 Scope • OS 3 will incorporate a similar scope of Schedule 75 Office Solutions: Supplies & Services, Special Item number (SIN)75 200 Office Products for Federal Government-wide usage, as part of the OS 2 Federal Strategic Sourcing Initiative, however since this is not a multiple-award Schedule contract, will not utilize respective SINS, except as a reference point. • OS 3 will be a total acquisition solution: • OS 3 Purchasing • Global Supply Transformation Program (Requisition) (i. e. GSA Global Supply)-GSTP • 4 th Party Logistics (4 PL) • GSTP and 4 PL will be separate solicitations • Today’s discussion is for the DRAFT OS 3 -Purchasing channel only… 8

OS 3 Scope • OS 3 Scope • OS 3 will incorporate a similar scope of Schedule 75 Office Solutions: Supplies & Services, Special Item number (SIN)75 200 Office Products for Federal Government-wide usage, as part of the OS 2 Federal Strategic Sourcing Initiative, however since this is not a multiple-award Schedule contract, will not utilize respective SINS, except as a reference point. • OS 3 will be a total acquisition solution: • OS 3 Purchasing • Global Supply Transformation Program (Requisition) (i. e. GSA Global Supply)-GSTP • 4 th Party Logistics (4 PL) • GSTP and 4 PL will be separate solicitations • Today’s discussion is for the DRAFT OS 3 -Purchasing channel only… 8

Nelson Duncan, Lead Contracting Officer, FSSI PMO office 9

Nelson Duncan, Lead Contracting Officer, FSSI PMO office 9

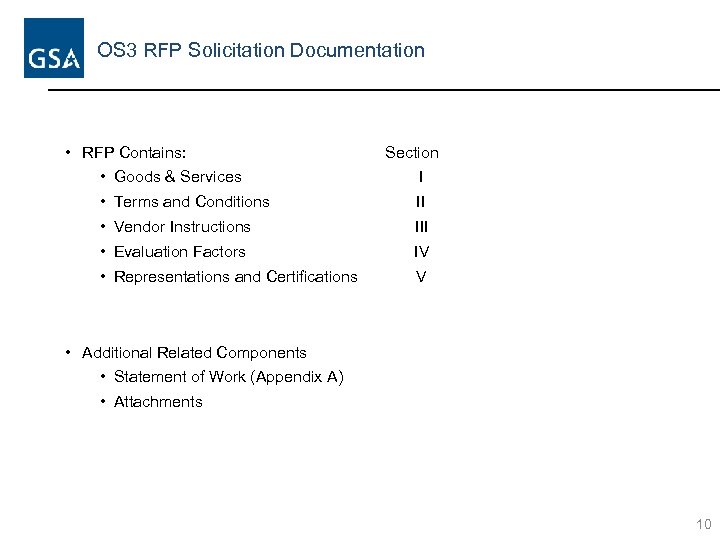

OS 3 RFP Solicitation Documentation • RFP Contains: Section • Goods & Services I • Terms and Conditions II • Vendor Instructions III • Evaluation Factors IV • Representations and Certifications V • Additional Related Components • Statement of Work (Appendix A) • Attachments 10

OS 3 RFP Solicitation Documentation • RFP Contains: Section • Goods & Services I • Terms and Conditions II • Vendor Instructions III • Evaluation Factors IV • Representations and Certifications V • Additional Related Components • Statement of Work (Appendix A) • Attachments 10

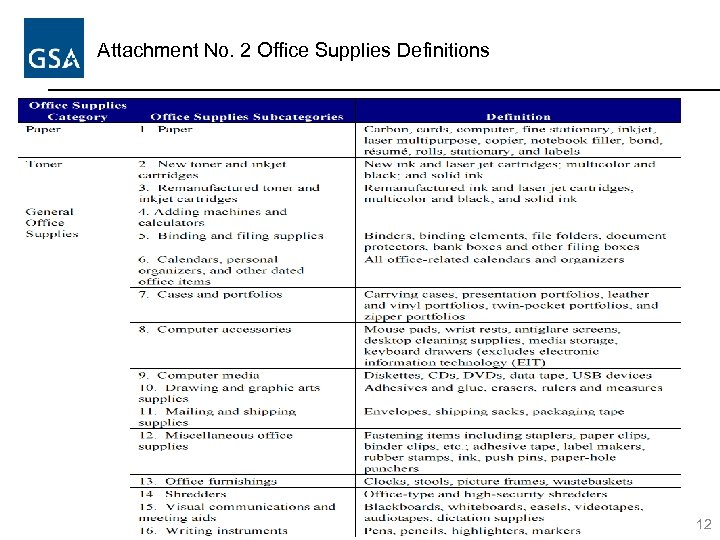

Section I: Goods & Services • OS 3 will utilize Four (4) Contract Line Item numbers to distinguish the categories of Office Supplies. • Contract Line Item Number = CLIN • CLIN 0001 General Office Supplies • CLIN 0002 Paper • CLIN 0003 Toner/Ink • CLIN 0004 GSA On-the Go (unrestricted) Gen. Office Supplies • See Attachment No. 2 for Office Supplies Definitions 11

Section I: Goods & Services • OS 3 will utilize Four (4) Contract Line Item numbers to distinguish the categories of Office Supplies. • Contract Line Item Number = CLIN • CLIN 0001 General Office Supplies • CLIN 0002 Paper • CLIN 0003 Toner/Ink • CLIN 0004 GSA On-the Go (unrestricted) Gen. Office Supplies • See Attachment No. 2 for Office Supplies Definitions 11

Attachment No. 2 Office Supplies Definitions 12

Attachment No. 2 Office Supplies Definitions 12

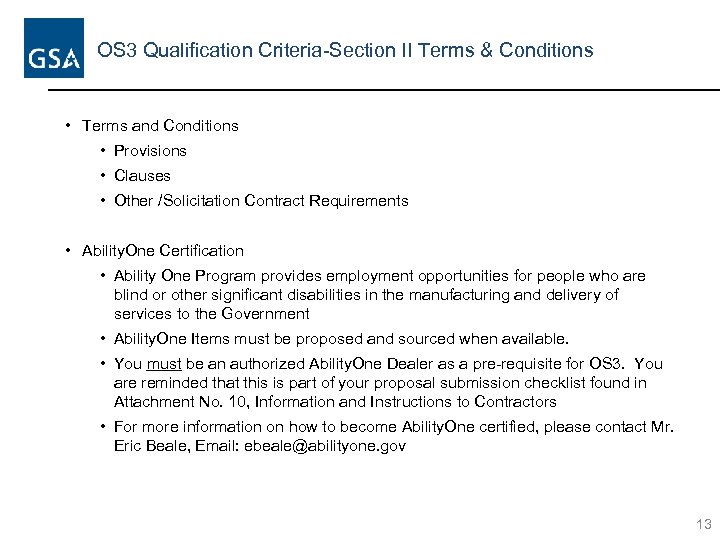

OS 3 Qualification Criteria-Section II Terms & Conditions • Terms and Conditions • Provisions • Clauses • Other /Solicitation Contract Requirements • Ability. One Certification • Ability One Program provides employment opportunities for people who are blind or other significant disabilities in the manufacturing and delivery of services to the Government • Ability. One Items must be proposed and sourced when available. • You must be an authorized Ability. One Dealer as a pre-requisite for OS 3. You are reminded that this is part of your proposal submission checklist found in Attachment No. 10, Information and Instructions to Contractors • For more information on how to become Ability. One certified, please contact Mr. Eric Beale, Email: ebeale@abilityone. gov 13

OS 3 Qualification Criteria-Section II Terms & Conditions • Terms and Conditions • Provisions • Clauses • Other /Solicitation Contract Requirements • Ability. One Certification • Ability One Program provides employment opportunities for people who are blind or other significant disabilities in the manufacturing and delivery of services to the Government • Ability. One Items must be proposed and sourced when available. • You must be an authorized Ability. One Dealer as a pre-requisite for OS 3. You are reminded that this is part of your proposal submission checklist found in Attachment No. 10, Information and Instructions to Contractors • For more information on how to become Ability. One certified, please contact Mr. Eric Beale, Email: ebeale@abilityone. gov 13

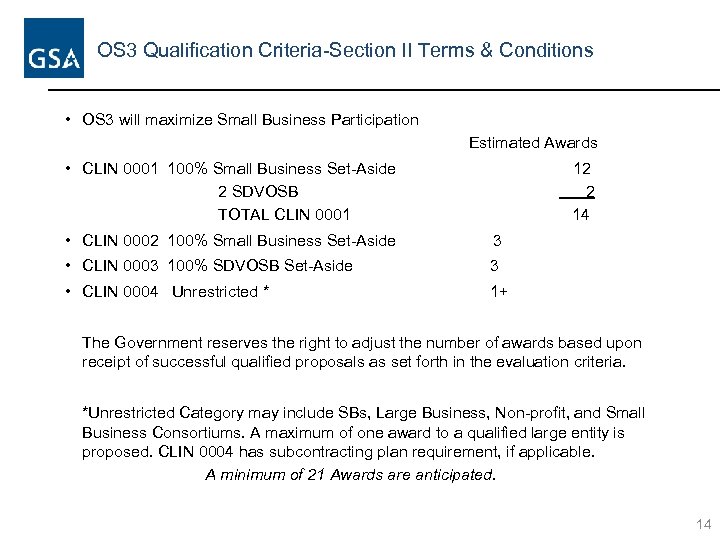

OS 3 Qualification Criteria-Section II Terms & Conditions • OS 3 will maximize Small Business Participation Estimated Awards • CLIN 0001 100% Small Business Set-Aside 12 2 SDVOSB 2 TOTAL CLIN 0001 14 • CLIN 0002 100% Small Business Set-Aside 3 • CLIN 0003 100% SDVOSB Set-Aside 3 • CLIN 0004 Unrestricted * 1+ The Government reserves the right to adjust the number of awards based upon receipt of successful qualified proposals as set forth in the evaluation criteria. *Unrestricted Category may include SBs, Large Business, Non-profit, and Small Business Consortiums. A maximum of one award to a qualified large entity is proposed. CLIN 0004 has subcontracting plan requirement, if applicable. A minimum of 21 Awards are anticipated. 14

OS 3 Qualification Criteria-Section II Terms & Conditions • OS 3 will maximize Small Business Participation Estimated Awards • CLIN 0001 100% Small Business Set-Aside 12 2 SDVOSB 2 TOTAL CLIN 0001 14 • CLIN 0002 100% Small Business Set-Aside 3 • CLIN 0003 100% SDVOSB Set-Aside 3 • CLIN 0004 Unrestricted * 1+ The Government reserves the right to adjust the number of awards based upon receipt of successful qualified proposals as set forth in the evaluation criteria. *Unrestricted Category may include SBs, Large Business, Non-profit, and Small Business Consortiums. A maximum of one award to a qualified large entity is proposed. CLIN 0004 has subcontracting plan requirement, if applicable. A minimum of 21 Awards are anticipated. 14

OS 3 Qualification Criteria-Section II Terms & Conditions • Ability to Supply Level III Data • Monthly Usage Reports with Transactional Data Capture/Report Data at Point of Sale (Line Item) level • Quarterly Performance Reports • Requirements are located in SOW, Appendix A, Section 5. 3. 3. 15

OS 3 Qualification Criteria-Section II Terms & Conditions • Ability to Supply Level III Data • Monthly Usage Reports with Transactional Data Capture/Report Data at Point of Sale (Line Item) level • Quarterly Performance Reports • Requirements are located in SOW, Appendix A, Section 5. 3. 3. 15

Michael Cullis, Contracting Officer, FSSI PMO office 16

Michael Cullis, Contracting Officer, FSSI PMO office 16

Monthly Usage Reports with Transactional Data Fields · · · Order Date Order Number Product Description Manufacturer Name Manufacturer Part Number UPC-A Code Unit of Issue Quantity FSC Code (Federal Supply Code) UNSPSC (United Nations Standard Products and Services Code) Subcategory (Ink, Paper, Toner, General Office Supplies) 17

Monthly Usage Reports with Transactional Data Fields · · · Order Date Order Number Product Description Manufacturer Name Manufacturer Part Number UPC-A Code Unit of Issue Quantity FSC Code (Federal Supply Code) UNSPSC (United Nations Standard Products and Services Code) Subcategory (Ink, Paper, Toner, General Office Supplies) 17

Monthly Usage Reports with Transactional Data Fields · · · OS 3 Price MAS Contract Price if any Commercial List Price Environmental Preferred Product (EPP) Comprehensive Procurement Guidelines (CPG) Compatible or Remanufactured Toner Post Consumer Recycled Percent Total Recycling Content Delivery Method (Standard, Overnight, Secured Desktop) Freight Charge Shipping Weight 18

Monthly Usage Reports with Transactional Data Fields · · · OS 3 Price MAS Contract Price if any Commercial List Price Environmental Preferred Product (EPP) Comprehensive Procurement Guidelines (CPG) Compatible or Remanufactured Toner Post Consumer Recycled Percent Total Recycling Content Delivery Method (Standard, Overnight, Secured Desktop) Freight Charge Shipping Weight 18

Monthly Usage Reports with Transactional Data Fields · · · · · Discount Amount Supplemental Fees Total Purchase Amount Credit or Debit Agency of Customer Sub- Agency to Major Command Identity Information DODAAC (Dept. of Defense Activity Address Code) Pay Method (Smart Card, ETF, Net 30, check, etc. Pay Date (Date Payment Received) Sales Channel (GSA Advantage, Do. D Emall, Fax, phone, etc. ) 19

Monthly Usage Reports with Transactional Data Fields · · · · · Discount Amount Supplemental Fees Total Purchase Amount Credit or Debit Agency of Customer Sub- Agency to Major Command Identity Information DODAAC (Dept. of Defense Activity Address Code) Pay Method (Smart Card, ETF, Net 30, check, etc. Pay Date (Date Payment Received) Sales Channel (GSA Advantage, Do. D Emall, Fax, phone, etc. ) 19

Monthly Usage Reports with Transactional Data Fields · · · Zip Code Delivered To Location Zip Code Sent From Location Charge Processing Date Transaction Number Contractor Name Contract Number 20

Monthly Usage Reports with Transactional Data Fields · · · Zip Code Delivered To Location Zip Code Sent From Location Charge Processing Date Transaction Number Contractor Name Contract Number 20

Nelson Duncan, Lead Contracting Officer, FSSI PMO office 21

Nelson Duncan, Lead Contracting Officer, FSSI PMO office 21

OS 3 Qualification Criteria-Sections III thru V • Vendor Instructions III • Evaluation Factors IV • Representations and Certifications V • These sections also contain informative Federal Acquisition Regulation (FAR) Clauses and regulations such as FAR: • 52. 204 -3 Taxpayer Identification (III) • 52. 215 -6 Place of Performance • 52. 216 -1 Type of Contract • 52. 212 -2 Evaluation of Commercial Items (IV) • 52. 219 -1 Small Business Representation (V) • OS 3 is a Multi-Agency Multiple Award Indefinite-Delivery Indefinite Quantity (IDIQ) Contract • It will be a Firm-Fixed Price type contract with an Economic Price Adjustment Provision (EPA). Prices must be held firm for a period of no less than 180 days after award. 22

OS 3 Qualification Criteria-Sections III thru V • Vendor Instructions III • Evaluation Factors IV • Representations and Certifications V • These sections also contain informative Federal Acquisition Regulation (FAR) Clauses and regulations such as FAR: • 52. 204 -3 Taxpayer Identification (III) • 52. 215 -6 Place of Performance • 52. 216 -1 Type of Contract • 52. 212 -2 Evaluation of Commercial Items (IV) • 52. 219 -1 Small Business Representation (V) • OS 3 is a Multi-Agency Multiple Award Indefinite-Delivery Indefinite Quantity (IDIQ) Contract • It will be a Firm-Fixed Price type contract with an Economic Price Adjustment Provision (EPA). Prices must be held firm for a period of no less than 180 days after award. 22

Section III: Vendor Instructions • Although located between Terms and Conditions and Evaluation Factors, Contractors are reminded to pay attention to instructions throughout the RFP, SOW and related document Attachments. • Attachment 3 is the Contractor’s Information cover sheet which is to provide: • Basic Contractor Information • Socio. Economic Overview • Operations Overview • Financial Information • Sales Information (Capability and Capacity) • You may submit a tailored version however failure to address all elements may result in your proposal being determined to be unacceptable. • Attach additional pages as needed to fully demonstrate performance ability. • Attachment 10 provides some very basic additional guidance for submission, such as the requirements of a digital certificate to submit your proposal, supplier information and agent forms and checklist. • Reference also Section 7 of SOW, Appendix A for Proposal Formatting Instructions. 23

Section III: Vendor Instructions • Although located between Terms and Conditions and Evaluation Factors, Contractors are reminded to pay attention to instructions throughout the RFP, SOW and related document Attachments. • Attachment 3 is the Contractor’s Information cover sheet which is to provide: • Basic Contractor Information • Socio. Economic Overview • Operations Overview • Financial Information • Sales Information (Capability and Capacity) • You may submit a tailored version however failure to address all elements may result in your proposal being determined to be unacceptable. • Attach additional pages as needed to fully demonstrate performance ability. • Attachment 10 provides some very basic additional guidance for submission, such as the requirements of a digital certificate to submit your proposal, supplier information and agent forms and checklist. • Reference also Section 7 of SOW, Appendix A for Proposal Formatting Instructions. 23

Section III: Vendor Instructions Continued…Past Performance • Attachment 5 is your Past Performance Questionnaire • List Performance Data on your five (5) most recently completed Federal Government contracts (not to exceed three years since completion) for like or similar items required by this solicitation indicating highest Office Supplies sales. • If you do not have 5 Federal Government contracts, then list state, local or commercial contracts, in that order, to complete this report. • Specify the nature, types and percentage of products provided within each contract referenced to demonstrate previous performance. • A copy of respective invoice may be submitted along with form. • Submit as many copies of Attachment 5 as needed. You may submit more than 5 references if needed to depict the scope and variety of your performance. • NOTE: Fewer than 5 references will result in a non-responsiveness determination. 24

Section III: Vendor Instructions Continued…Past Performance • Attachment 5 is your Past Performance Questionnaire • List Performance Data on your five (5) most recently completed Federal Government contracts (not to exceed three years since completion) for like or similar items required by this solicitation indicating highest Office Supplies sales. • If you do not have 5 Federal Government contracts, then list state, local or commercial contracts, in that order, to complete this report. • Specify the nature, types and percentage of products provided within each contract referenced to demonstrate previous performance. • A copy of respective invoice may be submitted along with form. • Submit as many copies of Attachment 5 as needed. You may submit more than 5 references if needed to depict the scope and variety of your performance. • NOTE: Fewer than 5 references will result in a non-responsiveness determination. 24

Section IV Evaluation Factors • Technical Go/No-Go (CLINS 0001, 0002, and 0003) • Small Business Certification; • Ability. One-certified contractor; • Demonstrated ability to meet all environmental reporting and green product requirements; • Demonstrated ability to provide 100 percent core-items list products; • Demonstrated capability to provide real-time order status to GSA Advantage! ®; • Currently be able to provide point of sale discount for all IDIQ Contract orders; • Agency-defined reports at no additional cost; • Standard delivery anywhere CONUS within 3 to 4 business days; • Demonstrated Level III transaction data at the line-item level; and • Satisfactory past performance. • Price • Adjusted Market Basket Proposal (Block G 15 of Attachment No 1) Technical is more important than Price, and Price is less important than Technical. 25

Section IV Evaluation Factors • Technical Go/No-Go (CLINS 0001, 0002, and 0003) • Small Business Certification; • Ability. One-certified contractor; • Demonstrated ability to meet all environmental reporting and green product requirements; • Demonstrated ability to provide 100 percent core-items list products; • Demonstrated capability to provide real-time order status to GSA Advantage! ®; • Currently be able to provide point of sale discount for all IDIQ Contract orders; • Agency-defined reports at no additional cost; • Standard delivery anywhere CONUS within 3 to 4 business days; • Demonstrated Level III transaction data at the line-item level; and • Satisfactory past performance. • Price • Adjusted Market Basket Proposal (Block G 15 of Attachment No 1) Technical is more important than Price, and Price is less important than Technical. 25

Section IV Evaluation Factors Continued… CLIN 0004 GSA On-the-Go (Unrestricted) • Ability. One-certified Contractor; • Demonstrated ability to meet all environmental reporting and green product requirements; • Demonstrated ability to provide 100 percent core-items list products; • Demonstrated capability to provide real-time order status to GSA Advantage! ®; • Currently be able to provide point of sale discount for all IDIQ Contract orders; • Agency-defined reports at no additional cost; • Demonstrated ability to provide desktop delivery and secure desktop delivery; • Standard delivery; Expedited delivery to include same day if requested. • Demonstrated ability to provide expedited or same day delivery method for immediate purchases • Ability to deliver to Alaska, Hawaii, Puerto Rico, and international locations; • Demonstrated ability to proposal Fill or Kill status; • Demonstrated Level III transaction data at line-item level; • Ability to report subcontracting quarterly, other than small business only; • Satisfactory past performance; • Submission of completed Subcontracting Plan, if applicable. 26

Section IV Evaluation Factors Continued… CLIN 0004 GSA On-the-Go (Unrestricted) • Ability. One-certified Contractor; • Demonstrated ability to meet all environmental reporting and green product requirements; • Demonstrated ability to provide 100 percent core-items list products; • Demonstrated capability to provide real-time order status to GSA Advantage! ®; • Currently be able to provide point of sale discount for all IDIQ Contract orders; • Agency-defined reports at no additional cost; • Demonstrated ability to provide desktop delivery and secure desktop delivery; • Standard delivery; Expedited delivery to include same day if requested. • Demonstrated ability to provide expedited or same day delivery method for immediate purchases • Ability to deliver to Alaska, Hawaii, Puerto Rico, and international locations; • Demonstrated ability to proposal Fill or Kill status; • Demonstrated Level III transaction data at line-item level; • Ability to report subcontracting quarterly, other than small business only; • Satisfactory past performance; • Submission of completed Subcontracting Plan, if applicable. 26

Section IV Evaluation Factors Continued… CLIN 0004 • Price • Adjusted Market Basket Proposal (Block G 15 of Attachment No 1) Technical is more important than Price, and Price is less important than Technical. • ALL CLINS: • The Government reserves the right to award without discussions, based upon initial submission. Contractors are therefore encouraged to submit competitive pricing at the onset. • In efforts to further increase competition and narrow price variations the price evaluation phase may include a reverse auction. In the price evaluation phase, the Government reserves the right to conduct multiple rounds of revised pricing submissions, as necessary. • If revised pricing submissions are utilized, the Government may publish contractor proposed pricing information to all respective contractors within CLIN range with the aim of aiding contractors in more effectively revising their Proposals without names to directly compare their own prices against the best pricing proposed in the previous round of revised pricing submissions. 27

Section IV Evaluation Factors Continued… CLIN 0004 • Price • Adjusted Market Basket Proposal (Block G 15 of Attachment No 1) Technical is more important than Price, and Price is less important than Technical. • ALL CLINS: • The Government reserves the right to award without discussions, based upon initial submission. Contractors are therefore encouraged to submit competitive pricing at the onset. • In efforts to further increase competition and narrow price variations the price evaluation phase may include a reverse auction. In the price evaluation phase, the Government reserves the right to conduct multiple rounds of revised pricing submissions, as necessary. • If revised pricing submissions are utilized, the Government may publish contractor proposed pricing information to all respective contractors within CLIN range with the aim of aiding contractors in more effectively revising their Proposals without names to directly compare their own prices against the best pricing proposed in the previous round of revised pricing submissions. 27

Section V: Representations and Certifications • This area is where you provide verification and validation of: • Small Business Status • Ability One • FAR 52. 204 -8 Annual Reps & Certs • North American Industry Classification Standard (NAICS) applicable under OS 3 Purchasing: • 339940 – Office Supplies (except Paper) Manufacturing • 322121 – Paper (except Newsprint) Mills • 325992 – Photographic Film, Paper, Plate and Chemical Manufacturing (i. e. Toner/Ink) • The size standard for the above NAICS is 500 employees. A Non-Manufacturer Rule Waiver has been requested and pending approval for the above NAICS codes for this solicitation. NOTE: Your SAM account (formerly CCR) should reflect the respective association with the items being proposed in OS 3. 28

Section V: Representations and Certifications • This area is where you provide verification and validation of: • Small Business Status • Ability One • FAR 52. 204 -8 Annual Reps & Certs • North American Industry Classification Standard (NAICS) applicable under OS 3 Purchasing: • 339940 – Office Supplies (except Paper) Manufacturing • 322121 – Paper (except Newsprint) Mills • 325992 – Photographic Film, Paper, Plate and Chemical Manufacturing (i. e. Toner/Ink) • The size standard for the above NAICS is 500 employees. A Non-Manufacturer Rule Waiver has been requested and pending approval for the above NAICS codes for this solicitation. NOTE: Your SAM account (formerly CCR) should reflect the respective association with the items being proposed in OS 3. 28

Section V: Representations and Certifications Continued… • Another important Certification is located in Attachment No. 4 Business Rules and Agreement for Contract Holders • Acknowledgment and authorized signature is required on the last page. • Highlights include: • Requirement expectations • Complaint resolution • Improper content • Catalog and Spreadsheet contents • Delivery/Task Order/Purchase Order Information • Unsolicited Customer Marketing • Identification of “Green” Sustainable Products 29

Section V: Representations and Certifications Continued… • Another important Certification is located in Attachment No. 4 Business Rules and Agreement for Contract Holders • Acknowledgment and authorized signature is required on the last page. • Highlights include: • Requirement expectations • Complaint resolution • Improper content • Catalog and Spreadsheet contents • Delivery/Task Order/Purchase Order Information • Unsolicited Customer Marketing • Identification of “Green” Sustainable Products 29

Attachment No. 1 - OS 3 Price Proposal Spreadsheet. xlsm • Generated in MS Excel, this Attachment is where prices are proposed and submitted for evaluation • Submission of a completed Attachment 1 is a mandatory requirement of the OS 3 RFP • Failure to submit a complete Attachment 1 on a otherwise Technically Acceptable proposal will result in an unacceptable proposal submission and will no longer be considered eligible for award. • The Market Basket Items are considered to be a mandatory core-items list that represents high demand, frequently purchased and high volume Office Supplies based on previous actual purchases. • Items that you desire to propose that are within scope of Attachment 2, Definitions may be listed as part of a “Non-Market Basket” Mr. Joshua Royko, Supervisory Business Analyst will guide you through this critical piece of your submission. 30

Attachment No. 1 - OS 3 Price Proposal Spreadsheet. xlsm • Generated in MS Excel, this Attachment is where prices are proposed and submitted for evaluation • Submission of a completed Attachment 1 is a mandatory requirement of the OS 3 RFP • Failure to submit a complete Attachment 1 on a otherwise Technically Acceptable proposal will result in an unacceptable proposal submission and will no longer be considered eligible for award. • The Market Basket Items are considered to be a mandatory core-items list that represents high demand, frequently purchased and high volume Office Supplies based on previous actual purchases. • Items that you desire to propose that are within scope of Attachment 2, Definitions may be listed as part of a “Non-Market Basket” Mr. Joshua Royko, Supervisory Business Analyst will guide you through this critical piece of your submission. 30

Joshua Royko, Supervisory Business Analyst, CAR 31

Joshua Royko, Supervisory Business Analyst, CAR 31

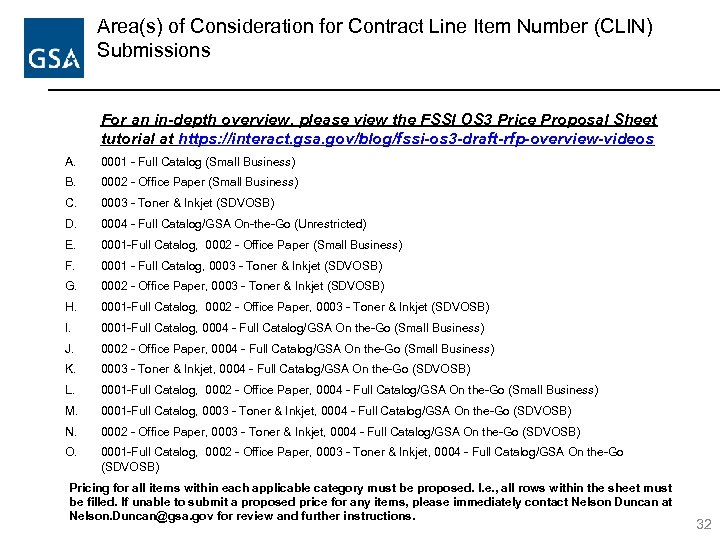

Area(s) of Consideration for Contract Line Item Number (CLIN) Submissions For an in-depth overview, please view the FSSI OS 3 Price Proposal Sheet tutorial at https: //interact. gsa. gov/blog/fssi-os 3 -draft-rfp-overview-videos A. 0001 - Full Catalog (Small Business) B. 0002 - Office Paper (Small Business) C. 0003 - Toner & Inkjet (SDVOSB) D. 0004 - Full Catalog/GSA On-the-Go (Unrestricted) E. 0001 -Full Catalog, 0002 - Office Paper (Small Business) F. 0001 - Full Catalog, 0003 - Toner & Inkjet (SDVOSB) G. 0002 - Office Paper, 0003 - Toner & Inkjet (SDVOSB) H. 0001 -Full Catalog, 0002 - Office Paper, 0003 - Toner & Inkjet (SDVOSB) I. 0001 -Full Catalog, 0004 - Full Catalog/GSA On the-Go (Small Business) J. 0002 - Office Paper, 0004 - Full Catalog/GSA On the-Go (Small Business) K. 0003 - Toner & Inkjet, 0004 - Full Catalog/GSA On the-Go (SDVOSB) L. 0001 -Full Catalog, 0002 - Office Paper, 0004 - Full Catalog/GSA On the-Go (Small Business) M. 0001 -Full Catalog, 0003 - Toner & Inkjet, 0004 - Full Catalog/GSA On the-Go (SDVOSB) N. 0002 - Office Paper, 0003 - Toner & Inkjet, 0004 - Full Catalog/GSA On the-Go (SDVOSB) O. 0001 -Full Catalog, 0002 - Office Paper, 0003 - Toner & Inkjet, 0004 - Full Catalog/GSA On the-Go (SDVOSB) Pricing for all items within each applicable category must be proposed. I. e. , all rows within the sheet must be filled. If unable to submit a proposed price for any items, please immediately contact Nelson Duncan at Nelson. Duncan@gsa. gov for review and further instructions. 32

Area(s) of Consideration for Contract Line Item Number (CLIN) Submissions For an in-depth overview, please view the FSSI OS 3 Price Proposal Sheet tutorial at https: //interact. gsa. gov/blog/fssi-os 3 -draft-rfp-overview-videos A. 0001 - Full Catalog (Small Business) B. 0002 - Office Paper (Small Business) C. 0003 - Toner & Inkjet (SDVOSB) D. 0004 - Full Catalog/GSA On-the-Go (Unrestricted) E. 0001 -Full Catalog, 0002 - Office Paper (Small Business) F. 0001 - Full Catalog, 0003 - Toner & Inkjet (SDVOSB) G. 0002 - Office Paper, 0003 - Toner & Inkjet (SDVOSB) H. 0001 -Full Catalog, 0002 - Office Paper, 0003 - Toner & Inkjet (SDVOSB) I. 0001 -Full Catalog, 0004 - Full Catalog/GSA On the-Go (Small Business) J. 0002 - Office Paper, 0004 - Full Catalog/GSA On the-Go (Small Business) K. 0003 - Toner & Inkjet, 0004 - Full Catalog/GSA On the-Go (SDVOSB) L. 0001 -Full Catalog, 0002 - Office Paper, 0004 - Full Catalog/GSA On the-Go (Small Business) M. 0001 -Full Catalog, 0003 - Toner & Inkjet, 0004 - Full Catalog/GSA On the-Go (SDVOSB) N. 0002 - Office Paper, 0003 - Toner & Inkjet, 0004 - Full Catalog/GSA On the-Go (SDVOSB) O. 0001 -Full Catalog, 0002 - Office Paper, 0003 - Toner & Inkjet, 0004 - Full Catalog/GSA On the-Go (SDVOSB) Pricing for all items within each applicable category must be proposed. I. e. , all rows within the sheet must be filled. If unable to submit a proposed price for any items, please immediately contact Nelson Duncan at Nelson. Duncan@gsa. gov for review and further instructions. 32

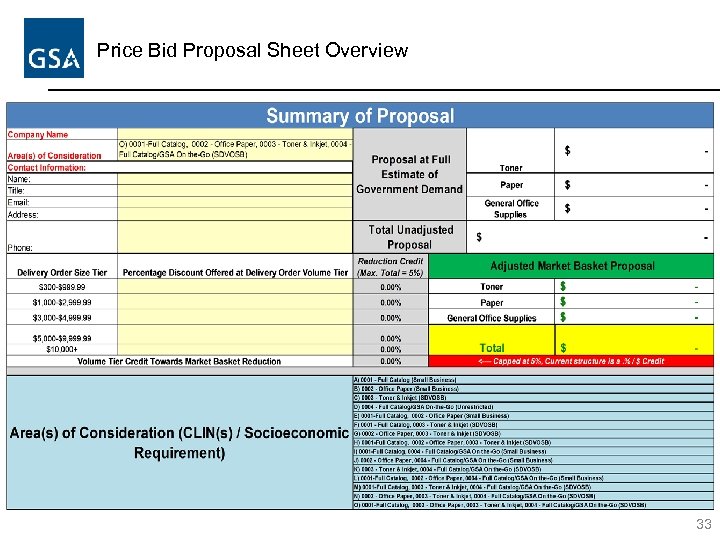

Price Bid Proposal Sheet Overview 33

Price Bid Proposal Sheet Overview 33

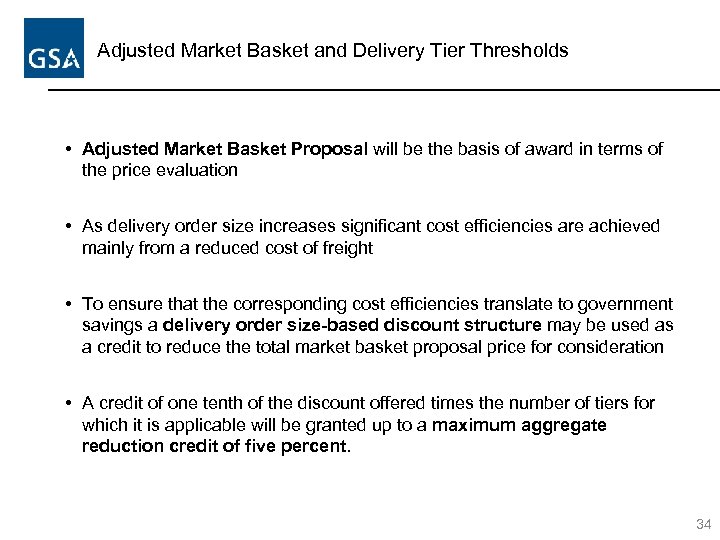

Adjusted Market Basket and Delivery Tier Thresholds • Adjusted Market Basket Proposal will be the basis of award in terms of the price evaluation • As delivery order size increases significant cost efficiencies are achieved mainly from a reduced cost of freight • To ensure that the corresponding cost efficiencies translate to government savings a delivery order size-based discount structure may be used as a credit to reduce the total market basket proposal price for consideration • A credit of one tenth of the discount offered times the number of tiers for which it is applicable will be granted up to a maximum aggregate reduction credit of five percent. 34

Adjusted Market Basket and Delivery Tier Thresholds • Adjusted Market Basket Proposal will be the basis of award in terms of the price evaluation • As delivery order size increases significant cost efficiencies are achieved mainly from a reduced cost of freight • To ensure that the corresponding cost efficiencies translate to government savings a delivery order size-based discount structure may be used as a credit to reduce the total market basket proposal price for consideration • A credit of one tenth of the discount offered times the number of tiers for which it is applicable will be granted up to a maximum aggregate reduction credit of five percent. 34

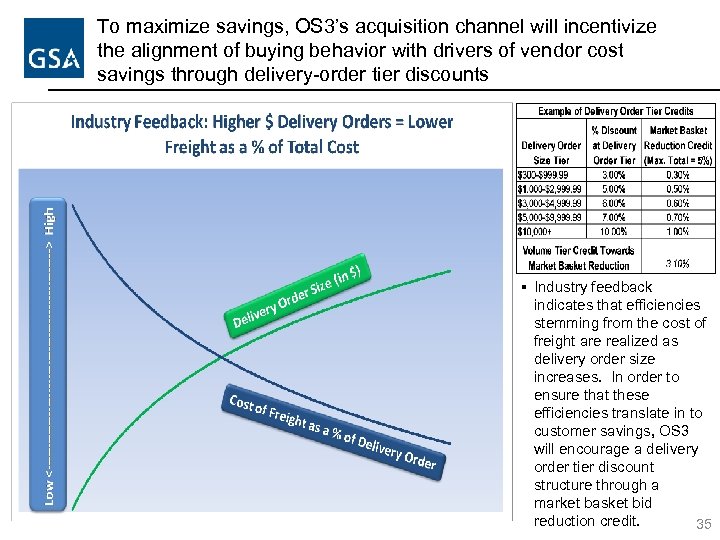

To maximize savings, OS 3’s acquisition channel will incentivize the alignment of buying behavior with drivers of vendor cost savings through delivery-order tier discounts § Industry feedback indicates that efficiencies stemming from the cost of freight are realized as delivery order size increases. In order to ensure that these efficiencies translate in to customer savings, OS 3 will encourage a delivery order tier discount structure through a market basket bid reduction credit. 35

To maximize savings, OS 3’s acquisition channel will incentivize the alignment of buying behavior with drivers of vendor cost savings through delivery-order tier discounts § Industry feedback indicates that efficiencies stemming from the cost of freight are realized as delivery order size increases. In order to ensure that these efficiencies translate in to customer savings, OS 3 will encourage a delivery order tier discount structure through a market basket bid reduction credit. 35

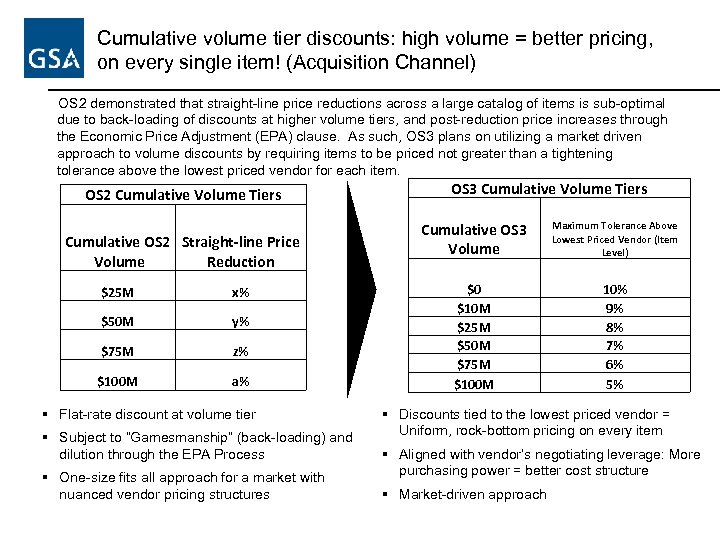

Cumulative volume tier discounts: high volume = better pricing, on every single item! (Acquisition Channel) OS 2 demonstrated that straight-line price reductions across a large catalog of items is sub-optimal due to back-loading of discounts at higher volume tiers, and post-reduction price increases through the Economic Price Adjustment (EPA) clause. As such, OS 3 plans on utilizing a market driven approach to volume discounts by requiring items to be priced not greater than a tightening tolerance above the lowest priced vendor for each item. OS 2 Cumulative Volume Tiers Cumulative OS 2 Straight-line Price Volume Reduction $25 M x% $50 M y% $75 M z% $100 M a% § Flat-rate discount at volume tier § Subject to “Gamesmanship” (back-loading) and dilution through the EPA Process § One-size fits all approach for a market with nuanced vendor pricing structures OS 3 Cumulative Volume Tiers Cumulative OS 3 Volume Maximum Tolerance Above Lowest Priced Vendor (Item Level) $0 $10 M $25 M $50 M $75 M $100 M 10% 9% 8% 7% 6% 5% § Discounts tied to the lowest priced vendor = Uniform, rock-bottom pricing on every item § Aligned with vendor’s negotiating leverage: More purchasing power = better cost structure § Market-driven approach

Cumulative volume tier discounts: high volume = better pricing, on every single item! (Acquisition Channel) OS 2 demonstrated that straight-line price reductions across a large catalog of items is sub-optimal due to back-loading of discounts at higher volume tiers, and post-reduction price increases through the Economic Price Adjustment (EPA) clause. As such, OS 3 plans on utilizing a market driven approach to volume discounts by requiring items to be priced not greater than a tightening tolerance above the lowest priced vendor for each item. OS 2 Cumulative Volume Tiers Cumulative OS 2 Straight-line Price Volume Reduction $25 M x% $50 M y% $75 M z% $100 M a% § Flat-rate discount at volume tier § Subject to “Gamesmanship” (back-loading) and dilution through the EPA Process § One-size fits all approach for a market with nuanced vendor pricing structures OS 3 Cumulative Volume Tiers Cumulative OS 3 Volume Maximum Tolerance Above Lowest Priced Vendor (Item Level) $0 $10 M $25 M $50 M $75 M $100 M 10% 9% 8% 7% 6% 5% § Discounts tied to the lowest priced vendor = Uniform, rock-bottom pricing on every item § Aligned with vendor’s negotiating leverage: More purchasing power = better cost structure § Market-driven approach

Question & Answer Session GSA welcomes the opportunity to address any questions that you may have at this time. To submit a question, please type it in to the Adobe Connect Chat Window. 37

Question & Answer Session GSA welcomes the opportunity to address any questions that you may have at this time. To submit a question, please type it in to the Adobe Connect Chat Window. 37