0134e3328ce004ba4f0ebff66bfb3c48.ppt

- Количество слайдов: 10

U OF U Entrepreneur Challenge Capital Sources EPIC Venture Fund Investing in seed and early-stage technology companies Opal Financial Group Emerging Manager of the Year 2009

U OF U Entrepreneur Challenge Capital Sources EPIC Venture Fund Investing in seed and early-stage technology companies Opal Financial Group Emerging Manager of the Year 2009

EPIC Venture Funds • Early-Stage IT and High Tech Venture Fund • $250+ mm under management between (Epic and Zions Funds) • EPIC Funds–Over 90 Total Investments - 32 Exits: 5 IPOs, 27 Acquisitions - 36 Active Companies • Zions SBIC – Strategic Venture Fund • 9 Total Staff • 3 Main Offices Currently (Salt Lake City, Boston, New Mexico) • Operations in Idaho and Phoenix Private and Confidential Page 2

EPIC Venture Funds • Early-Stage IT and High Tech Venture Fund • $250+ mm under management between (Epic and Zions Funds) • EPIC Funds–Over 90 Total Investments - 32 Exits: 5 IPOs, 27 Acquisitions - 36 Active Companies • Zions SBIC – Strategic Venture Fund • 9 Total Staff • 3 Main Offices Currently (Salt Lake City, Boston, New Mexico) • Operations in Idaho and Phoenix Private and Confidential Page 2

Bio • Kent I. Madsen, Managing Director, EPIC Venture Fund and Zions SBIC Fmr Advisor DFJ Me. VC (NYSE: MVC - $300 million fund) University Venture Fund (Non-profit Venture fund) Ford Motor Company, Advanced Technology and China Development University of Michigan, Instructor & Author M. B. A. from Wharton M. A. in International Studies from University of Pennsylvania M. S. E. in Mechanical Engineering from University of Michigan B. S. in Mechanical Engineering & Applied Mechanics, University of Pennsylvania Private and Confidential Page 3

Bio • Kent I. Madsen, Managing Director, EPIC Venture Fund and Zions SBIC Fmr Advisor DFJ Me. VC (NYSE: MVC - $300 million fund) University Venture Fund (Non-profit Venture fund) Ford Motor Company, Advanced Technology and China Development University of Michigan, Instructor & Author M. B. A. from Wharton M. A. in International Studies from University of Pennsylvania M. S. E. in Mechanical Engineering from University of Michigan B. S. in Mechanical Engineering & Applied Mechanics, University of Pennsylvania Private and Confidential Page 3

What to be an Professional Athlete? • Michael Jordan – Greatest Bball Player all time (Wealthiest)? • $300, 000/Game; $10, 000/minute • Endorsements $40 Million in one year; 187, 000/day • Sleeps 7 hrs/night - $52, 000/night • Makes $3, 710 for watch an episode of Friends • Buy a Jaguar / Acura NSX ($100 k) – save for 12 hrs • One year – Made more money than all past US Pres combined • 270 years – Number of years he’d have to do it to equal Bill Gates • Rather Than Be Michael Jordan • Buy MICHAEL JORDAN!!!!! Private and Confidential Page 4

What to be an Professional Athlete? • Michael Jordan – Greatest Bball Player all time (Wealthiest)? • $300, 000/Game; $10, 000/minute • Endorsements $40 Million in one year; 187, 000/day • Sleeps 7 hrs/night - $52, 000/night • Makes $3, 710 for watch an episode of Friends • Buy a Jaguar / Acura NSX ($100 k) – save for 12 hrs • One year – Made more money than all past US Pres combined • 270 years – Number of years he’d have to do it to equal Bill Gates • Rather Than Be Michael Jordan • Buy MICHAEL JORDAN!!!!! Private and Confidential Page 4

Things to know about VC What do you call a 1000 Lawyers tied together at the bottom of the ocean? A good start! Apparently we are such Jerks we can’t buy friends. 1 - VC’s can’t even buy friends… …. . An overview of Private Equity. Private and Confidential Page 5

Things to know about VC What do you call a 1000 Lawyers tied together at the bottom of the ocean? A good start! Apparently we are such Jerks we can’t buy friends. 1 - VC’s can’t even buy friends… …. . An overview of Private Equity. Private and Confidential Page 5

Capital Sources • Retail Banks (low Risk Tolerance) • Personal Guarantees / SBA loans (Moderate Risk Tolerance) • Angels / Family and Friends (Low/High Risk Tolerance) • Venture Capital (High Risk Tolerance) • Mezzanine (Moderate Risk Tolerance) • Private Equity / Buyout Funds (Moderate Risk Tolerance) Private and Confidential Page 6

Capital Sources • Retail Banks (low Risk Tolerance) • Personal Guarantees / SBA loans (Moderate Risk Tolerance) • Angels / Family and Friends (Low/High Risk Tolerance) • Venture Capital (High Risk Tolerance) • Mezzanine (Moderate Risk Tolerance) • Private Equity / Buyout Funds (Moderate Risk Tolerance) Private and Confidential Page 6

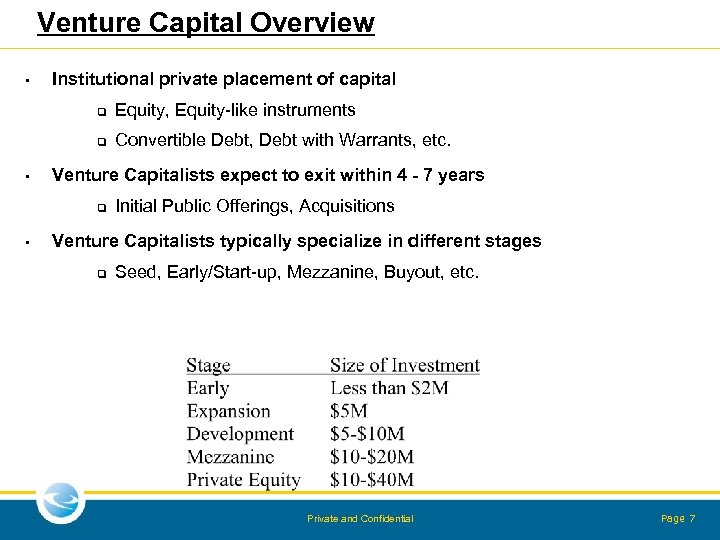

Venture Capital Overview • Institutional private placement of capital q q • Equity, Equity-like instruments Convertible Debt, Debt with Warrants, etc. Venture Capitalists expect to exit within 4 - 7 years q • Initial Public Offerings, Acquisitions Venture Capitalists typically specialize in different stages q Seed, Early/Start-up, Mezzanine, Buyout, etc. Private and Confidential Page 7

Venture Capital Overview • Institutional private placement of capital q q • Equity, Equity-like instruments Convertible Debt, Debt with Warrants, etc. Venture Capitalists expect to exit within 4 - 7 years q • Initial Public Offerings, Acquisitions Venture Capitalists typically specialize in different stages q Seed, Early/Start-up, Mezzanine, Buyout, etc. Private and Confidential Page 7

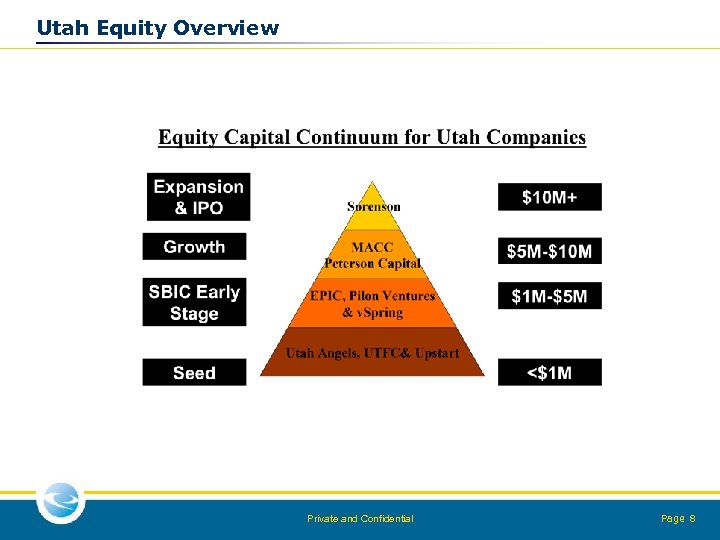

Utah Equity Overview Private and Confidential Page 8

Utah Equity Overview Private and Confidential Page 8

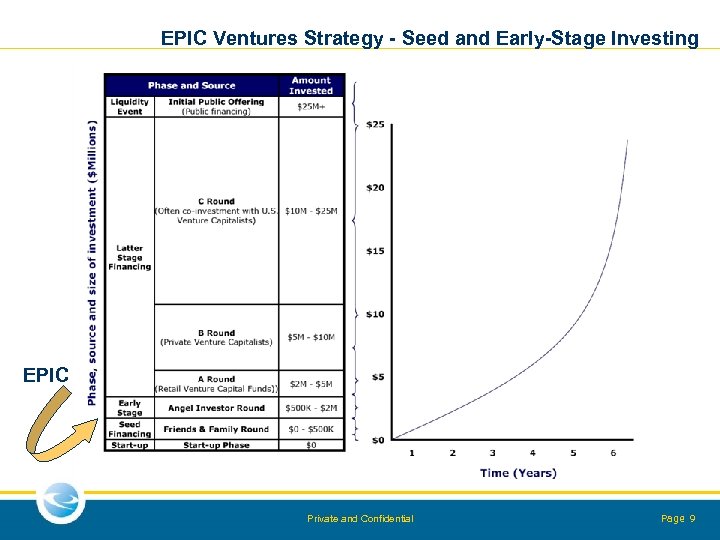

EPIC Ventures Strategy - Seed and Early-Stage Investing EPIC Private and Confidential Page 9

EPIC Ventures Strategy - Seed and Early-Stage Investing EPIC Private and Confidential Page 9

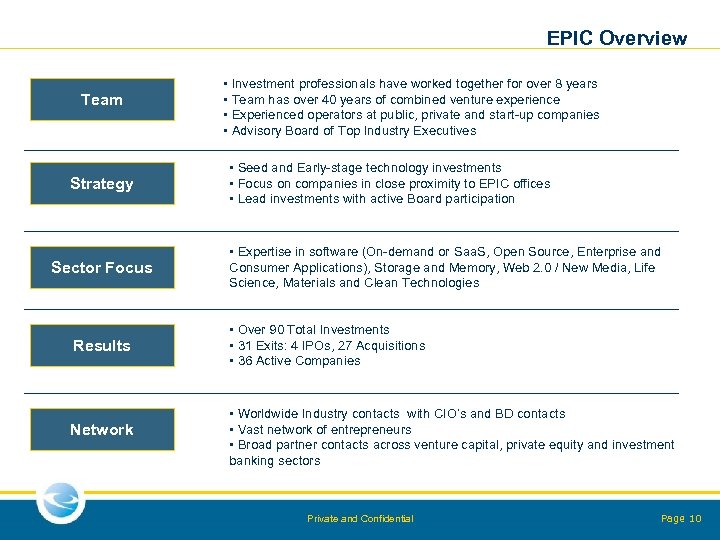

EPIC Overview Team Strategy Sector Focus Results Network • Investment professionals have worked together for over 8 years • Team has over 40 years of combined venture experience • Experienced operators at public, private and start-up companies • Advisory Board of Top Industry Executives • Seed and Early-stage technology investments • Focus on companies in close proximity to EPIC offices • Lead investments with active Board participation • Expertise in software (On-demand or Saa. S, Open Source, Enterprise and Consumer Applications), Storage and Memory, Web 2. 0 / New Media, Life Science, Materials and Clean Technologies • Over 90 Total Investments • 31 Exits: 4 IPOs, 27 Acquisitions • 36 Active Companies • Worldwide Industry contacts with CIO’s and BD contacts • Vast network of entrepreneurs • Broad partner contacts across venture capital, private equity and investment banking sectors Private and Confidential Page 10

EPIC Overview Team Strategy Sector Focus Results Network • Investment professionals have worked together for over 8 years • Team has over 40 years of combined venture experience • Experienced operators at public, private and start-up companies • Advisory Board of Top Industry Executives • Seed and Early-stage technology investments • Focus on companies in close proximity to EPIC offices • Lead investments with active Board participation • Expertise in software (On-demand or Saa. S, Open Source, Enterprise and Consumer Applications), Storage and Memory, Web 2. 0 / New Media, Life Science, Materials and Clean Technologies • Over 90 Total Investments • 31 Exits: 4 IPOs, 27 Acquisitions • 36 Active Companies • Worldwide Industry contacts with CIO’s and BD contacts • Vast network of entrepreneurs • Broad partner contacts across venture capital, private equity and investment banking sectors Private and Confidential Page 10