U 21 TAKEOVERS

U 21 TAKEOVERS

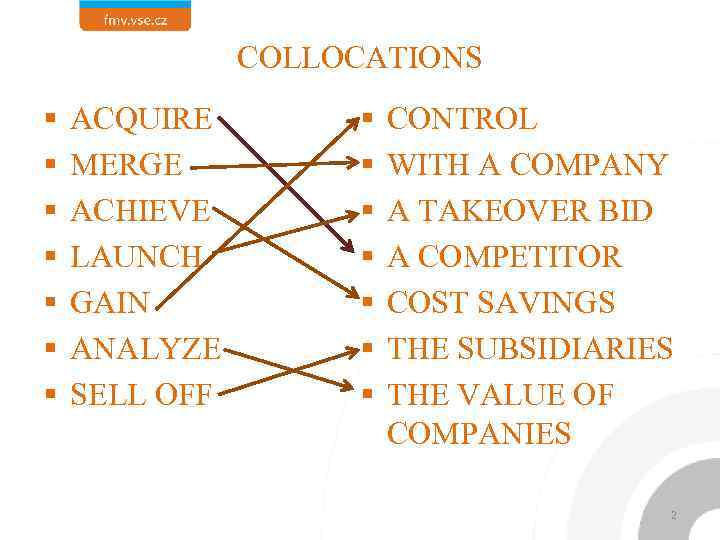

COLLOCATIONS § § § § ACQUIRE MERGE ACHIEVE LAUNCH GAIN ANALYZE SELL OFF § § § § CONTROL WITH A COMPANY A TAKEOVER BID A COMPETITOR COST SAVINGS THE SUBSIDIARIES THE VALUE OF COMPANIES 2

COLLOCATIONS § § § § ACQUIRE MERGE ACHIEVE LAUNCH GAIN ANALYZE SELL OFF § § § § CONTROL WITH A COMPANY A TAKEOVER BID A COMPETITOR COST SAVINGS THE SUBSIDIARIES THE VALUE OF COMPANIES 2

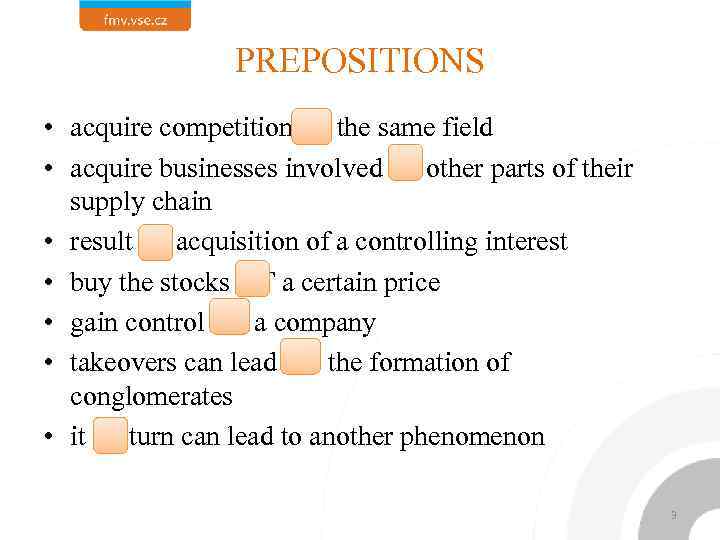

PREPOSITIONS • acquire competition IN the same field • acquire businesses involved IN other parts of their supply chain • result IN acquisition of a controlling interest • buy the stocks AT a certain price • gain control OF a company • takeovers can lead TO the formation of conglomerates • it IN turn can lead to another phenomenon 3

PREPOSITIONS • acquire competition IN the same field • acquire businesses involved IN other parts of their supply chain • result IN acquisition of a controlling interest • buy the stocks AT a certain price • gain control OF a company • takeovers can lead TO the formation of conglomerates • it IN turn can lead to another phenomenon 3

SUPPLY CHAIN • PRODUCTION • WHOLESALE TRADE • RETAIL TRADE • CUSTOMER • CONSUMER 4

SUPPLY CHAIN • PRODUCTION • WHOLESALE TRADE • RETAIL TRADE • CUSTOMER • CONSUMER 4

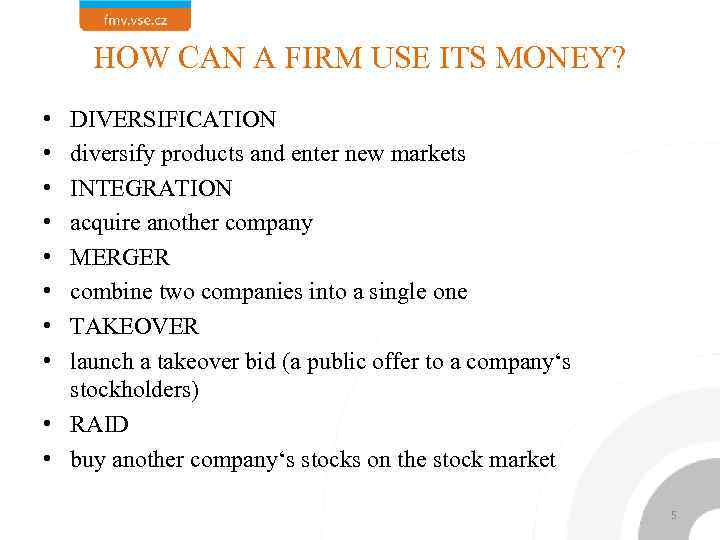

HOW CAN A FIRM USE ITS MONEY? • • DIVERSIFICATION diversify products and enter new markets INTEGRATION acquire another company MERGER combine two companies into a single one TAKEOVER launch a takeover bid (a public offer to a company‘s stockholders) • RAID • buy another company‘s stocks on the stock market 5

HOW CAN A FIRM USE ITS MONEY? • • DIVERSIFICATION diversify products and enter new markets INTEGRATION acquire another company MERGER combine two companies into a single one TAKEOVER launch a takeover bid (a public offer to a company‘s stockholders) • RAID • buy another company‘s stocks on the stock market 5

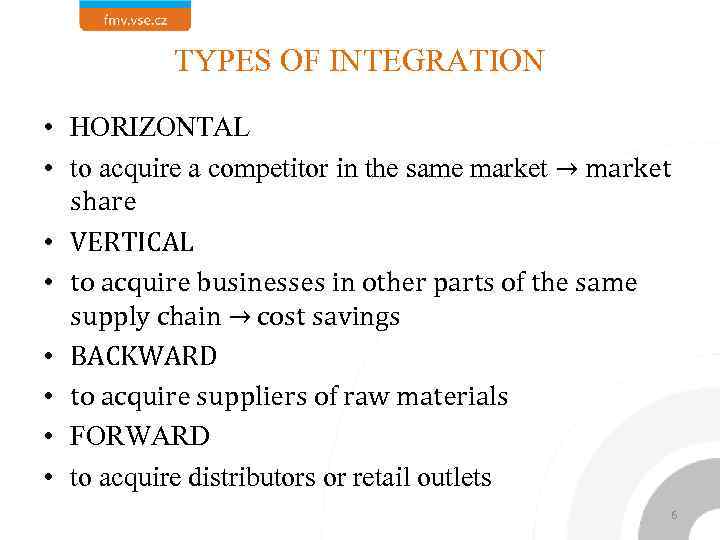

TYPES OF INTEGRATION • HORIZONTAL • to acquire a competitor in the same market → market share • VERTICAL • to acquire businesses in other parts of the same supply chain → cost savings • BACKWARD • to acquire suppliers of raw materials • FORWARD • to acquire distributors or retail outlets 6

TYPES OF INTEGRATION • HORIZONTAL • to acquire a competitor in the same market → market share • VERTICAL • to acquire businesses in other parts of the same supply chain → cost savings • BACKWARD • to acquire suppliers of raw materials • FORWARD • to acquire distributors or retail outlets 6

THE ROLE OF INVESTMENT BANKS • Investment banks function as mediators in such transactions as they have large mergers and acquisitions departments analysing the value of listed companies. They also advise companies involved in mergers and takeovers → high earnings for banks. 7

THE ROLE OF INVESTMENT BANKS • Investment banks function as mediators in such transactions as they have large mergers and acquisitions departments analysing the value of listed companies. They also advise companies involved in mergers and takeovers → high earnings for banks. 7

LEVERAGED BUYOUT (LBO) • When corporate raiders or private equity funds consider that a conglomerate resulting from a series of takeovers has not achieved synergy and has become inefficient and market capitalization is lower than its total assets, raiders borrow money by issuing bonds and buy it, then close or sell subsidiaries, sell assets → asset stripping → then repay bonds and make profit 8

LEVERAGED BUYOUT (LBO) • When corporate raiders or private equity funds consider that a conglomerate resulting from a series of takeovers has not achieved synergy and has become inefficient and market capitalization is lower than its total assets, raiders borrow money by issuing bonds and buy it, then close or sell subsidiaries, sell assets → asset stripping → then repay bonds and make profit 8

TERMS REVISION • A company’s sales expressed as a percentage of the 1 total sales in a market. MARKET SHARE • Cost reductions resulting from increased production. 2 ECONOMIES OF SCALE • All the organizations involved in the production, 3 distribution and sale of a product. SUPPLY CHAIN • Companies that sell a manufacturer’s products to customers. RETAILERS 4 • Places where goods are sold to customers. RETAIL OUTLETS 5 9

TERMS REVISION • A company’s sales expressed as a percentage of the 1 total sales in a market. MARKET SHARE • Cost reductions resulting from increased production. 2 ECONOMIES OF SCALE • All the organizations involved in the production, 3 distribution and sale of a product. SUPPLY CHAIN • Companies that sell a manufacturer’s products to customers. RETAILERS 4 • Places where goods are sold to customers. RETAIL OUTLETS 5 9

• Groups of diverse companies that are under common ownership and run as single organizations. 6 CONGLOMERATES • Companies that are owned and controlled by a parent 7 company. SUBSIDIARIES 8 • A reduction in price. DISCOUNT 10

• Groups of diverse companies that are under common ownership and run as single organizations. 6 CONGLOMERATES • Companies that are owned and controlled by a parent 7 company. SUBSIDIARIES 8 • A reduction in price. DISCOUNT 10

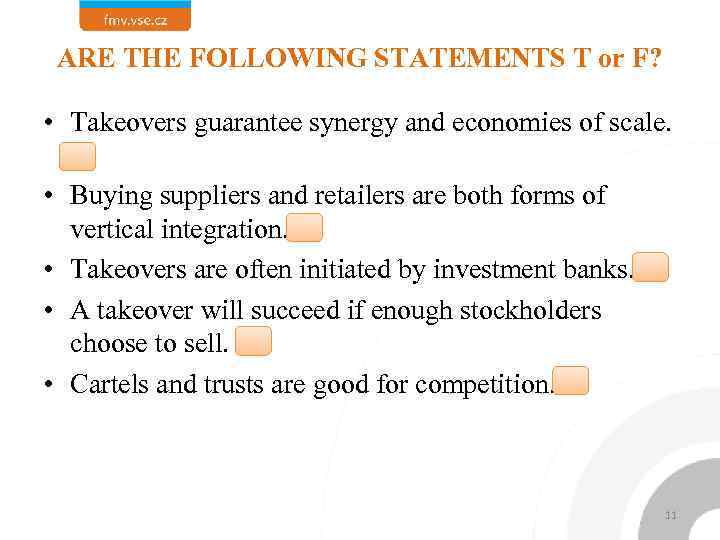

ARE THE FOLLOWING STATEMENTS T or F? • Takeovers guarantee synergy and economies of scale. F • Buying suppliers and retailers are both forms of vertical integration. T • Takeovers are often initiated by investment banks. F • A takeover will succeed if enough stockholders choose to sell. T • Cartels and trusts are good for competition. F 11

ARE THE FOLLOWING STATEMENTS T or F? • Takeovers guarantee synergy and economies of scale. F • Buying suppliers and retailers are both forms of vertical integration. T • Takeovers are often initiated by investment banks. F • A takeover will succeed if enough stockholders choose to sell. T • Cartels and trusts are good for competition. F 11