4e93da32a5ea19cbbb9c074d2adfec06.ppt

- Количество слайдов: 33

Types of Investments

Types of Investments

Types of Investments • Stocks • Bonds • Mutual Funds • Real Estate • Savings/Certificates of Deposit • Collectibles

Types of Investments • Stocks • Bonds • Mutual Funds • Real Estate • Savings/Certificates of Deposit • Collectibles

Stocks • An investment that represents ownership in a company or corporation.

Stocks • An investment that represents ownership in a company or corporation.

How Well the Stock Market is Doing Overall

How Well the Stock Market is Doing Overall

3 Basic Indicators • Dow Jones Industrial Average (“DOW”) – Lists the 30 leading industrial blue chip stocks • Standard and Poor’s 500 Composite Index – Covers market activity for 500 stocks – More accurate than DOW because it evaluates a greater variety of stock • National Association of Security Dealers Automated Quotations (“NASDAQ”) – Monitors fast moving technology companies – Speculative stocks, show dramatic ups and downs

3 Basic Indicators • Dow Jones Industrial Average (“DOW”) – Lists the 30 leading industrial blue chip stocks • Standard and Poor’s 500 Composite Index – Covers market activity for 500 stocks – More accurate than DOW because it evaluates a greater variety of stock • National Association of Security Dealers Automated Quotations (“NASDAQ”) – Monitors fast moving technology companies – Speculative stocks, show dramatic ups and downs

Ups and Downs • The term bull market means the market is doing well because investors are optimistic about the economy and are purchasing stocks • The term bear market means the market is doing poorly and investors are not purchasing stocks or selling stocks already owned

Ups and Downs • The term bull market means the market is doing well because investors are optimistic about the economy and are purchasing stocks • The term bear market means the market is doing poorly and investors are not purchasing stocks or selling stocks already owned

Purchasing Stock

Purchasing Stock

Brokers • A Broker is a person who is licensed to buy and sell stocks, provide investment advice, and collect a commission on each purchase or sale – Purchases stocks on an organized exchange (stock market) – Over ¾ of all stocks are bought and sold on an organized exchange

Brokers • A Broker is a person who is licensed to buy and sell stocks, provide investment advice, and collect a commission on each purchase or sale – Purchases stocks on an organized exchange (stock market) – Over ¾ of all stocks are bought and sold on an organized exchange

Organized Exchanges • Minimum requirements for a stock to ensure only reputable companies are used • Each exchange has a limited number of seats available which brokerage firms purchase to give them the legal right to buy and sell stocks on the exchange

Organized Exchanges • Minimum requirements for a stock to ensure only reputable companies are used • Each exchange has a limited number of seats available which brokerage firms purchase to give them the legal right to buy and sell stocks on the exchange

New York Stock Exchange • New York Stock Exchange (NYSE) – Oldest and largest, began in 1792 – 1, 366 seats available – 2, 800 companies – Average stock price is $33. 00 – Strict requirements

New York Stock Exchange • New York Stock Exchange (NYSE) – Oldest and largest, began in 1792 – 1, 366 seats available – 2, 800 companies – Average stock price is $33. 00 – Strict requirements

American Stock Exchange • American Stock Exchange – Began in 1849 – 2 nd largest exchange – It’s requirements are not as strict as NYSE allowing younger, smaller companies to list – Average stock price is $24. 00

American Stock Exchange • American Stock Exchange – Began in 1849 – 2 nd largest exchange – It’s requirements are not as strict as NYSE allowing younger, smaller companies to list – Average stock price is $24. 00

Regional Stock Exchanges • Regional Stock Exchanges – Stocks are traded to investors living in a specific geographical area • Including Boston, Cincinnati, Philadelphia, Spokane

Regional Stock Exchanges • Regional Stock Exchanges – Stocks are traded to investors living in a specific geographical area • Including Boston, Cincinnati, Philadelphia, Spokane

NASDAQ • National Association of Securities Dealers Automated Quotations – Stocks are traded in an over the counter electronic market – 4, 000 small companies • Company requirements are not as strict – More volatile because companies are young and new – Average stock price is $11. 00

NASDAQ • National Association of Securities Dealers Automated Quotations – Stocks are traded in an over the counter electronic market – 4, 000 small companies • Company requirements are not as strict – More volatile because companies are young and new – Average stock price is $11. 00

Bonds • A security representing a loan of money from a lender to a borrower for a set time period, which pays a fixed rate of interest.

Bonds • A security representing a loan of money from a lender to a borrower for a set time period, which pays a fixed rate of interest.

Mutual Funds • An investment that pools money from several investors to buy a particular type of investment, such as stocks.

Mutual Funds • An investment that pools money from several investors to buy a particular type of investment, such as stocks.

Real Estate • An investor buys pieces of property, such as land or a building, in hopes of generating a profit.

Real Estate • An investor buys pieces of property, such as land or a building, in hopes of generating a profit.

Savings/Certificates of Deposits • A deposit that earns a fixed interest rate for a specified length of time. – The longer the time period the greater the rate of return. – There is a substantial penalty for early withdrawal.

Savings/Certificates of Deposits • A deposit that earns a fixed interest rate for a specified length of time. – The longer the time period the greater the rate of return. – There is a substantial penalty for early withdrawal.

Collectibles • Unique items that are relatively rare or highly valued. – Art work – Baseball trading cards – Coins – Automobiles – Antiques

Collectibles • Unique items that are relatively rare or highly valued. – Art work – Baseball trading cards – Coins – Automobiles – Antiques

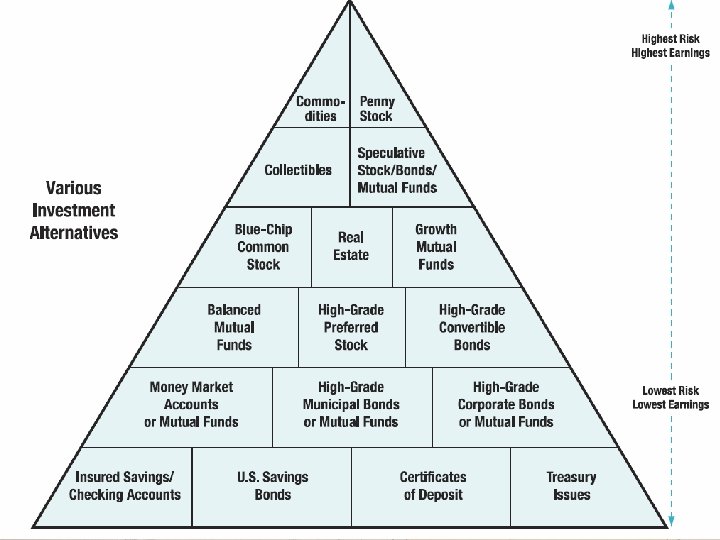

Risk vs. Return • On average, stocks have a high rate of return – The increase or decrease in the original purchase price of an investment • Higher rate of return = greater risk – Uncertainty about the outcome of an investment • Stocks provide portfolio diversification – Money invested in a variety of investment tools

Risk vs. Return • On average, stocks have a high rate of return – The increase or decrease in the original purchase price of an investment • Higher rate of return = greater risk – Uncertainty about the outcome of an investment • Stocks provide portfolio diversification – Money invested in a variety of investment tools

Short-term Investment Strategies • Buying on margin is where an investor borrows part of the money needed to invest in a stock from a brokerage firm. – There is a 50% margin requirement. – If you want to purchase $2, 000 worth of stock you can borrow up to $1, 000 to make the purchase.

Short-term Investment Strategies • Buying on margin is where an investor borrows part of the money needed to invest in a stock from a brokerage firm. – There is a 50% margin requirement. – If you want to purchase $2, 000 worth of stock you can borrow up to $1, 000 to make the purchase.

Short-term Investment Strategies • Short selling is where an investor sells shares of stock that they don’t own with the intent to buy them back later at a lower price. – Let’s use rollerblades as an example.

Short-term Investment Strategies • Short selling is where an investor sells shares of stock that they don’t own with the intent to buy them back later at a lower price. – Let’s use rollerblades as an example.

• Your friend buys new rollerblades for $80. • You borrow them and sell them for $80. • The price at the stores has been lowered to $45. • You buy a new pair for $45 and give them to your friend. • You made $35!!!

• Your friend buys new rollerblades for $80. • You borrow them and sell them for $80. • The price at the stores has been lowered to $45. • You buy a new pair for $45 and give them to your friend. • You made $35!!!

Long-term Investment Strategies • Diversification is spreading your assets among different types of investments to reduce risk. – Don’t put all your eggs in one basket.

Long-term Investment Strategies • Diversification is spreading your assets among different types of investments to reduce risk. – Don’t put all your eggs in one basket.

Long-term Investment Strategies • Dollar Cost Averaging is buying an equal amount of the same stock at equal intervals. – Invest $100 in e-bay every month. The price you pay for the stock averages out over time.

Long-term Investment Strategies • Dollar Cost Averaging is buying an equal amount of the same stock at equal intervals. – Invest $100 in e-bay every month. The price you pay for the stock averages out over time.

Dollar Cost Averaging One-Time Investment Amount Invested Shares Share Price ($) Purchased $1, 000. 00 $20. 00 50. 00 Dollar-Cost Averaging Amount Invested $100. 00 $100. 00 $1, 000. 00 Shares Share Price ($) Purchased $20. 00 $19. 50 $19. 25 $19. 75 $19. 20 $18. 90 $18. 00 $18. 60 $19. 78 $20. 90 $19. 39* 5. 00 5. 13 5. 19 5. 06 5. 21 5. 29 5. 56 5. 38 5. 06 4. 78 51. 66 * Average Share Price

Dollar Cost Averaging One-Time Investment Amount Invested Shares Share Price ($) Purchased $1, 000. 00 $20. 00 50. 00 Dollar-Cost Averaging Amount Invested $100. 00 $100. 00 $1, 000. 00 Shares Share Price ($) Purchased $20. 00 $19. 50 $19. 25 $19. 75 $19. 20 $18. 90 $18. 00 $18. 60 $19. 78 $20. 90 $19. 39* 5. 00 5. 13 5. 19 5. 06 5. 21 5. 29 5. 56 5. 38 5. 06 4. 78 51. 66 * Average Share Price

Long-term Investment Strategies • Buy and hold technique is where an investor buys stock and holds on to it for a number of years. – During that time you are paid dividends and the price of the stock may go up.

Long-term Investment Strategies • Buy and hold technique is where an investor buys stock and holds on to it for a number of years. – During that time you are paid dividends and the price of the stock may go up.

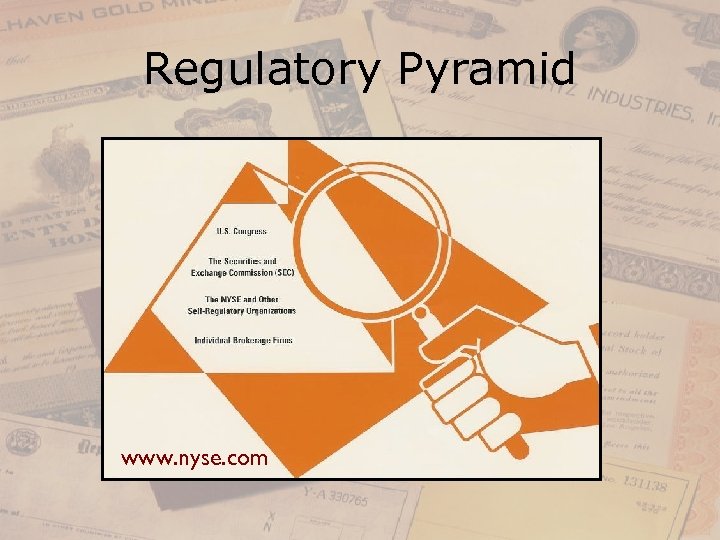

How Can Government Regulations Protect Investors? • Regulatory Pyramid – A network of safeguards that surrounds the securities industry from individual brokerages all the way up to the U. S. Congress.

How Can Government Regulations Protect Investors? • Regulatory Pyramid – A network of safeguards that surrounds the securities industry from individual brokerages all the way up to the U. S. Congress.

Regulatory Pyramid www. nyse. com

Regulatory Pyramid www. nyse. com

Sources of Investment Information • Prospectus – A formal written offer to sell securities that sets forth a plan for a proposed business enterprise. A prospectus should contain the facts that an investor needs to make an informed decision.

Sources of Investment Information • Prospectus – A formal written offer to sell securities that sets forth a plan for a proposed business enterprise. A prospectus should contain the facts that an investor needs to make an informed decision.

Sources of Investment Information • Annual report – A document detailing the business activity of a company over the previous year, and containing an income statement, cash flow statement, and balance sheet.

Sources of Investment Information • Annual report – A document detailing the business activity of a company over the previous year, and containing an income statement, cash flow statement, and balance sheet.

Sources of Investment Information • Financial publications – Wall Street Journal – Fortune – Kiplingers Personal Finance • Online information – http: //finance. yahoo. com – http: //moneycentral. msn. com

Sources of Investment Information • Financial publications – Wall Street Journal – Fortune – Kiplingers Personal Finance • Online information – http: //finance. yahoo. com – http: //moneycentral. msn. com

How Do You Buy and Sell Investments? • Full-service broker • Discount broker • Online broker • Investment advisors

How Do You Buy and Sell Investments? • Full-service broker • Discount broker • Online broker • Investment advisors