6d09f50191f985d597e4e38aad247cf6.ppt

- Количество слайдов: 25

Types of Credit

Loans • Borrowing a specific amount for a certain period of time

Single payment loans The debtor pays the loan back in full at the end of the loan period. Installment loans The debtor pays back the loan in monthly installments.

Loans are commonly used for

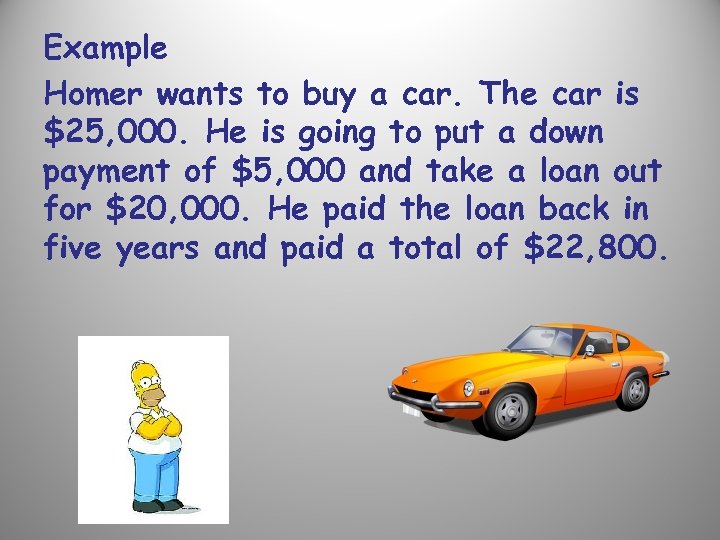

Example Homer wants to buy a car. The car is $25, 000. He is going to put a down payment of $5, 000 and take a loan out for $20, 000. He paid the loan back in five years and paid a total of $22, 800.

Sources of Loans • Commercial Banks • Credit Unions • Savings and Loans Associations (S&Ls) • Consumer Finance Companies • Life Insurance Companies • Friends/Family

Credit Cards • Bank cards such as • Store credit cards • Gas credit cards

Revolving account Credit cards are considered to be revolving accounts. A revolving account is an account in which only part of the balance needs to be paid during the monthly pay period.

Charge cards • Charge cards require that you pay the balance in full at the end of the monthly pay period. • Usually, there is no spending limit. • Example – American Express

What’s the difference between a debit card and a credit card? • When you use a debit card when you buy something, the amount of the purchase is automatically deducted from your checking account. • When you use a credit card when you buy something, your credit card is billed and you pay the amount later.

Grace period a time period when no finance charges are added to your account January 11 th Purchase -- $100 January 17 th Bill arrives -- $100 (minimum due is $10) February 18 th Bill is due

3 Cs of credit 1. Character – a person’s willingness to pay his/her debts 2. Capacity - a person’s ability to pay his/her debts 3. Collateral – property that backs a loan

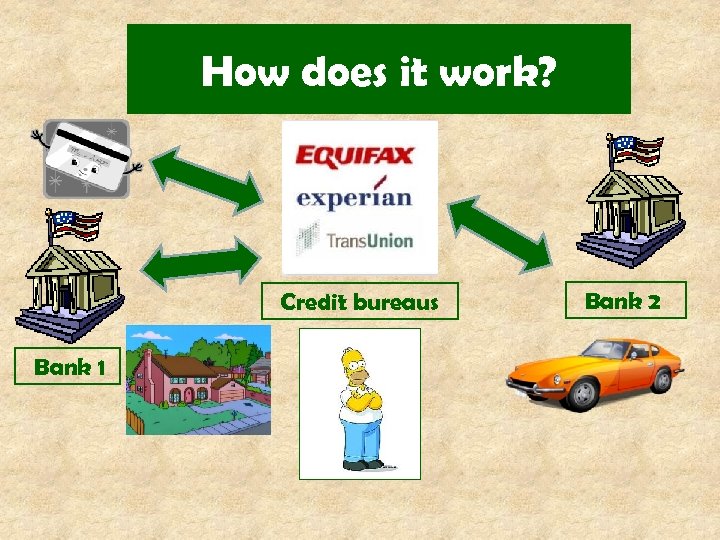

Credit bureaus • a company that collects information relating to the credit ratings of individuals and makes it available to credit card companies, financial institutions, etc. • All 3 major credit bureaus – Trans. Union – Equifax – Experian

What is a credit score? • Your credit score summarizes the information in your credit file. • The higher your credit score, the less of a risk you are.

How does it work? Credit bureaus Bank 1 Bank 2

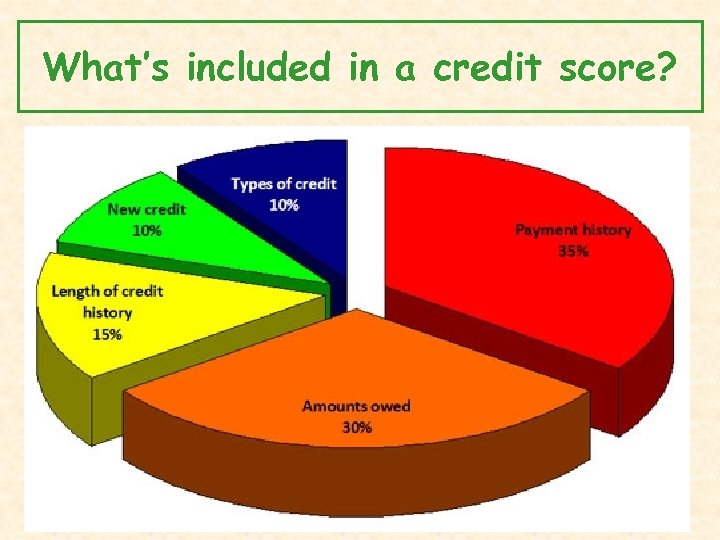

What’s included in a credit score?

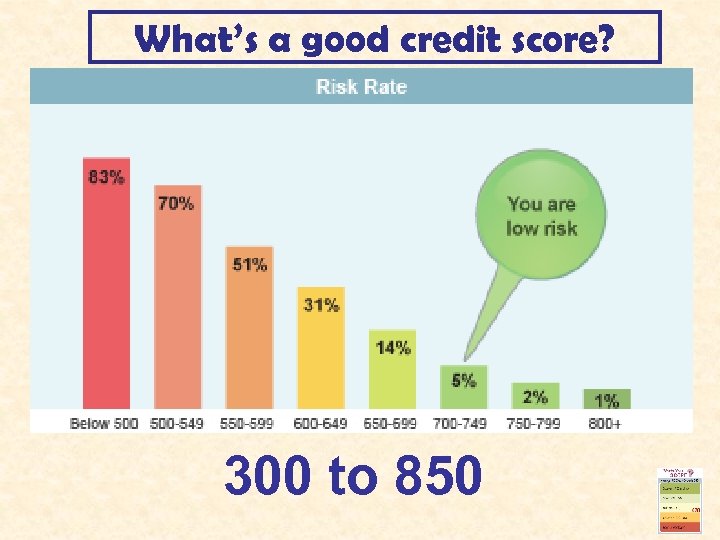

What’s a good credit score? 300 to 850

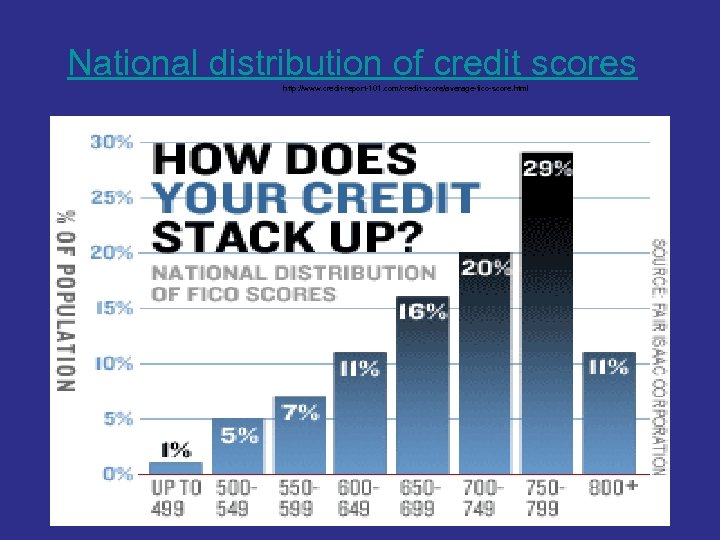

National distribution of credit scores http: //www. credit-report-101. com/credit-score/average-fico-score. html

How do you first establish good credit? • • Get a credit card Purchase something small. Pay the whole bill in the grace period. Repeat

Benefits of a good credit score • • • Lower rates on loans Discount on car insurance Bargaining power for rates, etc. Getting a job Approval for renting an apartment

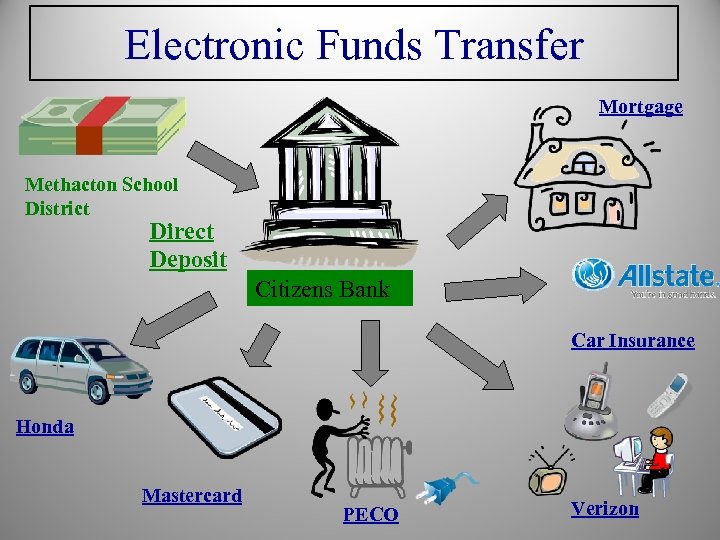

Electronic Funds Transfer Mortgage Methacton School District Direct Deposit Citizens Bank Car Insurance Honda Mastercard PECO Verizon

Honda Civic LX 2009

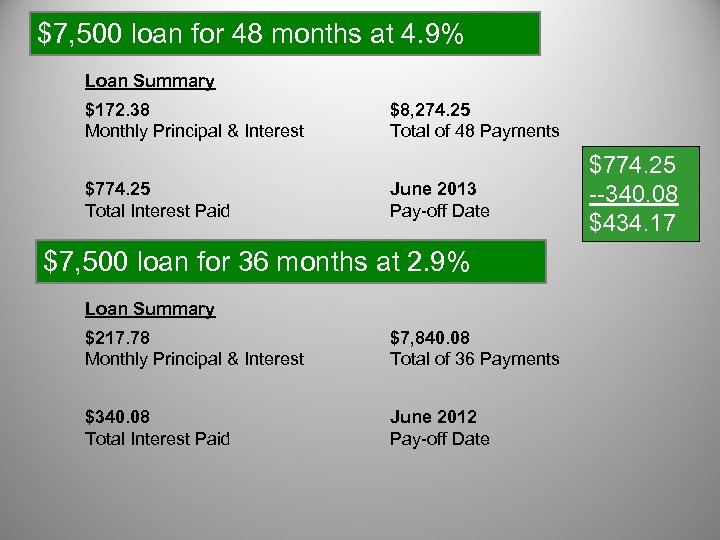

$7, 500 loan for 48 months at 4. 9% Loan Summary $172. 38 Monthly Principal & Interest $774. 25 Total Interest Paid $8, 274. 25 Total of 48 Payments June 2013 Pay-off Date $7, 500 loan for 36 months at 2. 9% Loan Summary $217. 78 Monthly Principal & Interest $7, 840. 08 Total of 36 Payments $340. 08 Total Interest Paid June 2012 Pay-off Date $774. 25 --340. 08 $434. 17

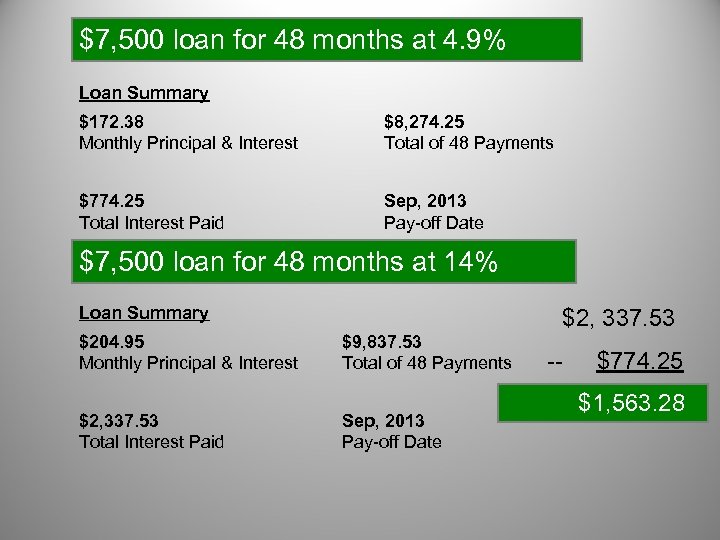

$7, 500 loan for 48 months at 4. 9% Loan Summary $172. 38 Monthly Principal & Interest $8, 274. 25 Total of 48 Payments $774. 25 Total Interest Paid Sep, 2013 Pay-off Date $7, 500 loan for 48 months at 14% Loan Summary $204. 95 Monthly Principal & Interest $2, 337. 53 Total Interest Paid $2, 337. 53 $9, 837. 53 Total of 48 Payments Sep, 2013 Pay-off Date -- $774. 25 $1, 563. 28

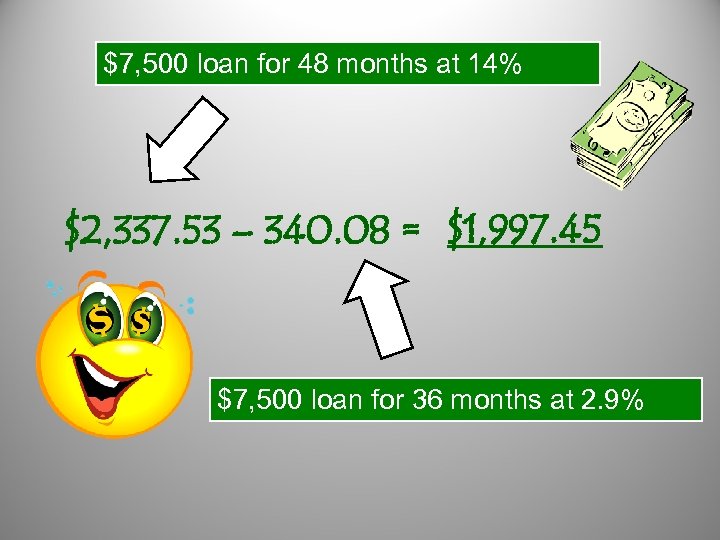

$7, 500 loan for 48 months at 14% $2, 337. 53 – 340. 08 = $1, 997. 45 $7, 500 loan for 36 months at 2. 9%

6d09f50191f985d597e4e38aad247cf6.ppt