06de15da847bc039d7185e17695616da.ppt

- Количество слайдов: 51

Tyler Junior College State of the College April 8, 2011

Tyler Junior College State of the College April 8, 2011

Tyler Junior College Board of Trustees • • • Clint Roxburgh, Board President John Hills, First Vice President Joe Prud’homme, Second Vice President Rohn Boone Ann Brookshire Mike Coker David Hudson Peggy Smith Lonny Uzzell

Tyler Junior College Board of Trustees • • • Clint Roxburgh, Board President John Hills, First Vice President Joe Prud’homme, Second Vice President Rohn Boone Ann Brookshire Mike Coker David Hudson Peggy Smith Lonny Uzzell

Tyler Junior College Board of Trustees • Elected to 6 -year terms as required by Texas Education Code • Elections take place in even-numbered years in the spring • Unpaid positions serving at large • Members must be residents of the district • By design of founding Board policies, members are entrusted with protecting the monetary and physical assets of the College • Serve to represent the community and make prudent decisions

Tyler Junior College Board of Trustees • Elected to 6 -year terms as required by Texas Education Code • Elections take place in even-numbered years in the spring • Unpaid positions serving at large • Members must be residents of the district • By design of founding Board policies, members are entrusted with protecting the monetary and physical assets of the College • Serve to represent the community and make prudent decisions

Tyler Junior College Service Area • State-assisted community colleges are assigned to serve specific regions. • Tyler Junior College’s service area includes Smith, Van Zandt, Wood and Cherokee counties, an area that includes 26 high schools.

Tyler Junior College Service Area • State-assisted community colleges are assigned to serve specific regions. • Tyler Junior College’s service area includes Smith, Van Zandt, Wood and Cherokee counties, an area that includes 26 high schools.

Tyler Junior College Tax District • The TJC Tax District includes properties within the Tyler, Lindale, Winona, New Chapel Hill, Van Zandt and Van independent school districts. • The current tax rate is. 182926.

Tyler Junior College Tax District • The TJC Tax District includes properties within the Tyler, Lindale, Winona, New Chapel Hill, Van Zandt and Van independent school districts. • The current tax rate is. 182926.

College’s Challenges • Protect College Resources • Weather State Budget Cuts and Growing Demands • Discover and Implement Efficiencies • Plan for the Future

College’s Challenges • Protect College Resources • Weather State Budget Cuts and Growing Demands • Discover and Implement Efficiencies • Plan for the Future

Challenge: Protect Resources

Challenge: Protect Resources

Challenge: Protect Resources • During preparation of a new Campus Master Plan, Dr. Mike Metke discovered the College had critical infrastructure needs. • In the Fall of 2008, Board members toured the Main campus to review these needs. • February 26, 2009 – Board agrees infrastructure needs must be addressed before any Master Plan phase. • April/May 2009 – Dr. Metke conducts meetings with individuals and groups to discuss TJC’s infrastructure and to seek input on methods to fund repairs. • The College had no capacity for additional debt and only minimal reserves.

Challenge: Protect Resources • During preparation of a new Campus Master Plan, Dr. Mike Metke discovered the College had critical infrastructure needs. • In the Fall of 2008, Board members toured the Main campus to review these needs. • February 26, 2009 – Board agrees infrastructure needs must be addressed before any Master Plan phase. • April/May 2009 – Dr. Metke conducts meetings with individuals and groups to discuss TJC’s infrastructure and to seek input on methods to fund repairs. • The College had no capacity for additional debt and only minimal reserves.

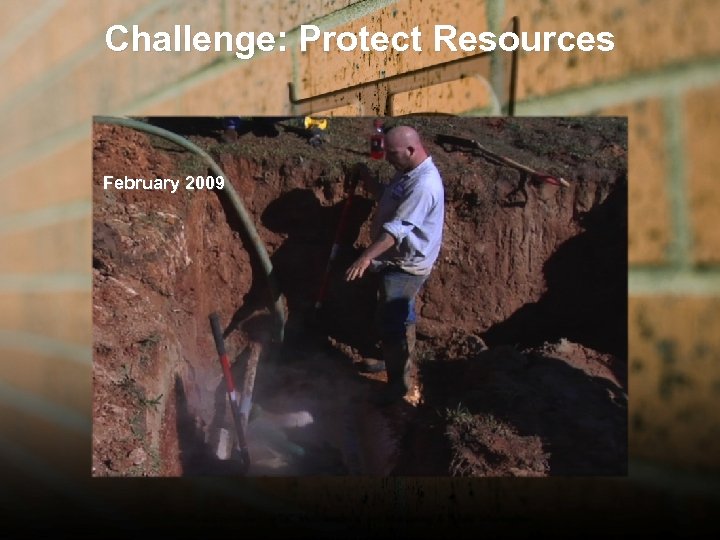

Challenge: Protect Resources February 2009 Hot water line bursts in front of library

Challenge: Protect Resources February 2009 Hot water line bursts in front of library

Challenge: Protect Resources February 2009

Challenge: Protect Resources February 2009

Challenge: Protect Resources February 2009

Challenge: Protect Resources February 2009

Challenge: Protect Resources May 2009 The collection of useless and broken parts was growing

Challenge: Protect Resources May 2009 The collection of useless and broken parts was growing

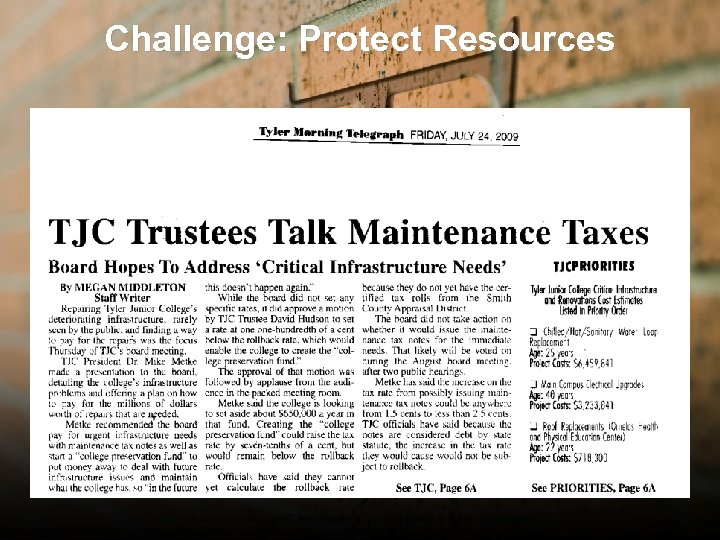

Challenge: Protect Resources • July 16, 2009 – Tyler Leadership Roundtable agrees that while these are difficult times to consider tax increases, TJC has an obligation to protect its physical assets. • August 6, 2009 – The Tyler Area Chamber Executive Board endorses TJC’s plans to address infrastructure needs and issue maintenance tax notes to fund critical repairs and renovations. • August 13 and 20, 2009 – The College holds public hearings on a proposal to increase the tax rate to . 136950 and to utilize the additional revenue to create a College Preservation Fund to avoid TJC ever again facing the critical infrastructure needs it presently faces.

Challenge: Protect Resources • July 16, 2009 – Tyler Leadership Roundtable agrees that while these are difficult times to consider tax increases, TJC has an obligation to protect its physical assets. • August 6, 2009 – The Tyler Area Chamber Executive Board endorses TJC’s plans to address infrastructure needs and issue maintenance tax notes to fund critical repairs and renovations. • August 13 and 20, 2009 – The College holds public hearings on a proposal to increase the tax rate to . 136950 and to utilize the additional revenue to create a College Preservation Fund to avoid TJC ever again facing the critical infrastructure needs it presently faces.

Challenge: Protect Resources

Challenge: Protect Resources

Challenge: Protect Resources • September 2009 – The College receives a “AA+” credit rating with a “Stable” Outlook from Standard & Poor’s. • The Board of Trustees approves the issuance of Tyler Junior College District Maintenance Tax Notes, to be retired by revenue from a new maintenance tax. • August 26, 2010, the Board votes unanimously to establish a maintenance tax to retire maintenance bonds.

Challenge: Protect Resources • September 2009 – The College receives a “AA+” credit rating with a “Stable” Outlook from Standard & Poor’s. • The Board of Trustees approves the issuance of Tyler Junior College District Maintenance Tax Notes, to be retired by revenue from a new maintenance tax. • August 26, 2010, the Board votes unanimously to establish a maintenance tax to retire maintenance bonds.

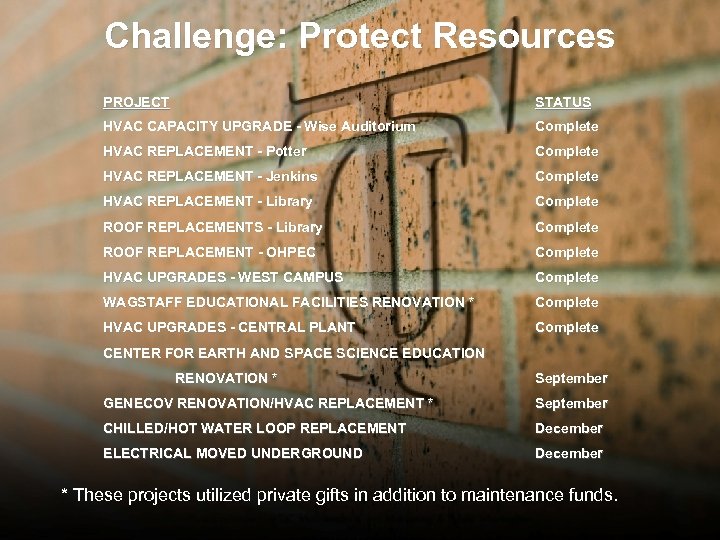

Challenge: Protect Resources PROJECT STATUS HVAC CAPACITY UPGRADE - Wise Auditorium Complete HVAC REPLACEMENT - Potter Complete HVAC REPLACEMENT - Jenkins Complete HVAC REPLACEMENT - Library Complete ROOF REPLACEMENTS - Library Complete ROOF REPLACEMENT - OHPEC Complete HVAC UPGRADES - WEST CAMPUS Complete WAGSTAFF EDUCATIONAL FACILITIES RENOVATION * Complete HVAC UPGRADES - CENTRAL PLANT Complete CENTER FOR EARTH AND SPACE SCIENCE EDUCATION RENOVATION * September GENECOV RENOVATION/HVAC REPLACEMENT * September CHILLED/HOT WATER LOOP REPLACEMENT December ELECTRICAL MOVED UNDERGROUND December * These projects utilized private gifts in addition to maintenance funds.

Challenge: Protect Resources PROJECT STATUS HVAC CAPACITY UPGRADE - Wise Auditorium Complete HVAC REPLACEMENT - Potter Complete HVAC REPLACEMENT - Jenkins Complete HVAC REPLACEMENT - Library Complete ROOF REPLACEMENTS - Library Complete ROOF REPLACEMENT - OHPEC Complete HVAC UPGRADES - WEST CAMPUS Complete WAGSTAFF EDUCATIONAL FACILITIES RENOVATION * Complete HVAC UPGRADES - CENTRAL PLANT Complete CENTER FOR EARTH AND SPACE SCIENCE EDUCATION RENOVATION * September GENECOV RENOVATION/HVAC REPLACEMENT * September CHILLED/HOT WATER LOOP REPLACEMENT December ELECTRICAL MOVED UNDERGROUND December * These projects utilized private gifts in addition to maintenance funds.

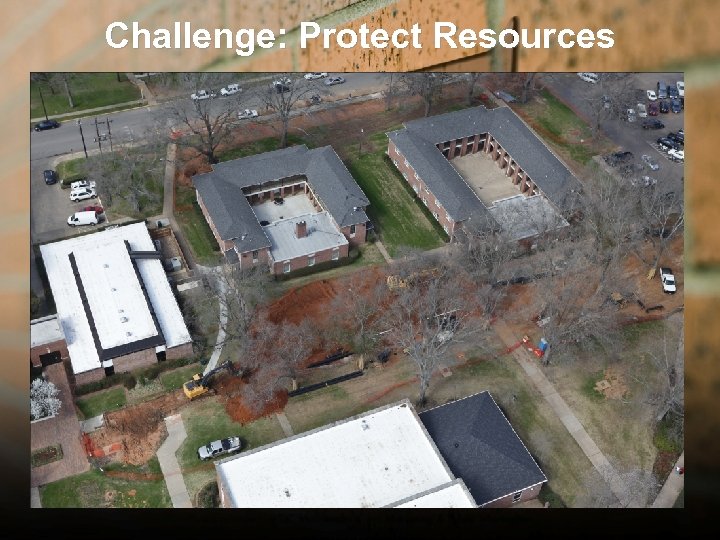

Challenge: Protect Resources

Challenge: Protect Resources

Challenge: Protect Resources

Challenge: Protect Resources

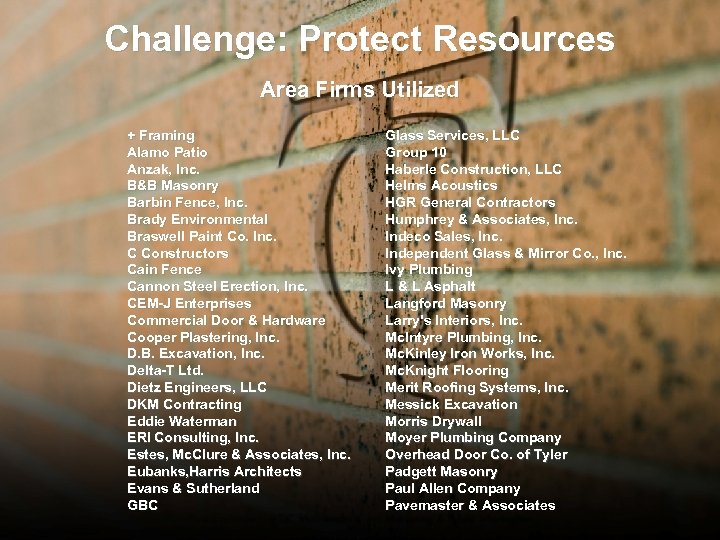

Challenge: Protect Resources Area Firms Utilized + Framing Alamo Patio Anzak, Inc. B&B Masonry Barbin Fence, Inc. Brady Environmental Braswell Paint Co. Inc. C Constructors Cain Fence Cannon Steel Erection, Inc. CEM-J Enterprises Commercial Door & Hardware Cooper Plastering, Inc. D. B. Excavation, Inc. Delta-T Ltd. Dietz Engineers, LLC DKM Contracting Eddie Waterman ERI Consulting, Inc. Estes, Mc. Clure & Associates, Inc. Eubanks, Harris Architects Evans & Sutherland GBC Glass Services, LLC Group 10 Haberle Construction, LLC Helms Acoustics HGR General Contractors Humphrey & Associates, Inc. Indeco Sales, Inc. Independent Glass & Mirror Co. , Inc. Ivy Plumbing L & L Asphalt Langford Masonry Larry's Interiors, Inc. Mc. Intyre Plumbing, Inc. Mc. Kinley Iron Works, Inc. Mc. Knight Flooring Merit Roofing Systems, Inc. Messick Excavation Morris Drywall Moyer Plumbing Company Overhead Door Co. of Tyler Padgett Masonry Paul Allen Company Pavemaster & Associates

Challenge: Protect Resources Area Firms Utilized + Framing Alamo Patio Anzak, Inc. B&B Masonry Barbin Fence, Inc. Brady Environmental Braswell Paint Co. Inc. C Constructors Cain Fence Cannon Steel Erection, Inc. CEM-J Enterprises Commercial Door & Hardware Cooper Plastering, Inc. D. B. Excavation, Inc. Delta-T Ltd. Dietz Engineers, LLC DKM Contracting Eddie Waterman ERI Consulting, Inc. Estes, Mc. Clure & Associates, Inc. Eubanks, Harris Architects Evans & Sutherland GBC Glass Services, LLC Group 10 Haberle Construction, LLC Helms Acoustics HGR General Contractors Humphrey & Associates, Inc. Indeco Sales, Inc. Independent Glass & Mirror Co. , Inc. Ivy Plumbing L & L Asphalt Langford Masonry Larry's Interiors, Inc. Mc. Intyre Plumbing, Inc. Mc. Kinley Iron Works, Inc. Mc. Knight Flooring Merit Roofing Systems, Inc. Messick Excavation Morris Drywall Moyer Plumbing Company Overhead Door Co. of Tyler Padgett Masonry Paul Allen Company Pavemaster & Associates

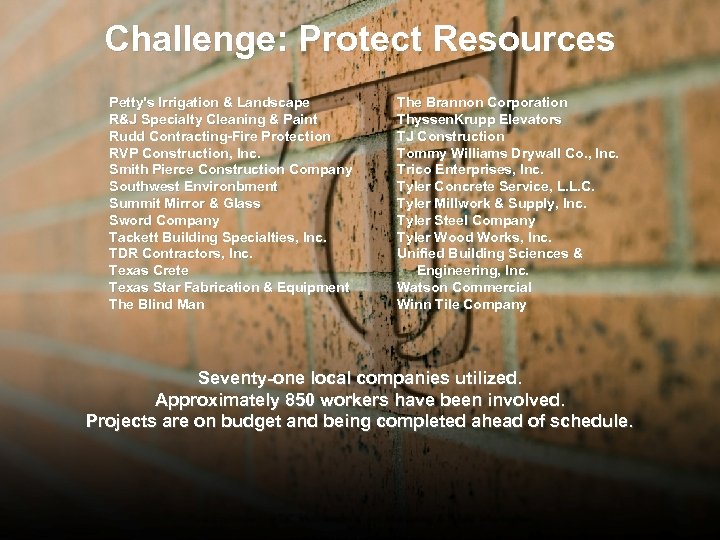

Challenge: Protect Resources Petty's Irrigation & Landscape R&J Specialty Cleaning & Paint Rudd Contracting-Fire Protection RVP Construction, Inc. Smith Pierce Construction Company Southwest Environbment Summit Mirror & Glass Sword Company Tackett Building Specialties, Inc. TDR Contractors, Inc. Texas Crete Texas Star Fabrication & Equipment The Blind Man The Brannon Corporation Thyssen. Krupp Elevators TJ Construction Tommy Williams Drywall Co. , Inc. Trico Enterprises, Inc. Tyler Concrete Service, L. L. C. Tyler Millwork & Supply, Inc. Tyler Steel Company Tyler Wood Works, Inc. Unified Building Sciences & Engineering, Inc. Watson Commercial Winn Tile Company Seventy-one local companies utilized. Approximately 850 workers have been involved. Projects are on budget and being completed ahead of schedule.

Challenge: Protect Resources Petty's Irrigation & Landscape R&J Specialty Cleaning & Paint Rudd Contracting-Fire Protection RVP Construction, Inc. Smith Pierce Construction Company Southwest Environbment Summit Mirror & Glass Sword Company Tackett Building Specialties, Inc. TDR Contractors, Inc. Texas Crete Texas Star Fabrication & Equipment The Blind Man The Brannon Corporation Thyssen. Krupp Elevators TJ Construction Tommy Williams Drywall Co. , Inc. Trico Enterprises, Inc. Tyler Concrete Service, L. L. C. Tyler Millwork & Supply, Inc. Tyler Steel Company Tyler Wood Works, Inc. Unified Building Sciences & Engineering, Inc. Watson Commercial Winn Tile Company Seventy-one local companies utilized. Approximately 850 workers have been involved. Projects are on budget and being completed ahead of schedule.

Challenge: Weather State Cuts

Challenge: Weather State Cuts

Challenge: Weather State Cuts • Approximately $9 million in State allocation reduction is anticipated for the next biennium • Continue to work with local legislators to minimize damage • While the College is determined to keep student costs low, tuition and fee increases will be necessary • Student costs provide over half of the total budget

Challenge: Weather State Cuts • Approximately $9 million in State allocation reduction is anticipated for the next biennium • Continue to work with local legislators to minimize damage • While the College is determined to keep student costs low, tuition and fee increases will be necessary • Student costs provide over half of the total budget

Challenge: Weather State Cuts • State appropriations would have been $18, 157, 589 for fiscal year 2011. • Current budget is based upon appropriations of $16, 641, 830, after the initial state-mandated 5% cut. • With additional 2. 5% cut the figure is $16, 187, 890, a decline of $1, 969, 699.

Challenge: Weather State Cuts • State appropriations would have been $18, 157, 589 for fiscal year 2011. • Current budget is based upon appropriations of $16, 641, 830, after the initial state-mandated 5% cut. • With additional 2. 5% cut the figure is $16, 187, 890, a decline of $1, 969, 699.

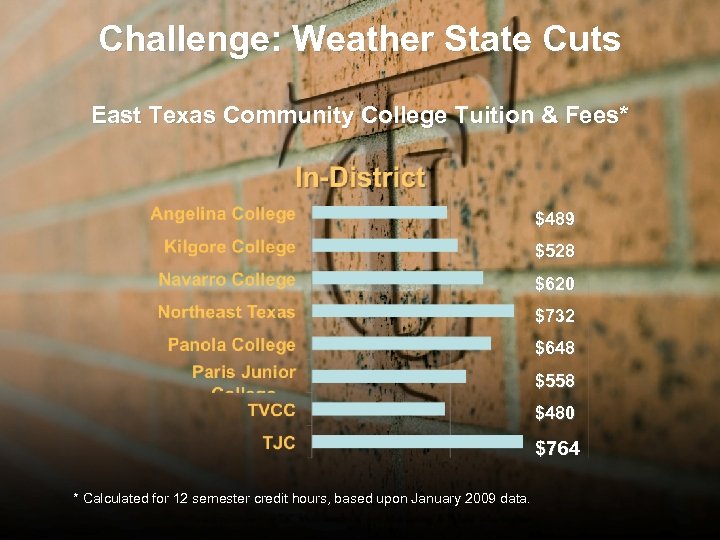

Challenge: Weather State Cuts East Texas Community College Tuition & Fees* $489 $528 $620 $732 $648 $558 $480 $764 * Calculated for 12 semester credit hours, based upon January 2009 data.

Challenge: Weather State Cuts East Texas Community College Tuition & Fees* $489 $528 $620 $732 $648 $558 $480 $764 * Calculated for 12 semester credit hours, based upon January 2009 data.

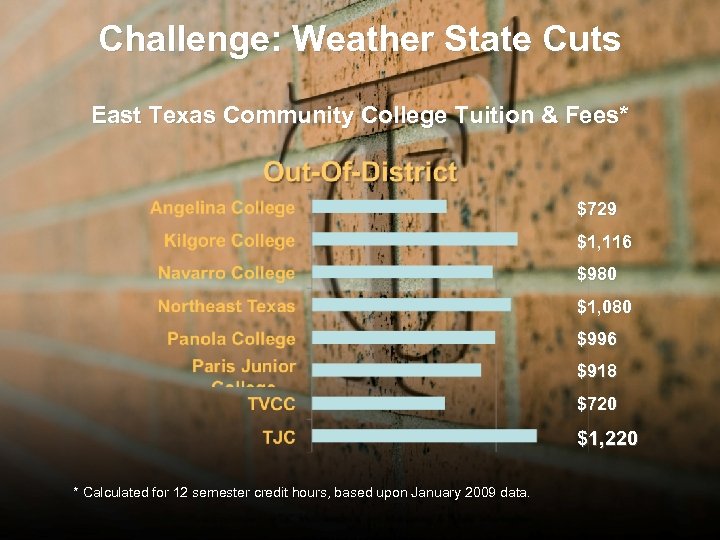

Challenge: Weather State Cuts East Texas Community College Tuition & Fees* $729 $1, 116 $980 $1, 080 $996 $918 $720 $1, 220 * Calculated for 12 semester credit hours, based upon January 2009 data.

Challenge: Weather State Cuts East Texas Community College Tuition & Fees* $729 $1, 116 $980 $1, 080 $996 $918 $720 $1, 220 * Calculated for 12 semester credit hours, based upon January 2009 data.

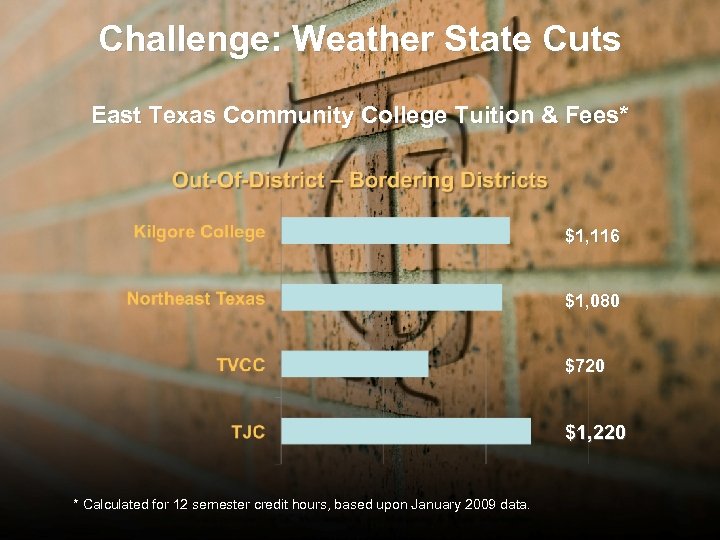

Challenge: Weather State Cuts East Texas Community College Tuition & Fees* $1, 116 $1, 080 $720 $1, 220 * Calculated for 12 semester credit hours, based upon January 2009 data.

Challenge: Weather State Cuts East Texas Community College Tuition & Fees* $1, 116 $1, 080 $720 $1, 220 * Calculated for 12 semester credit hours, based upon January 2009 data.

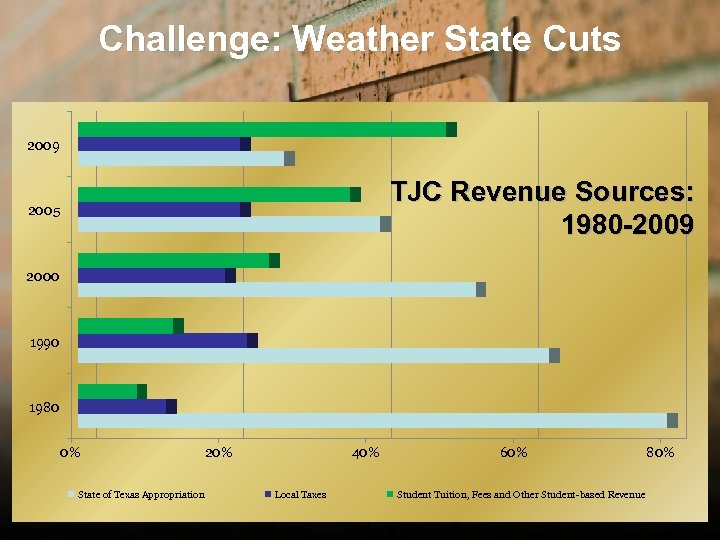

Challenge: Weather State Cuts 2009 TJC Revenue Sources: 1980 -2009 2005 2000 1990 1980 0% 20% State of Texas Appropriation 40% Local Taxes 60% Student Tuition, Fees and Other Student-based Revenue 80%

Challenge: Weather State Cuts 2009 TJC Revenue Sources: 1980 -2009 2005 2000 1990 1980 0% 20% State of Texas Appropriation 40% Local Taxes 60% Student Tuition, Fees and Other Student-based Revenue 80%

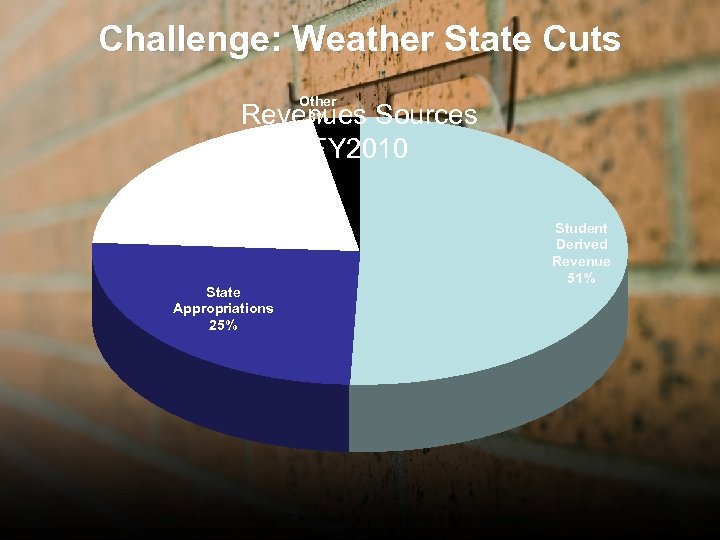

Challenge: Weather State Cuts Other 3% Revenues Sources FY 2010 District Taxes 21% State Appropriations 25% Student Derived Revenue 51%

Challenge: Weather State Cuts Other 3% Revenues Sources FY 2010 District Taxes 21% State Appropriations 25% Student Derived Revenue 51%

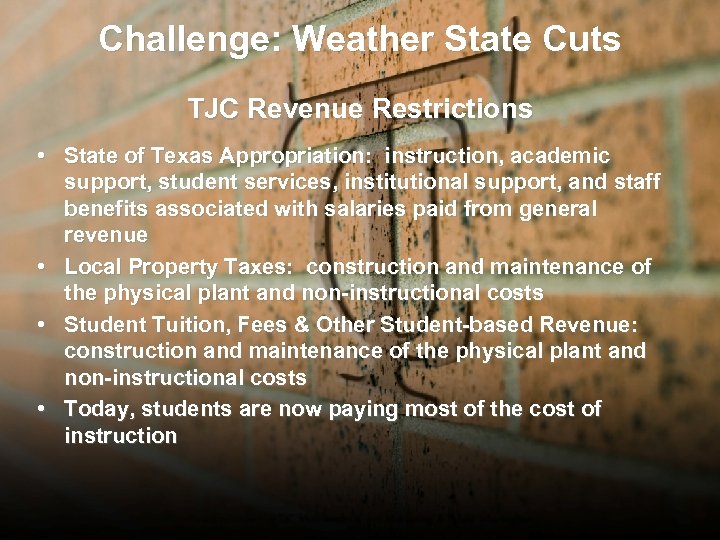

Challenge: Weather State Cuts TJC Revenue Restrictions • State of Texas Appropriation: instruction, academic support, student services, institutional support, and staff benefits associated with salaries paid from general revenue • Local Property Taxes: construction and maintenance of the physical plant and non-instructional costs • Student Tuition, Fees & Other Student-based Revenue: construction and maintenance of the physical plant and non-instructional costs • Today, students are now paying most of the cost of instruction

Challenge: Weather State Cuts TJC Revenue Restrictions • State of Texas Appropriation: instruction, academic support, student services, institutional support, and staff benefits associated with salaries paid from general revenue • Local Property Taxes: construction and maintenance of the physical plant and non-instructional costs • Student Tuition, Fees & Other Student-based Revenue: construction and maintenance of the physical plant and non-instructional costs • Today, students are now paying most of the cost of instruction

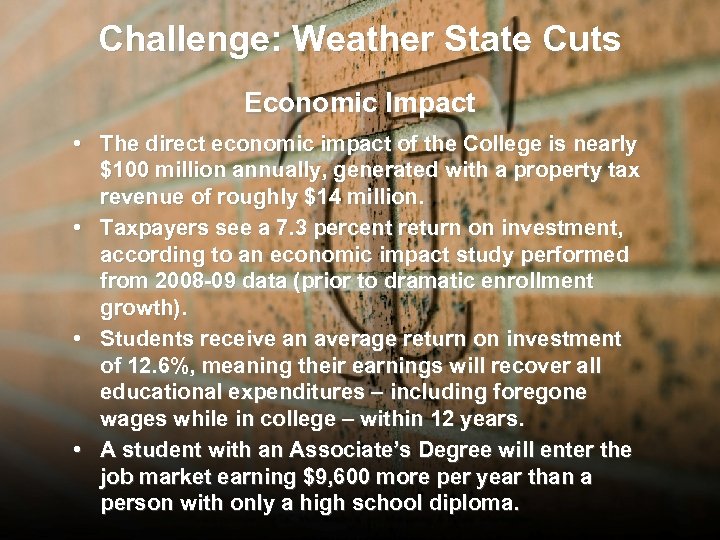

Challenge: Weather State Cuts Economic Impact • The direct economic impact of the College is nearly $100 million annually, generated with a property tax revenue of roughly $14 million. • Taxpayers see a 7. 3 percent return on investment, according to an economic impact study performed from 2008 -09 data (prior to dramatic enrollment growth). • Students receive an average return on investment of 12. 6%, meaning their earnings will recover all educational expenditures – including foregone wages while in college – within 12 years. • A student with an Associate’s Degree will enter the job market earning $9, 600 more per year than a person with only a high school diploma.

Challenge: Weather State Cuts Economic Impact • The direct economic impact of the College is nearly $100 million annually, generated with a property tax revenue of roughly $14 million. • Taxpayers see a 7. 3 percent return on investment, according to an economic impact study performed from 2008 -09 data (prior to dramatic enrollment growth). • Students receive an average return on investment of 12. 6%, meaning their earnings will recover all educational expenditures – including foregone wages while in college – within 12 years. • A student with an Associate’s Degree will enter the job market earning $9, 600 more per year than a person with only a high school diploma.

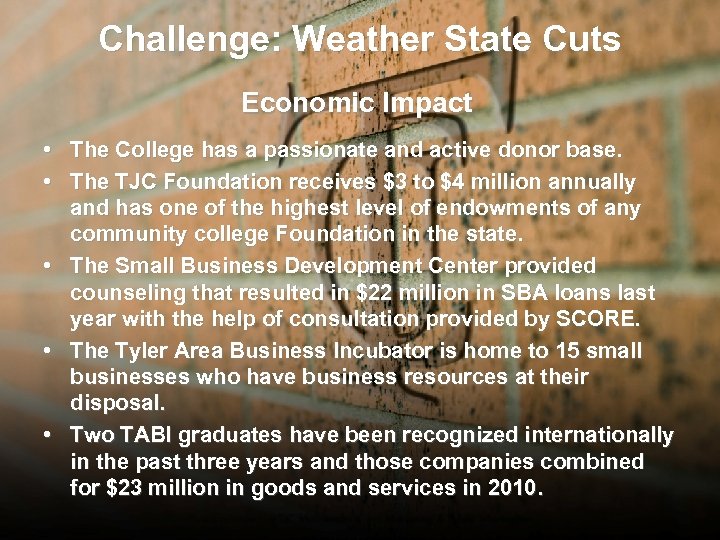

Challenge: Weather State Cuts Economic Impact • The College has a passionate and active donor base. • The TJC Foundation receives $3 to $4 million annually and has one of the highest level of endowments of any community college Foundation in the state. • The Small Business Development Center provided counseling that resulted in $22 million in SBA loans last year with the help of consultation provided by SCORE. • The Tyler Area Business Incubator is home to 15 small businesses who have business resources at their disposal. • Two TABI graduates have been recognized internationally in the past three years and those companies combined for $23 million in goods and services in 2010.

Challenge: Weather State Cuts Economic Impact • The College has a passionate and active donor base. • The TJC Foundation receives $3 to $4 million annually and has one of the highest level of endowments of any community college Foundation in the state. • The Small Business Development Center provided counseling that resulted in $22 million in SBA loans last year with the help of consultation provided by SCORE. • The Tyler Area Business Incubator is home to 15 small businesses who have business resources at their disposal. • Two TABI graduates have been recognized internationally in the past three years and those companies combined for $23 million in goods and services in 2010.

Challenge: Weather State Cuts Economic Impact • National studies indicate that 90 percent of all jobs existing or to be created in the next 25 years will require at least two years of post-secondary education and training. • Merchants benefit when our classes are in session. • Budget has not grown comparatively to the work. load, with increased enrollment that is not funded by State allocations. • Texas ranks last nationally in benefits provided to public employees. • TJC employees do not pay into Social Security.

Challenge: Weather State Cuts Economic Impact • National studies indicate that 90 percent of all jobs existing or to be created in the next 25 years will require at least two years of post-secondary education and training. • Merchants benefit when our classes are in session. • Budget has not grown comparatively to the work. load, with increased enrollment that is not funded by State allocations. • Texas ranks last nationally in benefits provided to public employees. • TJC employees do not pay into Social Security.

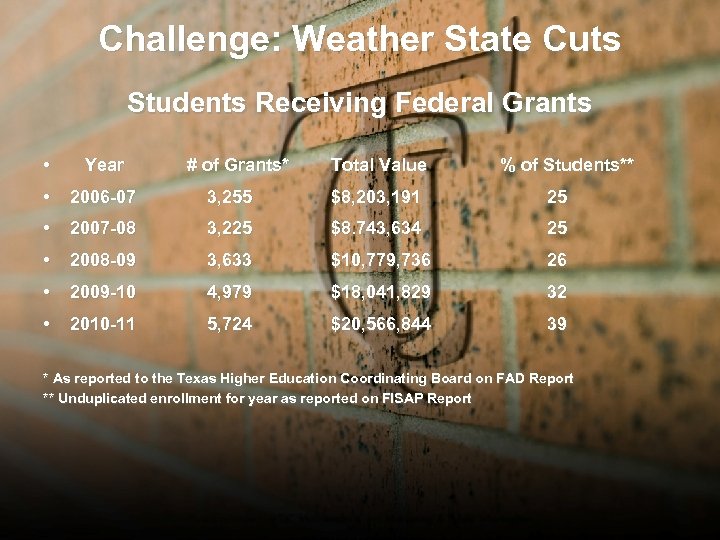

Challenge: Weather State Cuts Students Receiving Federal Grants • Year # of Grants* Total Value % of Students** • 2006 -07 3, 255 $8, 203, 191 25 • 2007 -08 3, 225 $8. 743, 634 25 • 2008 -09 3, 633 $10, 779, 736 26 • 2009 -10 4, 979 $18, 041, 829 32 • 2010 -11 5, 724 $20, 566, 844 39 * As reported to the Texas Higher Education Coordinating Board on FAD Report ** Unduplicated enrollment for year as reported on FISAP Report

Challenge: Weather State Cuts Students Receiving Federal Grants • Year # of Grants* Total Value % of Students** • 2006 -07 3, 255 $8, 203, 191 25 • 2007 -08 3, 225 $8. 743, 634 25 • 2008 -09 3, 633 $10, 779, 736 26 • 2009 -10 4, 979 $18, 041, 829 32 • 2010 -11 5, 724 $20, 566, 844 39 * As reported to the Texas Higher Education Coordinating Board on FAD Report ** Unduplicated enrollment for year as reported on FISAP Report

Challenge: Weather State Cuts Financial Impact of Unfunded Mandates • Unfunded mandates from the State of Texas, the Federal Government and accrediting agencies such as the Southern Association of Colleges and Schools cost money and time. • Examples: – Healthcare benefits for employees – Achieving the Dream Initiative – State of Texas “Momentum Points” – 3 -clicks mandate for website – Quality Enhancement Plan – Closing the Gaps – Texas Public Education Grant ($323, 610) – State mandated tuition/fee exemptions & waivers

Challenge: Weather State Cuts Financial Impact of Unfunded Mandates • Unfunded mandates from the State of Texas, the Federal Government and accrediting agencies such as the Southern Association of Colleges and Schools cost money and time. • Examples: – Healthcare benefits for employees – Achieving the Dream Initiative – State of Texas “Momentum Points” – 3 -clicks mandate for website – Quality Enhancement Plan – Closing the Gaps – Texas Public Education Grant ($323, 610) – State mandated tuition/fee exemptions & waivers

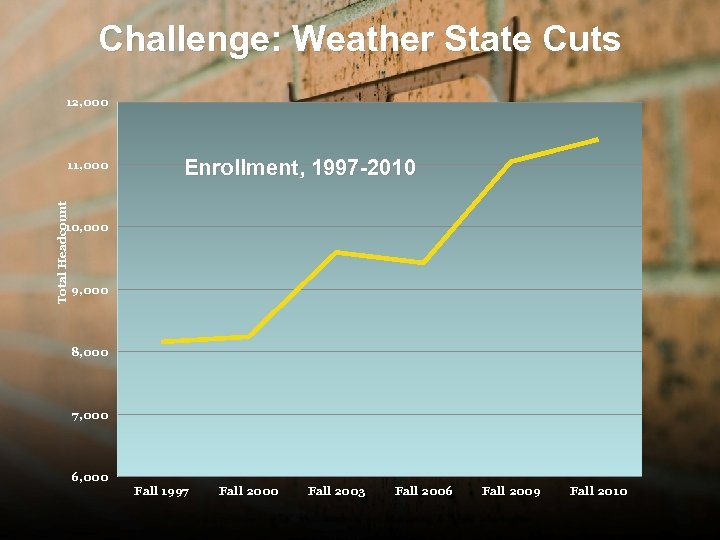

Challenge: Weather State Cuts 12, 000 Total Headcount 11, 000 Enrollment, 1997 -2010 10, 000 9, 000 8, 000 7, 000 6, 000 Fall 1997 Fall 2000 Fall 2003 Fall 2006 Fall 2009 Fall 2010

Challenge: Weather State Cuts 12, 000 Total Headcount 11, 000 Enrollment, 1997 -2010 10, 000 9, 000 8, 000 7, 000 6, 000 Fall 1997 Fall 2000 Fall 2003 Fall 2006 Fall 2009 Fall 2010

Challenge: Weather State Cuts Record Enrollment • Over 50% of TJC students are “out-of-district” which means over $16 million in tuition, fees, and student-based revenue from outside of the TJC taxing district. • TJC enrolls almost 12, 000 credit students both full and part-time. Students provide over 50% of the College’s revenue. • Approximately 60% of TJC students receive some form of financial aid. • TJC’s student body is diverse: 11% Hispanic, 22% African. American, 63% White (4% other). • During the academic year 2009 through May of 2010, 2075 students graduated from TJC with an Associate’s Degree or certificate in a professional field.

Challenge: Weather State Cuts Record Enrollment • Over 50% of TJC students are “out-of-district” which means over $16 million in tuition, fees, and student-based revenue from outside of the TJC taxing district. • TJC enrolls almost 12, 000 credit students both full and part-time. Students provide over 50% of the College’s revenue. • Approximately 60% of TJC students receive some form of financial aid. • TJC’s student body is diverse: 11% Hispanic, 22% African. American, 63% White (4% other). • During the academic year 2009 through May of 2010, 2075 students graduated from TJC with an Associate’s Degree or certificate in a professional field.

Challenge: Discover Efficiencies

Challenge: Discover Efficiencies

Challenge: Discover Efficiencies • Vacant positions replaced only if deemed critical to daily operation – Presently 26 full-time positions are unfilled and will remain unfilled • Focus groups were conducted across campus to identify cost-saving initiatives • Executive cabinet is reviewing and will recommend implementation of most cost-effective savings ideas • Replacing some retiring faculty with adjunct instructors • Travel restricted • No salary increases last two years and none planned • Despite declining State allocations, the Board of Trustees has committed not to raise the existing tax rate in 2011

Challenge: Discover Efficiencies • Vacant positions replaced only if deemed critical to daily operation – Presently 26 full-time positions are unfilled and will remain unfilled • Focus groups were conducted across campus to identify cost-saving initiatives • Executive cabinet is reviewing and will recommend implementation of most cost-effective savings ideas • Replacing some retiring faculty with adjunct instructors • Travel restricted • No salary increases last two years and none planned • Despite declining State allocations, the Board of Trustees has committed not to raise the existing tax rate in 2011

Challenge: Discover Efficiencies • Cut an additional $1 million from budget for 2011 -12, at minimum • Consider elimination of free audits, waivers and exemptions not mandated by state or federal law • Implement a new fee schedule for use of TJC facilities by private groups • Rely on partnerships wherever possible • Freeze purchases of computer lab equipment, office computers and suspend replacement plan • Evaluate program vitality and consider sunsetting programs that are less vital • Evaluate personnel and make appropriate moves as warranted

Challenge: Discover Efficiencies • Cut an additional $1 million from budget for 2011 -12, at minimum • Consider elimination of free audits, waivers and exemptions not mandated by state or federal law • Implement a new fee schedule for use of TJC facilities by private groups • Rely on partnerships wherever possible • Freeze purchases of computer lab equipment, office computers and suspend replacement plan • Evaluate program vitality and consider sunsetting programs that are less vital • Evaluate personnel and make appropriate moves as warranted

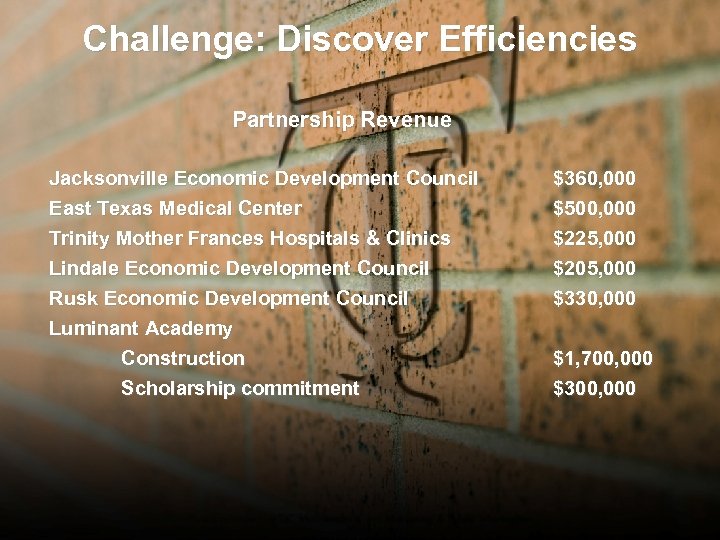

Challenge: Discover Efficiencies Partnership Revenue Jacksonville Economic Development Council East Texas Medical Center $360, 000 $500, 000 Trinity Mother Frances Hospitals & Clinics Lindale Economic Development Council Rusk Economic Development Council Luminant Academy Construction Scholarship commitment $225, 000 $205, 000 $330, 000 $1, 700, 000 $300, 000

Challenge: Discover Efficiencies Partnership Revenue Jacksonville Economic Development Council East Texas Medical Center $360, 000 $500, 000 Trinity Mother Frances Hospitals & Clinics Lindale Economic Development Council Rusk Economic Development Council Luminant Academy Construction Scholarship commitment $225, 000 $205, 000 $330, 000 $1, 700, 000 $300, 000

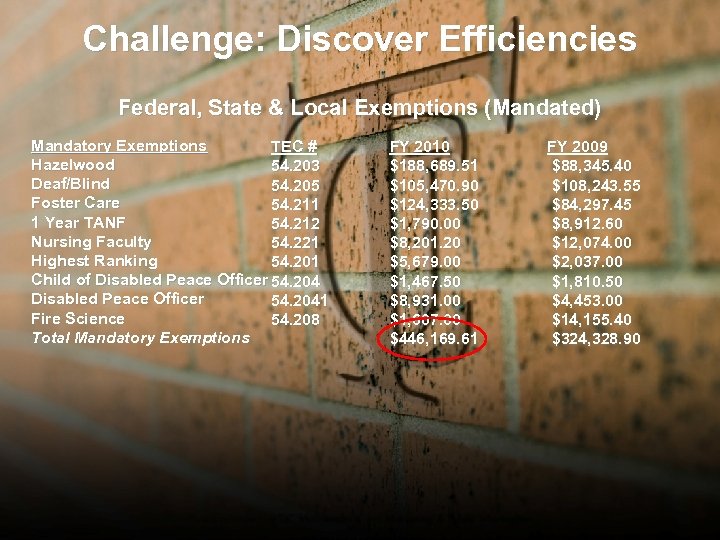

Challenge: Discover Efficiencies Federal, State & Local Exemptions (Mandated) Mandatory Exemptions TEC # Hazelwood 54. 203 Deaf/Blind 54. 205 Foster Care 54. 211 1 Year TANF 54. 212 Nursing Faculty 54. 221 Highest Ranking 54. 201 Child of Disabled Peace Officer 54. 2041 Fire Science 54. 208 Total Mandatory Exemptions FY 2010 $188, 689. 51 $105, 470. 90 $124, 333. 50 $1, 790. 00 $8, 201. 20 $5, 679. 00 $1, 467. 50 $8, 931. 00 $1, 607. 00 $446, 169. 61 FY 2009 $88, 345. 40 $108, 243. 55 $84, 297. 45 $8, 912. 60 $12, 074. 00 $2, 037. 00 $1, 810. 50 $4, 453. 00 $14, 155. 40 $324, 328. 90

Challenge: Discover Efficiencies Federal, State & Local Exemptions (Mandated) Mandatory Exemptions TEC # Hazelwood 54. 203 Deaf/Blind 54. 205 Foster Care 54. 211 1 Year TANF 54. 212 Nursing Faculty 54. 221 Highest Ranking 54. 201 Child of Disabled Peace Officer 54. 2041 Fire Science 54. 208 Total Mandatory Exemptions FY 2010 $188, 689. 51 $105, 470. 90 $124, 333. 50 $1, 790. 00 $8, 201. 20 $5, 679. 00 $1, 467. 50 $8, 931. 00 $1, 607. 00 $446, 169. 61 FY 2009 $88, 345. 40 $108, 243. 55 $84, 297. 45 $8, 912. 60 $12, 074. 00 $2, 037. 00 $1, 810. 50 $4, 453. 00 $14, 155. 40 $324, 328. 90

Challenge: Plan for the Future

Challenge: Plan for the Future

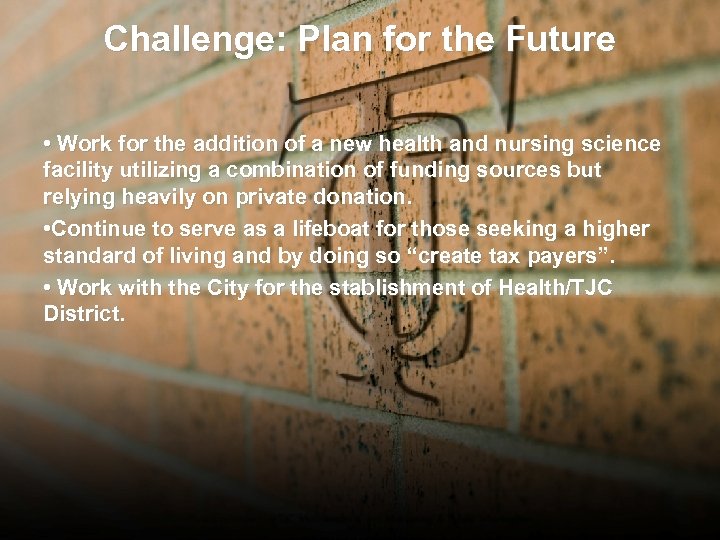

Challenge: Plan for the Future • Work for the addition of a new health and nursing science facility utilizing a combination of funding sources but relying heavily on private donation. • Continue to serve as a lifeboat for those seeking a higher standard of living and by doing so “create tax payers”. • Work with the City for the stablishment of Health/TJC District.

Challenge: Plan for the Future • Work for the addition of a new health and nursing science facility utilizing a combination of funding sources but relying heavily on private donation. • Continue to serve as a lifeboat for those seeking a higher standard of living and by doing so “create tax payers”. • Work with the City for the stablishment of Health/TJC District.

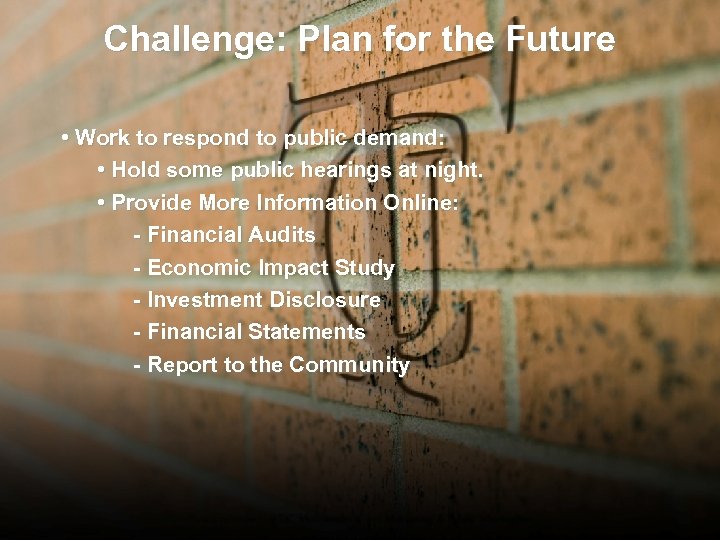

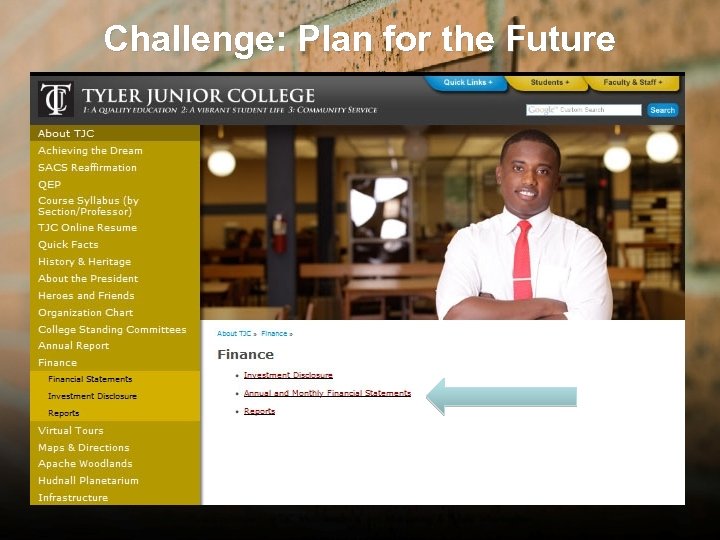

Challenge: Plan for the Future • Work to respond to public demand: • Hold some public hearings at night. • Provide More Information Online: - Financial Audits - Economic Impact Study - Investment Disclosure - Financial Statements - Report to the Community

Challenge: Plan for the Future • Work to respond to public demand: • Hold some public hearings at night. • Provide More Information Online: - Financial Audits - Economic Impact Study - Investment Disclosure - Financial Statements - Report to the Community

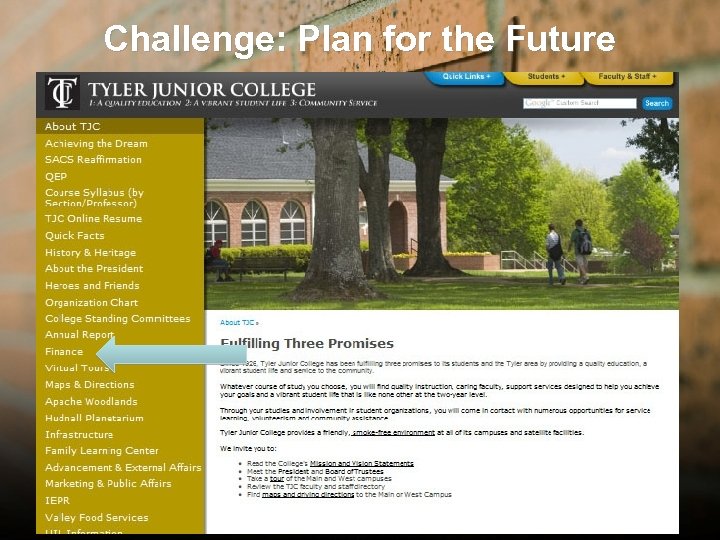

Challenge: Plan for the Future

Challenge: Plan for the Future

Challenge: Plan for the Future

Challenge: Plan for the Future

Challenge: Plan for the Future

Challenge: Plan for the Future

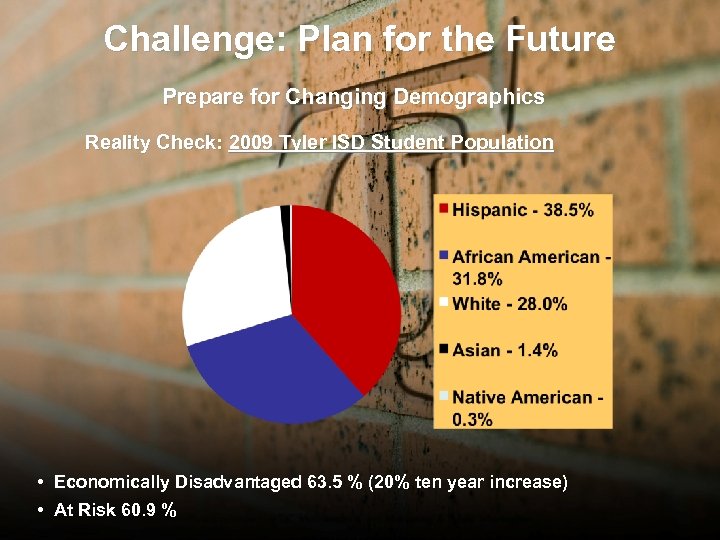

Challenge: Plan for the Future Prepare for Changing Demographics Reality Check: 2009 Tyler ISD Student Population • Economically Disadvantaged 63. 5 % (20% ten year increase) • At Risk 60. 9 %

Challenge: Plan for the Future Prepare for Changing Demographics Reality Check: 2009 Tyler ISD Student Population • Economically Disadvantaged 63. 5 % (20% ten year increase) • At Risk 60. 9 %

Your Questions

Your Questions

Tyler Junior College © Copyright Tyler Junior College, August, 2010

Tyler Junior College © Copyright Tyler Junior College, August, 2010