eb52d932f4aed4858994ddd81a796986.ppt

- Количество слайдов: 52

Two theories of Imperfect Competition Imperfect competition: more than one seller competes with other sellers; . . . each firm has control over the price they charge. • Two market structures lie between the two extremes of Monopoly and Perfect Competition… Monopolistic competition & Oligopoly • These two market structures are the most common in the economy…most goods and services are produced by firms that are monopolistically competitive or oligopolistic. • The major differences between Monopolistic competition and Oligopoly is the number of firms in the industry and how much of the market those firms control.

Two theories of Imperfect Competition Imperfect competition: more than one seller competes with other sellers; . . . each firm has control over the price they charge. • Two market structures lie between the two extremes of Monopoly and Perfect Competition… Monopolistic competition & Oligopoly • These two market structures are the most common in the economy…most goods and services are produced by firms that are monopolistically competitive or oligopolistic. • The major differences between Monopolistic competition and Oligopoly is the number of firms in the industry and how much of the market those firms control.

Monopolistic competition A. Characteristics 1. There a relatively large number of firms. Each firm produces a small part of the total market share in the industry. 2. Each firm produces a similar, but not identical product. . . each firm produces a differentiated product • These differences arise because of: the quality of good, packaging, image, service, brand name, etc. However, each firm is said to be in the same Product Group. . . closely related, but not identical, goods that serve the same purpose for consumers.

Monopolistic competition A. Characteristics 1. There a relatively large number of firms. Each firm produces a small part of the total market share in the industry. 2. Each firm produces a similar, but not identical product. . . each firm produces a differentiated product • These differences arise because of: the quality of good, packaging, image, service, brand name, etc. However, each firm is said to be in the same Product Group. . . closely related, but not identical, goods that serve the same purpose for consumers.

Monopolistic competition 3. Relative freedom of entry and exit exist. The need to establish a differentiated product makes entry slightly more difficult than perfect competition. B. Implications Because a firm only produces a small market share, each firm will have little effect on the market share of other firms…. . . so firm’s won’t react to other firms choice of output and price… …moreover, because of the number of firms in the industry, cooperation to set price among firms is not possible.

Monopolistic competition 3. Relative freedom of entry and exit exist. The need to establish a differentiated product makes entry slightly more difficult than perfect competition. B. Implications Because a firm only produces a small market share, each firm will have little effect on the market share of other firms…. . . so firm’s won’t react to other firms choice of output and price… …moreover, because of the number of firms in the industry, cooperation to set price among firms is not possible.

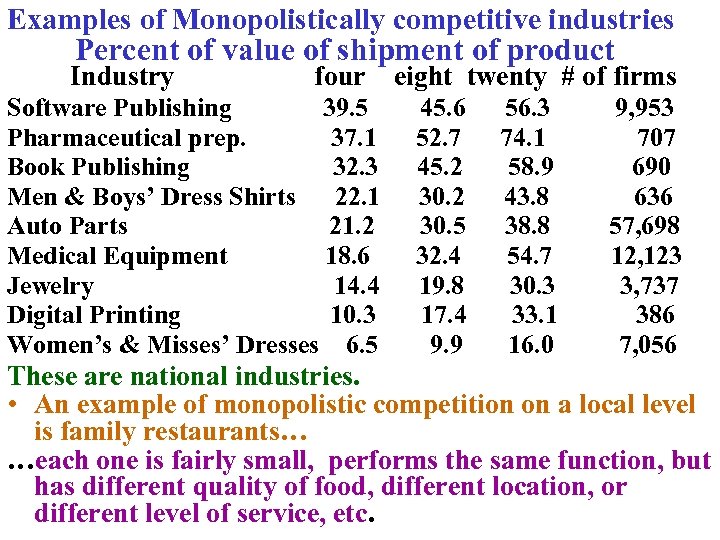

Examples of Monopolistically competitive industries Percent of value of shipment of product Industry four Software Publishing 39. 5 Pharmaceutical prep. 37. 1 Book Publishing 32. 3 Men & Boys’ Dress Shirts 22. 1 Auto Parts 21. 2 Medical Equipment 18. 6 Jewelry 14. 4 Digital Printing 10. 3 Women’s & Misses’ Dresses 6. 5 eight twenty # of firms 45. 6 52. 7 45. 2 30. 5 32. 4 19. 8 17. 4 9. 9 56. 3 74. 1 58. 9 43. 8 38. 8 54. 7 30. 3 33. 1 16. 0 9, 953 707 690 636 57, 698 12, 123 3, 737 386 7, 056 These are national industries. • An example of monopolistic competition on a local level is family restaurants… …each one is fairly small, performs the same function, but has different quality of food, different location, or different level of service, etc.

Examples of Monopolistically competitive industries Percent of value of shipment of product Industry four Software Publishing 39. 5 Pharmaceutical prep. 37. 1 Book Publishing 32. 3 Men & Boys’ Dress Shirts 22. 1 Auto Parts 21. 2 Medical Equipment 18. 6 Jewelry 14. 4 Digital Printing 10. 3 Women’s & Misses’ Dresses 6. 5 eight twenty # of firms 45. 6 52. 7 45. 2 30. 5 32. 4 19. 8 17. 4 9. 9 56. 3 74. 1 58. 9 43. 8 38. 8 54. 7 30. 3 33. 1 16. 0 9, 953 707 690 636 57, 698 12, 123 3, 737 386 7, 056 These are national industries. • An example of monopolistic competition on a local level is family restaurants… …each one is fairly small, performs the same function, but has different quality of food, different location, or different level of service, etc.

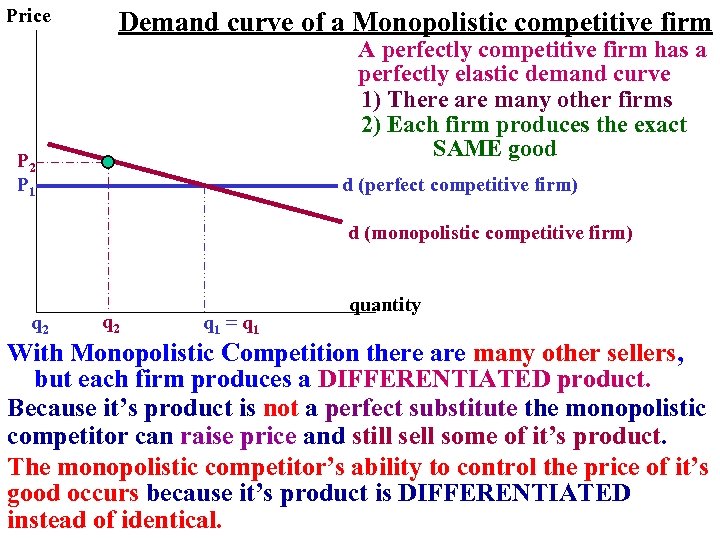

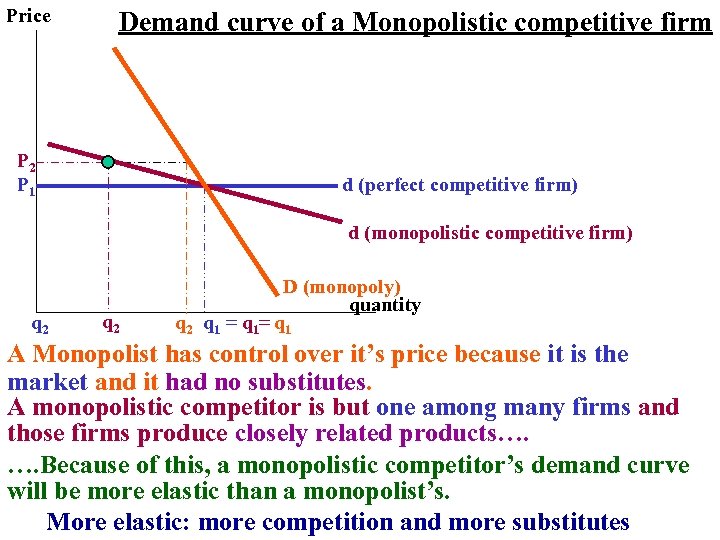

Price Demand curve of a Monopolistic competitive firm A perfectly competitive firm has a perfectly elastic demand curve 1) There are many other firms 2) Each firm produces the exact SAME good P 2 P 1 d (perfect competitive firm) d (monopolistic competitive firm) q 2 q 1 = q 1 quantity With Monopolistic Competition there are many other sellers, but each firm produces a DIFFERENTIATED product. Because it’s product is not a perfect substitute the monopolistic competitor can raise price and still sell some of it’s product. The monopolistic competitor’s ability to control the price of it’s good occurs because it’s product is DIFFERENTIATED instead of identical.

Price Demand curve of a Monopolistic competitive firm A perfectly competitive firm has a perfectly elastic demand curve 1) There are many other firms 2) Each firm produces the exact SAME good P 2 P 1 d (perfect competitive firm) d (monopolistic competitive firm) q 2 q 1 = q 1 quantity With Monopolistic Competition there are many other sellers, but each firm produces a DIFFERENTIATED product. Because it’s product is not a perfect substitute the monopolistic competitor can raise price and still sell some of it’s product. The monopolistic competitor’s ability to control the price of it’s good occurs because it’s product is DIFFERENTIATED instead of identical.

Price Demand curve of a Monopolistic competitive firm P 2 P 1 d (perfect competitive firm) d (monopolistic competitive firm) q 2 D (monopoly) quantity q 2 q 1 = q 1 A Monopolist has control over it’s price because it is the market and it had no substitutes. A monopolistic competitor is but one among many firms and those firms produce closely related products…. …. Because of this, a monopolistic competitor’s demand curve will be more elastic than a monopolist’s. More elastic: more competition and more substitutes

Price Demand curve of a Monopolistic competitive firm P 2 P 1 d (perfect competitive firm) d (monopolistic competitive firm) q 2 D (monopoly) quantity q 2 q 1 = q 1 A Monopolist has control over it’s price because it is the market and it had no substitutes. A monopolistic competitor is but one among many firms and those firms produce closely related products…. …. Because of this, a monopolistic competitor’s demand curve will be more elastic than a monopolist’s. More elastic: more competition and more substitutes

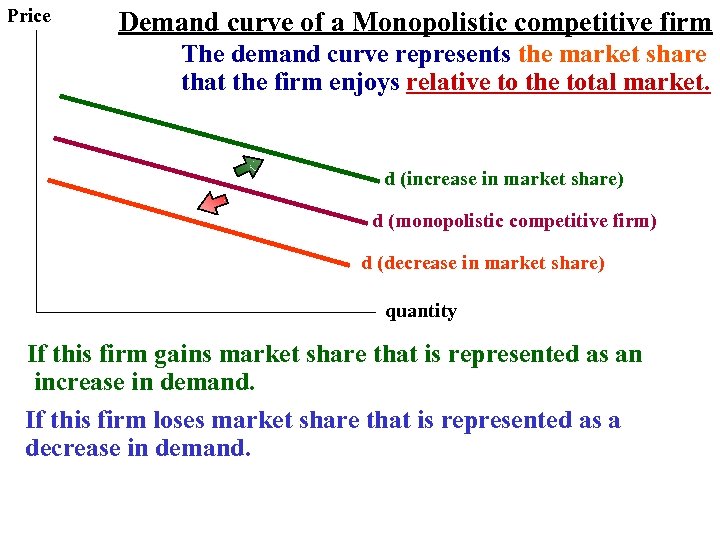

Price Demand curve of a Monopolistic competitive firm The demand curve represents the market share that the firm enjoys relative to the total market. d (increase in market share) d (monopolistic competitive firm) d (decrease in market share) quantity If this firm gains market share that is represented as an increase in demand. If this firm loses market share that is represented as a decrease in demand.

Price Demand curve of a Monopolistic competitive firm The demand curve represents the market share that the firm enjoys relative to the total market. d (increase in market share) d (monopolistic competitive firm) d (decrease in market share) quantity If this firm gains market share that is represented as an increase in demand. If this firm loses market share that is represented as a decrease in demand.

Monopolistic Competition: Short run to Long Run

Monopolistic Competition: Short run to Long Run

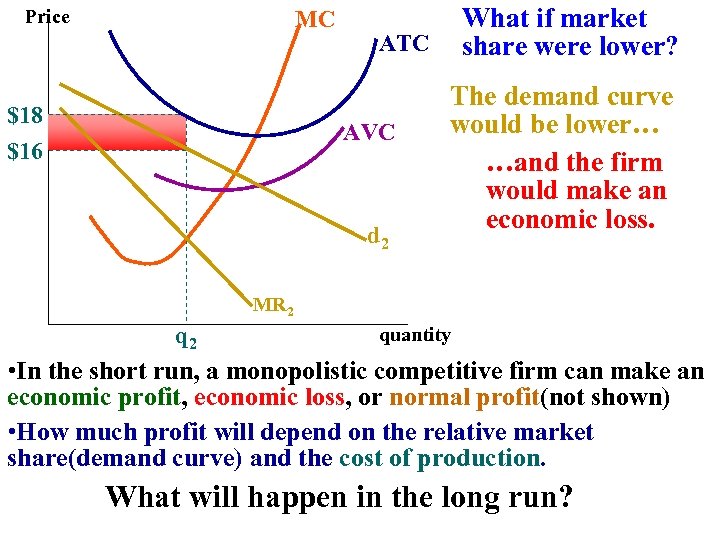

Price MC ATC What if market Suppose d 1 is the demand curve for this share were lower? firm. . . The demand curve …this Monopolistic would be lower…will Competitive firm AVC be…and the firm able to make an d 1 Economic profitan would make $20 $18 ATC $17 $16 d 2 economic loss. MR 1 MR 2 q 1 quantity • In the short run, a monopolistic competitive firm can make an economic profit, economic loss, or normal profit(not shown) • How much profit will depend on the relative market share(demand curve) and the cost of production. What will happen in the long run?

Price MC ATC What if market Suppose d 1 is the demand curve for this share were lower? firm. . . The demand curve …this Monopolistic would be lower…will Competitive firm AVC be…and the firm able to make an d 1 Economic profitan would make $20 $18 ATC $17 $16 d 2 economic loss. MR 1 MR 2 q 1 quantity • In the short run, a monopolistic competitive firm can make an economic profit, economic loss, or normal profit(not shown) • How much profit will depend on the relative market share(demand curve) and the cost of production. What will happen in the long run?

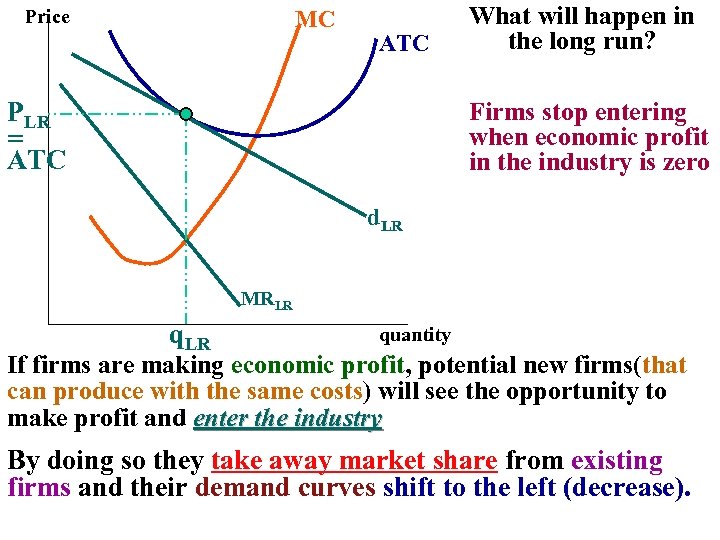

Price MC What will happen in the long run? ATC A firm making economic profit $20 PLR ATC = $17 ATC d. LR MRLR q 1 d 1 Firms stop entering when economic profit in the industry is zero MR 1 quantity If firms are making economic profit, potential new firms(that can produce with the same costs) will see the opportunity to make profit and enter the industry By doing so they take away market share from existing firms and their demand curves shift to the left (decrease).

Price MC What will happen in the long run? ATC A firm making economic profit $20 PLR ATC = $17 ATC d. LR MRLR q 1 d 1 Firms stop entering when economic profit in the industry is zero MR 1 quantity If firms are making economic profit, potential new firms(that can produce with the same costs) will see the opportunity to make profit and enter the industry By doing so they take away market share from existing firms and their demand curves shift to the left (decrease).

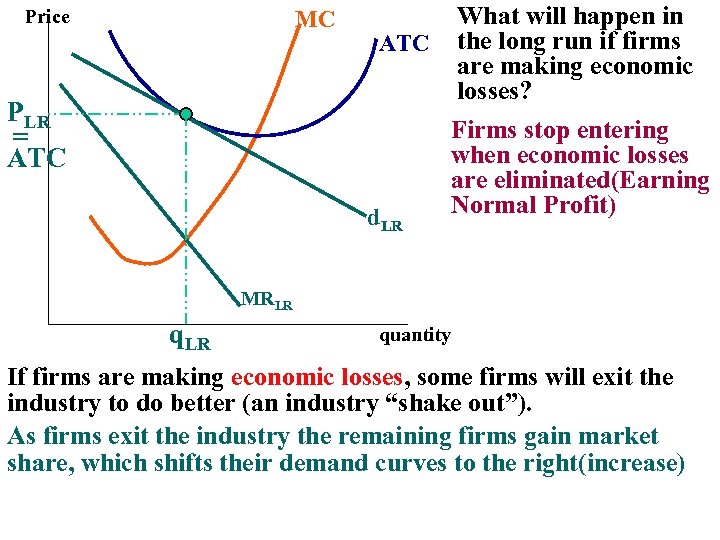

Price MC $18 PLR ATC AVC = ATC $15 What will happen in the long run if firms are making economic losses? d. LR A firm making an economic loss Firms stop entering when economic losses are eliminated(Earning Normal Profit) d 2 MRMRLR 2 qq. LR 2 quantity If firms are making economic losses, some firms will exit the industry to do better (an industry “shake out”). As firms exit the industry the remaining firms gain market share, which shifts their demand curves to the right(increase)

Price MC $18 PLR ATC AVC = ATC $15 What will happen in the long run if firms are making economic losses? d. LR A firm making an economic loss Firms stop entering when economic losses are eliminated(Earning Normal Profit) d 2 MRMRLR 2 qq. LR 2 quantity If firms are making economic losses, some firms will exit the industry to do better (an industry “shake out”). As firms exit the industry the remaining firms gain market share, which shifts their demand curves to the right(increase)

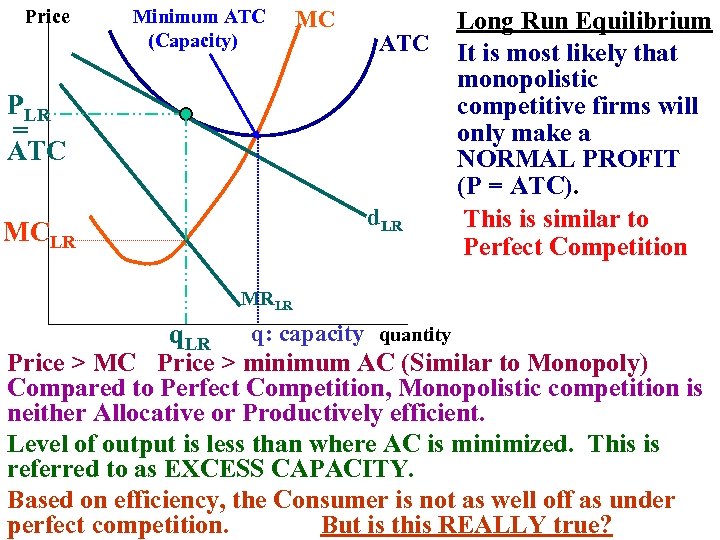

Price Minimum ATC (Capacity) MC ATC PLR = ATC d. LR MCLR Long Run Equilibrium It is most likely that monopolistic competitive firms will only make a NORMAL PROFIT (P = ATC). This is similar to Perfect Competition MRLR q: capacity quantity Price > MC Price > minimum AC (Similar to Monopoly) Compared to Perfect Competition, Monopolistic competition is neither Allocative or Productively efficient. Level of output is less than where AC is minimized. This is referred to as EXCESS CAPACITY. Based on efficiency, the Consumer is not as well off as under perfect competition. But is this REALLY true?

Price Minimum ATC (Capacity) MC ATC PLR = ATC d. LR MCLR Long Run Equilibrium It is most likely that monopolistic competitive firms will only make a NORMAL PROFIT (P = ATC). This is similar to Perfect Competition MRLR q: capacity quantity Price > MC Price > minimum AC (Similar to Monopoly) Compared to Perfect Competition, Monopolistic competition is neither Allocative or Productively efficient. Level of output is less than where AC is minimized. This is referred to as EXCESS CAPACITY. Based on efficiency, the Consumer is not as well off as under perfect competition. But is this REALLY true?

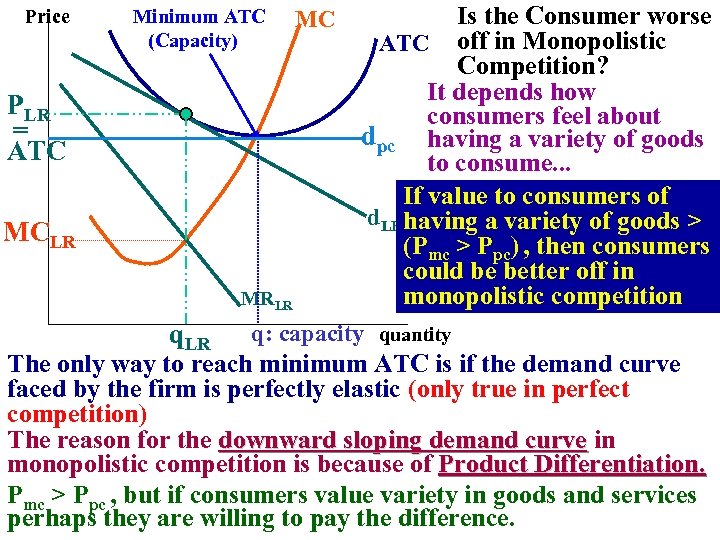

Price Minimum ATC (Capacity) PLR = ATC MCLR MRLR q. LR MC Is the Consumer worse ATC off in Monopolistic Competition? It depends how consumers feel about dpc having a variety of goods to consume. . . If value to consumers of d. LRhaving a variety of goods > (Pmc > Ppc) , then consumers could be better off in monopolistic competition q: capacity quantity The only way to reach minimum ATC is if the demand curve faced by the firm is perfectly elastic (only true in perfect competition) The reason for the downward sloping demand curve in monopolistic competition is because of Product Differentiation. Pmc > Ppc , but if consumers value variety in goods and services perhaps they are willing to pay the difference.

Price Minimum ATC (Capacity) PLR = ATC MCLR MRLR q. LR MC Is the Consumer worse ATC off in Monopolistic Competition? It depends how consumers feel about dpc having a variety of goods to consume. . . If value to consumers of d. LRhaving a variety of goods > (Pmc > Ppc) , then consumers could be better off in monopolistic competition q: capacity quantity The only way to reach minimum ATC is if the demand curve faced by the firm is perfectly elastic (only true in perfect competition) The reason for the downward sloping demand curve in monopolistic competition is because of Product Differentiation. Pmc > Ppc , but if consumers value variety in goods and services perhaps they are willing to pay the difference.

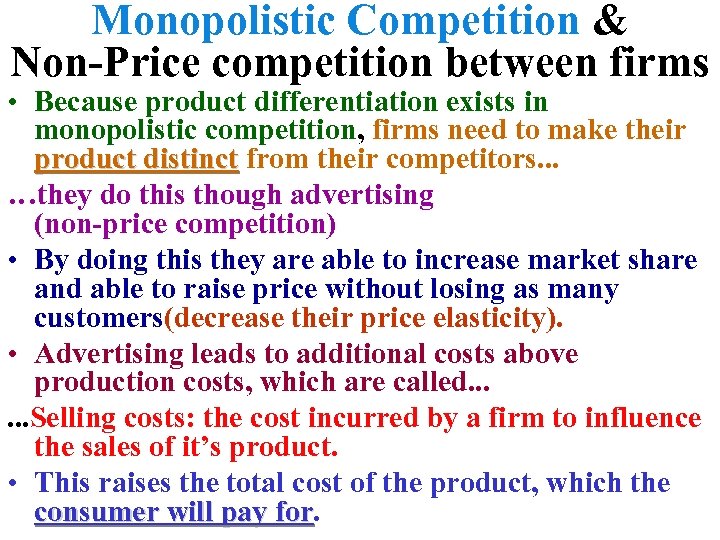

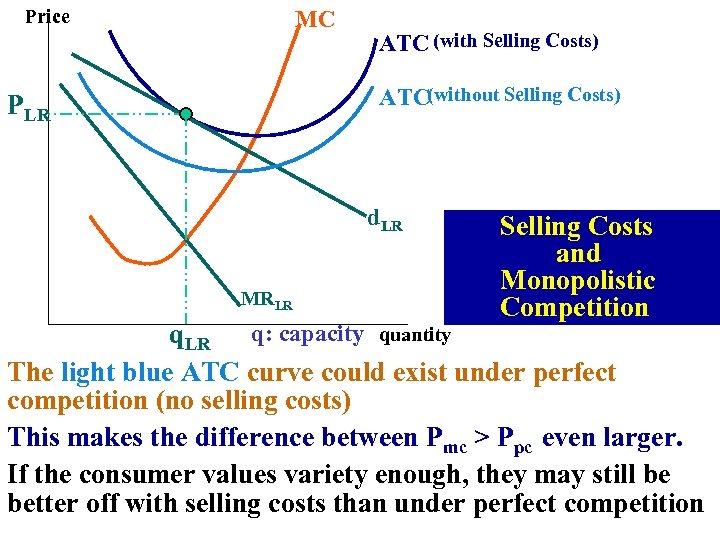

Monopolistic Competition & Non-Price competition between firms • Because product differentiation exists in monopolistic competition, firms need to make their product distinct from their competitors. . . …they do this though advertising (non-price competition) • By doing this they are able to increase market share and able to raise price without losing as many customers(decrease their price elasticity). • Advertising leads to additional costs above production costs, which are called. . . Selling costs: the cost incurred by a firm to influence the sales of it’s product. • This raises the total cost of the product, which the consumer will pay for

Monopolistic Competition & Non-Price competition between firms • Because product differentiation exists in monopolistic competition, firms need to make their product distinct from their competitors. . . …they do this though advertising (non-price competition) • By doing this they are able to increase market share and able to raise price without losing as many customers(decrease their price elasticity). • Advertising leads to additional costs above production costs, which are called. . . Selling costs: the cost incurred by a firm to influence the sales of it’s product. • This raises the total cost of the product, which the consumer will pay for

Price MC ATC (with Selling Costs) ATC(without Selling Costs) PLR d. LR MRLR Selling Costs and Monopolistic Competition q. LR q: capacity quantity The light blue ATC curve could exist under perfect competition (no selling costs) This makes the difference between Pmc > Ppc even larger. If the consumer values variety enough, they may still be better off with selling costs than under perfect competition

Price MC ATC (with Selling Costs) ATC(without Selling Costs) PLR d. LR MRLR Selling Costs and Monopolistic Competition q. LR q: capacity quantity The light blue ATC curve could exist under perfect competition (no selling costs) This makes the difference between Pmc > Ppc even larger. If the consumer values variety enough, they may still be better off with selling costs than under perfect competition

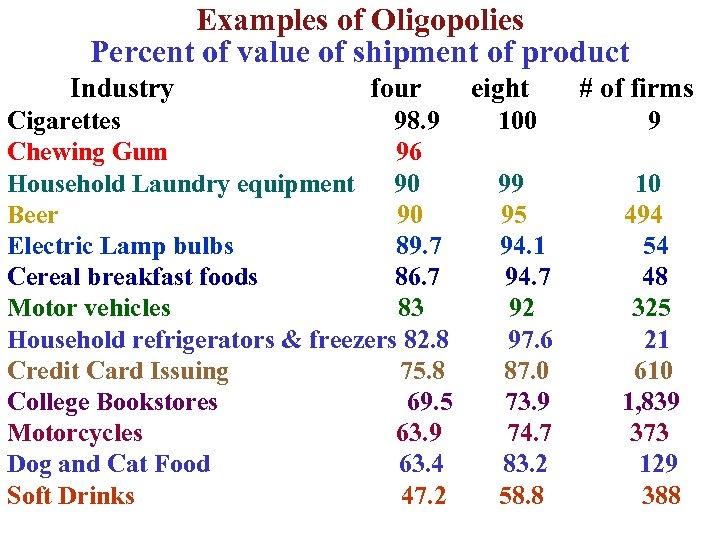

Examples of Oligopolies Percent of value of shipment of product Industry four Cigarettes 98. 9 Chewing Gum 96 Household Laundry equipment 90 Beer 90 Electric Lamp bulbs 89. 7 Cereal breakfast foods 86. 7 Motor vehicles 83 Household refrigerators & freezers 82. 8 Credit Card Issuing 75. 8 College Bookstores 69. 5 Motorcycles 63. 9 Dog and Cat Food 63. 4 Soft Drinks 47. 2 eight 100 99 95 94. 1 94. 7 92 97. 6 87. 0 73. 9 74. 7 83. 2 58. 8 # of firms 9 10 494 54 48 325 21 610 1, 839 373 129 388

Examples of Oligopolies Percent of value of shipment of product Industry four Cigarettes 98. 9 Chewing Gum 96 Household Laundry equipment 90 Beer 90 Electric Lamp bulbs 89. 7 Cereal breakfast foods 86. 7 Motor vehicles 83 Household refrigerators & freezers 82. 8 Credit Card Issuing 75. 8 College Bookstores 69. 5 Motorcycles 63. 9 Dog and Cat Food 63. 4 Soft Drinks 47. 2 eight 100 99 95 94. 1 94. 7 92 97. 6 87. 0 73. 9 74. 7 83. 2 58. 8 # of firms 9 10 494 54 48 325 21 610 1, 839 373 129 388

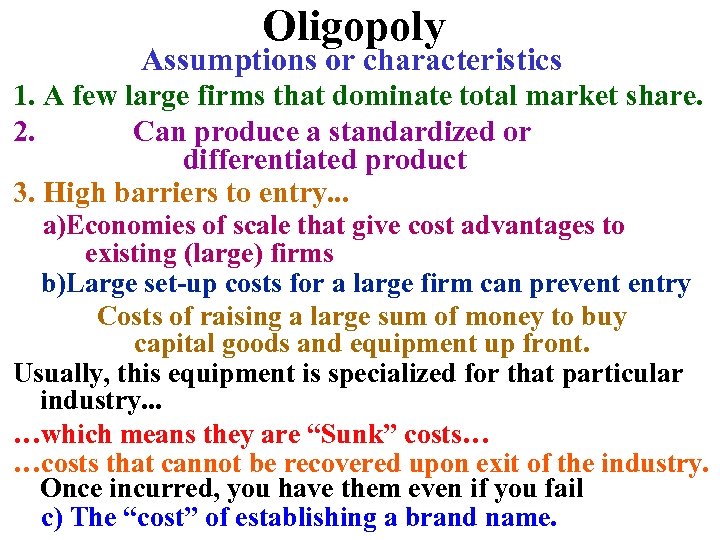

Oligopoly Assumptions or characteristics 1. A few large firms that dominate total market share. 2. Can produce a standardized or differentiated product 3. High barriers to entry. . . a)Economies of scale that give cost advantages to existing (large) firms b)Large set-up costs for a large firm can prevent entry Costs of raising a large sum of money to buy capital goods and equipment up front. Usually, this equipment is specialized for that particular industry. . . …which means they are “Sunk” costs… …costs that cannot be recovered upon exit of the industry. Once incurred, you have them even if you fail c) The “cost” of establishing a brand name.

Oligopoly Assumptions or characteristics 1. A few large firms that dominate total market share. 2. Can produce a standardized or differentiated product 3. High barriers to entry. . . a)Economies of scale that give cost advantages to existing (large) firms b)Large set-up costs for a large firm can prevent entry Costs of raising a large sum of money to buy capital goods and equipment up front. Usually, this equipment is specialized for that particular industry. . . …which means they are “Sunk” costs… …costs that cannot be recovered upon exit of the industry. Once incurred, you have them even if you fail c) The “cost” of establishing a brand name.

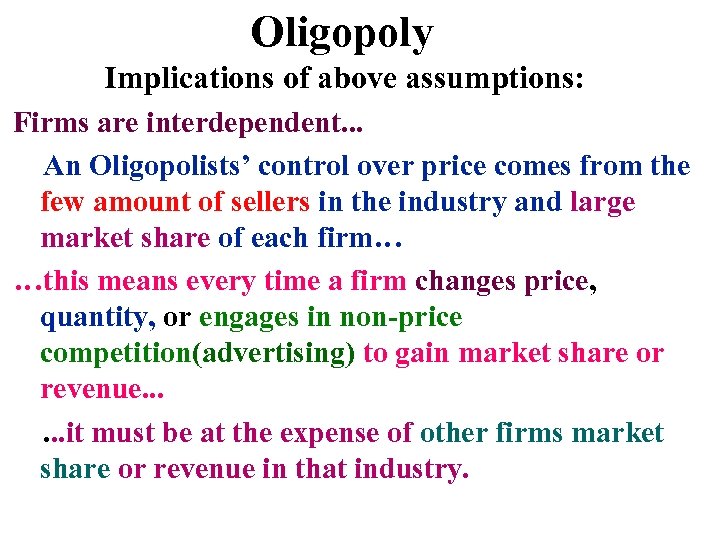

Oligopoly Implications of above assumptions: Firms are interdependent. . . An Oligopolists’ control over price comes from the few amount of sellers in the industry and large market share of each firm… …this means every time a firm changes price, quantity, or engages in non-price competition(advertising) to gain market share or revenue. . . it must be at the expense of other firms market share or revenue in that industry.

Oligopoly Implications of above assumptions: Firms are interdependent. . . An Oligopolists’ control over price comes from the few amount of sellers in the industry and large market share of each firm… …this means every time a firm changes price, quantity, or engages in non-price competition(advertising) to gain market share or revenue. . . it must be at the expense of other firms market share or revenue in that industry.

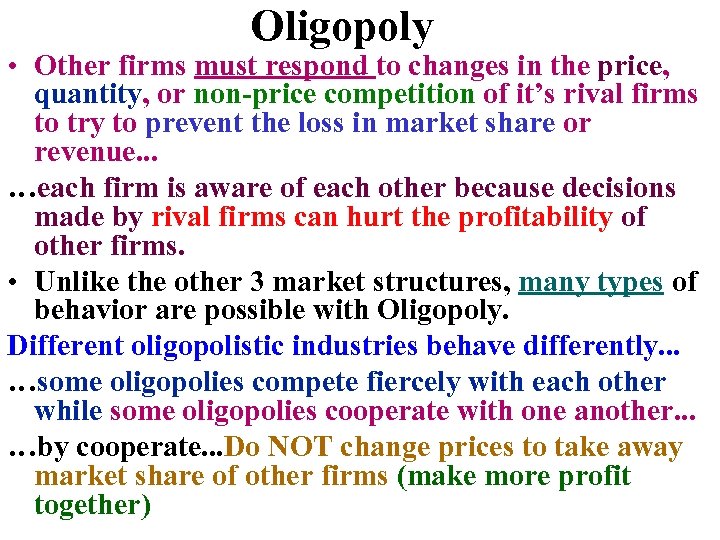

Oligopoly • Other firms must respond to changes in the price, quantity, or non-price competition of it’s rival firms to try to prevent the loss in market share or revenue. . . …each firm is aware of each other because decisions made by rival firms can hurt the profitability of other firms. • Unlike the other 3 market structures, many types of behavior are possible with Oligopoly. Different oligopolistic industries behave differently. . . …some oligopolies compete fiercely with each other while some oligopolies cooperate with one another. . . …by cooperate. . . Do NOT change prices to take away market share of other firms (make more profit together)

Oligopoly • Other firms must respond to changes in the price, quantity, or non-price competition of it’s rival firms to try to prevent the loss in market share or revenue. . . …each firm is aware of each other because decisions made by rival firms can hurt the profitability of other firms. • Unlike the other 3 market structures, many types of behavior are possible with Oligopoly. Different oligopolistic industries behave differently. . . …some oligopolies compete fiercely with each other while some oligopolies cooperate with one another. . . …by cooperate. . . Do NOT change prices to take away market share of other firms (make more profit together)

Oligopoly Oligopolist’s dilemma: Cooperate or Compete • Although there are more than a few models on oligopoly behavior, they can be divided into two categories based on the Oligopolist’s dilemma. Models where firms compete Models where firms cooperate

Oligopoly Oligopolist’s dilemma: Cooperate or Compete • Although there are more than a few models on oligopoly behavior, they can be divided into two categories based on the Oligopolist’s dilemma. Models where firms compete Models where firms cooperate

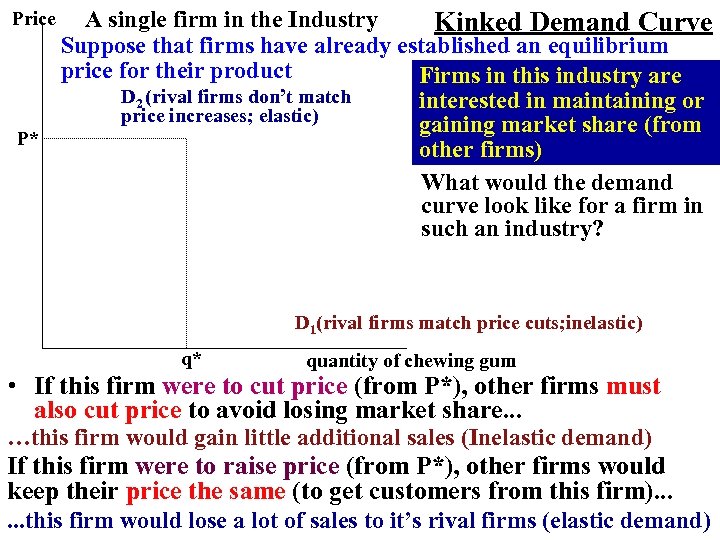

A single firm in the Industry Kinked Demand Curve Suppose that firms have already established an equilibrium price for their product Firms in this industry are D 2 (rival firms don’t match interested in maintaining or price increases; elastic) gaining market share (from P* other firms) What would the demand curve look like for a firm in such an industry? Price D 1(rival firms match price cuts; inelastic) q* quantity of chewing gum • If this firm were to cut price (from P*), other firms must also cut price to avoid losing market share. . . …this firm would gain little additional sales (Inelastic demand) If this firm were to raise price (from P*), other firms would keep their price the same (to get customers from this firm). . . this firm would lose a lot of sales to it’s rival firms (elastic demand)

A single firm in the Industry Kinked Demand Curve Suppose that firms have already established an equilibrium price for their product Firms in this industry are D 2 (rival firms don’t match interested in maintaining or price increases; elastic) gaining market share (from P* other firms) What would the demand curve look like for a firm in such an industry? Price D 1(rival firms match price cuts; inelastic) q* quantity of chewing gum • If this firm were to cut price (from P*), other firms must also cut price to avoid losing market share. . . …this firm would gain little additional sales (Inelastic demand) If this firm were to raise price (from P*), other firms would keep their price the same (to get customers from this firm). . . this firm would lose a lot of sales to it’s rival firms (elastic demand)

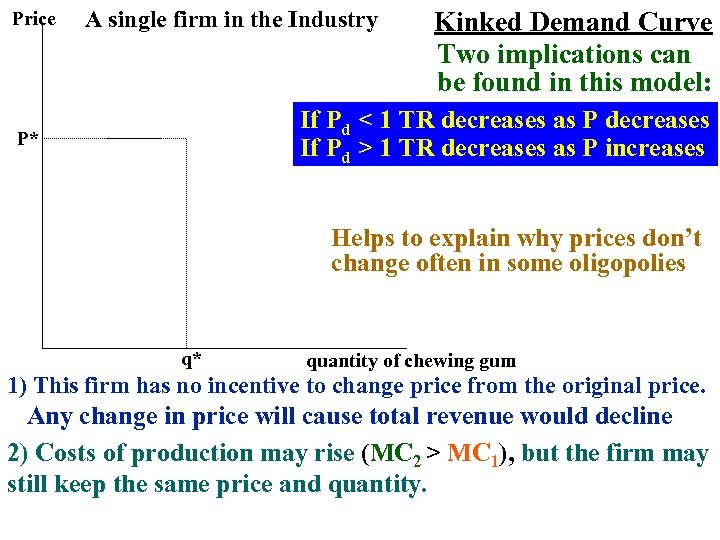

Price A single firm in the Industry Kinked Demand Curve Two implications can be found in this model: If Pd < 1 TR decreases as P decreases If Pd > 1 TR decreases as P increases P* Helps to explain why prices don’t change often in some oligopolies q* quantity of chewing gum 1) This firm has no incentive to change price from the original price. Any change in price will cause total revenue would decline 2) Costs of production may rise (MC 2 > MC 1), but the firm may still keep the same price and quantity.

Price A single firm in the Industry Kinked Demand Curve Two implications can be found in this model: If Pd < 1 TR decreases as P decreases If Pd > 1 TR decreases as P increases P* Helps to explain why prices don’t change often in some oligopolies q* quantity of chewing gum 1) This firm has no incentive to change price from the original price. Any change in price will cause total revenue would decline 2) Costs of production may rise (MC 2 > MC 1), but the firm may still keep the same price and quantity.

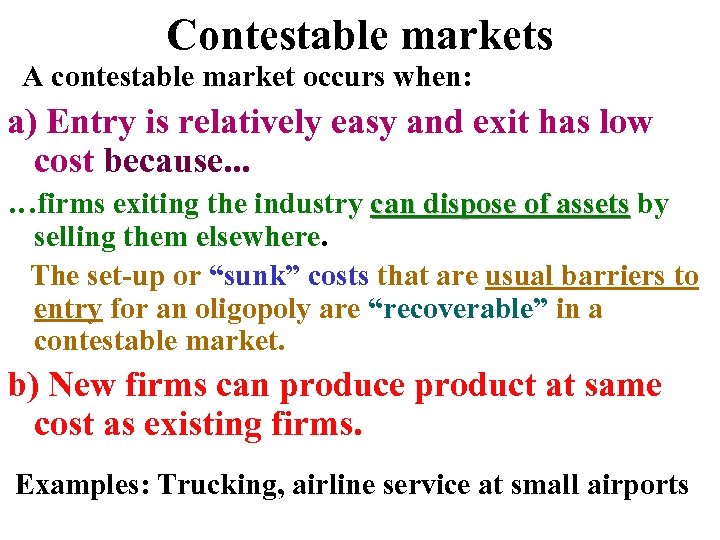

Contestable markets A contestable market occurs when: a) Entry is relatively easy and exit has low cost because. . . …firms exiting the industry can dispose of assets by selling them elsewhere. The set-up or “sunk” costs that are usual barriers to entry for an oligopoly are “recoverable” in a contestable market. b) New firms can produce product at same cost as existing firms. Examples: Trucking, airline service at small airports

Contestable markets A contestable market occurs when: a) Entry is relatively easy and exit has low cost because. . . …firms exiting the industry can dispose of assets by selling them elsewhere. The set-up or “sunk” costs that are usual barriers to entry for an oligopoly are “recoverable” in a contestable market. b) New firms can produce product at same cost as existing firms. Examples: Trucking, airline service at small airports

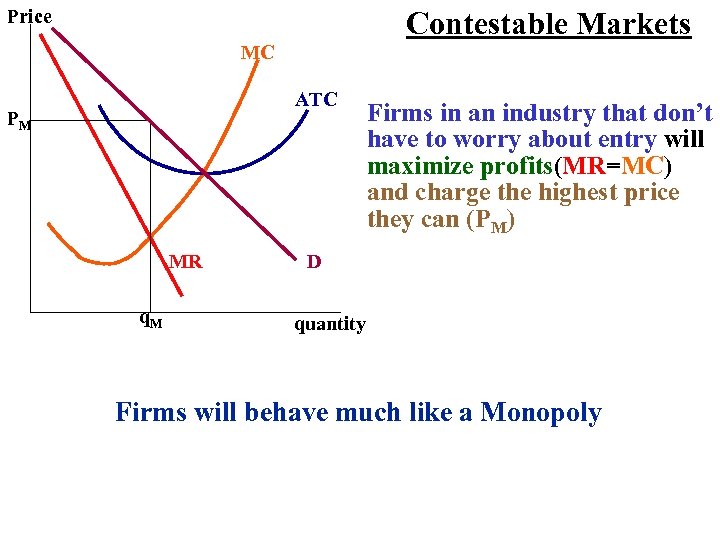

Price Contestable Markets MC ATC PM MR q. M Firms in an industry that don’t have to worry about entry will maximize profits(MR=MC) and charge the highest price they can (PM) D quantity Firms will behave much like a Monopoly

Price Contestable Markets MC ATC PM MR q. M Firms in an industry that don’t have to worry about entry will maximize profits(MR=MC) and charge the highest price they can (PM) D quantity Firms will behave much like a Monopoly

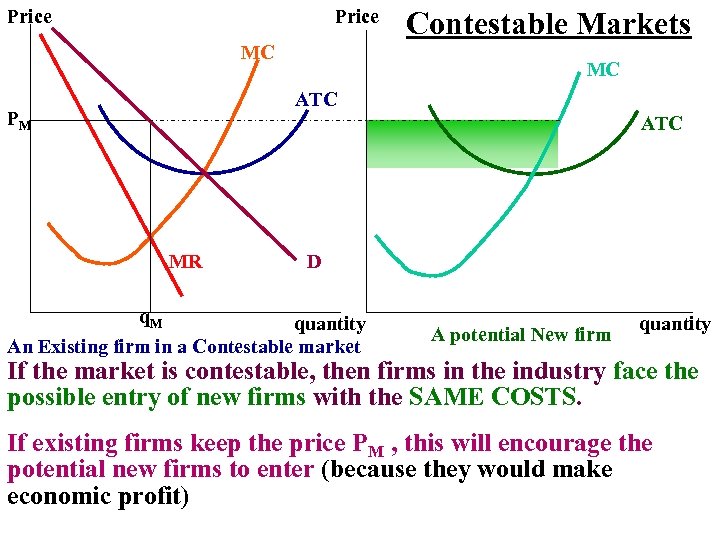

Price MC Contestable Markets MC ATC PM ATC MR q. M D quantity An Existing firm in a Contestable market A potential New firm quantity If the market is contestable, then firms in the industry face the possible entry of new firms with the SAME COSTS. If existing firms keep the price PM , this will encourage the potential new firms to enter (because they would make economic profit)

Price MC Contestable Markets MC ATC PM ATC MR q. M D quantity An Existing firm in a Contestable market A potential New firm quantity If the market is contestable, then firms in the industry face the possible entry of new firms with the SAME COSTS. If existing firms keep the price PM , this will encourage the potential new firms to enter (because they would make economic profit)

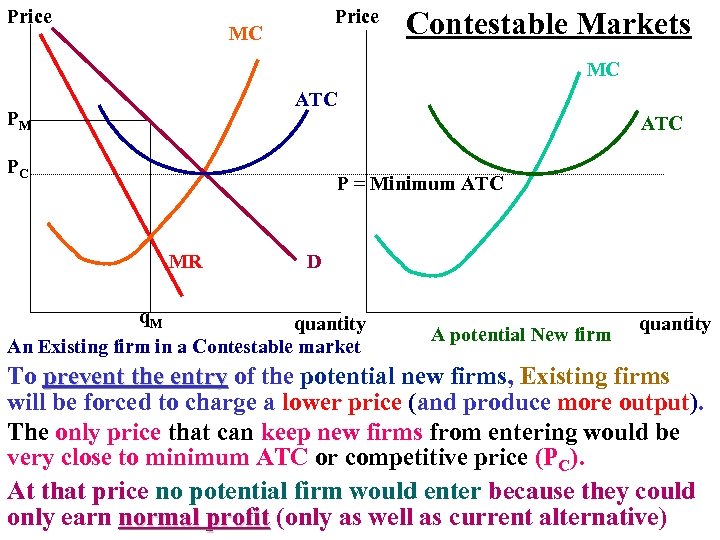

Price MC Contestable Markets MC ATC PM ATC PC P = Minimum ATC MR q. M D quantity An Existing firm in a Contestable market A potential New firm quantity To prevent the entry of the potential new firms, Existing firms will be forced to charge a lower price (and produce more output). The only price that can keep new firms from entering would be very close to minimum ATC or competitive price (PC). At that price no potential firm would enter because they could only earn normal profit (only as well as current alternative)

Price MC Contestable Markets MC ATC PM ATC PC P = Minimum ATC MR q. M D quantity An Existing firm in a Contestable market A potential New firm quantity To prevent the entry of the potential new firms, Existing firms will be forced to charge a lower price (and produce more output). The only price that can keep new firms from entering would be very close to minimum ATC or competitive price (PC). At that price no potential firm would enter because they could only earn normal profit (only as well as current alternative)

Implications of Contestable Market theory 1. A small number of firms does not always imply a lack of a competitive outcome. . . …firms in contestable markets may make close to or only a normal profit. . . …if markets are contestable, an industry with few firms may come close to the perfectly competitive outcome (P = MC = Min ATC) 2. Inefficient firms cannot survive because they can’t keep price low enough to prevent entry into the industry. If an existing firms costs are higher than a potential new firm, that firm will fail. It is the threat of entry(and not the actual entry) that keeps a contestable market competitive

Implications of Contestable Market theory 1. A small number of firms does not always imply a lack of a competitive outcome. . . …firms in contestable markets may make close to or only a normal profit. . . …if markets are contestable, an industry with few firms may come close to the perfectly competitive outcome (P = MC = Min ATC) 2. Inefficient firms cannot survive because they can’t keep price low enough to prevent entry into the industry. If an existing firms costs are higher than a potential new firm, that firm will fail. It is the threat of entry(and not the actual entry) that keeps a contestable market competitive

Price leadership theory : tacit collusion • The industry usually has one dominant firm and then a handful of smaller firms that would compete against one another. The dominant firm sets it’s price to maximize it’s profits. . . …the other firms follow by setting their prices close to (or equal) to the dominant firms price. Example: Most large airports are dominated by one airline. . . when that airline raises fares, the other airlines usually follow.

Price leadership theory : tacit collusion • The industry usually has one dominant firm and then a handful of smaller firms that would compete against one another. The dominant firm sets it’s price to maximize it’s profits. . . …the other firms follow by setting their prices close to (or equal) to the dominant firms price. Example: Most large airports are dominated by one airline. . . when that airline raises fares, the other airlines usually follow.

Price leadership theory : tacit collusion Why would the smaller firms follow the dominant firm? 1) Fear retaliation of the dominant firm if they attempt to gain market share through cutting price. Dominant firm could practice Predatory pricing. . . cutting price far enough below average costs to put rival firms out of business (illegal in the United States) 2) The smaller firms believe that the dominant firm has better information than they do about the industry. In the banking industry, small banks may follow interest rate changes by large banks Industries with equal size firms can use: Cost-Plus pricing. . . Firms charge a certain % above average costs. Since costs are virtually the same for all firms, prices will be too.

Price leadership theory : tacit collusion Why would the smaller firms follow the dominant firm? 1) Fear retaliation of the dominant firm if they attempt to gain market share through cutting price. Dominant firm could practice Predatory pricing. . . cutting price far enough below average costs to put rival firms out of business (illegal in the United States) 2) The smaller firms believe that the dominant firm has better information than they do about the industry. In the banking industry, small banks may follow interest rate changes by large banks Industries with equal size firms can use: Cost-Plus pricing. . . Firms charge a certain % above average costs. Since costs are virtually the same for all firms, prices will be too.

Cartel theory: explicit collusion A Cartel is a group of firms that act together to coordinate output decisions and control prices. In other words, act like a monopoly. Conditions needed to establish and maintain a Cartel: 1) Large barriers to entry and few good substitutes …to prevent other sellers from entering at the high prices that the cartel will establish. 2) Divide up the joint (monopoly) profit by. . . establishing quotas on the amount of output produced for each firm. . . . so that the industry produces the monopoly output. Or use Market segmentation. . each firm gets a “part” of the market and that firm has the responsibility to enforce the cartel price in their part of the market.

Cartel theory: explicit collusion A Cartel is a group of firms that act together to coordinate output decisions and control prices. In other words, act like a monopoly. Conditions needed to establish and maintain a Cartel: 1) Large barriers to entry and few good substitutes …to prevent other sellers from entering at the high prices that the cartel will establish. 2) Divide up the joint (monopoly) profit by. . . establishing quotas on the amount of output produced for each firm. . . . so that the industry produces the monopoly output. Or use Market segmentation. . each firm gets a “part” of the market and that firm has the responsibility to enforce the cartel price in their part of the market.

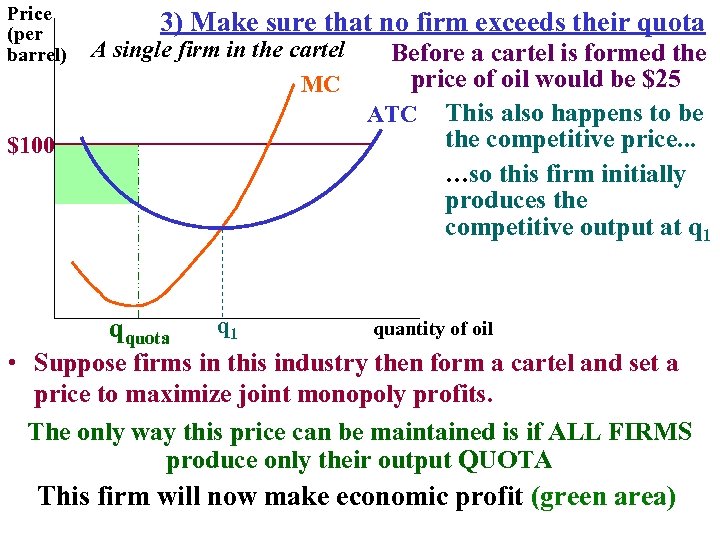

Price (per barrel) 3) Make sure that no firm exceeds their quota A single firm in the cartel MC $100 $25 qquota q 1 Before a cartel is formed the price of oil would be $25 ATC This also happens to be the competitive price. . . …so this firm initially produces the competitive output at q 1 quantity of oil • Suppose firms in this industry then form a cartel and set a price to maximize joint monopoly profits. The only way this price can be maintained is if ALL FIRMS produce only their output QUOTA This firm will now make economic profit (green area)

Price (per barrel) 3) Make sure that no firm exceeds their quota A single firm in the cartel MC $100 $25 qquota q 1 Before a cartel is formed the price of oil would be $25 ATC This also happens to be the competitive price. . . …so this firm initially produces the competitive output at q 1 quantity of oil • Suppose firms in this industry then form a cartel and set a price to maximize joint monopoly profits. The only way this price can be maintained is if ALL FIRMS produce only their output QUOTA This firm will now make economic profit (green area)

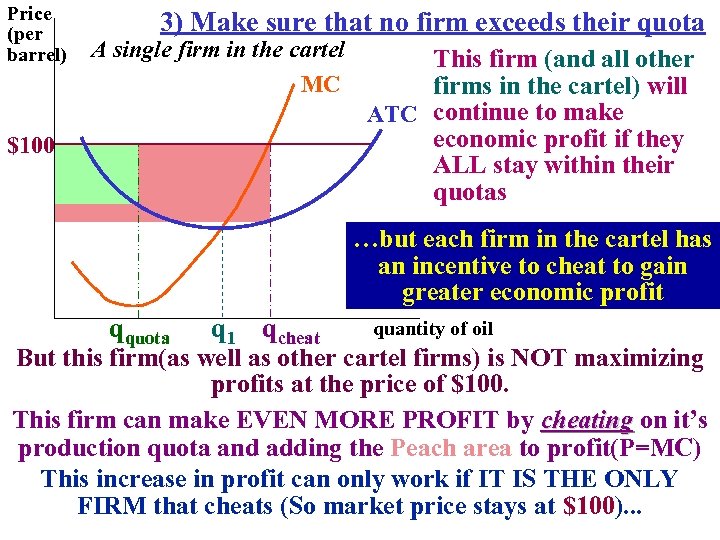

Price (per barrel) 3) Make sure that no firm exceeds their quota A single firm in the cartel MC $100 This firm (and all other firms in the cartel) will ATC continue to make economic profit if they ALL stay within their quotas …but each firm in the cartel has an incentive to cheat to gain greater economic profit qquota q 1 qcheat quantity of oil But this firm(as well as other cartel firms) is NOT maximizing profits at the price of $100. This firm can make EVEN MORE PROFIT by cheating on it’s production quota and adding the Peach area to profit(P=MC) This increase in profit can only work if IT IS THE ONLY FIRM that cheats (So market price stays at $100). . .

Price (per barrel) 3) Make sure that no firm exceeds their quota A single firm in the cartel MC $100 This firm (and all other firms in the cartel) will ATC continue to make economic profit if they ALL stay within their quotas …but each firm in the cartel has an incentive to cheat to gain greater economic profit qquota q 1 qcheat quantity of oil But this firm(as well as other cartel firms) is NOT maximizing profits at the price of $100. This firm can make EVEN MORE PROFIT by cheating on it’s production quota and adding the Peach area to profit(P=MC) This increase in profit can only work if IT IS THE ONLY FIRM that cheats (So market price stays at $100). . .

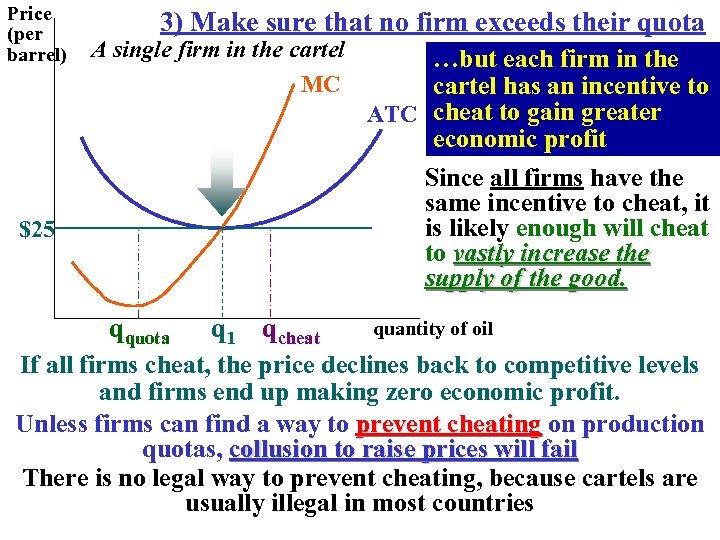

Price (per barrel) 3) Make sure that no firm exceeds their quota A single firm in the cartel MC $100 …but each firm in the cartel has an incentive to ATC cheat to gain greater economic profit Since all firms have the same incentive to cheat, it is likely enough will cheat to vastly increase the supply of the good. $25 qquota q 1 qcheat quantity of oil If all firms cheat, the price declines back to competitive levels and firms end up making zero economic profit. Unless firms can find a way to prevent cheating on production quotas, collusion to raise prices will fail There is no legal way to prevent cheating, because cartels are usually illegal in most countries

Price (per barrel) 3) Make sure that no firm exceeds their quota A single firm in the cartel MC $100 …but each firm in the cartel has an incentive to ATC cheat to gain greater economic profit Since all firms have the same incentive to cheat, it is likely enough will cheat to vastly increase the supply of the good. $25 qquota q 1 qcheat quantity of oil If all firms cheat, the price declines back to competitive levels and firms end up making zero economic profit. Unless firms can find a way to prevent cheating on production quotas, collusion to raise prices will fail There is no legal way to prevent cheating, because cartels are usually illegal in most countries

Cartels are most successful if: 1) There are very few firms: usually less than 5 2) Easy to detect quota violations 3) Entry barriers are very high 4) No anti-trust legislation in the country

Cartels are most successful if: 1) There are very few firms: usually less than 5 2) Easy to detect quota violations 3) Entry barriers are very high 4) No anti-trust legislation in the country

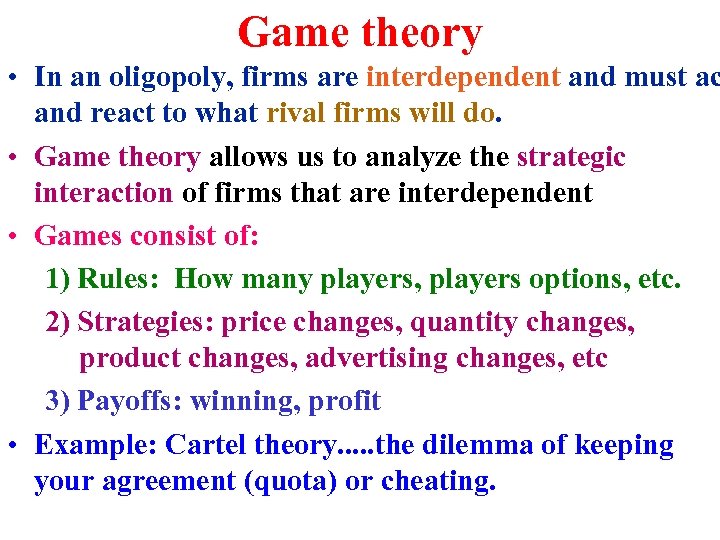

Game theory • In an oligopoly, firms are interdependent and must ac and react to what rival firms will do. • Game theory allows us to analyze the strategic interaction of firms that are interdependent • Games consist of: 1) Rules: How many players, players options, etc. 2) Strategies: price changes, quantity changes, product changes, advertising changes, etc 3) Payoffs: winning, profit • Example: Cartel theory. . . the dilemma of keeping your agreement (quota) or cheating.

Game theory • In an oligopoly, firms are interdependent and must ac and react to what rival firms will do. • Game theory allows us to analyze the strategic interaction of firms that are interdependent • Games consist of: 1) Rules: How many players, players options, etc. 2) Strategies: price changes, quantity changes, product changes, advertising changes, etc 3) Payoffs: winning, profit • Example: Cartel theory. . . the dilemma of keeping your agreement (quota) or cheating.

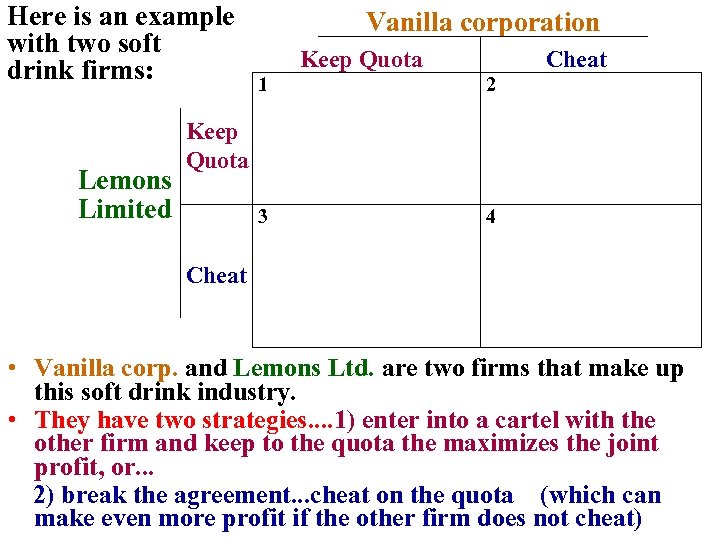

Here is an example with two soft drink firms: Lemons Limited Vanilla corporation Keep Quota Cheat 1 2 3 4 Keep Quota Cheat • Vanilla corp. and Lemons Ltd. are two firms that make up this soft drink industry. • They have two strategies. . 1) enter into a cartel with the other firm and keep to the quota the maximizes the joint profit, or. . . 2) break the agreement. . . cheat on the quota (which can make even more profit if the other firm does not cheat)

Here is an example with two soft drink firms: Lemons Limited Vanilla corporation Keep Quota Cheat 1 2 3 4 Keep Quota Cheat • Vanilla corp. and Lemons Ltd. are two firms that make up this soft drink industry. • They have two strategies. . 1) enter into a cartel with the other firm and keep to the quota the maximizes the joint profit, or. . . 2) break the agreement. . . cheat on the quota (which can make even more profit if the other firm does not cheat)

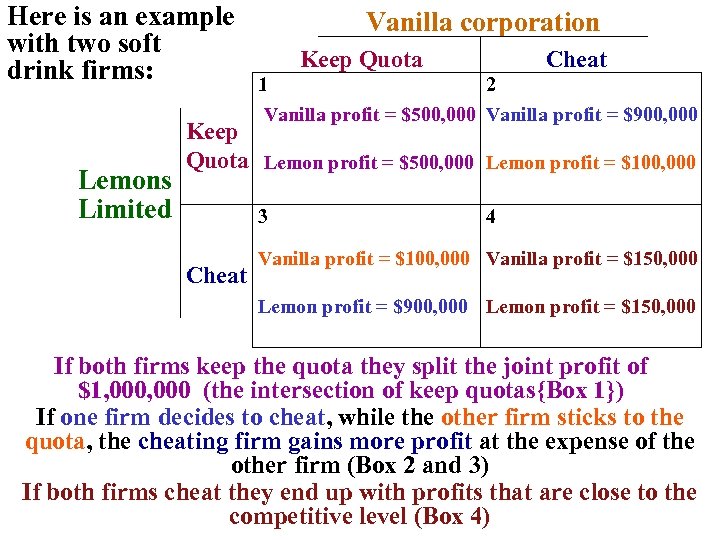

Here is an example with two soft drink firms: Lemons Limited Vanilla corporation Keep Quota Cheat 1 2 Vanilla profit = $500, 000 Vanilla profit = $900, 000 Keep Quota Lemon profit = $500, 000 Lemon profit = $100, 000 3 Cheat 4 Vanilla profit = $100, 000 Vanilla profit = $150, 000 Lemon profit = $900, 000 Lemon profit = $150, 000 If both firms keep the quota they split the joint profit of $1, 000 (the intersection of keep quotas{Box 1}) If one firm decides to cheat, while the other firm sticks to the quota, the cheating firm gains more profit at the expense of the other firm (Box 2 and 3) If both firms cheat they end up with profits that are close to the competitive level (Box 4)

Here is an example with two soft drink firms: Lemons Limited Vanilla corporation Keep Quota Cheat 1 2 Vanilla profit = $500, 000 Vanilla profit = $900, 000 Keep Quota Lemon profit = $500, 000 Lemon profit = $100, 000 3 Cheat 4 Vanilla profit = $100, 000 Vanilla profit = $150, 000 Lemon profit = $900, 000 Lemon profit = $150, 000 If both firms keep the quota they split the joint profit of $1, 000 (the intersection of keep quotas{Box 1}) If one firm decides to cheat, while the other firm sticks to the quota, the cheating firm gains more profit at the expense of the other firm (Box 2 and 3) If both firms cheat they end up with profits that are close to the competitive level (Box 4)

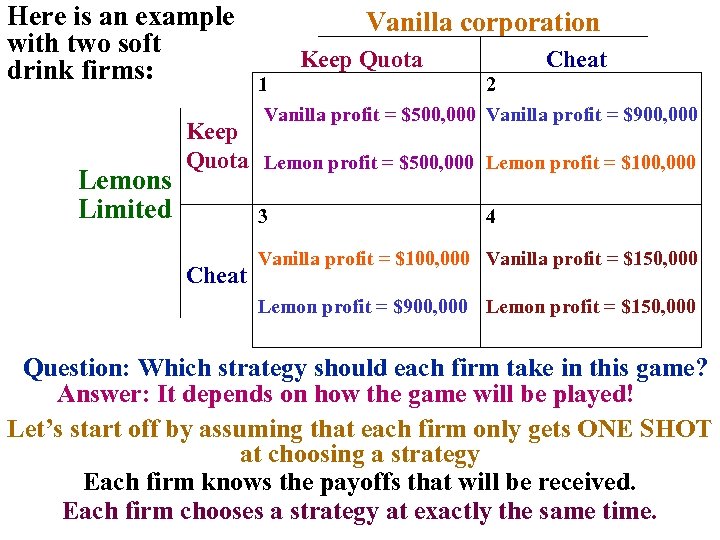

Here is an example with two soft drink firms: Lemons Limited Vanilla corporation Keep Quota Cheat 1 2 Vanilla profit = $500, 000 Vanilla profit = $900, 000 Keep Quota Lemon profit = $500, 000 Lemon profit = $100, 000 3 Cheat 4 Vanilla profit = $100, 000 Vanilla profit = $150, 000 Lemon profit = $900, 000 Lemon profit = $150, 000 Question: Which strategy should each firm take in this game? Answer: It depends on how the game will be played! Let’s start off by assuming that each firm only gets ONE SHOT at choosing a strategy Each firm knows the payoffs that will be received. Each firm chooses a strategy at exactly the same time.

Here is an example with two soft drink firms: Lemons Limited Vanilla corporation Keep Quota Cheat 1 2 Vanilla profit = $500, 000 Vanilla profit = $900, 000 Keep Quota Lemon profit = $500, 000 Lemon profit = $100, 000 3 Cheat 4 Vanilla profit = $100, 000 Vanilla profit = $150, 000 Lemon profit = $900, 000 Lemon profit = $150, 000 Question: Which strategy should each firm take in this game? Answer: It depends on how the game will be played! Let’s start off by assuming that each firm only gets ONE SHOT at choosing a strategy Each firm knows the payoffs that will be received. Each firm chooses a strategy at exactly the same time.

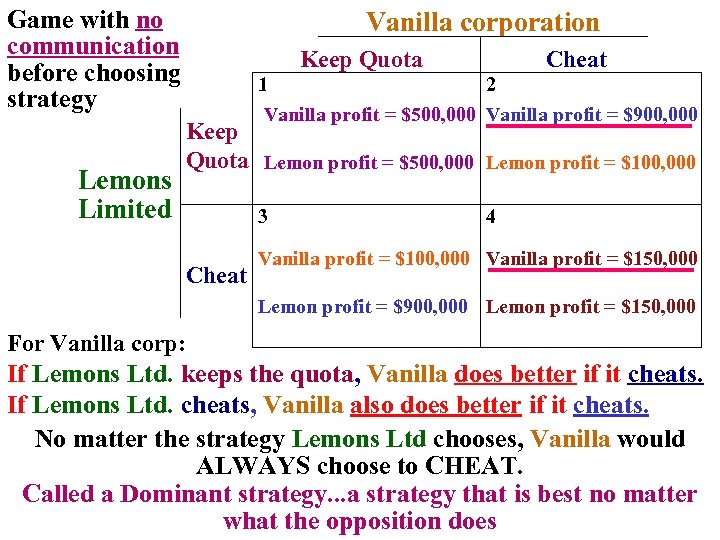

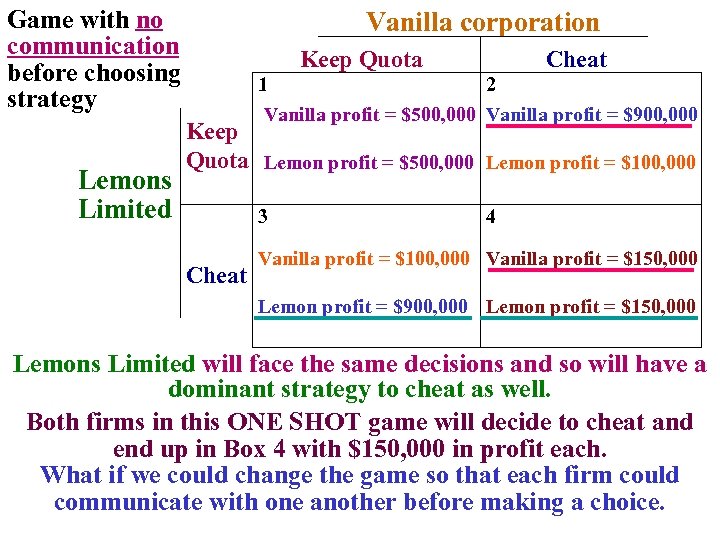

Game with no communication before choosing strategy Lemons Limited Vanilla corporation Keep Quota Cheat 1 2 Vanilla profit = $500, 000 Vanilla profit = $900, 000 Keep Quota Lemon profit = $500, 000 Lemon profit = $100, 000 3 Cheat 4 Vanilla profit = $100, 000 Vanilla profit = $150, 000 Lemon profit = $900, 000 Lemon profit = $150, 000 For Vanilla corp: If Lemons Ltd. keeps the quota, Vanilla does better if it cheats. If Lemons Ltd. cheats, Vanilla also does better if it cheats. No matter the strategy Lemons Ltd chooses, Vanilla would ALWAYS choose to CHEAT. Called a Dominant strategy. . . a strategy that is best no matter what the opposition does

Game with no communication before choosing strategy Lemons Limited Vanilla corporation Keep Quota Cheat 1 2 Vanilla profit = $500, 000 Vanilla profit = $900, 000 Keep Quota Lemon profit = $500, 000 Lemon profit = $100, 000 3 Cheat 4 Vanilla profit = $100, 000 Vanilla profit = $150, 000 Lemon profit = $900, 000 Lemon profit = $150, 000 For Vanilla corp: If Lemons Ltd. keeps the quota, Vanilla does better if it cheats. If Lemons Ltd. cheats, Vanilla also does better if it cheats. No matter the strategy Lemons Ltd chooses, Vanilla would ALWAYS choose to CHEAT. Called a Dominant strategy. . . a strategy that is best no matter what the opposition does

Game with no communication before choosing strategy Lemons Limited Vanilla corporation Keep Quota Cheat 1 2 Vanilla profit = $500, 000 Vanilla profit = $900, 000 Keep Quota Lemon profit = $500, 000 Lemon profit = $100, 000 3 Cheat 4 Vanilla profit = $100, 000 Vanilla profit = $150, 000 Lemon profit = $900, 000 Lemon profit = $150, 000 Lemons Limited will face the same decisions and so will have a dominant strategy to cheat as well. Both firms in this ONE SHOT game will decide to cheat and end up in Box 4 with $150, 000 in profit each. What if we could change the game so that each firm could communicate with one another before making a choice.

Game with no communication before choosing strategy Lemons Limited Vanilla corporation Keep Quota Cheat 1 2 Vanilla profit = $500, 000 Vanilla profit = $900, 000 Keep Quota Lemon profit = $500, 000 Lemon profit = $100, 000 3 Cheat 4 Vanilla profit = $100, 000 Vanilla profit = $150, 000 Lemon profit = $900, 000 Lemon profit = $150, 000 Lemons Limited will face the same decisions and so will have a dominant strategy to cheat as well. Both firms in this ONE SHOT game will decide to cheat and end up in Box 4 with $150, 000 in profit each. What if we could change the game so that each firm could communicate with one another before making a choice.

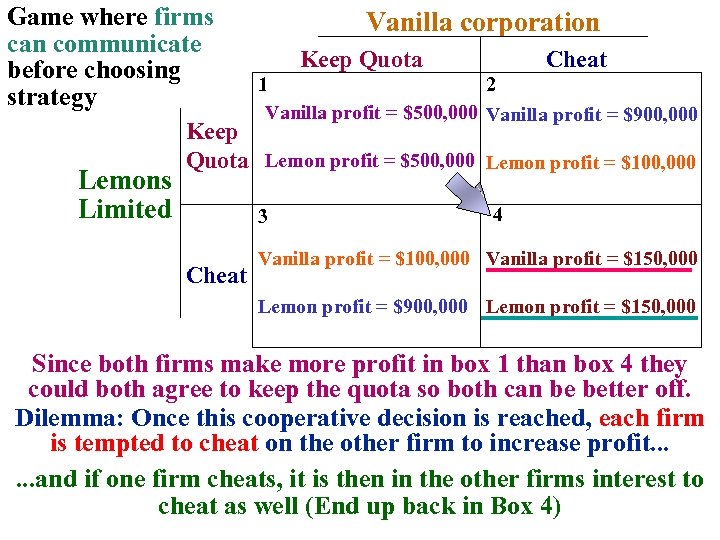

Game where firms can communicate before choosing strategy Lemons Limited Vanilla corporation Keep Quota Cheat 1 2 Vanilla profit = $500, 000 Vanilla profit = $900, 000 Keep Quota Lemon profit = $500, 000 Lemon profit = $100, 000 3 Cheat 4 Vanilla profit = $100, 000 Vanilla profit = $150, 000 Lemon profit = $900, 000 Lemon profit = $150, 000 Since both firms make more profit in box 1 than box 4 they could both agree to keep the quota so both can be better off. Dilemma: Once this cooperative decision is reached, each firm is tempted to cheat on the other firm to increase profit. . . and if one firm cheats, it is then in the other firms interest to cheat as well (End up back in Box 4)

Game where firms can communicate before choosing strategy Lemons Limited Vanilla corporation Keep Quota Cheat 1 2 Vanilla profit = $500, 000 Vanilla profit = $900, 000 Keep Quota Lemon profit = $500, 000 Lemon profit = $100, 000 3 Cheat 4 Vanilla profit = $100, 000 Vanilla profit = $150, 000 Lemon profit = $900, 000 Lemon profit = $150, 000 Since both firms make more profit in box 1 than box 4 they could both agree to keep the quota so both can be better off. Dilemma: Once this cooperative decision is reached, each firm is tempted to cheat on the other firm to increase profit. . . and if one firm cheats, it is then in the other firms interest to cheat as well (End up back in Box 4)

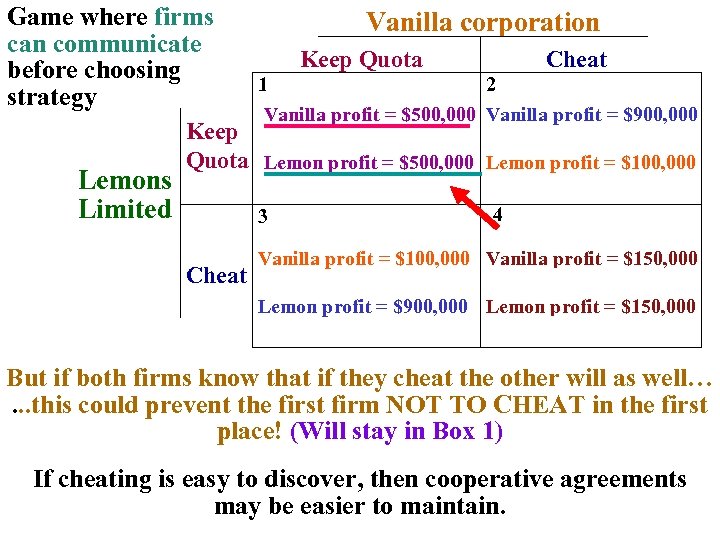

Game where firms can communicate before choosing strategy Lemons Limited Vanilla corporation Keep Quota Cheat 1 2 Vanilla profit = $500, 000 Vanilla profit = $900, 000 Keep Quota Lemon profit = $500, 000 Lemon profit = $100, 000 3 Cheat 4 Vanilla profit = $100, 000 Vanilla profit = $150, 000 Lemon profit = $900, 000 Lemon profit = $150, 000 But if both firms know that if they cheat the other will as well…. . . this could prevent the first firm NOT TO CHEAT in the first place! (Will stay in Box 1) If cheating is easy to discover, then cooperative agreements may be easier to maintain.

Game where firms can communicate before choosing strategy Lemons Limited Vanilla corporation Keep Quota Cheat 1 2 Vanilla profit = $500, 000 Vanilla profit = $900, 000 Keep Quota Lemon profit = $500, 000 Lemon profit = $100, 000 3 Cheat 4 Vanilla profit = $100, 000 Vanilla profit = $150, 000 Lemon profit = $900, 000 Lemon profit = $150, 000 But if both firms know that if they cheat the other will as well…. . . this could prevent the first firm NOT TO CHEAT in the first place! (Will stay in Box 1) If cheating is easy to discover, then cooperative agreements may be easier to maintain.

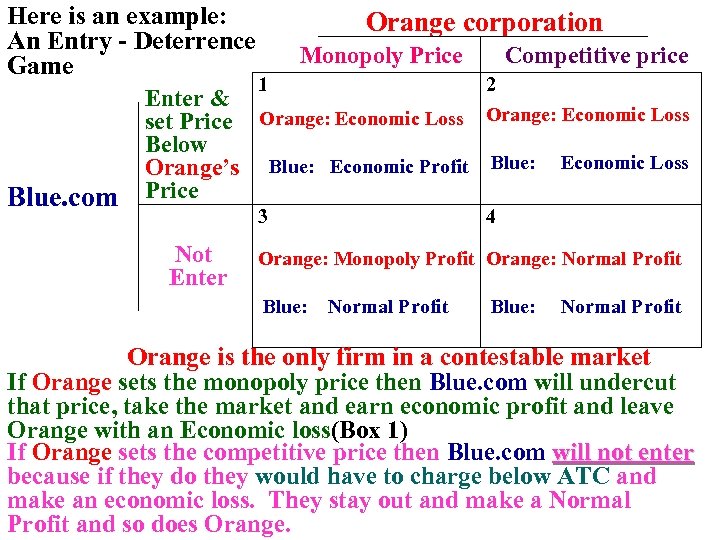

Here is an example: An Entry - Deterrence Game Blue. com Orange corporation Monopoly Price 1 Competitive price 2 Orange: Economic Loss Enter & set Price Orange: Economic Loss Below Orange’s Blue: Economic Profit Blue: Price 3 Not Enter Economic Loss 4 Orange: Monopoly Profit Orange: Normal Profit Blue: Normal Profit Orange is the only firm in a contestable market If Orange sets the monopoly price then Blue. com will undercut that price, take the market and earn economic profit and leave Orange with an Economic loss(Box 1) If Orange sets the competitive price then Blue. com will not enter because if they do they would have to charge below ATC and make an economic loss. They stay out and make a Normal Profit and so does Orange.

Here is an example: An Entry - Deterrence Game Blue. com Orange corporation Monopoly Price 1 Competitive price 2 Orange: Economic Loss Enter & set Price Orange: Economic Loss Below Orange’s Blue: Economic Profit Blue: Price 3 Not Enter Economic Loss 4 Orange: Monopoly Profit Orange: Normal Profit Blue: Normal Profit Orange is the only firm in a contestable market If Orange sets the monopoly price then Blue. com will undercut that price, take the market and earn economic profit and leave Orange with an Economic loss(Box 1) If Orange sets the competitive price then Blue. com will not enter because if they do they would have to charge below ATC and make an economic loss. They stay out and make a Normal Profit and so does Orange.

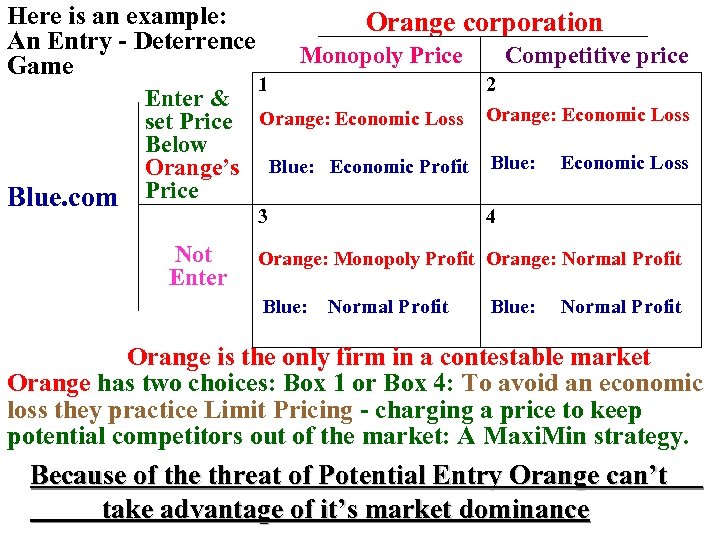

Here is an example: An Entry - Deterrence Game Blue. com Orange corporation Monopoly Price 1 Competitive price 2 Orange: Economic Loss Enter & set Price Orange: Economic Loss Below Orange’s Blue: Economic Profit Blue: Price 3 Not Enter Economic Loss 4 Orange: Monopoly Profit Orange: Normal Profit Blue: Normal Profit Orange is the only firm in a contestable market Orange has two choices: Box 1 or Box 4: To avoid an economic loss they practice Limit Pricing - charging a price to keep potential competitors out of the market: A Maxi. Min strategy. Because of the threat of Potential Entry Orange can’t take advantage of it’s market dominance

Here is an example: An Entry - Deterrence Game Blue. com Orange corporation Monopoly Price 1 Competitive price 2 Orange: Economic Loss Enter & set Price Orange: Economic Loss Below Orange’s Blue: Economic Profit Blue: Price 3 Not Enter Economic Loss 4 Orange: Monopoly Profit Orange: Normal Profit Blue: Normal Profit Orange is the only firm in a contestable market Orange has two choices: Box 1 or Box 4: To avoid an economic loss they practice Limit Pricing - charging a price to keep potential competitors out of the market: A Maxi. Min strategy. Because of the threat of Potential Entry Orange can’t take advantage of it’s market dominance

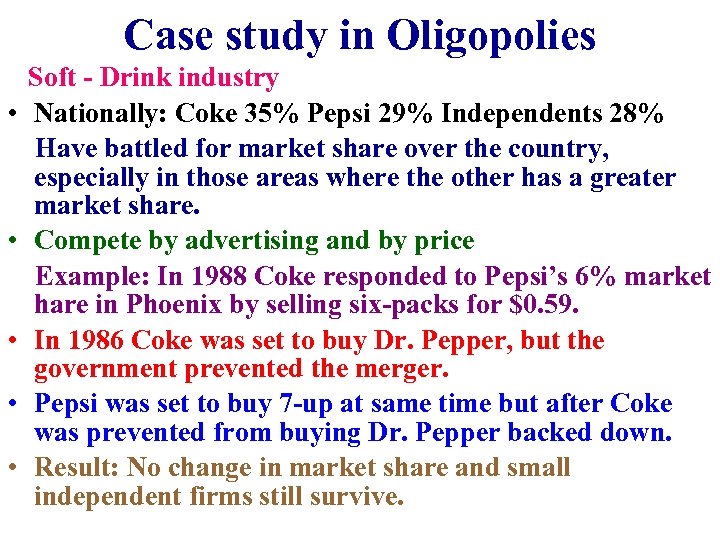

Case study in Oligopolies • • • Soft - Drink industry Nationally: Coke 35% Pepsi 29% Independents 28% Have battled for market share over the country, especially in those areas where the other has a greater market share. Compete by advertising and by price Example: In 1988 Coke responded to Pepsi’s 6% market hare in Phoenix by selling six-packs for $0. 59. In 1986 Coke was set to buy Dr. Pepper, but the government prevented the merger. Pepsi was set to buy 7 -up at same time but after Coke was prevented from buying Dr. Pepper backed down. Result: No change in market share and small independent firms still survive.

Case study in Oligopolies • • • Soft - Drink industry Nationally: Coke 35% Pepsi 29% Independents 28% Have battled for market share over the country, especially in those areas where the other has a greater market share. Compete by advertising and by price Example: In 1988 Coke responded to Pepsi’s 6% market hare in Phoenix by selling six-packs for $0. 59. In 1986 Coke was set to buy Dr. Pepper, but the government prevented the merger. Pepsi was set to buy 7 -up at same time but after Coke was prevented from buying Dr. Pepper backed down. Result: No change in market share and small independent firms still survive.

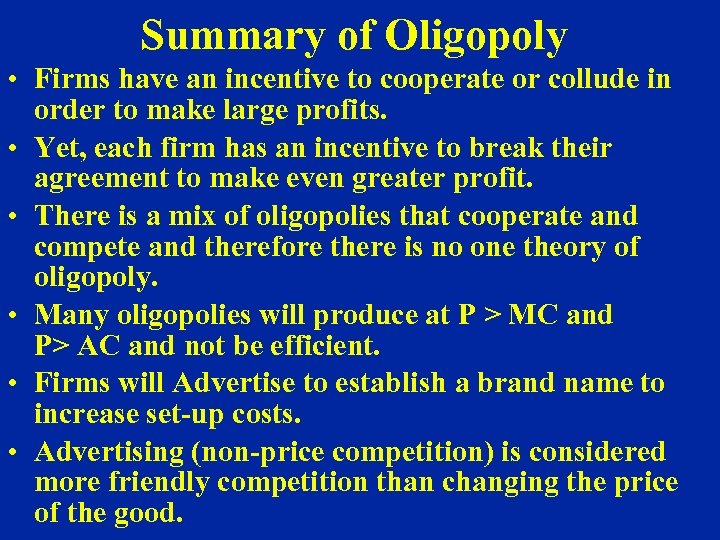

Summary of Oligopoly • Firms have an incentive to cooperate or collude in order to make large profits. • Yet, each firm has an incentive to break their agreement to make even greater profit. • There is a mix of oligopolies that cooperate and compete and therefore there is no one theory of oligopoly. • Many oligopolies will produce at P > MC and P> AC and not be efficient. • Firms will Advertise to establish a brand name to increase set-up costs. • Advertising (non-price competition) is considered more friendly competition than changing the price of the good.

Summary of Oligopoly • Firms have an incentive to cooperate or collude in order to make large profits. • Yet, each firm has an incentive to break their agreement to make even greater profit. • There is a mix of oligopolies that cooperate and compete and therefore there is no one theory of oligopoly. • Many oligopolies will produce at P > MC and P> AC and not be efficient. • Firms will Advertise to establish a brand name to increase set-up costs. • Advertising (non-price competition) is considered more friendly competition than changing the price of the good.