78aa35e7e0a0d29cae5aa238d4068e8a.ppt

- Количество слайдов: 14

tw. BB tw. AAA tw. AA Outlook: Taiwan’s Container Shipping Industry Daniel Hsiao Associate Director Corporate Ratings, Taiwan Ratings Corp. Sept. 8, 2005

tw. BB Characteristics of Container Shipping tw. AAA Industry tw. AA • • • Growing Industry Highly Cyclical Capital Intensive Fragmented Structure Low volatility than other shipping industry (Dry bulk carriers)

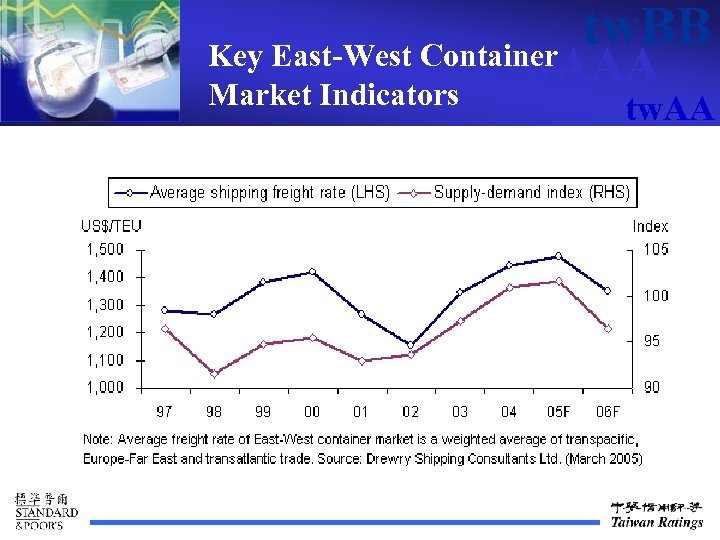

tw. BB Key East-West Container tw. AAA Market Indicators tw. AA

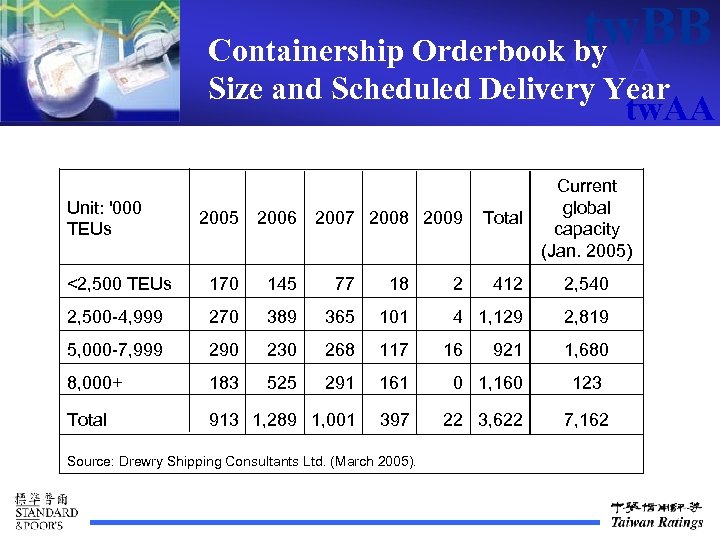

tw. BB Containership Orderbook by tw. AAA Size and Scheduled Delivery Year tw. AA Unit: '000 TEUs Total Current global capacity (Jan. 2005) 412 2, 540 4 1, 129 2, 819 2005 2006 2007 2008 2009 <2, 500 TEUs 170 145 77 18 2, 500 -4, 999 270 389 365 101 5, 000 -7, 999 290 230 268 117 8, 000+ 183 525 291 161 0 1, 160 123 Total 913 1, 289 1, 001 397 22 3, 622 7, 162 Source: Drewry Shipping Consultants Ltd. (March 2005). 2 16 921 1, 680

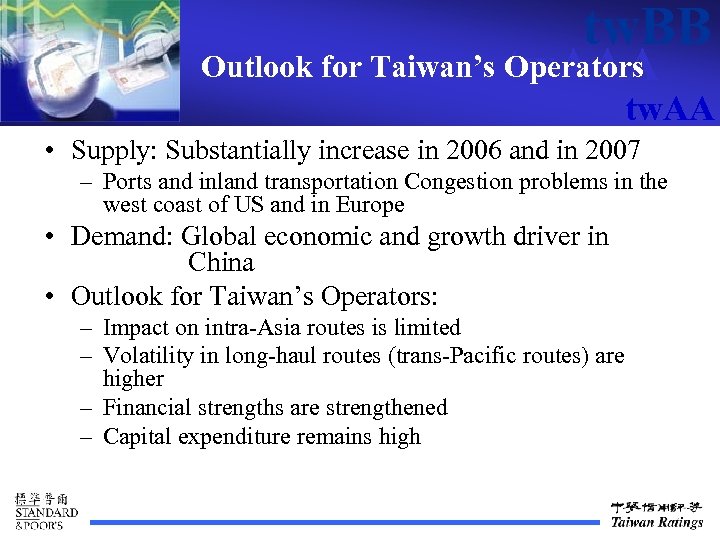

tw. BB Outlook for Taiwan’s Operators tw. AAA tw. AA • Supply: Substantially increase in 2006 and in 2007 – Ports and inland transportation Congestion problems in the west coast of US and in Europe • Demand: Global economic and growth driver in China • Outlook for Taiwan’s Operators: – Impact on intra-Asia routes is limited – Volatility in long-haul routes (trans-Pacific routes) are higher – Financial strengths are strengthened – Capital expenditure remains high

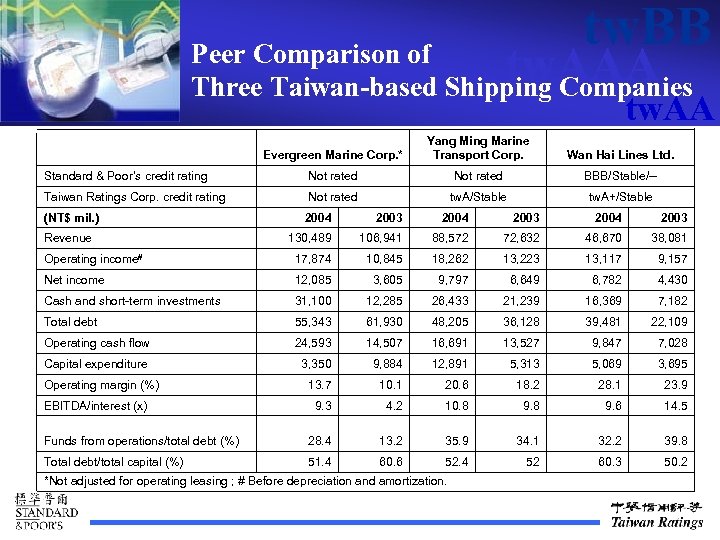

tw. BB tw. AAA Peer Comparison of Three Taiwan-based Shipping Companies tw. AA Evergreen Marine Corp. * Yang Ming Marine Transport Corp. Wan Hai Lines Ltd. Standard & Poor’s credit rating Not rated BBB/Stable/-- Taiwan Ratings Corp. credit rating Not rated tw. A/Stable tw. A+/Stable (NT$ mil. ) 2004 2003 130, 489 106, 941 88, 572 72, 632 46, 670 38, 081 Operating income# 17, 874 10, 845 18, 262 13, 223 13, 117 9, 157 Net income 12, 085 3, 605 9, 797 6, 649 6, 782 4, 430 Cash and short-term investments 31, 100 12, 285 26, 433 21, 239 16, 369 7, 182 Total debt 55, 343 61, 930 48, 205 36, 128 39, 481 22, 109 Operating cash flow 24, 593 14, 507 16, 691 13, 527 9, 847 7, 028 Capital expenditure 3, 350 9, 884 12, 891 5, 313 5, 069 3, 695 13. 7 10. 1 20. 6 18. 2 28. 1 23. 9 9. 3 4. 2 10. 8 9. 6 14. 5 Funds from operations/total debt (%) 28. 4 13. 2 35. 9 34. 1 32. 2 39. 8 Total debt/total capital (%) 51. 4 60. 6 52. 4 52 60. 3 50. 2 Revenue Operating margin (%) EBITDA/interest (x) *Not adjusted for operating leasing ; # Before depreciation and amortization.

tw. BB tw. AAA tw. AA Outlook: Telecom Industry in Taiwan

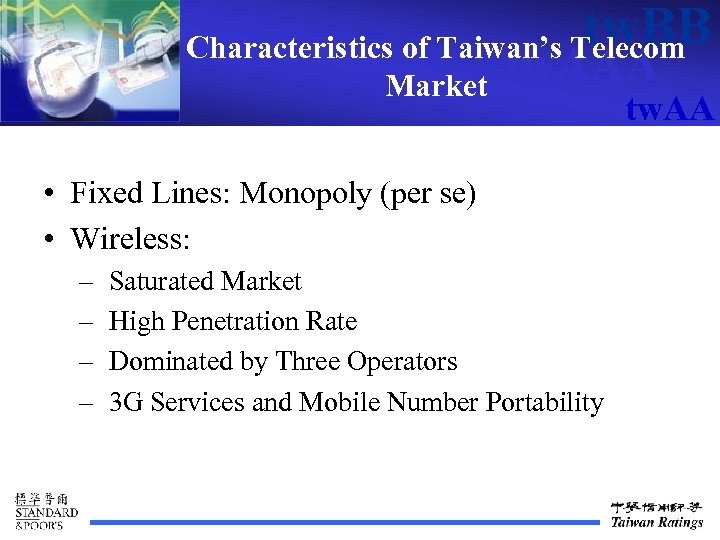

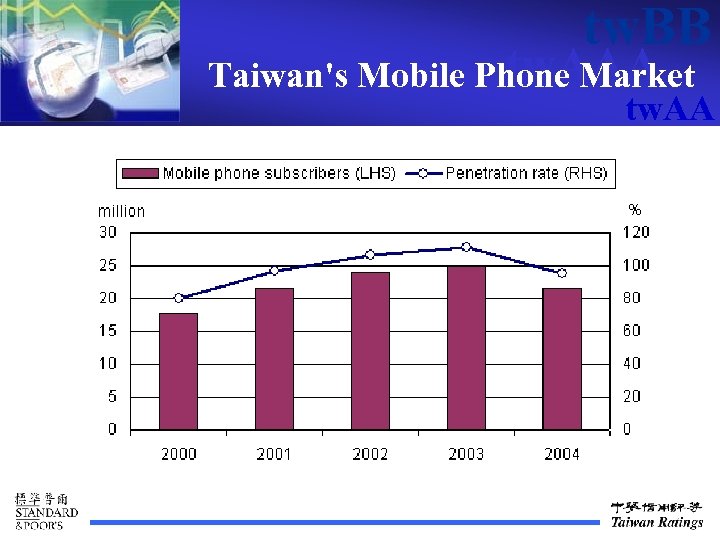

tw. BB Characteristics of Taiwan’s Telecom Market tw. AAA • Fixed Lines: Monopoly (per se) • Wireless: – – Saturated Market High Penetration Rate Dominated by Three Operators 3 G Services and Mobile Number Portability tw. AA

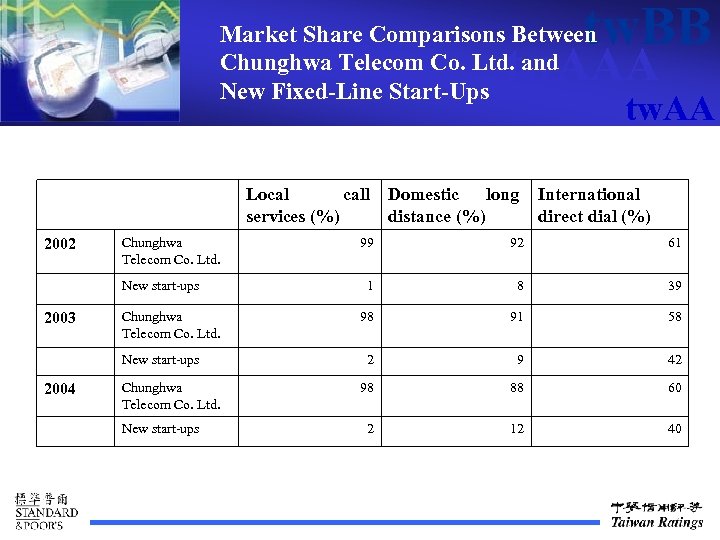

tw. BB Market Share Comparisons Between Chunghwa Telecom Co. Ltd. and New Fixed-Line Start-Ups tw. AAA Local call services (%) 2002 Chunghwa Telecom Co. Ltd. New start-ups 2003 Chunghwa Telecom Co. Ltd. New start-ups 2004 Chunghwa Telecom Co. Ltd. New start-ups Domestic long distance (%) tw. AA International direct dial (%) 99 92 61 1 8 39 98 91 58 2 9 42 98 88 60 2 12 40

tw. BB tw. AAA Taiwan's Mobile Phone Market tw. AA

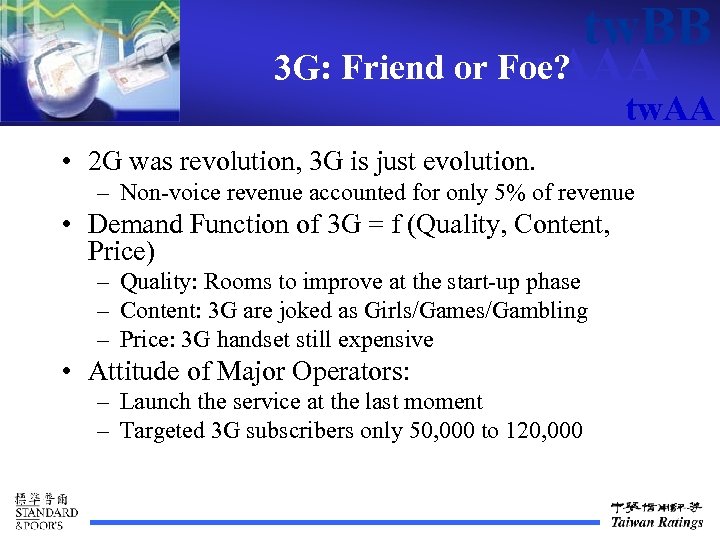

tw. BB 3 G: Friend or Foe? tw. AAA tw. AA • 2 G was revolution, 3 G is just evolution. – Non-voice revenue accounted for only 5% of revenue • Demand Function of 3 G = f (Quality, Content, Price) – Quality: Rooms to improve at the start-up phase – Content: 3 G are joked as Girls/Games/Gambling – Price: 3 G handset still expensive • Attitude of Major Operators: – Launch the service at the last moment – Targeted 3 G subscribers only 50, 000 to 120, 000

MNP: Opportunity for tw. BB tw. AAA New Start-ups tw. AA • Experiences from Other Markets in the Region – Hong Kong – Singapore • Taiwan? – Transfer fee – Three dominated operators equally share the market – It is an opportunity for new start-ups, but at the expense of profit

tw. BB Trends on Taiwan’s tw. AAA Telecom Industry tw. AA • Fixed Lines Market: – Dominated by One Incumbent – Potential Threat from Vo. IP • Wireless Market: – Low growth – Limited competition from new entrants • Outlook: Stable

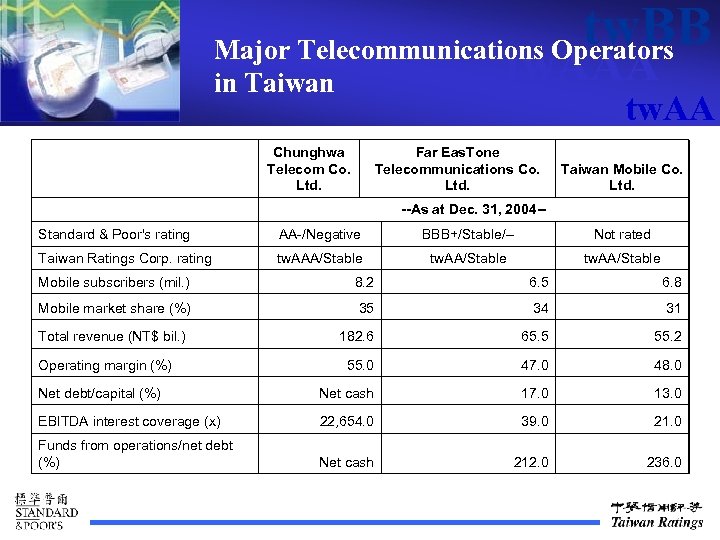

tw. BB Major Telecommunications Operators tw. AAA in Taiwan tw. AA Chunghwa Telecom Co. Ltd. Far Eas. Tone Telecommunications Co. Ltd. Taiwan Mobile Co. Ltd. --As at Dec. 31, 2004 -- Standard & Poor's rating AA-/Negative BBB+/Stable/-- Not rated Taiwan Ratings Corp. rating tw. AAA/Stable tw. AA/Stable Mobile subscribers (mil. ) 8. 2 6. 5 6. 8 Mobile market share (%) 35 34 31 182. 6 65. 5 55. 2 55. 0 47. 0 48. 0 Net debt/capital (%) Net cash 17. 0 13. 0 EBITDA interest coverage (x) 22, 654. 0 39. 0 21. 0 Funds from operations/net debt (%) Net cash 212. 0 236. 0 Total revenue (NT$ bil. ) Operating margin (%)

78aa35e7e0a0d29cae5aa238d4068e8a.ppt