7 expenditure multiplier.ppt

- Количество слайдов: 16

Tutorial Expenditure multiplier

Tutorial Expenditure multiplier

Q 1: Consumption expenditure depends on ____. A the price level, expected future income, and the real interest rate B wealth and the propensity to save C real GDP and expected future income D disposable income, expected future income, and the real interest rate © 2012 Pearson Addison-Wesley

Q 1: Consumption expenditure depends on ____. A the price level, expected future income, and the real interest rate B wealth and the propensity to save C real GDP and expected future income D disposable income, expected future income, and the real interest rate © 2012 Pearson Addison-Wesley

Q 2: Suppose that the consumption function is given by the equation C = 100 + 0. 8 YD, where YD is disposable income. What is the marginal propensity to consume? A 0. 2 B 0. 8 C 2. 0 D 100 © 2012 Pearson Addison-Wesley

Q 2: Suppose that the consumption function is given by the equation C = 100 + 0. 8 YD, where YD is disposable income. What is the marginal propensity to consume? A 0. 2 B 0. 8 C 2. 0 D 100 © 2012 Pearson Addison-Wesley

Q 3: The curve that shows how total planned expenditure changes as real GDP changes is the ____. A equilibrium expenditure curve B consumption function C saving function D aggregate expenditure curve © 2012 Pearson Addison-Wesley

Q 3: The curve that shows how total planned expenditure changes as real GDP changes is the ____. A equilibrium expenditure curve B consumption function C saving function D aggregate expenditure curve © 2012 Pearson Addison-Wesley

Q 4: At the equilibrium expenditure, ____. A there can be unplanned inventory accumulation B purchasers will be prone to bid up prices C aggregate planned expenditure equals the amount of real GDP that is produced D an increase in planned expenditure cannot increase real GDP © 2012 Pearson Addison-Wesley

Q 4: At the equilibrium expenditure, ____. A there can be unplanned inventory accumulation B purchasers will be prone to bid up prices C aggregate planned expenditure equals the amount of real GDP that is produced D an increase in planned expenditure cannot increase real GDP © 2012 Pearson Addison-Wesley

Q 5: If real GDP exceeds aggregate planned expenditure, _____. A investment increases and aggregate planned expenditure increase until it equals real GDP B equilibrium expenditure increases until it equals real GDP C inventories accumulate and real GDP decreases D investment increases and aggregate planned expenditure increases © 2012 Pearson Addison-Wesley

Q 5: If real GDP exceeds aggregate planned expenditure, _____. A investment increases and aggregate planned expenditure increase until it equals real GDP B equilibrium expenditure increases until it equals real GDP C inventories accumulate and real GDP decreases D investment increases and aggregate planned expenditure increases © 2012 Pearson Addison-Wesley

Q 6: The multiplier effect occurs because a change in ____. A the price level induces a change in consumption and investment B autonomous expenditure induces a change in consumption expenditure C induced expenditure creates a change in government expenditure D income taxes induces a change in government expenditure © 2012 Pearson Addison-Wesley

Q 6: The multiplier effect occurs because a change in ____. A the price level induces a change in consumption and investment B autonomous expenditure induces a change in consumption expenditure C induced expenditure creates a change in government expenditure D income taxes induces a change in government expenditure © 2012 Pearson Addison-Wesley

Q 7: The value of the multiplier will increase if the ____. A marginal propensity to import increases B marginal tax rate increases C marginal propensity to consume decreases D marginal propensity to save decreases © 2012 Pearson Addison-Wesley

Q 7: The value of the multiplier will increase if the ____. A marginal propensity to import increases B marginal tax rate increases C marginal propensity to consume decreases D marginal propensity to save decreases © 2012 Pearson Addison-Wesley

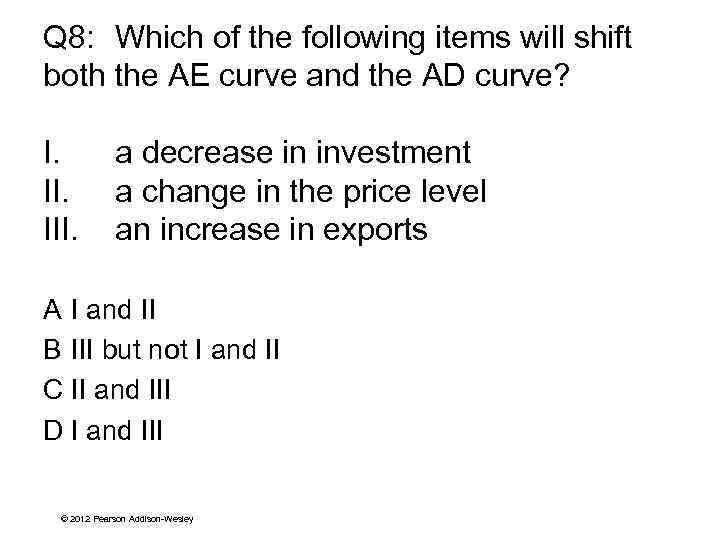

Q 8: Which of the following items will shift both the AE curve and the AD curve? I. III. a decrease in investment a change in the price level an increase in exports A I and II B III but not I and II C II and III D I and III © 2012 Pearson Addison-Wesley

Q 8: Which of the following items will shift both the AE curve and the AD curve? I. III. a decrease in investment a change in the price level an increase in exports A I and II B III but not I and II C II and III D I and III © 2012 Pearson Addison-Wesley

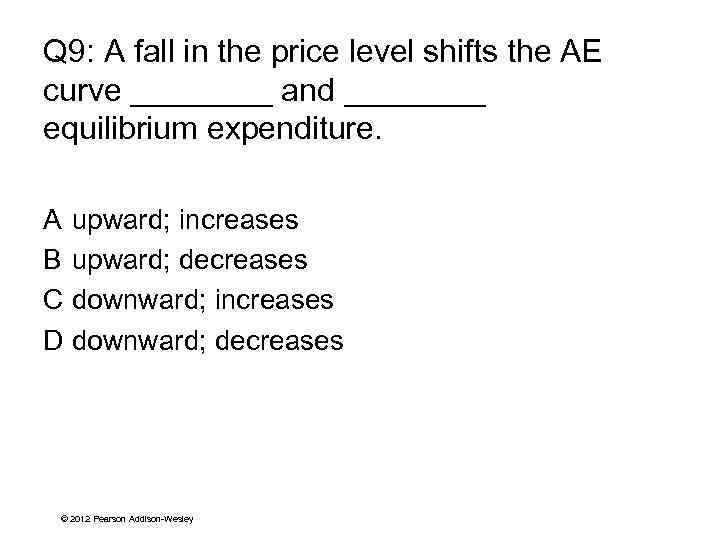

Q 9: A fall in the price level shifts the AE curve ____ and ____ equilibrium expenditure. A upward; increases B upward; decreases C downward; increases D downward; decreases © 2012 Pearson Addison-Wesley

Q 9: A fall in the price level shifts the AE curve ____ and ____ equilibrium expenditure. A upward; increases B upward; decreases C downward; increases D downward; decreases © 2012 Pearson Addison-Wesley

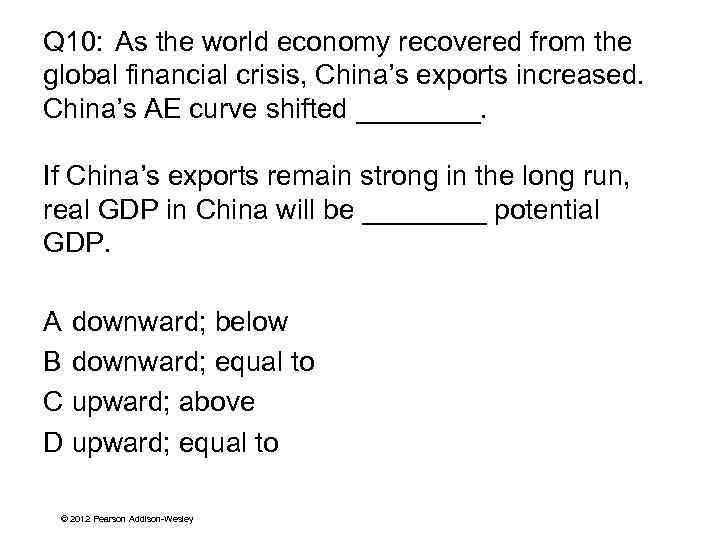

Q 10: As the world economy recovered from the global financial crisis, China’s exports increased. China’s AE curve shifted ____. If China’s exports remain strong in the long run, real GDP in China will be ____ potential GDP. A downward; below B downward; equal to C upward; above D upward; equal to © 2012 Pearson Addison-Wesley

Q 10: As the world economy recovered from the global financial crisis, China’s exports increased. China’s AE curve shifted ____. If China’s exports remain strong in the long run, real GDP in China will be ____ potential GDP. A downward; below B downward; equal to C upward; above D upward; equal to © 2012 Pearson Addison-Wesley

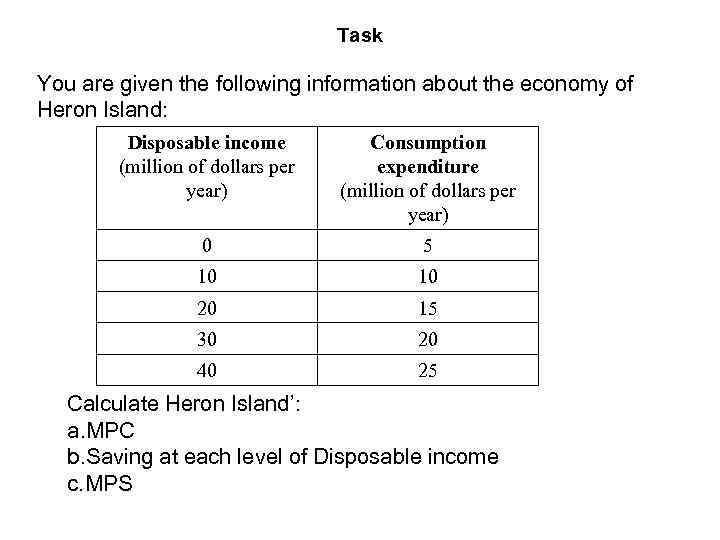

Task You are given the following information about the economy of Heron Island: Disposable income (million of dollars per year) Consumption expenditure (million of dollars per year) 0 5 10 10 20 15 30 20 40 25 Calculate Heron Island’: a. MPC b. Saving at each level of Disposable income c. MPS

Task You are given the following information about the economy of Heron Island: Disposable income (million of dollars per year) Consumption expenditure (million of dollars per year) 0 5 10 10 20 15 30 20 40 25 Calculate Heron Island’: a. MPC b. Saving at each level of Disposable income c. MPS

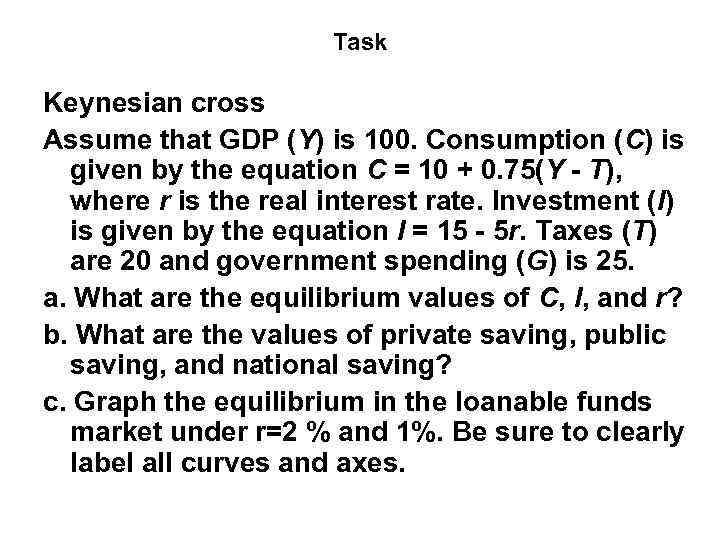

Task Keynesian cross Assume that GDP (Y) is 100. Consumption (C) is given by the equation C = 10 + 0. 75(Y - T), where r is the real interest rate. Investment (I) is given by the equation I = 15 - 5 r. Taxes (T) are 20 and government spending (G) is 25. a. What are the equilibrium values of C, I, and r? b. What are the values of private saving, public saving, and national saving? c. Graph the equilibrium in the loanable funds market under r=2 % and 1%. Be sure to clearly label all curves and axes.

Task Keynesian cross Assume that GDP (Y) is 100. Consumption (C) is given by the equation C = 10 + 0. 75(Y - T), where r is the real interest rate. Investment (I) is given by the equation I = 15 - 5 r. Taxes (T) are 20 and government spending (G) is 25. a. What are the equilibrium values of C, I, and r? b. What are the values of private saving, public saving, and national saving? c. Graph the equilibrium in the loanable funds market under r=2 % and 1%. Be sure to clearly label all curves and axes.

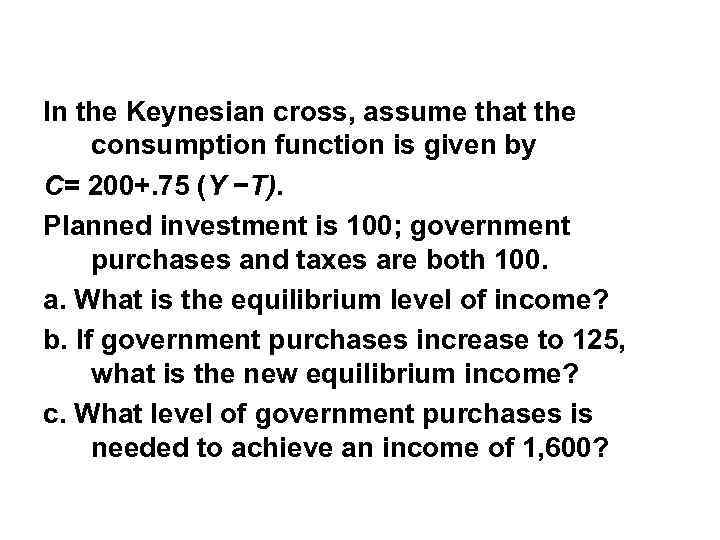

In the Keynesian cross, assume that the consumption function is given by C= 200+. 75 (Y −T). Planned investment is 100; government purchases and taxes are both 100. a. What is the equilibrium level of income? b. If government purchases increase to 125, what is the new equilibrium income? c. What level of government purchases is needed to achieve an income of 1, 600?

In the Keynesian cross, assume that the consumption function is given by C= 200+. 75 (Y −T). Planned investment is 100; government purchases and taxes are both 100. a. What is the equilibrium level of income? b. If government purchases increase to 125, what is the new equilibrium income? c. What level of government purchases is needed to achieve an income of 1, 600?

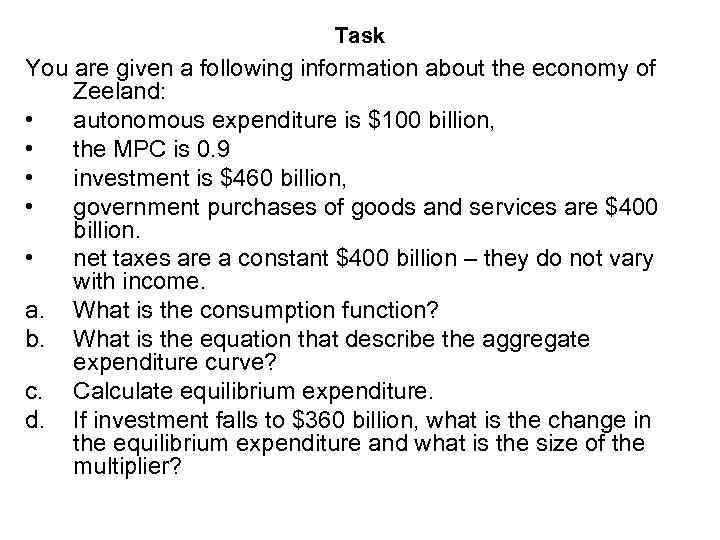

Task You are given a following information about the economy of Zeeland: • autonomous expenditure is $100 billion, • the MPC is 0. 9 • investment is $460 billion, • government purchases of goods and services are $400 billion. • net taxes are a constant $400 billion – they do not vary with income. a. What is the consumption function? b. What is the equation that describe the aggregate expenditure curve? c. Calculate equilibrium expenditure. d. If investment falls to $360 billion, what is the change in the equilibrium expenditure and what is the size of the multiplier?

Task You are given a following information about the economy of Zeeland: • autonomous expenditure is $100 billion, • the MPC is 0. 9 • investment is $460 billion, • government purchases of goods and services are $400 billion. • net taxes are a constant $400 billion – they do not vary with income. a. What is the consumption function? b. What is the equation that describe the aggregate expenditure curve? c. Calculate equilibrium expenditure. d. If investment falls to $360 billion, what is the change in the equilibrium expenditure and what is the size of the multiplier?

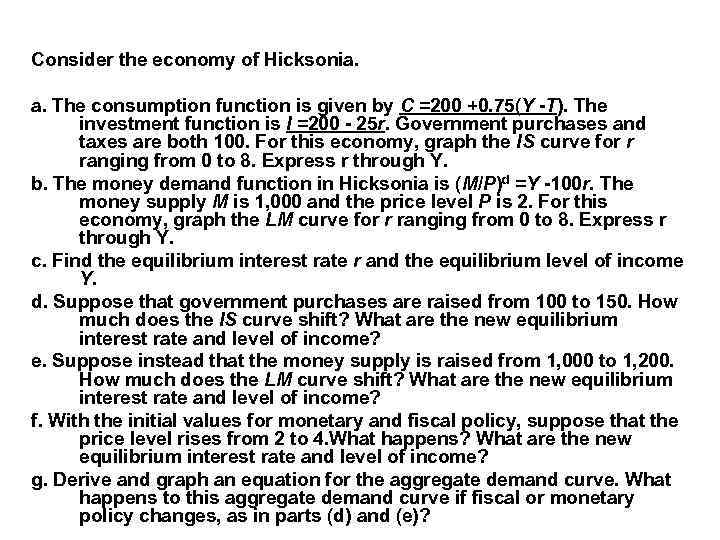

Consider the economy of Hicksonia. a. The consumption function is given by C =200 +0. 75(Y -T). The investment function is I =200 - 25 r. Government purchases and taxes are both 100. For this economy, graph the IS curve for r ranging from 0 to 8. Express r through Y. b. The money demand function in Hicksonia is (M/P)d =Y -100 r. The money supply M is 1, 000 and the price level P is 2. For this economy, graph the LM curve for r ranging from 0 to 8. Express r through Y. c. Find the equilibrium interest rate r and the equilibrium level of income Y. d. Suppose that government purchases are raised from 100 to 150. How much does the IS curve shift? What are the new equilibrium interest rate and level of income? e. Suppose instead that the money supply is raised from 1, 000 to 1, 200. How much does the LM curve shift? What are the new equilibrium interest rate and level of income? f. With the initial values for monetary and fiscal policy, suppose that the price level rises from 2 to 4. What happens? What are the new equilibrium interest rate and level of income? g. Derive and graph an equation for the aggregate demand curve. What happens to this aggregate demand curve if fiscal or monetary policy changes, as in parts (d) and (e)?

Consider the economy of Hicksonia. a. The consumption function is given by C =200 +0. 75(Y -T). The investment function is I =200 - 25 r. Government purchases and taxes are both 100. For this economy, graph the IS curve for r ranging from 0 to 8. Express r through Y. b. The money demand function in Hicksonia is (M/P)d =Y -100 r. The money supply M is 1, 000 and the price level P is 2. For this economy, graph the LM curve for r ranging from 0 to 8. Express r through Y. c. Find the equilibrium interest rate r and the equilibrium level of income Y. d. Suppose that government purchases are raised from 100 to 150. How much does the IS curve shift? What are the new equilibrium interest rate and level of income? e. Suppose instead that the money supply is raised from 1, 000 to 1, 200. How much does the LM curve shift? What are the new equilibrium interest rate and level of income? f. With the initial values for monetary and fiscal policy, suppose that the price level rises from 2 to 4. What happens? What are the new equilibrium interest rate and level of income? g. Derive and graph an equation for the aggregate demand curve. What happens to this aggregate demand curve if fiscal or monetary policy changes, as in parts (d) and (e)?