7995478a192d4bcfa9177b5be4f6b065.ppt

- Количество слайдов: 27

TÜRK EKONOMİ BANKASI A. Ş. 2007 1 st. Q CONSOLIDATED RESULTS

BNP PARIBAS JOINT VENTURE Outline -TEB Financial Group -Türk Ekonomi Bankası -Financial Highlights Türk Ekonomi Bankası A. Ş. 2

TEB Financial Group of Companies

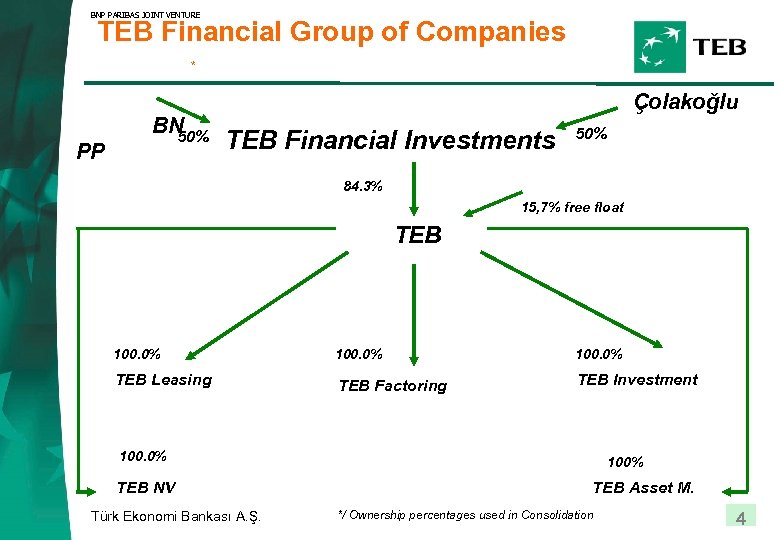

BNP PARIBAS JOINT VENTURE TEB Financial Group of Companies * PP BN 50% Çolakoğlu TEB Financial Investments 50% 84. 3% 15, 7% free float TEB 100. 0% TEB Leasing TEB Factoring TEB Investment 100. 0% TEB NV Türk Ekonomi Bankası A. Ş. 100% TEB Asset M. */ Ownership percentages used in Consolidation 4

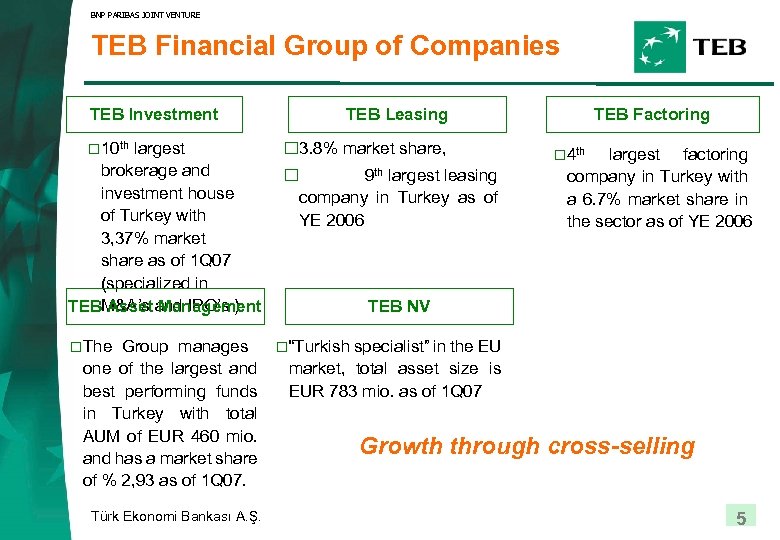

BNP PARIBAS JOINT VENTURE TEB Financial Group of Companies TEB Investment 10 th largest brokerage and investment house of Turkey with 3, 37% market share as of 1 Q 07 (specialized in TEBM&A’s and IPO’s ) Asset Management The Group manages one of the largest and best performing funds in Turkey with total AUM of EUR 460 mio. and has a market share of % 2, 93 as of 1 Q 07. Türk Ekonomi Bankası A. Ş. TEB Leasing 3. 8% market share, 9 th largest leasing company in Turkey as of YE 2006 TEB Factoring 4 th largest factoring company in Turkey with a 6. 7% market share in the sector as of YE 2006 TEB NV “Turkish specialist” in the EU market, total asset size is EUR 783 mio. as of 1 Q 07 Growth through cross-selling 5

Türk Ekonomi Bankası

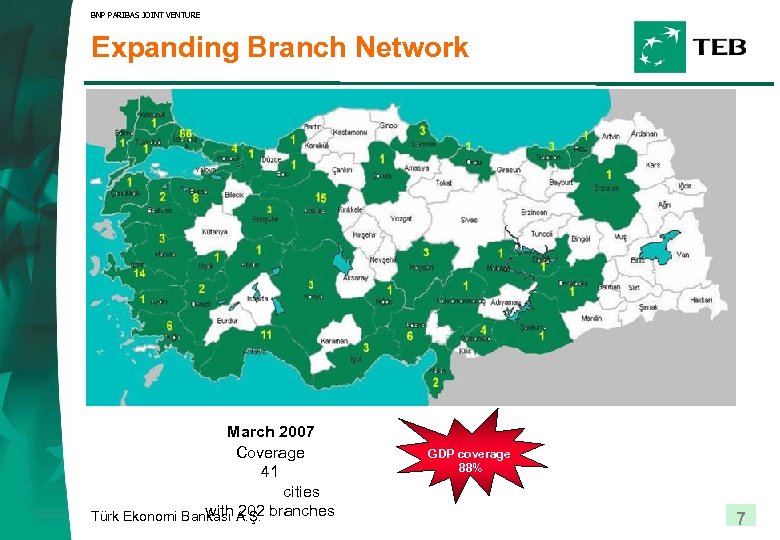

BNP PARIBAS JOINT VENTURE Expanding Branch Network March 2007 Coverage 41 cities with 202 Türk Ekonomi Bankası A. Ş. branches GDP coverage 88% 7

BNP PARIBAS JOINT VENTURE Corporate Banking Ø Multinationals and corporates with over US$ 50 mio annual turnover Ø Contribution to results (as of 1 Q 07): § 27. 85 % of loans § 24. 71 % of deposits § 34. 10 % of customer contribution Leader in cash management services Ø TEB Cash Management was awarded "The Most Innovative and Cost-effective Payments Processing Solution Award" in Excellence, in Payments Innovation Awards competition organized by the European Payments Consulting Association (EPCA). Project Finance solutions Ø Ø Ø Türk Ekonomi Bankası A. Ş. 8

BNP PARIBAS JOINT VENTURE International Trade Ø 3 trade Ø centers in cooperation with BNPP trade centers network Success story of synergy: Turkish Desks in Algeria, Ukraine and Egypt Share of TEB in foreign trade (mio US$, %) (March 2007) Ø Ø Ø Undersecretariat of Foreign Trade awarded TEB with “Support of Export Award” Türk Ekonomi Bankası A. Ş. 9

BNP PARIBAS JOINT VENTURE Commercial Banking Türk Ekonomi Bankası A. Ş. Solution Partner in SMEs 1

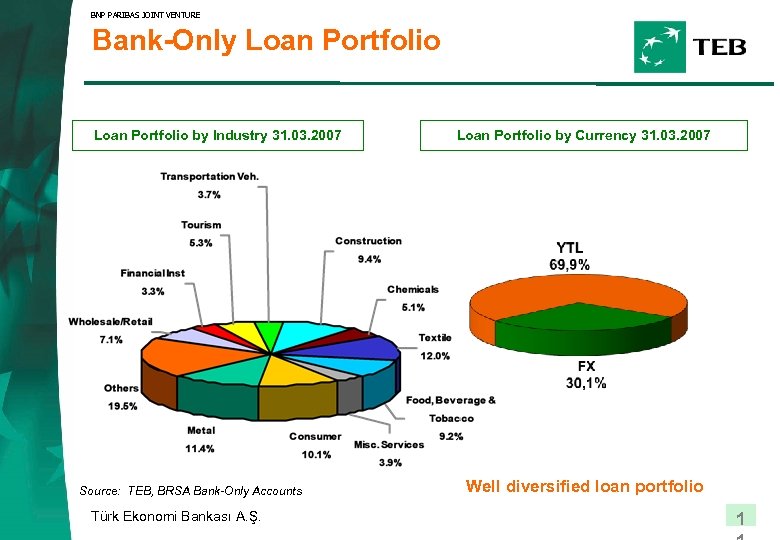

BNP PARIBAS JOINT VENTURE Bank-Only Loan Portfolio by Industry 31. 03. 2007 Source: TEB, BRSA Bank-Only Accounts Türk Ekonomi Bankası A. Ş. Loan Portfolio by Currency 31. 03. 2007 Well diversified loan portfolio 1

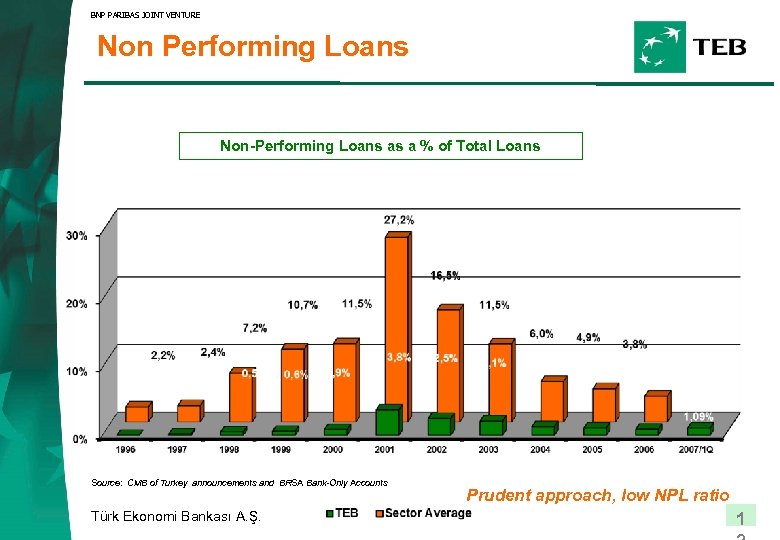

BNP PARIBAS JOINT VENTURE Non Performing Loans Non-Performing Loans as a % of Total Loans Source: CMB of Turkey announcements and BRSA Bank-Only Accounts Türk Ekonomi Bankası A. Ş. Prudent approach, low NPL ratio 1

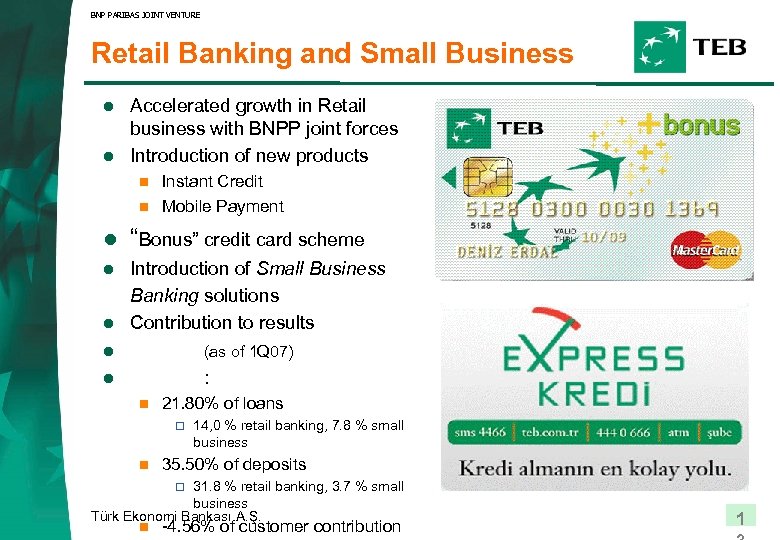

BNP PARIBAS JOINT VENTURE Retail Banking and Small Business l l Accelerated growth in Retail business with BNPP joint forces Introduction of new products n n Instant Credit Mobile Payment l “Bonus” credit card scheme l Introduction of Small Business Banking solutions Contribution to results l l (as of 1 Q 07) l : n 21. 80% of loans o n 14, 0 % retail banking, 7. 8 % small business 35. 50% of deposits 31. 8 % retail banking, 3. 7 % small business Türk Ekonomi Bankası A. Ş. o n -4. 56% of customer contribution 1

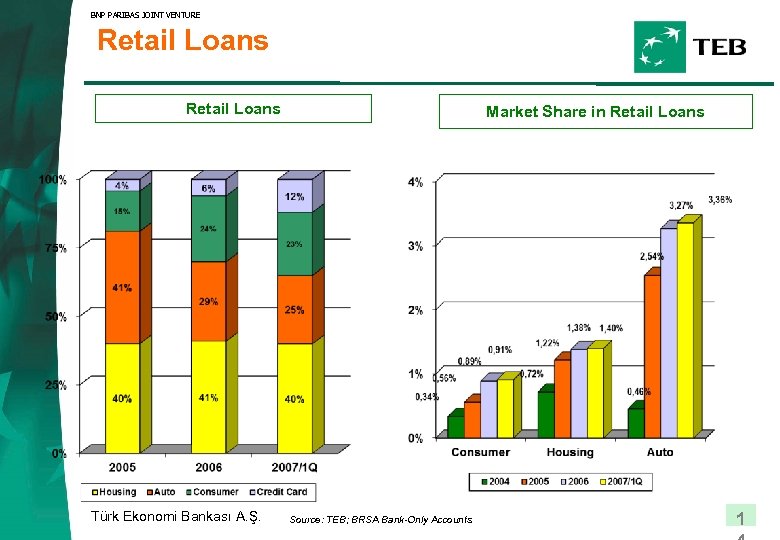

BNP PARIBAS JOINT VENTURE Retail Loans Türk Ekonomi Bankası A. Ş. Market Share in Retail Loans Source: TEB; BRSA Bank-Only Accounts 1

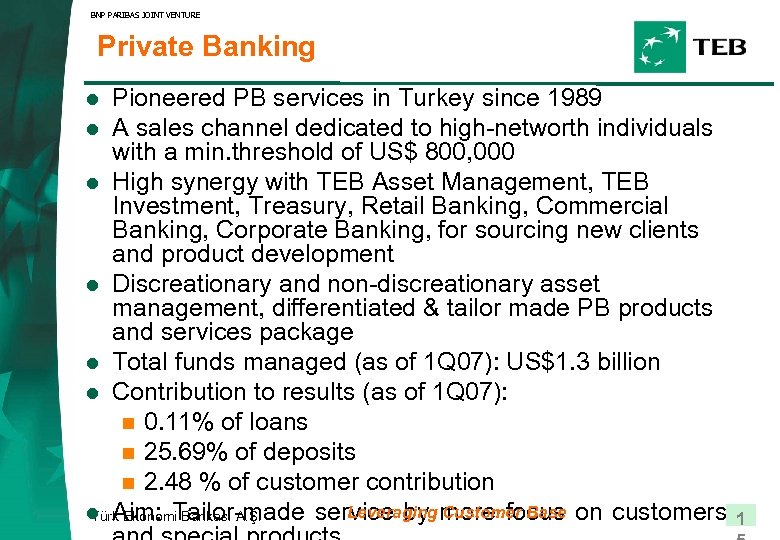

BNP PARIBAS JOINT VENTURE Private Banking Pioneered PB services in Turkey since 1989 l A sales channel dedicated to high-networth individuals with a min. threshold of US$ 800, 000 l High synergy with TEB Asset Management, TEB Investment, Treasury, Retail Banking, Commercial Banking, Corporate Banking, for sourcing new clients and product development l Discreationary and non-discreationary asset management, differentiated & tailor made PB products and services package l Total funds managed (as of 1 Q 07): US$1. 3 billion l Contribution to results (as of 1 Q 07): n 0. 11% of loans n 25. 69% of deposits n 2. 48 % of customer contribution Leveraging Customer Base l Aim: Tailor-made service by more focus on customers Türk Ekonomi Bankası A. Ş. l 1

Financial Highlights

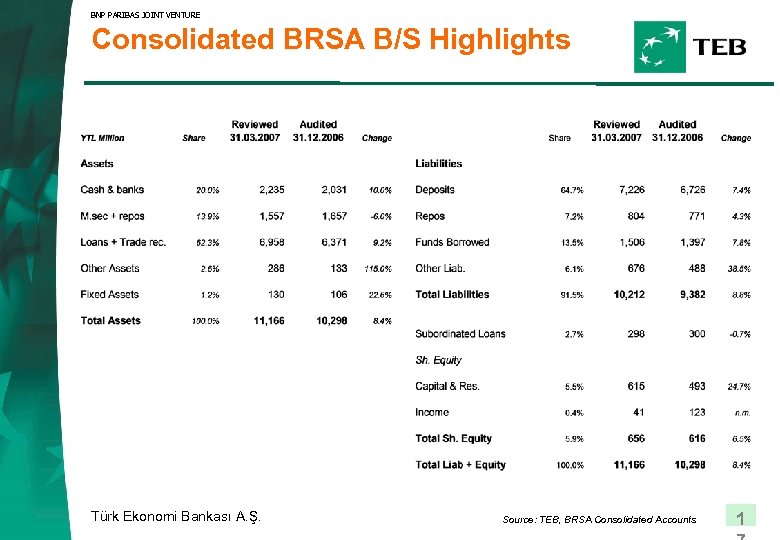

BNP PARIBAS JOINT VENTURE Consolidated BRSA B/S Highlights Türk Ekonomi Bankası A. Ş. Source: TEB, BRSA Consolidated Accounts 1

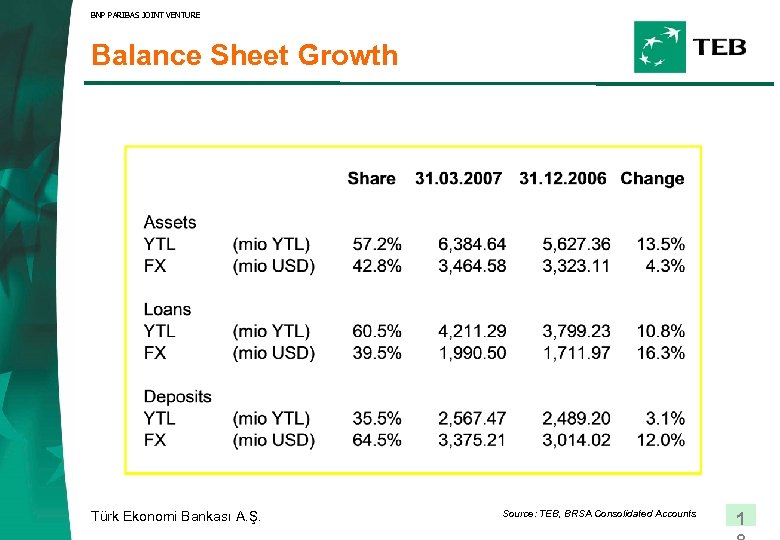

BNP PARIBAS JOINT VENTURE Balance Sheet Growth Türk Ekonomi Bankası A. Ş. Source: TEB, BRSA Consolidated Accounts 1

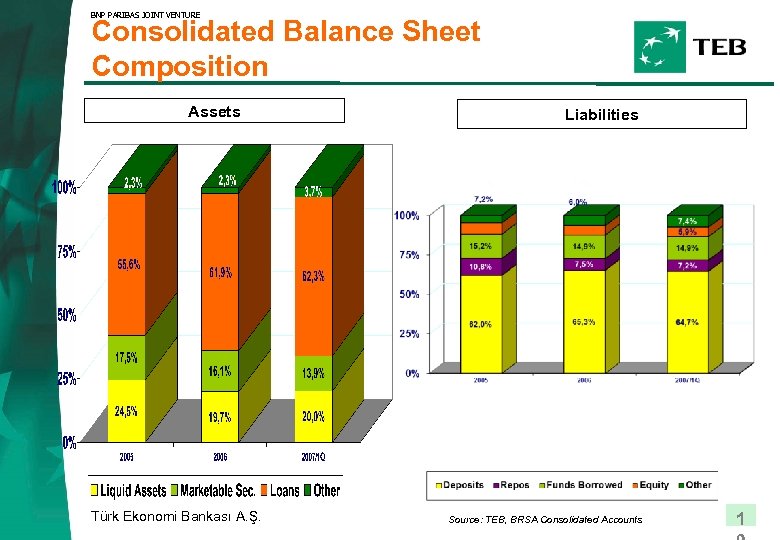

BNP PARIBAS JOINT VENTURE Consolidated Balance Sheet Composition Assets Türk Ekonomi Bankası A. Ş. Liabilities Source: TEB, BRSA Consolidated Accounts 1

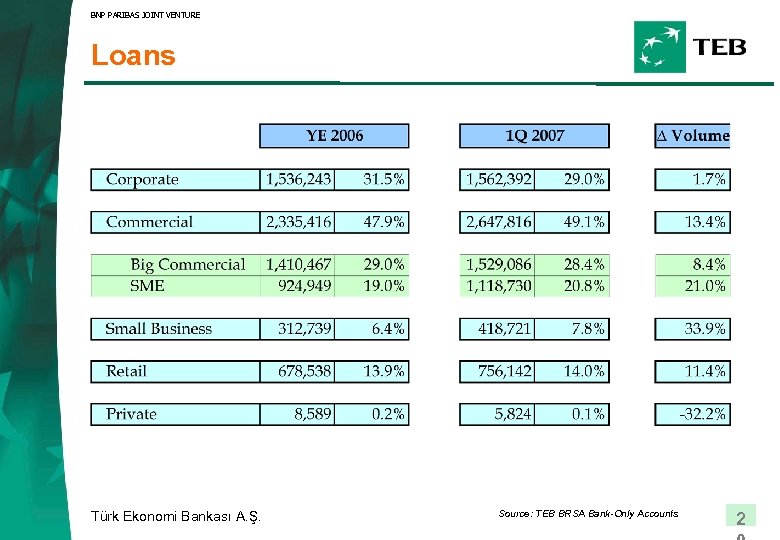

BNP PARIBAS JOINT VENTURE Loans Türk Ekonomi Bankası A. Ş. Source: TEB BRSA Bank-Only Accounts 2

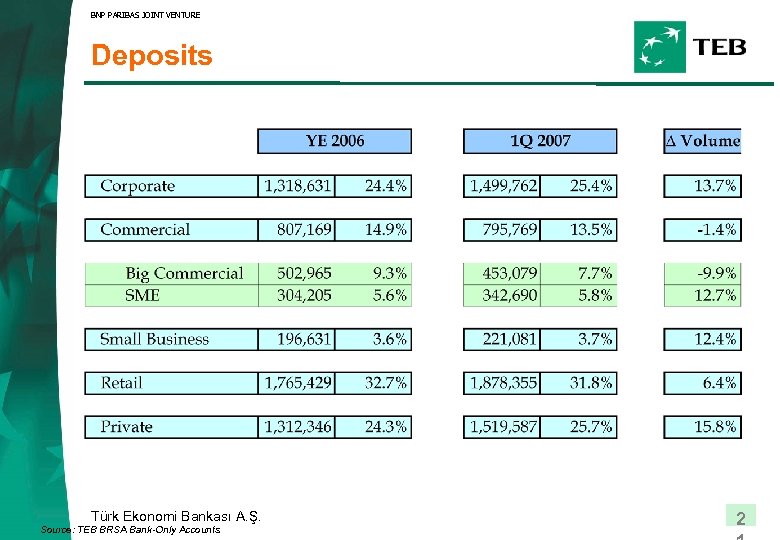

BNP PARIBAS JOINT VENTURE Deposits Türk Ekonomi Bankası A. Ş. Source: TEB BRSA Bank-Only Accounts 2

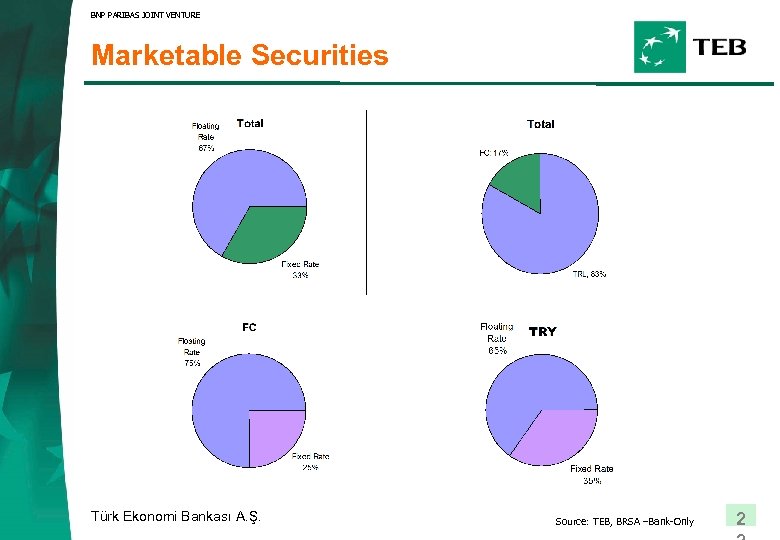

BNP PARIBAS JOINT VENTURE Marketable Securities Türk Ekonomi Bankası A. Ş. Source: TEB, BRSA –Bank-Only 2

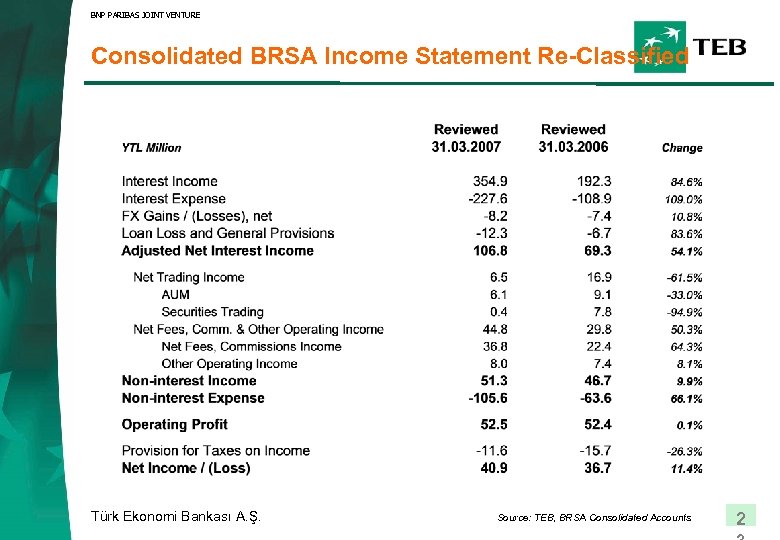

BNP PARIBAS JOINT VENTURE Consolidated BRSA Income Statement Re-Classified Türk Ekonomi Bankası A. Ş. Source: TEB, BRSA Consolidated Accounts 2

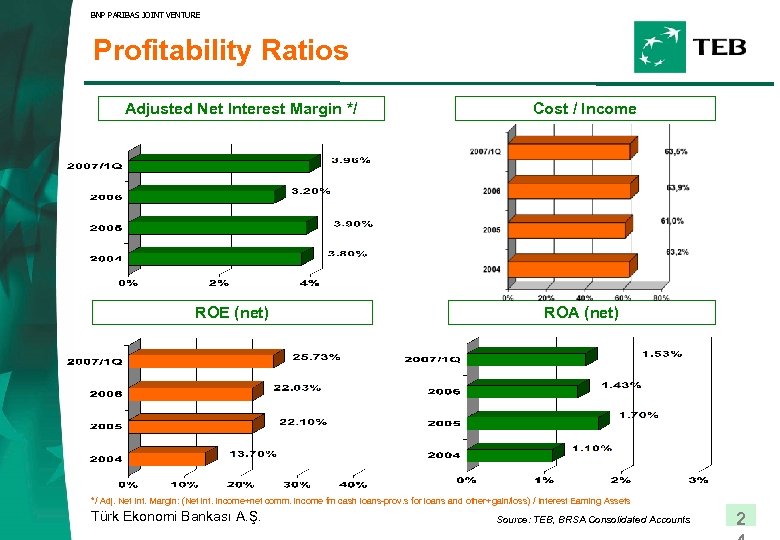

BNP PARIBAS JOINT VENTURE Profitability Ratios Adjusted Net Interest Margin */ ROE (net) Cost / Income ROA (net) */ Adj. Net Int. Margin: (Net int. income+net comm. income fm cash loans-prov. s for loans and other+gain/loss) / Interest Earning Assets Türk Ekonomi Bankası A. Ş. Source: TEB, BRSA Consolidated Accounts 2

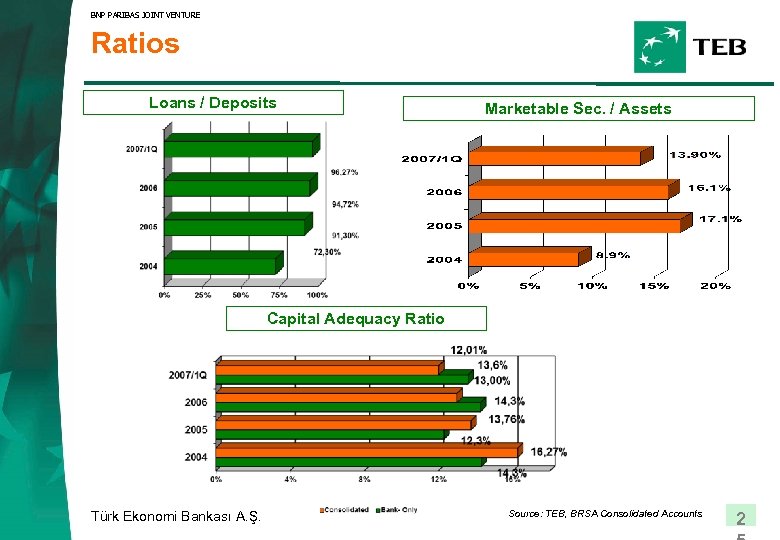

BNP PARIBAS JOINT VENTURE Ratios Loans / Deposits Marketable Sec. / Assets Capital Adequacy Ratio Türk Ekonomi Bankası A. Ş. Source: TEB, BRSA Consolidated Accounts 2

BNP PARIBAS JOINT VENTURE Contact Details Investor Relations +90 212 2512121 http: //www. teb. com. tr l Levent Çelebioğlu (ext. 1341) Levent. Celebioglu@teb. com. tr l Çiğdem Başaran (ext. 1532) Cigdem. Basaran@teb. com. tr Türk Ekonomi Bankası A. Ş. 2

BNP PARIBAS JOINT VENTURE Disclaimer The information and opinions obtained in this document have been compiled or arrived at by TEB from sources believed to be reliable, but no representation or warranty is made as to their accuracy, completeness or correctness. All opinions and estimates contained in this document constitute TEB’s judgement as of the date of this document and are subject to change without notice. This document is published for the assistance of the recipients, but is not to be relied upon as authoritative or taken in subtitution for the exercise of judgement by any recipient. TEB does not accept any liability for any direct or consequential loss arising from any use of this document or its contents. This document is strictly confidential and may not be reproduced, distributed or published for any purpose. Türk Ekonomi Bankası A. Ş. 2

7995478a192d4bcfa9177b5be4f6b065.ppt