12d785726a1622757b8967ed7c19f297.ppt

- Количество слайдов: 24

Tunneling or Propping: Evidence from Connected Transactions in China By Winnie Peng, K. C. John Wei and Zhishu Yang Presenter: Winnie Peng, HKUST NTUICF, December, 2006

Tunneling or Propping: Evidence from Connected Transactions in China By Winnie Peng, K. C. John Wei and Zhishu Yang Presenter: Winnie Peng, HKUST NTUICF, December, 2006

Outline 1. Research motivation 2. Hypotheses development 3. Data and methodology 4. Empirical results 5. Conclusion 1

Outline 1. Research motivation 2. Hypotheses development 3. Data and methodology 4. Empirical results 5. Conclusion 1

Research Motivation l A model in Friedman et al. (2003) The controlling shareholder’s optimal choice: – A moderate adverse shock => Propping – No shock or shock is too small => Tunneling l Empirical results of Friedman et al. (2003) – Propping exists during the Asian financial crisis – Issuing debt commits propping easily in pyramid groups l This paper provides direct evidence of propping and tunneling, by studying connected transactions in China 2

Research Motivation l A model in Friedman et al. (2003) The controlling shareholder’s optimal choice: – A moderate adverse shock => Propping – No shock or shock is too small => Tunneling l Empirical results of Friedman et al. (2003) – Propping exists during the Asian financial crisis – Issuing debt commits propping easily in pyramid groups l This paper provides direct evidence of propping and tunneling, by studying connected transactions in China 2

Research Motivation (cont’d) l Why China? – Unique ownership structure of Chinese firms • Large number of Listed firms are “carve outs” from SOEs => Connected transactions are common (84. 6% of listed firms in 1997, 93. 2% in 2000) – Unique stock market regulations in China • Risk of delisting (ST, PT, *ST) and losing rights to issue new equity => Enable us to differentiate firms in sound financial conditions from poor financial conditions 3

Research Motivation (cont’d) l Why China? – Unique ownership structure of Chinese firms • Large number of Listed firms are “carve outs” from SOEs => Connected transactions are common (84. 6% of listed firms in 1997, 93. 2% in 2000) – Unique stock market regulations in China • Risk of delisting (ST, PT, *ST) and losing rights to issue new equity => Enable us to differentiate firms in sound financial conditions from poor financial conditions 3

Research Motivation (cont’d) l Connected transactions in China – A connected transaction is defined as any transaction between a firm (or any of its subsidiaries) and a connected person. A listed firm’s major connected persons include its shareholders, its shareholders’ affiliates and its own affiliates. – CSRC: Connected transactions of a total value greater than RMB 1 million (US$121, 000) or 0. 5% of net assets, whichever is higher, must be reported to the exchange within two working days following the signing of the contract. 4

Research Motivation (cont’d) l Connected transactions in China – A connected transaction is defined as any transaction between a firm (or any of its subsidiaries) and a connected person. A listed firm’s major connected persons include its shareholders, its shareholders’ affiliates and its own affiliates. – CSRC: Connected transactions of a total value greater than RMB 1 million (US$121, 000) or 0. 5% of net assets, whichever is higher, must be reported to the exchange within two working days following the signing of the contract. 4

Hypotheses development l Tunneling: to extract cash from listed firms, transfer assets from the listed firm to other firms under the same controlling shareholder, buy low/sell high, etc. – Jian and Wong (2003): a group-controlled firm within the raw material industry in China is more likely to use connected transactions to tunnel firm value. – Liu and Lu (2004): earnings management in Chinese listed firms is mainly induced by controlling owner’s tunneling activity. l Hypothesis 1: When a listed firm is in sound financial conditions, the market will react negatively to the announcements of connected transactions. 5

Hypotheses development l Tunneling: to extract cash from listed firms, transfer assets from the listed firm to other firms under the same controlling shareholder, buy low/sell high, etc. – Jian and Wong (2003): a group-controlled firm within the raw material industry in China is more likely to use connected transactions to tunnel firm value. – Liu and Lu (2004): earnings management in Chinese listed firms is mainly induced by controlling owner’s tunneling activity. l Hypothesis 1: When a listed firm is in sound financial conditions, the market will react negatively to the announcements of connected transactions. 5

Hypotheses development (cont’d) l Propping: to inject cash to listed firms, inject good asset with bad asset in return, buy high/sell low etc. – Bai, Liu and Song (2004): ST firms in China have generated 31. 8 percentage points of abnormal stock market performance over the two years after being designated. l Hypothesis 2: When a listed firm is in poor financial conditions, the market will react positively to announcements of connected transactions. 6

Hypotheses development (cont’d) l Propping: to inject cash to listed firms, inject good asset with bad asset in return, buy high/sell low etc. – Bai, Liu and Song (2004): ST firms in China have generated 31. 8 percentage points of abnormal stock market performance over the two years after being designated. l Hypothesis 2: When a listed firm is in poor financial conditions, the market will react positively to announcements of connected transactions. 6

Data and methodology l l Sample: 1, 311 connected transactions and 669 nonconnected transactions from 787 non-financial firms listed on the SHSE and SZSE during the 1998 -2004 period Transaction information from Shenzhen GTA Information Technology Corporation, Beijing Sinofin Information Service, and Shenzhen Bloomberg Database Corporation l Accounting information from the Genius database l Stock information from the CSMAR Database 7

Data and methodology l l Sample: 1, 311 connected transactions and 669 nonconnected transactions from 787 non-financial firms listed on the SHSE and SZSE during the 1998 -2004 period Transaction information from Shenzhen GTA Information Technology Corporation, Beijing Sinofin Information Service, and Shenzhen Bloomberg Database Corporation l Accounting information from the Genius database l Stock information from the CSMAR Database 7

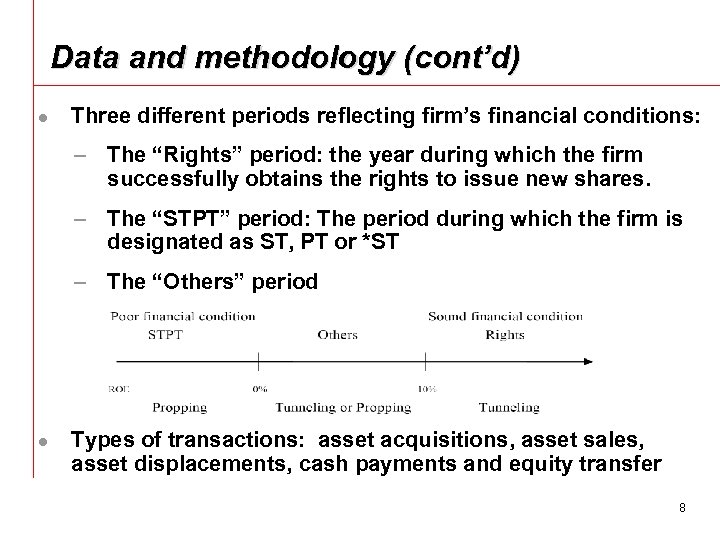

Data and methodology (cont’d) l Three different periods reflecting firm’s financial conditions: – The “Rights” period: the year during which the firm successfully obtains the rights to issue new shares. – The “STPT” period: The period during which the firm is designated as ST, PT or *ST – The “Others” period l Types of transactions: asset acquisitions, asset sales, asset displacements, cash payments and equity transfer 8

Data and methodology (cont’d) l Three different periods reflecting firm’s financial conditions: – The “Rights” period: the year during which the firm successfully obtains the rights to issue new shares. – The “STPT” period: The period during which the firm is designated as ST, PT or *ST – The “Others” period l Types of transactions: asset acquisitions, asset sales, asset displacements, cash payments and equity transfer 8

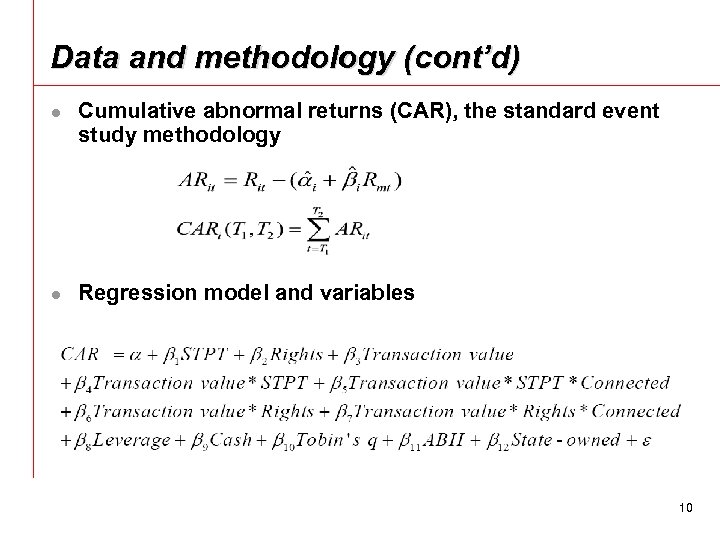

Data and methodology (cont’d) l l Cumulative abnormal returns (CAR), the standard event study methodology Regression model and variables 10

Data and methodology (cont’d) l l Cumulative abnormal returns (CAR), the standard event study methodology Regression model and variables 10

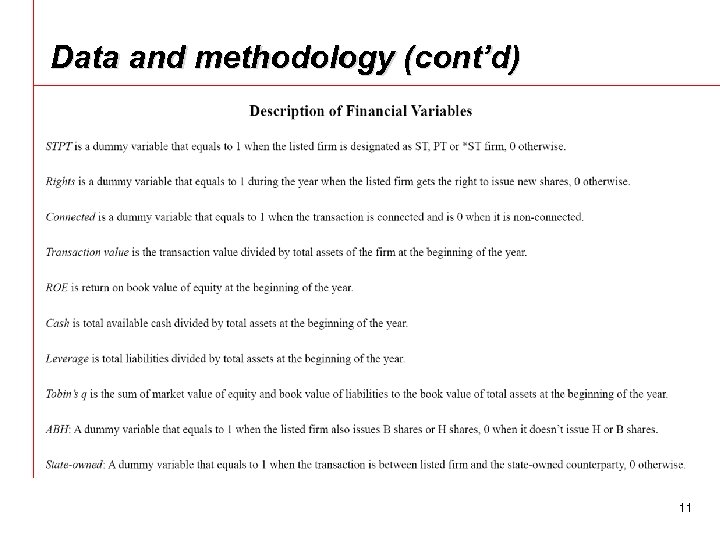

Data and methodology (cont’d) 11

Data and methodology (cont’d) 11

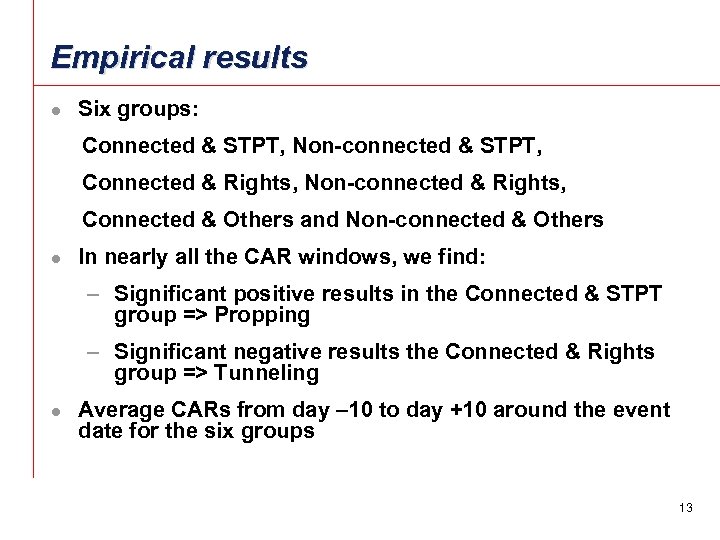

Empirical results l Six groups: Connected & STPT, Non-connected & STPT, Connected & Rights, Non-connected & Rights, Connected & Others and Non-connected & Others l In nearly all the CAR windows, we find: – Significant positive results in the Connected & STPT group => Propping – Significant negative results the Connected & Rights group => Tunneling l Average CARs from day – 10 to day +10 around the event date for the six groups 13

Empirical results l Six groups: Connected & STPT, Non-connected & STPT, Connected & Rights, Non-connected & Rights, Connected & Others and Non-connected & Others l In nearly all the CAR windows, we find: – Significant positive results in the Connected & STPT group => Propping – Significant negative results the Connected & Rights group => Tunneling l Average CARs from day – 10 to day +10 around the event date for the six groups 13

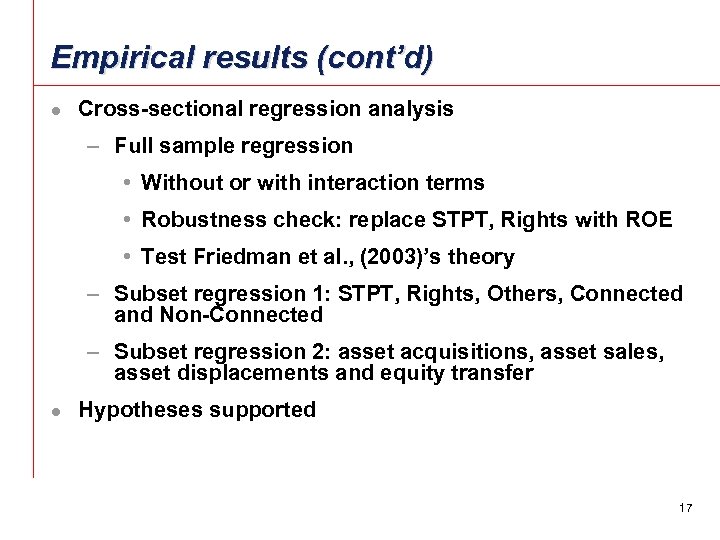

Empirical results (cont’d) l Cross-sectional regression analysis – Full sample regression • Without or with interaction terms • Robustness check: replace STPT, Rights with ROE • Test Friedman et al. , (2003)’s theory – Subset regression 1: STPT, Rights, Others, Connected and Non-Connected – Subset regression 2: asset acquisitions, asset sales, asset displacements and equity transfer l Hypotheses supported 17

Empirical results (cont’d) l Cross-sectional regression analysis – Full sample regression • Without or with interaction terms • Robustness check: replace STPT, Rights with ROE • Test Friedman et al. , (2003)’s theory – Subset regression 1: STPT, Rights, Others, Connected and Non-Connected – Subset regression 2: asset acquisitions, asset sales, asset displacements and equity transfer l Hypotheses supported 17

Conclusion l l A negative market reaction is found towards the connected transactions when a listed firm is in sound financial conditions, which indicates the tunneling view. A positive market reaction is found towards the connected transactions when a listed firm is in poor financial conditions, which indicates the propping view. The non-connected transactions don’t show quite different results during the two different conditions. No significant difference among the four types of transactions. 22

Conclusion l l A negative market reaction is found towards the connected transactions when a listed firm is in sound financial conditions, which indicates the tunneling view. A positive market reaction is found towards the connected transactions when a listed firm is in poor financial conditions, which indicates the propping view. The non-connected transactions don’t show quite different results during the two different conditions. No significant difference among the four types of transactions. 22

Thank You!

Thank You!