05329b873f923587621b43dbc2f76f5b.ppt

- Количество слайдов: 33

TT 2003 RESULTS BRIEFING

CORPORATE PROFILE

TT WHO WE ARE • One of the largest international traders of electrical and electronic goods in Singapore with integrated logistics capabilities • Specialist in global emerging markets – global network spanning 60 countries • Brand development – house brand AKIRA

OUR BUSINESS TT Two Core Segments: • Retail & Distribution – Public & Distributors / Dealers • Trading – Sourcing and onward selling of electrical and electronics products to trading customers Two Supplementary Segments: • Third-party Warehousing & Services Logistics – Inventory management, cargo transportation, custom documentation, etc for clients; – State-of-the-art Automated Storage and Retrieval System

TT OUR BUSINESS • Knowledge-based Business • Brand Builder • Diversified Global Operations, mostly in niche markets • Integrated Trade and Logistics Solution provider

TT OUR COMPETITIVE STRENGTHS • Diversified Global Market – More than 60 countries worldwide – Diversification, the corner stone of our risk management • Niche in serving emerging market economies – Higher economic growth and household formation rate – Stronghold in Indochina – Strong pioneering spirit

TT OUR COMPETITIVE STRENGTHS • Flexibility of Sourcing – More than 100 suppliers globally – Many established principals • Complementary core businesses – Efficient one-stop logistics capabilities – Total supply chain management

TT SOME OF OUR KEY MARKETS

OUR NETWORK OF SUBSIDIARIES TT • Distribution Network (Subsidiaries): – – – – Brunei Cambodia East and West Malaysia Philippines Myanmar Singapore Emirate of Dubai – Vietnam

TT OUR GLOBAL TRADING / RETAIL NETWORKS • Trading Network: – – – ASEAN East Asia Africa and Middle East CIS, Russia and Eastern Europe Others • Retail Network: – Cambodia, Myanmar and Singapore • Comprehensive Range

TT THE WORLD IS OUR MARKET Localized Assembling & ODM Suppliers - Int’l brands 0 - 9, 000 models - 100 suppliers Market Information Customer - > 60 countries s - Diversified markets Loyalty - 80% repeat Bulk Supply TT Trade & Logistics Hub for customers and Customised services

TT FY 2003 FULL YEAR RESULTS

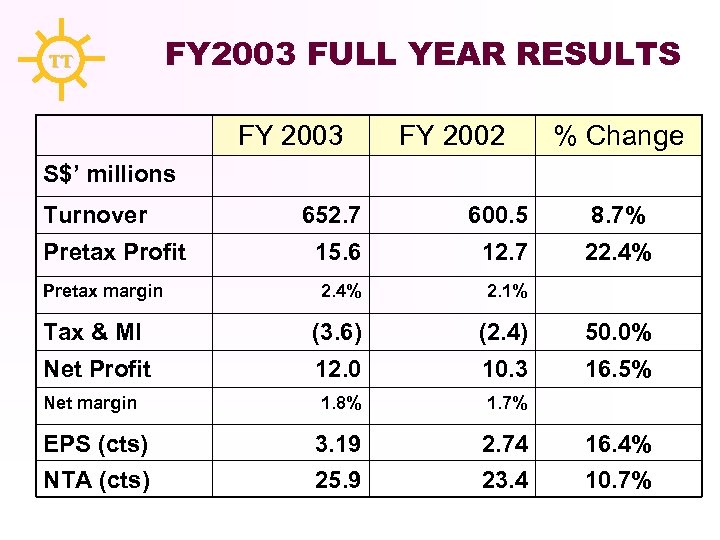

TT FY 2003 FULL YEAR RESULTS FY 2003 FY 2002 % Change S$’ millions Turnover 652. 7 600. 5 8. 7% 15. 6 12. 7 22. 4% 2. 1% Tax & MI (3. 6) (2. 4) 50. 0% Net Profit 12. 0 10. 3 16. 5% 1. 8% 1. 7% 3. 19 25. 9 2. 74 23. 4 Pretax Profit Pretax margin Net margin EPS (cts) NTA (cts) 16. 4% 10. 7%

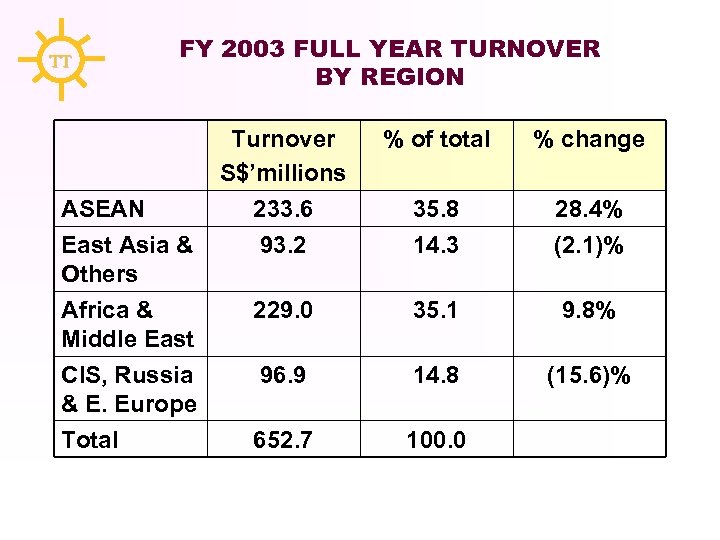

TT FY 2003 FULL YEAR TURNOVER BY REGION Turnover S$’millions ASEAN 233. 6 East Asia & 93. 2 Others Africa & Middle East CIS, Russia & E. Europe Total % of total % change 35. 8 14. 3 28. 4% (2. 1)% 229. 0 35. 1 9. 8% 96. 9 14. 8 (15. 6)% 652. 7 100. 0

TT FY 2003 FULL YEAR RESULTS HIGHLIGHTS • Turnover up 8. 7% – Broad-based growth, up in all regions except CIS, Russia & Eastern Europe • Overall gross margin up 1%, contributed both by better-priced branded electronics products and higher sales of “AKIRA” products. • AKIRA up 76. 2% – Sales increased to $136. 0 M from $77. 2 M – AKIRA contributed 21. 7% of sales (vs 13. 4% for 2002)

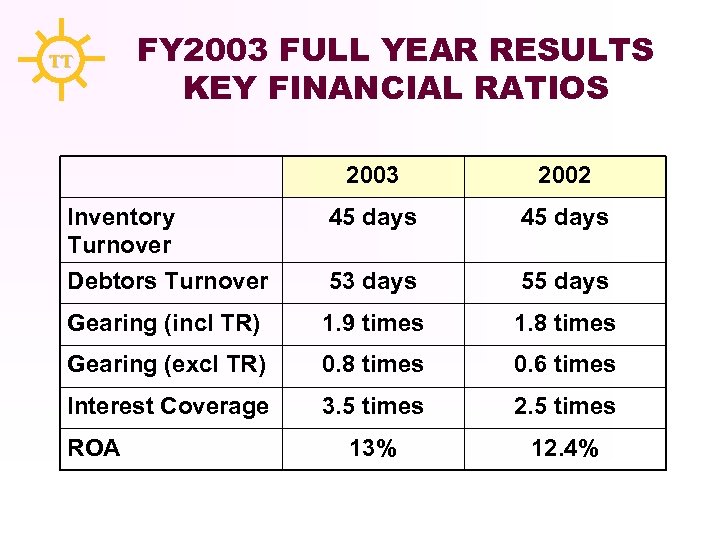

TT FY 2003 FULL YEAR RESULTS KEY FINANCIAL RATIOS 2003 2002 Inventory Turnover 45 days Debtors Turnover 53 days 55 days Gearing (incl TR) 1. 9 times 1. 8 times Gearing (excl TR) 0. 8 times 0. 6 times Interest Coverage 3. 5 times 2. 5 times 13% 12. 4% ROA

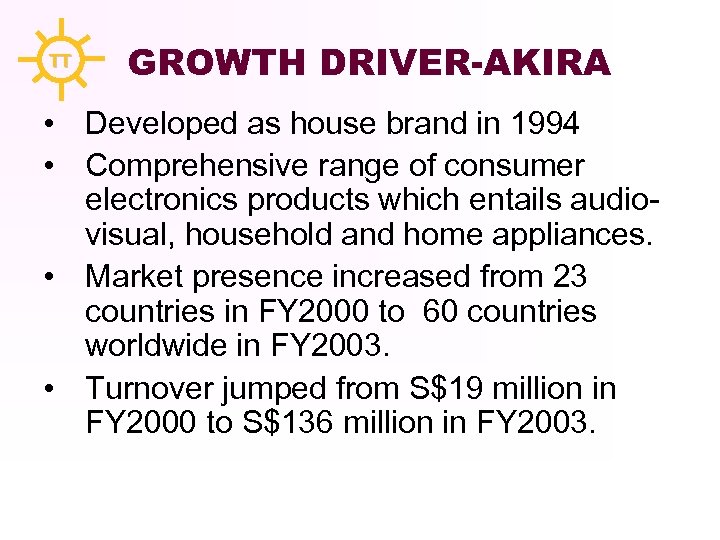

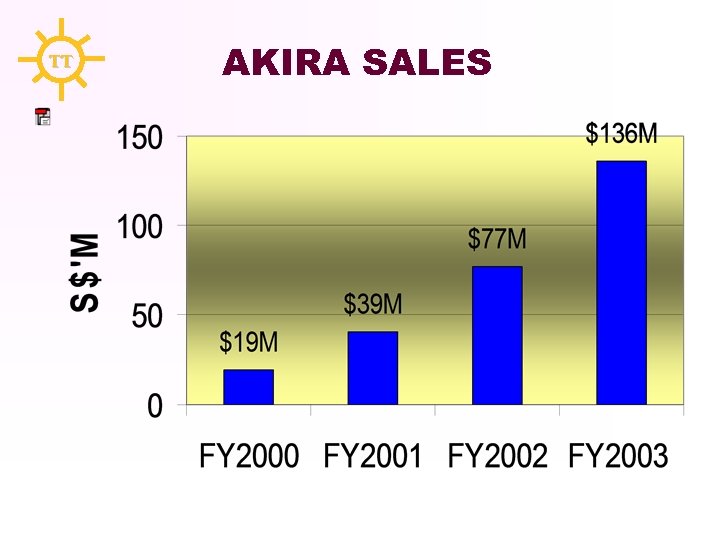

TT GROWTH DRIVER-AKIRA • Developed as house brand in 1994 • Comprehensive range of consumer electronics products which entails audiovisual, household and home appliances. • Market presence increased from 23 countries in FY 2000 to 60 countries worldwide in FY 2003. • Turnover jumped from S$19 million in FY 2000 to S$136 million in FY 2003.

TT AKIRA SALES

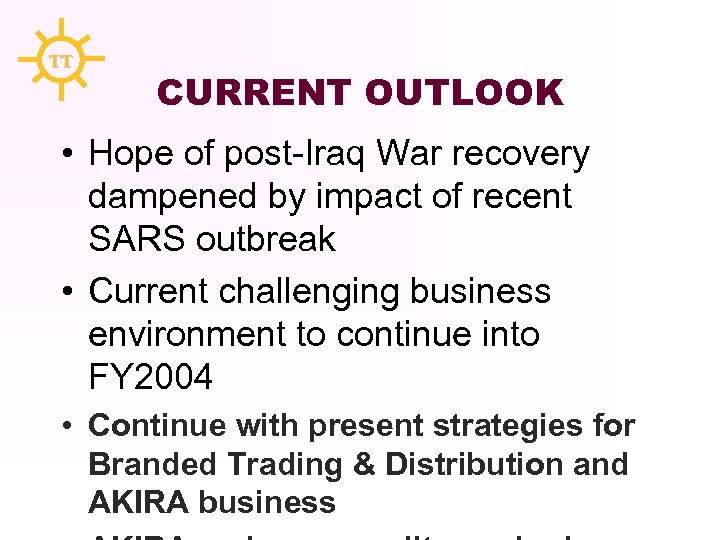

TT CURRENT OUTLOOK • Hope of post-Iraq War recovery dampened by impact of recent SARS outbreak • Current challenging business environment to continue into FY 2004 • Continue with present strategies for Branded Trading & Distribution and AKIRA business

ANNOUNCEMENTS - DEVELOPMENTS STRATEGIES FOR GROWTH

TT ANNOUNCEMENTS • TT International Awarded Global Trader Programme (GTP) Status – By IE Singapore – 5 years effective 1 October 2002 – Concessionary tax of 10% on qualifying income

TT ANNOUNCEMENTS Strategic Acquisition • 49% stake in Cabletron Electronics (M) Sdn Bhd – Manufacture of competitively priced CTV, VCD and DVD including OEM and ODM products – Located in Sungei Petani, Kedah, Malaysia – Cost of Investment RM 1 million (with additional investment if target is met) – Considered a subsidiary • Rationale: Opportunity for TT to springboard a new core activity – Localised assembly – Original Design Manufacturing (ODM)

TT CABLETRON PROFILE • ODM for a few hyper-stores in Malaysia • Source, import and supply home appliances to hyperstores • Design of software and hardware solutions for CTV, working with Philips to offer design to CTV manufacturer • Licensed Manufacturing Warehouse status & CEPT permit • Most products qualify for ASEAN Free Trade Export status • Strong in-house design capabilities complement TT core businesses • Strategy: – Sell directly to hyperstores, e. g. , Tesco, Giant, Mydin

TT AKIRA MILESTONES FY 1994 FY 1999 building FY 2000 - countries FY 2001 countries Registered as house brand Launch of aggressive marketing & brand Sales expanded to 23 Sales expanded to 31

AKIRA MILESTONES TT FY 2002 sales Spore - entities to products countries Set up AKIRA International Marketing Division Set up spare parts & afterservices team in Incorporated 6 overseas distribute AKIRA Expanded QC team Sales expanded to 43

AKIRA MILESTONES TT FY 2003 - overseas - countries Further expand distribution network with new entities Strengthen AKIRA QC and after-sales services Sales expanded to 60

TT FOUNDATIONS FOR AKIRA’s GROWTH • Strong market knowledge • Established distribution network • Logistics and support capabilities

TT FUTURE PLANS • Expand new markets • Introduce new AKIRA product lines • Strengthen AKIRA brand • Forge strategic and synergistic alliances

TT STRATEGIES FOR AKIRA • Develop and strengthen AKIRA brand – Establish AKIRA International Marketing Division in Spore to develop global marketing strategies and expand product range – Establish spare parts & after sales services in Spore HQ to support global after sales services – Establish QC team to ensure quality of

TT STRATEGIES FOR AKIRA • Further increase existing market share of AKIRA & other brands in – Middle East & Africa – ASEAN (East & West Malaysia, Indonesia) – Russia & Eastern Europe • To leverage on our knowledge of each market • To expand market coverage of AKIRA to more than 60 countries

TT OVERALL GROWTH STRATEGIES • Customer link • Entrenched distribution network in global markets based on niche market know-how • Supplier link • Locked-in win-win relationship with all suppliers based on niche market know-how and market positioning strategy • ODM link • To complement and further enhance the above two core activities to form a seamless total supply chain management cycle

TT OVERALL GROWTH STRATEGIES • Establishing a Third Pillar – TT becomes the vital link in the value chain of TT’s Principals with the consumers in each local markets – Set up local sub-assemblies in regional hubs – Assimilated knowledge on workflows from current experience for some principals – ODM Subsidiary Cabletron’s expertise and track record

TT Thank You! Q & A Session

05329b873f923587621b43dbc2f76f5b.ppt