3e98354ae526ddec0aa2c435cef653c4.ppt

- Количество слайдов: 26

TRUST RECEIPTS LAW P. D. NO. 115 29 JANUARY 1973

TRUST RECEIPTS LAW P. D. NO. 115 29 JANUARY 1973

Policy Objectives 1. To encourage and promote the use of trust receipts 2. To provide for the regulation of trust receipt transactions 3. To penalize violations as a criminal offense (Sec. 2)

Policy Objectives 1. To encourage and promote the use of trust receipts 2. To provide for the regulation of trust receipt transactions 3. To penalize violations as a criminal offense (Sec. 2)

What is a ‘Trust Receipt’? It is a written or printed document signed by the entrustee in favor of the entruster containing terms and conditions substantially complying with the provisions of this Decree. (Sec. 3, cf. Sec. 4)

What is a ‘Trust Receipt’? It is a written or printed document signed by the entrustee in favor of the entruster containing terms and conditions substantially complying with the provisions of this Decree. (Sec. 3, cf. Sec. 4)

Parties to a Trust Receipt Entruster – person holding title over the goods, documents or instruments Entrustee – person having or taking possession of goods, documents or instruments (Sec. 3)

Parties to a Trust Receipt Entruster – person holding title over the goods, documents or instruments Entrustee – person having or taking possession of goods, documents or instruments (Sec. 3)

What is a ‘Trust Receipt Transaction’? Any transaction by and between the entruster and the entrustee, whereby the entruster, who owns or holds absolute title or security interests over certain specified goods, documents or instruments, releases the same to the possession of the entrustee upon the latter's execution and delivery to the entruster of a trust receipt, or for other purposes substantially equivalent to those specified in Sec. 4

What is a ‘Trust Receipt Transaction’? Any transaction by and between the entruster and the entrustee, whereby the entruster, who owns or holds absolute title or security interests over certain specified goods, documents or instruments, releases the same to the possession of the entrustee upon the latter's execution and delivery to the entruster of a trust receipt, or for other purposes substantially equivalent to those specified in Sec. 4

Form of Trust Receipts A trust receipt need not be in any particular form but it must substantially contain: (1) a description of the goods, documents or instruments subject of the trust receipt (2) the total invoice value of the goods and the amount of the draft to be paid by the entrustee (3) an undertaking or a commitment of the entrustee to: - hold in trust for the entruster the goods, documents or instruments therein described; dispose of them in the manner provided for in the trust receipt; and to turn over the proceeds of the sale of the goods, documents or instruments to the entruster to the extent of the amount owing to the entruster or as appears in the trust receipt or to return the goods, documents or instruments in the event of their non-sale within the period specified therein. (Sec. 5)

Form of Trust Receipts A trust receipt need not be in any particular form but it must substantially contain: (1) a description of the goods, documents or instruments subject of the trust receipt (2) the total invoice value of the goods and the amount of the draft to be paid by the entrustee (3) an undertaking or a commitment of the entrustee to: - hold in trust for the entruster the goods, documents or instruments therein described; dispose of them in the manner provided for in the trust receipt; and to turn over the proceeds of the sale of the goods, documents or instruments to the entruster to the extent of the amount owing to the entruster or as appears in the trust receipt or to return the goods, documents or instruments in the event of their non-sale within the period specified therein. (Sec. 5)

Origin of Trust Receipts The device first came into general use in importing transactions, where goods were consigned directly to a bank which paid a draft for the price on the credit of the intended buyer who engaged to repay the bank’s advances

Origin of Trust Receipts The device first came into general use in importing transactions, where goods were consigned directly to a bank which paid a draft for the price on the credit of the intended buyer who engaged to repay the bank’s advances

Use of Trust Receipts It is a convenient aid to commerce and trade Over time, trust receipts have become indispensable contracts in international and domestic business transactions (People vs. Nitafan)

Use of Trust Receipts It is a convenient aid to commerce and trade Over time, trust receipts have become indispensable contracts in international and domestic business transactions (People vs. Nitafan)

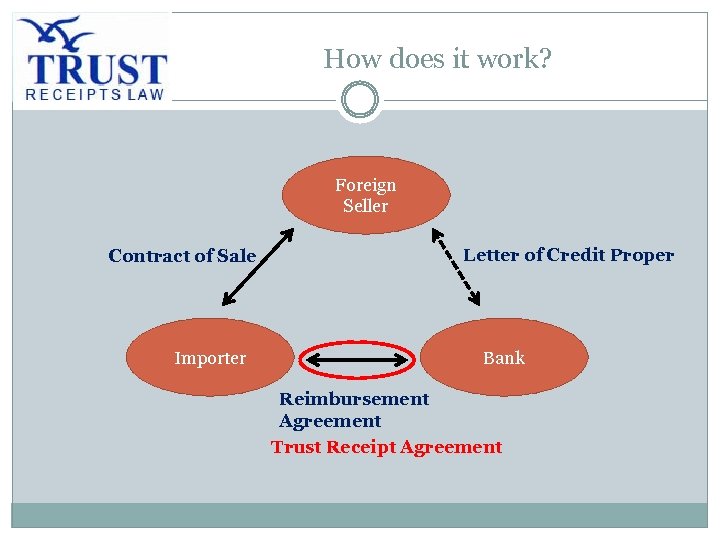

How does it work? Foreign Seller Contract of Sale Importer Letter of Credit Proper Bank Reimbursement Agreement Trust Receipt Agreement

How does it work? Foreign Seller Contract of Sale Importer Letter of Credit Proper Bank Reimbursement Agreement Trust Receipt Agreement

How does it work? Antecedent acts in a trust receipt transaction: 1. Application and approval of letter of credit (Reimbursement Agreement) 2. Making of marginal deposit 3. Effective importation of goods through the efforts of the importer (Colinares vs. CA)

How does it work? Antecedent acts in a trust receipt transaction: 1. Application and approval of letter of credit (Reimbursement Agreement) 2. Making of marginal deposit 3. Effective importation of goods through the efforts of the importer (Colinares vs. CA)

How does it work? Traditionally, there are 3 parties to a trust receipt transaction: 1. The importer/entrustee 2. The bank/entruster 3. The foreign seller However, the Supreme Court has held that even a bipartite contract is covered by PD 115 (Robles vs. CA)

How does it work? Traditionally, there are 3 parties to a trust receipt transaction: 1. The importer/entrustee 2. The bank/entruster 3. The foreign seller However, the Supreme Court has held that even a bipartite contract is covered by PD 115 (Robles vs. CA)

Basic Features of Trust Receipt Agreements 1. Loan feature – usually represented by a Letter of Credit 2. Security feature – the trust receipt proper (Vintola vs. IBAA)

Basic Features of Trust Receipt Agreements 1. Loan feature – usually represented by a Letter of Credit 2. Security feature – the trust receipt proper (Vintola vs. IBAA)

Security Feature A trust receipt is a security agreement pursuant to which the entruster acquires a “security interest” in the goods. Security interest, defined. It is property interest in goods, documents or instruments to secure performance of some obligations of the entrustee or of some third persons to the entruster and includes title, whether or not expressed to be absolute, whenever such title is in substance taken or retained for security only. (Sec. 3)

Security Feature A trust receipt is a security agreement pursuant to which the entruster acquires a “security interest” in the goods. Security interest, defined. It is property interest in goods, documents or instruments to secure performance of some obligations of the entrustee or of some third persons to the entruster and includes title, whether or not expressed to be absolute, whenever such title is in substance taken or retained for security only. (Sec. 3)

Security Feature The security interest is similar to a “lien” on the goods because the entruster’s advances will have to be settled first before the entrustee can consolidate his ownership over the goods. (Prudential Bank vs. NLRC) The entruster’s security interest is valid against all creditors for the duration of the trust receipt agreement (Sec. 12)

Security Feature The security interest is similar to a “lien” on the goods because the entruster’s advances will have to be settled first before the entrustee can consolidate his ownership over the goods. (Prudential Bank vs. NLRC) The entruster’s security interest is valid against all creditors for the duration of the trust receipt agreement (Sec. 12)

Security Feature “The title of the bank to the security is the one sought to be protected (by the law) and not the loan which is a separate and distinct agreement. ” (Prudential Bank vs. NLRC)

Security Feature “The title of the bank to the security is the one sought to be protected (by the law) and not the loan which is a separate and distinct agreement. ” (Prudential Bank vs. NLRC)

Who holds title? The entruster takes the full title to the goods at the very beginning—as soon as goods are bought and paid by him. (Ibid. )

Who holds title? The entruster takes the full title to the goods at the very beginning—as soon as goods are bought and paid by him. (Ibid. )

Who owns the goods? - The goods remain the importer’s property. Entrustee is factual owner. - The bank does not become real owner of the goods. It remains a lender and creditor. Entruster’s ownership is merely legal fiction. (Abad vs. CA)

Who owns the goods? - The goods remain the importer’s property. Entrustee is factual owner. - The bank does not become real owner of the goods. It remains a lender and creditor. Entruster’s ownership is merely legal fiction. (Abad vs. CA)

Nature of Trust Receipts In a certain manner, a trust receipt partakes of the nature of a conditional sale as provided in the Chattel Mortgage Law, i. e. , the importer becomes absolute owner of the imported merchandise as soon as he has paid its price. (Ibid. )

Nature of Trust Receipts In a certain manner, a trust receipt partakes of the nature of a conditional sale as provided in the Chattel Mortgage Law, i. e. , the importer becomes absolute owner of the imported merchandise as soon as he has paid its price. (Ibid. )

TR vs. Chattel Mortgage It is not a chattel mortgage because: - it does not require the formalities set forth in the Chattel Mortgage Law, such as the affidavit and oath (Secs. 3(j) and 5, cf. Sec. 5, Act 1508) - it does not have to be registered with the Register of Deeds (Sec. 3(j), cf. Sec. 198, Admin. Code)

TR vs. Chattel Mortgage It is not a chattel mortgage because: - it does not require the formalities set forth in the Chattel Mortgage Law, such as the affidavit and oath (Secs. 3(j) and 5, cf. Sec. 5, Act 1508) - it does not have to be registered with the Register of Deeds (Sec. 3(j), cf. Sec. 198, Admin. Code)

TR vs. Conditional Sale It is not a conditional sale per se because: - the entruster is not a seller as contemplated by law. He does not take on the obligations and warranties of a seller (Sec. 8, cf. Arts. 1495 -1581, Civil Code) - the transaction between the entruster and the entrustee is more akin to a credit transaction than a sale.

TR vs. Conditional Sale It is not a conditional sale per se because: - the entruster is not a seller as contemplated by law. He does not take on the obligations and warranties of a seller (Sec. 8, cf. Arts. 1495 -1581, Civil Code) - the transaction between the entruster and the entrustee is more akin to a credit transaction than a sale.

TR vs. Pledge It is not a pledge because: - the entrustee/debtor is not the absolute owner of the goods (cf. Art. 2085) - the entrustee/debtor does not deliver the possession of the goods to the entruster/creditor (cf. Art. 2093)

TR vs. Pledge It is not a pledge because: - the entrustee/debtor is not the absolute owner of the goods (cf. Art. 2085) - the entrustee/debtor does not deliver the possession of the goods to the entruster/creditor (cf. Art. 2093)

TR vs. Consignment It is different from consignment because the entrustee is the real owner of the goods and not a mere dealer/agent Note: But if the consignment is evidenced by a delivery trust receipt, it will fall under the Trust Receipts Law (Robles vs. CA)

TR vs. Consignment It is different from consignment because the entrustee is the real owner of the goods and not a mere dealer/agent Note: But if the consignment is evidenced by a delivery trust receipt, it will fall under the Trust Receipts Law (Robles vs. CA)

Rights of the Entruster The entruster shall be entitled: - (a) to the proceeds of the sale of the goods, documents or instruments covered by a trust receipt to the extent of the amount owed to him; OR (b) to the return of such goods, docs, or instruments in case of non-sale - to enforce all other rights conferred to him in the trust receipt - to cancel the trust and take possession of the goods, etc. in case of default or breach of the terms of the trust receipt and to have these sold in a private or public auction (Sec. 7)

Rights of the Entruster The entruster shall be entitled: - (a) to the proceeds of the sale of the goods, documents or instruments covered by a trust receipt to the extent of the amount owed to him; OR (b) to the return of such goods, docs, or instruments in case of non-sale - to enforce all other rights conferred to him in the trust receipt - to cancel the trust and take possession of the goods, etc. in case of default or breach of the terms of the trust receipt and to have these sold in a private or public auction (Sec. 7)

Obligations of the Entrustee (1) To hold the goods, documents or instruments in trust for the entruster and shall dispose of them strictly in accordance with the terms and conditions of the trust receipt; (2) To receive the proceeds in trust for the entruster and turn over the same to the entruster to the extent of the amount owing to the entruster or as appears on the trust receipt; (3) To insure the goods for their total value against loss from fire, theft, pilferage or other casualties; (4) To keep said goods or proceeds thereof whether in money or whatever form, separate and capable of identification as property of the entruster;

Obligations of the Entrustee (1) To hold the goods, documents or instruments in trust for the entruster and shall dispose of them strictly in accordance with the terms and conditions of the trust receipt; (2) To receive the proceeds in trust for the entruster and turn over the same to the entruster to the extent of the amount owing to the entruster or as appears on the trust receipt; (3) To insure the goods for their total value against loss from fire, theft, pilferage or other casualties; (4) To keep said goods or proceeds thereof whether in money or whatever form, separate and capable of identification as property of the entruster;

Obligations of the Entrustee (5) To return the goods, documents or instruments in the event of non-sale or upon demand of the entruster; and (6) To observe all other terms and conditions of the trust receipt not contrary to the provisions of the law. (Sec. 9) In any event, entrustee bears risk of loss (Sec. 10)

Obligations of the Entrustee (5) To return the goods, documents or instruments in the event of non-sale or upon demand of the entruster; and (6) To observe all other terms and conditions of the trust receipt not contrary to the provisions of the law. (Sec. 9) In any event, entrustee bears risk of loss (Sec. 10)

Criminal Liability Art. 315 Revised Penal Code 1. With unfaithfulness or abuse of confidence, namely: … (b) By misappropriating or converting, to the prejudice of another, money, goods, or any other personal property received by the offender in trust or on commission, or for administration, or under any other obligation involving the duty to make delivery of or to return the same, even though such obligation be totally or partially guaranteed by a bond; or by denying having received such money, goods, or other property.

Criminal Liability Art. 315 Revised Penal Code 1. With unfaithfulness or abuse of confidence, namely: … (b) By misappropriating or converting, to the prejudice of another, money, goods, or any other personal property received by the offender in trust or on commission, or for administration, or under any other obligation involving the duty to make delivery of or to return the same, even though such obligation be totally or partially guaranteed by a bond; or by denying having received such money, goods, or other property.