1bc15ccd0a690bebe44cc3e4a5ada73e.ppt

- Количество слайдов: 22

Trust Board Integrated Performance Report 3 rd June 2010 | 0

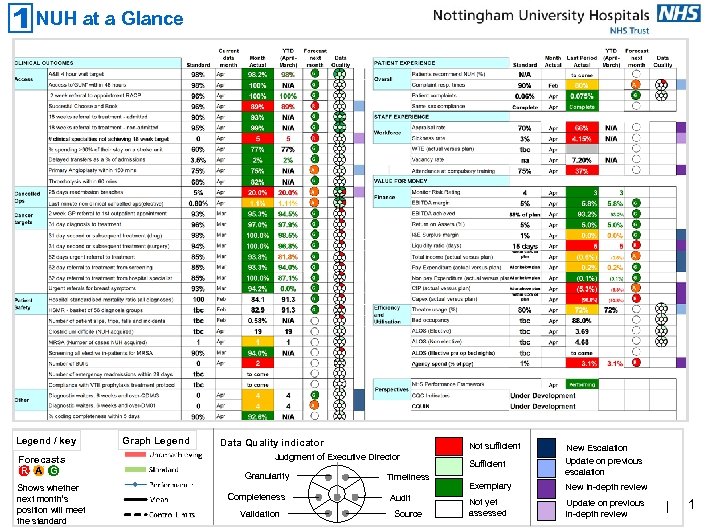

NUH at a Glance Legend / key Forecasts R A G Shows whether next month’s position will meet the standard Graph Legend Data Quality indicator Not sufficient Judgment of Executive Director Granularity Completeness Validation Timeliness Audit Source New Escalation Sufficient Update on previous escalation Exemplary New In-depth review Not yet assessed Update on previous in-depth review | 1

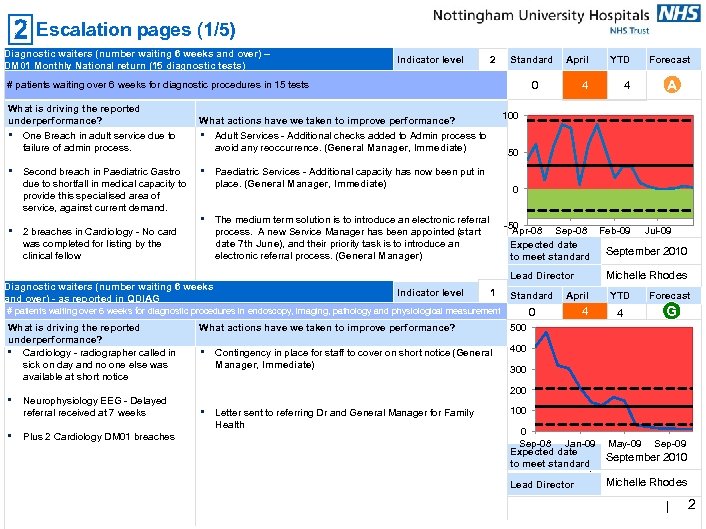

Escalation pages (1/5) Diagnostic waiters (number waiting 6 weeks and over) – DM 01 Monthly National return (15 diagnostic tests) Indicator level 2 Standard What is driving the reported underperformance? ▪ One Breach in adult service due to failure of admin process. What actions have we taken to improve performance? ▪ Adult Services - Additional checks added to Admin process to avoid any reoccurrence. (General Manager, Immediate) ▪ ▪ 2 breaches in Cardiology - No card was completed for listing by the clinical fellow ▪ ▪ Neurophysiology EEG - Delayed referral received at 7 weeks Plus 2 Cardiology DM 01 breaches 4 0 The medium term solution is to introduce an electronic referral process. A new Service Manager has been appointed (start date 7 th June), and their priority task is to introduce an electronic referral process. (General Manager) -50 Apr-08 Sep-08 Feb-09 Jul-09 Expected date September 2010 to meet standard Michelle Rhodes Lead Director Indicator level A 50 1 Standard # patients waiting over 6 weeks for diagnostic procedures in endoscopy, imaging, pathology and physiological measurement What is driving the reported underperformance? ▪ Cardiology - radiographer called in sick on day and no one else was available at short notice 4 Forecast 100 Paediatric Services - Additional capacity has now been put in place. (General Manager, Immediate) Diagnostic waiters (number waiting 6 weeks and over) - as reported in QDIAG YTD 0 # patients waiting over 6 weeks for diagnostic procedures in 15 tests Second breach in Paediatric Gastro due to shortfall in medical capacity to provide this specialised area of service, against current demand. April 0 What actions have we taken to improve performance? Forecast 4 G 500 ▪ 4 YTD 400 Contingency in place for staff to cover on short notice (General Manager, Immediate) 300 200 ▪ Letter sent to referring Dr and General Manager for Family Health 100 0 Sep-08 Jan-09 May-09 Sep-09 Expected date September 2010 to meet standard Lead Director Michelle Rhodes | 2

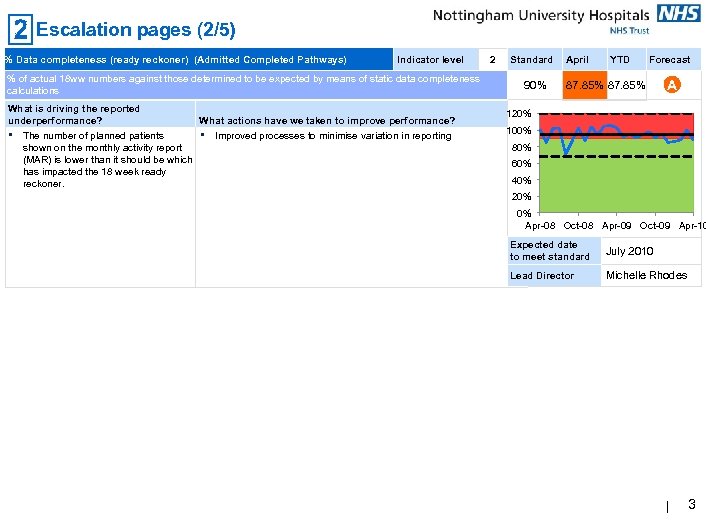

Escalation pages (2/5) % Data completeness (ready reckoner) (Admitted Completed Pathways) Indicator level % of actual 18 ww numbers against those determined to be expected by means of static data completeness calculations What is driving the reported underperformance? What actions have we taken to improve performance? ▪ The number of planned patients • Improved processes to minimise variation in reporting shown on the monthly activity report (MAR) is lower than it should be which has impacted the 18 week ready reckoner. 2 Standard 90% April YTD Forecast 87. 85% A 120% 100% 80% 60% 40% 20% 0% Apr-08 Oct-08 Apr-09 Oct-09 Apr-10 Expected date to meet standard July 2010 Lead Director Michelle Rhodes | 3

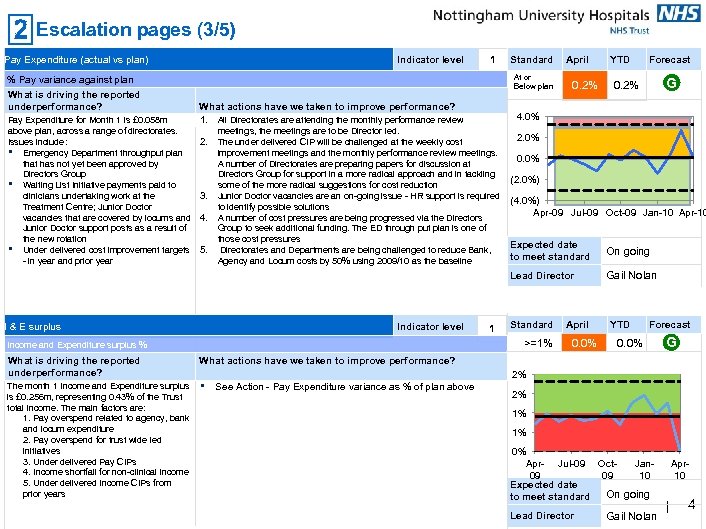

Escalation pages (3/5) Pay Expenditure (actual vs plan) Indicator level 1 At or Below plan % Pay variance against plan What is driving the reported underperformance? Pay Expenditure for Month 1 is £ 0. 058 m above plan, across a range of directorates. Issues include: • Emergency Department throughput plan that has not yet been approved by Directors Group • Waiting List Initiative payments paid to clinicians undertaking work at the Treatment Centre; Junior Doctor vacancies that are covered by locums and Junior Doctor support posts as a result of the new rotation • Under delivered cost improvement targets - in year and prior year Standard What actions have we taken to improve performance? 1. 2. 3. 4. All Directorates are attending the monthly performance review meetings, the meetings are to be Director led. The under delivered CIP will be challenged at the weekly cost improvement meetings and the monthly performance review meetings. A number of Directorates are preparing papers for discussion at Directors Group for support in a more radical approach and in tackling some of the more radical suggestions for cost reduction Junior Doctor vacancies are an on-going issue - HR support is required to identify possible solutions A number of cost pressures are being progressed via the Directors Group to seek additional funding. The ED through put plan is one of those cost pressures Directorates and Departments are being challenged to reduce Bank, Agency and Locum costs by 50% using 2009/10 as the baseline April 0. 2% YTD Forecast G 0. 2% 4. 0% 2. 0% 0. 0% (2. 0%) (4. 0%) Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Indicator level I & E surplus The month 1 Income and Expenditure surplus is £ 0. 256 m, representing 0. 43% of the Trust total income. The main factors are: 1. Pay overspend related to agency, bank and locum expenditure 2. Pay overspend for trust wide led initiatives 3. Under delivered Pay CIPs 4. Income shortfall for non-clinical income 5. Under delivered Income CIPs from prior years On going Gail Nolan Standard >=1% Income and Expenditure surplus % What is driving the reported underperformance? 1 Expected date to meet standard Lead Director 5. April 0. 0% YTD Forecast 0. 0% G What actions have we taken to improve performance? ▪ 2% See Action - Pay Expenditure variance as % of plan above 2% 1% 1% 0% Apr- Jul-09 Oct. Jan 09 09 10 Expected date On going to meet standard Lead Director Gail Nolan Apr 10 | 4

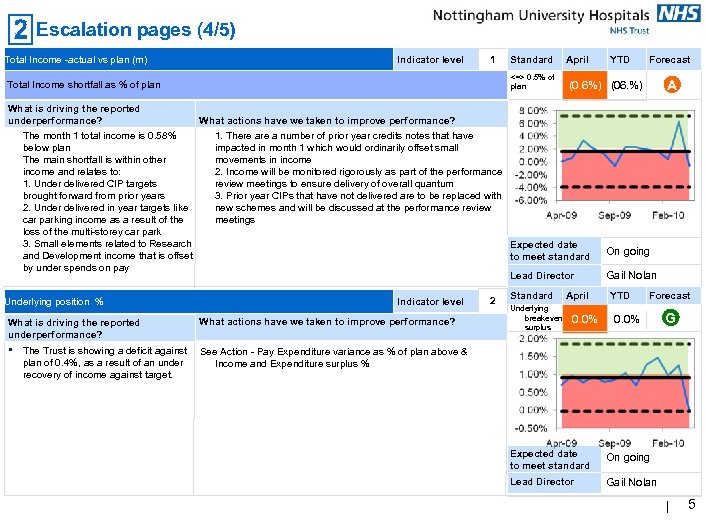

Escalation pages (4/5) Total Income -actual vs plan (m) Indicator level 1 Standard <=> 0. 5% of plan Total Income shortfall as % of plan April What is driving the reported underperformance? • Indicator level What actions have we taken to improve performance? 2 Standard Forecast A (0. 6%) (06. %) What is driving the reported underperformance? What actions have we taken to improve performance? The month 1 total income is 0. 58% 1. There a number of prior year credits notes that have below plan impacted in month 1 which would ordinarily offset small The main shortfall is within other movements in income and relates to: 2. Income will be monitored rigorously as part of the performance 1. Under delivered CIP targets review meetings to ensure delivery of overall quantum brought forward from prior years 3. Prior year CIPs that have not delivered are to be replaced with 2. Under delivered in year targets like new schemes and will be discussed at the performance review car parking income as a result of the meetings loss of the multi-storey car park 3. Small elements related to Research Expected date and Development income that is offset to meet standard by under spends on pay Lead Director Underlying position % YTD April Underlying breakeven or 0. 0% surplus On going Gail Nolan YTD Forecast 0. 0% G The Trust is showing a deficit against See Action - Pay Expenditure variance as % of plan above & plan of 0. 4%, as a result of an under Income and Expenditure surplus % recovery of income against target. Expected date to meet standard On going Lead Director Gail Nolan | 5

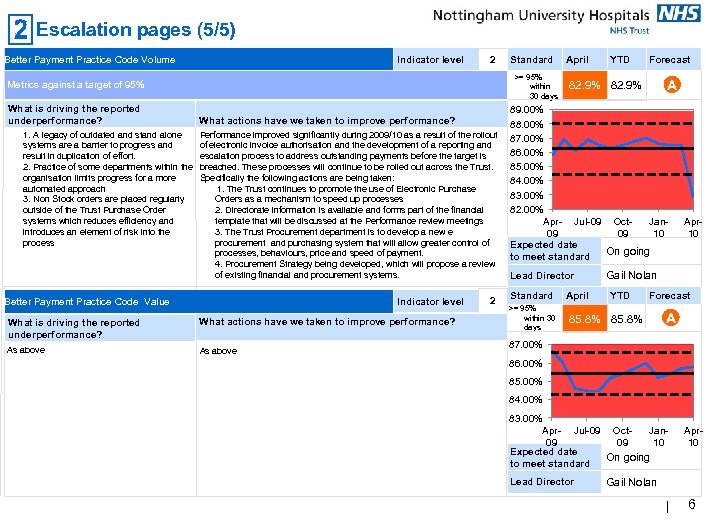

Escalation pages (5/5) Better Payment Practice Code Volume Indicator level 2 >= 95% within 30 days Metrics against a target of 95% What is driving the reported underperformance? 1. A legacy of outdated and stand alone systems are a barrier to progress and result in duplication of effort. 2. Practice of some departments within the organisation limits progress for a more automated approach 3. Non Stock orders are placed regularly outside of the Trust Purchase Order systems which reduces efficiency and introduces an element of risk into the process Standard What actions have we taken to improve performance? Performance improved significantly during 2009/10 as a result of the rollout of electronic invoice authorisation and the development of a reporting and escalation process to address outstanding payments before the target is breached. These processes will continue to be rolled out across the Trust. Specifically the following actions are being taken: 1. The Trust continues to promote the use of Electronic Purchase Orders as a mechanism to speed up processes 2. Directorate information is available and forms part of the financial template that will be discussed at the Performance review meetings 3. The Trust Procurement department is to develop a new e procurement and purchasing system that will allow greater control of processes, behaviours, price and speed of payment. 4. Procurement Strategy being developed, which will propose a review of existing financial and procurement systems. Indicator level Better Payment Practice Code Value What is driving the reported underperformance? What actions have we taken to improve performance? As above 2 April YTD Forecast A 82. 9% 89. 00% 88. 00% 87. 00% 86. 00% 85. 00% 84. 00% 83. 00% 82. 00% Apr- Jul-09 Oct. Jan 09 09 10 Expected date On going to meet standard Lead Director Standard >= 95% within 30 days April Apr 10 Gail Nolan YTD Forecast 85. 8% A 87. 00% 86. 00% 85. 00% 84. 00% 83. 00% Apr- Jul-09 Oct. Jan 09 09 10 Expected date On going to meet standard Lead Director Apr 10 Gail Nolan | 6

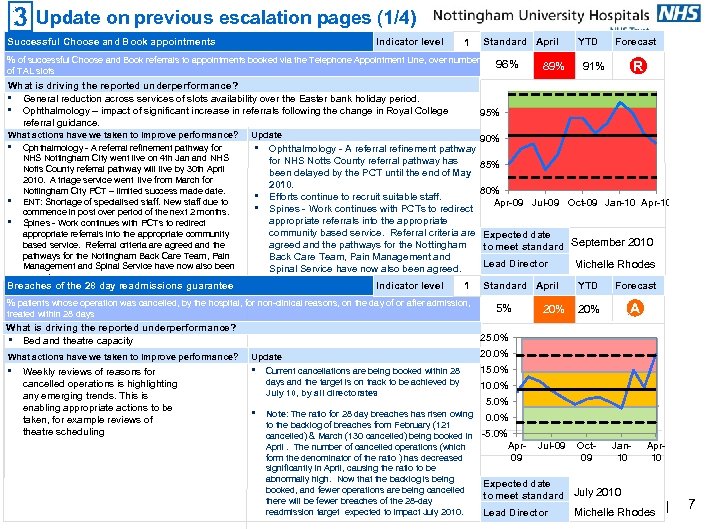

Update on previous escalation pages (1/4) Successful Choose and Book appointments Indicator level Standard April 1 % of successful Choose and Book referrals to appointments booked via the Telephone Appointment Line, over number of TAL slots What is driving the reported underperformance? General reduction across services of slots availability over the Easter bank holiday period. Ophthalmology – impact of significant increase in referrals following the change in Royal College referral guidance. ▪ ▪ What actions have we taken to improve performance? Ophthalmology - A referral refinement pathway for NHS Nottingham City went live on 4 th Jan and NHS Notts County referral pathway will live by 30 th April 2010. A triage service went live from March for Nottingham City PCT – limited success made date. ▪ ENT: Shortage of specialised staff. New staff due to commence in post over period of the next 2 months. ▪ Spines - Work continues with PCTs to redirect appropriate referrals into the appropriate community based service. Referral criteria are agreed and the pathways for the Nottingham Back Care Team, Pain Management and Spinal Service have now also been agreed. ▪ 96% 89% YTD Forecast R 91% 95% Update ▪ ▪ ▪ 90% Ophthalmology - A referral refinement pathway for NHS Notts County referral pathway has 85% been delayed by the PCT until the end of May 2010. 80% Efforts continue to recruit suitable staff. Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Spines - Work continues with PCTs to redirect appropriate referrals into the appropriate community based service. Referral criteria are Expected date agreed and the pathways for the Nottingham to meet standard September 2010 Back Care Team, Pain Management and Lead Director Michelle Rhodes Spinal Service have now also been agreed. Breaches of the 28 day readmissions guarantee Indicator level 1 % patients whose operation was cancelled, by the hospital, for non-clinical reasons, on the day of or after admission, treated within 28 days What is driving the reported underperformance? • Bed and theatre capacity Standard April 5% YTD Forecast 20% A Jul-09 Oct 09 25. 0% What actions have we taken to improve performance? Update 20. 0% ▪ ▪ 15. 0% Weekly reviews of reasons for cancelled operations is highlighting any emerging trends. This is enabling appropriate actions to be taken, for example reviews of theatre scheduling ▪ Current cancellations are being booked within 28 days and the target is on track to be achieved by July 10, by all directorates Note: The ratio for 28 day breaches has risen owing to the backlog of breaches from February (121 cancelled) & March (130 cancelled) being booked in April. The number of cancelled operations (which form the denominator of the ratio ) has decreased significantly in April, causing the ratio to be abnormally high. Now that the backlog is being booked, and fewer operations are being cancelled there will be fewer breaches of the 28 -day readmission target expected to impact July 2010. 0% 5. 0% 0. 0% -5. 0% Apr 09 Jan 10 Apr 10 Expected date to meet standard July 2010 Lead Director Michelle Rhodes | 7

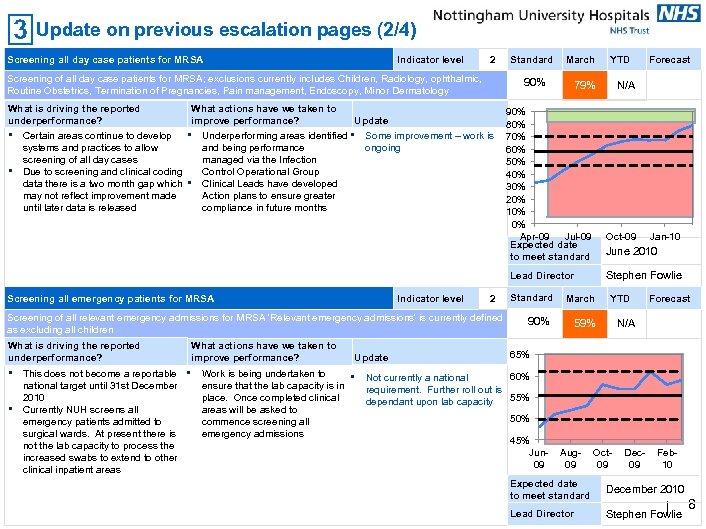

Update on previous escalation pages (2/4) Screening all day case patients for MRSA Indicator level 2 Screening of all day case patients for MRSA; exclusions currently includes Children, Radiology, ophthalmic, Routine Obstetrics, Termination of Pregnancies, Pain management, Endoscopy, Minor Dermatology Standard 90% What is driving the reported What actions have we taken to underperformance? improve performance? Update ▪ Certain areas continue to develop ▪ Underperforming areas identified ▪ Some improvement – work is systems and practices to allow and being performance ongoing screening of all day cases managed via the Infection ▪ Due to screening and clinical coding Control Operational Group data there is a two month gap which ▪ Clinical Leads have developed may not reflect improvement made Action plans to ensure greater until later data is released compliance in future months March 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Apr-09 Jul-09 Expected date to meet standard Indicator level 2 Screening of all relevant emergency admissions for MRSA 'Relevant emergency admissions' is currently defined as excluding all children What is driving the reported underperformance? ▪ ▪ This does not become a reportable national target until 31 st December 2010 Currently NUH screens all emergency patients admitted to surgical wards. At present there is not the lab capacity to process the increased swabs to extend to other clinical inpatient areas What actions have we taken to improve performance? ▪ Work is being undertaken to ensure that the lab capacity is in place. Once completed clinical areas will be asked to commence screening all emergency admissions Update ▪ Standard 90% Forecast N/A 79% Oct-09 Jan-10 June 2010 Stephen Fowlie Lead Director Screening all emergency patients for MRSA YTD March YTD Forecast N/A 59% 65% 60% Not currently a national requirement. Further roll out is 55% dependant upon lab capacity 50% 45% Jun 09 Aug 09 Oct 09 Dec 09 Feb 10 Expected date to meet standard December 2010 Lead Director Stephen Fowlie | 8

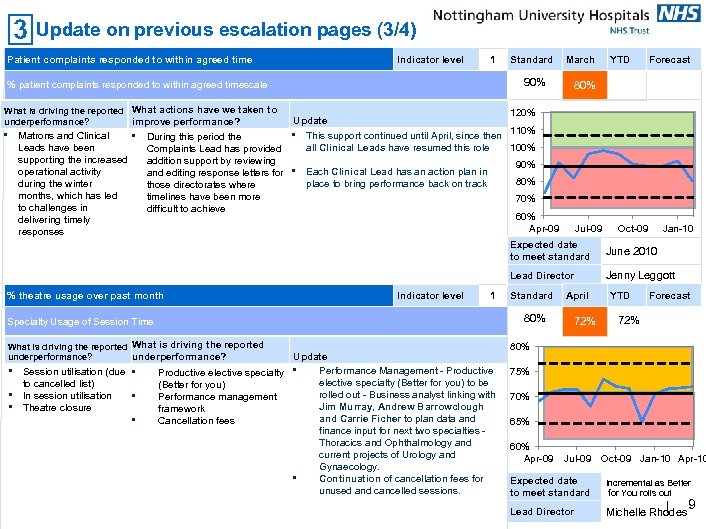

Update on previous escalation pages (3/4) Patient complaints responded to within agreed time Indicator level 1 Standard 90% % patient complaints responded to within agreed timescale March YTD Forecast 80% What is driving the reported What actions have we taken to improve performance? underperformance? ▪ Matrons and Clinical ▪ Leads have been supporting the increased operational activity during the winter months, which has led to challenges in delivering timely responses 120% Update ▪ This support continued until April, since then 110% During this period the all Clinical Leads have resumed this role 100% Complaints Lead has provided addition support by reviewing 90% and editing response letters for ▪ Each Clinical Lead has an action plan in 80% place to bring performance back on track those directorates where timelines have been more 70% difficult to achieve 60% Apr-09 Jul-09 Oct-09 Jan-10 Expected date to meet standard Lead Director % theatre usage over past month Indicator level 1 June 2010 Jenny Leggott Standard 80% Specialty Usage of Session Time What is driving the reported underperformance? 72% YTD Forecast 72% 80% ▪ April 75% ▪ ▪ Session utilisation (due to cancelled list) In session utilisation Theatre closure ▪ ▪ ▪ Update ▪ Performance Management - Productive elective specialty (Better for you) to be (Better for you) rolled out - Business analyst linking with Performance management Jim Murray, Andrew Barrowclough framework and Carrie Ficher to plan data and Cancellation fees finance input for next two specialties - Thoracics and Ophthalmology and current projects of Urology and Gynaecology. ▪ Continuation of cancellation fees for unused and cancelled sessions. 70% 65% 60% Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Expected date to meet standard Incremental as Better for You rolls out Lead Director Michelle Rhodes | 9

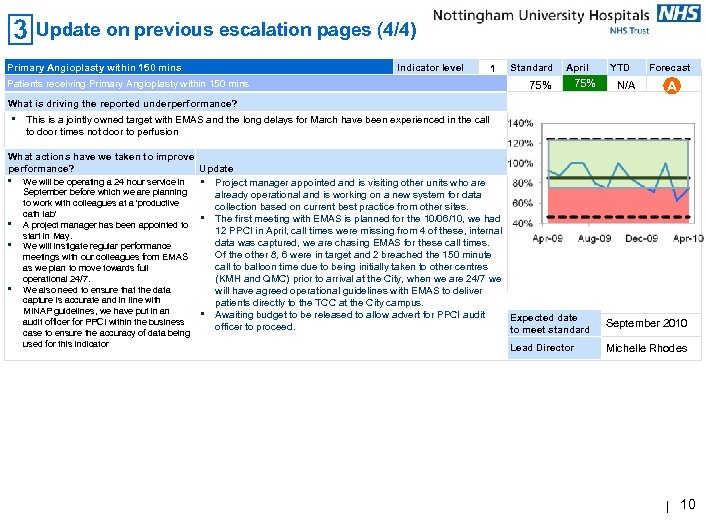

Update on previous escalation pages (4/4) Primary Angioplasty within 150 mins Indicator level 1 Patients receiving Primary Angioplasty within 150 mins Standard 75% April 75% YTD N/A Forecast A What is driving the reported underperformance? ▪ This is a jointly owned target with EMAS and the long delays for March have been experienced in the call to door times not door to perfusion What actions have we taken to improve Update performance? ▪ We will be operating a 24 hour service in ▪ Project manager appointed and is visiting other units who are September before which we are planning already operational and is working on a new system for data to work with colleagues at a 'productive collection based on current best practice from other sites. cath lab‘ ▪ The first meeting with EMAS is planned for the 10/06/10, we had ▪ A project manager has been appointed to 12 PPCI in April, call times were missing from 4 of these, internal start in May. data was captured, we are chasing EMAS for these call times. ▪ We will instigate regular performance Of the other 8, 6 were in target and 2 breached the 150 minute meetings with our colleagues from EMAS call to balloon time due to being initially taken to other centres as we plan to move towards full (KMH and QMC) prior to arrival at the City, when we are 24/7 we operational 24/7. ▪ We also need to ensure that the data will have agreed operational guidelines with EMAS to deliver capture is accurate and in line with patients directly to the TCC at the City campus. MINAP guidelines, we have put in an ▪ Awaiting budget to be released to allow advert for PPCI audit Expected date audit officer for PPCI within the business officer to proceed. to meet standard case to ensure the accuracy of data being used for this indicator Lead Director September 2010 Michelle Rhodes | 10

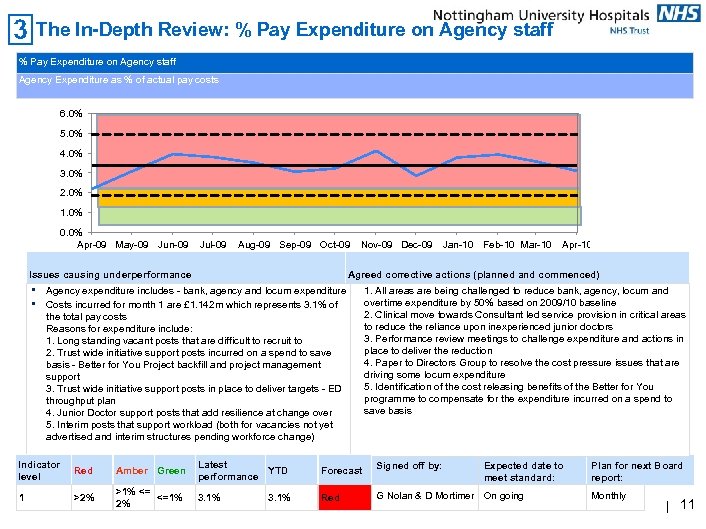

The In-Depth Review: % Pay Expenditure on Agency staff Agency Expenditure as % of actual pay costs 6. 0% 5. 0% 4. 0% 3. 0% 2. 0% 1. 0% 0. 0% Apr-09 May-09 Jun-09 Jul-09 Aug-09 Sep-09 Oct-09 Issues causing underperformance • • Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr-10 Agreed corrective actions (planned and commenced) Agency expenditure includes - bank, agency and locum expenditure Costs incurred for month 1 are £ 1. 142 m which represents 3. 1% of the total pay costs Reasons for expenditure include: 1. Long standing vacant posts that are difficult to recruit to 2. Trust wide initiative support posts incurred on a spend to save basis - Better for You Project backfill and project management support 3. Trust wide initiative support posts in place to deliver targets - ED throughput plan 4. Junior Doctor support posts that add resilience at change over 5. Interim posts that support workload (both for vacancies not yet advertised and interim structures pending workforce change) 1. All areas are being challenged to reduce bank, agency, locum and overtime expenditure by 50% based on 2009/10 baseline 2. Clinical move towards Consultant led service provision in critical areas to reduce the reliance upon inexperienced junior doctors 3. Performance review meetings to challenge expenditure and actions in place to deliver the reduction 4. Paper to Directors Group to resolve the cost pressure issues that are driving some locum expenditure 5. Identification of the cost releasing benefits of the Better for You programme to compensate for the expenditure incurred on a spend to save basis Indicator level Red Amber Green Latest YTD performance Forecast Signed off by: 1 >2% >1% <= <=1% 2% 3. 1% Red G Nolan & D Mortimer On going 3. 1% Expected date to meet standard: Plan for next Board report: Monthly | 11

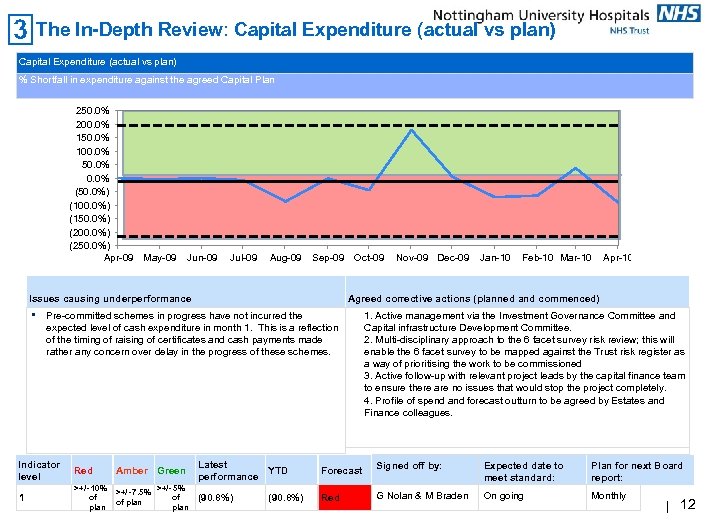

The In-Depth Review: Capital Expenditure (actual vs plan) % Shortfall in expenditure against the agreed Capital Plan 250. 0% 200. 0% 150. 0% 100. 0% 50. 0% (50. 0%) (100. 0%) (150. 0%) (200. 0%) (250. 0%) Apr-09 May-09 Jun-09 Jul-09 Aug-09 Sep-09 Oct-09 Issues causing underperformance • Red 1 >+/- 10% >+/- 5% >+/- 7. 5% of of of plan Amber Green Jan-10 Feb-10 Mar-10 Apr-10 Agreed corrective actions (planned and commenced) Pre-committed schemes in progress have not incurred the expected level of cash expenditure in month 1. This is a reflection of the timing of raising of certificates and cash payments made rather any concern over delay in the progress of these schemes. Indicator level Nov-09 Dec-09 1. Active management via the Investment Governance Committee and Capital infrastructure Development Committee. 2. Multi-disciplinary approach to the 6 facet survey risk review; this will enable the 6 facet survey to be mapped against the Trust risk register as a way of prioritising the work to be commissioned 3. Active follow-up with relevant project leads by the capital finance team to ensure there are no issues that would stop the project completely. 4. Profile of spend and forecast outturn to be agreed by Estates and Finance colleagues. Latest YTD performance Forecast Signed off by: Expected date to meet standard: Plan for next Board report: (90. 8%) Red G Nolan & M Braden On going Monthly (90. 8%) | 12

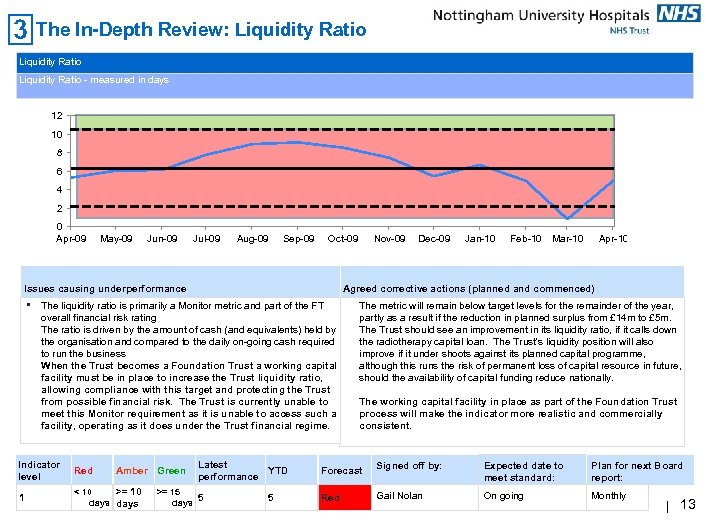

The In-Depth Review: Liquidity Ratio - measured in days 12 10 8 6 4 2 0 Apr-09 May-09 Jun-09 Jul-09 Aug-09 Sep-09 Oct-09 Issues causing underperformance • Red 1 >= 10 < 10 days Amber Green Dec-09 Jan-10 Feb-10 Mar-10 Apr-10 Agreed corrective actions (planned and commenced) The liquidity ratio is primarily a Monitor metric and part of the FT overall financial risk rating The ratio is driven by the amount of cash (and equivalents) held by the organisation and compared to the daily on-going cash required to run the business When the Trust becomes a Foundation Trust a working capital facility must be in place to increase the Trust liquidity ratio, allowing compliance with this target and protecting the Trust from possible financial risk. The Trust is currently unable to meet this Monitor requirement as it is unable to access such a facility, operating as it does under the Trust financial regime. Indicator level Nov-09 Latest YTD performance >= 15 5 days 5 The metric will remain below target levels for the remainder of the year, partly as a result if the reduction in planned surplus from £ 14 m to £ 5 m. The Trust should see an improvement in its liquidity ratio, if it calls down the radiotherapy capital loan. The Trust's liquidity position will also improve if it under shoots against its planned capital programme, although this runs the risk of permanent loss of capital resource in future, should the availability of capital funding reduce nationally. The working capital facility in place as part of the Foundation Trust process will make the indicator more realistic and commercially consistent. Forecast Signed off by: Expected date to meet standard: Plan for next Board report: Red Gail Nolan On going Monthly | 13

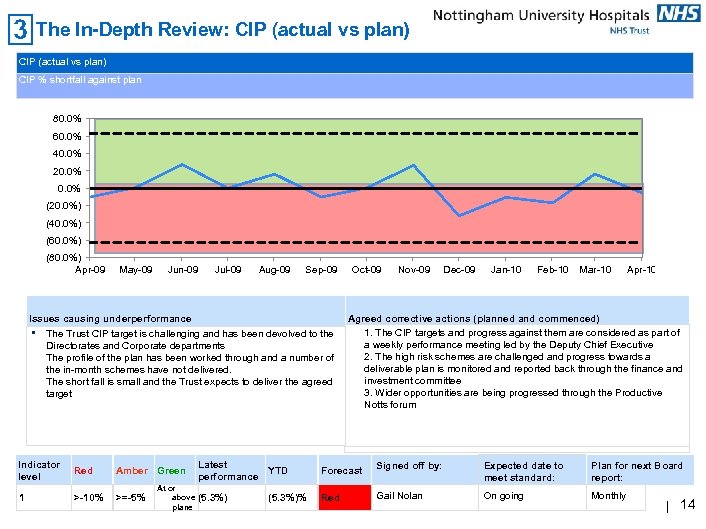

The In-Depth Review: CIP (actual vs plan) CIP % shortfall against plan 80. 0% 60. 0% 40. 0% 20. 0% (20. 0%) (40. 0%) (60. 0%) (80. 0%) Apr-09 May-09 Jun-09 Jul-09 Aug-09 Sep-09 Issues causing underperformance • The Trust CIP target is challenging and has been devolved to the Directorates and Corporate departments The profile of the plan has been worked through and a number of the in-month schemes have not delivered. The short fall is small and the Trust expects to deliver the agreed target Indicator level Red Amber Green 1 >-10% >=-5% Latest YTD performance At or above (5. 3%) plane (5. 3%)% Oct-09 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr-10 Agreed corrective actions (planned and commenced) 1. The CIP targets and progress against them are considered as part of a weekly performance meeting led by the Deputy Chief Executive 2. The high risk schemes are challenged and progress towards a deliverable plan is monitored and reported back through the finance and investment committee 3. Wider opportunities are being progressed through the Productive Notts forum Forecast Signed off by: Expected date to meet standard: Plan for next Board report: Red Gail Nolan On going Monthly | 14

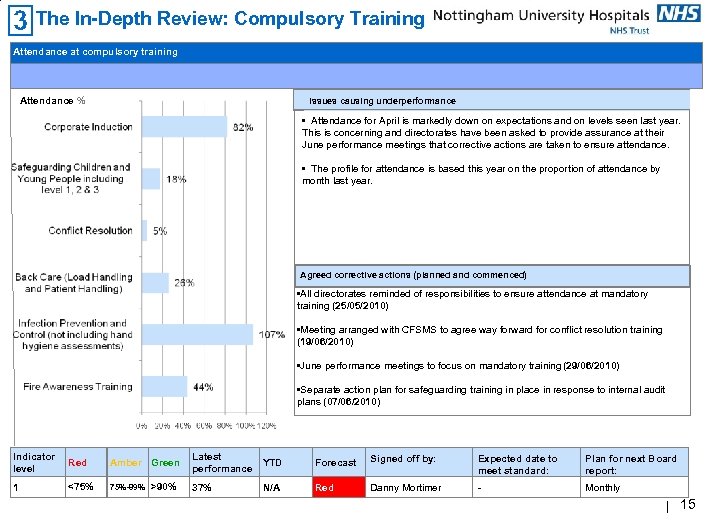

The In-Depth Review: Compulsory Training Attendance at compulsory training Attendance % Issues causing underperformance • Attendance for April is markedly down on expectations and on levels seen last year. This is concerning and directorates have been asked to provide assurance at their June performance meetings that corrective actions are taken to ensure attendance. • The profile for attendance is based this year on the proportion of attendance by month last year. Agreed corrective actions (planned and commenced) • All directorates reminded of responsibilities to ensure attendance at mandatory training (25/05/2010) • Meeting arranged with CFSMS to agree way forward for conflict resolution training (19/06/2010) • June performance meetings to focus on mandatory training (29/06/2010) • Separate action plan for safeguarding training in place in response to internal audit plans (07/06/2010) Indicator level Red Amber Green 1 <75% 75%-89% >90% Latest YTD performance Forecast Signed off by: Expected date to meet standard: Plan for next Board report: 37% Red Danny Mortimer - Monthly N/A | 15

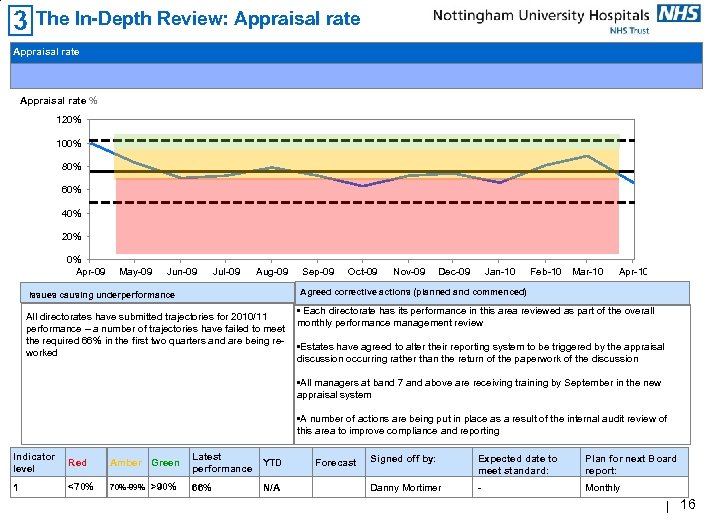

The In-Depth Review: Appraisal rate % 120% 100% 80% 60% 40% 20% 0% Apr-09 May-09 Jun-09 Jul-09 Aug-09 Sep-09 Oct-09 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr-10 Agreed corrective actions (planned and commenced) Issues causing underperformance • Each directorate has its performance in this area reviewed as part of the overall All directorates have submitted trajectories for 2010/11 monthly performance management review performance – a number of trajectories have failed to meet the required 66% in the first two quarters and are being re • Estates have agreed to alter their reporting system to be triggered by the appraisal worked discussion occurring rather than the return of the paperwork of the discussion • All managers at band 7 and above are receiving training by September in the new appraisal system • A number of actions are being put in place as a result of the internal audit review of this area to improve compliance and reporting Indicator level Red Amber Green 1 <70% 70%-89% >90% Latest YTD performance Forecast Signed off by: Expected date to meet standard: Plan for next Board report: 66% - Danny Mortimer - Monthly N/A | 16

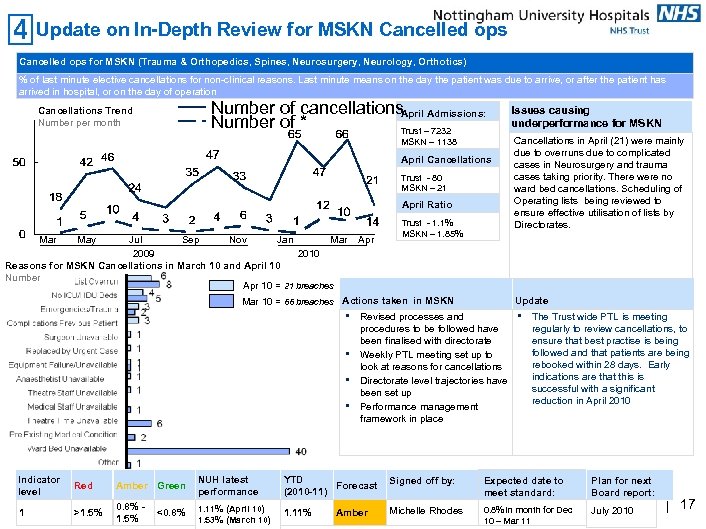

Update on In-Depth Review for MSKN Cancelled ops for MSKN (Trauma & Orthopedics, Spines, Neurosurgery, Neurology, Orthotics) % of last minute elective cancellations for non-clinical reasons. Last minute means on the day the patient was due to arrive, or after the patient has arrived in hospital, or on the day of operation Number of cancellations. April Admissions: Number of * Trust – 7232 Cancellations Trend Number per month MSKN – 1138 April Cancellations Trust - 80 MSKN – 21 38 April Ratio Mar Trust - 1. 1% MSKN – 1. 85% May Jul Sep Nov Jan Mar Apr 2009 2010 Reasons for MSKN Cancellations in March 10 and April 10 Number Apr 10 = 21 breaches Mar 10 = 66 breaches Actions taken in MSKN ▪ ▪ Issues causing underperformance for MSKN Cancellations in April (21) were mainly due to overruns due to complicated cases in Neurosurgery and trauma cases taking priority. There were no ward bed cancellations. Scheduling of Operating lists being reviewed to ensure effective utilisation of lists by Directorates. Update Revised processes and procedures to be followed have been finalised with directorate Weekly PTL meeting set up to look at reasons for cancellations Directorate level trajectories have been set up Performance management framework in place • The Trust wide PTL is meeting regularly to review cancellations, to ensure that best practise is being followed and that patients are being rebooked within 28 days. Early indications are that this is successful with a significant reduction in April 2010 Indicator level Red Amber Green NUH latest performance YTD Forecast (2010 -11) Signed off by: Expected date to meet standard: Plan for next Board report: 1 >1. 5% 0. 8% - <0. 8% 1. 5% 1. 11% (April 10) 1. 53% (March 10) 1. 11% Michelle Rhodes 0. 8% in month for Dec 10 – Mar 11 July 2010 Amber | 17

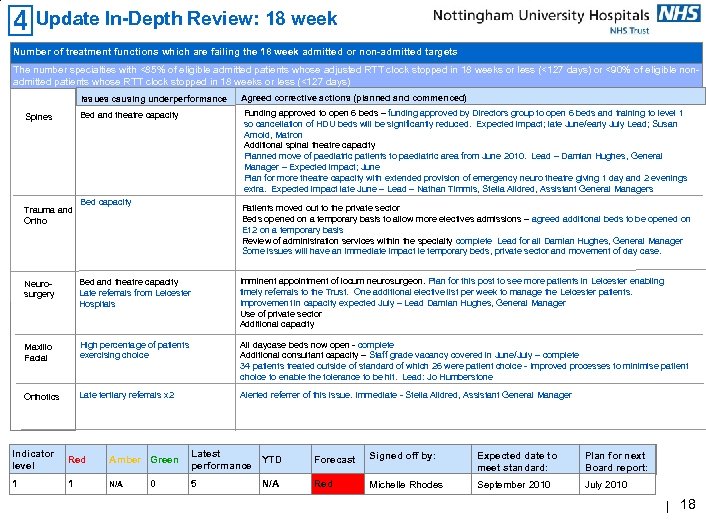

Update In-Depth Review: 18 week Number of treatment functions which are failing the 18 week admitted or non-admitted targets The number specialties with <85% of eligible admitted patients whose adjusted RTT clock stopped in 18 weeks or less (<127 days) or <90% of eligible nonadmitted patients whose RTT clock stopped in 18 weeks or less (<127 days) Issues causing underperformance Funding approved to open 6 beds – funding approved by Directors group to open 6 beds and training to level 1 so cancellation of HDU beds will be significantly reduced. Expected impact; late June/early July Lead; Susan Arnold, Matron Additional spinal theatre capacity Planned move of paediatric patients to paediatric area from June 2010. Lead – Damian Hughes, General Manager – Expected impact; June Plan for more theatre capacity with extended provision of emergency neuro theatre giving 1 day and 2 evenings extra. Expected impact late June – Lead – Nathan Timmis, Stella Alldred, Assistant General Managers Bed and theatre capacity Spines Trauma and Ortho Agreed corrective actions (planned and commenced) Bed capacity Patients moved out to the private sector Beds opened on a temporary basis to allow more electives admissions – agreed additional beds to be opened on E 12 on a temporary basis Review of administration services within the specialty complete Lead for all Damian Hughes, General Manager Some issues will have an immediate impact ie temporary beds, private sector and movement of day case. Neurosurgery Bed and theatre capacity Late referrals from Leicester Hospitals Imminent appointment of locum neurosurgeon. Plan for this post to see more patients in Leicester enabling timely referrals to the Trust. One additional elective list per week to manage the Leicester patients. Improvement in capacity expected July – Lead Damian Hughes, General Manager Use of private sector Additional capacity Maxillo Facial High percentage of patients exercising choice All daycase beds now open - complete Additional consultant capacity – Staff grade vacancy covered in June/July – complete 34 patients treated outside of standard of which 26 were patient choice - Improved processes to minimise patient choice to enable the tolerance to be hit. Lead: Jo Humberstone Orthotics Late tertiary referrals x 2 Alerted referrer of this issue. Immediate - Stella Alldred, Assistant General Manager Indicator level Red Amber Green 1 1 N/A 0 Latest YTD performance Forecast Signed off by: Expected date to meet standard: Plan for next Board report: 5 Red Michelle Rhodes September 2010 July 2010 N/A | 18

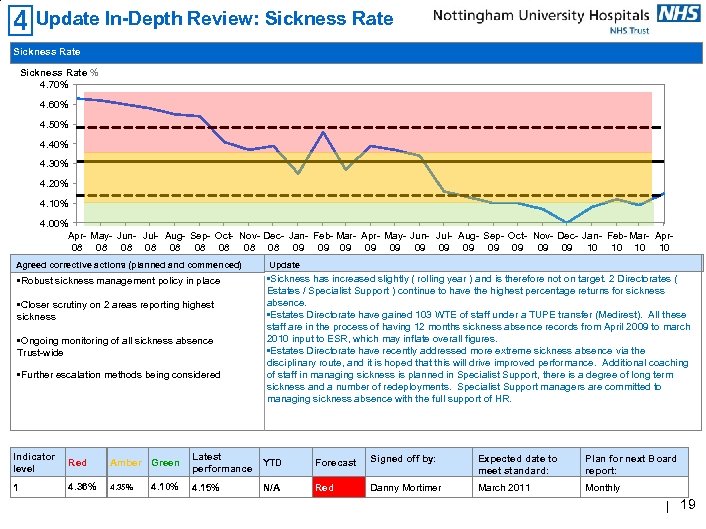

Update In-Depth Review: Sickness Rate % 4. 70% 4. 60% 4. 50% 4. 40% 4. 30% 4. 20% 4. 10% 4. 00% Apr- May- Jun- Jul- Aug- Sep- Oct- Nov- Dec- Jan- Feb- Mar- Apr 08 08 08 09 09 09 10 10 Agreed corrective actions (planned and commenced) Update • Robust sickness management policy in place • Sickness has increased slightly ( rolling year ) and is therefore not on target. 2 Directorates ( Estates / Specialist Support ) continue to have the highest percentage returns for sickness absence. • Estates Directorate have gained 103 WTE of staff under a TUPE transfer (Medirest). All these staff are in the process of having 12 months sickness absence records from April 2009 to march 2010 input to ESR, which may inflate overall figures. • Estates Directorate have recently addressed more extreme sickness absence via the disciplinary route, and it is hoped that this will drive improved performance. Additional coaching of staff in managing sickness is planned in Specialist Support, there is a degree of long term sickness and a number of redeployments. Specialist Support managers are committed to managing sickness absence with the full support of HR. • Closer scrutiny on 2 areas reporting highest sickness • Ongoing monitoring of all sickness absence Trust-wide • Further escalation methods being considered Indicator level Red Amber Green 1 4. 36% 4. 35% 4. 10% Latest YTD performance Forecast Signed off by: Expected date to meet standard: Plan for next Board report: 4. 15% Red Danny Mortimer March 2011 Monthly N/A | 19

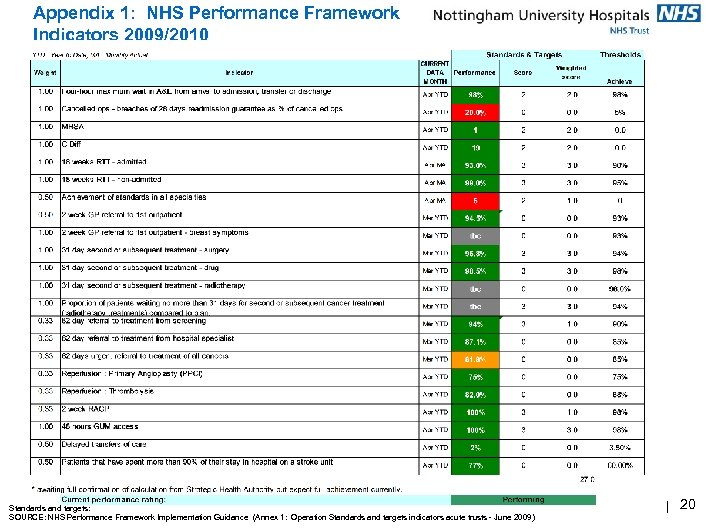

Appendix 1: NHS Performance Framework Indicators 2009/2010 Standards and targets: SOURCE: NHS Performance Framework Implementation Guidance (Annex 1: Operation Standards and targets indicators acute trusts - June 2009) | 20

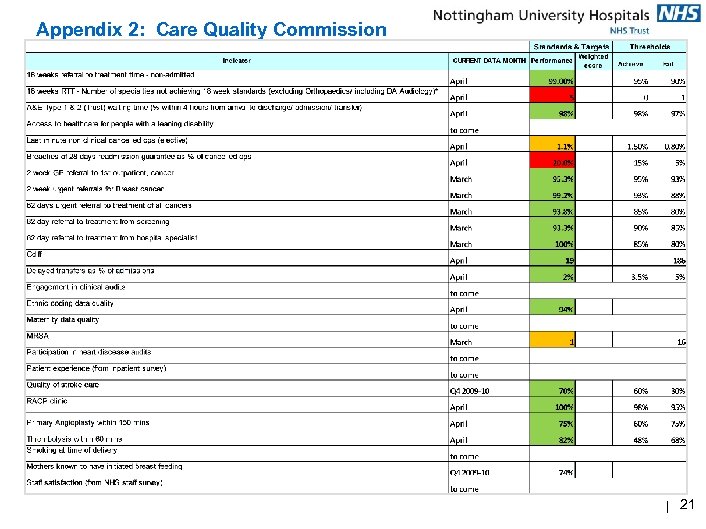

Appendix 2: Care Quality Commission | 21

1bc15ccd0a690bebe44cc3e4a5ada73e.ppt