e3bb26a7a887a0817bb1f27761129e6c.ppt

- Количество слайдов: 18

Trust as the Foundational Economic Exchange Principle

Trust as the Foundational Economic Exchange Principle

Trust and the economic exchange process • We will argue that – Trust does not just add to the functioning of economic exchange (e. g. ) but – Builds the foundation of economic exchange • We will provide a socio-cognitive analysis of how trust works in both exchange scenarios: – Barter – Money mediated exchange 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 2

Trust and the economic exchange process • We will argue that – Trust does not just add to the functioning of economic exchange (e. g. ) but – Builds the foundation of economic exchange • We will provide a socio-cognitive analysis of how trust works in both exchange scenarios: – Barter – Money mediated exchange 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 2

Our questions: How does Money impact on Trust relationships? What kinds of Trust does Money require?

Our questions: How does Money impact on Trust relationships? What kinds of Trust does Money require?

Trust – a definition • In our view (Castelfranchi, 2008; Castelfranchi & Falcone, 2001), Trust is a mental state, a complex attitude on an agent X towards another agent Y about the behavior/action α relevant for the result (goal) g – Trust (X Y τ) • First, one trusts another only relative to some goal • Second, trust itself consists of beliefs 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 4

Trust – a definition • In our view (Castelfranchi, 2008; Castelfranchi & Falcone, 2001), Trust is a mental state, a complex attitude on an agent X towards another agent Y about the behavior/action α relevant for the result (goal) g – Trust (X Y τ) • First, one trusts another only relative to some goal • Second, trust itself consists of beliefs 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 4

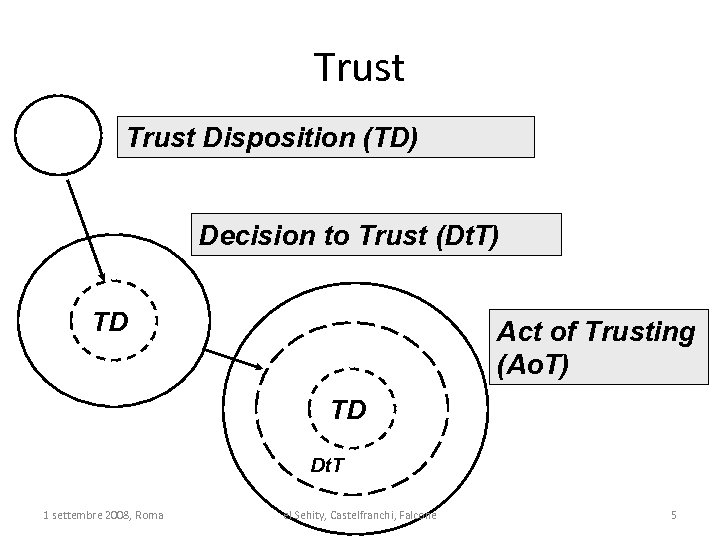

Trust Disposition (TD) Decision to Trust (Dt. T) TD Act of Trusting (Ao. T) TD Dt. T 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 5

Trust Disposition (TD) Decision to Trust (Dt. T) TD Act of Trusting (Ao. T) TD Dt. T 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 5

Barter, a socio-cognitive perspective (1/3) • Economists consider barter as the primitive precursor to monetary exchange. Since Javons‘ (1875) famous formulation „double coincidence of wants“ barter has been dismissed as an inefficient form of exchange. • It is however less the double coincidence of wants rather than the „trust-intensiveness“ which renders barter inefficient: 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 6

Barter, a socio-cognitive perspective (1/3) • Economists consider barter as the primitive precursor to monetary exchange. Since Javons‘ (1875) famous formulation „double coincidence of wants“ barter has been dismissed as an inefficient form of exchange. • It is however less the double coincidence of wants rather than the „trust-intensiveness“ which renders barter inefficient: 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 6

Barter, a socio-cognitive perspective (2/3) • The true difficulty in barter is not the „wants“ dimension but – when and how fast giving and taking (exchange) will conclude (Hobbesian „Covenant dilemma“) – both exchanging parties need to agree explicitely on the terms of exchange due to the improbable synchronizity (who gives what where and when first) • Given the contractualization of economic exchange processes, trust has to be considered an apriori condition to the factual exchange 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 7

Barter, a socio-cognitive perspective (2/3) • The true difficulty in barter is not the „wants“ dimension but – when and how fast giving and taking (exchange) will conclude (Hobbesian „Covenant dilemma“) – both exchanging parties need to agree explicitely on the terms of exchange due to the improbable synchronizity (who gives what where and when first) • Given the contractualization of economic exchange processes, trust has to be considered an apriori condition to the factual exchange 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 7

Barter, a socio-cognitive perspective (3/3) • Sussessful barter requires the same trust disposition beliefs of both exchanging parties: • Both, X and Y, have to trust: 1) The other agent, in terms of his/her Willingness, Motivation Belief, Skills and Compentences • Reliability evaluation: she/he will give me what he/she told me 2) The offered Goods: not only does the other need to be reliable, but the good has to be a good one (quality) • Thus, a fourfold trustworthyness has to mediate the barter exchange 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 8

Barter, a socio-cognitive perspective (3/3) • Sussessful barter requires the same trust disposition beliefs of both exchanging parties: • Both, X and Y, have to trust: 1) The other agent, in terms of his/her Willingness, Motivation Belief, Skills and Compentences • Reliability evaluation: she/he will give me what he/she told me 2) The offered Goods: not only does the other need to be reliable, but the good has to be a good one (quality) • Thus, a fourfold trustworthyness has to mediate the barter exchange 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 8

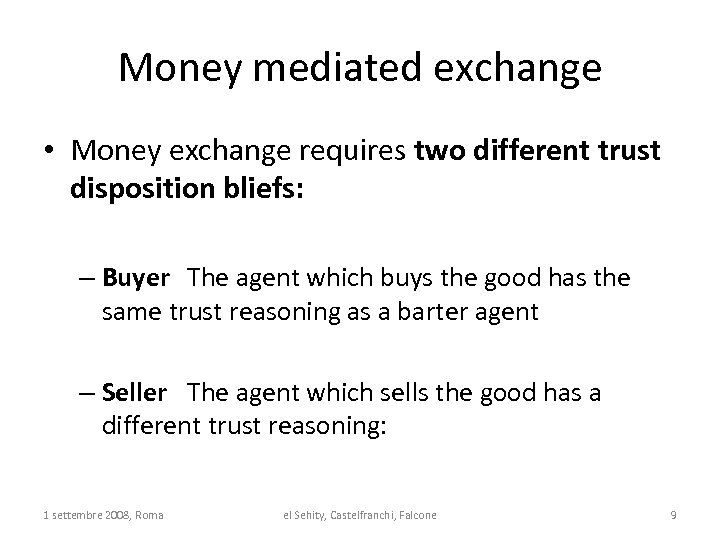

Money mediated exchange • Money exchange requires two different trust disposition bliefs: – Buyer The agent which buys the good has the same trust reasoning as a barter agent – Seller The agent which sells the good has a different trust reasoning: 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 9

Money mediated exchange • Money exchange requires two different trust disposition bliefs: – Buyer The agent which buys the good has the same trust reasoning as a barter agent – Seller The agent which sells the good has a different trust reasoning: 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 9

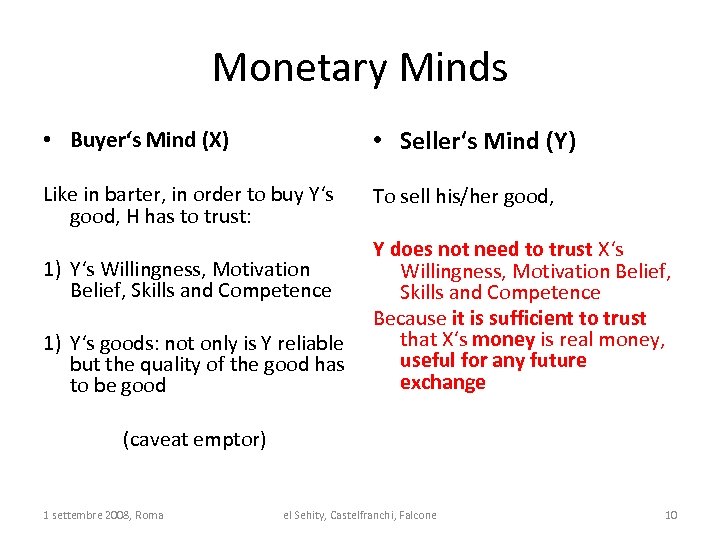

Monetary Minds • Buyer‘s Mind (X) • Seller‘s Mind (Y) Like in barter, in order to buy Y‘s good, H has to trust: To sell his/her good, 1) Y‘s Willingness, Motivation Belief, Skills and Competence 1) Y‘s goods: not only is Y reliable but the quality of the good has to be good Y does not need to trust X‘s Willingness, Motivation Belief, Skills and Competence Because it is sufficient to trust that X‘s money is real money, useful for any future exchange (caveat emptor) 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 10

Monetary Minds • Buyer‘s Mind (X) • Seller‘s Mind (Y) Like in barter, in order to buy Y‘s good, H has to trust: To sell his/her good, 1) Y‘s Willingness, Motivation Belief, Skills and Competence 1) Y‘s goods: not only is Y reliable but the quality of the good has to be good Y does not need to trust X‘s Willingness, Motivation Belief, Skills and Competence Because it is sufficient to trust that X‘s money is real money, useful for any future exchange (caveat emptor) 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 10

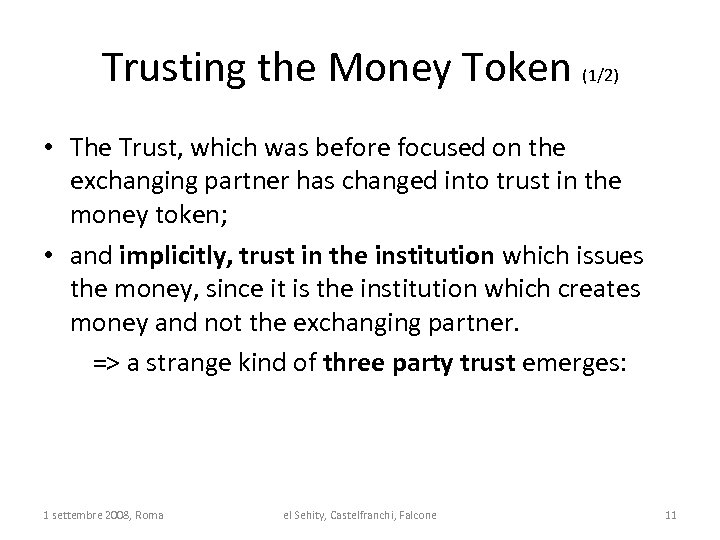

Trusting the Money Token (1/2) • The Trust, which was before focused on the exchanging partner has changed into trust in the money token; • and implicitly, trust in the institution which issues the money, since it is the institution which creates money and not the exchanging partner. => a strange kind of three party trust emerges: 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 11

Trusting the Money Token (1/2) • The Trust, which was before focused on the exchanging partner has changed into trust in the money token; • and implicitly, trust in the institution which issues the money, since it is the institution which creates money and not the exchanging partner. => a strange kind of three party trust emerges: 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 11

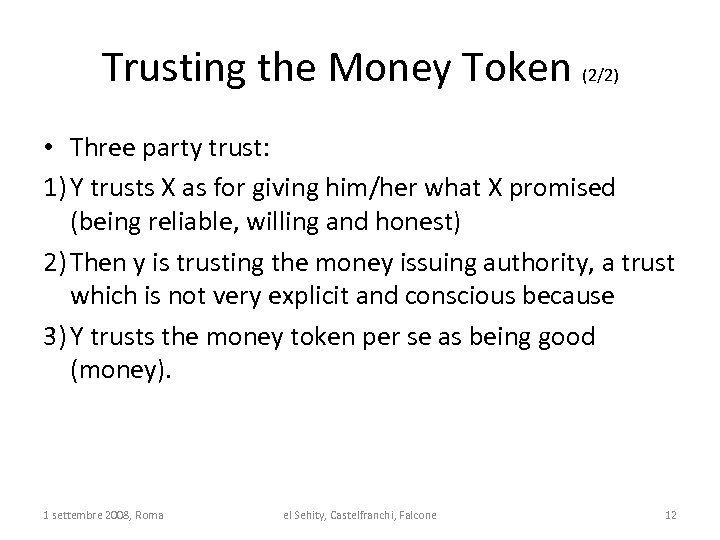

Trusting the Money Token (2/2) • Three party trust: 1) Y trusts X as for giving him/her what X promised (being reliable, willing and honest) 2) Then y is trusting the money issuing authority, a trust which is not very explicit and conscious because 3) Y trusts the money token per se as being good (money). 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 12

Trusting the Money Token (2/2) • Three party trust: 1) Y trusts X as for giving him/her what X promised (being reliable, willing and honest) 2) Then y is trusting the money issuing authority, a trust which is not very explicit and conscious because 3) Y trusts the money token per se as being good (money). 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 12

The Implicit Money Complicity (1/2) • However for money to function as money the act of giving money has to count as buying or paying (not allways giving money is buying…) • The „count as“ notion refers to the fact that both agents have to recognize the act of giving/taking money as buying/selling. • The count-as function apears to be automatic implicit and mechanic, however: 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 13

The Implicit Money Complicity (1/2) • However for money to function as money the act of giving money has to count as buying or paying (not allways giving money is buying…) • The „count as“ notion refers to the fact that both agents have to recognize the act of giving/taking money as buying/selling. • The count-as function apears to be automatic implicit and mechanic, however: 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 13

The Implicit Money Complicity (2/2) • The Count-as money function presupposes the „complicity“ that the involved agents share the view, that is, share the belief in the same cognitive action frame so that the other will behave accordingly • Only the complicity of the interacting other establishes the functioning of money as a medium of exchange • Thus the buyer has to trust that „money counts as money“ for the seller 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 14

The Implicit Money Complicity (2/2) • The Count-as money function presupposes the „complicity“ that the involved agents share the view, that is, share the belief in the same cognitive action frame so that the other will behave accordingly • Only the complicity of the interacting other establishes the functioning of money as a medium of exchange • Thus the buyer has to trust that „money counts as money“ for the seller 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 14

The Reification of Trust in Money • Money canceles almost one half of the trust required for direct exchange. • The trustworthyness of the payer is reduced to the sole reliability of paying • The „eliminated“ trust is transfered to a third party, which promisses that this money is good for future exchanges with all sellers • The promiss of the institution is however based on pure trust that all sellers trust the institution‘s promise • The trust loop from market agents to the institution back to the market agents leads to the reification of the complex tust scheme into an implicit operational trust in the money token per se. 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 15

The Reification of Trust in Money • Money canceles almost one half of the trust required for direct exchange. • The trustworthyness of the payer is reduced to the sole reliability of paying • The „eliminated“ trust is transfered to a third party, which promisses that this money is good for future exchanges with all sellers • The promiss of the institution is however based on pure trust that all sellers trust the institution‘s promise • The trust loop from market agents to the institution back to the market agents leads to the reification of the complex tust scheme into an implicit operational trust in the money token per se. 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 15

Consequences • The inherent unilateral information asymmetry in money mediated exchange: – The buyer pays for a "supposed" value of V! (in terms of SEU, the supposed value * the probability of its expected quality => This necessary is less than the proclaimed value by the seller) – Further, the buyer also pays with anxiety, trust effort, etc. (costs) – > thus, a rational for the „endowment effect“ rather than the asymmetric loss/gains reasoning of the Prospect Theory framework. Empirical data (e. g. Dupont & Le, 2002) 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 16

Consequences • The inherent unilateral information asymmetry in money mediated exchange: – The buyer pays for a "supposed" value of V! (in terms of SEU, the supposed value * the probability of its expected quality => This necessary is less than the proclaimed value by the seller) – Further, the buyer also pays with anxiety, trust effort, etc. (costs) – > thus, a rational for the „endowment effect“ rather than the asymmetric loss/gains reasoning of the Prospect Theory framework. Empirical data (e. g. Dupont & Le, 2002) 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 16

Stop? 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 17

Stop? 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 17

References • Castelfranchi, C. (2008). Trust and reciprocity: misundertandings. International Review of Economics, 55, 45 -63. • Castelfranchi, C. and Falcone, R. (2001). Social Trust: a cognitive approach. In Kluwer Academic Publishers, Trust and deception in virtual societies. • Castelfranchi, C. and Falcone, R. (in press). Trust • Dupont, D. Y. and Lee, G. S. (2002). The Endowment Effect, Status Quo Bias and Loss Aversion: Rational Alternative Explanations. The Journal of Risk and Uncertainty, 25, 87 -101. • Javons, W. S. (1875). Money and the Mechanism of Exchange. London: Appleton, 1875. 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 18

References • Castelfranchi, C. (2008). Trust and reciprocity: misundertandings. International Review of Economics, 55, 45 -63. • Castelfranchi, C. and Falcone, R. (2001). Social Trust: a cognitive approach. In Kluwer Academic Publishers, Trust and deception in virtual societies. • Castelfranchi, C. and Falcone, R. (in press). Trust • Dupont, D. Y. and Lee, G. S. (2002). The Endowment Effect, Status Quo Bias and Loss Aversion: Rational Alternative Explanations. The Journal of Risk and Uncertainty, 25, 87 -101. • Javons, W. S. (1875). Money and the Mechanism of Exchange. London: Appleton, 1875. 1 settembre 2008, Roma el Sehity, Castelfranchi, Falcone 18