9d90c4faed2f3fb3d643bdf11619aff2.ppt

- Количество слайдов: 38

Tribal Child Support Enforcement (CSET) Joe Lonergan, Director Division of Mandatory Grants October, 2007 Boise, ID 1

Topics for Discussion Today Tribal Child Support Enforcement 1. Applying for the Grant (2 Year Start-Up Grant) 2. Report Due Dates 3. OMB Directives 4. Obligation and Liquidation of Funds 5. In-kind Contributions 6. Staffing Levels 7. Budget Justification 8. Construction – Major or Minor 9. Reporting (OLDC) 2

2 Year Start-Up Grant • Tribes must submit application and proposed budget for ACF approval. • Grant period is for two Years (effective beginning the first quarter after approval). • Example: 04/01/2007 to 3/31/2009. • Expenditures are funded at 100% (first two years). 3

Reports: Due Dates START-UP CHILD SUPPORT TRIBAL GRANTS (2 yrs) Example: 04/01/2007 and Ending: 03/31/2009 Sixty days prior to the end of Year One (on 01/31/2008): 1. 2. Report the status or a progress review of the fourteen (14) items in your application. Submit budget estimates and SF-424 for Year Two (04/01/2008 to 03/31/2009). Sixty days prior to the end of Year Two (on 01/31/2009): 1. 2. 3. 4. Report a progress of the fourteen (14) items in your application (per 309. 65 of the final rule). Submit a Comprehensive Plan for approval; with a start date after the end of Year Two grant period (04/01/2009). Submit budget to fund the program from the end of Year Two to the beginning of the next Federal Fiscal Year (FFY) - 04/01/2009 to 9/30/2009 (6 months) (see note). Ask for a 90 day ‘no cost’ extension starting 04/01/2009. Give phone number of person to contact regarding the start date for the Comprehensive program. Note: Start-up grants that end in June, submit a budget for the next fiscal year plus any additional months to the end of the current fiscal year (up to 15 months). 4

Reports: Due Dates (cont’d) Comprehensive Child Support Plan • Funding for the Child Support Program will not occur until ACF approves the Comprehensive Plan. • Tribes not submitting Comprehensive Plans 60 days prior to the end of Year Two may experience delays in being funded for the first quarter after the start-up grant has ended. 5

Start-up Grants Terms and Conditions • The following Circulars from the Office of Management and Budget (OMB) apply to federal grants: – – 2 CFR Part 225, Cost Principles for State, Local and Indian Tribal Governments (formerly OMB Circular A-87) OMB Circular A-133, Audits of States, Local Governments, and Non-Profit Organizations and the Single Audit Act of 1984, as amended. 6

Obligation of Funds An obligation occurs when funds are encumbered or a valid purchase order or requisition to cover the cost of purchasing an authorized item such as a contract, travel order, etc. , up to the last day of the grant period in the award. Any funds not properly obligated by the recipient within the grant award period will lapse and revert to the awarding agency. Funds for official travel. 7

Obligation of Funds (cont’d) The obligation deadline is the last day of the grant award period. For example, if the award time period is 10/1/2007 to 9/30/2009, the obligation deadline is 9/30/2009. No additional obligations can be incurred after the end of this period. 8

No Cost Extension of Start-up Grants Dear Grantee: The Administration for Children and Families has approved the Tribe’s request for a three-month no-cost extension of its Child Support Enforcement Tribal Program (CSET) Start-Up Grant. This action extends the grant period to (date). While this action does not increase funding for the grant, it allows previously awarded funds available for obligation and liquidation until the new end date. A final financial report will be due 90 days after the expiration of the Start-Up Grant. During this 90 day period, grantees are expected to reconcile accounts, liquidating any previously unliquidated obligations. No new obligations are permitted using Start-Up Grant funds during the final report preparation period. If the Tribe’s Comprehensive Plan is approved before the end of the extension; comprehensive funding will be made available immediately upon approval. Funding for the Comprehensive Program will be retroactive to (date), the first day of the Federal Fiscal Quarter in which the funding decision was made. Please note, however that Start-Up Grant periods and Comprehensive Grant periods cannot overlap. 9

Liquidation of Funds Liquidation of funds could be an advance payment which is not an expenditure; i. e. , a payment made by Treasury check or other appropriate payment mechanism to a recipient upon their request either before expenditures are made by the recipient or through the use of predetermined payment schedules. 10

Liquidation of Funds (cont’d) Liquidation of funds could be actual expenditure of funds. These are payments which are the sum of cash disbursements for direct charges for goods and services, the amount of indirect expense charged, the value of third party in-kind contributions applied and the amount of payments made to vendors. For purposes of TCSE start-up grants, the grant period is a cumulative two-year period for start-up funds totaling up to $500, 000. 11

Liquidation of Funds (cont’d) Federal funds awarded under a Tribal Child Support Enforcement grant must be obligated no later than the final day of that cumulative time period. All obligations must be liquidated no later than 90 days following the final day of the cumulative start-up grant period. Any Federal funds from this award remaining un-liquidated or un-obligated after 90 days from the final day of the grant period are recouped by the Federal government. 12

Tribal Child Support Enforcement • In-Kind Contributions – For personnel who volunteer to answer telephones for a particular day and receive no pay, the pay they would have otherwise receive at the current rate of such services may be taken as an in-kind contribution; however, if you pay someone as little as $1 for any of the hours that they work on that particular day, none of the hours that they work that day may be counted as in-kind contribution because they received pay in the amount of $1 for their services. 13

In-Kind Contributions • Tribes are required to keep records of all in-kind transactions and must maintain these records in active files. 14

In-Kind Contributions Lease or Rental Charges • If the dollar amount actually being paid by a tribe for lease or rental charges is less than the actual prevailing real estate market rates for that geographical area, the difference between those dollar amounts may not be categorized as an inkind contribution. The amount paid by a tribe for lease or rental charges, even if it is as little as one dollar, constitutes payment of lease or rental charges for the location being leased or rented. 15

In-Kind Contributions Volunteer Services • Volunteer services are services which are not paid for by the grantee or cost -type contractor. Volunteer services may be furnished by professional and technical personnel, consultants and other skilled and unskilled persons. Each hour of volunteered service may be counted if the service is an integral and necessary part of an approved project. To count the time of a volunteer as match, the volunteer must be providing a service to and not receiving a service from the program. The procedures for valuing volunteer services are in 45 CFR 92. 24. • If a volunteer’s time is being paid for under another Federal grant, it may not be used for match, nor may volunteer’s time be used to match more than one grant (45 CFR 92. 24(a)(3). • Note that Labor Laws could negate your ability to take such action and if challenged later on, you may be required to pay the claimant and to reimburse the Federal government for negated in-kind contributions. 16

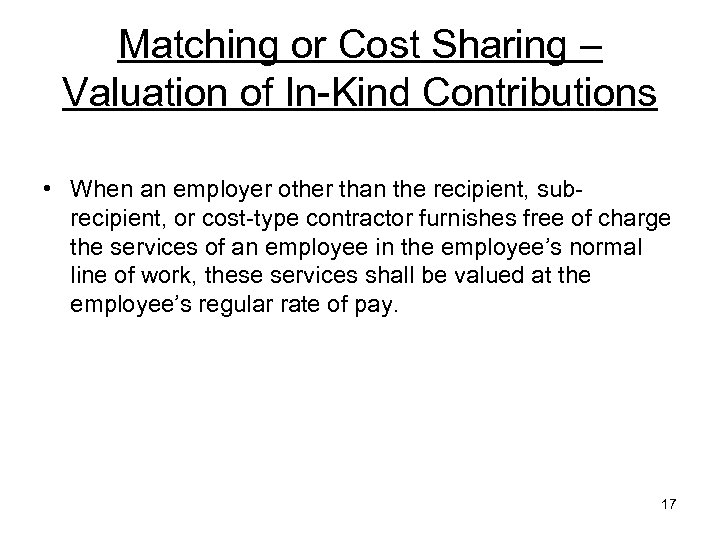

Matching or Cost Sharing – Valuation of In-Kind Contributions • When an employer other than the recipient, subrecipient, or cost-type contractor furnishes free of charge the services of an employee in the employee’s normal line of work, these services shall be valued at the employee’s regular rate of pay. 17

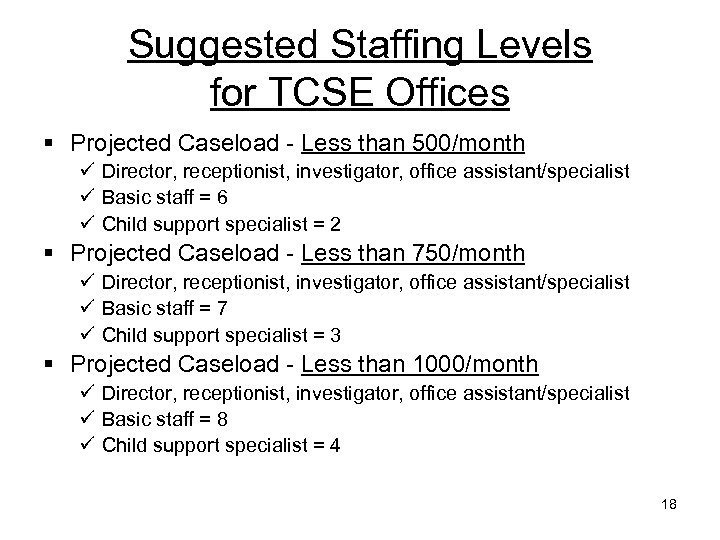

Suggested Staffing Levels for TCSE Offices § Projected Caseload - Less than 500/month ü Director, receptionist, investigator, office assistant/specialist ü Basic staff = 6 ü Child support specialist = 2 § Projected Caseload - Less than 750/month ü Director, receptionist, investigator, office assistant/specialist ü Basic staff = 7 ü Child support specialist = 3 § Projected Caseload - Less than 1000/month ü Director, receptionist, investigator, office assistant/specialist ü Basic staff = 8 ü Child support specialist = 4 18

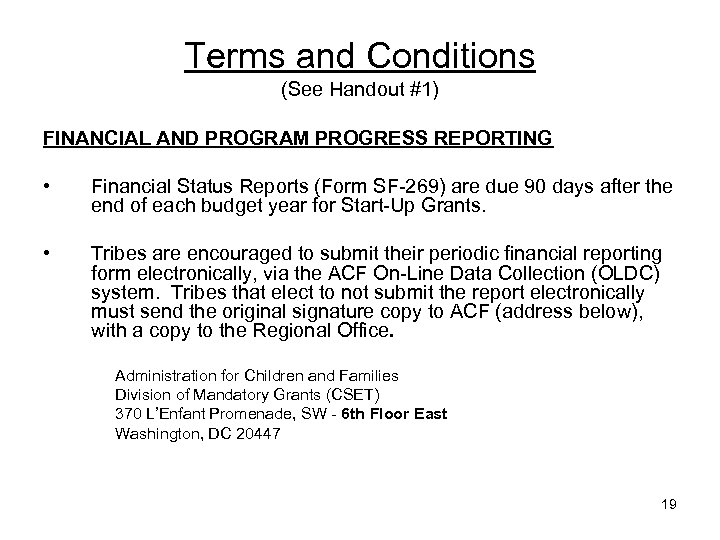

Terms and Conditions (See Handout #1) FINANCIAL AND PROGRAM PROGRESS REPORTING • Financial Status Reports (Form SF-269) are due 90 days after the end of each budget year for Start-Up Grants. • Tribes are encouraged to submit their periodic financial reporting form electronically, via the ACF On-Line Data Collection (OLDC) system. Tribes that elect to not submit the report electronically must send the original signature copy to ACF (address below), with a copy to the Regional Office. Administration for Children and Families Division of Mandatory Grants (CSET) 370 L’Enfant Promenade, SW - 6 th Floor East Washington, DC 20447 19

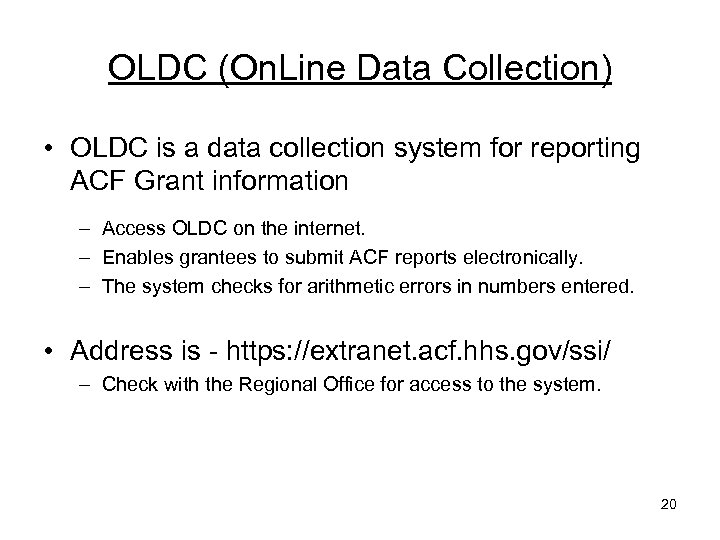

OLDC (On. Line Data Collection) • OLDC is a data collection system for reporting ACF Grant information – Access OLDC on the internet. – Enables grantees to submit ACF reports electronically. – The system checks for arithmetic errors in numbers entered. • Address is - https: //extranet. acf. hhs. gov/ssi/ – Check with the Regional Office for access to the system. 20

![First Year Start-Up Funding SF 424 N/A [x] Non Construction [X] New Continuation Revision First Year Start-Up Funding SF 424 N/A [x] Non Construction [X] New Continuation Revision](https://present5.com/presentation/9d90c4faed2f3fb3d643bdf11619aff2/image-21.jpg)

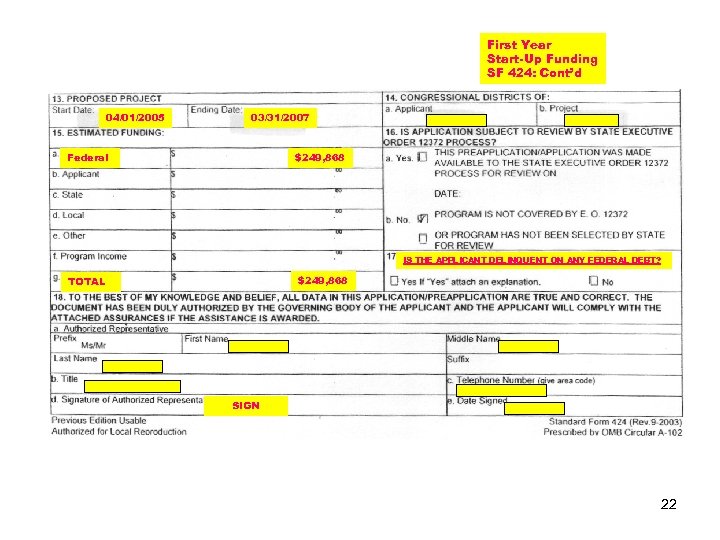

First Year Start-Up Funding SF 424 N/A [x] Non Construction [X] New Continuation Revision N/A K Administration for Children and Families 93 – 563 Start-Up Funding Child Support Program 21

First Year Start-Up Funding SF 424: Cont’d 04/01/2005 03/31/2007 Federal $249, 868 IS THE APPLICANT DELINQUENT ON ANY FEDERAL DEBT? $249, 868 TOTAL SIGN 22

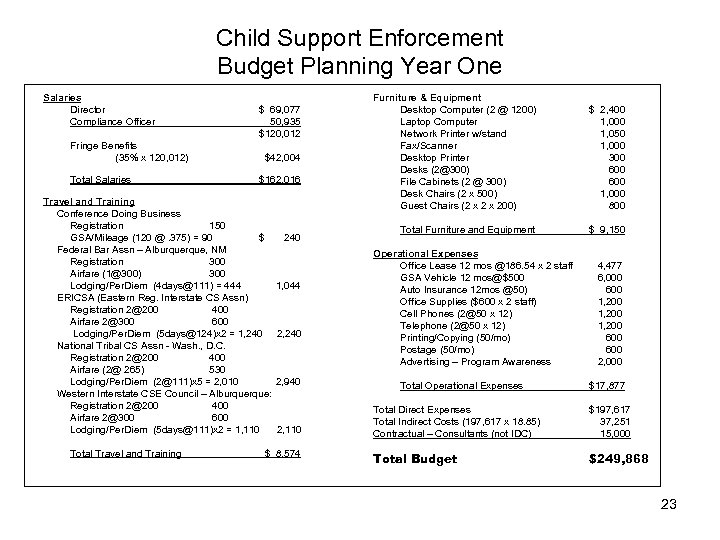

Child Support Enforcement Budget Planning Year One Salaries Director Compliance Officer Fringe Benefits (35% x 120, 012) Total Salaries $ 69, 077 50, 935 $120, 012 $42, 004 $162, 016 Travel and Training Conference Doing Business Registration 150 GSA/Mileage (120 @. 375) = 90 $ Federal Bar Assn – Alburque, NM Registration 300 Airfare (1@300) 300 Lodging/Per. Diem (4 days@111) = 444 ERICSA (Eastern Reg. Interstate CS Assn) Registration 2@200 400 Airfare 2@300 600 Lodging/Per. Diem (5 days@124)x 2 = 1, 240 National Tribal CS Assn - Wash. , D. C. Registration 2@200 400 Airfare (2@ 265) 530 Lodging/Per. Diem (2@111)x 5 = 2, 010 Western Interstate CSE Council – Alburque: Registration 2@200 400 Airfare 2@300 600 Lodging/Per. Diem (5 days@111)x 2 = 1, 110 Total Travel and Training 240 1, 044 2, 240 2, 940 2, 110 $ 8, 574 Furniture & Equipment Desktop Computer (2 @ 1200) Laptop Computer Network Printer w/stand Fax/Scanner Desktop Printer Desks (2@300) File Cabinets (2 @ 300) Desk Chairs (2 x 500) Guest Chairs (2 x 200) $ 2, 400 1, 050 1, 000 300 600 1, 000 800 Total Furniture and Equipment $ 9, 150 Operational Expenses Office Lease 12 mos @186. 54 x 2 staff GSA Vehicle 12 mos@$500 Auto Insurance 12 mos @50) Office Supplies ($600 x 2 staff) Cell Phones (2@50 x 12) Telephone (2@50 x 12) Printing/Copying (50/mo) Postage (50/mo) Advertising – Program Awareness Total Operational Expenses 4, 477 6, 000 600 1, 200 600 2, 000 $17, 877 Total Direct Expenses Total Indirect Costs (197, 617 x 18. 85) Contractual – Consultants (not IDC) $197, 617 37, 251 15, 000 Total Budget $249, 868 23

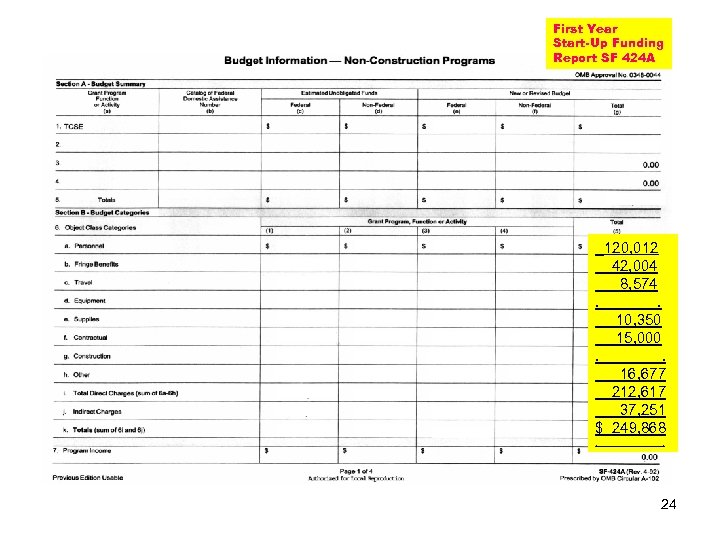

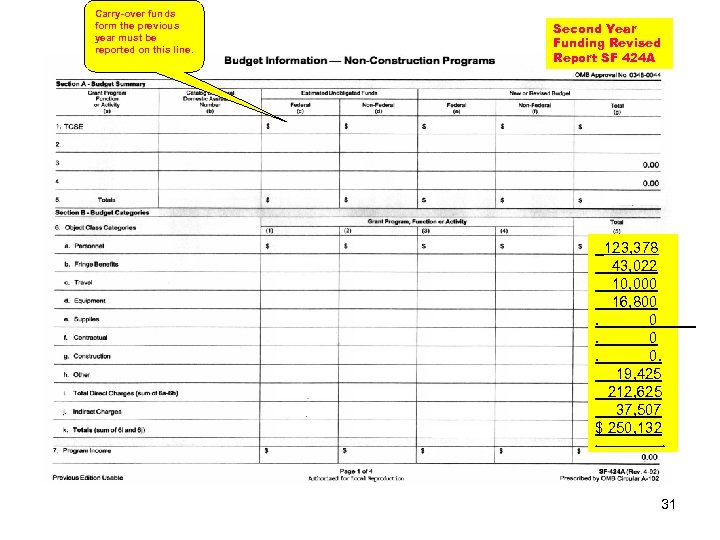

First Year Start-Up Funding Report SF 424 A 120, 012 42, 004 8, 574. . 10, 350 15, 000. . 16, 677 212, 617 37, 251 $ 249, 868. . 24

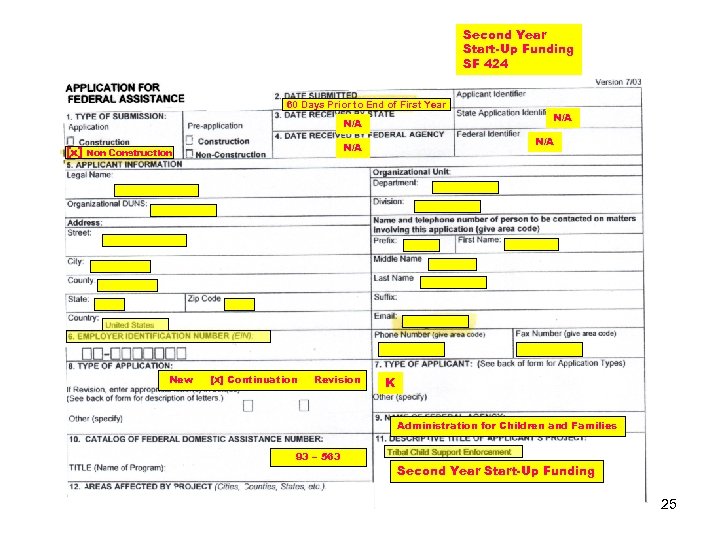

Second Year Start-Up Funding SF 424 60 Days Prior to End of First Year N/A New N/A [x] Non Construction [ X] Continuation Revision N/A K Administration for Children and Families 93 – 563 Second Year Start-Up Funding 25

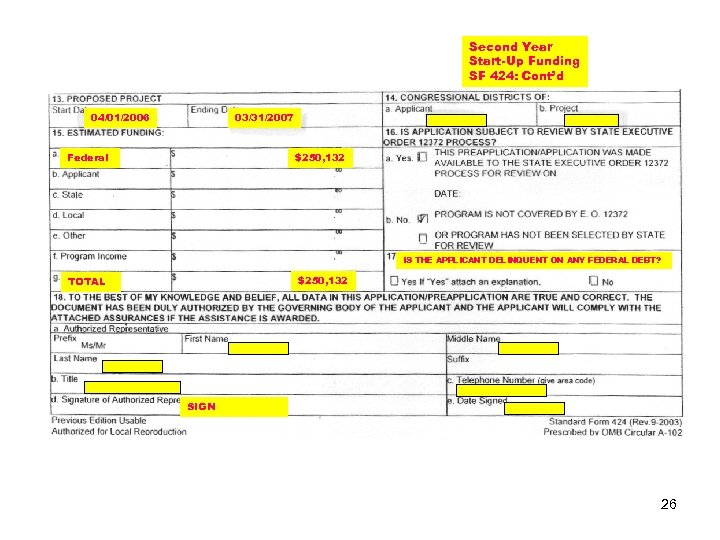

Second Year Start-Up Funding SF 424: Cont’d 04/01/2006 03/31/2007 Federal $250, 132 IS THE APPLICANT DELINQUENT ON ANY FEDERAL DEBT? $250, 132 TOTAL SIGN 26

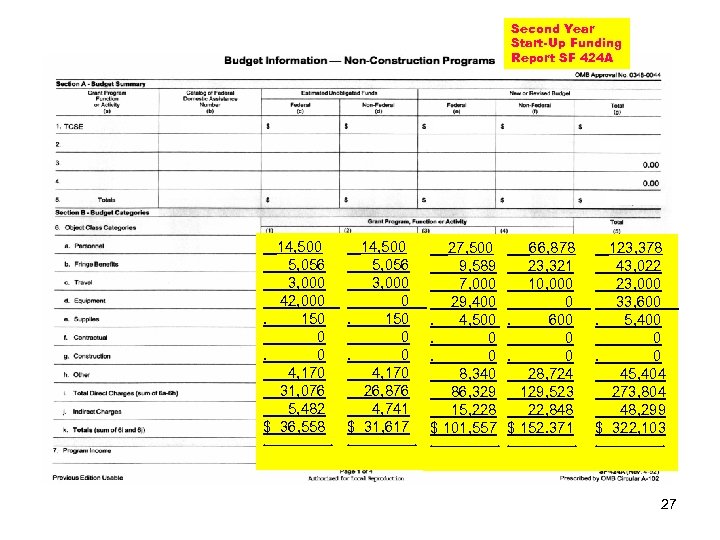

Second Year Start-Up Funding Report SF 424 A 14, 500 5, 056 3, 000 42, 000. 150 0. 0 4, 170 31, 076 5, 482 $ 36, 558. 14, 500 5, 056 3, 000 0. 150 0. 0 4, 170 26, 876 4, 741 $ 31, 617. . . 27, 500 66, 878 9, 589 23, 321 7, 000 10, 000 29, 400 0. 4, 500. 600. 0. 0 8, 340 28, 724 86, 329 129, 523 15, 228 22, 848 $ 101, 557 $ 152. 371 123, 378 43, 022 23, 000 33, 600. 5, 400 0. 0 45, 404 273, 804 48, 299 $ 322, 103 . . . 27

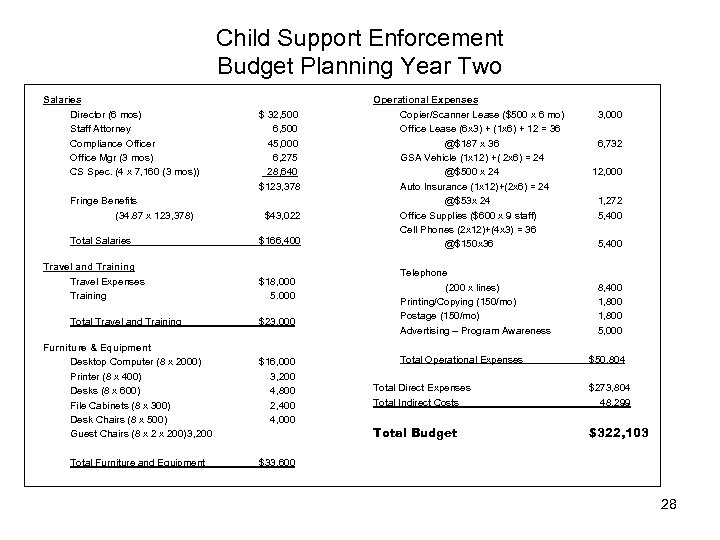

Child Support Enforcement Budget Planning Year Two Salaries Director (6 mos) Staff Attorney Compliance Officer Office Mgr (3 mos) CS Spec. (4 x 7, 160 (3 mos)) Fringe Benefits (34. 87 x 123, 378) Total Salaries Travel and Training Travel Expenses Training $ 32, 500 6, 500 45, 000 6, 275 28, 640 $123, 378 $43, 022 $166, 400 $18, 000 5. 000 Total Travel and Training $23, 000 Furniture & Equipment Desktop Computer (8 x 2000) Printer (8 x 400) Desks (8 x 600) File Cabinets (8 x 300) Desk Chairs (8 x 500) Guest Chairs (8 x 200)3, 200 $16, 000 3, 200 4, 800 2, 400 4, 000 Total Furniture and Equipment Operational Expenses Copier/Scanner Lease ($500 x 6 mo) Office Lease (6 x 3) + (1 x 6) + 12 = 36 @$187 x 36 GSA Vehicle (1 x 12) +( 2 x 6) = 24 @$500 x 24 Auto Insurance (1 x 12)+(2 x 6) = 24 @$53 x 24 Office Supplies ($600 x 9 staff) Cell Phones (2 x 12)+(4 x 3) = 36 @$150 x 36 Telephone (200 x lines) Printing/Copying (150/mo) Postage (150/mo) Advertising – Program Awareness Total Operational Expenses 3, 000 6, 732 12, 000 1, 272 5, 400 8, 400 1, 800 5, 000 $50, 804 Total Direct Expenses Total Indirect Costs $273, 804 48, 299 Total Budget $322, 103 $33, 600 28

![Second Year Revised Funding SF 424 [x] Non Construction New Continuation [X] Revision K Second Year Revised Funding SF 424 [x] Non Construction New Continuation [X] Revision K](https://present5.com/presentation/9d90c4faed2f3fb3d643bdf11619aff2/image-29.jpg)

Second Year Revised Funding SF 424 [x] Non Construction New Continuation [X] Revision K Administration for Children and Families 93 – 563 Second Year Start-Up Funding 29

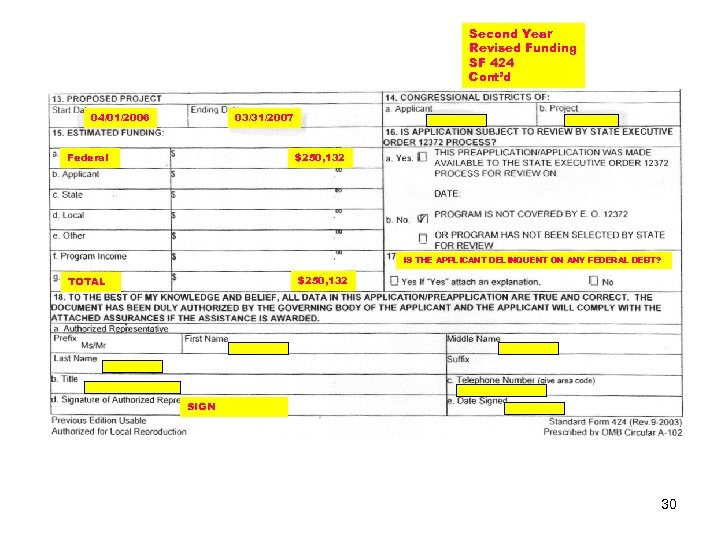

Second Year Revised Funding SF 424 Cont’d 04/01/2006 03/31/2007 Federal $250, 132 IS THE APPLICANT DELINQUENT ON ANY FEDERAL DEBT? $250, 132 TOTAL SIGN 30

Carry-over funds form the previous year must be reported on this line. Second Year Funding Revised Report SF 424 A 123, 378 43, 022 10, 000 16, 800. 0. 19, 425 212, 625 37, 507 $ 250, 132. . 31

Drawing Down Your Funds for Tribal Child Support Enforcement (Copies in Handout #1) Grant Award Letter (2) & PMS Report 32

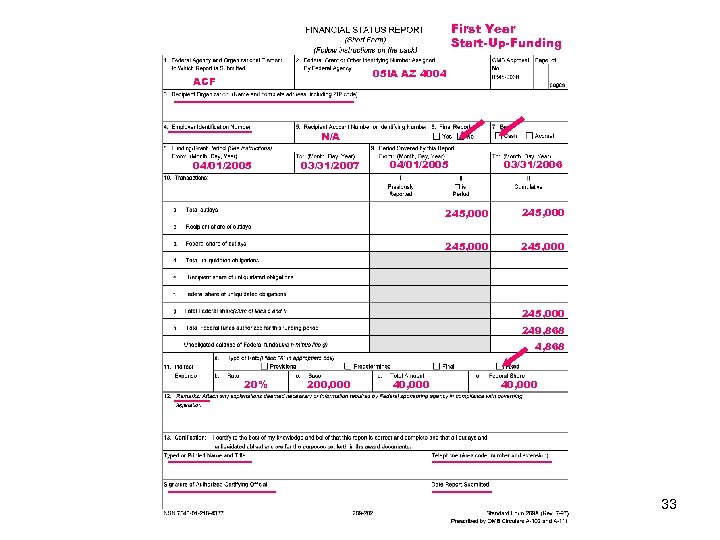

First Year Start-Up-Funding 05 IA AZ 4004 ACF N/A 04/01/2005 03/31/2007 04/01/2005 03/31/2006 245, 000 245, 000 249, 868 4, 868 20% 200, 000 40, 000 33

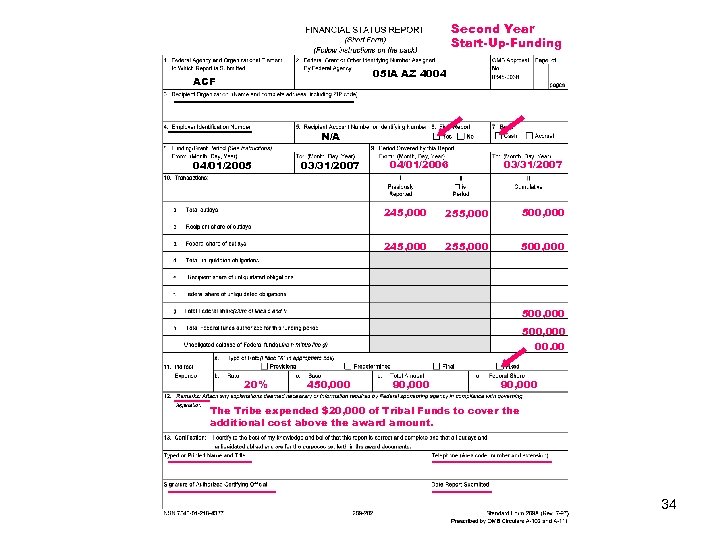

Second Year Start-Up-Funding 05 IA AZ 4004 ACF N/A 04/01/2005 03/31/2007 04/01/2006 03/31/2007 245, 000 255, 000 500, 000 00. 00 20% 450, 000 90, 000 The Tribe expended $20, 000 of Tribal Funds to cover the additional cost above the award amount. 34

• Reporting Child Support Collections • (See Handout #1) OCSE-34 A : Quarterly Report of Collections 35

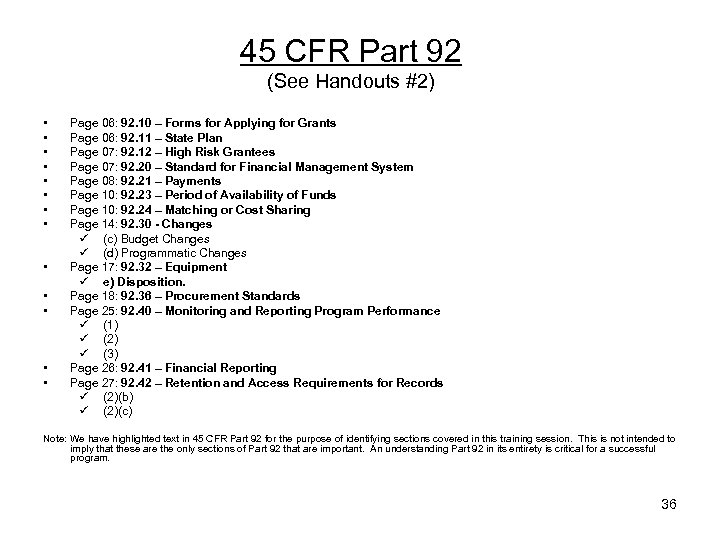

45 CFR Part 92 (See Handouts #2) • • • • Page 06: 92. 10 – Forms for Applying for Grants Page 06: 92. 11 – State Plan Page 07: 92. 12 – High Risk Grantees Page 07: 92. 20 – Standard for Financial Management System Page 08: 92. 21 – Payments Page 10: 92. 23 – Period of Availability of Funds Page 10: 92. 24 – Matching or Cost Sharing Page 14: 92. 30 - Changes ü (c) Budget Changes ü (d) Programmatic Changes Page 17: 92. 32 – Equipment ü e) Disposition. Page 18: 92. 36 – Procurement Standards Page 25: 92. 40 – Monitoring and Reporting Program Performance ü (1) ü (2) ü (3) Page 26: 92. 41 – Financial Reporting Page 27: 92. 42 – Retention and Access Requirements for Records ü (2)(b) ü (2)(c) Note: We have highlighted text in 45 CFR Part 92 for the purpose of identifying sections covered in this training session. This is not intended to imply that these are the only sections of Part 92 that are important. An understanding Part 92 in its entirety is critical for a successful program. 36

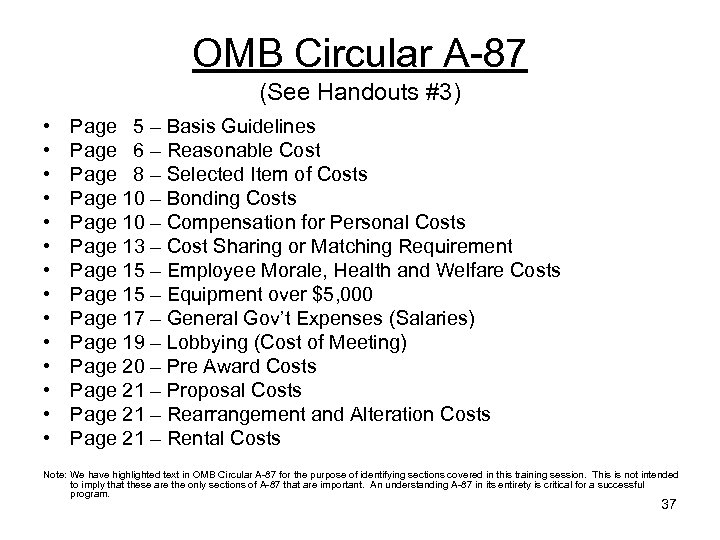

OMB Circular A-87 (See Handouts #3) • • • • Page 5 – Basis Guidelines Page 6 – Reasonable Cost Page 8 – Selected Item of Costs Page 10 – Bonding Costs Page 10 – Compensation for Personal Costs Page 13 – Cost Sharing or Matching Requirement Page 15 – Employee Morale, Health and Welfare Costs Page 15 – Equipment over $5, 000 Page 17 – General Gov’t Expenses (Salaries) Page 19 – Lobbying (Cost of Meeting) Page 20 – Pre Award Costs Page 21 – Proposal Costs Page 21 – Rearrangement and Alteration Costs Page 21 – Rental Costs Note: We have highlighted text in OMB Circular A-87 for the purpose of identifying sections covered in this training session. This is not intended to imply that these are the only sections of A-87 that are important. An understanding A-87 in its entirety is critical for a successful program. 37

THE END • Questions? ? ? • Thank-YOU!! 38

9d90c4faed2f3fb3d643bdf11619aff2.ppt