3f0cd03bfda1927dfd1403962fd0ac83.ppt

- Количество слайдов: 18

Trends in Student Loan Debt May 24, 2016 Mark Kantrowitz Publisher and VP of Strategy Cappex. com

Outstanding Student Loan Debt Milestones 2010 Federal and private student loan debt exceeds credit card debt 2011 Federal and private student loan debt exceeds auto loan debt 2012 Federal and private student loan debt reaches $1 trillion 2013 Federal student loan debt reaches $1 trillion on its own Federal and private student loan debt reaches $1. 2 trillion 2014 Cohort default rates drop for the first time since the start of the economic downturn New federal education loan volume drops for second year in a row

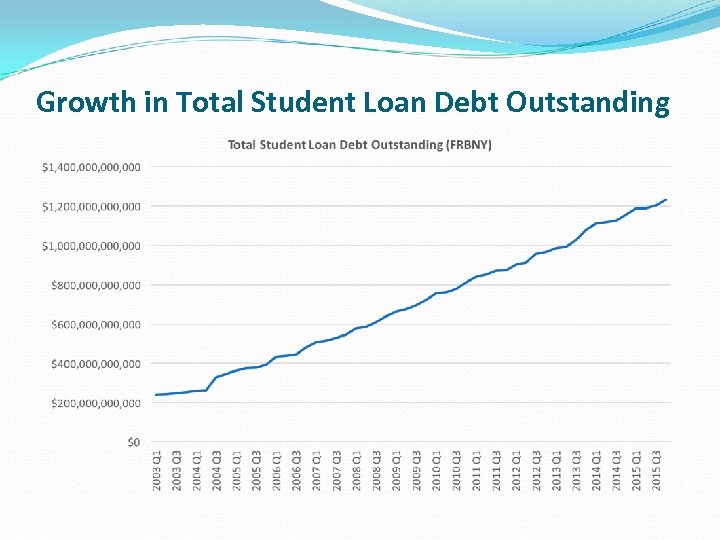

Growth in Total Student Loan Debt Outstanding

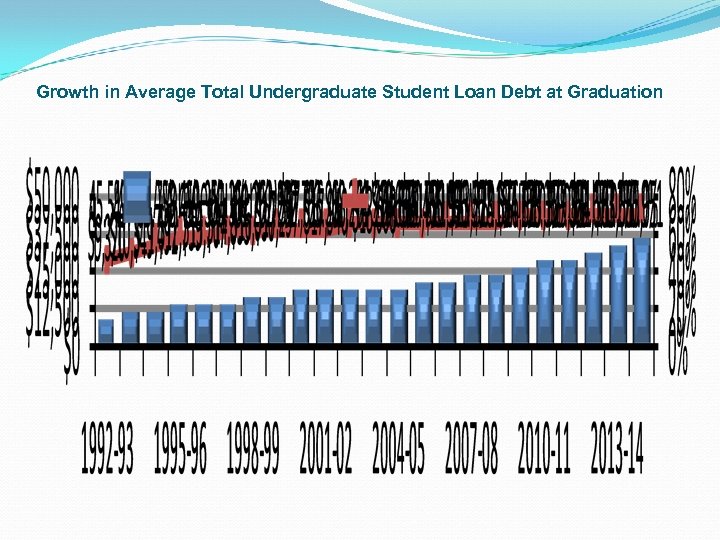

Growth in Average Total Undergraduate Student Loan Debt at Graduation

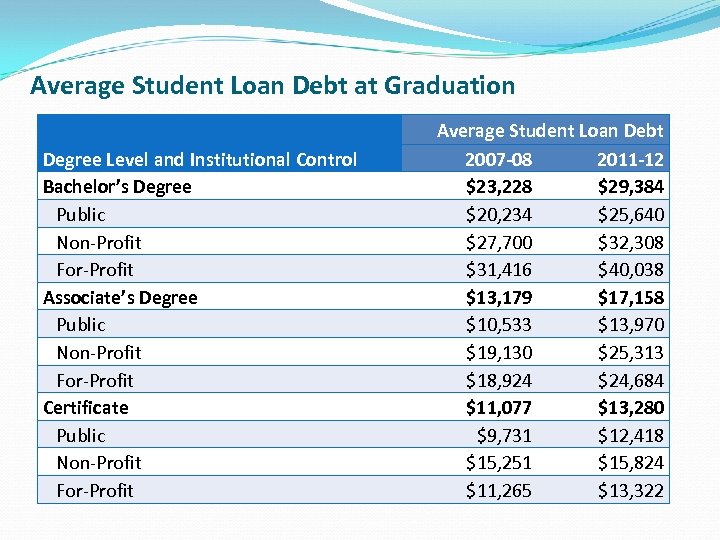

Average Student Loan Debt at Graduation Degree Level and Institutional Control Bachelor’s Degree Public Non-Profit For-Profit Associate’s Degree Public Non-Profit For-Profit Certificate Public Non-Profit For-Profit Average Student Loan Debt 2007 -08 2011 -12 $23, 228 $29, 384 $20, 234 $25, 640 $27, 700 $32, 308 $31, 416 $40, 038 $13, 179 $17, 158 $10, 533 $13, 970 $19, 130 $25, 313 $18, 924 $24, 684 $11, 077 $13, 280 $9, 731 $12, 418 $15, 251 $15, 824 $11, 265 $13, 322

How Much Debt is Reasonable and Affordable? Students (and parents) need to keep their total student loan debt in sync with income. Total student loan debt at graduation should be less than the annual starting salary and, ideally, a lot less. If total debt is less than annual income, the borrower should be able to repay his or her student loans in ten years or less. If total debt exceeds annual income, the borrower will struggle to repay the debt and will need an alternate repayment plan, like extended repayment or income-based repayment, to afford the monthly loan payments. Equivalent to a debt-service-to-income ratio of up to 10% Parents should borrow no more for all their children than they can afford to repay in ten years or by the time they retire, whichever comes first.

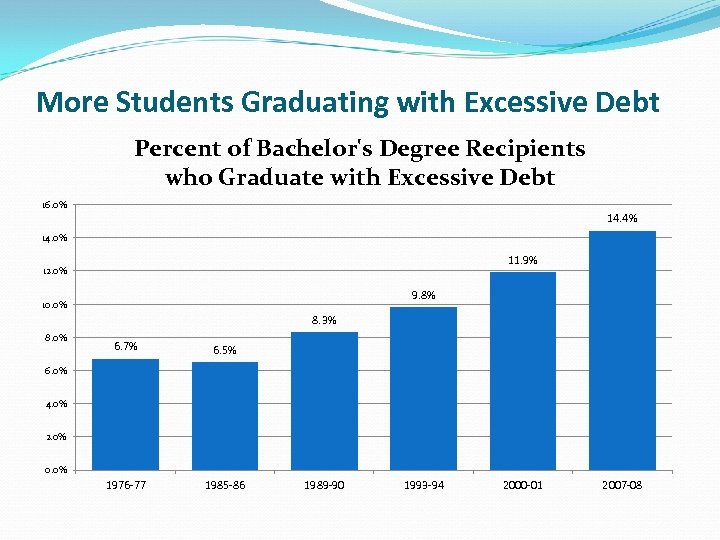

More Students Graduating with Excessive Debt Percent of Bachelor's Degree Recipients who Graduate with Excessive Debt 16. 0% 14. 4% 14. 0% 11. 9% 12. 0% 9. 8% 10. 0% 8. 3% 8. 0% 6. 7% 6. 5% 1976 -77 1985 -86 6. 0% 4. 0% 2. 0% 0. 0% 1989 -90 1993 -94 2000 -01 2007 -08

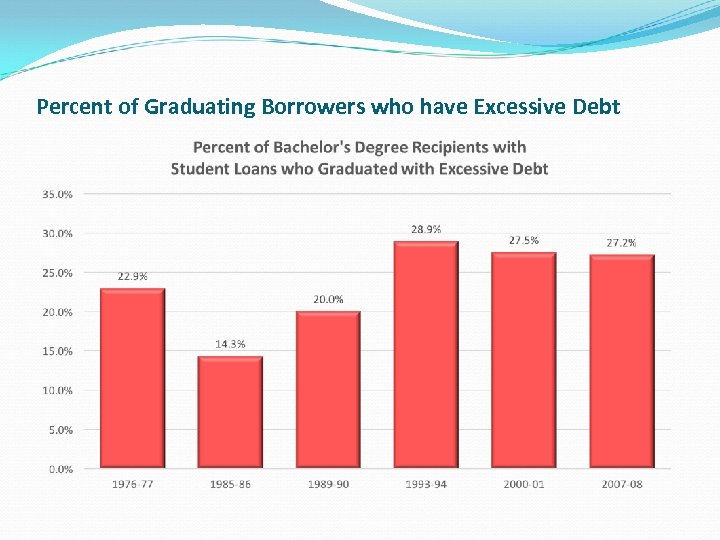

Percent of Graduating Borrowers who have Excessive Debt

Higher-Cost Colleges Drive Student Loan Debt at Graduation

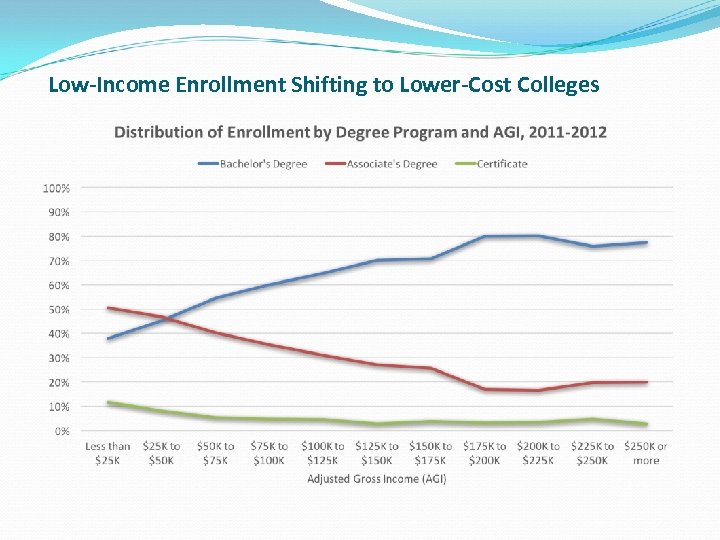

Low-Income Enrollment Shifting to Lower-Cost Colleges

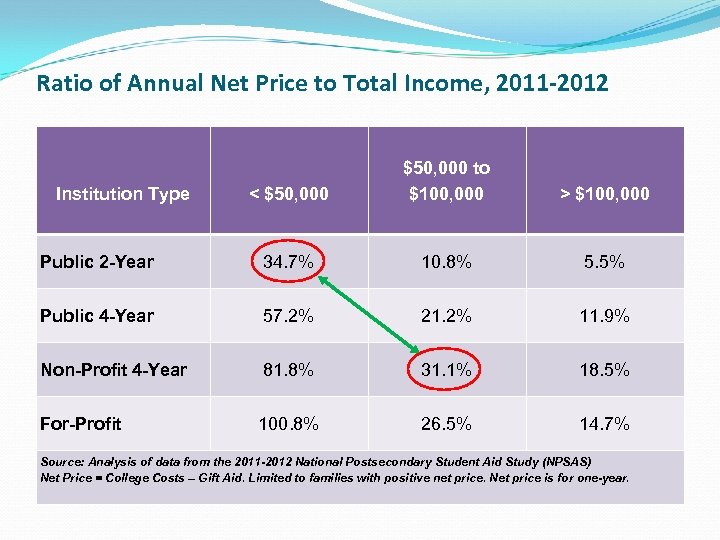

Ratio of Annual Net Price to Total Income, 2011 -2012 < $50, 000 to $100, 000 > $100, 000 Public 2 -Year 34. 7% 10. 8% 5. 5% Public 4 -Year 57. 2% 21. 2% 11. 9% Non-Profit 4 -Year 81. 8% 31. 1% 18. 5% For-Profit 100. 8% 26. 5% 14. 7% Institution Type Source: Analysis of data from the 2011 -2012 National Postsecondary Student Aid Study (NPSAS) Net Price = College Costs – Gift Aid. Limited to families with positive net price. Net price is for one-year.

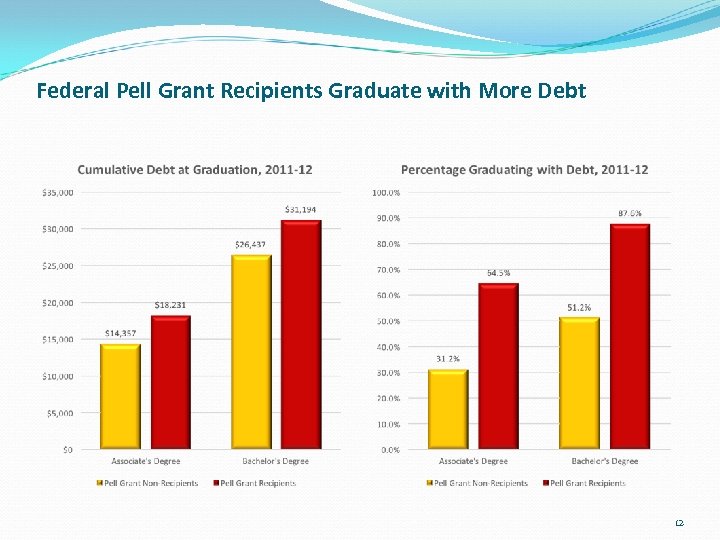

Federal Pell Grant Recipients Graduate with More Debt 12

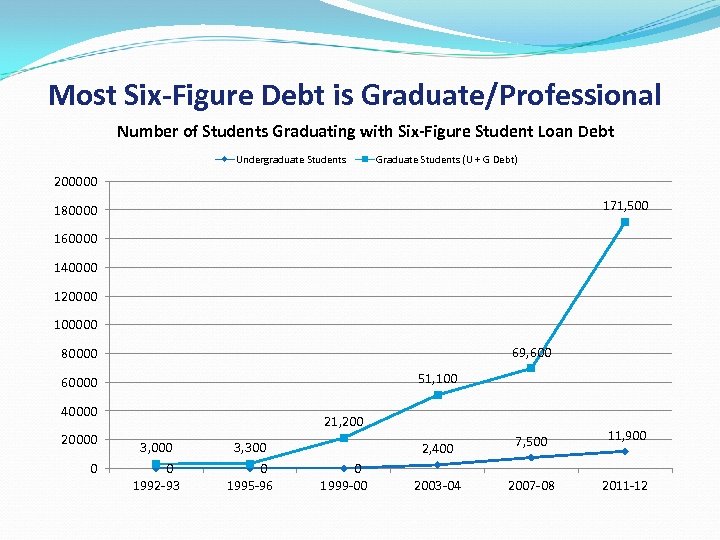

Most Six-Figure Debt is Graduate/Professional Number of Students Graduating with Six-Figure Student Loan Debt Undergraduate Students Graduate Students (U + G Debt) 200000 171, 500 180000 160000 140000 120000 100000 69, 600 80000 51, 100 60000 40000 20000 0 21, 200 3, 000 0 1992 -93 3, 300 0 1995 -96 2, 400 0 1999 -00 2003 -04 7, 500 11, 900 2007 -08 2011 -12

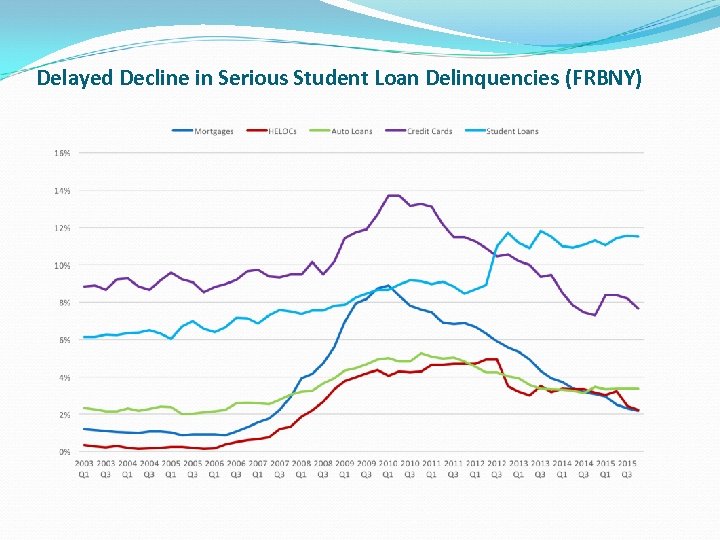

Delayed Decline in Serious Student Loan Delinquencies (FRBNY)

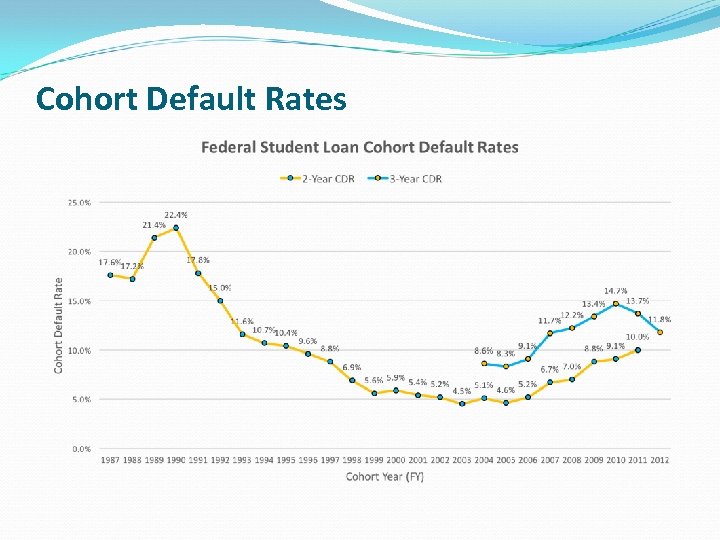

Cohort Default Rates

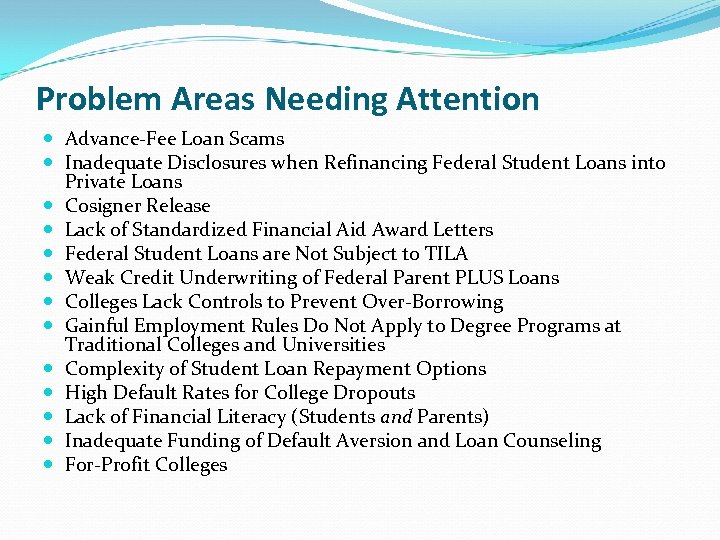

Problem Areas Needing Attention Advance-Fee Loan Scams Inadequate Disclosures when Refinancing Federal Student Loans into Private Loans Cosigner Release Lack of Standardized Financial Aid Award Letters Federal Student Loans are Not Subject to TILA Weak Credit Underwriting of Federal Parent PLUS Loans Colleges Lack Controls to Prevent Over-Borrowing Gainful Employment Rules Do Not Apply to Degree Programs at Traditional Colleges and Universities Complexity of Student Loan Repayment Options High Default Rates for College Dropouts Lack of Financial Literacy (Students and Parents) Inadequate Funding of Default Aversion and Loan Counseling For-Profit Colleges

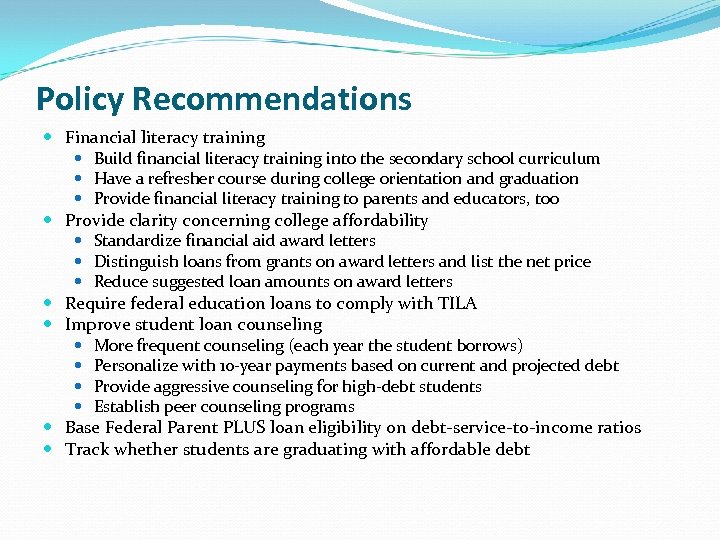

Policy Recommendations Financial literacy training Build financial literacy training into the secondary school curriculum Have a refresher course during college orientation and graduation Provide financial literacy training to parents and educators, too Provide clarity concerning college affordability Standardize financial aid award letters Distinguish loans from grants on award letters and list the net price Reduce suggested loan amounts on award letters Require federal education loans to comply with TILA Improve student loan counseling More frequent counseling (each year the student borrows) Personalize with 10 -year payments based on current and projected debt Provide aggressive counseling for high-debt students Establish peer counseling programs Base Federal Parent PLUS loan eligibility on debt-service-to-income ratios Track whether students are graduating with affordable debt

Thank You Follow Mark Kantrowitz on Twitter at @mkant Read policy research at www. studentaidpolicy. com 18

3f0cd03bfda1927dfd1403962fd0ac83.ppt