1826a8d324f51f9bed15698b30d307b8.ppt

- Количество слайдов: 66

Trends in Intergovernmental Finances: 2000/01 – 2006/07 01 September 2004

Trends in Intergovernmental Finances: 2000/01 – 2006/07 01 September 2004

Trends in Intergovt Finances • Trends in Intergovt Finances is an update on 2003 Intergovt Fiscal Review – Mini-IGFR • Prov revenue and spending trends from 2000/01 to 2006/07 and municipal budgets in 2003 -04 • Past and future budgets (7 years) • Provides consolidated info of municipalities and provinces – Allows comparison between provinces and municipalities • Covers 8 sectors

Trends in Intergovt Finances • Trends in Intergovt Finances is an update on 2003 Intergovt Fiscal Review – Mini-IGFR • Prov revenue and spending trends from 2000/01 to 2006/07 and municipal budgets in 2003 -04 • Past and future budgets (7 years) • Provides consolidated info of municipalities and provinces – Allows comparison between provinces and municipalities • Covers 8 sectors

Document covers • 11 Chapter in the document: – – – Chapter 1: Introduction Chapter 2: Trends in provincial budgets Chapter 3: Local government finances Chapter 4: Education Chapter 5: Health Chapter 6: Social development Chapter 7: Agriculture and land Chapter 8: Roads and Transport Chapter 9: Housing Chapter 10: Water and Sanitation Chapter 11: Electricity

Document covers • 11 Chapter in the document: – – – Chapter 1: Introduction Chapter 2: Trends in provincial budgets Chapter 3: Local government finances Chapter 4: Education Chapter 5: Health Chapter 6: Social development Chapter 7: Agriculture and land Chapter 8: Roads and Transport Chapter 9: Housing Chapter 10: Water and Sanitation Chapter 11: Electricity

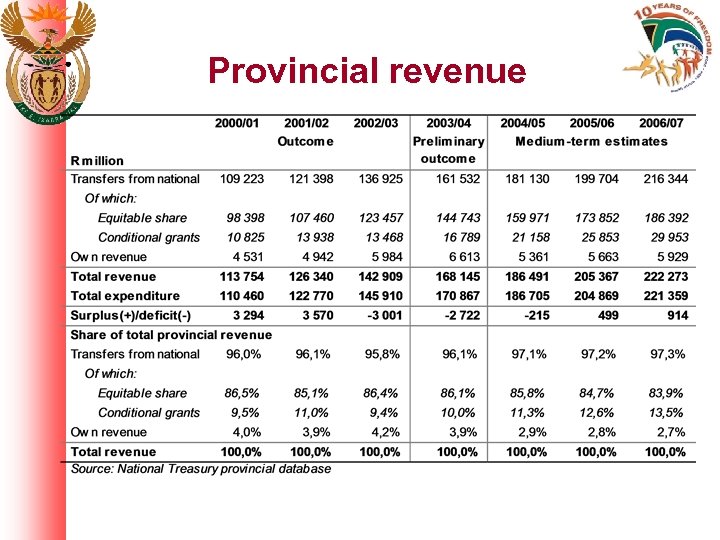

Intergovernmental Fiscal System • 3 spheres of govt, all with different functions • Biggest budgets at provincial level – 2004 budgeted non-interest revenue R 318, 5 bn in 2004/05 • • National – R 120, 6 bn or 38, 2 % Provinces – R 181, 1 bn or 57, 3 % Local government – R 14, 3 bn or 4, 5% provincial share grows to 58, 0 per cent in 2006/07 – Provinces draw up their own budgets after national budget • allocate national transfers (97, 1%) plus own revenue (2, 9%) • national transfers grows to 97, 3% in 2006/07

Intergovernmental Fiscal System • 3 spheres of govt, all with different functions • Biggest budgets at provincial level – 2004 budgeted non-interest revenue R 318, 5 bn in 2004/05 • • National – R 120, 6 bn or 38, 2 % Provinces – R 181, 1 bn or 57, 3 % Local government – R 14, 3 bn or 4, 5% provincial share grows to 58, 0 per cent in 2006/07 – Provinces draw up their own budgets after national budget • allocate national transfers (97, 1%) plus own revenue (2, 9%) • national transfers grows to 97, 3% in 2006/07

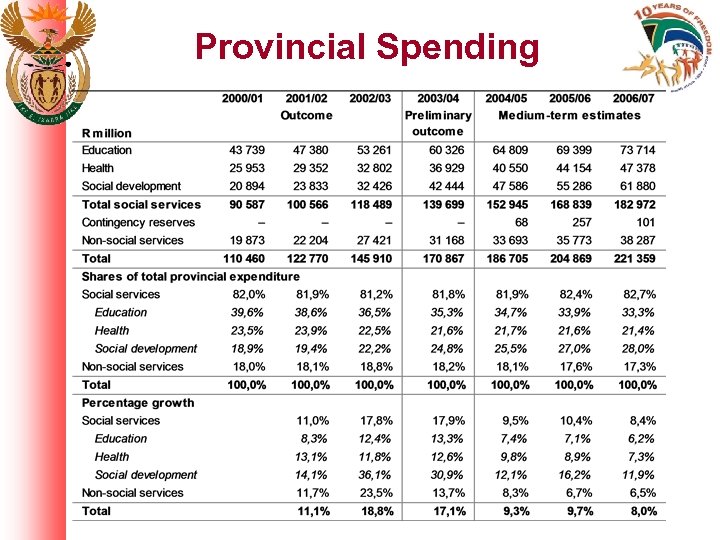

Provincial budgets • 2004 Budget consolidated and made comparable by function • 2004/05 budget R 186, 7 bn • outer years R 204, 9 bn and R 221, 4 bn – – – biggest budget KZN R 37, 8 bn, smallest NC (R 4, 4 bn) social services 81, 9% Compensation of employees 47, 3% Capital 6, 1% at R 11, 3 bn, to R 13, 7 bn in 2006/07 Non-compensation non-capex R 87, 1 bn or 46, 6%

Provincial budgets • 2004 Budget consolidated and made comparable by function • 2004/05 budget R 186, 7 bn • outer years R 204, 9 bn and R 221, 4 bn – – – biggest budget KZN R 37, 8 bn, smallest NC (R 4, 4 bn) social services 81, 9% Compensation of employees 47, 3% Capital 6, 1% at R 11, 3 bn, to R 13, 7 bn in 2006/07 Non-compensation non-capex R 87, 1 bn or 46, 6%

Non-Social Services Spending • Housing, provincial roads, agriculture, economic affairs, tourism and other admin functions) – R 107, 8 billion over next three years – positive economic spin offs for provinces – improve the quality of provincial infrastructure and contribution to EPWP – efficient delivery of other services – contribute to economic growth and job creation

Non-Social Services Spending • Housing, provincial roads, agriculture, economic affairs, tourism and other admin functions) – R 107, 8 billion over next three years – positive economic spin offs for provinces – improve the quality of provincial infrastructure and contribution to EPWP – efficient delivery of other services – contribute to economic growth and job creation

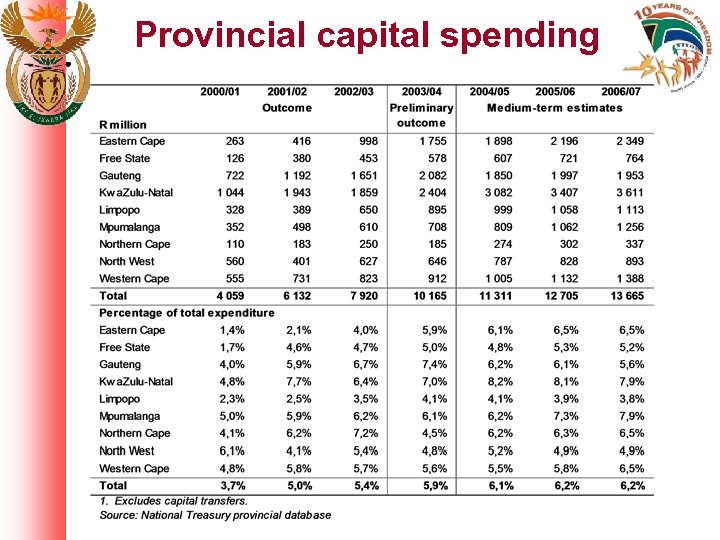

Key trends • Provinces are budgeting for a deficits of R 215 m in 2004/05 and surplus budgets in the outer years (R 499 m and R 914 m) • Capital spending growing strongly between 2000/01 and 2006/07 – Total prov capital spending (R 4, 1 bn to R 13, 7 bn) – Share in total spending also increase from 3, 7% to 6, 2% – Education from R 553 m to R 3, 5 bn – Health from R 1, 0 bn to R 3, 8 bn

Key trends • Provinces are budgeting for a deficits of R 215 m in 2004/05 and surplus budgets in the outer years (R 499 m and R 914 m) • Capital spending growing strongly between 2000/01 and 2006/07 – Total prov capital spending (R 4, 1 bn to R 13, 7 bn) – Share in total spending also increase from 3, 7% to 6, 2% – Education from R 553 m to R 3, 5 bn – Health from R 1, 0 bn to R 3, 8 bn

Provincial Spending

Provincial Spending

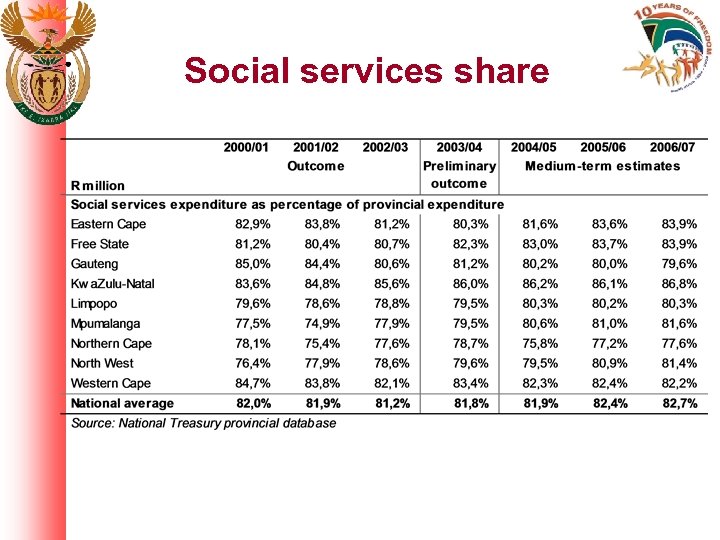

Social services share

Social services share

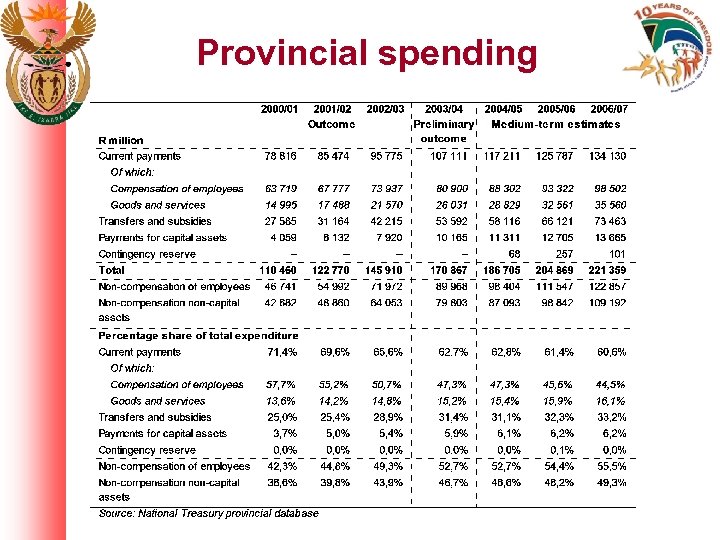

Provincial spending

Provincial spending

Provincial capital spending

Provincial capital spending

Provincial revenue

Provincial revenue

Chapter 3: Local government finances

Chapter 3: Local government finances

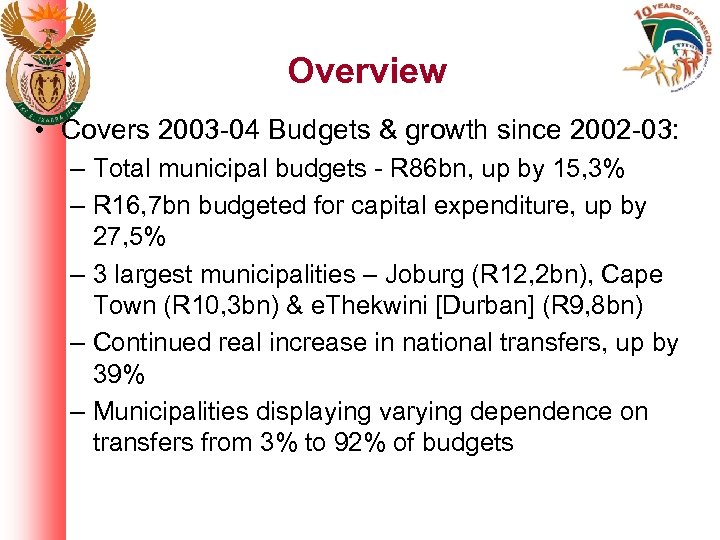

Overview • Covers 2003 -04 Budgets & growth since 2002 -03: – Total municipal budgets - R 86 bn, up by 15, 3% – R 16, 7 bn budgeted for capital expenditure, up by 27, 5% – 3 largest municipalities – Joburg (R 12, 2 bn), Cape Town (R 10, 3 bn) & e. Thekwini [Durban] (R 9, 8 bn) – Continued real increase in national transfers, up by 39% – Municipalities displaying varying dependence on transfers from 3% to 92% of budgets

Overview • Covers 2003 -04 Budgets & growth since 2002 -03: – Total municipal budgets - R 86 bn, up by 15, 3% – R 16, 7 bn budgeted for capital expenditure, up by 27, 5% – 3 largest municipalities – Joburg (R 12, 2 bn), Cape Town (R 10, 3 bn) & e. Thekwini [Durban] (R 9, 8 bn) – Continued real increase in national transfers, up by 39% – Municipalities displaying varying dependence on transfers from 3% to 92% of budgets

Key Challenges faced • Personnel costs – Up by 15, 2% since 02 -03 • Revenue Collection – Outstanding consumer debtors up to R 28 bn • Pro-poor policies: – Adequate infrastructure – Appropriate targeting mechanisms – Affordability

Key Challenges faced • Personnel costs – Up by 15, 2% since 02 -03 • Revenue Collection – Outstanding consumer debtors up to R 28 bn • Pro-poor policies: – Adequate infrastructure – Appropriate targeting mechanisms – Affordability

Reforms within LG sphere • Municipal Property Rating Act – Broaden rates base – Harmonise valuation methods to land + improvements – Municipalities to monitor impact of new system • Municipal Finance Management Act – Primary legislation governing municipal finances • Review of LG fiscal framework – inc. equitable share formula & RSC levies

Reforms within LG sphere • Municipal Property Rating Act – Broaden rates base – Harmonise valuation methods to land + improvements – Municipalities to monitor impact of new system • Municipal Finance Management Act – Primary legislation governing municipal finances • Review of LG fiscal framework – inc. equitable share formula & RSC levies

EDUCATION SPENDING

EDUCATION SPENDING

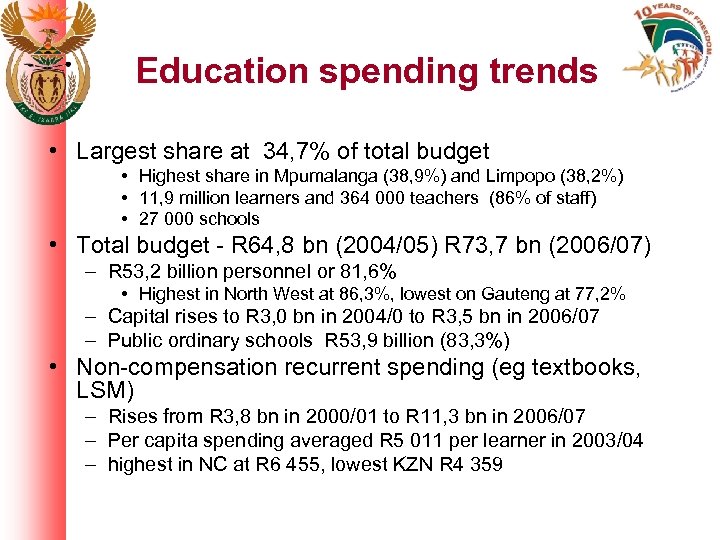

Education spending trends • Largest share at 34, 7% of total budget • Highest share in Mpumalanga (38, 9%) and Limpopo (38, 2%) • 11, 9 million learners and 364 000 teachers (86% of staff) • 27 000 schools • Total budget - R 64, 8 bn (2004/05) R 73, 7 bn (2006/07) – R 53, 2 billion personnel or 81, 6% • Highest in North West at 86, 3%, lowest on Gauteng at 77, 2% – Capital rises to R 3, 0 bn in 2004/0 to R 3, 5 bn in 2006/07 – Public ordinary schools R 53, 9 billion (83, 3%) • Non-compensation recurrent spending (eg textbooks, LSM) – Rises from R 3, 8 bn in 2000/01 to R 11, 3 bn in 2006/07 – Per capita spending averaged R 5 011 per learner in 2003/04 – highest in NC at R 6 455, lowest KZN R 4 359

Education spending trends • Largest share at 34, 7% of total budget • Highest share in Mpumalanga (38, 9%) and Limpopo (38, 2%) • 11, 9 million learners and 364 000 teachers (86% of staff) • 27 000 schools • Total budget - R 64, 8 bn (2004/05) R 73, 7 bn (2006/07) – R 53, 2 billion personnel or 81, 6% • Highest in North West at 86, 3%, lowest on Gauteng at 77, 2% – Capital rises to R 3, 0 bn in 2004/0 to R 3, 5 bn in 2006/07 – Public ordinary schools R 53, 9 billion (83, 3%) • Non-compensation recurrent spending (eg textbooks, LSM) – Rises from R 3, 8 bn in 2000/01 to R 11, 3 bn in 2006/07 – Per capita spending averaged R 5 011 per learner in 2003/04 – highest in NC at R 6 455, lowest KZN R 4 359

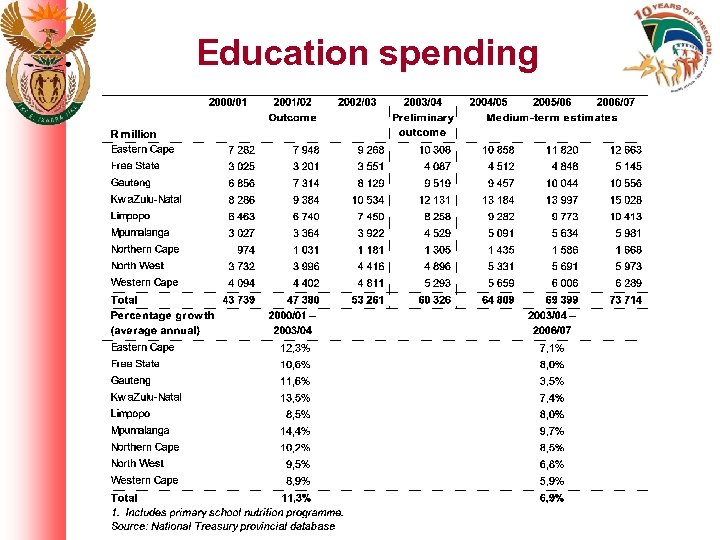

Education spending

Education spending

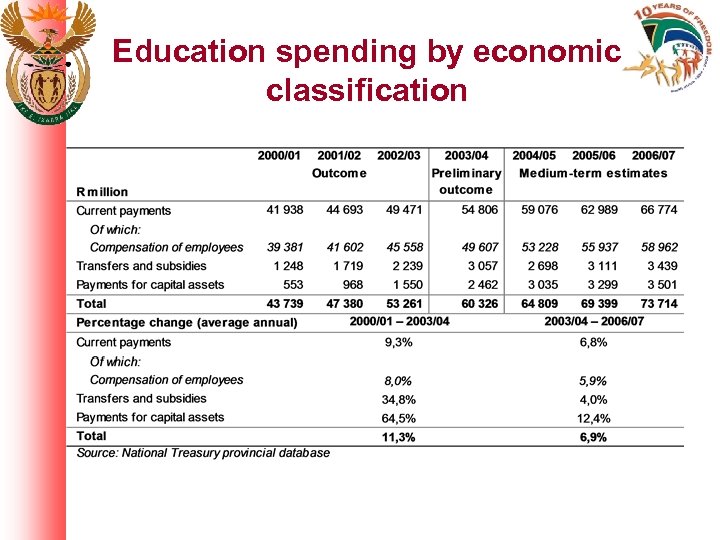

Education spending by economic classification

Education spending by economic classification

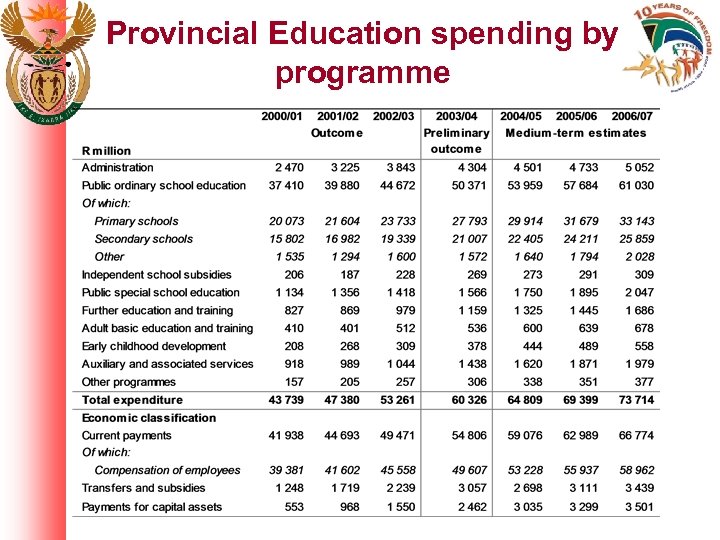

Provincial Education spending by programme

Provincial Education spending by programme

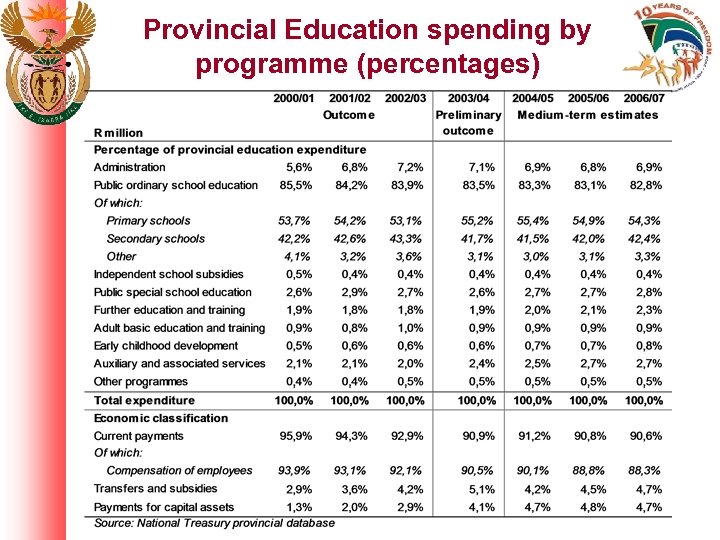

Provincial Education spending by programme (percentages)

Provincial Education spending by programme (percentages)

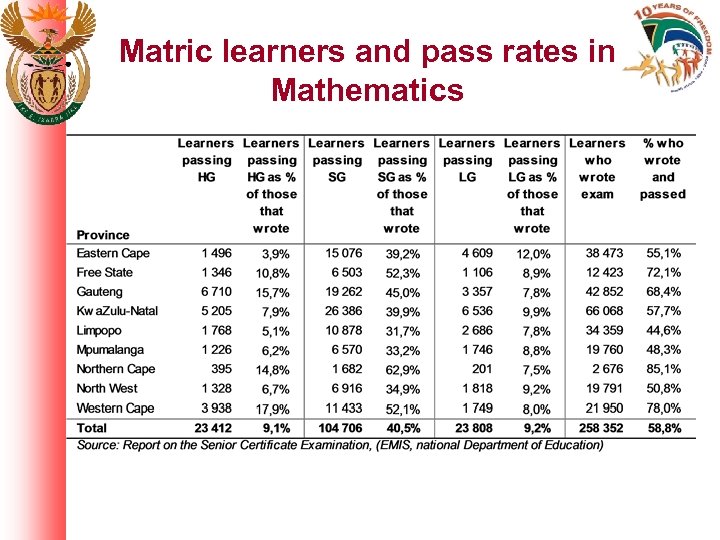

Matric learners and pass rates in Mathematics

Matric learners and pass rates in Mathematics

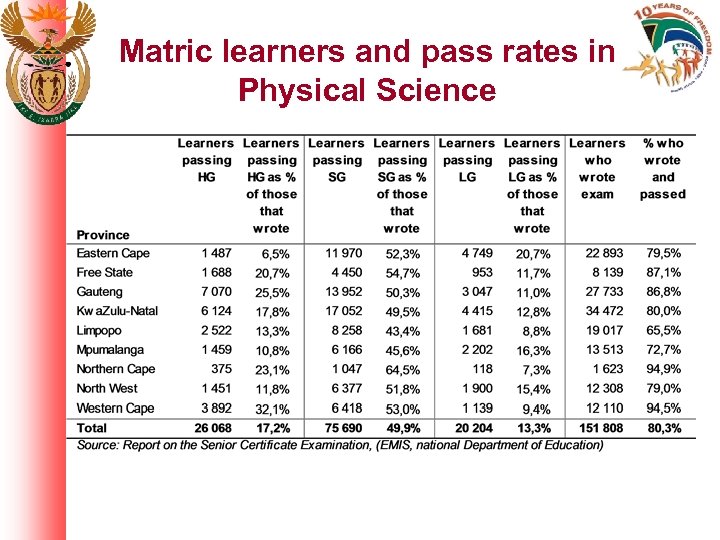

Matric learners and pass rates in Physical Science

Matric learners and pass rates in Physical Science

Chapter 5: HEALTH SPENDING

Chapter 5: HEALTH SPENDING

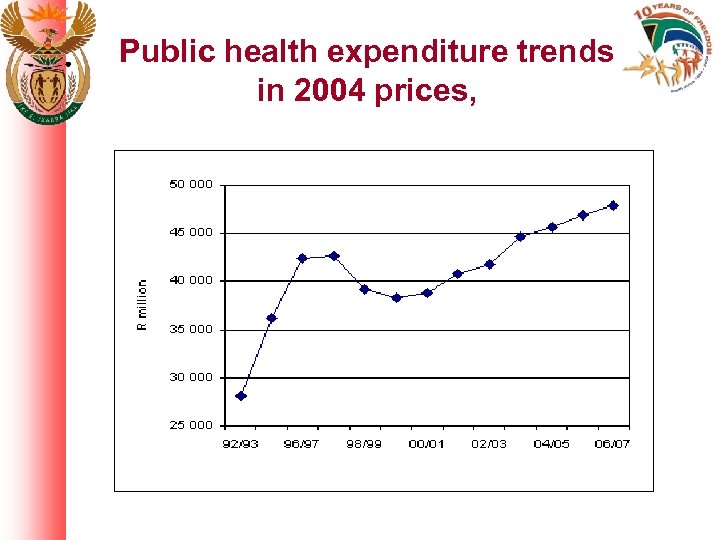

Health services • Strong spending in 2003/04 outcome • Stabilisation of health budgets – real annualised growth 4. 9% over 7 year period • Stabilisation and improvement in health personnel numbers • Substantial recovery in NPNC expenditure, including medicines • Strengthening of capital spending and hospital revitilisation (27 projects)

Health services • Strong spending in 2003/04 outcome • Stabilisation of health budgets – real annualised growth 4. 9% over 7 year period • Stabilisation and improvement in health personnel numbers • Substantial recovery in NPNC expenditure, including medicines • Strengthening of capital spending and hospital revitilisation (27 projects)

Health services • Inter-provincial equity improving • Significant increases in spending on primary health care, emergency medical services • Scarce skills and rural allowances implemented and backdated to July 2003 • HIV/AIDS spending significantly increasing with implementation of comprehensive programme • Other pressures: Health inflation; hospitals; PHC function shift

Health services • Inter-provincial equity improving • Significant increases in spending on primary health care, emergency medical services • Scarce skills and rural allowances implemented and backdated to July 2003 • HIV/AIDS spending significantly increasing with implementation of comprehensive programme • Other pressures: Health inflation; hospitals; PHC function shift

Health spending trends • Health 21, 7% of total budget declining to 21, 4% in 2006/07 • Two types of provinces – those with central hospitals have v high share – those without central hospitals • Capital R 1, 0 bn in 2000/01 to R 3, 8 bn in 2006/07 • Primary health care (R 7, 1 bn) • HIV and Aids spending – R 60 m in 2000/01 to R 2, 2 bn 2006/07 • EMS spending – R 719 m in 2000/01 to R 1, 6 bn in 06/07

Health spending trends • Health 21, 7% of total budget declining to 21, 4% in 2006/07 • Two types of provinces – those with central hospitals have v high share – those without central hospitals • Capital R 1, 0 bn in 2000/01 to R 3, 8 bn in 2006/07 • Primary health care (R 7, 1 bn) • HIV and Aids spending – R 60 m in 2000/01 to R 2, 2 bn 2006/07 • EMS spending – R 719 m in 2000/01 to R 1, 6 bn in 06/07

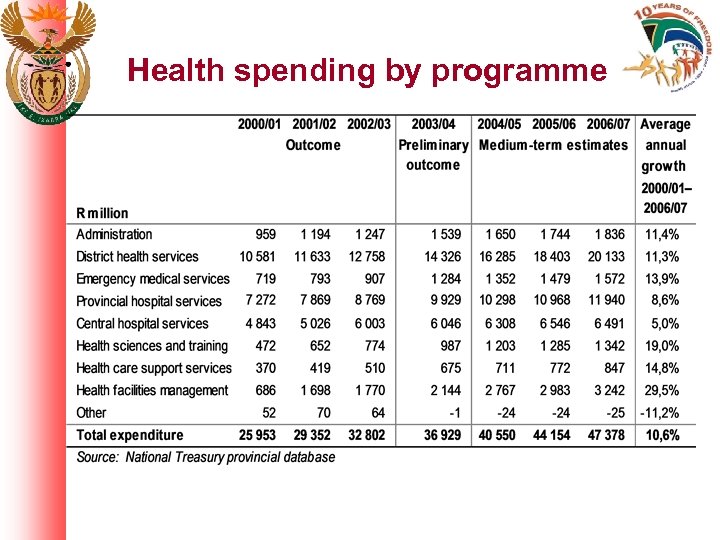

Health spending by programme

Health spending by programme

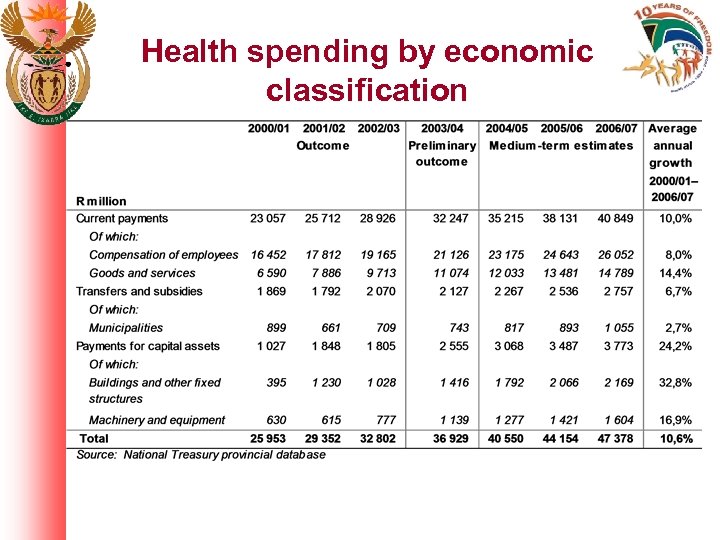

Health spending by economic classification

Health spending by economic classification

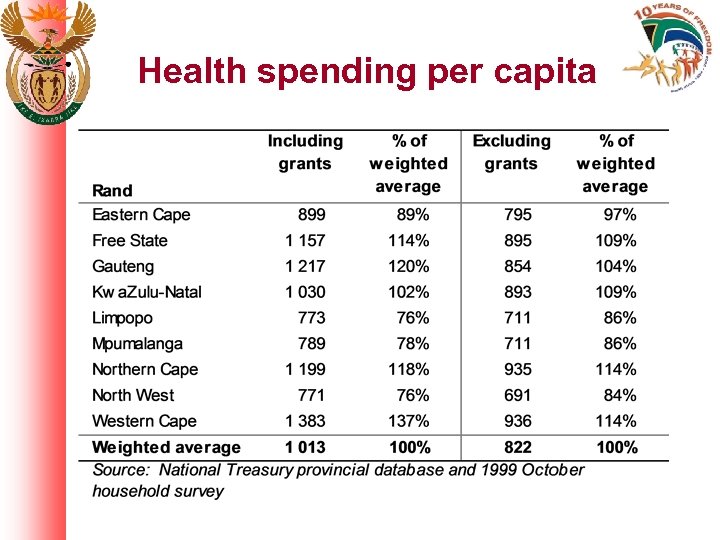

Health spending per capita

Health spending per capita

Public health expenditure trends in 2004 prices, Figure 5. 1 Public health expenditure trends in 2004 prices, 1992/93 to 2006/07

Public health expenditure trends in 2004 prices, Figure 5. 1 Public health expenditure trends in 2004 prices, 1992/93 to 2006/07

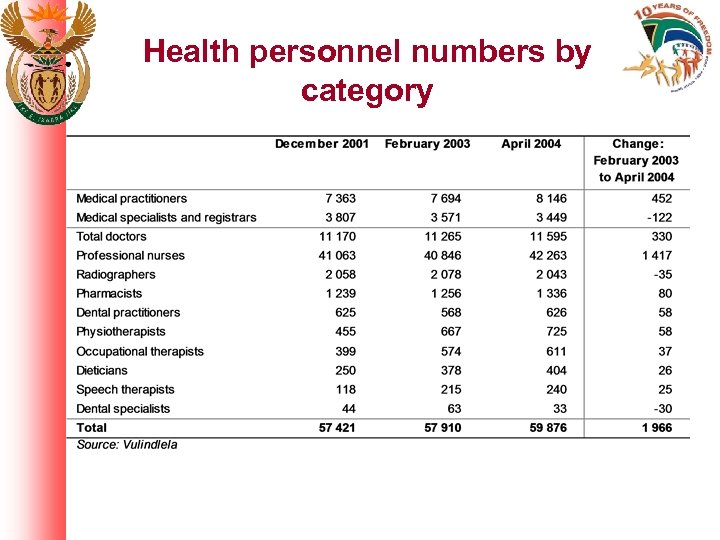

Health personnel numbers by category

Health personnel numbers by category

Chapter 6: Social Development

Chapter 6: Social Development

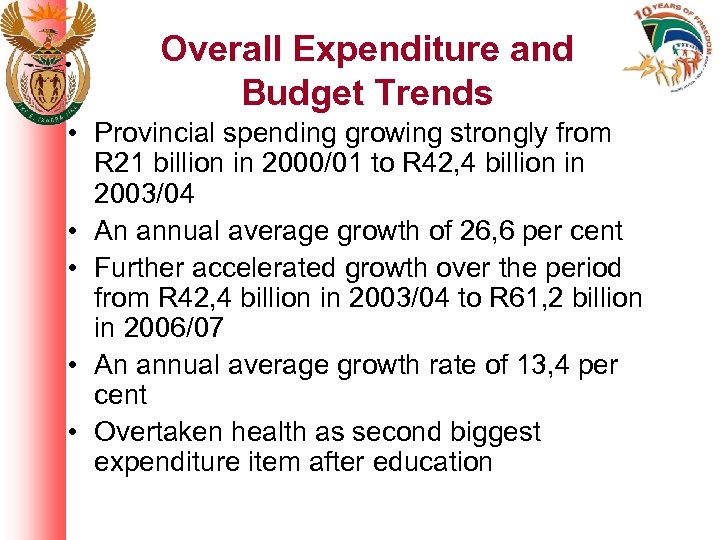

Overall Expenditure and Budget Trends • Provincial spending growing strongly from R 21 billion in 2000/01 to R 42, 4 billion in 2003/04 • An annual average growth of 26, 6 per cent • Further accelerated growth over the period from R 42, 4 billion in 2003/04 to R 61, 2 billion in 2006/07 • An annual average growth rate of 13, 4 per cent • Overtaken health as second biggest expenditure item after education

Overall Expenditure and Budget Trends • Provincial spending growing strongly from R 21 billion in 2000/01 to R 42, 4 billion in 2003/04 • An annual average growth of 26, 6 per cent • Further accelerated growth over the period from R 42, 4 billion in 2003/04 to R 61, 2 billion in 2006/07 • An annual average growth rate of 13, 4 per cent • Overtaken health as second biggest expenditure item after education

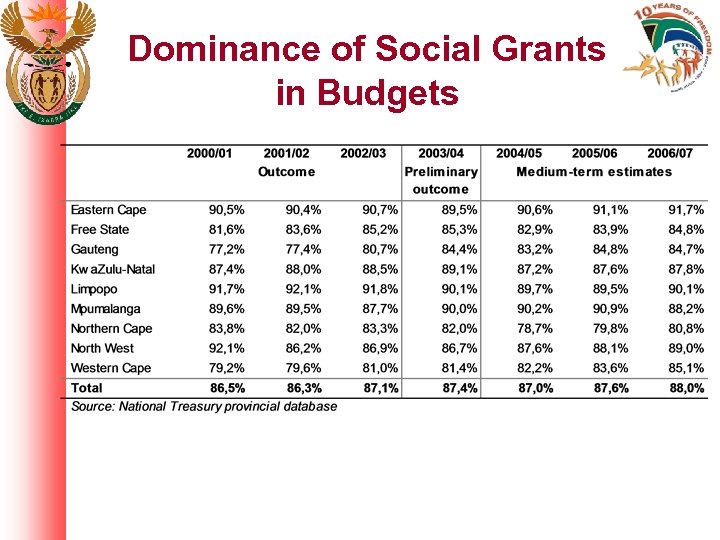

Dominance of Social Grants in Budgets

Dominance of Social Grants in Budgets

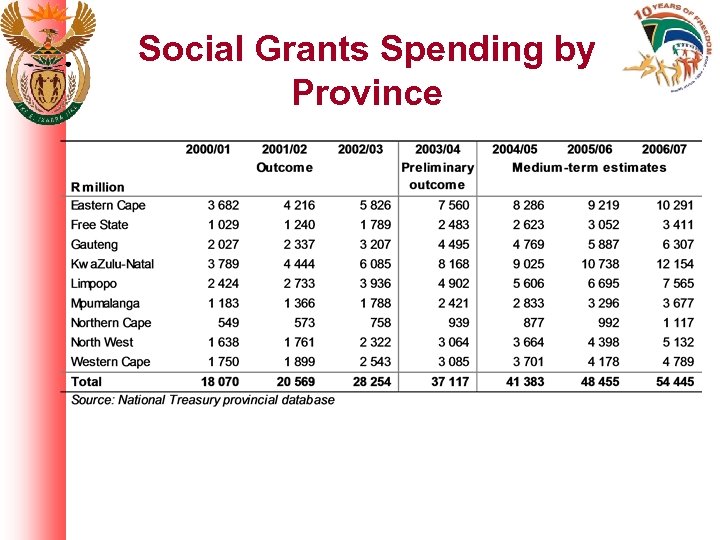

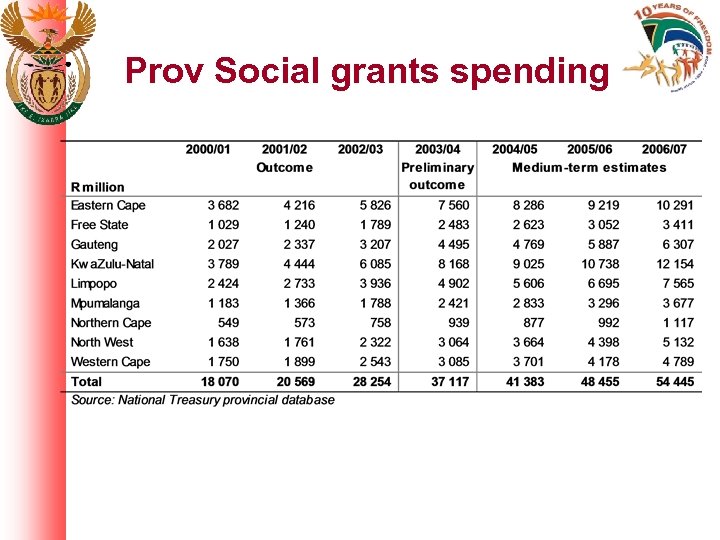

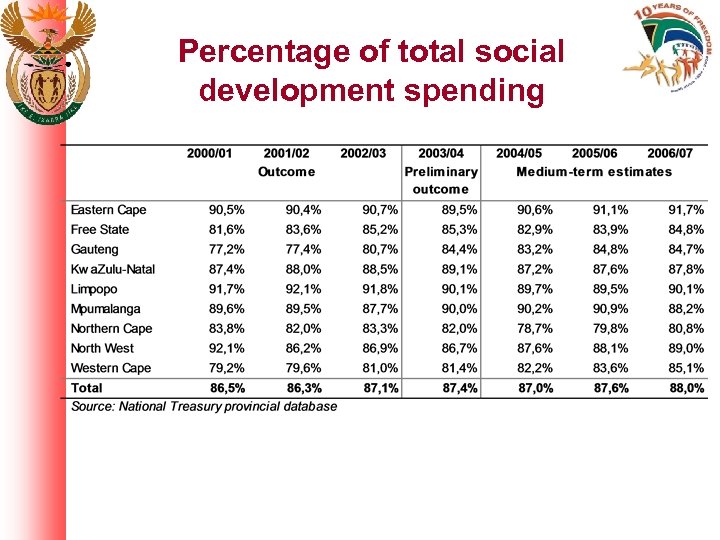

Social Grants Spending • Continued dominance of social grants within social development budgets as a result of the continuing expansion of the social grants and welfare services for the poor • Social grants spending is at an annual average of around 87 per cent within all provinces • Proportions are particularly high in a poor provinces such as EC and MP at around 90 per cent over MTEF • Especially extension of the child support grant to children up to their 14 th birthday, an average annual growth of 87 per cent • Strong overall growth in grants spending from more than R 18 billion to R 37, 1 billion expenditure between 2000/01 to 2003/04 • This spending grows to R 54, 4 billion in 2006/07

Social Grants Spending • Continued dominance of social grants within social development budgets as a result of the continuing expansion of the social grants and welfare services for the poor • Social grants spending is at an annual average of around 87 per cent within all provinces • Proportions are particularly high in a poor provinces such as EC and MP at around 90 per cent over MTEF • Especially extension of the child support grant to children up to their 14 th birthday, an average annual growth of 87 per cent • Strong overall growth in grants spending from more than R 18 billion to R 37, 1 billion expenditure between 2000/01 to 2003/04 • This spending grows to R 54, 4 billion in 2006/07

Social Grants Spending by Province

Social Grants Spending by Province

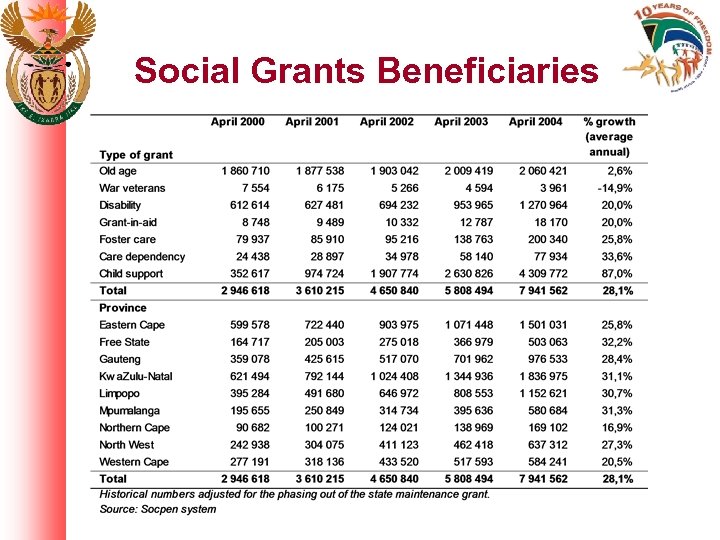

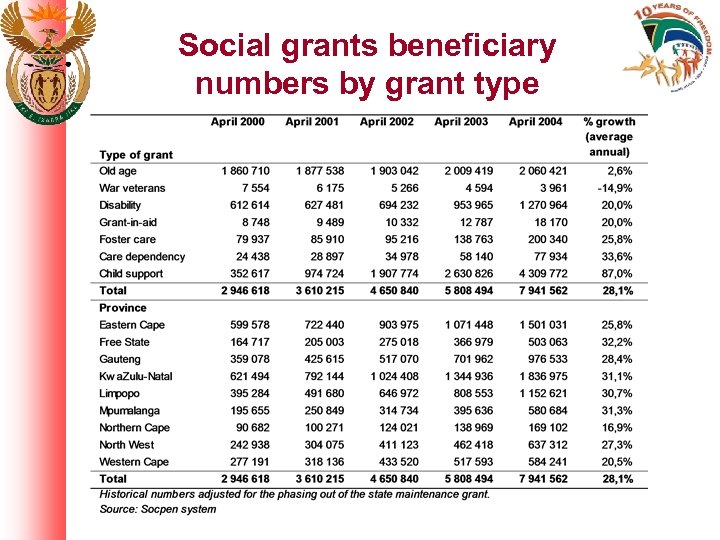

Social Grants Beneficiaries • Rapid growth in beneficiary numbers • 2000 beneficiary numbers were more than 2. 9 million • By April 2004 beneficiary number more than 7. 9 million • An increase of more than 5 million over 5 years • Highest growth in child support and disability grant beneficiary numbers – more than 4. 3 million children by end of April 2004

Social Grants Beneficiaries • Rapid growth in beneficiary numbers • 2000 beneficiary numbers were more than 2. 9 million • By April 2004 beneficiary number more than 7. 9 million • An increase of more than 5 million over 5 years • Highest growth in child support and disability grant beneficiary numbers – more than 4. 3 million children by end of April 2004

Social Grants Beneficiaries

Social Grants Beneficiaries

Prov Social grants spending

Prov Social grants spending

Percentage of total social development spending

Percentage of total social development spending

Social grants beneficiary numbers by grant type

Social grants beneficiary numbers by grant type

Chapter 7: AGRICULTURE AND LAND

Chapter 7: AGRICULTURE AND LAND

Agriculture • Spending on Agriculture rises from R 3 billion in 00/01 to R 5, 5 b in 06/07 – growth of 10, 6% • Provinces account for just under 80% of total sector spending • Provincial budget grows by 16, 9% from R 3, 2 b in 03/04 to R 3, 8 b in 04/05, rising to R 4, 2 b in 06/07 – spending on personnel account for largest share but declined from 71, 9% in 00/01 to 60, 4% in 02/03, will further fall to 56, 7% in 06/07 – Non personnel spending increases to enhance farmer support programmes including infrastructure – Additional funds through conditional grant (R 750 m over 2004 MTEF) to implement a new framework for farmer support – Comprehensive Agricultural Support Programme

Agriculture • Spending on Agriculture rises from R 3 billion in 00/01 to R 5, 5 b in 06/07 – growth of 10, 6% • Provinces account for just under 80% of total sector spending • Provincial budget grows by 16, 9% from R 3, 2 b in 03/04 to R 3, 8 b in 04/05, rising to R 4, 2 b in 06/07 – spending on personnel account for largest share but declined from 71, 9% in 00/01 to 60, 4% in 02/03, will further fall to 56, 7% in 06/07 – Non personnel spending increases to enhance farmer support programmes including infrastructure – Additional funds through conditional grant (R 750 m over 2004 MTEF) to implement a new framework for farmer support – Comprehensive Agricultural Support Programme

Land • Spending on land reform programme increase from R 518 m in 00/01 to R 1, 3 b in 2003/04 , further rising to R 2, 2 b in 06/07 – Restitution programme account for the largest increase in spending from R 265 m in 00/01 to R 839 m in 03/04, budget to rise to R 1, 4 b in 06/07 – 60, 8% (48, 463) claims settled at cost of R 3, 7 b benefiting 616, 429 beneficiaries – 64% of unsettled claims are urban, mostly in metros – By 06/07 settlement of restitution claims will be completed

Land • Spending on land reform programme increase from R 518 m in 00/01 to R 1, 3 b in 2003/04 , further rising to R 2, 2 b in 06/07 – Restitution programme account for the largest increase in spending from R 265 m in 00/01 to R 839 m in 03/04, budget to rise to R 1, 4 b in 06/07 – 60, 8% (48, 463) claims settled at cost of R 3, 7 b benefiting 616, 429 beneficiaries – 64% of unsettled claims are urban, mostly in metros – By 06/07 settlement of restitution claims will be completed

Key Challenges & Initiatives • Increasing access to farmer support services to enable effective land use – Linking land reform programme with post transfer farmer support – High spending on personnel but shortage of appropriate skills mix – Newly settled farmers need access to capital but difficult to access financial markets – Need to support research on appropriate technology for small scale farmers • Comprehensive Agriculture Support Programme provides a new framework to increase farmer support services targeting small scale farmers and land reform beneficiaries

Key Challenges & Initiatives • Increasing access to farmer support services to enable effective land use – Linking land reform programme with post transfer farmer support – High spending on personnel but shortage of appropriate skills mix – Newly settled farmers need access to capital but difficult to access financial markets – Need to support research on appropriate technology for small scale farmers • Comprehensive Agriculture Support Programme provides a new framework to increase farmer support services targeting small scale farmers and land reform beneficiaries

Chapter 8: TRANSPORT AND ROADS

Chapter 8: TRANSPORT AND ROADS

Overview • All spheres have some responsibility for – Roads – Public Transport and – Traffic management and safety • Government spending on roads amount to R 9, 8 bn in 03/04 – municipalities account for 34, 1% (R 3 bn) of which 51% is spent by metros – National (SANRAL) 13, 1% or R 1, 3 bn rising to R 1, 7 bn in 06/07 – Provinces account for 65, 5% or R 5, 6 bn – Provincial spending rises to R 7, 6 bn in 06/07 – Maintenance account for 52, 3% of prov road spending

Overview • All spheres have some responsibility for – Roads – Public Transport and – Traffic management and safety • Government spending on roads amount to R 9, 8 bn in 03/04 – municipalities account for 34, 1% (R 3 bn) of which 51% is spent by metros – National (SANRAL) 13, 1% or R 1, 3 bn rising to R 1, 7 bn in 06/07 – Provinces account for 65, 5% or R 5, 6 bn – Provincial spending rises to R 7, 6 bn in 06/07 – Maintenance account for 52, 3% of prov road spending

Public Transport & Traffic • National government spending on transport subsidies increase from R 3, 2 bn in 00/01 to R 5, 3 b in 06/7 – Bus subsidies account for about 45%, and rail 53% • Provincial spending on public transport rises from R 308 m in 00/01 to R 771 m in 03/04, budget to increase to R 1, 4 bn in 06/07 • National and provinces spent R 1, 1 bn on traffic & safety, with province accounting for 84% or R 960 m

Public Transport & Traffic • National government spending on transport subsidies increase from R 3, 2 bn in 00/01 to R 5, 3 b in 06/7 – Bus subsidies account for about 45%, and rail 53% • Provincial spending on public transport rises from R 308 m in 00/01 to R 771 m in 03/04, budget to increase to R 1, 4 bn in 06/07 • National and provinces spent R 1, 1 bn on traffic & safety, with province accounting for 84% or R 960 m

Key Challenges and Initiatives • Sector is complex & presents challenge for coordination between spheres – Developing new framework for road sector to facilitate inter-sphere coordination in planning and prioritisation – Reforming the current subsidy system which is fragmented and inequitable – Improve effectiveness of traffic control and management – Na. TIS being upgraded to improve on its current weaknesses

Key Challenges and Initiatives • Sector is complex & presents challenge for coordination between spheres – Developing new framework for road sector to facilitate inter-sphere coordination in planning and prioritisation – Reforming the current subsidy system which is fragmented and inequitable – Improve effectiveness of traffic control and management – Na. TIS being upgraded to improve on its current weaknesses

Chapter 9: Housing

Chapter 9: Housing

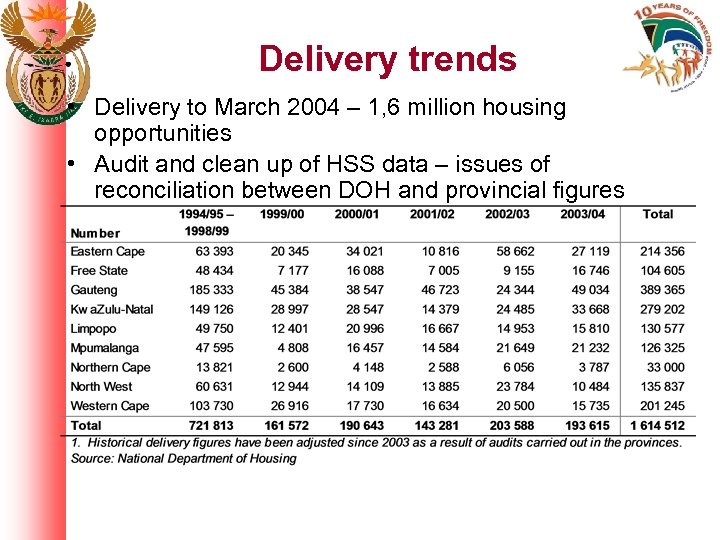

Delivery trends • Delivery to March 2004 – 1, 6 million housing opportunities • Audit and clean up of HSS data – issues of reconciliation between DOH and provincial figures

Delivery trends • Delivery to March 2004 – 1, 6 million housing opportunities • Audit and clean up of HSS data – issues of reconciliation between DOH and provincial figures

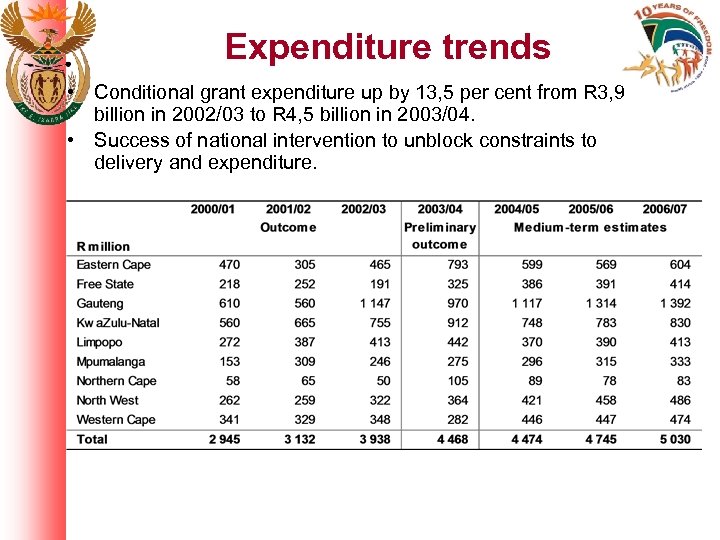

Expenditure trends • Conditional grant expenditure up by 13, 5 per cent from R 3, 9 billion in 2002/03 to R 4, 5 billion in 2003/04. • Success of national intervention to unblock constraints to delivery and expenditure.

Expenditure trends • Conditional grant expenditure up by 13, 5 per cent from R 3, 9 billion in 2002/03 to R 4, 5 billion in 2003/04. • Success of national intervention to unblock constraints to delivery and expenditure.

Understanding the impact of the housing programme • A Housing beneficiary survey showed: – a notable sense of security, independence and pride in home-ownership. – Beneficiaries are not satisfied with the quality of houses or the access to social services and amenities provided in new residential areas. • Census 2001 showed that while a greater proportion of households now live in formal housing, – the housing backlog has grown and; – more households are also living in inadequate housing in informal settlements.

Understanding the impact of the housing programme • A Housing beneficiary survey showed: – a notable sense of security, independence and pride in home-ownership. – Beneficiaries are not satisfied with the quality of houses or the access to social services and amenities provided in new residential areas. • Census 2001 showed that while a greater proportion of households now live in formal housing, – the housing backlog has grown and; – more households are also living in inadequate housing in informal settlements.

Understanding the impact of the housing programme • The Township Residential Property Markets Study showed that: – 60 to 90% of households living in townships are not willing to sell their property and – the values of township residential properties have not increased at the same rate as property values in suburbs. This means that the asset value of subsidised houses is limited by the absence of a functioning secondary residential property market.

Understanding the impact of the housing programme • The Township Residential Property Markets Study showed that: – 60 to 90% of households living in townships are not willing to sell their property and – the values of township residential properties have not increased at the same rate as property values in suburbs. This means that the asset value of subsidised houses is limited by the absence of a functioning secondary residential property market.

Policy developments and future challenges • The Second National Housing Summit in November 2003 confirmed the need for partnerships in providing sustainable housing solutions. • New policy priorities in the housing sector include: – – – Informal settlement upgrading, integrated human settlement development, strengthening partnerships in housing delivery, extending social housing and rental options and; greater support for municipalities. • Housing delivery capacity (particularly municipal capacity) and the institutional arrangements for housing delivery remain a challenge.

Policy developments and future challenges • The Second National Housing Summit in November 2003 confirmed the need for partnerships in providing sustainable housing solutions. • New policy priorities in the housing sector include: – – – Informal settlement upgrading, integrated human settlement development, strengthening partnerships in housing delivery, extending social housing and rental options and; greater support for municipalities. • Housing delivery capacity (particularly municipal capacity) and the institutional arrangements for housing delivery remain a challenge.

Chapter 10: Water and Sanitation

Chapter 10: Water and Sanitation

Overview • Crucial for improving health, alleviating poverty and facilitating economic development • Substantial backlogs in water and sanitation • Represents a significant commitment of resources – – National budget allocation is R 3, 9 billion Municipal budgets contribution is R 6, 8 billion Water boards - approximately R 3 billion Staff complement : 4 200, 19 100 and 6 700 respectively for national, municipalities water boards’, about 30 000 personnel

Overview • Crucial for improving health, alleviating poverty and facilitating economic development • Substantial backlogs in water and sanitation • Represents a significant commitment of resources – – National budget allocation is R 3, 9 billion Municipal budgets contribution is R 6, 8 billion Water boards - approximately R 3 billion Staff complement : 4 200, 19 100 and 6 700 respectively for national, municipalities water boards’, about 30 000 personnel

Institutional & Legal Framework • Complex sector involving a wide range of organisations – Primary responsibility for water services rests with municipalities as water services authority (WSA) – DWAF performs functions in both water resources and water services – Water boards’ are mainly responsible for bulk water provision • Complexities has implications for coordination and accountability and capital investment for new infrastructure and rehabilitation • Institutional reforms are still in early stages and are likely to take several years to complete

Institutional & Legal Framework • Complex sector involving a wide range of organisations – Primary responsibility for water services rests with municipalities as water services authority (WSA) – DWAF performs functions in both water resources and water services – Water boards’ are mainly responsible for bulk water provision • Complexities has implications for coordination and accountability and capital investment for new infrastructure and rehabilitation • Institutional reforms are still in early stages and are likely to take several years to complete

Trends in expenditure • Authorisation of district municipalities as WSA resulted in a substantial increase in their budgeted expenditure • Transfers by DWAF to municipalities decline by 51, 6% as MIG is created on the vote of DPLG • However, R 8, 1 billion for water and sanitation available through MIG over the MTEF • Water boards revenue increase by 5, 8% – Operating expenditure increase by 7, 2% – Capital expenditure decrease marginally

Trends in expenditure • Authorisation of district municipalities as WSA resulted in a substantial increase in their budgeted expenditure • Transfers by DWAF to municipalities decline by 51, 6% as MIG is created on the vote of DPLG • However, R 8, 1 billion for water and sanitation available through MIG over the MTEF • Water boards revenue increase by 5, 8% – Operating expenditure increase by 7, 2% – Capital expenditure decrease marginally

Chapter 11: Electricity

Chapter 11: Electricity

Overview • Electricity, gas and water sectors contribute around 2% of the country’s GDP • 68% of South Africans had access to electricity by end 2002, compared to 50% in 1995 – Largest backlogs remain in rural areas – Progress made in the roll out of free basic electricity in municipal and Eskom areas • South Africa rated among cheapest coal and electricity producers and suppliers in the world • Eskom is projected to run out of excess capacity by 2007 – first station to be built in more than 20 years

Overview • Electricity, gas and water sectors contribute around 2% of the country’s GDP • 68% of South Africans had access to electricity by end 2002, compared to 50% in 1995 – Largest backlogs remain in rural areas – Progress made in the roll out of free basic electricity in municipal and Eskom areas • South Africa rated among cheapest coal and electricity producers and suppliers in the world • Eskom is projected to run out of excess capacity by 2007 – first station to be built in more than 20 years

Reform of generation and transmission industries • Electricity consists of generation, transmission and distribution • Reform of the electricity supply industry (generation and transmission) will introduce – Competition by separating transmission from generation – Private sector participation of up to 30% in the generation market (10% to BEE) – Original timeframe of 2003 shifted so that necessary regulatory and governance framework can be put in place

Reform of generation and transmission industries • Electricity consists of generation, transmission and distribution • Reform of the electricity supply industry (generation and transmission) will introduce – Competition by separating transmission from generation – Private sector participation of up to 30% in the generation market (10% to BEE) – Original timeframe of 2003 shifted so that necessary regulatory and governance framework can be put in place

Reform of electricity distribution industry (EDI) • Arrangements result of historical developments – Both municipalities and Eskom distribute electricity • Proposed reforms to EDI – 6 regional electricity distributors (REDs) consisting of Eskom and municipal electricity distribution businesses – 1 st RED to be established by 2005 and process to be completed by 2007 • Local government authorised i. t. o Constitution to reticulate electricity – Municipal buy-in critical to process – Restructuring should not adversely affect municipal finances

Reform of electricity distribution industry (EDI) • Arrangements result of historical developments – Both municipalities and Eskom distribute electricity • Proposed reforms to EDI – 6 regional electricity distributors (REDs) consisting of Eskom and municipal electricity distribution businesses – 1 st RED to be established by 2005 and process to be completed by 2007 • Local government authorised i. t. o Constitution to reticulate electricity – Municipal buy-in critical to process – Restructuring should not adversely affect municipal finances

Conclusion • Building sustainable communities remain a major issue • Budget choices must balance effective subsidisation of the poor and on one hand creating an enabling environment for growth and development • There remains a need to assess performance of critical sectors in the provision of public services • Both local and provincial govts require dedicated capacity building support • Lack of non-financial information and common methodologies for comparisons in the whole of government remains a concern

Conclusion • Building sustainable communities remain a major issue • Budget choices must balance effective subsidisation of the poor and on one hand creating an enabling environment for growth and development • There remains a need to assess performance of critical sectors in the provision of public services • Both local and provincial govts require dedicated capacity building support • Lack of non-financial information and common methodologies for comparisons in the whole of government remains a concern