1503190b34ea25cf6b577af4543ad7a4.ppt

- Количество слайдов: 22

Trend Adjusted APH (TA)

Trend Adjusted APH (TA)

Trend Adjusted APH (TA) Availability Available on Corn, Cotton, Grain Sorghum, Rice and Soybeans. – Excludes corn insured as silage – Excludes soybeans insured as specialty type – Excludes crops grown under organic or transitional farming practice

Trend Adjusted APH (TA) Availability Available on Corn, Cotton, Grain Sorghum, Rice and Soybeans. – Excludes corn insured as silage – Excludes soybeans insured as specialty type – Excludes crops grown under organic or transitional farming practice

Trend Adjusted APH (TA) Availability Limited Availability: Certain counties in Texas for Corn, Cotton, Soybeans, Rice and Grain Sorghum. County Trend Adjustment Factor- set by RMA. Different factors for different crops.

Trend Adjusted APH (TA) Availability Limited Availability: Certain counties in Texas for Corn, Cotton, Soybeans, Rice and Grain Sorghum. County Trend Adjustment Factor- set by RMA. Different factors for different crops.

Trend Adjusted APH Expanded Map

Trend Adjusted APH Expanded Map

Trend Adjusted APH Cotton Counties Deaf Smith, Parmer, and south Donley, Collingsworth and south Not in Randall or Armstrong counties

Trend Adjusted APH Cotton Counties Deaf Smith, Parmer, and south Donley, Collingsworth and south Not in Randall or Armstrong counties

Trend Adjusted APH Corn Counties Dallam, Sherman, Hansford, Ochiltree, Hartley Moore, Hutchinson, Carson, Gray, Deaf Smith Randall, Parmer, Castro, Swisher, Briscoe Lamb, Hale and Floyd

Trend Adjusted APH Corn Counties Dallam, Sherman, Hansford, Ochiltree, Hartley Moore, Hutchinson, Carson, Gray, Deaf Smith Randall, Parmer, Castro, Swisher, Briscoe Lamb, Hale and Floyd

Trend Adjusted APH Grain Sorghum Counties Wheeler, Collingsworth, Childress and Donley

Trend Adjusted APH Grain Sorghum Counties Wheeler, Collingsworth, Childress and Donley

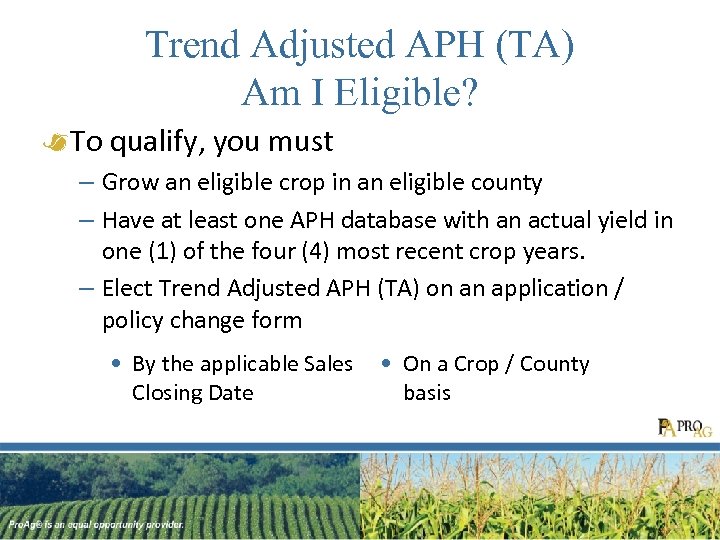

Trend Adjusted APH (TA) Am I Eligible? To qualify, you must – Grow an eligible crop in an eligible county – Have at least one APH database with an actual yield in one (1) of the four (4) most recent crop years. – Elect Trend Adjusted APH (TA) on an application / policy change form • By the applicable Sales • On a Crop / County Closing Date basis

Trend Adjusted APH (TA) Am I Eligible? To qualify, you must – Grow an eligible crop in an eligible county – Have at least one APH database with an actual yield in one (1) of the four (4) most recent crop years. – Elect Trend Adjusted APH (TA) on an application / policy change form • By the applicable Sales • On a Crop / County Closing Date basis

Trend Adjusted APH (TA) How Does it Work? A trend adjustment is made to each actual yield in the databased on 1. The number of actual yields in the database 2. The year of the actual yield 3. The county Trend Adjustment

Trend Adjusted APH (TA) How Does it Work? A trend adjustment is made to each actual yield in the databased on 1. The number of actual yields in the database 2. The year of the actual yield 3. The county Trend Adjustment

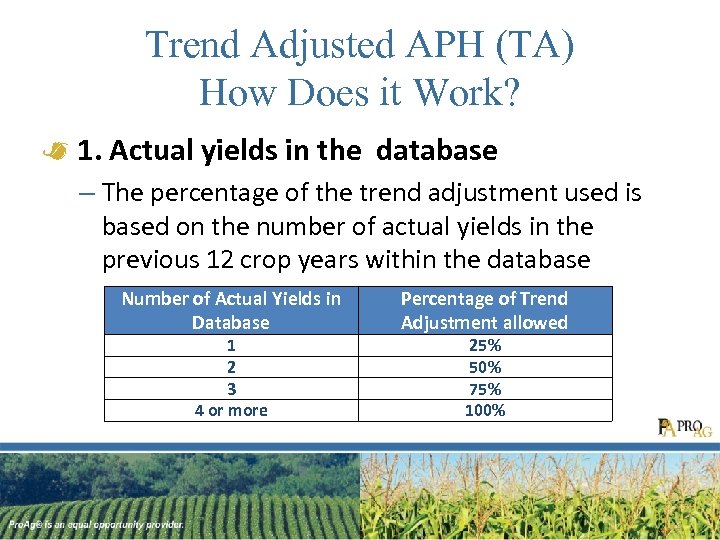

Trend Adjusted APH (TA) How Does it Work? 1. Actual yields in the database – The percentage of the trend adjustment used is based on the number of actual yields in the previous 12 crop years within the database Number of Actual Yields in Database 1 2 3 4 or more Percentage of Trend Adjustment allowed 25% 50% 75% 100%

Trend Adjusted APH (TA) How Does it Work? 1. Actual yields in the database – The percentage of the trend adjustment used is based on the number of actual yields in the previous 12 crop years within the database Number of Actual Yields in Database 1 2 3 4 or more Percentage of Trend Adjustment allowed 25% 50% 75% 100%

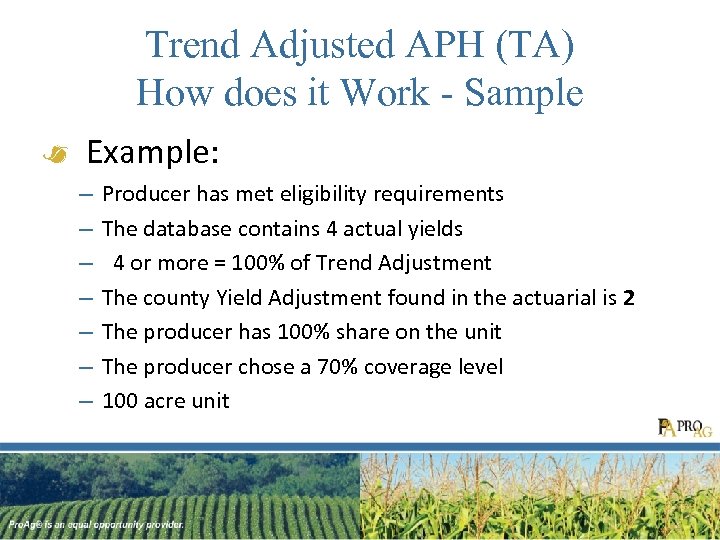

Trend Adjusted APH (TA) How does it Work - Sample Example: – – – – Producer has met eligibility requirements The database contains 4 actual yields 4 or more = 100% of Trend Adjustment The county Yield Adjustment found in the actuarial is 2 The producer has 100% share on the unit The producer chose a 70% coverage level 100 acre unit

Trend Adjusted APH (TA) How does it Work - Sample Example: – – – – Producer has met eligibility requirements The database contains 4 actual yields 4 or more = 100% of Trend Adjustment The county Yield Adjustment found in the actuarial is 2 The producer has 100% share on the unit The producer chose a 70% coverage level 100 acre unit

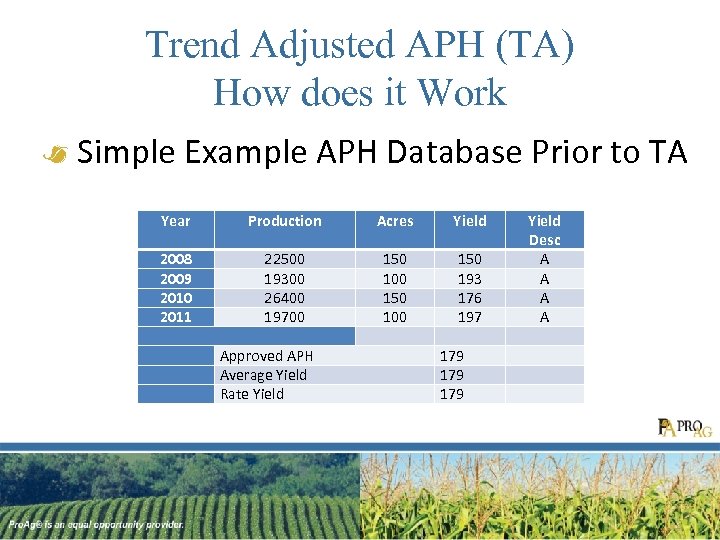

Trend Adjusted APH (TA) How does it Work Simple Example APH Database Prior to TA Year Acres Yield 2008 2009 2010 2011 Production 22500 19300 26400 19700 150 100 150 193 176 197 Approved APH Average Yield Rate Yield 179 179 Yield Desc A A

Trend Adjusted APH (TA) How does it Work Simple Example APH Database Prior to TA Year Acres Yield 2008 2009 2010 2011 Production 22500 19300 26400 19700 150 100 150 193 176 197 Approved APH Average Yield Rate Yield 179 179 Yield Desc A A

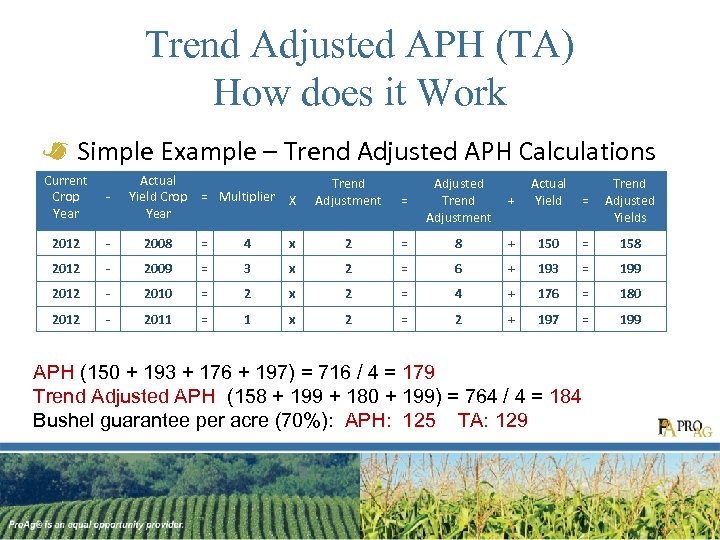

Trend Adjusted APH (TA) How does it Work Simple Example – Trend Adjusted APH Calculations Current Crop Year Actual Yield Crop = Multiplier X Year - 2012 - 2008 = 4 2012 - 2009 = 2012 - 2010 2012 - 2011 Trend Adjustment = Adjusted Trend Adjustment x 3 = = Actual Yield = + 2 = 8 + 150 = 158 x 2 = 6 + 193 = 199 2 x 2 = 4 + 176 = 180 1 x 2 = 2 + 197 = 199 APH (150 + 193 + 176 + 197) = 716 / 4 = 179 Trend Adjusted APH (158 + 199 + 180 + 199) = 764 / 4 = 184 Bushel guarantee per acre (70%): APH: 125 TA: 129 Trend Adjusted Yields

Trend Adjusted APH (TA) How does it Work Simple Example – Trend Adjusted APH Calculations Current Crop Year Actual Yield Crop = Multiplier X Year - 2012 - 2008 = 4 2012 - 2009 = 2012 - 2010 2012 - 2011 Trend Adjustment = Adjusted Trend Adjustment x 3 = = Actual Yield = + 2 = 8 + 150 = 158 x 2 = 6 + 193 = 199 2 x 2 = 4 + 176 = 180 1 x 2 = 2 + 197 = 199 APH (150 + 193 + 176 + 197) = 716 / 4 = 179 Trend Adjusted APH (158 + 199 + 180 + 199) = 764 / 4 = 184 Bushel guarantee per acre (70%): APH: 125 TA: 129 Trend Adjusted Yields

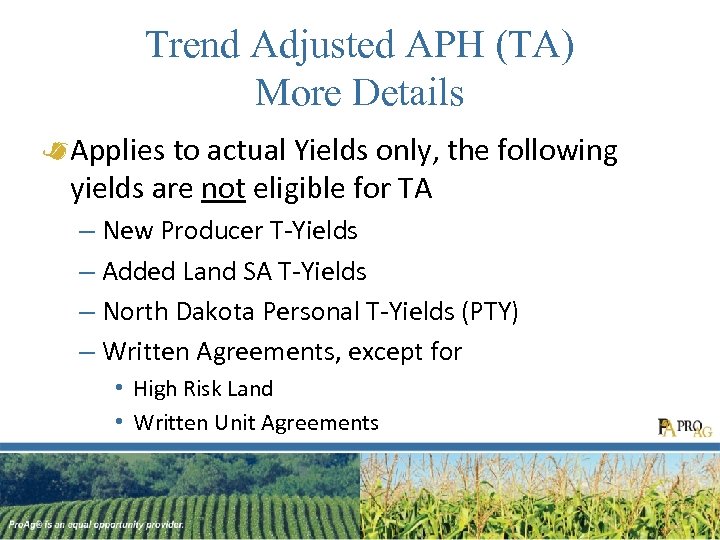

Trend Adjusted APH (TA) More Details Applies to actual Yields only, the following yields are not eligible for TA – New Producer T-Yields – Added Land SA T-Yields – North Dakota Personal T-Yields (PTY) – Written Agreements, except for • High Risk Land • Written Unit Agreements

Trend Adjusted APH (TA) More Details Applies to actual Yields only, the following yields are not eligible for TA – New Producer T-Yields – Added Land SA T-Yields – North Dakota Personal T-Yields (PTY) – Written Agreements, except for • High Risk Land • Written Unit Agreements

Trend Adjusted APH (TA) More Details Cups and Floors do not apply Yield reductions if applicable, still apply – Excessive Yields – Inconsistent Yield Reductions – Production Method Reductions – Trend Reductions

Trend Adjusted APH (TA) More Details Cups and Floors do not apply Yield reductions if applicable, still apply – Excessive Yields – Inconsistent Yield Reductions – Production Method Reductions – Trend Reductions

Trend Adjusted APH (TA) Continuous Election Once timely requested and applied to policy, TA is continuous unless – Cancelled in writing before applicable cancellation date – Pilot is terminated by FCIC

Trend Adjusted APH (TA) Continuous Election Once timely requested and applied to policy, TA is continuous unless – Cancelled in writing before applicable cancellation date – Pilot is terminated by FCIC

Trend Adjusted APH (TA) Cancellation If timely cancelled – Trend adjustments to yield will no longer apply – 10% cup will not apply the initial year – Standard APH procedures will apply – Yield Substitutions and Yield floors may apply

Trend Adjusted APH (TA) Cancellation If timely cancelled – Trend adjustments to yield will no longer apply – 10% cup will not apply the initial year – Standard APH procedures will apply – Yield Substitutions and Yield floors may apply

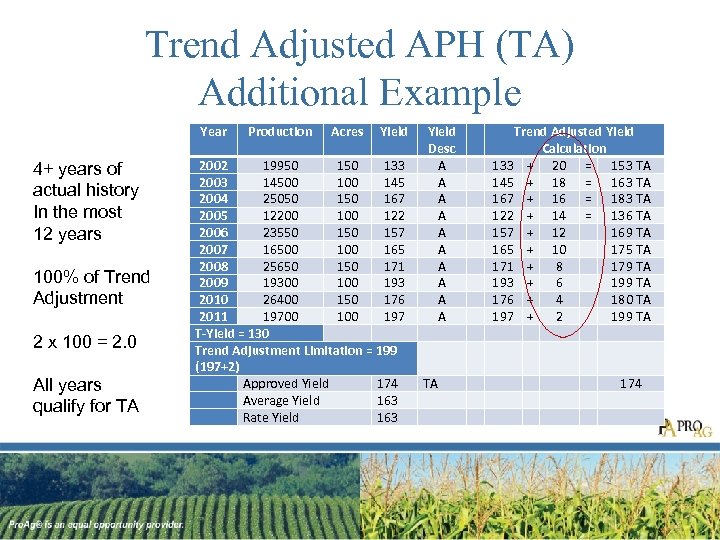

Trend Adjusted APH (TA) Additional Example Year 4+ years of actual history In the most 12 years 100% of Trend Adjustment 2 x 100 = 2. 0 All years qualify for TA Production Acres Yield 2002 19950 133 2003 14500 145 2004 25050 167 2005 12200 122 2006 23550 157 2007 16500 165 2008 25650 171 2009 19300 193 2010 26400 150 176 2011 19700 197 T-Yield = 130 Trend Adjustment Limitation = 199 (197+2) Approved Yield 174 Average Yield 163 Rate Yield 163 Yield Desc A A A A A TA Trend Adjusted Yield Calculation 133 + 20 = 153 TA 145 + 18 = 163 TA 167 + 16 = 183 TA 122 + 14 = 136 TA 157 + 12 169 TA 165 + 10 175 TA 171 + 8 179 TA 193 + 6 199 TA 176 + 4 180 TA 197 + 2 199 TA 174

Trend Adjusted APH (TA) Additional Example Year 4+ years of actual history In the most 12 years 100% of Trend Adjustment 2 x 100 = 2. 0 All years qualify for TA Production Acres Yield 2002 19950 133 2003 14500 145 2004 25050 167 2005 12200 122 2006 23550 157 2007 16500 165 2008 25650 171 2009 19300 193 2010 26400 150 176 2011 19700 197 T-Yield = 130 Trend Adjustment Limitation = 199 (197+2) Approved Yield 174 Average Yield 163 Rate Yield 163 Yield Desc A A A A A TA Trend Adjusted Yield Calculation 133 + 20 = 153 TA 145 + 18 = 163 TA 167 + 16 = 183 TA 122 + 14 = 136 TA 157 + 12 169 TA 165 + 10 175 TA 171 + 8 179 TA 193 + 6 199 TA 176 + 4 180 TA 197 + 2 199 TA 174

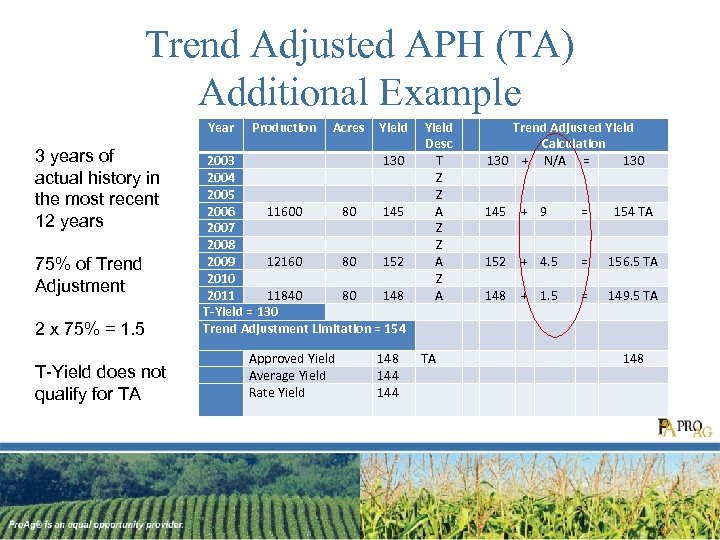

Trend Adjusted APH (TA) Additional Example Year 2 x 75% = 1. 5 2003 130 2004 2005 2006 11600 80 145 2007 2008 2009 12160 80 152 2010 2011 11840 80 148 T-Yield = 130 Trend Adjustment Limitation = 154 Yield Desc T Z Z A Z A T-Yield does not qualify for TA 3 years of actual history in the most recent 12 years 75% of Trend Adjustment Production Acres Approved Yield Average Yield Rate Yield 148 144 130 145 152 148 Trend Adjusted Yield Calculation + N/A = 130 + 9 = 154 TA + 4. 5 = 156. 5 TA + 1. 5 = 149. 5 TA 148

Trend Adjusted APH (TA) Additional Example Year 2 x 75% = 1. 5 2003 130 2004 2005 2006 11600 80 145 2007 2008 2009 12160 80 152 2010 2011 11840 80 148 T-Yield = 130 Trend Adjustment Limitation = 154 Yield Desc T Z Z A Z A T-Yield does not qualify for TA 3 years of actual history in the most recent 12 years 75% of Trend Adjustment Production Acres Approved Yield Average Yield Rate Yield 148 144 130 145 152 148 Trend Adjusted Yield Calculation + N/A = 130 + 9 = 154 TA + 4. 5 = 156. 5 TA + 1. 5 = 149. 5 TA 148

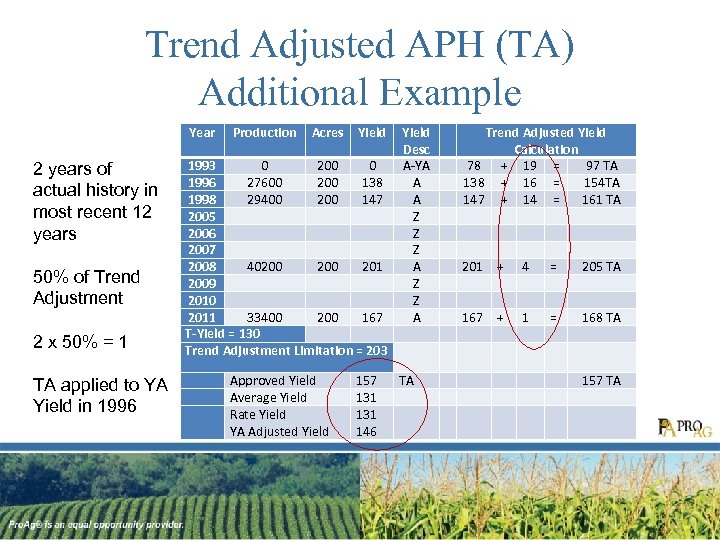

Trend Adjusted APH (TA) Additional Example Year 2 years of actual history in most recent 12 years 50% of Trend Adjustment 2 x 50% = 1 TA applied to YA Yield in 1996 Production Acres Yield Desc A-YA A A Z Z Z A TA 1993 0 200 0 1996 27600 200 138 1998 29400 200 147 2005 2006 2007 2008 40200 201 2009 2010 2011 33400 200 167 T-Yield = 130 Trend Adjustment Limitation = 203 Approved Yield Average Yield Rate Yield YA Adjusted Yield 157 131 146 Trend Adjusted Yield Calculation 78 + 19 = 97 TA 138 + 16 = 154 TA 147 + 14 = 161 TA 201 + 4 = 205 TA 167 + 1 = 168 TA 157 TA

Trend Adjusted APH (TA) Additional Example Year 2 years of actual history in most recent 12 years 50% of Trend Adjustment 2 x 50% = 1 TA applied to YA Yield in 1996 Production Acres Yield Desc A-YA A A Z Z Z A TA 1993 0 200 0 1996 27600 200 138 1998 29400 200 147 2005 2006 2007 2008 40200 201 2009 2010 2011 33400 200 167 T-Yield = 130 Trend Adjustment Limitation = 203 Approved Yield Average Yield Rate Yield YA Adjusted Yield 157 131 146 Trend Adjusted Yield Calculation 78 + 19 = 97 TA 138 + 16 = 154 TA 147 + 14 = 161 TA 201 + 4 = 205 TA 167 + 1 = 168 TA 157 TA

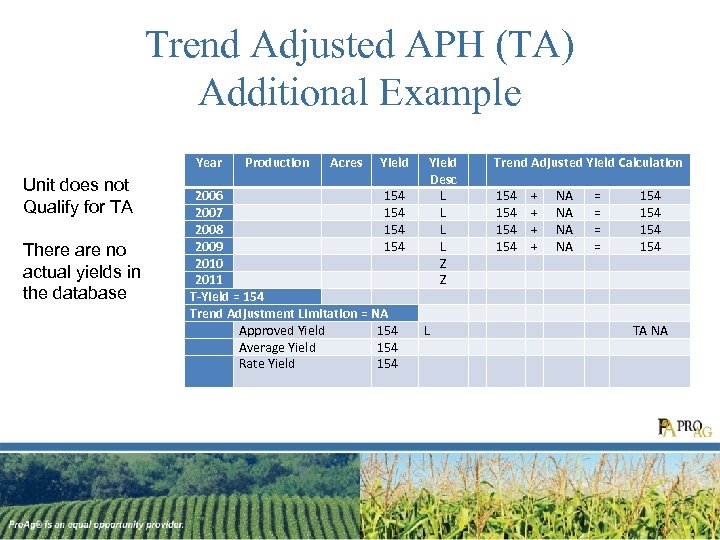

Trend Adjusted APH (TA) Additional Example Year Unit does not Qualify for TA There are no actual yields in the database Production Acres Yield 2006 154 2007 154 2008 154 2009 154 2010 2011 T-Yield = 154 Trend Adjustment Limitation = NA Approved Yield 154 Average Yield 154 Rate Yield 154 Yield Desc L L Z Z L Trend Adjusted Yield Calculation 154 154 + + NA NA = = 154 154 TA NA

Trend Adjusted APH (TA) Additional Example Year Unit does not Qualify for TA There are no actual yields in the database Production Acres Yield 2006 154 2007 154 2008 154 2009 154 2010 2011 T-Yield = 154 Trend Adjustment Limitation = NA Approved Yield 154 Average Yield 154 Rate Yield 154 Yield Desc L L Z Z L Trend Adjusted Yield Calculation 154 154 + + NA NA = = 154 154 TA NA

Trend Adjusted APH Questions

Trend Adjusted APH Questions