059594d2028933be8da4eccfdce6bf4e.ppt

- Количество слайдов: 24

TREASURER’S ROUNDTABLE March 4, 2017

Treasurer’s Roundtable § Treasurer’s Role § Software § Separate administrative and service accounts § Budgeting and financial reports § Dues invoicing § Foundations § Income Taxes § E-Checks

Treasurer’s Role § In rotation or permanent? § If in succession to be president § Training for future president § Future president’s understanding of club finances § If permanent treasurer § More suitable skills and experience § Continuity, historical perspective § Greater risk of fraud? § Working relationship with club secretary

Software § Accounting software § Quick. Books or equivalent (about $220, annual updates) § Includes bank accounts, financial reports, member dues invoices/statements/balances § Quick. Books Online § Cost, $10 per month § Remote accessibility on PCs, tablets, phones § Automatic upgrades § Most features same as desktop version § Excel spreadsheets for analyses and tracking

Separate Administrative and Service Accounts § Set up 2 separate companies, administrative and service § 2 sets of books on Quick Books (or equivalent) § Or use class function to identify company by item § Separate bank accounts and financial reports § Avoids intermingling of funds, per KI requirements § Enables clear financial reporting § Administrative reports with goal of at least a breakeven profit and cash flow § Service account showing each fundraiser and each donation, with all money raised given to charity

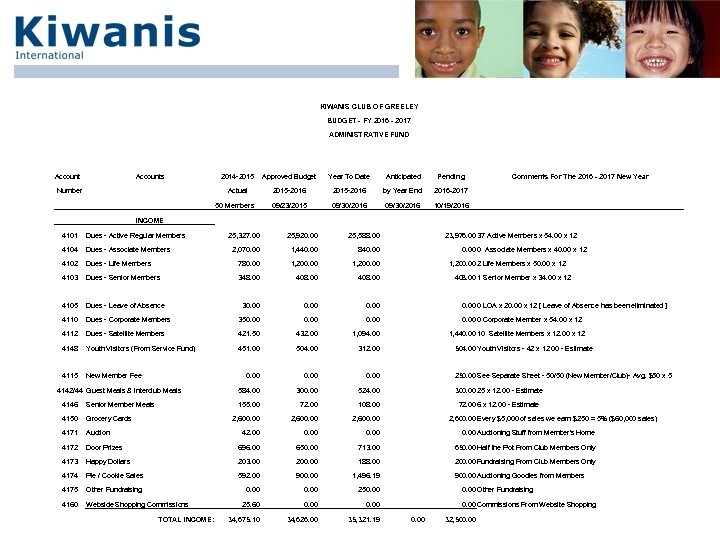

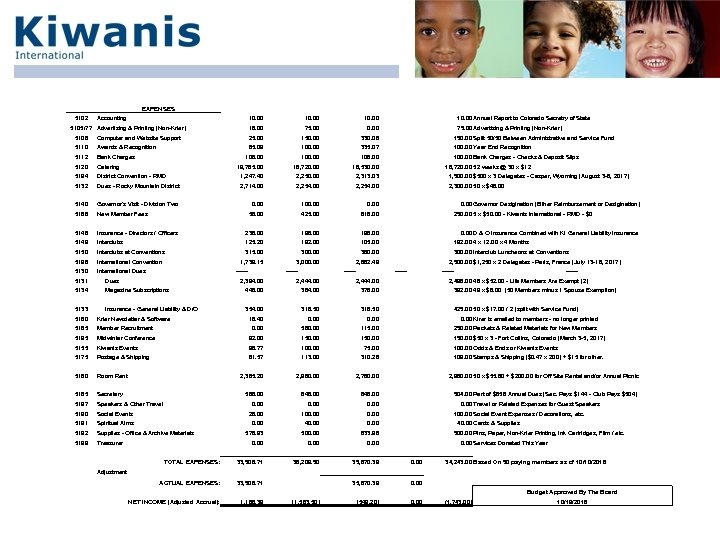

Budgeting § Budgets for administrative and service accounts § Annual basis with assumptions identified § Monthly basis for year to date tracking each month § Budgeting process § Annual or bi-annual § Periodic forecasts § Prepare with incoming president

KIWANIS CLUB OF GREELEY BUDGET - FY 2016 - 2017 ADMINISTRATIVE FUND Accounts Approved Budget Year To Date Anticipated Pending Actual Number 2014 -2015 -2016 by Year End 2016 -2017 09/23/2015 09/30/2016 10/19/2016 50 Members Comments For The 2016 - 2017 New Year INCOME 4101 Dues - Active Regular Members 4104 Dues - Associate Members 25, 327. 00 25, 920. 00 25, 588. 00 2, 070. 00 1, 440. 00 840. 00 4102 Dues - Life Members 780. 00 1, 200. 00 4103 Dues - Senior Members 348. 00 408. 00 4105 Dues - Leave of Absence 30. 00 0 LOA x 20. 00 x 12 [ Leave of Absence has been eliminated ] 4110 Dues - Corporate Members 350. 00 0 Corporate Member x 54. 00 x 12 4112 Dues - Satellite Members 421. 50 432. 00 1, 094. 00 4148 Youth Visitors (From Service Fund) 451. 00 504. 00 312. 00 4115 New Member Fee 0. 00 584. 00 300. 00 524. 00 300. 00 25 x 12. 00 - Estimate 155. 00 72. 00 108. 00 72. 00 6 x 12. 00 - Estimate 2, 600. 00 42. 00 0. 00 Auctioning Stuff from Member's Home 4142/44 Guest Meals & Interclub Meals 23, 976. 00 37 Active Members x 54. 00 x 12 0. 00 0 Associate Members x 40. 00 x 12 1, 200. 00 2 Life Members x 50. 00 x 12 408. 00 1 Senior Member x 34. 00 x 12 1, 440. 00 10 Satellite Members x 12. 00 x 12 504. 00 Youth Visitors - 42 x 12. 00 - Estimate 250. 00 See Separate Sheet - 50/50 (New Member/Club)- Avg. $50 x 5 4146 Senior Member Meals 4150 Grocery Cards 4171 Auction 4172 Door Prizes 696. 00 650. 00 713. 00 650. 00 Half the Pot From Club Members Only 4173 Happy Dollars 203. 00 200. 00 188. 00 200. 00 Fundraising From Club Members Only 4174 Pie / Cookie Sales 592. 00 900. 00 1, 496. 19 4175 Other Fundraising 4160 Webside Shopping Commissions 0. 00 TOTAL INCOME: 0. 00 34, 675. 10 34, 626. 00 35, 321. 19 900. 00 Auctioning Goodies from Members 250. 00 25. 60 2, 600. 00 Every $5, 000 of sales we earn $250 = 5% ($60, 000 sales) 0. 00 Other Fundraising 0. 00 Commissions From Website Shopping 0. 00 32, 500. 00

EXPENSES 5102 Accounting 10. 00 5106 5110 Awards & Recognition 5112 Bank Charges 5120 Catering 5194 5132 5140 Governor's Visit - Division Two 5168 New Member Fees 5148 5149 5150 Interclubs at Conventions 5196 International Convention 5130 International Dues 5131 Dues 5134 10. 00 75. 00 0. 00 25. 00 Computer and Website Support 10. 00 18. 00 5105/77 Advertising & Printing (Non-Krier) 10. 00 Annual Report to Colorado Secretry of State 150. 00 330. 06 150. 00 Split 50/50 Between Administrative and Service Fund 100. 00 Year End Recognition 75. 00 Advertising & Printing (Non-Krier) 85. 09 100. 00 335. 07 108. 00 100. 00 108. 00 19, 765. 00 18, 720. 00 18, 530. 00 District Convention - RMD 1, 247. 40 2, 250. 00 2, 313. 03 1, 500. 00 $500 x 3 Delegates - Casper, Wyoming (August 3 -6, 2017) Dues - Rocky Mountain District 2, 714. 00 2, 254. 00 2, 300. 00 50 x $46. 00 0. 00 100. 00 56. 00 425. 00 616. 00 Insurance - Directors / Officers 236. 00 196. 00 Interclubs 125. 20 192. 00 100. 00 Bank Charges - Checks & Deposit Slips 18, 720. 00 52 weeks @ 30 x $12 105. 00 315. 00 300. 00 3, 000. 00 D & O Insurance Combined with KI General Liability Insurance 192. 00 4 x 12. 00 x 4 Months 360. 00 1, 739. 15 0. 00 Governor Desigination (Either Reimbursement or Desigination) 250. 00 5 x $50. 00 - Kiwanis International - RMD - $0 2, 662. 49 ------ 300. 00 Interclub Luncheons at Conventions 2, 500. 00 $1, 250 x 2 Delegates - Paris, France (July 13 -16, 2017) ------ 2, 394. 00 2, 444. 00 2, 496. 00 48 x $52. 00 - Life Members Are Exempt (2) Magazine Subscriptions 448. 00 384. 00 376. 00 392. 00 49 x $8. 00 (50 Members minus 1 Spouse Exemption) 5133 Insurance - General Liability & D/O 354. 00 318. 50 425. 00 50 x $17. 00 / 2 (split with Service Fund) 5160 Krier Newsletter & Software 18. 40 0. 00 Kirer is emailed to members - no longer printed 5165 Member Recruitment 0. 00 560. 00 115. 00 250. 00 Packets & Related Materials for New Members 5195 Midwinter Conference 92. 00 150. 00 $50 x 3 - Fort Collins, Colorado (March 3 -5, 2017) 5155 Kiwanis Events 98. 77 100. 00 75. 00 5175 Postage & Shipping 81. 57 113. 00 310. 28 5180 Room Rent 2, 385. 20 2, 980. 00 2, 780. 00 5185 Secretary 588. 00 648. 00 5197 Speakers & Other Travel 0. 00 5190 Social Events 26. 00 100. 00 5191 Spiritual Aims 5192 Supplies - Office & Archive Materials 5199 Treasurer 100. 00 Odds & Ends or Kiwanis Events 109. 00 Stamps & Shipping ($0. 47 x 200) + $15 for other. 2, 980. 00 50 x $55. 60 + $200. 00 for Off Site Rental and/or Annual Picnic 504. 00 Part of $658 Annual Dues (Sec. Pays $144 - Club Pays $504) 0. 00 Travel or Related Expenses for Guest Speakers 100. 00 Social Event Expenses / Decorations, etc. 0. 00 833. 96 0. 00 33, 508. 71 36, 209. 50 35, 870. 39 0. 00 TOTAL EXPENSES: 0. 00 500. 00 40. 00 578. 93 Adjustment ACTUAL EXPENSES: 33, 508. 71 NET INCOME (Adjusted Accrual): 1, 166. 39 40. 00 Cards & Supplies 500. 00 Pins, Paper, Non-Krier Printing, Ink Cartridges, Film / etc. 0. 00 Services Donated This Year 35, 870. 39 0. 00 (549. 20) 0. 00 34, 243. 00 Based On 50 paying members as of 10/10/2016 Budget Approved By The Board (1, 583. 50) (1, 743. 00) 10/19/2016

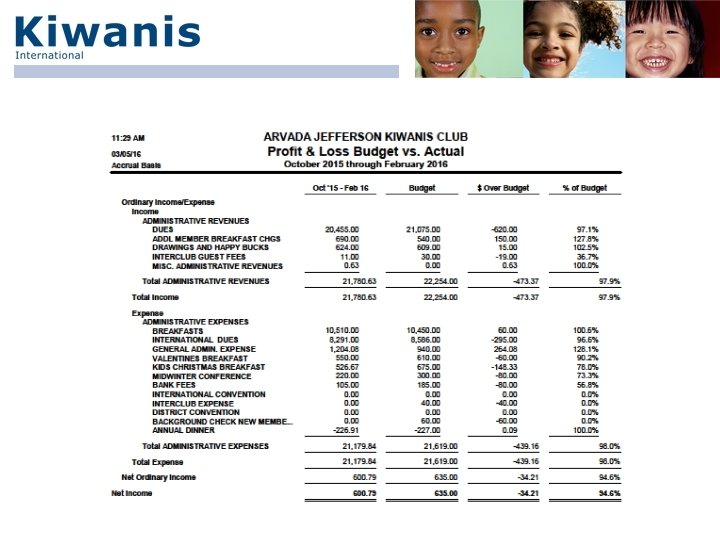

Financial Reports § Board meeting presentations: § Administrative and service P&L year to date vs. budget § Administrative and service current balance sheet § Member balances § Periodic forecasts showing predicted total year results § Annual report to club membership

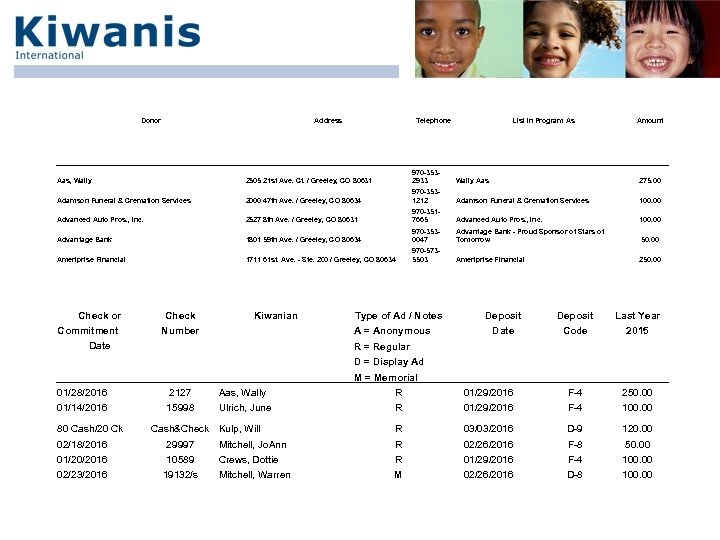

Financial Reports – Donations & Fundraisers § Tracking donations § Tracking methods § Receipt/thank you letters § Fundraiser analysis § P&L for each fundraiser § May be a separate analysis from Quick. Books § Only the proceeds and expenses from each fundraiser

Donor Address Telephone List in Program As Amount Check or Check Commitment Date Adamson Funeral & Cremation Services 100. 00 970 -3517665 Advanced Auto Pros. , Inc. 100. 00 970 -3530047 Advantage Bank - Proud Sponsor of Stars of Tomorrow 50. 00 1711 61 st. Ave. - Ste. 200 / Greeley, CO 80634 Ameriprise Financial 275. 00 1801 59 th Ave. / Greeley, CO 80634 Advantage Bank Wally Aas 970 -3531212 2527 8 th Ave. / Greeley, CO 80631 Advanced Auto Pros. , Inc. 970 -3532933 2000 47 th Ave. / Greeley, CO 80634 Adamson Funeral & Cremation Services 2505 21 st Ave. Ct. / Greeley, CO 80631 Aas, Wally 970 -5735503 Ameriprise Financial 250. 00 Kiwanian Number Type of Ad / Notes Deposit Last Year Date A = Anonymous Deposit Code 2015 R = Regular D = Display Ad M = Memorial 01/28/2016 2127 Aas, Wally R 01/29/2016 F-4 250. 00 01/14/2016 15998 Ulrich, June R 01/29/2016 F-4 100. 00 80 Cash/20 Ck R 03/03/2016 D-9 120. 00 02/18/2016 Cash&Check Kulp, Will 29997 Mitchell, Jo. Ann R 02/26/2016 F-8 50. 00 01/20/2016 10589 Crews, Dottie R 01/29/2016 F-4 100. 00 02/23/2016 19132/s Mitchell, Warren M 02/26/2016 D-8 100. 00

January 20, 2017 William and Susan Hurt 5630 W. 24 th Street Greeley, CO 80634 Dear William and Susan Hurt: Thank you for your donation of $250. 00 (check # 1779 dated 01/20/2017) designated for Stars of Tomorrow with the Kiwanis Club of Greeley. Pursuant to regulations of the Internal Revenue Service, this letter should be retained as written substantiation of this gift and evidence that the Kiwanis Foundation of Weld County, Inc. , a 501(c)(3) tax exempt organization has provided no goods or services in consideration for this gift. Sincerely, Marcia L. Siebring Treasurer

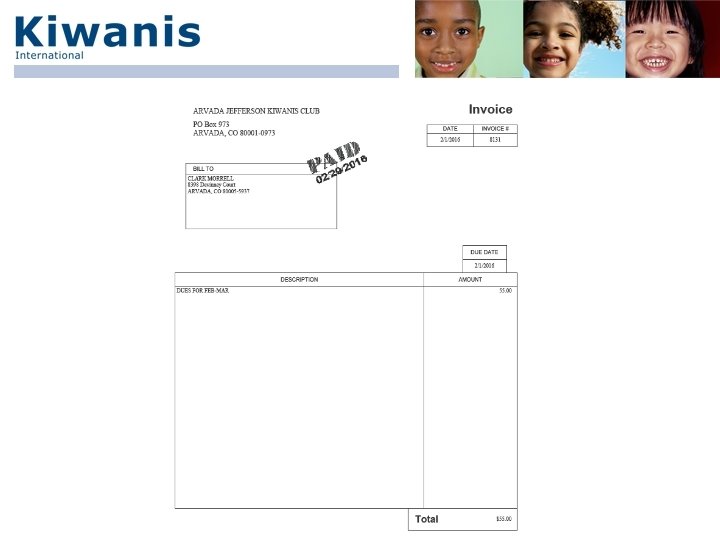

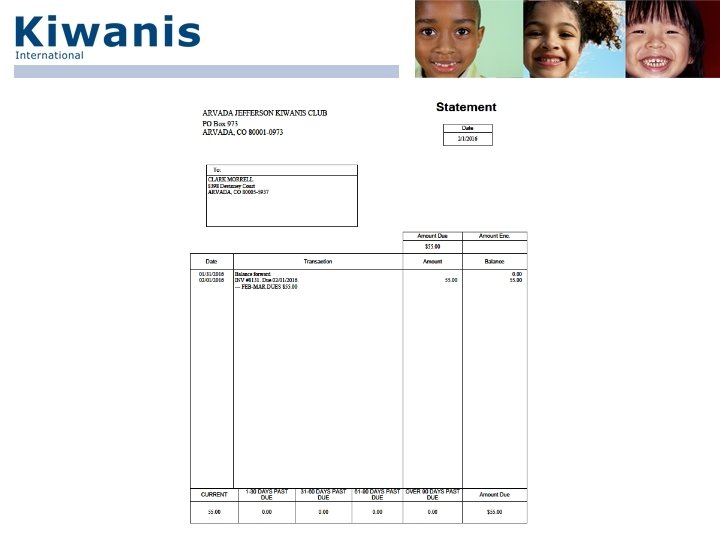

Dues Invoicing alternatives: § ACH (automatic clearing house) § E-mail § In person or regular mail § Invoice or statement from Quick. Books Collection alternatives § ACH § In person or regular mail § Pay. Pal or mobile phone § Monthly/bi-monthly or annually

Dues Invoicing ACH (automatic clearing house) the preferred method § Dues automatically transferred from member’s bank account to club account each pay period § Set time and amount each pay period § Needs member’s permission, bank account number and routing number for member’s bank § Guaranteed payment on time, no member involvement, easy to do each pay period § Cost to club of about $35 per month regardless of number of members using

Dues Invoicing E-mail next best alternative § E-mail invoice or statement directly from software to member’s e-mail address § Invoicing time much less than time to print and mail each invoice or statement § Needs member’s permission to use e-mail § Faster and more secure than regular mail and saves postage

Foundations § Use the foundation for service accounts § Tax deductibility for donations if foundation is a 501(c)(3) corporation; clubs are 501(c)(4)s and donations are not tax deductible § Insures separateness from the club account § Can be same members, officers, and directors as the club § Funds and donations for both short-term charity, and longterm endowment with limited current access § Set up investment committee for long term endowment investments, to make recommendations to the board and manage the investments

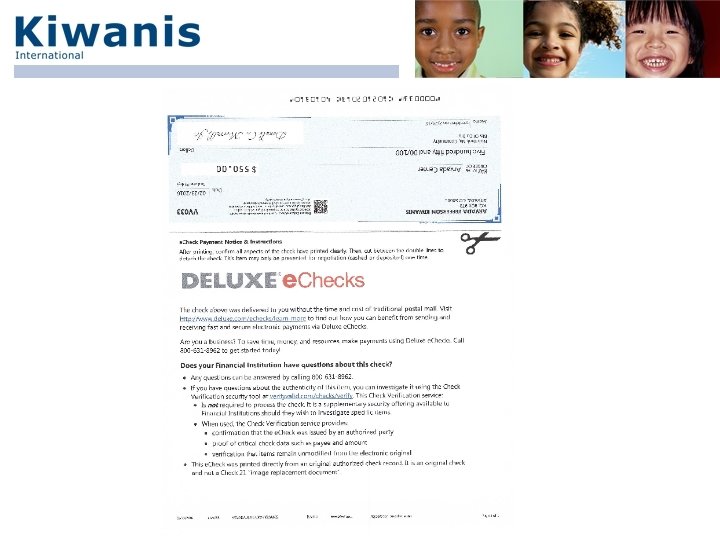

E-Checks § Electronic checks from Deluxe or other check suppliers § Checks created and tracked on-line; no need for check books, manual check registers, or carbon copies of checks § Checks can be printed for delivery or mail to recipients and for your records § Or, checks can be e-mailed directly to the recipient

E-Checks continued § Recipient cuts out the check and deposits or cashes it at their bank like a conventional check § Acceptable at all banks and by Kiwanis International § Faster and more secure than conventional checks if e-mailed § Inexpensive at $55 per 100 checks; reorder is immediate and safe (no delivery or mailing of physical checks)

Income Taxes § Due February following October – September fiscal year § Revenue below $50 thousand, form 990 N with no details § Revenue above $50 thousand, form 990 EZ, more complex § Use professional/CPA for 990 EZ, might not be treasurer § If administrative and service accounts are in separate companies, need separate income tax filings

059594d2028933be8da4eccfdce6bf4e.ppt