3281f1a4d41f0b8353b7a85e9771f251.ppt

- Количество слайдов: 21

Transshipment / Transit Trade

Transshipment / Transit Trade

Definitions n Transshipment: Transshipment is an act for shipping goods to an intermediate destination prior to reaching their ultimate end use. It also means taking of the cargo out of one vessel and loading it in to another. In the Customs Act, 1969 “Transshipment” is used in the sense of removal of imported goods at the Customs station from one conveyance (vessel, aircraft, vehicle or animal), to another for being taken to another Customs station or a foreign destination.

Definitions n Transshipment: Transshipment is an act for shipping goods to an intermediate destination prior to reaching their ultimate end use. It also means taking of the cargo out of one vessel and loading it in to another. In the Customs Act, 1969 “Transshipment” is used in the sense of removal of imported goods at the Customs station from one conveyance (vessel, aircraft, vehicle or animal), to another for being taken to another Customs station or a foreign destination.

THE CUSTOMS ACT, 1969 CHAPTER XII TRANSHIPMENT

THE CUSTOMS ACT, 1969 CHAPTER XII TRANSHIPMENT

[121. Transshipment of goods without payment of duty. - (1) Subject to the provisions of section 15 and the rules, the appropriate officer may, on application by the owner of any goods imported at any customs-station and specially and distinctly manifested at the time of importation as for transshipment to some other customs-station or foreign destination, grant leave to transship the same without payment of duty, if any, chargeable on such goods with or without any security or bond for the due arrival and entry of the goods at the customs-station of destination. ard The (2) may deem fit to impose, authorize certain carriers to transport goods under the multimodal, scheme. Goods transported under the multimodal scheme shall be specially and distinctly manifested at the time of importation as for transshipment to some other customs-station or foreign destination and shall not -

[121. Transshipment of goods without payment of duty. - (1) Subject to the provisions of section 15 and the rules, the appropriate officer may, on application by the owner of any goods imported at any customs-station and specially and distinctly manifested at the time of importation as for transshipment to some other customs-station or foreign destination, grant leave to transship the same without payment of duty, if any, chargeable on such goods with or without any security or bond for the due arrival and entry of the goods at the customs-station of destination. ard The (2) may deem fit to impose, authorize certain carriers to transport goods under the multimodal, scheme. Goods transported under the multimodal scheme shall be specially and distinctly manifested at the time of importation as for transshipment to some other customs-station or foreign destination and shall not -

(a) require distinct permission for transhipment from the customs station of first entry into the country to be transported to the customs station of destination. The principal carrier issuing the multimodal bill of lading or air way bill will be responsible for the sanctity of the cargo during transportation between the customs station of first entry into the country to the customs station of destination; and (b) be subject to the risk management system at the customs station of first entry. (3) The Board may, subject to such conditions as it may deem fit, grant licence to any carrier to carry goods under the multimodal scheme. ]

(a) require distinct permission for transhipment from the customs station of first entry into the country to be transported to the customs station of destination. The principal carrier issuing the multimodal bill of lading or air way bill will be responsible for the sanctity of the cargo during transportation between the customs station of first entry into the country to the customs station of destination; and (b) be subject to the risk management system at the customs station of first entry. (3) The Board may, subject to such conditions as it may deem fit, grant licence to any carrier to carry goods under the multimodal scheme. ]

![122. Superintendence of transhipment. An officer of customs 3[may] be deputed free of charge 122. Superintendence of transhipment. An officer of customs 3[may] be deputed free of charge](https://present5.com/presentation/3281f1a4d41f0b8353b7a85e9771f251/image-6.jpg) 122. Superintendence of transhipment. An officer of customs 3[may] be deputed free of charge to superintend the removal of transshipped goods from one conveyance to another 4[: ] 5[Provided that nothing in this section shall apply to the goods transported under the multimodal scheme. ] [123. Entry, etc. , of transshipped goods. (1) All goods transshipped under sub section (2) of section 121 to any customs station shall, on their arrival at such customs station be entered in the same manner as goods on , their first importation and shall be dealt with likewise. (2) All goods being transshipped under sub section (1) of section 121 from a customs station of first entry into the country, where the Customs Computerized System is operational and the goods are determined to be high risk by the risk management system shall be dealt with under rules on the subject. ]

122. Superintendence of transhipment. An officer of customs 3[may] be deputed free of charge to superintend the removal of transshipped goods from one conveyance to another 4[: ] 5[Provided that nothing in this section shall apply to the goods transported under the multimodal scheme. ] [123. Entry, etc. , of transshipped goods. (1) All goods transshipped under sub section (2) of section 121 to any customs station shall, on their arrival at such customs station be entered in the same manner as goods on , their first importation and shall be dealt with likewise. (2) All goods being transshipped under sub section (1) of section 121 from a customs station of first entry into the country, where the Customs Computerized System is operational and the goods are determined to be high risk by the risk management system shall be dealt with under rules on the subject. ]

124. Transhipment of provisions and stores from one conveyance to another of the same owner without payment of duty. Any provisions and stores in use or being carried for use on board a conveyance may, at the discretion of the appropriate officers be transshipped to another conveyance belonging wholly or partly to the same owner and present simultaneously at the same customs station, without payment of duty. 125. Levy of transhipment fees. Subject to the rules, a transhipment fee on any goods or class of goods transshipped under this Act may be levied at such rates, according to weight, measurement, quantity, number, bale, package or container, as the Board may, by notification in the official Gazette, prescribe for any customs station or class of customs stations.

124. Transhipment of provisions and stores from one conveyance to another of the same owner without payment of duty. Any provisions and stores in use or being carried for use on board a conveyance may, at the discretion of the appropriate officers be transshipped to another conveyance belonging wholly or partly to the same owner and present simultaneously at the same customs station, without payment of duty. 125. Levy of transhipment fees. Subject to the rules, a transhipment fee on any goods or class of goods transshipped under this Act may be levied at such rates, according to weight, measurement, quantity, number, bale, package or container, as the Board may, by notification in the official Gazette, prescribe for any customs station or class of customs stations.

Conditions for qualifying as a bonded carrier & its operations • A minimum number of 25 vehicles either registered or leased by him. • Vehicles should have permanently installed /fixed tracking device of a reputable company. • License shall be issued by the Collector Customs Appraisement Karachi for one year on the recommendations of a team comprising of Collector Customs Appraisement, Preventive & Port Qasim Karachi. • Carrier should be registered under the companies ordinance 1984 (XL VII of 1984) , with Chamber of Commerce and Industry and Transporter’s Association. • Should have a National Tax Number. • Permission granted for bonded transportation is not transferrable and shall not be used by any sub contractor.

Conditions for qualifying as a bonded carrier & its operations • A minimum number of 25 vehicles either registered or leased by him. • Vehicles should have permanently installed /fixed tracking device of a reputable company. • License shall be issued by the Collector Customs Appraisement Karachi for one year on the recommendations of a team comprising of Collector Customs Appraisement, Preventive & Port Qasim Karachi. • Carrier should be registered under the companies ordinance 1984 (XL VII of 1984) , with Chamber of Commerce and Industry and Transporter’s Association. • Should have a National Tax Number. • Permission granted for bonded transportation is not transferrable and shall not be used by any sub contractor.

• A bank guarantee or Defense saving certificate or a mix of both to be deposited with the concerned Collector of Customs to safe guard Govt Revenue. • Vehicles of one bonded carrier are not to be used by another bonded carrier. • All bonded carrier permit holders to obtain and posses Customs Clearing and forwarding license.

• A bank guarantee or Defense saving certificate or a mix of both to be deposited with the concerned Collector of Customs to safe guard Govt Revenue. • Vehicles of one bonded carrier are not to be used by another bonded carrier. • All bonded carrier permit holders to obtain and posses Customs Clearing and forwarding license.

Responsibilities of the Carrier 1. Carrier shall satisfy himself that the actual description, quantity, quality and weight of the goods under transshipment are as per declaration in the IGM of the vessel. In case of any misdeclaration / substitution carrier shall be held responsible under Sec 32 & 121 of the Act 2. Shall deliver the goods to its destination within prescribed time limit. 3. Any deviation from the authorized route and delay in the delivery will require a written explanation. 4. Except Pakistan Railways and NLC, all carriers shall submit a revolving Insurance to the Assistant collector (Import Section) covering all aspects and types of risk. 5. Except Pakistan Railways & NLC, the carrier shall submit the list of transport units owned or leased including registration number, engine and chassis number make, model, tare weight along with photographs of each vehicle showing both sides, front, rear as well as chassis number, to the Assistant Collector (Import Section) 6. The permit issued by the Assistant Collector (Import Section) to transport units shall be treated as consolidated registration with Customs House

Responsibilities of the Carrier 1. Carrier shall satisfy himself that the actual description, quantity, quality and weight of the goods under transshipment are as per declaration in the IGM of the vessel. In case of any misdeclaration / substitution carrier shall be held responsible under Sec 32 & 121 of the Act 2. Shall deliver the goods to its destination within prescribed time limit. 3. Any deviation from the authorized route and delay in the delivery will require a written explanation. 4. Except Pakistan Railways and NLC, all carriers shall submit a revolving Insurance to the Assistant collector (Import Section) covering all aspects and types of risk. 5. Except Pakistan Railways & NLC, the carrier shall submit the list of transport units owned or leased including registration number, engine and chassis number make, model, tare weight along with photographs of each vehicle showing both sides, front, rear as well as chassis number, to the Assistant Collector (Import Section) 6. The permit issued by the Assistant Collector (Import Section) to transport units shall be treated as consolidated registration with Customs House

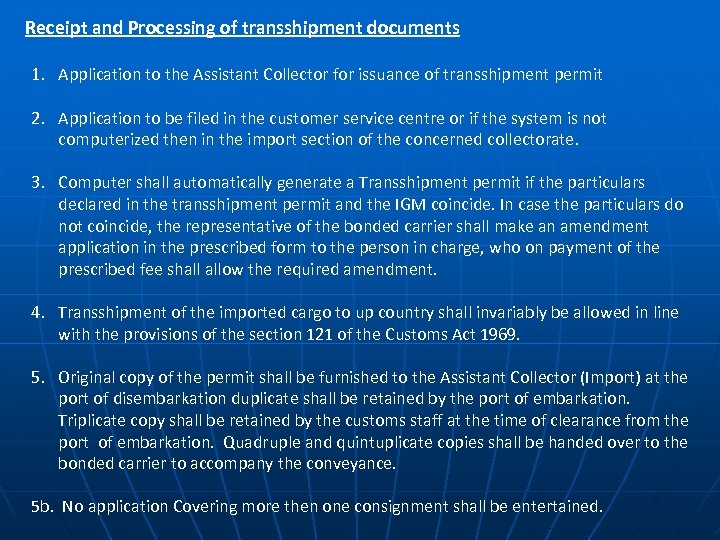

Receipt and Processing of transshipment documents 1. Application to the Assistant Collector for issuance of transshipment permit 2. Application to be filed in the customer service centre or if the system is not computerized then in the import section of the concerned collectorate. 3. Computer shall automatically generate a Transshipment permit if the particulars declared in the transshipment permit and the IGM coincide. In case the particulars do not coincide, the representative of the bonded carrier shall make an amendment application in the prescribed form to the person in charge, who on payment of the prescribed fee shall allow the required amendment. 4. Transshipment of the imported cargo to up country shall invariably be allowed in line with the provisions of the section 121 of the Customs Act 1969. 5. Original copy of the permit shall be furnished to the Assistant Collector (Import) at the port of disembarkation duplicate shall be retained by the port of embarkation. Triplicate copy shall be retained by the customs staff at the time of clearance from the port of embarkation. Quadruple and quintuplicate copies shall be handed over to the bonded carrier to accompany the conveyance. 5 b. No application Covering more then one consignment shall be entertained.

Receipt and Processing of transshipment documents 1. Application to the Assistant Collector for issuance of transshipment permit 2. Application to be filed in the customer service centre or if the system is not computerized then in the import section of the concerned collectorate. 3. Computer shall automatically generate a Transshipment permit if the particulars declared in the transshipment permit and the IGM coincide. In case the particulars do not coincide, the representative of the bonded carrier shall make an amendment application in the prescribed form to the person in charge, who on payment of the prescribed fee shall allow the required amendment. 4. Transshipment of the imported cargo to up country shall invariably be allowed in line with the provisions of the section 121 of the Customs Act 1969. 5. Original copy of the permit shall be furnished to the Assistant Collector (Import) at the port of disembarkation duplicate shall be retained by the port of embarkation. Triplicate copy shall be retained by the customs staff at the time of clearance from the port of embarkation. Quadruple and quintuplicate copies shall be handed over to the bonded carrier to accompany the conveyance. 5 b. No application Covering more then one consignment shall be entertained.

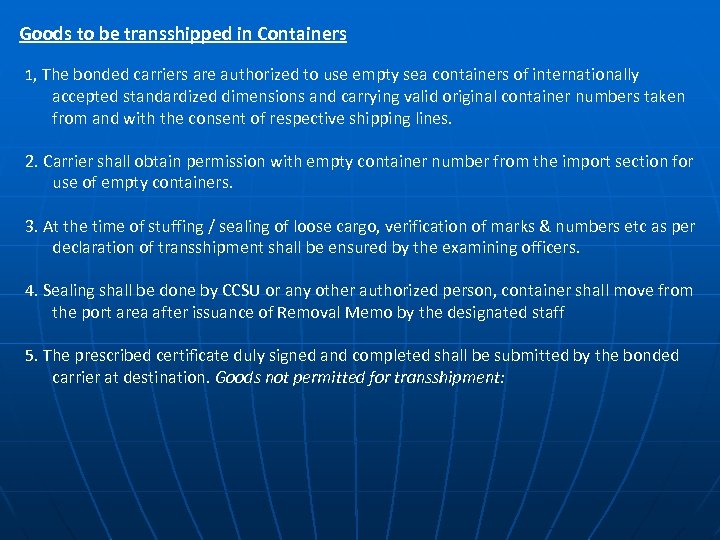

Goods to be transshipped in Containers 1, The bonded carriers are authorized to use empty sea containers of internationally accepted standardized dimensions and carrying valid original container numbers taken from and with the consent of respective shipping lines. 2. Carrier shall obtain permission with empty container number from the import section for use of empty containers. 3. At the time of stuffing / sealing of loose cargo, verification of marks & numbers etc as per declaration of transshipment shall be ensured by the examining officers. 4. Sealing shall be done by CCSU or any other authorized person, container shall move from the port area after issuance of Removal Memo by the designated staff 5. The prescribed certificate duly signed and completed shall be submitted by the bonded carrier at destination. Goods not permitted for transshipment:

Goods to be transshipped in Containers 1, The bonded carriers are authorized to use empty sea containers of internationally accepted standardized dimensions and carrying valid original container numbers taken from and with the consent of respective shipping lines. 2. Carrier shall obtain permission with empty container number from the import section for use of empty containers. 3. At the time of stuffing / sealing of loose cargo, verification of marks & numbers etc as per declaration of transshipment shall be ensured by the examining officers. 4. Sealing shall be done by CCSU or any other authorized person, container shall move from the port area after issuance of Removal Memo by the designated staff 5. The prescribed certificate duly signed and completed shall be submitted by the bonded carrier at destination. Goods not permitted for transshipment:

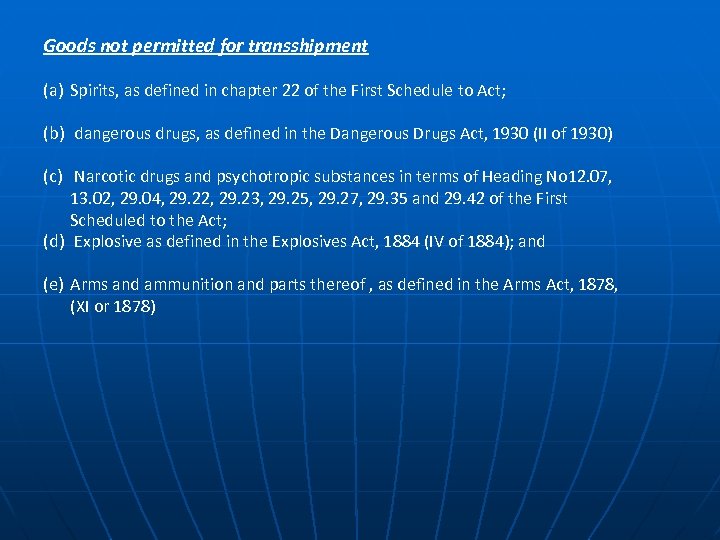

Goods not permitted for transshipment (a) Spirits, as defined in chapter 22 of the First Schedule to Act; (b) dangerous drugs, as defined in the Dangerous Drugs Act, 1930 (II of 1930) (c) Narcotic drugs and psychotropic substances in terms of Heading No 12. 07, 13. 02, 29. 04, 29. 22, 29. 23, 29. 25, 29. 27, 29. 35 and 29. 42 of the First Scheduled to the Act; (d) Explosive as defined in the Explosives Act, 1884 (IV of 1884); and (e) Arms and ammunition and parts thereof , as defined in the Arms Act, 1878, (XI or 1878)

Goods not permitted for transshipment (a) Spirits, as defined in chapter 22 of the First Schedule to Act; (b) dangerous drugs, as defined in the Dangerous Drugs Act, 1930 (II of 1930) (c) Narcotic drugs and psychotropic substances in terms of Heading No 12. 07, 13. 02, 29. 04, 29. 22, 29. 23, 29. 25, 29. 27, 29. 35 and 29. 42 of the First Scheduled to the Act; (d) Explosive as defined in the Explosives Act, 1884 (IV of 1884); and (e) Arms and ammunition and parts thereof , as defined in the Arms Act, 1878, (XI or 1878)

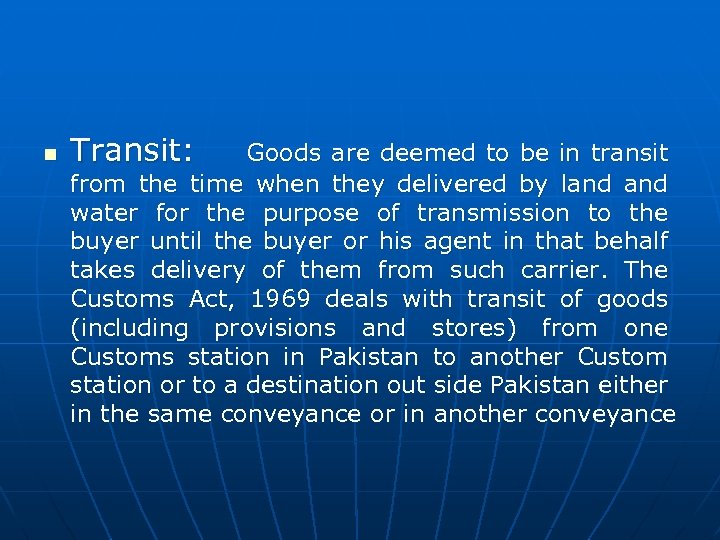

n Transit: Goods are deemed to be in transit from the time when they delivered by land water for the purpose of transmission to the buyer until the buyer or his agent in that behalf takes delivery of them from such carrier. The Customs Act, 1969 deals with transit of goods (including provisions and stores) from one Customs station in Pakistan to another Custom station or to a destination out side Pakistan either in the same conveyance or in another conveyance

n Transit: Goods are deemed to be in transit from the time when they delivered by land water for the purpose of transmission to the buyer until the buyer or his agent in that behalf takes delivery of them from such carrier. The Customs Act, 1969 deals with transit of goods (including provisions and stores) from one Customs station in Pakistan to another Custom station or to a destination out side Pakistan either in the same conveyance or in another conveyance

THE CUSTOMS ACT, 1969 CHAPTER XIII TRANSIT

THE CUSTOMS ACT, 1969 CHAPTER XIII TRANSIT

n n 126. Chapter not to apply to baggage and postal articles. The provisions of this Chapter shall not apply to (a) baggage, and (b) goods imported by post. 127. Transit of goods in the same conveyance. ~ (1) Subject to the provisions of section 15 and the rules any goods imported in a conveyance and mentioned in the import manifest as for transit in the same conveyance to customsstation in Pakistan or to any destination outside Pakistan may be allowed to be so transited without payment of duty, if any, leviable on such goods at the customs-station of transit. • (2) Any stores and provisions imported on board a conveyance which is in transit through Pakistan to a destination outside Pakistan may, subject to rules, be allowed to be consumed on board that conveyance without payment of the duties which would otherwise be chargeable on them. n 128. Transport of certain classes of goods subject to prescribed conditions. - Any goods may be transported from one part of Pakistan to another through any foreign territory, subject to such conditions as to their due arrival at the destination as may be prescribed by rules.

n n 126. Chapter not to apply to baggage and postal articles. The provisions of this Chapter shall not apply to (a) baggage, and (b) goods imported by post. 127. Transit of goods in the same conveyance. ~ (1) Subject to the provisions of section 15 and the rules any goods imported in a conveyance and mentioned in the import manifest as for transit in the same conveyance to customsstation in Pakistan or to any destination outside Pakistan may be allowed to be so transited without payment of duty, if any, leviable on such goods at the customs-station of transit. • (2) Any stores and provisions imported on board a conveyance which is in transit through Pakistan to a destination outside Pakistan may, subject to rules, be allowed to be consumed on board that conveyance without payment of the duties which would otherwise be chargeable on them. n 128. Transport of certain classes of goods subject to prescribed conditions. - Any goods may be transported from one part of Pakistan to another through any foreign territory, subject to such conditions as to their due arrival at the destination as may be prescribed by rules.

n 129. Transit of goods across Pakistan to a foreign territory. - Where any goods are entered for transit across Pakistan to a destination outside Pakistan, the appropriate officer may, subject to the provisions of the rules, allow the goods to be so transited without payment ofthe duties which would otherwise by chargeable on such goods 1[: ] • 2[Provided that the Federal Government may, by notification in the official Gazette, prohibit the bringing into Pakistan by sea, land or air in transit to a foreign territory any goods or class of goods.

n 129. Transit of goods across Pakistan to a foreign territory. - Where any goods are entered for transit across Pakistan to a destination outside Pakistan, the appropriate officer may, subject to the provisions of the rules, allow the goods to be so transited without payment ofthe duties which would otherwise by chargeable on such goods 1[: ] • 2[Provided that the Federal Government may, by notification in the official Gazette, prohibit the bringing into Pakistan by sea, land or air in transit to a foreign territory any goods or class of goods.

Transit Trade 1. Agreement signed between the Govt of Pakistan and Govt of Afghanistan on 2 -3 -1965, to grant and guarantee to each other the freedom of transit to and from their territories. 2. No duties, taxes dues or charges of any nature shall be levied except for transportation of good or those commensurate with the cost of services rendered. 3. Goods shall be stored at Karachi port in sheds specifically marked for Afghan Transit Trade. Prescribed transit routes are: (a) Peshawar – Torkham and vice versa. (b) Chaman – Spin Baldak and vice versa. 4. Route permits shall be issued by the country in which the vehicles are registered. 5. Driving licenses and certificate of fitness issued in one country shall be valid in the other country. 6. Period of stay of vehicles of a country on each trip shall be fixed on reciprocal basis. Transporters shall be granted Multiple entry visa for six months at a time.

Transit Trade 1. Agreement signed between the Govt of Pakistan and Govt of Afghanistan on 2 -3 -1965, to grant and guarantee to each other the freedom of transit to and from their territories. 2. No duties, taxes dues or charges of any nature shall be levied except for transportation of good or those commensurate with the cost of services rendered. 3. Goods shall be stored at Karachi port in sheds specifically marked for Afghan Transit Trade. Prescribed transit routes are: (a) Peshawar – Torkham and vice versa. (b) Chaman – Spin Baldak and vice versa. 4. Route permits shall be issued by the country in which the vehicles are registered. 5. Driving licenses and certificate of fitness issued in one country shall be valid in the other country. 6. Period of stay of vehicles of a country on each trip shall be fixed on reciprocal basis. Transporters shall be granted Multiple entry visa for six months at a time.

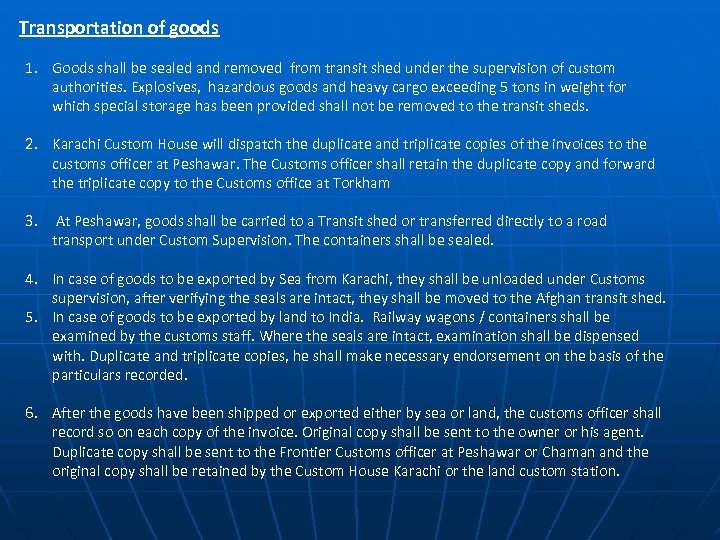

Transportation of goods 1. Goods shall be sealed and removed from transit shed under the supervision of custom authorities. Explosives, hazardous goods and heavy cargo exceeding 5 tons in weight for which special storage has been provided shall not be removed to the transit sheds. 2. Karachi Custom House will dispatch the duplicate and triplicate copies of the invoices to the customs officer at Peshawar. The Customs officer shall retain the duplicate copy and forward the triplicate copy to the Customs office at Torkham 3. At Peshawar, goods shall be carried to a Transit shed or transferred directly to a road transport under Custom Supervision. The containers shall be sealed. 4. In case of goods to be exported by Sea from Karachi, they shall be unloaded under Customs supervision, after verifying the seals are intact, they shall be moved to the Afghan transit shed. 5. In case of goods to be exported by land to India. Railway wagons / containers shall be examined by the customs staff. Where the seals are intact, examination shall be dispensed with. Duplicate and triplicate copies, he shall make necessary endorsement on the basis of the particulars recorded. 6. After the goods have been shipped or exported either by sea or land, the customs officer shall record so on each copy of the invoice. Original copy shall be sent to the owner or his agent. Duplicate copy shall be sent to the Frontier Customs officer at Peshawar or Chaman and the original copy shall be retained by the Custom House Karachi or the land custom station.

Transportation of goods 1. Goods shall be sealed and removed from transit shed under the supervision of custom authorities. Explosives, hazardous goods and heavy cargo exceeding 5 tons in weight for which special storage has been provided shall not be removed to the transit sheds. 2. Karachi Custom House will dispatch the duplicate and triplicate copies of the invoices to the customs officer at Peshawar. The Customs officer shall retain the duplicate copy and forward the triplicate copy to the Customs office at Torkham 3. At Peshawar, goods shall be carried to a Transit shed or transferred directly to a road transport under Custom Supervision. The containers shall be sealed. 4. In case of goods to be exported by Sea from Karachi, they shall be unloaded under Customs supervision, after verifying the seals are intact, they shall be moved to the Afghan transit shed. 5. In case of goods to be exported by land to India. Railway wagons / containers shall be examined by the customs staff. Where the seals are intact, examination shall be dispensed with. Duplicate and triplicate copies, he shall make necessary endorsement on the basis of the particulars recorded. 6. After the goods have been shipped or exported either by sea or land, the customs officer shall record so on each copy of the invoice. Original copy shall be sent to the owner or his agent. Duplicate copy shall be sent to the Frontier Customs officer at Peshawar or Chaman and the original copy shall be retained by the Custom House Karachi or the land custom station.

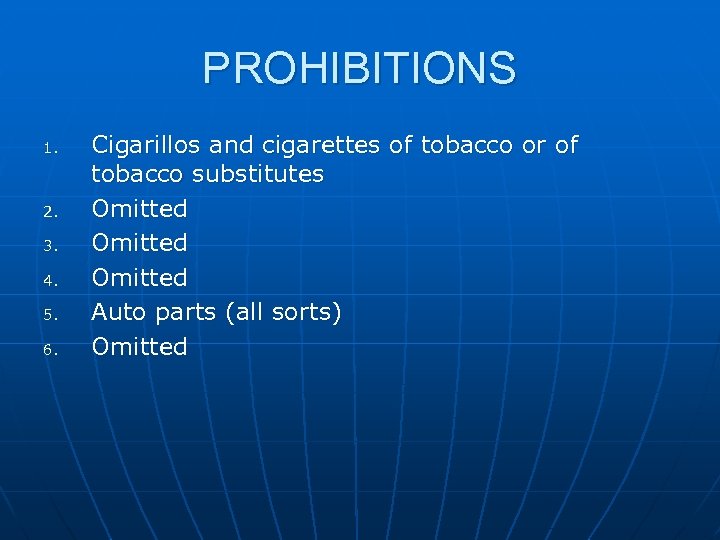

PROHIBITIONS 1. 2. 3. 4. 5. 6. Cigarillos and cigarettes of tobacco or of tobacco substitutes Omitted Auto parts (all sorts) Omitted

PROHIBITIONS 1. 2. 3. 4. 5. 6. Cigarillos and cigarettes of tobacco or of tobacco substitutes Omitted Auto parts (all sorts) Omitted

The prohibitions on bringing in or taking out of goods, as specified in Section 15 or any rule, into or out of Pakistan, shall apply to such good, which are manifested for transit. Such prohibitions may, however, be relaxed in suitable cases by the Federal Government by an order under Section 15 of the Customs Act, 1969.

The prohibitions on bringing in or taking out of goods, as specified in Section 15 or any rule, into or out of Pakistan, shall apply to such good, which are manifested for transit. Such prohibitions may, however, be relaxed in suitable cases by the Federal Government by an order under Section 15 of the Customs Act, 1969.