dfcbc61decc86816357bcced236d15ba.ppt

- Количество слайдов: 35

Transparency and International Portfolio Investment (Journal of Finance 2005) R. Gaston Gelos and Shang-Jin Wei

Transparency and International Portfolio Investment (Journal of Finance 2005) R. Gaston Gelos and Shang-Jin Wei

“ A lack of transparency was a feature of the buildup to the Mexican crises of 1994 -95 and of the emerging market crises of 1997 -98. ” International Monetary Fund (2001)

“ A lack of transparency was a feature of the buildup to the Mexican crises of 1994 -95 and of the emerging market crises of 1997 -98. ” International Monetary Fund (2001)

Objectives of Paper (1)To document empirically the effect of transparency at a country level on international investment (2)To examine the effect of transparency on herding among international funds

Objectives of Paper (1)To document empirically the effect of transparency at a country level on international investment (2)To examine the effect of transparency on herding among international funds

Literature: Transparency and investment Diamond and Verrechia (1991) Less information asymmetry -> more investment at the corporate level ***************************** If (a) Non-transparency = information asymmetry (b) International and corporate investment are analogous Then, more transparency at a country level -> more investment by international funds

Literature: Transparency and investment Diamond and Verrechia (1991) Less information asymmetry -> more investment at the corporate level ***************************** If (a) Non-transparency = information asymmetry (b) International and corporate investment are analogous Then, more transparency at a country level -> more investment by international funds

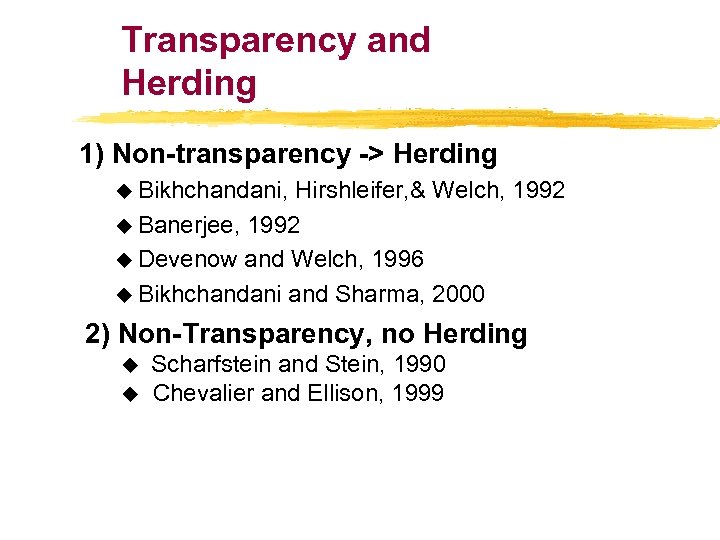

Transparency and Herding 1) Non-transparency -> Herding u Bikhchandani, Hirshleifer, & Welch, 1992 u Banerjee, 1992 u Devenow and Welch, 1996 u Bikhchandani and Sharma, 2000 2) Non-Transparency, no Herding Scharfstein and Stein, 1990 u Chevalier and Ellison, 1999 u

Transparency and Herding 1) Non-transparency -> Herding u Bikhchandani, Hirshleifer, & Welch, 1992 u Banerjee, 1992 u Devenow and Welch, 1996 u Bikhchandani and Sharma, 2000 2) Non-Transparency, no Herding Scharfstein and Stein, 1990 u Chevalier and Ellison, 1999 u

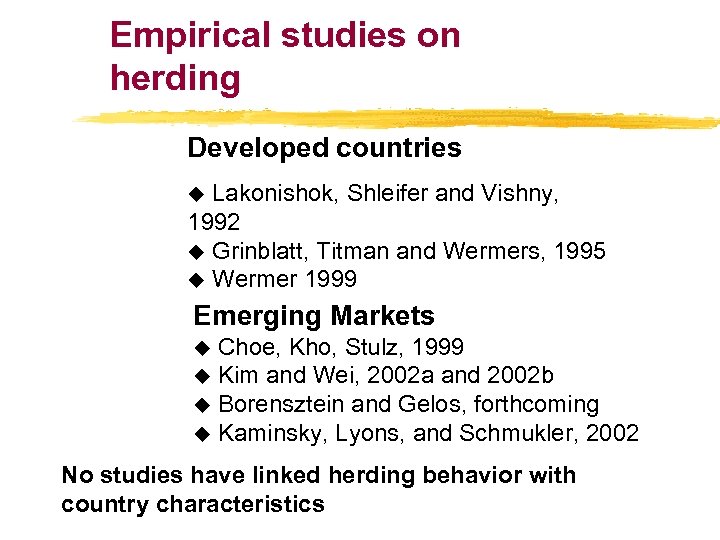

Empirical studies on herding Developed countries u Lakonishok, Shleifer and Vishny, 1992 u Grinblatt, Titman and Wermers, 1995 u Wermer 1999 Emerging Markets u Choe, Kho, Stulz, 1999 u Kim and Wei, 2002 a and 2002 b u Borensztein and Gelos, forthcoming u Kaminsky, Lyons, and Schmukler, 2002 No studies have linked herding behavior with country characteristics

Empirical studies on herding Developed countries u Lakonishok, Shleifer and Vishny, 1992 u Grinblatt, Titman and Wermers, 1995 u Wermer 1999 Emerging Markets u Choe, Kho, Stulz, 1999 u Kim and Wei, 2002 a and 2002 b u Borensztein and Gelos, forthcoming u Kaminsky, Lyons, and Schmukler, 2002 No studies have linked herding behavior with country characteristics

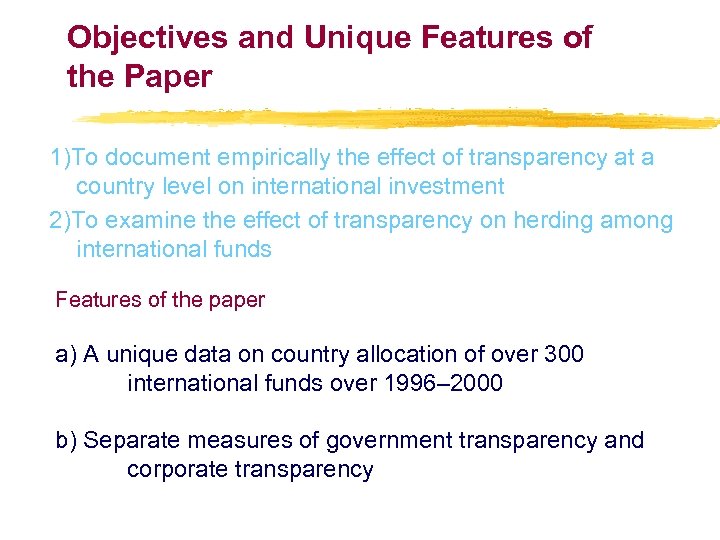

Objectives and Unique Features of the Paper 1)To document empirically the effect of transparency at a country level on international investment 2)To examine the effect of transparency on herding among international funds Features of the paper a) A unique data on country allocation of over 300 international funds over 1996– 2000 b) Separate measures of government transparency and corporate transparency

Objectives and Unique Features of the Paper 1)To document empirically the effect of transparency at a country level on international investment 2)To examine the effect of transparency on herding among international funds Features of the paper a) A unique data on country allocation of over 300 international funds over 1996– 2000 b) Separate measures of government transparency and corporate transparency

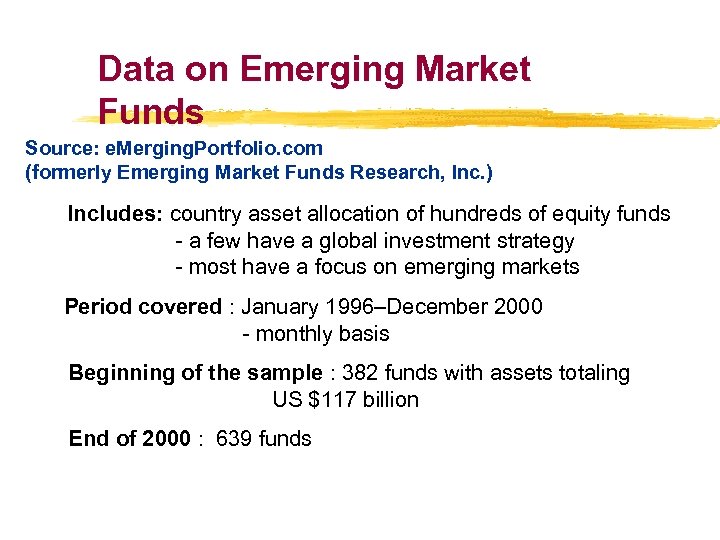

Data on Emerging Market Funds Source: e. Merging. Portfolio. com (formerly Emerging Market Funds Research, Inc. ) Includes: country asset allocation of hundreds of equity funds - a few have a global investment strategy - most have a focus on emerging markets Period covered : January 1996–December 2000 - monthly basis Beginning of the sample : 382 funds with assets totaling US $117 billion End of 2000 : 639 funds

Data on Emerging Market Funds Source: e. Merging. Portfolio. com (formerly Emerging Market Funds Research, Inc. ) Includes: country asset allocation of hundreds of equity funds - a few have a global investment strategy - most have a focus on emerging markets Period covered : January 1996–December 2000 - monthly basis Beginning of the sample : 382 funds with assets totaling US $117 billion End of 2000 : 639 funds

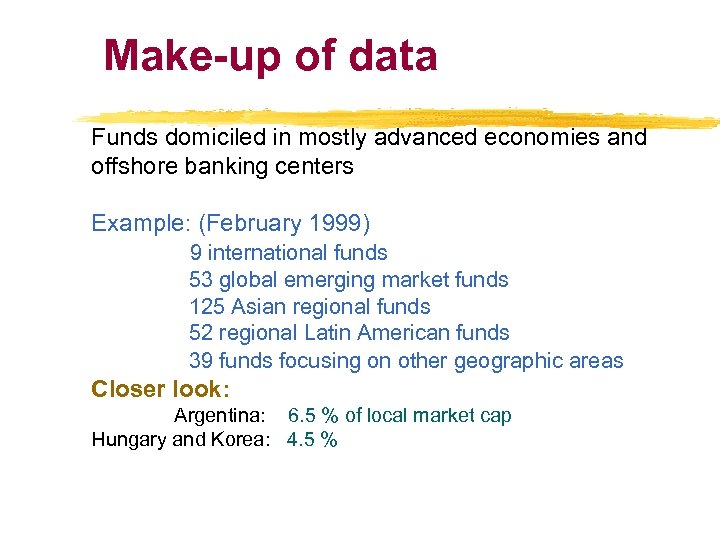

Make-up of data Funds domiciled in mostly advanced economies and offshore banking centers Example: (February 1999) 9 international funds 53 global emerging market funds 125 Asian regional funds 52 regional Latin American funds 39 funds focusing on other geographic areas Closer look: Argentina: 6. 5 % of local market cap Hungary and Korea: 4. 5 %

Make-up of data Funds domiciled in mostly advanced economies and offshore banking centers Example: (February 1999) 9 international funds 53 global emerging market funds 125 Asian regional funds 52 regional Latin American funds 39 funds focusing on other geographic areas Closer look: Argentina: 6. 5 % of local market cap Hungary and Korea: 4. 5 %

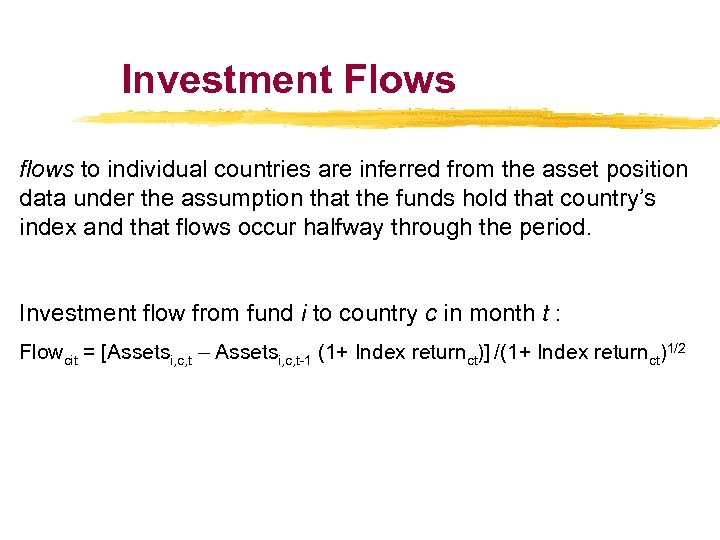

Investment Flows flows to individual countries are inferred from the asset position data under the assumption that the funds hold that country’s index and that flows occur halfway through the period. Investment flow from fund i to country c in month t : Flowcit = [Assetsi, c, t – Assetsi, c, t-1 (1+ Index returnct)] /(1+ Index returnct)1/2

Investment Flows flows to individual countries are inferred from the asset position data under the assumption that the funds hold that country’s index and that flows occur halfway through the period. Investment flow from fund i to country c in month t : Flowcit = [Assetsi, c, t – Assetsi, c, t-1 (1+ Index returnct)] /(1+ Index returnct)1/2

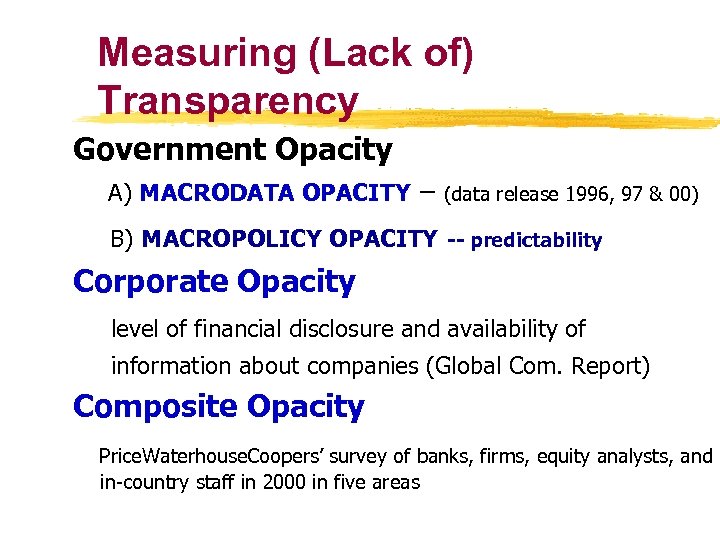

Measuring (Lack of) Transparency Government Opacity A) MACRODATA OPACITY – (data release 1996, 97 & 00) B) MACROPOLICY OPACITY -- predictability Corporate Opacity level of financial disclosure and availability of information about companies (Global Com. Report) Composite Opacity Price. Waterhouse. Coopers’ survey of banks, firms, equity analysts, and in-country staff in 2000 in five areas

Measuring (Lack of) Transparency Government Opacity A) MACRODATA OPACITY – (data release 1996, 97 & 00) B) MACROPOLICY OPACITY -- predictability Corporate Opacity level of financial disclosure and availability of information about companies (Global Com. Report) Composite Opacity Price. Waterhouse. Coopers’ survey of banks, firms, equity analysts, and in-country staff in 2000 in five areas

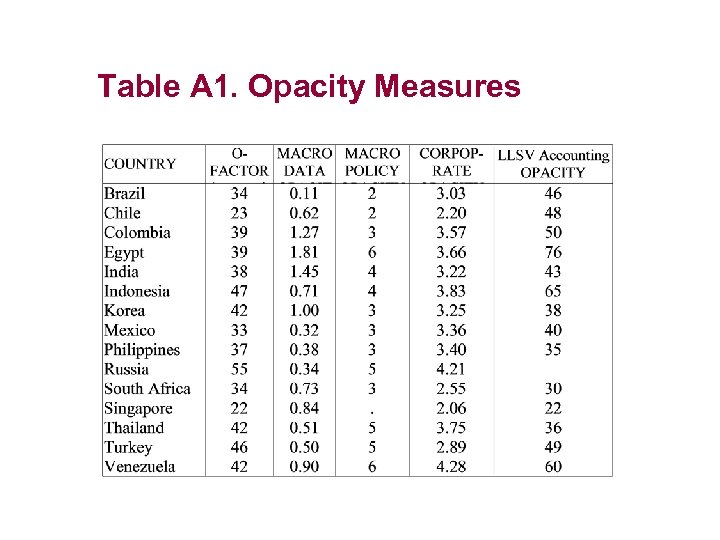

Table A 1. Opacity Measures

Table A 1. Opacity Measures

TRANS PAREN CY RATING

TRANS PAREN CY RATING

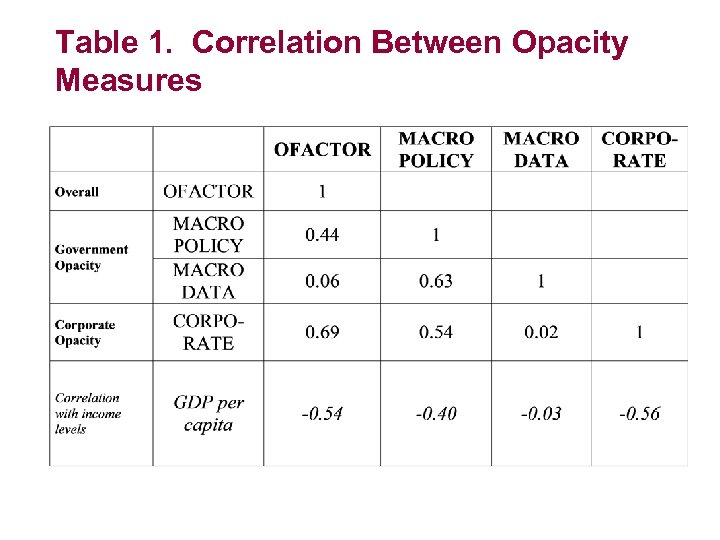

Table 1. Correlation Between Opacity Measures

Table 1. Correlation Between Opacity Measures

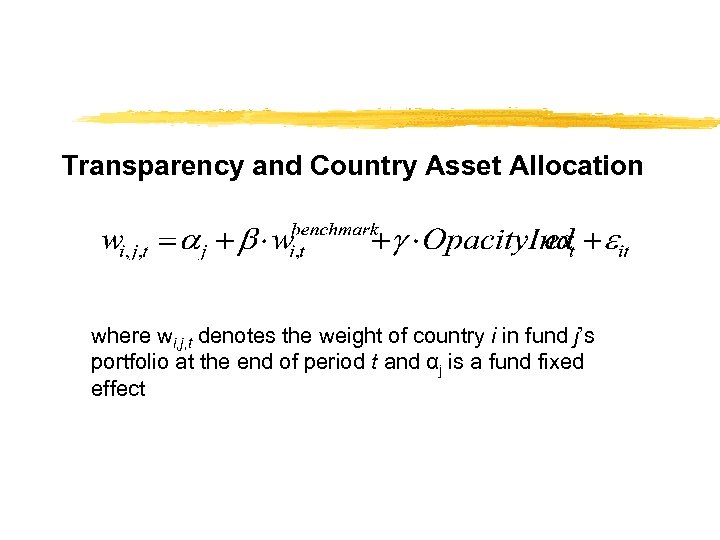

Transparency and Country Asset Allocation where wi, j, t denotes the weight of country i in fund j’s portfolio at the end of period t and αj is a fund fixed effect

Transparency and Country Asset Allocation where wi, j, t denotes the weight of country i in fund j’s portfolio at the end of period t and αj is a fund fixed effect

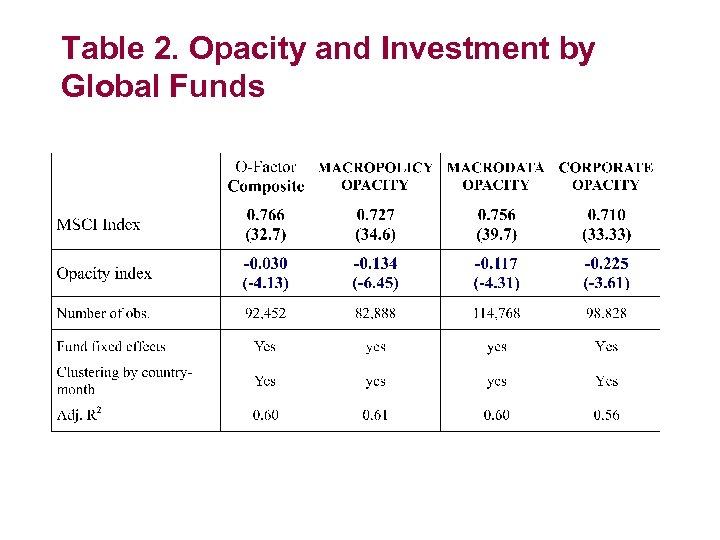

Table 2. Opacity and Investment by Global Funds

Table 2. Opacity and Investment by Global Funds

Additional Controls: Part 1 z 1. Liquidity of market z 2. Protection of minority shareholders y(PSSV, 98; PRG, 2000) z 3. z 4. z 5. z 6. Closely held ownership Level of economic development Other economic risks Other political risks

Additional Controls: Part 1 z 1. Liquidity of market z 2. Protection of minority shareholders y(PSSV, 98; PRG, 2000) z 3. z 4. z 5. z 6. Closely held ownership Level of economic development Other economic risks Other political risks

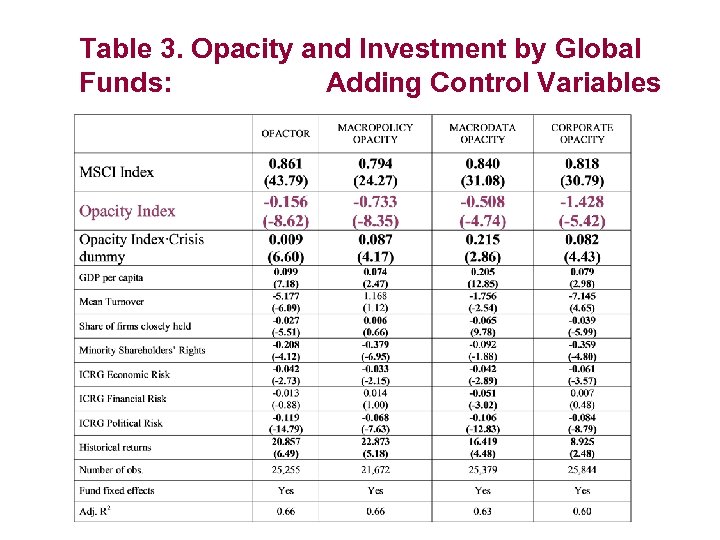

Table 3. Opacity and Investment by Global Funds: Adding Control Variables

Table 3. Opacity and Investment by Global Funds: Adding Control Variables

Additional controls: Part 2 z 7. Past returns z 8. Crisis periods z 9. Exchange rate regimes (de facto classification a la Reinhart and Rogoff 2002) z 10. Alternative measure of corporate opacity (LLSV quality of accounting system)

Additional controls: Part 2 z 7. Past returns z 8. Crisis periods z 9. Exchange rate regimes (de facto classification a la Reinhart and Rogoff 2002) z 10. Alternative measure of corporate opacity (LLSV quality of accounting system)

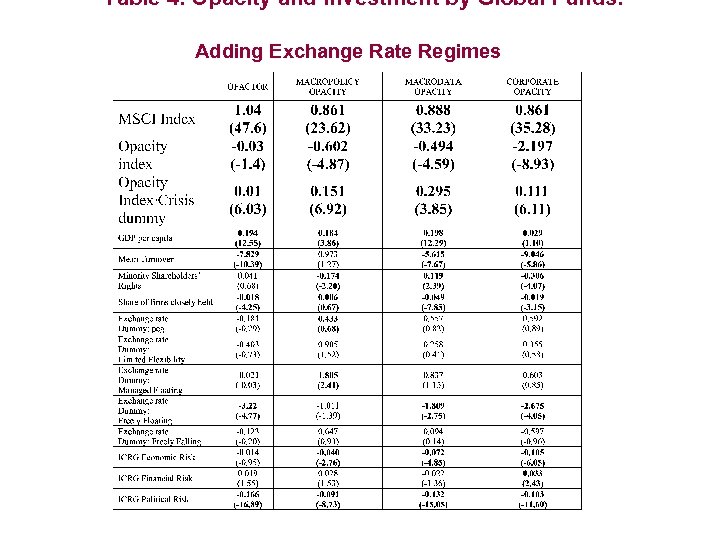

Table 4. Opacity and Investment by Global Funds: Adding Exchange Rate Regimes

Table 4. Opacity and Investment by Global Funds: Adding Exchange Rate Regimes

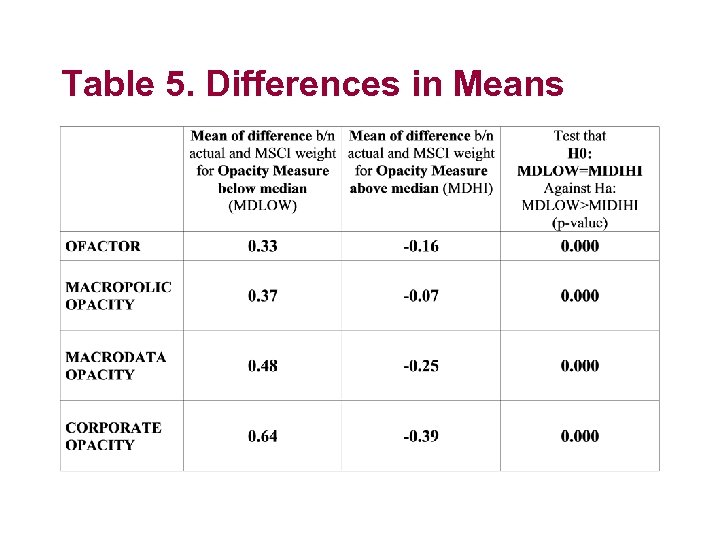

Going back to the basics z. To ensure the results don’t come from a few outliers z. A) Classify all countries to those whose opacity is below the median vs. those whose opacity is above the median z. B) Compare the actual investment with the prediction of the ICAPM

Going back to the basics z. To ensure the results don’t come from a few outliers z. A) Classify all countries to those whose opacity is below the median vs. those whose opacity is above the median z. B) Compare the actual investment with the prediction of the ICAPM

Table 5. Differences in Means

Table 5. Differences in Means

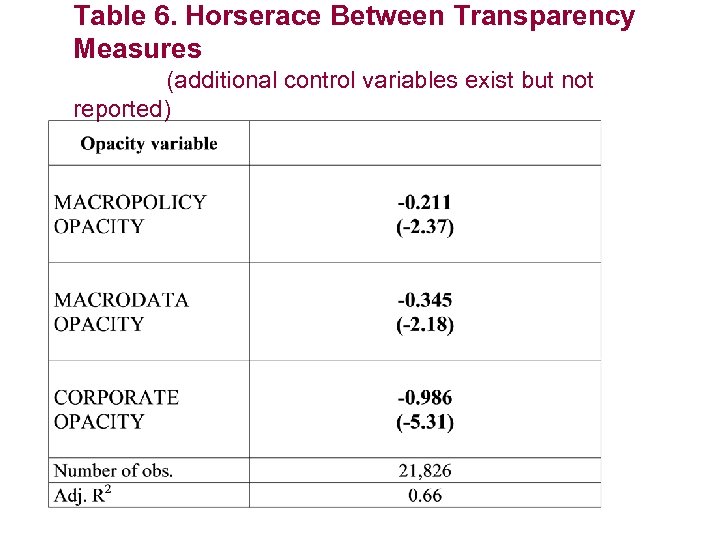

Table 6. Horserace Between Transparency Measures (additional control variables exist but not reported)

Table 6. Horserace Between Transparency Measures (additional control variables exist but not reported)

Transparency and Herding z Herding concept: The pattern that investors mimic each other’s behavior, sometimes ignoring private information that is socially useful. z Measure: The extent to which investors’ trading patterns are correlated, or the extent to which they all buy or sell a common sub-set of assets.

Transparency and Herding z Herding concept: The pattern that investors mimic each other’s behavior, sometimes ignoring private information that is socially useful. z Measure: The extent to which investors’ trading patterns are correlated, or the extent to which they all buy or sell a common sub-set of assets.

![Transparency and Investors’ Herding Behavior Herding Measure: HMit = |pit-E[pit]| - E|pit-E[pit]| where pit Transparency and Investors’ Herding Behavior Herding Measure: HMit = |pit-E[pit]| - E|pit-E[pit]| where pit](https://present5.com/presentation/dfcbc61decc86816357bcced236d15ba/image-25.jpg) Transparency and Investors’ Herding Behavior Herding Measure: HMit = |pit-E[pit]| - E|pit-E[pit]| where pit is the proportion of all funds active in country i in month t that are buyers: and E[pit] is its expected value. By taking the absolute value, the first term in equation (3) captures imbalances in both directions, buying or selling

Transparency and Investors’ Herding Behavior Herding Measure: HMit = |pit-E[pit]| - E|pit-E[pit]| where pit is the proportion of all funds active in country i in month t that are buyers: and E[pit] is its expected value. By taking the absolute value, the first term in equation (3) captures imbalances in both directions, buying or selling

![Expected fraction of buyers E[pit] total number of net buyers across all countries divided Expected fraction of buyers E[pit] total number of net buyers across all countries divided](https://present5.com/presentation/dfcbc61decc86816357bcced236d15ba/image-26.jpg) Expected fraction of buyers E[pit] total number of net buyers across all countries divided by the total number of active funds in that month: Absolute value of the first expression is not centered around zero, the expected value E|pit-E[pit]| needs to be subtracted. Under the null hypothesis of no herding, expected value is calculated assuming that the number of buyers follows a binomial distribution

Expected fraction of buyers E[pit] total number of net buyers across all countries divided by the total number of active funds in that month: Absolute value of the first expression is not centered around zero, the expected value E|pit-E[pit]| needs to be subtracted. Under the null hypothesis of no herding, expected value is calculated assuming that the number of buyers follows a binomial distribution

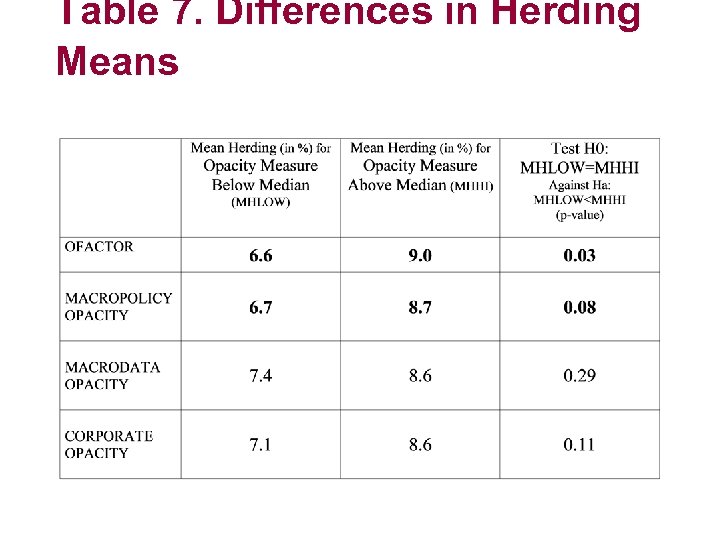

Table 7. Differences in Herding Means

Table 7. Differences in Herding Means

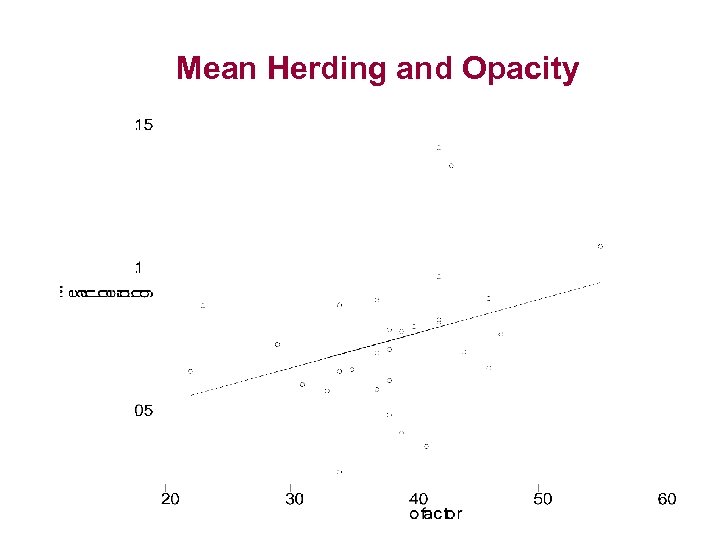

Mean Herding and Opacity

Mean Herding and Opacity

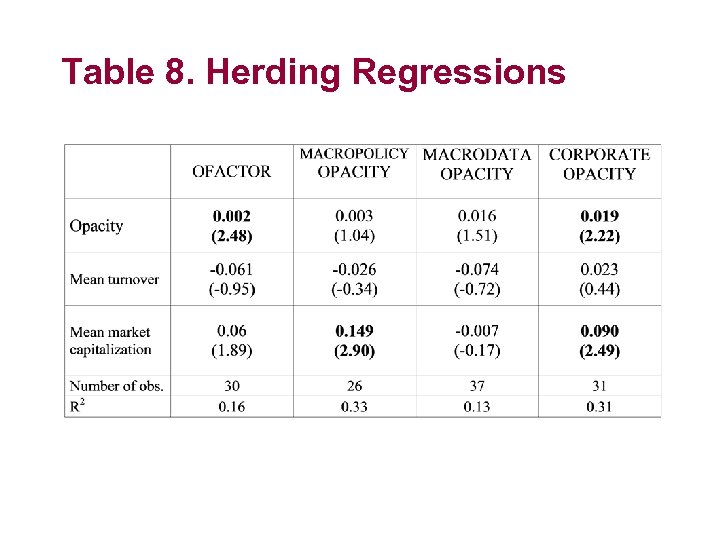

Table 8. Herding Regressions

Table 8. Herding Regressions

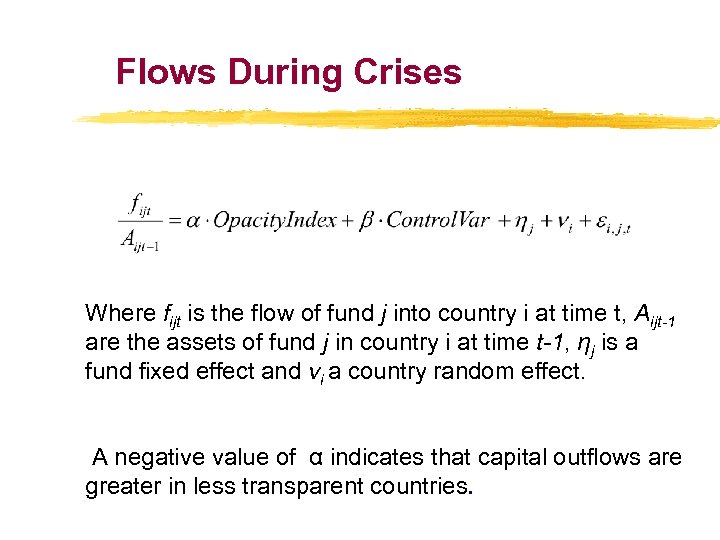

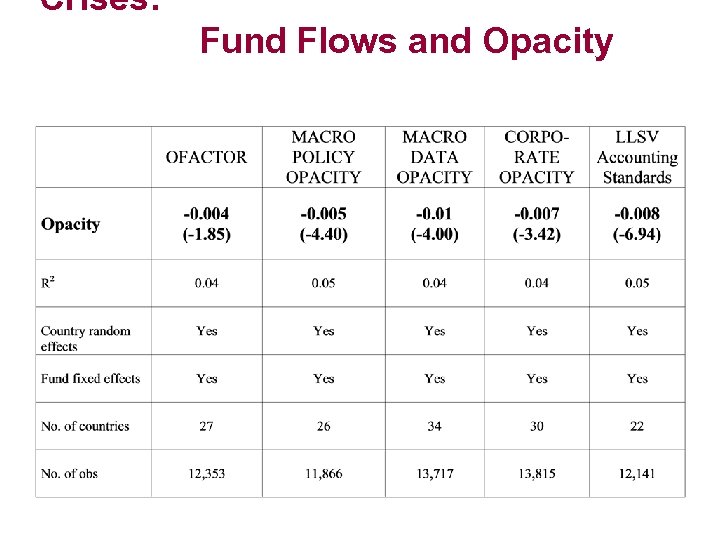

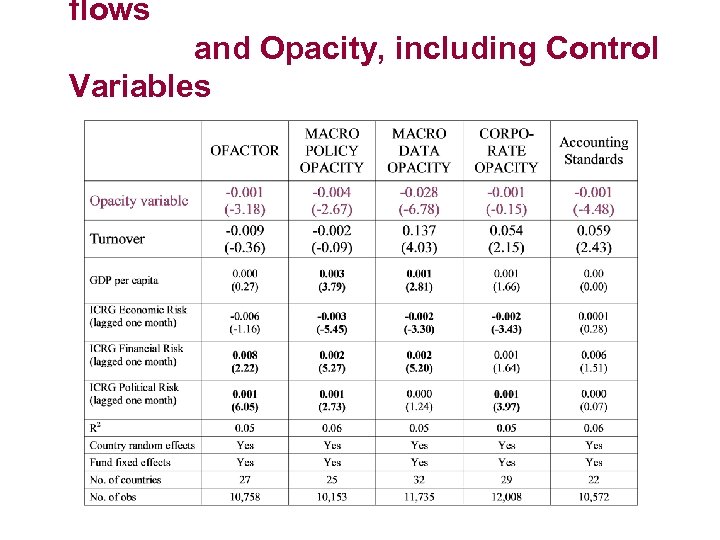

Flows During Crises Where fijt is the flow of fund j into country i at time t, Aijt-1 are the assets of fund j in country i at time t-1, ηj is a fund fixed effect and νi a country random effect. A negative value of α indicates that capital outflows are greater in less transparent countries.

Flows During Crises Where fijt is the flow of fund j into country i at time t, Aijt-1 are the assets of fund j in country i at time t-1, ηj is a fund fixed effect and νi a country random effect. A negative value of α indicates that capital outflows are greater in less transparent countries.

Crises: Fund Flows and Opacity

Crises: Fund Flows and Opacity

flows and Opacity, including Control Variables

flows and Opacity, including Control Variables

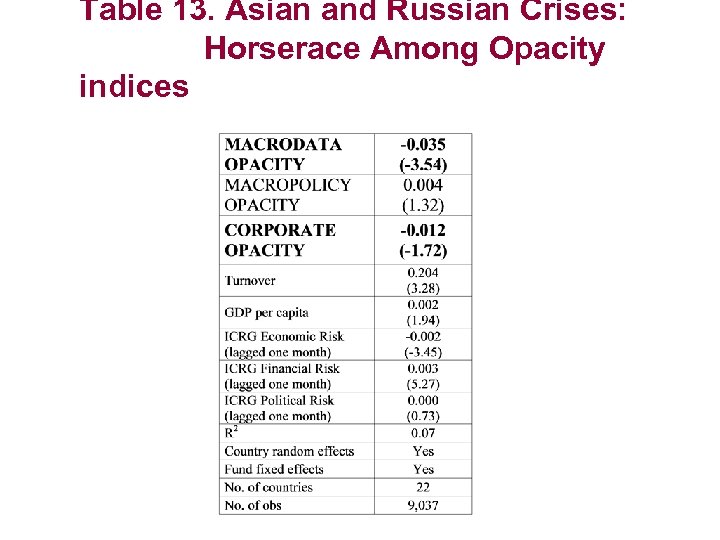

Table 13. Asian and Russian Crises: Horserace Among Opacity indices

Table 13. Asian and Russian Crises: Horserace Among Opacity indices

Conclusions z 1. Strong evidence that international funds invest less in opaque countries. z 2. Moderate evidence that herding intensity by funds is related to opacity in countries. z 3. Moderate evidence that capital exodus during a crisis is bigger in less transparent countries.

Conclusions z 1. Strong evidence that international funds invest less in opaque countries. z 2. Moderate evidence that herding intensity by funds is related to opacity in countries. z 3. Moderate evidence that capital exodus during a crisis is bigger in less transparent countries.

“What is your opinion on the connection between transparency and investment? z. Africa: Investment? z. Eastern Europe: Opinion? z. Russia: Transparency? z. President Clinton: Is?

“What is your opinion on the connection between transparency and investment? z. Africa: Investment? z. Eastern Europe: Opinion? z. Russia: Transparency? z. President Clinton: Is?