f3a5ddcfb8597bc6b3aa5fe1ce0c8f2d.ppt

- Количество слайдов: 71

Translation of Foreign Currency Financial Statements

Translation of Foreign Currency Financial Statements

TRANSLATION OF FOREIGN CURRENCY FINANCIAL STATEMENTS Conceptual issues of foreign currency financial statements translation. Balance sheet vs. transaction exposure. Methods of financial statement translation. Temporal and current rate methods illustrated. U. S. GAAP, IFRSs, and other standards related to translation. Hedging balance sheet exposure.

TRANSLATION OF FOREIGN CURRENCY FINANCIAL STATEMENTS Conceptual issues of foreign currency financial statements translation. Balance sheet vs. transaction exposure. Methods of financial statement translation. Temporal and current rate methods illustrated. U. S. GAAP, IFRSs, and other standards related to translation. Hedging balance sheet exposure.

TRANSLATING FOREIGN CURRENCY FINANCIAL STATEMENTS -- CONCEPTUAL ISSUES Foreign country operations of a MNC usually prepare financial statements using local currency as the monetary unit. These operations also typically use local GAAP. When these operations are consolidated by the MNC, the foreign operation’s financial statements must be translated into the currency and GAAP of the MNC.

TRANSLATING FOREIGN CURRENCY FINANCIAL STATEMENTS -- CONCEPTUAL ISSUES Foreign country operations of a MNC usually prepare financial statements using local currency as the monetary unit. These operations also typically use local GAAP. When these operations are consolidated by the MNC, the foreign operation’s financial statements must be translated into the currency and GAAP of the MNC.

TRANSLATING FOREIGN CURRENCY FINANCIAL STATEMENTS -- CONCEPTUAL ISSUES Primary conceptual issues Each financial statement item must be translated using some, hopefully relevant, exchange rate. What rate should be used? the current exchange rate? The average exchange rate? the historical exchange rate? Given that any adjustment is, at the point of translation, unrealized, how should the resulting adjustment be recognized? in current income? in an equity account on the balance sheet?

TRANSLATING FOREIGN CURRENCY FINANCIAL STATEMENTS -- CONCEPTUAL ISSUES Primary conceptual issues Each financial statement item must be translated using some, hopefully relevant, exchange rate. What rate should be used? the current exchange rate? The average exchange rate? the historical exchange rate? Given that any adjustment is, at the point of translation, unrealized, how should the resulting adjustment be recognized? in current income? in an equity account on the balance sheet?

BALANCE SHEET EXPOSURE Assets and liabilities translated at the current exchange rate are exposed to risk of a translation adjustment. When foreign currency appreciates, a net asset exposure results in a positive translation adjustment. When foreign currency appreciates, a net liability exposure results in a negative translation adjustment. Assets and liabilities translated at the historical exchange rate are not exposed to a translation adjustment.

BALANCE SHEET EXPOSURE Assets and liabilities translated at the current exchange rate are exposed to risk of a translation adjustment. When foreign currency appreciates, a net asset exposure results in a positive translation adjustment. When foreign currency appreciates, a net liability exposure results in a negative translation adjustment. Assets and liabilities translated at the historical exchange rate are not exposed to a translation adjustment.

A SIMPLE EXAMPLE Let’s say XYZ has a 1000 euro current note receivable on its books. The euro/$ direct rate is $ 1 on 1/1. On 12/31, it is $. 9091. Should we record: No change? An decrease in value of $90. 90? And if we do report a change, where should the offsetting gain be reported?

A SIMPLE EXAMPLE Let’s say XYZ has a 1000 euro current note receivable on its books. The euro/$ direct rate is $ 1 on 1/1. On 12/31, it is $. 9091. Should we record: No change? An decrease in value of $90. 90? And if we do report a change, where should the offsetting gain be reported?

ANOTHER SIMPLE EXAMPLE: Let’s say XYZ has land on its books that is held by a subsidiary located in the EU. The land was purchased on 1/1 for 1, 000 euros when the euro/$ direct rate was $ 1. On 12/31, it is $. 9091. Should we record: No change? An decrease in value of $90, 900? And if we do report a change, where should the offsetting gain be reported?

ANOTHER SIMPLE EXAMPLE: Let’s say XYZ has land on its books that is held by a subsidiary located in the EU. The land was purchased on 1/1 for 1, 000 euros when the euro/$ direct rate was $ 1. On 12/31, it is $. 9091. Should we record: No change? An decrease in value of $90, 900? And if we do report a change, where should the offsetting gain be reported?

THE QUESTION: How do we account for these effects? The matter is complex because the economic impact will vary depending on what type of asset is held and what is driving FX movements. There is also an interaction with accounting imperfections and constraints.

THE QUESTION: How do we account for these effects? The matter is complex because the economic impact will vary depending on what type of asset is held and what is driving FX movements. There is also an interaction with accounting imperfections and constraints.

THE CURRENT RATE METHOD: The receivable would be translated using the current rate. The land would be translated at the current rate.

THE CURRENT RATE METHOD: The receivable would be translated using the current rate. The land would be translated at the current rate.

TRANSLATION METHODS Current Rate Method Presumes that the parent’s entire investment in a foreign subsidiary is exposed to exchange risk. All assets and liabilities are translated at the current exchange rate. Stockholders’ equity accounts are translated at historical exchange rates. Income statement items are translated at the exchange rate in effect at the time of the transaction.

TRANSLATION METHODS Current Rate Method Presumes that the parent’s entire investment in a foreign subsidiary is exposed to exchange risk. All assets and liabilities are translated at the current exchange rate. Stockholders’ equity accounts are translated at historical exchange rates. Income statement items are translated at the exchange rate in effect at the time of the transaction.

CURRENT RATE METHOD Advantages Simple to do Ratios are not distorted

CURRENT RATE METHOD Advantages Simple to do Ratios are not distorted

BUT WHAT IF: Inflation differences caused the decline in the value of the euro? If the inflation differential was 10%, then: Before, 1, 000 E=1, 000$ Now, 1, 100, 000 E=1, 000$; Thus the direct exchange rate would be. 9091 (1, 000/1, 100, 000). Thus the current value of the land, in euros, is now 1, 100, 000 E. The valuation should be 1100000*. 9091 = 1, 000$, i. e. , no change.

BUT WHAT IF: Inflation differences caused the decline in the value of the euro? If the inflation differential was 10%, then: Before, 1, 000 E=1, 000$ Now, 1, 100, 000 E=1, 000$; Thus the direct exchange rate would be. 9091 (1, 000/1, 100, 000). Thus the current value of the land, in euros, is now 1, 100, 000 E. The valuation should be 1100000*. 9091 = 1, 000$, i. e. , no change.

THE CURRENT RATE METHOD Disadvantages Can produce disparate results that are not consistent with the economics that are really going on. What does the FC adjustment mean? Possibility of disappearing assets in inflationary economies.

THE CURRENT RATE METHOD Disadvantages Can produce disparate results that are not consistent with the economics that are really going on. What does the FC adjustment mean? Possibility of disappearing assets in inflationary economies.

THE PROBLEM: The receivable is a monetary asset. The land is a non-monetary asset.

THE PROBLEM: The receivable is a monetary asset. The land is a non-monetary asset.

TRANSLATION METHODS Monetary/Nonmonetary Method Monetary assets and liabilities are translated at the current exchange rate. Nonmonetary assets and liabilities and stockholders’ equity accounts are translated at historical exchange rates. The translation adjustment measures the net foreign exchange gain or loss on current assets and liabilities as if these items were carried on the parent’s books.

TRANSLATION METHODS Monetary/Nonmonetary Method Monetary assets and liabilities are translated at the current exchange rate. Nonmonetary assets and liabilities and stockholders’ equity accounts are translated at historical exchange rates. The translation adjustment measures the net foreign exchange gain or loss on current assets and liabilities as if these items were carried on the parent’s books.

IN OUR EXAMPLE: The receivable would be translated using the current rate. The land would be translated at the historical rate.

IN OUR EXAMPLE: The receivable would be translated using the current rate. The land would be translated at the historical rate.

MONETARY/NON-MONETARY Advantages Easy to understand. Makes intuitive sense. Usually not difficult to classify assets and liabilities.

MONETARY/NON-MONETARY Advantages Easy to understand. Makes intuitive sense. Usually not difficult to classify assets and liabilities.

BUT WHAT IF: A monetary asset/liability is booked at historical cost (e. g. long term bonds) A nonmonetary asset/liability is booked at current cost (e. g. , revalued property, plant and equipment)

BUT WHAT IF: A monetary asset/liability is booked at historical cost (e. g. long term bonds) A nonmonetary asset/liability is booked at current cost (e. g. , revalued property, plant and equipment)

MONETARY/NON-MONETARY METHOD Disadvantages Valuation basis in accounting doesn’t always line up right with classification, producing potentially meaningless values. Thus some assets can disappear in the presence of inflation while others are over or under-reported.

MONETARY/NON-MONETARY METHOD Disadvantages Valuation basis in accounting doesn’t always line up right with classification, producing potentially meaningless values. Thus some assets can disappear in the presence of inflation while others are over or under-reported.

TRANSLATION METHODS Current/Noncurrent Method Current assets and liabilities are translated at the current exchange rate. Noncurrent assets and liabilities and stockholders’ equity accounts are translated at historical exchange rates.

TRANSLATION METHODS Current/Noncurrent Method Current assets and liabilities are translated at the current exchange rate. Noncurrent assets and liabilities and stockholders’ equity accounts are translated at historical exchange rates.

IN OUR EXAMPLE: The receivable would be classified as current and translated using the current rate. The land would be classified as noncurrent and translated at the historical rate.

IN OUR EXAMPLE: The receivable would be classified as current and translated using the current rate. The land would be classified as noncurrent and translated at the historical rate.

CURENT/NONCURRENT Advantages? Simplistic. Requires no more characterization of assets/liabilities than is already provided by the financial statements Seems to solve the monetary/non-monetary problem while remaining more consistent with underlying accounting basis being used.

CURENT/NONCURRENT Advantages? Simplistic. Requires no more characterization of assets/liabilities than is already provided by the financial statements Seems to solve the monetary/non-monetary problem while remaining more consistent with underlying accounting basis being used.

CURRENT/NON-CURRENT METHOD Disadvantages Can still misspecify monetary assets/liabilities. Example: inventories, noncurrent marketable equity securities. Does not explicitly address the accounting problem. For example, some current assets use historical cost basis. Some noncurrent assets are booked at current value. Thus some assets can still disappear in the presence of severe inflation. Others can be severely over or undervalued.

CURRENT/NON-CURRENT METHOD Disadvantages Can still misspecify monetary assets/liabilities. Example: inventories, noncurrent marketable equity securities. Does not explicitly address the accounting problem. For example, some current assets use historical cost basis. Some noncurrent assets are booked at current value. Thus some assets can still disappear in the presence of severe inflation. Others can be severely over or undervalued.

TRANSLATION METHODS Temporal Method Objective is to translate financial statements as if the subsidiary had been using the parent’s currency. Items carried on subsidiary’s books at historical cost, including all stockholders’ equity items are translated at historical exchange rates. Items carried on subsidiary’s books at current value are translated at current exchange rates. Income statement items are translated at the exchange rate in effect at the time of the transaction.

TRANSLATION METHODS Temporal Method Objective is to translate financial statements as if the subsidiary had been using the parent’s currency. Items carried on subsidiary’s books at historical cost, including all stockholders’ equity items are translated at historical exchange rates. Items carried on subsidiary’s books at current value are translated at current exchange rates. Income statement items are translated at the exchange rate in effect at the time of the transaction.

IN OUR EXAMPLE: The receivable translated using the current rate. If reported at historical cost, the land would be translated at the historical rate. If reported at fair value, the land would be translated at the current rate.

IN OUR EXAMPLE: The receivable translated using the current rate. If reported at historical cost, the land would be translated at the historical rate. If reported at fair value, the land would be translated at the current rate.

TEMPORAL METHOD Advantages Lines up with valuation basis used in accounting. Thus the numbers have most consistent internal meaning. They will still be misspecified, however, but only to the extent the underlying accounting numbers already are.

TEMPORAL METHOD Advantages Lines up with valuation basis used in accounting. Thus the numbers have most consistent internal meaning. They will still be misspecified, however, but only to the extent the underlying accounting numbers already are.

TEMPORAL METHOD Disadvantages Lots of volatility in financial statements. Mixing of valuations: does the sum make any sense?

TEMPORAL METHOD Disadvantages Lots of volatility in financial statements. Mixing of valuations: does the sum make any sense?

For our purposes, because they are both called for in current accounting standards on FX translation, we will focus on: Current rate method Temporal Method

For our purposes, because they are both called for in current accounting standards on FX translation, we will focus on: Current rate method Temporal Method

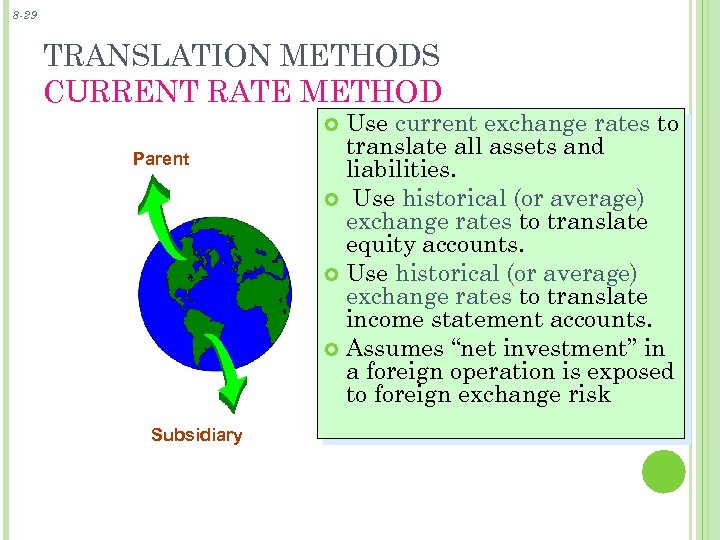

8 -29 TRANSLATION METHODS CURRENT RATE METHOD Use current exchange rates to translate all assets and liabilities. Use historical (or average) exchange rates to translate equity accounts. Use historical (or average) exchange rates to translate income statement accounts. Assumes “net investment” in a foreign operation is exposed to foreign exchange risk Parent Subsidiary

8 -29 TRANSLATION METHODS CURRENT RATE METHOD Use current exchange rates to translate all assets and liabilities. Use historical (or average) exchange rates to translate equity accounts. Use historical (or average) exchange rates to translate income statement accounts. Assumes “net investment” in a foreign operation is exposed to foreign exchange risk Parent Subsidiary

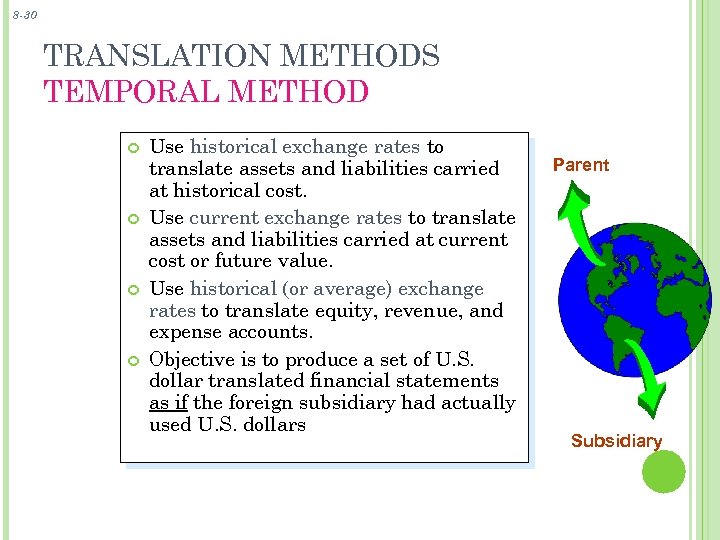

8 -30 TRANSLATION METHODS TEMPORAL METHOD Use historical exchange rates to translate assets and liabilities carried at historical cost. Use current exchange rates to translate assets and liabilities carried at current cost or future value. Use historical (or average) exchange rates to translate equity, revenue, and expense accounts. Objective is to produce a set of U. S. dollar translated financial statements as if the foreign subsidiary had actually used U. S. dollars Parent Subsidiary

8 -30 TRANSLATION METHODS TEMPORAL METHOD Use historical exchange rates to translate assets and liabilities carried at historical cost. Use current exchange rates to translate assets and liabilities carried at current cost or future value. Use historical (or average) exchange rates to translate equity, revenue, and expense accounts. Objective is to produce a set of U. S. dollar translated financial statements as if the foreign subsidiary had actually used U. S. dollars Parent Subsidiary

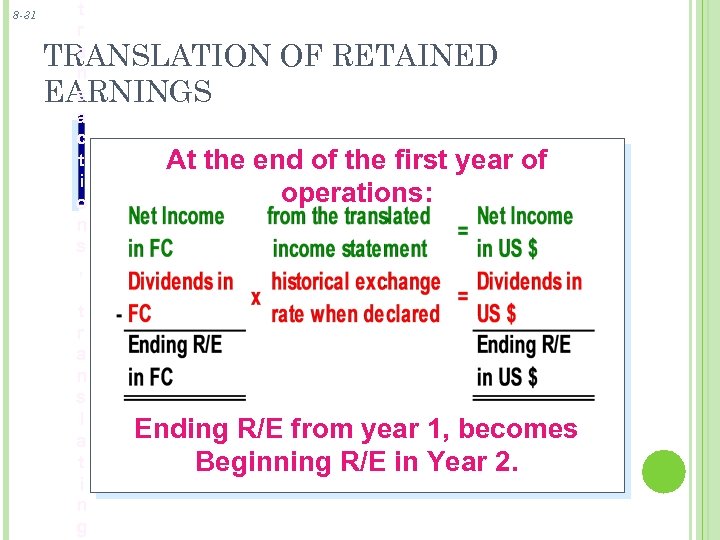

8 -31 t r a n s a c t i o n s , TRANSLATION OF RETAINED EARNINGS t r a n s l a t i n g At the end of the first year of operations: Ending R/E from year 1, becomes Beginning R/E in Year 2.

8 -31 t r a n s a c t i o n s , TRANSLATION OF RETAINED EARNINGS t r a n s l a t i n g At the end of the first year of operations: Ending R/E from year 1, becomes Beginning R/E in Year 2.

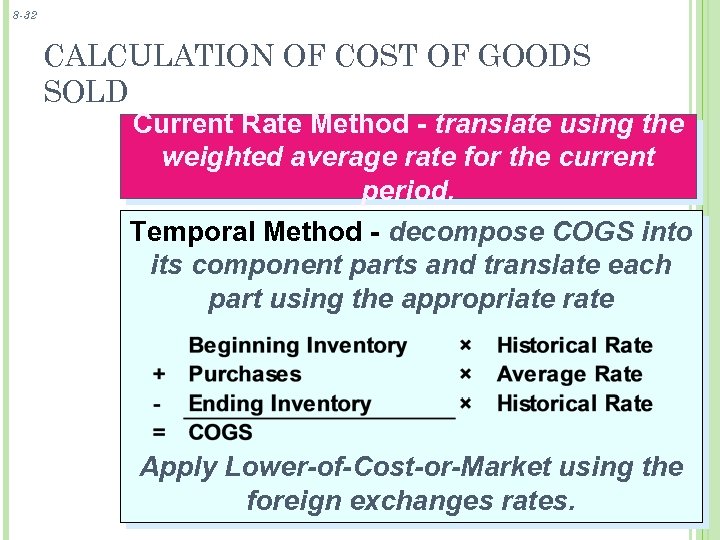

8 -32 CALCULATION OF COST OF GOODS SOLD Current Rate Method - translate using the weighted average rate for the current period. Temporal Method - decompose COGS into its component parts and translate each part using the appropriate rate Apply Lower-of-Cost-or-Market using the foreign exchanges rates.

8 -32 CALCULATION OF COST OF GOODS SOLD Current Rate Method - translate using the weighted average rate for the current period. Temporal Method - decompose COGS into its component parts and translate each part using the appropriate rate Apply Lower-of-Cost-or-Market using the foreign exchanges rates.

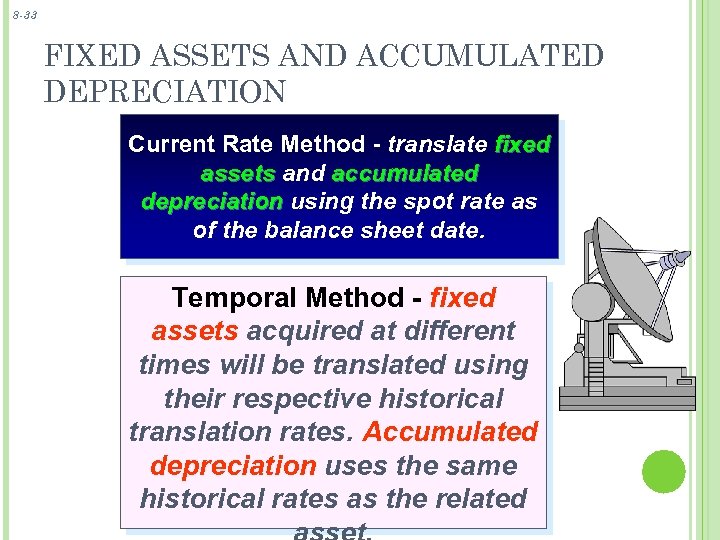

8 -33 FIXED ASSETS AND ACCUMULATED DEPRECIATION Current Rate Method - translate fixed assets and accumulated depreciation using the spot rate as of the balance sheet date. Temporal Method - fixed assets acquired at different times will be translated using their respective historical translation rates. Accumulated depreciation uses the same historical rates as the related

8 -33 FIXED ASSETS AND ACCUMULATED DEPRECIATION Current Rate Method - translate fixed assets and accumulated depreciation using the spot rate as of the balance sheet date. Temporal Method - fixed assets acquired at different times will be translated using their respective historical translation rates. Accumulated depreciation uses the same historical rates as the related

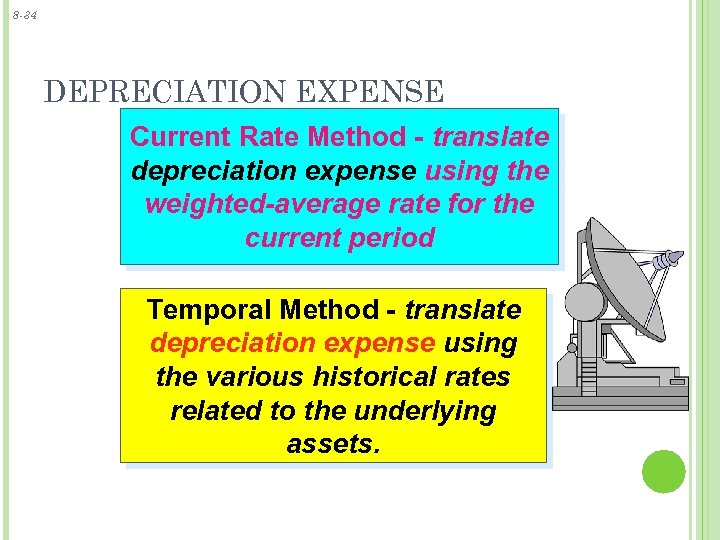

8 -34 DEPRECIATION EXPENSE Current Rate Method - translate depreciation expense using the weighted-average rate for the current period Temporal Method - translate depreciation expense using the various historical rates related to the underlying assets.

8 -34 DEPRECIATION EXPENSE Current Rate Method - translate depreciation expense using the weighted-average rate for the current period Temporal Method - translate depreciation expense using the various historical rates related to the underlying assets.

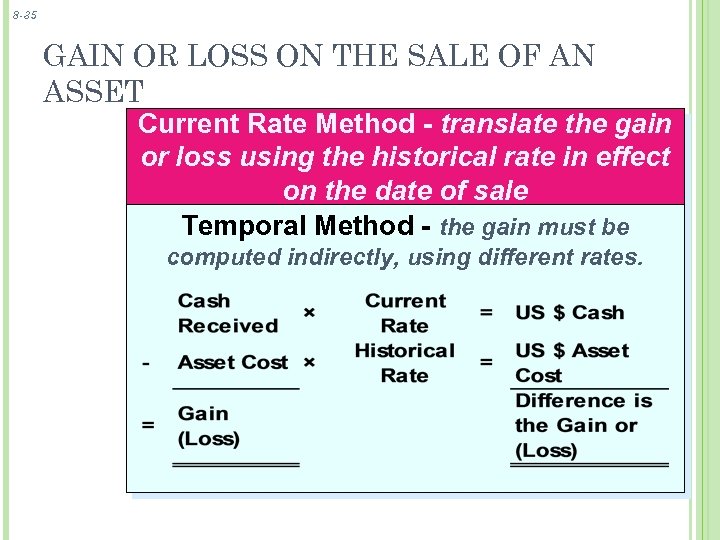

8 -35 GAIN OR LOSS ON THE SALE OF AN ASSET Current Rate Method - translate the gain or loss using the historical rate in effect on the date of sale Temporal Method - the gain must be computed indirectly, using different rates.

8 -35 GAIN OR LOSS ON THE SALE OF AN ASSET Current Rate Method - translate the gain or loss using the historical rate in effect on the date of sale Temporal Method - the gain must be computed indirectly, using different rates.

8 -36 DISPOSITION OF TRANSLATION ADJUSTMENT Current Method Translation Adjustment is reported on the Balance Sheet. Temporal Method Adjustment is reported on the Income Statement as a Translation Gain or (Loss)

8 -36 DISPOSITION OF TRANSLATION ADJUSTMENT Current Method Translation Adjustment is reported on the Balance Sheet. Temporal Method Adjustment is reported on the Income Statement as a Translation Gain or (Loss)

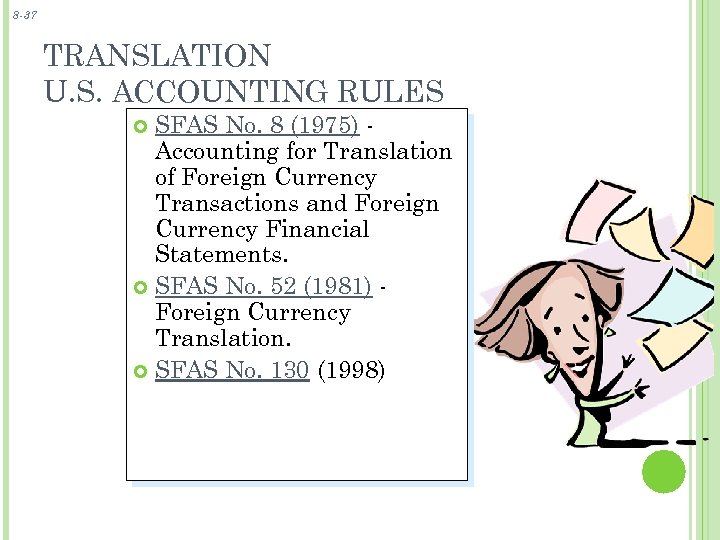

8 -37 TRANSLATION U. S. ACCOUNTING RULES SFAS No. 8 (1975) Accounting for Translation of Foreign Currency Transactions and Foreign Currency Financial Statements. SFAS No. 52 (1981) Foreign Currency Translation. SFAS No. 130 (1998)

8 -37 TRANSLATION U. S. ACCOUNTING RULES SFAS No. 8 (1975) Accounting for Translation of Foreign Currency Transactions and Foreign Currency Financial Statements. SFAS No. 52 (1981) Foreign Currency Translation. SFAS No. 130 (1998)

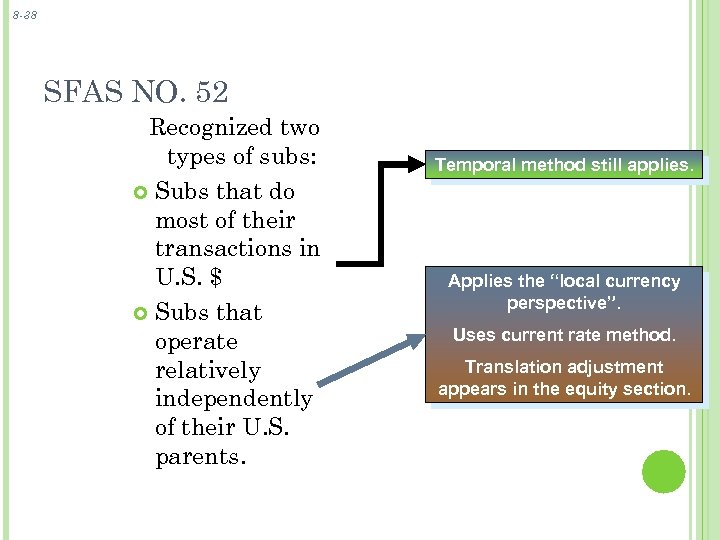

8 -38 SFAS NO. 52 Recognized two types of subs: Subs that do most of their transactions in U. S. $ Subs that operate relatively independently of their U. S. parents. Temporal method still applies. Applies the “local currency perspective”. Uses current rate method. Translation adjustment appears in the equity section.

8 -38 SFAS NO. 52 Recognized two types of subs: Subs that do most of their transactions in U. S. $ Subs that operate relatively independently of their U. S. parents. Temporal method still applies. Applies the “local currency perspective”. Uses current rate method. Translation adjustment appears in the equity section.

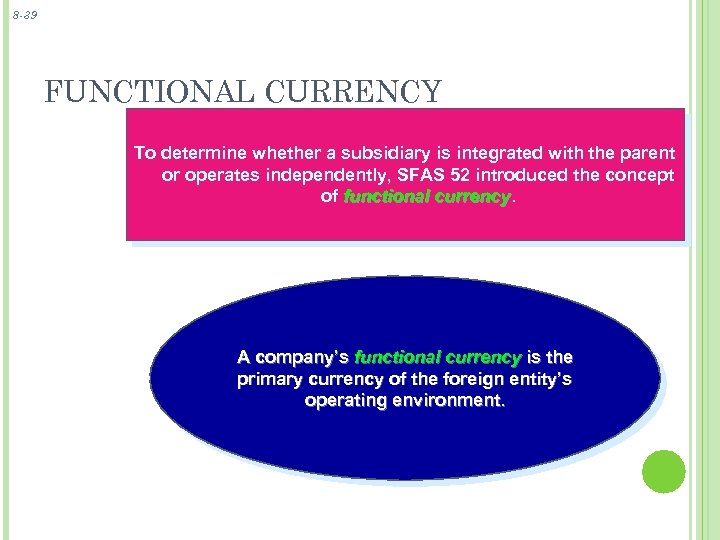

8 -39 FUNCTIONAL CURRENCY To determine whether a subsidiary is integrated with the parent or operates independently, SFAS 52 introduced the concept of functional currency A company’s functional currency is the primary currency of the foreign entity’s operating environment.

8 -39 FUNCTIONAL CURRENCY To determine whether a subsidiary is integrated with the parent or operates independently, SFAS 52 introduced the concept of functional currency A company’s functional currency is the primary currency of the foreign entity’s operating environment.

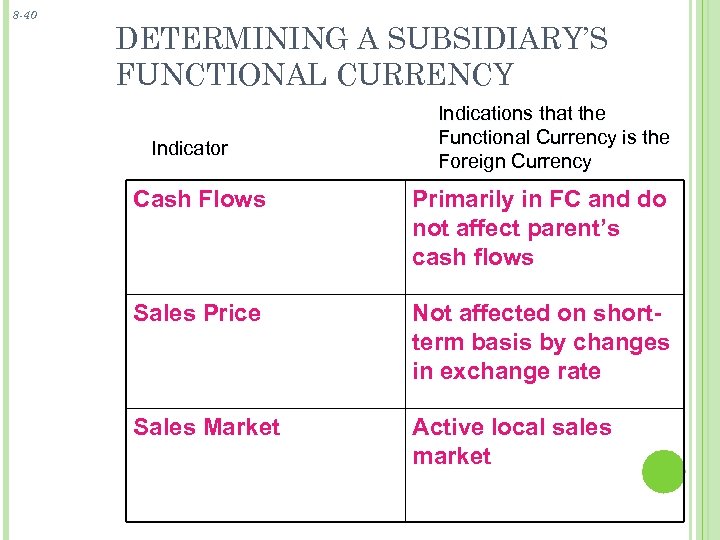

8 -40 DETERMINING A SUBSIDIARY’S FUNCTIONAL CURRENCY Indicator Indications that the Functional Currency is the Foreign Currency Cash Flows Primarily in FC and do not affect parent’s cash flows Sales Price Not affected on shortterm basis by changes in exchange rate Sales Market Active local sales market

8 -40 DETERMINING A SUBSIDIARY’S FUNCTIONAL CURRENCY Indicator Indications that the Functional Currency is the Foreign Currency Cash Flows Primarily in FC and do not affect parent’s cash flows Sales Price Not affected on shortterm basis by changes in exchange rate Sales Market Active local sales market

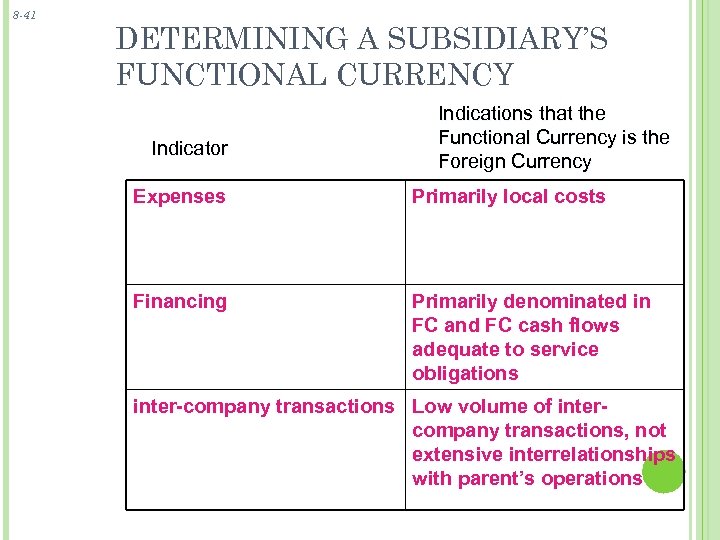

8 -41 DETERMINING A SUBSIDIARY’S FUNCTIONAL CURRENCY Indicator Indications that the Functional Currency is the Foreign Currency Expenses Primarily local costs Financing Primarily denominated in FC and FC cash flows adequate to service obligations inter-company transactions Low volume of intercompany transactions, not extensive interrelationships with parent’s operations

8 -41 DETERMINING A SUBSIDIARY’S FUNCTIONAL CURRENCY Indicator Indications that the Functional Currency is the Foreign Currency Expenses Primarily local costs Financing Primarily denominated in FC and FC cash flows adequate to service obligations inter-company transactions Low volume of intercompany transactions, not extensive interrelationships with parent’s operations

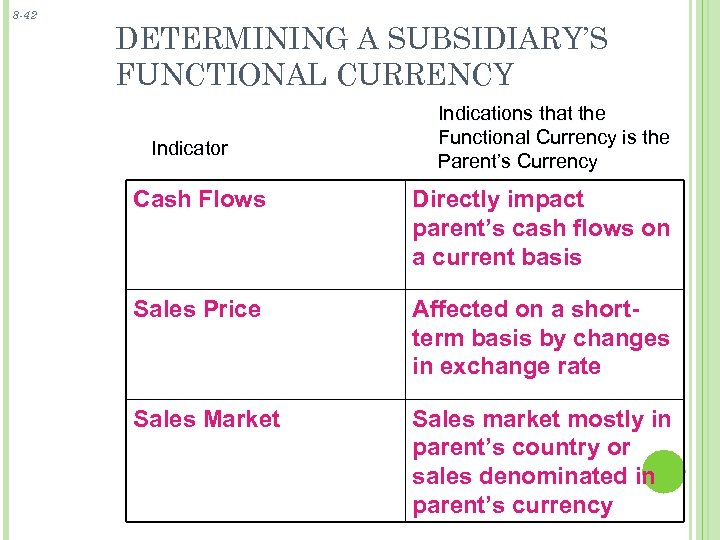

8 -42 DETERMINING A SUBSIDIARY’S FUNCTIONAL CURRENCY Indicator Indications that the Functional Currency is the Parent’s Currency Cash Flows Directly impact parent’s cash flows on a current basis Sales Price Affected on a shortterm basis by changes in exchange rate Sales Market Sales market mostly in parent’s country or sales denominated in parent’s currency

8 -42 DETERMINING A SUBSIDIARY’S FUNCTIONAL CURRENCY Indicator Indications that the Functional Currency is the Parent’s Currency Cash Flows Directly impact parent’s cash flows on a current basis Sales Price Affected on a shortterm basis by changes in exchange rate Sales Market Sales market mostly in parent’s country or sales denominated in parent’s currency

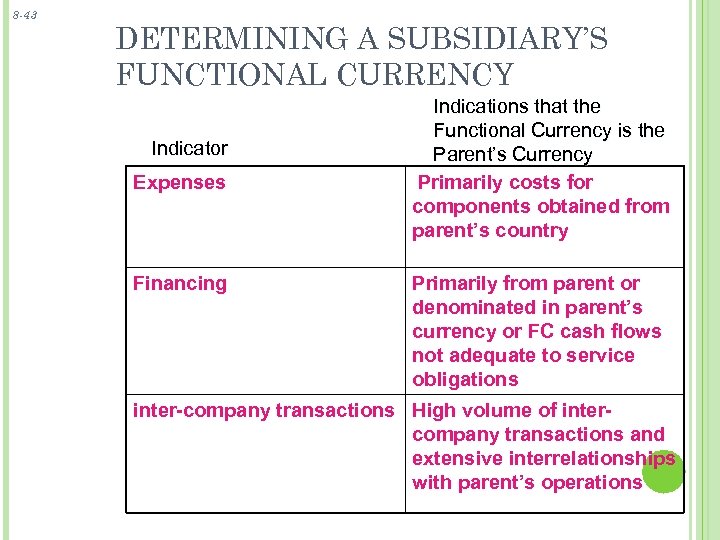

8 -43 DETERMINING A SUBSIDIARY’S FUNCTIONAL CURRENCY Indicator Expenses Financing Indications that the Functional Currency is the Parent’s Currency Primarily costs for components obtained from parent’s country Primarily from parent or denominated in parent’s currency or FC cash flows not adequate to service obligations inter-company transactions High volume of intercompany transactions and extensive interrelationships with parent’s operations

8 -43 DETERMINING A SUBSIDIARY’S FUNCTIONAL CURRENCY Indicator Expenses Financing Indications that the Functional Currency is the Parent’s Currency Primarily costs for components obtained from parent’s country Primarily from parent or denominated in parent’s currency or FC cash flows not adequate to service obligations inter-company transactions High volume of intercompany transactions and extensive interrelationships with parent’s operations

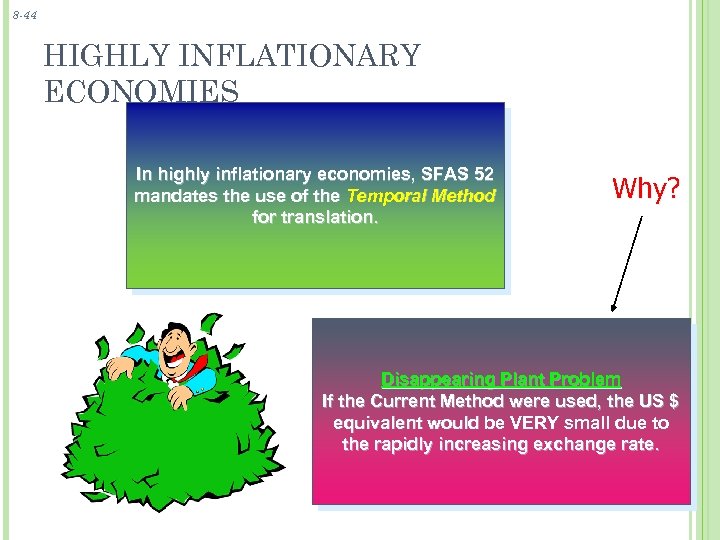

8 -44 HIGHLY INFLATIONARY ECONOMIES In highly inflationary economies, SFAS 52 mandates the use of the Temporal Method for translation. Why? Disappearing Plant Problem If the Current Method were used, the US $ equivalent would be VERY small due to the rapidly increasing exchange rate.

8 -44 HIGHLY INFLATIONARY ECONOMIES In highly inflationary economies, SFAS 52 mandates the use of the Temporal Method for translation. Why? Disappearing Plant Problem If the Current Method were used, the US $ equivalent would be VERY small due to the rapidly increasing exchange rate.

8 -45 DEFINING “HIGHLY INFLATIONARY ECONOMY” Remember, SFAS 52 mandates use of the temporal method, with re-measurement gains or losses reported in income!!! A “highly inflationary economy” is one having a cumulative three-year inflation exceeding 100% (With compounding, this is about 26% inflation per year for three straight years)

8 -45 DEFINING “HIGHLY INFLATIONARY ECONOMY” Remember, SFAS 52 mandates use of the temporal method, with re-measurement gains or losses reported in income!!! A “highly inflationary economy” is one having a cumulative three-year inflation exceeding 100% (With compounding, this is about 26% inflation per year for three straight years)

8 -46 CURRENT RATE METHOD EXAMPLE Duzy Co. , is a wholly owned foreign sub of Maly Corporation. Duzy Co. ’s transactions and financial statements are denominated in the local (functional) currency, the Pater (PT). Using the following information, translate their statements into US $.

8 -46 CURRENT RATE METHOD EXAMPLE Duzy Co. , is a wholly owned foreign sub of Maly Corporation. Duzy Co. ’s transactions and financial statements are denominated in the local (functional) currency, the Pater (PT). Using the following information, translate their statements into US $.

8 -47 CURRENT RATE METHOD EXAMPLE Duzy Co. ’s common stock was issued in 1992 when the exchange rate was $1. 00 = 1. 20 PT. Fixed assets were acquired in 1993 when the exchange rate was $1. 00 = 1. 10 PT. As of Jan. 1, 2008, the R/E balance was translated at $350, 000. Inventory was acquired evenly throughout the year.

8 -47 CURRENT RATE METHOD EXAMPLE Duzy Co. ’s common stock was issued in 1992 when the exchange rate was $1. 00 = 1. 20 PT. Fixed assets were acquired in 1993 when the exchange rate was $1. 00 = 1. 10 PT. As of Jan. 1, 2008, the R/E balance was translated at $350, 000. Inventory was acquired evenly throughout the year.

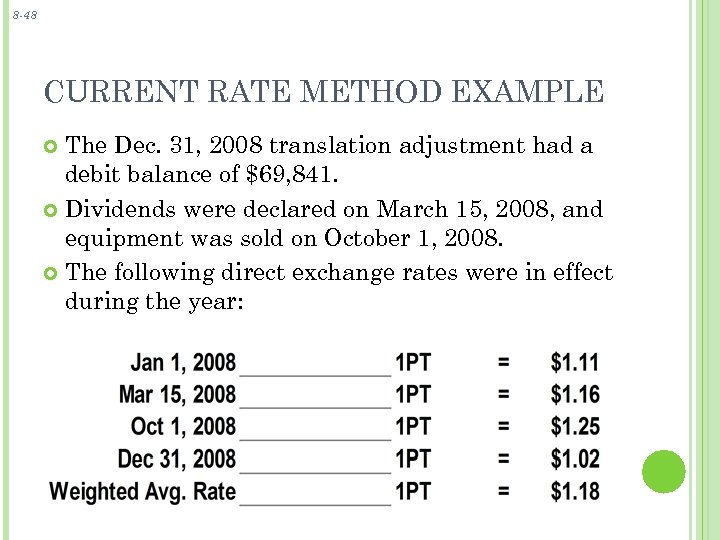

8 -48 CURRENT RATE METHOD EXAMPLE The Dec. 31, 2008 translation adjustment had a debit balance of $69, 841. Dividends were declared on March 15, 2008, and equipment was sold on October 1, 2008. The following direct exchange rates were in effect during the year:

8 -48 CURRENT RATE METHOD EXAMPLE The Dec. 31, 2008 translation adjustment had a debit balance of $69, 841. Dividends were declared on March 15, 2008, and equipment was sold on October 1, 2008. The following direct exchange rates were in effect during the year:

Note: The following example uses a division process and indirect rates. This may seem to differ from what is described in your text. But there is no real difference. For example, if translation of $ 1, 000 PT is made using the Oct 1 st direct rate of $ 1. 25, the same translation can be made using the indirect rate, which is the inverse, i. e. , 1 $ =. 80 PT. To use the direct rate, one multiplies the # of PT by 1. 25; 1. 25 x 1000 = $ 1, 250. To use the indirect rate, one divides the # of PT by the indirect rate, . 80; 1000/. 80 = $ 1, 250.

Note: The following example uses a division process and indirect rates. This may seem to differ from what is described in your text. But there is no real difference. For example, if translation of $ 1, 000 PT is made using the Oct 1 st direct rate of $ 1. 25, the same translation can be made using the indirect rate, which is the inverse, i. e. , 1 $ =. 80 PT. To use the direct rate, one multiplies the # of PT by 1. 25; 1. 25 x 1000 = $ 1, 250. To use the indirect rate, one divides the # of PT by the indirect rate, . 80; 1000/. 80 = $ 1, 250.

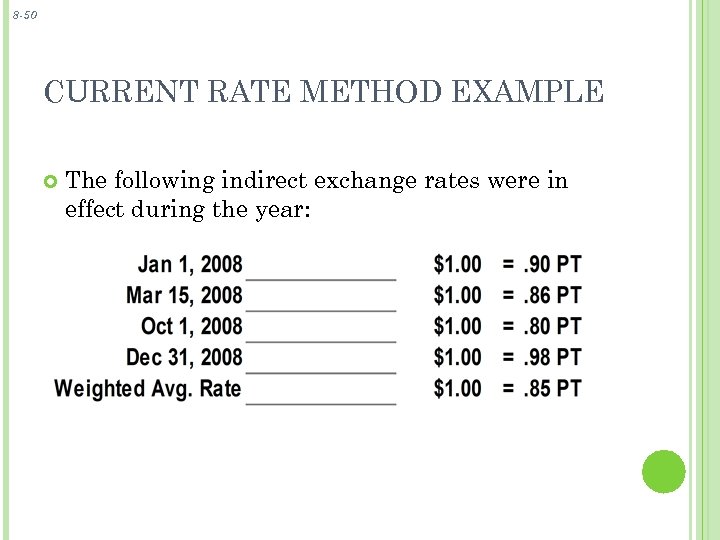

8 -50 CURRENT RATE METHOD EXAMPLE The following indirect exchange rates were in effect during the year:

8 -50 CURRENT RATE METHOD EXAMPLE The following indirect exchange rates were in effect during the year:

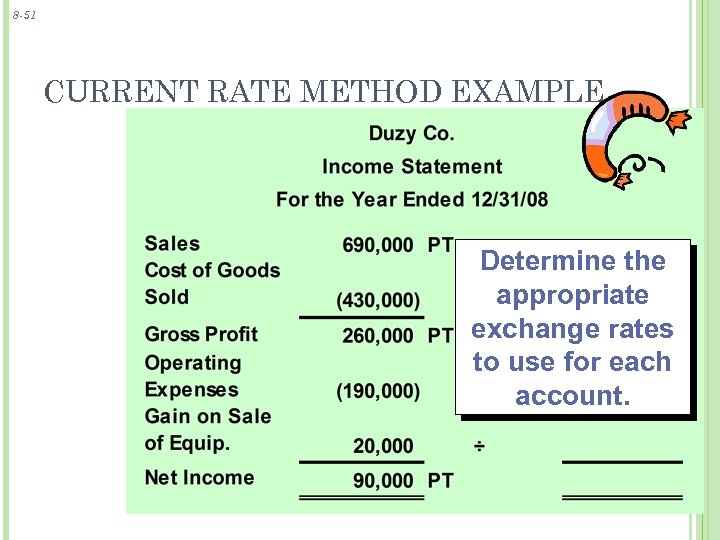

8 -51 CURRENT RATE METHOD EXAMPLE Determine the appropriate exchange rates to use for each account.

8 -51 CURRENT RATE METHOD EXAMPLE Determine the appropriate exchange rates to use for each account.

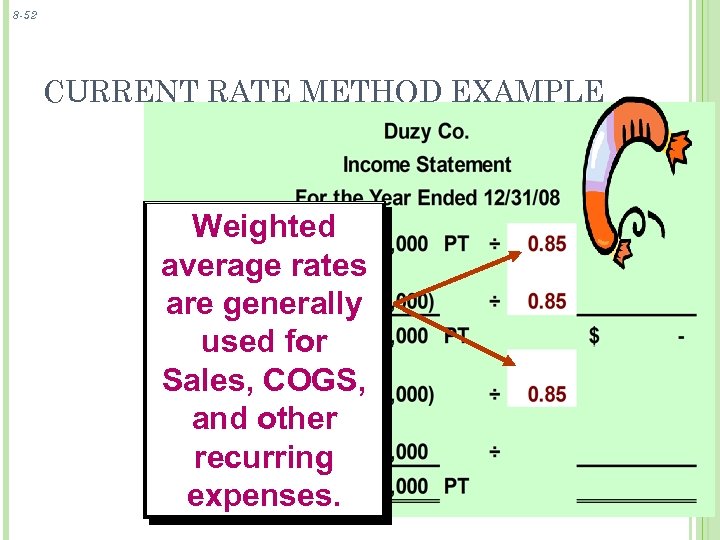

8 -52 CURRENT RATE METHOD EXAMPLE Weighted average rates are generally used for Sales, COGS, and other recurring expenses.

8 -52 CURRENT RATE METHOD EXAMPLE Weighted average rates are generally used for Sales, COGS, and other recurring expenses.

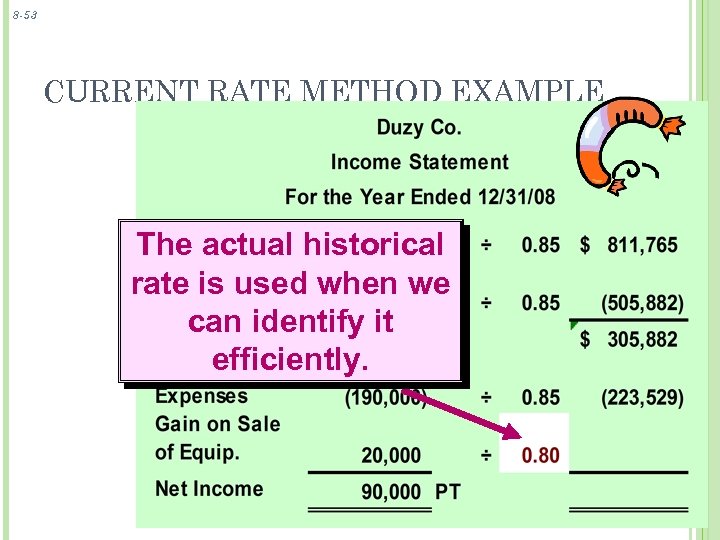

8 -53 CURRENT RATE METHOD EXAMPLE The actual historical rate is used when we can identify it efficiently.

8 -53 CURRENT RATE METHOD EXAMPLE The actual historical rate is used when we can identify it efficiently.

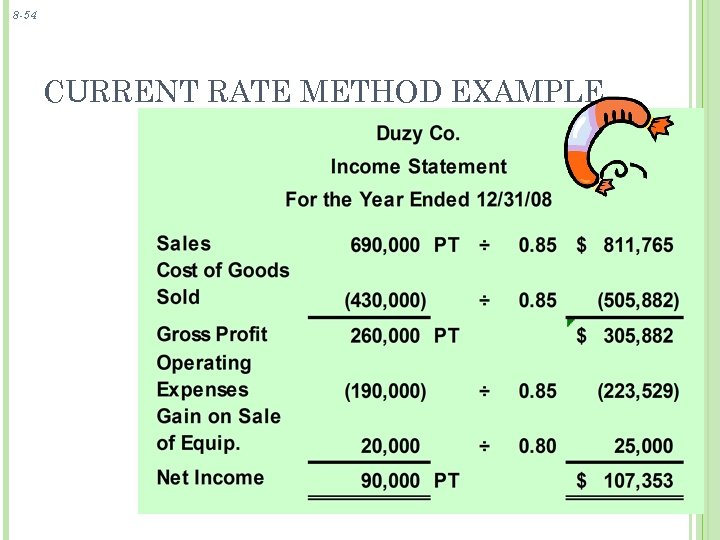

8 -54 CURRENT RATE METHOD EXAMPLE

8 -54 CURRENT RATE METHOD EXAMPLE

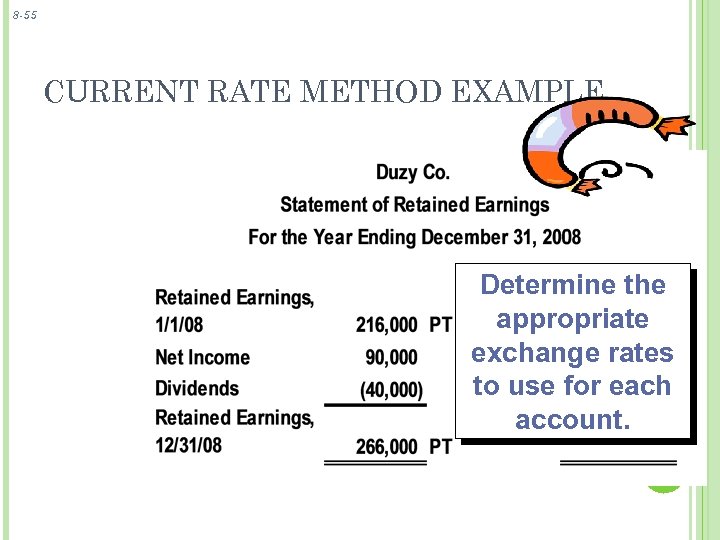

8 -55 CURRENT RATE METHOD EXAMPLE Determine the appropriate exchange rates to use for each account.

8 -55 CURRENT RATE METHOD EXAMPLE Determine the appropriate exchange rates to use for each account.

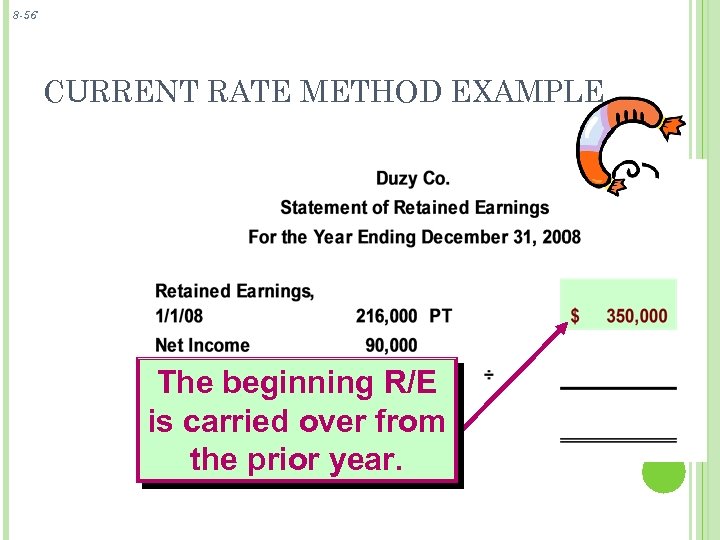

8 -56 CURRENT RATE METHOD EXAMPLE The beginning R/E is carried over from the prior year.

8 -56 CURRENT RATE METHOD EXAMPLE The beginning R/E is carried over from the prior year.

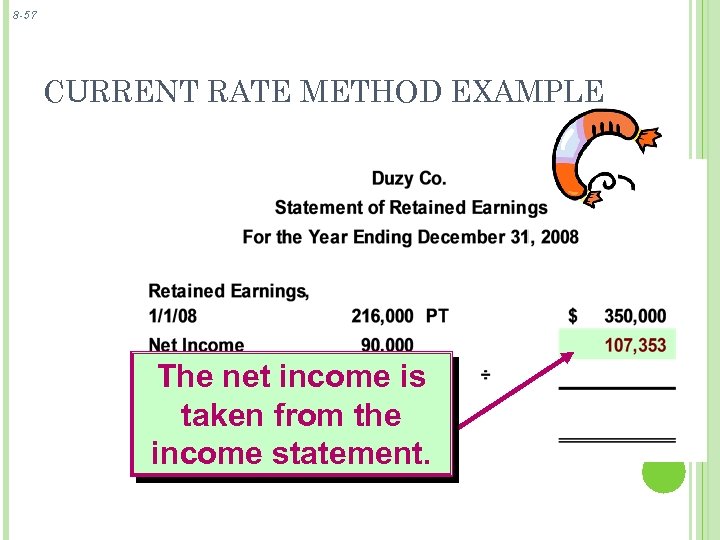

8 -57 CURRENT RATE METHOD EXAMPLE The net income is taken from the income statement.

8 -57 CURRENT RATE METHOD EXAMPLE The net income is taken from the income statement.

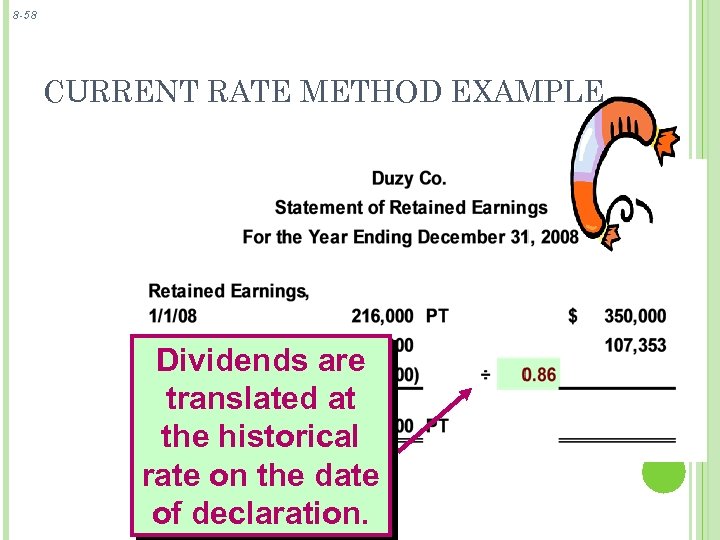

8 -58 CURRENT RATE METHOD EXAMPLE Dividends are translated at the historical rate on the date of declaration.

8 -58 CURRENT RATE METHOD EXAMPLE Dividends are translated at the historical rate on the date of declaration.

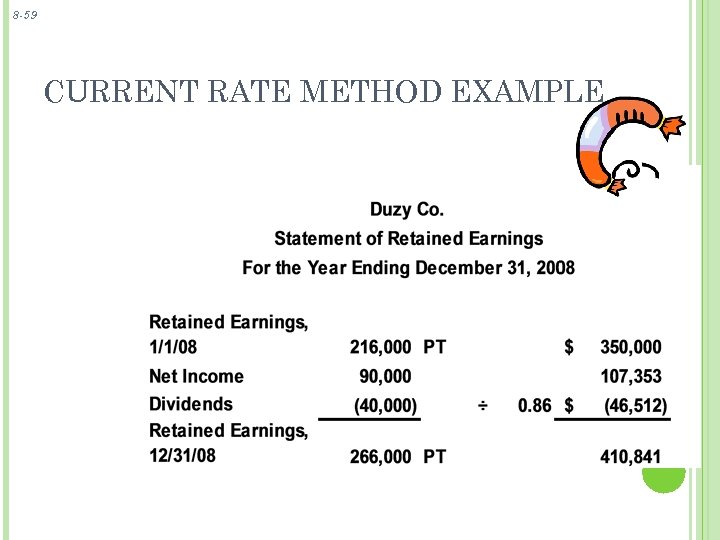

8 -59 CURRENT RATE METHOD EXAMPLE

8 -59 CURRENT RATE METHOD EXAMPLE

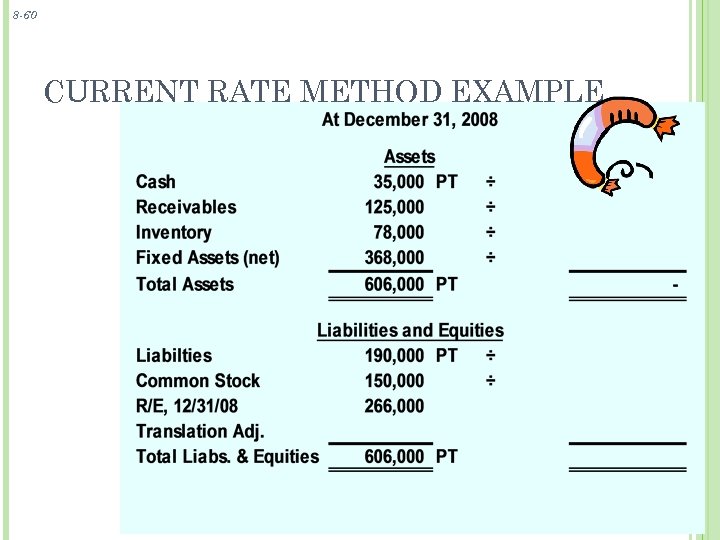

8 -60 CURRENT RATE METHOD EXAMPLE

8 -60 CURRENT RATE METHOD EXAMPLE

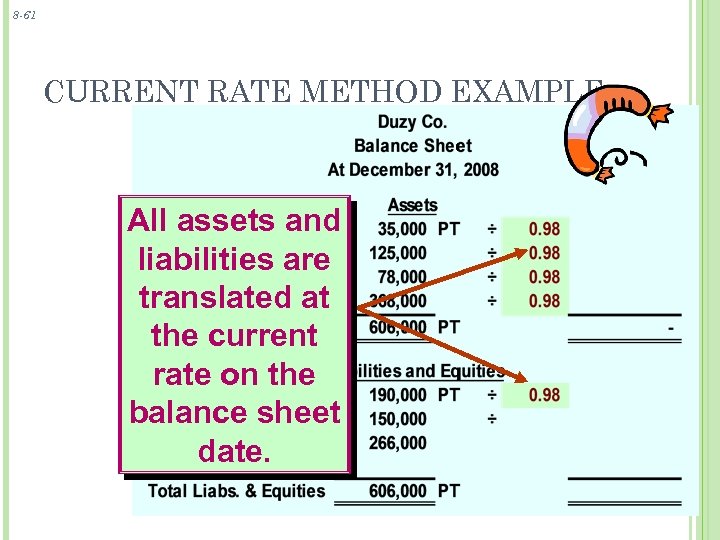

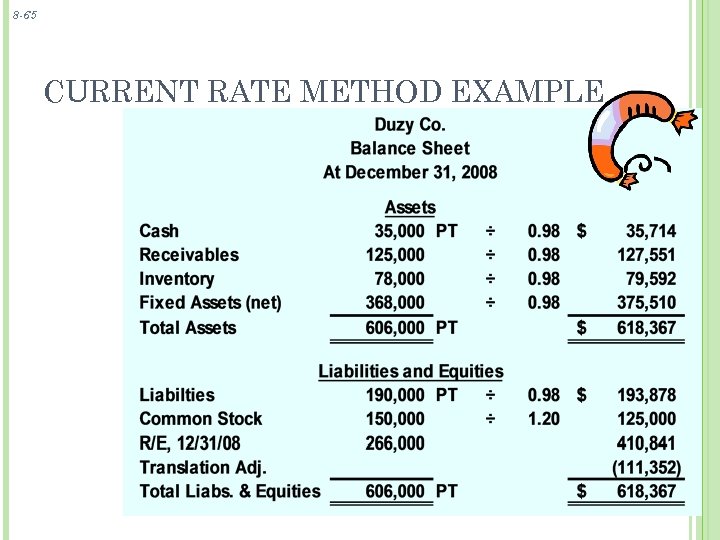

8 -61 CURRENT RATE METHOD EXAMPLE All assets and liabilities are translated at the current rate on the balance sheet date.

8 -61 CURRENT RATE METHOD EXAMPLE All assets and liabilities are translated at the current rate on the balance sheet date.

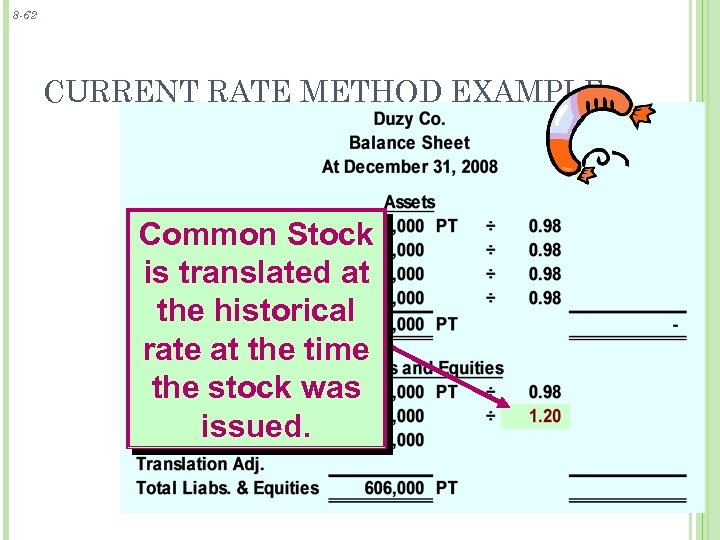

8 -62 CURRENT RATE METHOD EXAMPLE Common Stock is translated at the historical rate at the time the stock was issued.

8 -62 CURRENT RATE METHOD EXAMPLE Common Stock is translated at the historical rate at the time the stock was issued.

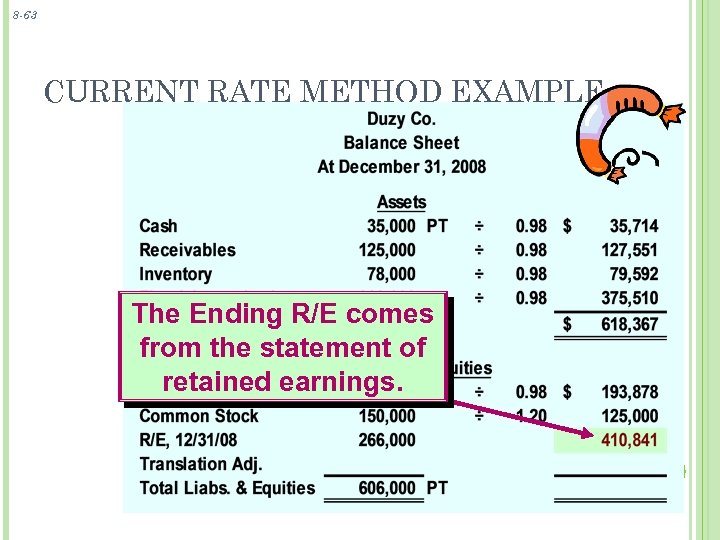

8 -63 CURRENT RATE METHOD EXAMPLE The Ending R/E comes from the statement of retained earnings.

8 -63 CURRENT RATE METHOD EXAMPLE The Ending R/E comes from the statement of retained earnings.

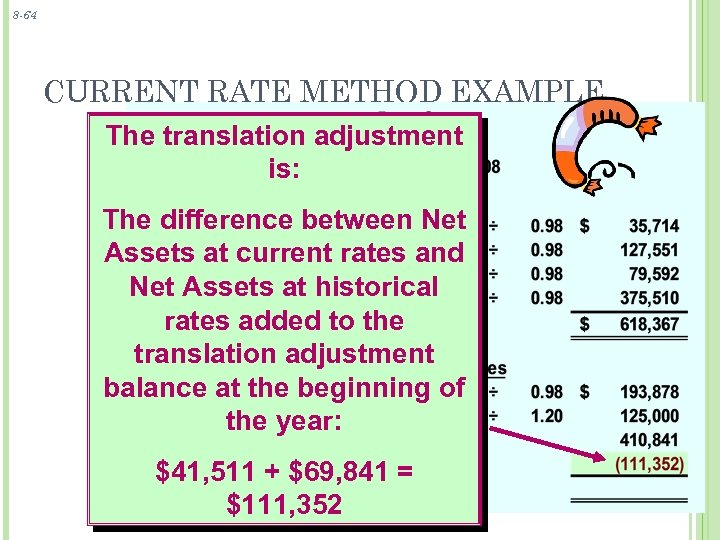

8 -64 CURRENT RATE METHOD EXAMPLE The translation adjustment is: The difference between Net Assets at current rates and Net Assets at historical rates added to the translation adjustment balance at the beginning of the year: $41, 511 + $69, 841 = $111, 352

8 -64 CURRENT RATE METHOD EXAMPLE The translation adjustment is: The difference between Net Assets at current rates and Net Assets at historical rates added to the translation adjustment balance at the beginning of the year: $41, 511 + $69, 841 = $111, 352

8 -65 CURRENT RATE METHOD EXAMPLE

8 -65 CURRENT RATE METHOD EXAMPLE

8 -66 RE-MEASUREMENT OF FINANCIAL STATEMENTS If the sub’s functional currency is the U. S. $, then any balances denominated in the local currency, must be re-measured. re-measurement requires the application of the temporal method. The re-measurement gain or loss appears on the income statement.

8 -66 RE-MEASUREMENT OF FINANCIAL STATEMENTS If the sub’s functional currency is the U. S. $, then any balances denominated in the local currency, must be re-measured. re-measurement requires the application of the temporal method. The re-measurement gain or loss appears on the income statement.

8 -67 NONLOCAL CURRENCY BALANCES If any accounts of the foreign subsidiary are denominated in a currency other than the local currency (or the US$), they would first have to be restated into the local currency Both the foreign currency balance and any related foreign exchange gain or loss would then be translated (or re-measured) into US$

8 -67 NONLOCAL CURRENCY BALANCES If any accounts of the foreign subsidiary are denominated in a currency other than the local currency (or the US$), they would first have to be restated into the local currency Both the foreign currency balance and any related foreign exchange gain or loss would then be translated (or re-measured) into US$

8 -68 HEDGING BALANCE SHEET EXPOSURE Translation adjustments and re-measurement gains or losses arise from: (1)Exchange rate changes and (2)Balance sheet exposure can be hedged, either through derivatives such as forward contracts or foreign currency options or through the use of such non-derivative instruments as foreign currency borrowings Ironically, in seeking to avoid unrealized translation adjustments, realized foreign exchange gains and losses can occur!

8 -68 HEDGING BALANCE SHEET EXPOSURE Translation adjustments and re-measurement gains or losses arise from: (1)Exchange rate changes and (2)Balance sheet exposure can be hedged, either through derivatives such as forward contracts or foreign currency options or through the use of such non-derivative instruments as foreign currency borrowings Ironically, in seeking to avoid unrealized translation adjustments, realized foreign exchange gains and losses can occur!

8 -69 SUMMARY Because many US firms have significant financial investments in foreign countries, the translation of foreign currency financial statements is an important accounting challenge The two primary methods used are the temporal and current rate methods SFAS 52 established translation through the use of the current rate method when the foreign operation’s functional currency is a foreign currency re-measurement through the temporal method is appropriate when the operation’s functional currency is the US$, or in the case of a highly inflationary economy

8 -69 SUMMARY Because many US firms have significant financial investments in foreign countries, the translation of foreign currency financial statements is an important accounting challenge The two primary methods used are the temporal and current rate methods SFAS 52 established translation through the use of the current rate method when the foreign operation’s functional currency is a foreign currency re-measurement through the temporal method is appropriate when the operation’s functional currency is the US$, or in the case of a highly inflationary economy

8 -70 POSSIBLE CRITICISMS Some critics contend that the functional currency decision can be quite subjective. Others argue that having two fundamentally different approaches to translation creates confusion. Reporting unrealized gains and losses as an element of the balance sheet is controversial. WHAT DO YOU THINK? ?

8 -70 POSSIBLE CRITICISMS Some critics contend that the functional currency decision can be quite subjective. Others argue that having two fundamentally different approaches to translation creates confusion. Reporting unrealized gains and losses as an element of the balance sheet is controversial. WHAT DO YOU THINK? ?

Thus we see a myriad of measurement problems arise when the value of money changes and is uncertain. The economic impact of FX changes vary as a function of the cause of the change and the type of exposure (asset/liability; monetary/non-monetary). Accounting limitations (e. g. , historical cost) mix with this uncertainty. The current standard is SFAS 52. This could easily change at any time, as it has several times before.

Thus we see a myriad of measurement problems arise when the value of money changes and is uncertain. The economic impact of FX changes vary as a function of the cause of the change and the type of exposure (asset/liability; monetary/non-monetary). Accounting limitations (e. g. , historical cost) mix with this uncertainty. The current standard is SFAS 52. This could easily change at any time, as it has several times before.