Шокавая терп.pptx

- Количество слайдов: 24

TRANSITION TO MARKET ECONOMY.

TRANSITION TO MARKET ECONOMY.

The transitional period is the period of time when the country passes from one historical step of development to another. This time during which national economy passes in new, qualitatively other condition in connection with cardinal reforms of economic system. Transition period - a necessary and natural stage in evolution of economic systems. This situation was stated for the first time by K. Marx in "Criticism of the Gothic program": "Between capitalist and communistic society, K. Marx wrote, - the period of revolutionary transformation of the first in the second lies. To this period there corresponds also a political transition period, and the state of this period can't be anything other, except as revolutionary dictatorship of the proletariat""

The transitional period is the period of time when the country passes from one historical step of development to another. This time during which national economy passes in new, qualitatively other condition in connection with cardinal reforms of economic system. Transition period - a necessary and natural stage in evolution of economic systems. This situation was stated for the first time by K. Marx in "Criticism of the Gothic program": "Between capitalist and communistic society, K. Marx wrote, - the period of revolutionary transformation of the first in the second lies. To this period there corresponds also a political transition period, and the state of this period can't be anything other, except as revolutionary dictatorship of the proletariat""

The beginning of a transition period is change of a political system in the country. In Russia it happened in 1991 as a result of disintegration of the USSR, self-dissolution of the Supreme Council of the USSR and the compelled refusal of the power of President M. S. Gorbachev. In Hungary noncommunistic forces came to the power in 1989 as a result of peace parliamentary elections. In Poland, Czechoslovakia, Bulgaria change of a political system in 1989 -1990 gg. it was accompanied by demonstrations and strikes, but generally carried, as well as in Hungary, peace character.

The beginning of a transition period is change of a political system in the country. In Russia it happened in 1991 as a result of disintegration of the USSR, self-dissolution of the Supreme Council of the USSR and the compelled refusal of the power of President M. S. Gorbachev. In Hungary noncommunistic forces came to the power in 1989 as a result of peace parliamentary elections. In Poland, Czechoslovakia, Bulgaria change of a political system in 1989 -1990 gg. it was accompanied by demonstrations and strikes, but generally carried, as well as in Hungary, peace character.

By what criteria it is possible to judge end of a transition period? First, this emergence of integral system of market institutes, completion of market reforms: privatizations, market reform of the enterprises, structural reform, reform of public finances, tax reform, social and agrarian reforms. Secondly, beginning of steady economic recovery. Thirdly, integration into world economy. Fourthly, formation of big and strong middle class.

By what criteria it is possible to judge end of a transition period? First, this emergence of integral system of market institutes, completion of market reforms: privatizations, market reform of the enterprises, structural reform, reform of public finances, tax reform, social and agrarian reforms. Secondly, beginning of steady economic recovery. Thirdly, integration into world economy. Fourthly, formation of big and strong middle class.

the maintenance of a transitional economy is expressed in its regularities. These are the following regularities. 1) Change of a role of the state. It is the main regularity of a transitional economy. 2) The second regularity - economy stabilization. Stabilization of economy is a prevention, braking of economic recession, fixing and maintenance of indicators of functioning of economy at a certain level, economy improvement. 3) Privatization is a sale of state ownership in a private property of physical and legal entities. 4) Transformational recession. The term "transformational recession" was entered into Y. Kornay's transitional economy. He noted that upon transition from a planned economy to market the economy endures the deep crisis caused by a transition, transformational state of economic system. 5) Integration into the world economy. to define, corresponding to its scales and potential, a place in the world economy.

the maintenance of a transitional economy is expressed in its regularities. These are the following regularities. 1) Change of a role of the state. It is the main regularity of a transitional economy. 2) The second regularity - economy stabilization. Stabilization of economy is a prevention, braking of economic recession, fixing and maintenance of indicators of functioning of economy at a certain level, economy improvement. 3) Privatization is a sale of state ownership in a private property of physical and legal entities. 4) Transformational recession. The term "transformational recession" was entered into Y. Kornay's transitional economy. He noted that upon transition from a planned economy to market the economy endures the deep crisis caused by a transition, transformational state of economic system. 5) Integration into the world economy. to define, corresponding to its scales and potential, a place in the world economy.

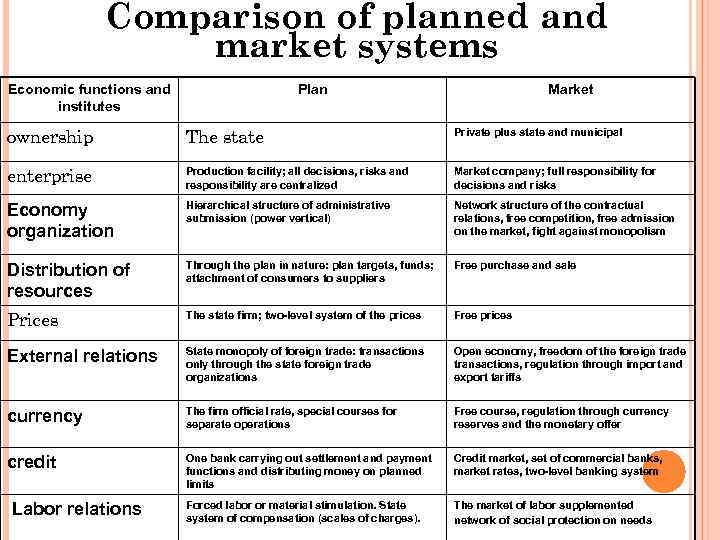

Comparison of planned and market systems Economic functions and institutes Plan Market ownership The state Private plus state and municipal enterprise Production facility; all decisions, risks and responsibility are centralized Market company; full responsibility for decisions and risks Economy organization Hierarchical structure of administrative submission (power vertical) Network structure of the contractual relations, free competition, free admission on the market, fight against monopolism Distribution of resources Through the plan in nature: plan targets, funds; attachment of consumers to suppliers Free purchase and sale Prices The state firm; two-level system of the prices Free prices External relations State monopoly of foreign trade: transactions only through the state foreign trade organizations Open economy, freedom of the foreign trade transactions, regulation through import and export tariffs currency The firm official rate, special courses for separate operations Free course, regulation through currency reserves and the monetary offer credit One bank carrying out settlement and payment functions and distributing money on planned limits Credit market, set of commercial banks, market rates, two-level banking system Forced labor or material stimulation. State system of compensation (scales of charges). The market of labor supplemented network of social protection on needs Labor relations

Comparison of planned and market systems Economic functions and institutes Plan Market ownership The state Private plus state and municipal enterprise Production facility; all decisions, risks and responsibility are centralized Market company; full responsibility for decisions and risks Economy organization Hierarchical structure of administrative submission (power vertical) Network structure of the contractual relations, free competition, free admission on the market, fight against monopolism Distribution of resources Through the plan in nature: plan targets, funds; attachment of consumers to suppliers Free purchase and sale Prices The state firm; two-level system of the prices Free prices External relations State monopoly of foreign trade: transactions only through the state foreign trade organizations Open economy, freedom of the foreign trade transactions, regulation through import and export tariffs currency The firm official rate, special courses for separate operations Free course, regulation through currency reserves and the monetary offer credit One bank carrying out settlement and payment functions and distributing money on planned limits Credit market, set of commercial banks, market rates, two-level banking system Forced labor or material stimulation. State system of compensation (scales of charges). The market of labor supplemented network of social protection on needs Labor relations

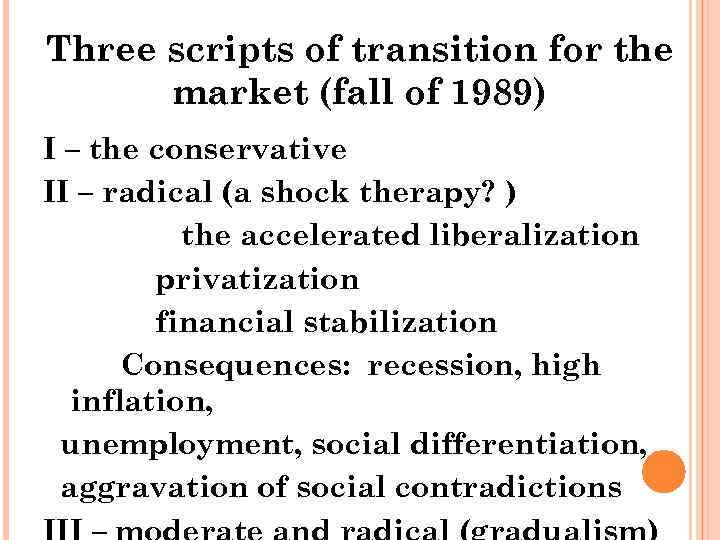

Three scripts of transition for the market (fall of 1989) I – the conservative II – radical (a shock therapy? ) the accelerated liberalization privatization financial stabilization Consequences: recession, high inflation, unemployment, social differentiation, aggravation of social contradictions 7

Three scripts of transition for the market (fall of 1989) I – the conservative II – radical (a shock therapy? ) the accelerated liberalization privatization financial stabilization Consequences: recession, high inflation, unemployment, social differentiation, aggravation of social contradictions 7

Each country is unique and peculiar. Nevertheless, in theory and in practice of carrying out market reforms it is possible to allocate two concepts expressing opposite approaches to carrying out reforms. One of them is called "gradualism", and the second received the "shock therapy" name.

Each country is unique and peculiar. Nevertheless, in theory and in practice of carrying out market reforms it is possible to allocate two concepts expressing opposite approaches to carrying out reforms. One of them is called "gradualism", and the second received the "shock therapy" name.

market reforms began in China in 1978 possibilities of China for that time: • narrow concerning solvency domestic market; • low level of industrialization and infrastructure development; • rural, generally illiterate population • generally untrained labor, limited human capital, insignificant number of scientists, engineers and technicians; • unsuccessful functioning of a planned economy; • limited natural resources;

market reforms began in China in 1978 possibilities of China for that time: • narrow concerning solvency domestic market; • low level of industrialization and infrastructure development; • rural, generally illiterate population • generally untrained labor, limited human capital, insignificant number of scientists, engineers and technicians; • unsuccessful functioning of a planned economy; • limited natural resources;

Since 1985 rates of economic growth in China average 10, 3% a year stunning, highest indicator for any large country of the world. Thus the real wage and a standard of living increase, the middle class is formed. The current growth rates steadily keep at about 10%. China quickly turns into the leading industrial country with rather low rates of inflation. The considerable positive balance of trade balance is noted, there are the stocks of foreign currency making more than 100 billion dollars. As a result of carrying out tough monetary policy at high growth rates and low inflation China during carrying out transformations was successful in "soft landing".

Since 1985 rates of economic growth in China average 10, 3% a year stunning, highest indicator for any large country of the world. Thus the real wage and a standard of living increase, the middle class is formed. The current growth rates steadily keep at about 10%. China quickly turns into the leading industrial country with rather low rates of inflation. The considerable positive balance of trade balance is noted, there are the stocks of foreign currency making more than 100 billion dollars. As a result of carrying out tough monetary policy at high growth rates and low inflation China during carrying out transformations was successful in "soft landing".

China began with reform in agriculture, shattered large-scale collective farms into smaller, but more effective units and entered system of responsibility of households. Growth of productivity reached thanks to it had enormous consequences if to consider that the huge part of the population of the country (80%) lives in rural areas. Peasants grew rich, began to transform the agricultural system providing hitherto only living wage, to trade with the city and created huge, earlier being absent domestic market of consumer goods. It also led to mass movement of the population from the village to the city - to the largest resettlement in the history of mankind and to formation of huge potential of labor in the cities.

China began with reform in agriculture, shattered large-scale collective farms into smaller, but more effective units and entered system of responsibility of households. Growth of productivity reached thanks to it had enormous consequences if to consider that the huge part of the population of the country (80%) lives in rural areas. Peasants grew rich, began to transform the agricultural system providing hitherto only living wage, to trade with the city and created huge, earlier being absent domestic market of consumer goods. It also led to mass movement of the population from the village to the city - to the largest resettlement in the history of mankind and to formation of huge potential of labor in the cities.

China organized coastal free economic zones in the south of the country, in the Province of Guangdong, having created thereby conditions for achievement of the purposes in Hong Kong, created "the second Hong Kong" in Shenchzhen, and in the east of the country, in the Province of Fujian, provided access to Taiwan. These zones involved to themselves the industrial production focused on export that gave the chance to earn necessary foreign currency.

China organized coastal free economic zones in the south of the country, in the Province of Guangdong, having created thereby conditions for achievement of the purposes in Hong Kong, created "the second Hong Kong" in Shenchzhen, and in the east of the country, in the Province of Fujian, provided access to Taiwan. These zones involved to themselves the industrial production focused on export that gave the chance to earn necessary foreign currency.

China weakened the centralized control and concentrated attention on "new economy", instead of on squandering of poor resources during privatization "old", stimulated development of the new enterprises of national, provincial, settlement and rural levels. The local initiative was successful. Especially it belongs to the new private, settlement and rural enterprises which can use the boundless potential of labor from rural areas

China weakened the centralized control and concentrated attention on "new economy", instead of on squandering of poor resources during privatization "old", stimulated development of the new enterprises of national, provincial, settlement and rural levels. The local initiative was successful. Especially it belongs to the new private, settlement and rural enterprises which can use the boundless potential of labor from rural areas

Upon transition to market economy China also faces a number of problems: • corruption and bribery; • recurrence of agricultural production when because of poor harvests inflation amplifies; • inefficiency of the state enterprises - unprofitable and not having opportunity to repay the bank credits; • failures of the program of rigid economy entered since 1994 and credit restrictions; • difficulties with maintenance of increase in production and the income, possibility of return of the 20% inflation as it was in 1994 in connection with a crop failure when to agricultural producers it was assisted for building of agricultural production; • the problems connected with housing and social payments in rural areas and the cities for newcomers of citizens;

Upon transition to market economy China also faces a number of problems: • corruption and bribery; • recurrence of agricultural production when because of poor harvests inflation amplifies; • inefficiency of the state enterprises - unprofitable and not having opportunity to repay the bank credits; • failures of the program of rigid economy entered since 1994 and credit restrictions; • difficulties with maintenance of increase in production and the income, possibility of return of the 20% inflation as it was in 1994 in connection with a crop failure when to agricultural producers it was assisted for building of agricultural production; • the problems connected with housing and social payments in rural areas and the cities for newcomers of citizens;

In the fall of 1989 literally in 2– 3 months all communistic modes in Eastern Europe failed. The Berlin wall is destroyed, N. Ceausescu is executed. In Poland which lived 10 years in a situation of state of emergency and the conflict between the power and "Solidarity", all this time tried to pursue moderate and reformatory policy without any useful results. At last, in September, 1989 the communistic government of M Rakovsky went on full liberalization of the prices, having assumed responsibility for inflation jump, thereby having exempted future reformers from need to do the dirtiest work. In two months elections I won "Solidarity", and since January, 1990 the government Mazovetsky – Baltserovich declared the program of the financial stabilization which has received the name of a shock therapy which included reduction of subsidies, the budgetary deficiency and monetary issue, liberalization plus to the internal prices of foreign trade and introduction of convertibility of national currency. It was just the radical option offered in our described above the concept as an extreme.

In the fall of 1989 literally in 2– 3 months all communistic modes in Eastern Europe failed. The Berlin wall is destroyed, N. Ceausescu is executed. In Poland which lived 10 years in a situation of state of emergency and the conflict between the power and "Solidarity", all this time tried to pursue moderate and reformatory policy without any useful results. At last, in September, 1989 the communistic government of M Rakovsky went on full liberalization of the prices, having assumed responsibility for inflation jump, thereby having exempted future reformers from need to do the dirtiest work. In two months elections I won "Solidarity", and since January, 1990 the government Mazovetsky – Baltserovich declared the program of the financial stabilization which has received the name of a shock therapy which included reduction of subsidies, the budgetary deficiency and monetary issue, liberalization plus to the internal prices of foreign trade and introduction of convertibility of national currency. It was just the radical option offered in our described above the concept as an extreme.

As a result the budget of the expanded government in 1990 was consolidated with surplus in 2, 8% of gross domestic product against deficiency of 7, 4% in 1989; the state budget in 1990 – with surplus of 0, 4% against deficiency of 3, 0% in 1989. The inflation index in 1989 (consumer prices) made 639, 6%, in 1990 – 249, 3, and in 1991 – already 60, 4%. The salary grew in 1989 by 291, 8%, i. e. really considerably went down, in 1990 its growth made 622, 4%, i. e. losses were partly compensated, but as a whole in 1990 private consumption in constant prices was reduced by 15, 3%. Gross domestic product in 1990 fell to 11, 6%, in 1991 – for 7%, and since 1992 already began рост*. It was one of the most successful experiences of radical transformation: initial example of a shock therapy.

As a result the budget of the expanded government in 1990 was consolidated with surplus in 2, 8% of gross domestic product against deficiency of 7, 4% in 1989; the state budget in 1990 – with surplus of 0, 4% against deficiency of 3, 0% in 1989. The inflation index in 1989 (consumer prices) made 639, 6%, in 1990 – 249, 3, and in 1991 – already 60, 4%. The salary grew in 1989 by 291, 8%, i. e. really considerably went down, in 1990 its growth made 622, 4%, i. e. losses were partly compensated, but as a whole in 1990 private consumption in constant prices was reduced by 15, 3%. Gross domestic product in 1990 fell to 11, 6%, in 1991 – for 7%, and since 1992 already began рост*. It was one of the most successful experiences of radical transformation: initial example of a shock therapy.

In the most consecutive look the doctrine of "shock therapy" is realized in Poland in 1990 -1991 gg. the first noncommunistic the government under the leadership of prime minister Leshek Baltserovich. Basic elements of this course were: liberalization of the prices and exchange rate, salary freezing, increase of a rate of bank percent, reduction of public financing of the industry and social sphere, liberalization of foreign economic activity. Baltserovich's government managed to solve the main problem to suppress inflation. If in 1990 of the price grew by 250%, in 1991 - only for 60%, and in the next years inflation fell to 20 -30% a year. Strengthening of monetary system in combination with rapid growth of the private sector and inflow of foreign investments allowed Poland in only three-four years after the beginning of "shock therapy" to enter into a stage of economic growth. The short history of a transitional economy shows that almost all post-socialist countries to some extent were guided by the "shock therapy" doctrine. In some countries, for example, in Poland, the Czech Republic and Estonia, this experience was quite successful.

In the most consecutive look the doctrine of "shock therapy" is realized in Poland in 1990 -1991 gg. the first noncommunistic the government under the leadership of prime minister Leshek Baltserovich. Basic elements of this course were: liberalization of the prices and exchange rate, salary freezing, increase of a rate of bank percent, reduction of public financing of the industry and social sphere, liberalization of foreign economic activity. Baltserovich's government managed to solve the main problem to suppress inflation. If in 1990 of the price grew by 250%, in 1991 - only for 60%, and in the next years inflation fell to 20 -30% a year. Strengthening of monetary system in combination with rapid growth of the private sector and inflow of foreign investments allowed Poland in only three-four years after the beginning of "shock therapy" to enter into a stage of economic growth. The short history of a transitional economy shows that almost all post-socialist countries to some extent were guided by the "shock therapy" doctrine. In some countries, for example, in Poland, the Czech Republic and Estonia, this experience was quite successful.

The main thing that the shock therapy led to success. First, in short terms deficiency was overcome, the consumer market was sated. Secondly, the state budget was balanced. Thirdly, the wave of a hyperinflation managed to be brought down literally in three months. Negative effects – decline in production, falling of the real income of the population, unemployment growth – were available. But it is interesting that strikes and exhausting fight of the government against strong labor unions, against well-known "Solidarity" thus stopped. In a context of this section it is important to understand that these results were quickly reached by vigorous measures for liberalization and financial stabilization. In January, 1990 when the shock therapy was just developed, Warsaw was visited by our delegation led by G. A. Yavlinsky. Results only some replenishment of shelves in da's shops revival of street trade wasn't visible yet.

The main thing that the shock therapy led to success. First, in short terms deficiency was overcome, the consumer market was sated. Secondly, the state budget was balanced. Thirdly, the wave of a hyperinflation managed to be brought down literally in three months. Negative effects – decline in production, falling of the real income of the population, unemployment growth – were available. But it is interesting that strikes and exhausting fight of the government against strong labor unions, against well-known "Solidarity" thus stopped. In a context of this section it is important to understand that these results were quickly reached by vigorous measures for liberalization and financial stabilization. In January, 1990 when the shock therapy was just developed, Warsaw was visited by our delegation led by G. A. Yavlinsky. Results only some replenishment of shelves in da's shops revival of street trade wasn't visible yet.

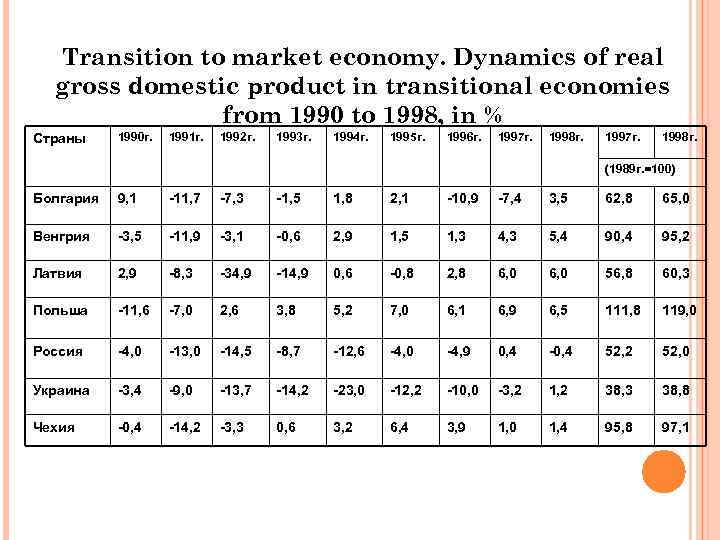

Transition to market economy. Dynamics of real gross domestic product in transitional economies from 1990 to 1998, in % Страны 1990 г. 1991 г. 1992 г. 1993 г. 1994 г. 1995 г. 1996 г. 1997 г. 1998 г. (1989 г. =100) Болгария 9, 1 -11, 7 -7, 3 -1, 5 1, 8 2, 1 -10, 9 -7, 4 3, 5 62, 8 65, 0 Венгрия -3, 5 -11, 9 -3, 1 -0, 6 2, 9 1, 5 1, 3 4, 3 5, 4 90, 4 95, 2 Латвия 2, 9 -8, 3 -34, 9 -14, 9 0, 6 -0, 8 2, 8 6, 0 56, 8 60, 3 Польша -11, 6 -7, 0 2, 6 3, 8 5, 2 7, 0 6, 1 6, 9 6, 5 111, 8 119, 0 Россия -4, 0 -13, 0 -14, 5 -8, 7 -12, 6 -4, 0 -4, 9 0, 4 -0, 4 52, 2 52, 0 Украина -3, 4 -9, 0 -13, 7 -14, 2 -23, 0 -12, 2 -10, 0 -3, 2 1, 2 38, 3 38, 8 Чехия -0, 4 -14, 2 -3, 3 0, 6 3, 2 6, 4 3, 9 1, 0 1, 4 95, 8 97, 1 19

Transition to market economy. Dynamics of real gross domestic product in transitional economies from 1990 to 1998, in % Страны 1990 г. 1991 г. 1992 г. 1993 г. 1994 г. 1995 г. 1996 г. 1997 г. 1998 г. (1989 г. =100) Болгария 9, 1 -11, 7 -7, 3 -1, 5 1, 8 2, 1 -10, 9 -7, 4 3, 5 62, 8 65, 0 Венгрия -3, 5 -11, 9 -3, 1 -0, 6 2, 9 1, 5 1, 3 4, 3 5, 4 90, 4 95, 2 Латвия 2, 9 -8, 3 -34, 9 -14, 9 0, 6 -0, 8 2, 8 6, 0 56, 8 60, 3 Польша -11, 6 -7, 0 2, 6 3, 8 5, 2 7, 0 6, 1 6, 9 6, 5 111, 8 119, 0 Россия -4, 0 -13, 0 -14, 5 -8, 7 -12, 6 -4, 0 -4, 9 0, 4 -0, 4 52, 2 52, 0 Украина -3, 4 -9, 0 -13, 7 -14, 2 -23, 0 -12, 2 -10, 0 -3, 2 1, 2 38, 3 38, 8 Чехия -0, 4 -14, 2 -3, 3 0, 6 3, 2 6, 4 3, 9 1, 0 1, 4 95, 8 97, 1 19

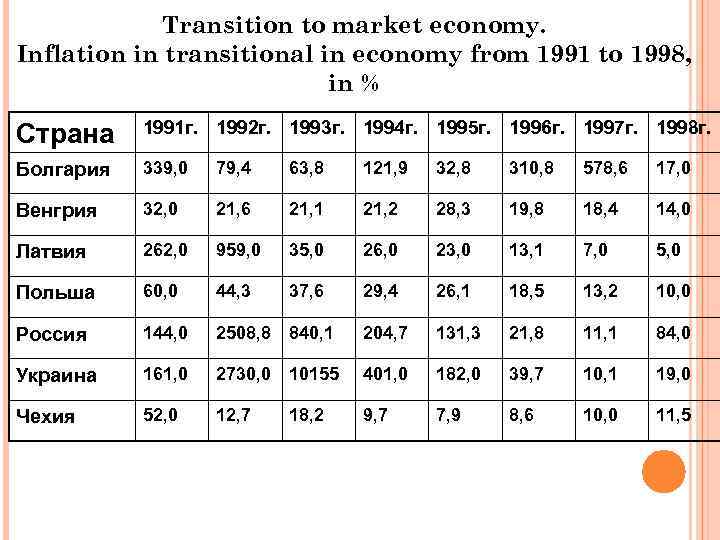

Transition to market economy. Inflation in transitional in economy from 1991 to 1998, in % Страна 1991 г. 1992 г. 1993 г. 1994 г. 1995 г. 1996 г. 1997 г. 1998 г. Болгария 339, 0 79, 4 63, 8 121, 9 32, 8 310, 8 578, 6 17, 0 Венгрия 32, 0 21, 6 21, 1 21, 2 28, 3 19, 8 18, 4 14, 0 Латвия 262, 0 959, 0 35, 0 26, 0 23, 0 13, 1 7, 0 5, 0 Польша 60, 0 44, 3 37, 6 29, 4 26, 1 18, 5 13, 2 10, 0 Россия 144, 0 2508, 8 840, 1 204, 7 131, 3 21, 8 11, 1 84, 0 Украина 161, 0 2730, 0 10155 401, 0 182, 0 39, 7 10, 1 19, 0 Чехия 52, 0 12, 7 18, 2 9, 7 7, 9 8, 6 10, 0 11, 5 20

Transition to market economy. Inflation in transitional in economy from 1991 to 1998, in % Страна 1991 г. 1992 г. 1993 г. 1994 г. 1995 г. 1996 г. 1997 г. 1998 г. Болгария 339, 0 79, 4 63, 8 121, 9 32, 8 310, 8 578, 6 17, 0 Венгрия 32, 0 21, 6 21, 1 21, 2 28, 3 19, 8 18, 4 14, 0 Латвия 262, 0 959, 0 35, 0 26, 0 23, 0 13, 1 7, 0 5, 0 Польша 60, 0 44, 3 37, 6 29, 4 26, 1 18, 5 13, 2 10, 0 Россия 144, 0 2508, 8 840, 1 204, 7 131, 3 21, 8 11, 1 84, 0 Украина 161, 0 2730, 0 10155 401, 0 182, 0 39, 7 10, 1 19, 0 Чехия 52, 0 12, 7 18, 2 9, 7 7, 9 8, 6 10, 0 11, 5 20

Price control – is norm of modern economy of all countries of the world. All states regulate the prices. For example, in the USA, France, Belgium, Switzerland, Japan the share of regulated prices makes from 25% to 40%, in China more than 50% During the era of the state-run economy, wage levels, bonuses and benefits were all set and controlled by the state. The mission of the Ministry of Land Resources as prescribed by the State Council of the People's Republic of China is: To be responsible for the planning , administration, protection and rational utilization of such natural resources as land , mineral and marine resources in the People's Republic of China. Major functions and responsibilities assigned to the Ministry of Land Resources by the 5 tate Council of the People's Republic of China are : To enact relevant laws and regulations and promulgate the rules governing the management of land, mineral and marine resources

Price control – is norm of modern economy of all countries of the world. All states regulate the prices. For example, in the USA, France, Belgium, Switzerland, Japan the share of regulated prices makes from 25% to 40%, in China more than 50% During the era of the state-run economy, wage levels, bonuses and benefits were all set and controlled by the state. The mission of the Ministry of Land Resources as prescribed by the State Council of the People's Republic of China is: To be responsible for the planning , administration, protection and rational utilization of such natural resources as land , mineral and marine resources in the People's Republic of China. Major functions and responsibilities assigned to the Ministry of Land Resources by the 5 tate Council of the People's Republic of China are : To enact relevant laws and regulations and promulgate the rules governing the management of land, mineral and marine resources

Chinese accounting standards are the accounting rules used in mainland China. As of February 2010, the Chinese accounting standard systems is composed of Basic Standard, 38 specific standards and application guidance. Chinese accounting standards are unique because they originated in a socialist period in which the state was the sole owner of industry. Therefore unlike Western accounting standards, they were less a tool of profit and loss, but an inventory of assets available to a company. In contrast to a Western balance sheet, Chinese accounting standards did not include an accounting of thedebts that a corporation holds, and were less suitable for management control than for accounting for tax purposes.

Chinese accounting standards are the accounting rules used in mainland China. As of February 2010, the Chinese accounting standard systems is composed of Basic Standard, 38 specific standards and application guidance. Chinese accounting standards are unique because they originated in a socialist period in which the state was the sole owner of industry. Therefore unlike Western accounting standards, they were less a tool of profit and loss, but an inventory of assets available to a company. In contrast to a Western balance sheet, Chinese accounting standards did not include an accounting of thedebts that a corporation holds, and were less suitable for management control than for accounting for tax purposes.

There is a piece missing from every developing country that has been the foundation of every developed country’s economic modernization, and this is individual property rights. Hong Kong, itself, has benefited from having a modern system of property rights. The history of those rights is a continuous line extending the 16 th Century — when Henry VIII sold off a half-million prime acres of England to raise money — to today’s Basic Law China was highly successful at maintaining a currency peg using a government monopoly over all currency conversion between the yuan and other currencies In a world of volatile foreign currency movements, exactly how does China maintain a fixed exchange rate? First, China promises to redeem dollars for yuan at the fixed rate. To do so, it must keep a good supply of dollars in reserve. Instead of holding dollar bills, it holds U. S. Treasuries, which it can quickly sell for dollars. As China's economy grows, it must buy more and more U. S. Treasuries to meet the growing number of yuan. As a result, China is the largest holder of Treasuries.

There is a piece missing from every developing country that has been the foundation of every developed country’s economic modernization, and this is individual property rights. Hong Kong, itself, has benefited from having a modern system of property rights. The history of those rights is a continuous line extending the 16 th Century — when Henry VIII sold off a half-million prime acres of England to raise money — to today’s Basic Law China was highly successful at maintaining a currency peg using a government monopoly over all currency conversion between the yuan and other currencies In a world of volatile foreign currency movements, exactly how does China maintain a fixed exchange rate? First, China promises to redeem dollars for yuan at the fixed rate. To do so, it must keep a good supply of dollars in reserve. Instead of holding dollar bills, it holds U. S. Treasuries, which it can quickly sell for dollars. As China's economy grows, it must buy more and more U. S. Treasuries to meet the growing number of yuan. As a result, China is the largest holder of Treasuries.

Some believe that foreign investment into China is set to slow over the coming years. This EIU special report argues that, in fact, the rapid expansion of Chinese consumer demand will mean that the country continues to attract FDI inflows, in particular into the services sector. It explains that this investment will continue to move towards booming inland metropolises such as Chongqing in search of cheaper labour and faster growing markets, and discusses the regulation and human capital issues at stake.

Some believe that foreign investment into China is set to slow over the coming years. This EIU special report argues that, in fact, the rapid expansion of Chinese consumer demand will mean that the country continues to attract FDI inflows, in particular into the services sector. It explains that this investment will continue to move towards booming inland metropolises such as Chongqing in search of cheaper labour and faster growing markets, and discusses the regulation and human capital issues at stake.