ccdd0cfa4285b492c950b909c035df0b.ppt

- Количество слайдов: 21

Transforming tomorrow: Arcelor. Mittal’s approach to Socially Responsible Investment Spanish EU Presidency CSR Conference 25 th March 2010

Agenda • • • Arcelor. Mittal - an overview Investor Relations and SRI Corporate responsibility strategy Key Initiatives; Outcomes and Results Conclusion and Next Steps 1

Arcelor. Mittal – an overview 2

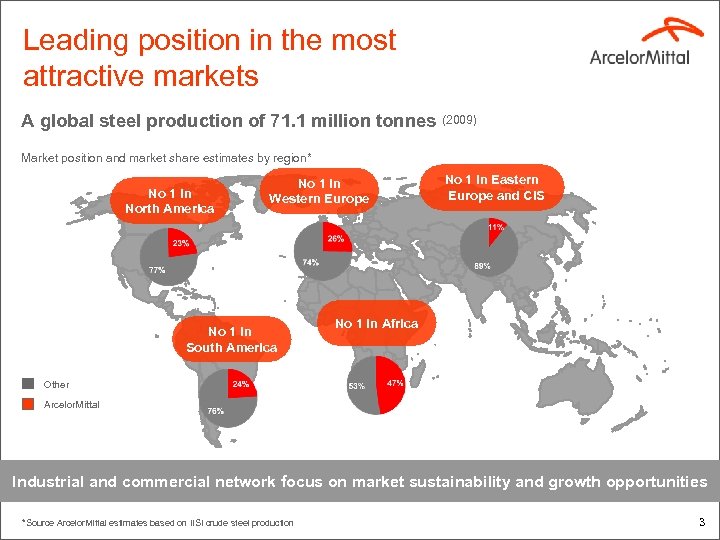

Leading position in the most attractive markets A global steel production of 71. 1 million tonnes (2009) Market position and market share estimates by region* No 1 in North America No 1 in Western Europe No 1 in South America No 1 in Eastern Europe and CIS No 1 in Africa Other Arcelor. Mittal Industrial and commercial network focus on market sustainability and growth opportunities *Source Arcelor. Mittal estimates based on IISI crude steel production 3

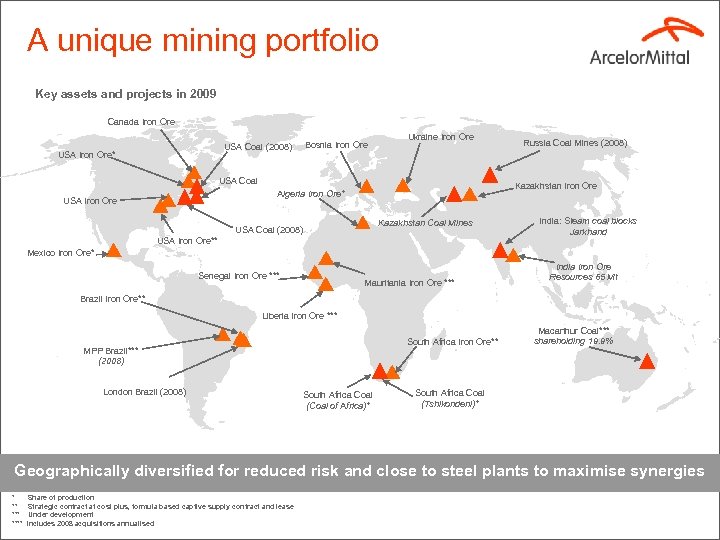

A unique mining portfolio Key assets and projects in 2009 Canada Iron Ore Bosnia Iron Ore USA Coal (2008) USA Iron Ore* Ukraine Iron Ore USA Coal Kazakhstan Iron Ore Algeria Iron Ore* USA Iron Ore Russia Coal Mines (2008) Kazakhstan Coal Mines USA Coal (2008) USA Iron Ore** India: Steam coal blocks Jarkhand Mexico Iron Ore* Senegal Iron Ore *** Mauritania Iron Ore *** India Iron Ore Resources 65 Mt Brazil Iron Ore** Liberia Iron Ore *** South Africa Iron Ore** MPP Brazil*** (2008) London Brazil (2008) South Africa Coal (Coal of Africa)* Macarthur Coal*** shareholding 19. 9% South Africa Coal (Tshikondeni)* Geographically diversified for reduced risk and close to steel plants to maximise synergies * ** **** Share of production Strategic contract at cost plus, formula based captive supply contract and lease Under development Includes 2008 acquisitions annualised

Main markets • Automotive – Worldwide no. 1 supplier – Global industrial presence via 42 coating lines in Europe, North America, South America, Africa • Construction – Worldwide no. 1 steel supplier – 44% of Arcelor. Mittal shipments to construction are added value products • White Goods – Rapidly growing market segment • Packaging – Concepts are continually developed to enable differentiation as well as sustainable solutions • Renewable Energy – Produce special steels for wind turbines and solar panels The market leader in a number of steel segments 5

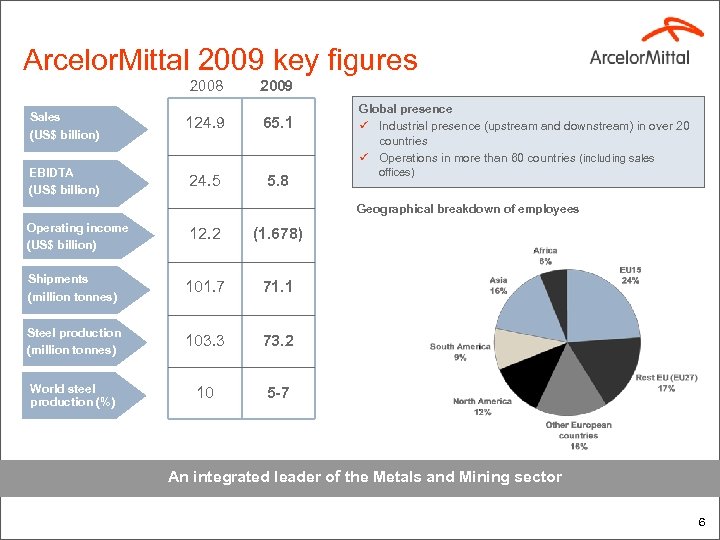

Arcelor. Mittal 2009 key figures 2008 2009 Sales (US$ billion) 124. 9 65. 1 EBIDTA (US$ billion) 24. 5 5. 8 Global presence ü Industrial presence (upstream and downstream) in over 20 countries ü Operations in more than 60 countries (including sales offices) Geographical breakdown of employees Operating income (US$ billion) 12. 2 (1. 678) Shipments (million tonnes) 101. 7 71. 1 Steel production (million tonnes) 103. 3 73. 2 World steel production (%) 10 5 -7 An integrated leader of the Metals and Mining sector 6

Facing the new challenges of the steel industry Developing capacity to ensure long-term growth without creating over-capacity Growth ü Systematically challenging investment projects Product Responding to customer demands for improved services, quality and innovations ü Investing in value added and downstream products Facing constant cost pressure in particular from raw materials and energy Cost ü Realising operational excellence and global sourcing Sustainable Development Driving a Group-wide Corporate Responsibility agenda directly linked to core business & measures to combat climate change. ü Implementing ambitious CR strategies Arcelor. Mittal’s strategy to answer the industry’s new challenges 7

Our philosophy, our values Our goal is to provide the leadership that will transform tomorrow’s steel industry. We have a clear vision of the future, underpinned by a consistent set of values: Sustainability • We are guiding the evolution of steel to secure the best future for the industry and for generations to come. Quality • We look beyond today to envision the steel of tomorrow. Leadership • We are visionary thinkers, creating opportunities every day. Transforming tomorrow to become the most admired company 8

Investor Relations and SRI 9

Objective of Investor Relations Ø By implementing high standards of financial information disclosure and providing clear, regular, transparent and even-handed information to all its shareholders, Arcelor. Mittal aims to be the first choice for investors in the sector Ø Arcelor. Mittal has an active and broad communications policy: roadshows conference calls, plant visits, one-on-one meetings, and a website featuring management comments on quarterly, half-year and full-year results Ø Meeting the growing Socially Responsible Investment (SRI) / sustainable investment community follows the same model Arcelor. Mittal aims to be the first choice for investors in the sector 10

Growth of SRI Ø Origins of religiously-motivated funds and trade union pension funds avoiding sin stocks (e. g. weapons, tobacco) in the 1960 s to divestment of companies operating in South Africa (1970 s – 1990 s) to emergence of specific green, ethical and sustainability funds Ø European SRI Market valued at € 2. 7 trillion at end of 2007* (17. 5% of asset management industry in Europe) Ø Investment strategies include: Ø Negative screening: excluding securities based on environmental and/or social criteria Ø Shareholder activism and engagement: positively influencing corporate behaviour through management meetings and proxy voting Ø Sustainability funds: identifying companies that will bring returns from e. g. low carbon economy Ø Increasingly mainstream investors are asking “CSR” questions either directly or indirectly From ethical investment to a strategy to maximising financial return from sustainable companies * European Sustainable Investment Forum (Eurosif) 11

Managing SRI at Arcelor. Mittal 12

Managing SRI at Arcelor. Mittal Ø Various approaches and shareholders Ø Ethical investors / green funds Ø Rating agencies Ø Sustainability indices e. g. FTSE 4 Good Ø Arcelor. Mittal has reviewed all rating agencies, leading teams (buy-side and sell-side) and its own shareholder capital related to SRI: Ø To prioritise key rating agencies and top shareholders Ø Incorporate and evaluate SRI questionnaires and issue identification into our own CR management and data collection processes Prioritising SRI community for effective management 13

Key initiatives; Outcomes and Results 14

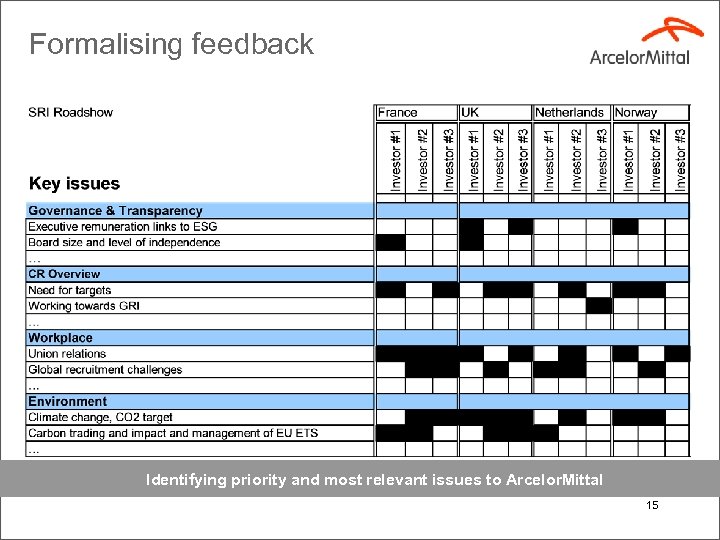

Formalising feedback Identifying priority and most relevant issues to Arcelor. Mittal 15

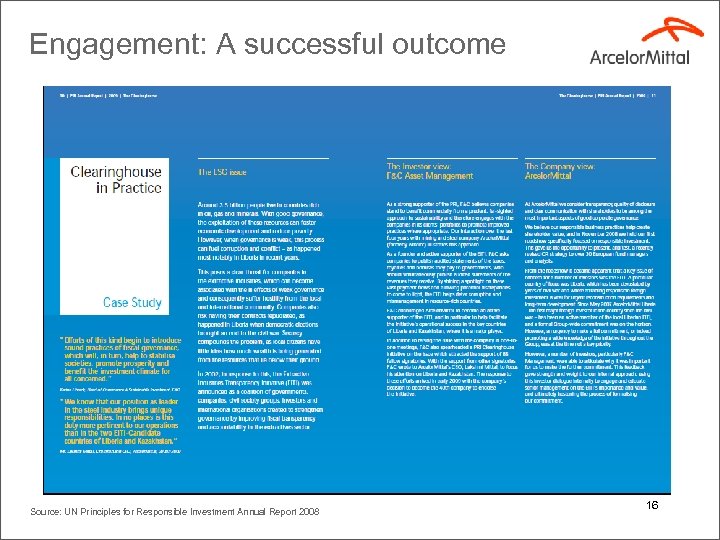

Engagement: A successful outcome Source: UN Principles for Responsible Investment Annual Report 2008 16

Feedback into our publications • Integrating comments and topics into our CR Report and other relevant documents and publications Quarterly earnings release now contains safety statistics and latest CR initiatives Fostering engagement through public reporting

Conclusion and Next Steps 18

Effective SRI management Ø SRI should follow similar model to all other investor relations Ø Prioritising analysts and agencies is crucial to effective management Ø SRI are an individual stakeholder group that can be utilised for more than just improved ratings Ø Formalising engagement tests our CR strategy, aids issue identification and improves our own disclosure Ø Next steps for Arcelor. Mittal to repeat this exercise with a new theme: managing CR through, and emerging from the economic crisis Transforming tomorrow 19

Q&A 20

ccdd0cfa4285b492c950b909c035df0b.ppt