ab32f1ace10eed78d94665dc847ddd80.ppt

- Количество слайдов: 8

Transforming the Business through Technology Innovation Presenter: Richard Anfang Chief Information Officer J. P. Morgan Worldwide Securities Services

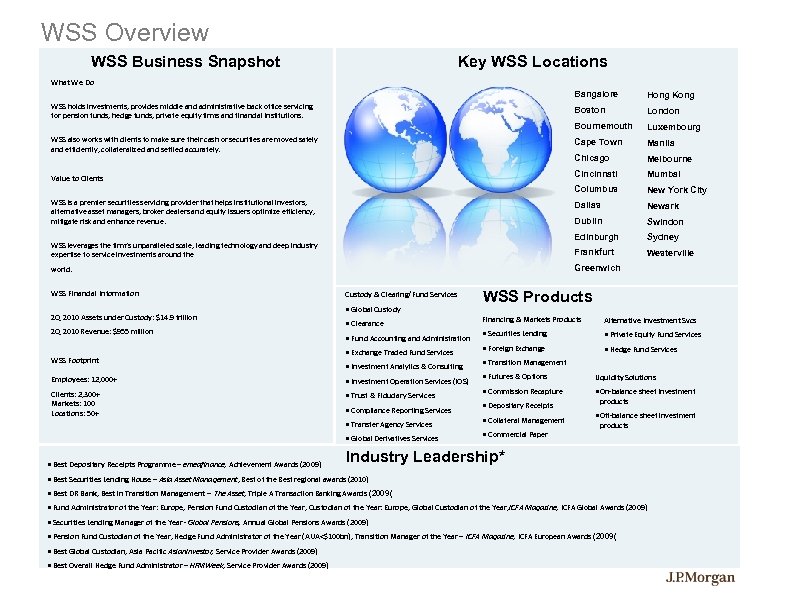

WSS Overview WSS Business Snapshot Key WSS Locations What We Do Bangalore 2 Q 2010 Revenue: $955 million WSS Footprint Newark Dublin Swindon Edinburgh Sydney Frankfurt Westerville Greenwich Custody & Clearing/Fund Services • Global Custody • Clearance • Fund Accounting and Administration • Exchange Traded Fund Services • Investment Analytics & Consulting Employees: 12, 000+ • Investment Operation Services (IOS) Clients: 2, 300+ Markets: 100 Locations: 50+ • Trust & Fiduciary Services • Compliance Reporting Services • Transfer Agency Services • Global Derivatives Services • Best Depositary Receipts Programme – emeafinance, Achievement Awards (2009) New York City Dallas world. 2 Q 2010 Assets under Custody: $14. 9 trillion Mumbai Columbus WSS Financial Information Melbourne Cincinnati WSS leverages the firm’s unparalleled scale, leading technology and deep industry expertise to service investments around the Manila Chicago WSS is a premier securities servicing provider that helps institutional investors, alternative asset managers, broker dealers and equity issuers optimize efficiency, mitigate risk and enhance revenue. Luxembourg Cape Town Value to Clients London Bournemouth WSS also works with clients to make sure their cash or securities are moved safely and efficiently, collateralized and settled accurately. Hong Kong Boston WSS holds investments, provides middle and administrative back office servicing for pension funds, hedge funds, private equity firms and financial institutions. WSS Products Financing & Markets Products Alternative Investment Svcs • Securities Lending • Private Equity Fund Services • Foreign Exchange • Hedge Fund Services • Transition Management • Futures & Options Liquidity Solutions • Commission Recapture • On-balance sheet investment • Depositary Receipts • Collateral Management • Commercial Paper products • Off-balance sheet investment products Industry Leadership* • Best Securities Lending House – Asia Asset Management, Best of the Best regional awards (2010) • Best DR Bank, Best in Transition Management – The Asset, Triple A Transaction Banking Awards (2009( • Fund Administrator of the Year: Europe, Pension Fund Custodian of the Year, Custodian of the Year: Europe, Global Custodian of the Year, ICFA Magazine, ICFA Global Awards (2009) • Securities Lending Manager of the Year - Global Pensions, Annual Global Pensions Awards (2009) • Pension Fund Custodian of the Year, Hedge Fund Administrator of the Year (AUA<$100 bn), Transition Manager of the Year – ICFA Magazine, ICFA European Awards (2009( • Best Global Custodian, Asia Pacific Asian. Investor, Service Provider Awards (2009) • Best Overall Hedge Fund Administrator – HFMWeek, Service Provider Awards (2009) For Internal Use Only

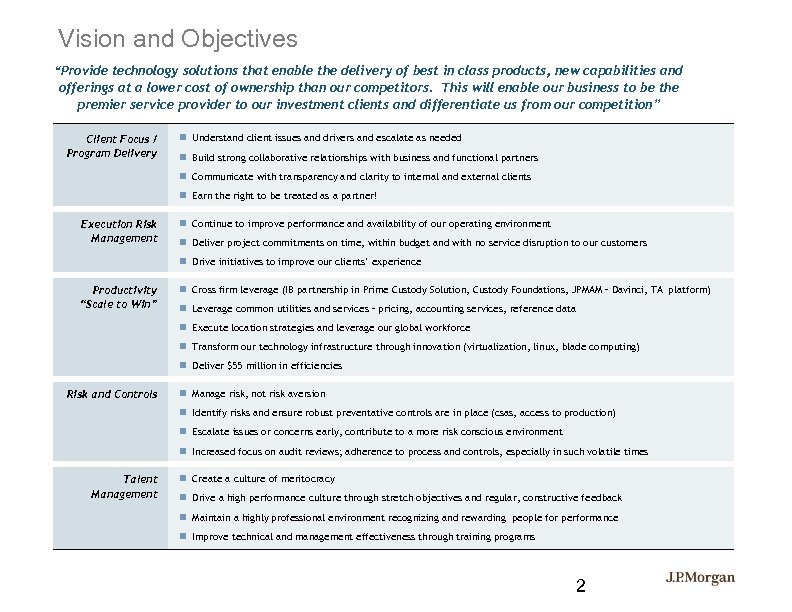

Vision and Objectives “Provide technology solutions that enable the delivery of best in class products, new capabilities and offerings at a lower cost of ownership than our competitors. This will enable our business to be the premier service provider to our investment clients and differentiate us from our competition” Client Focus / Program Delivery n Understand client issues and drivers and escalate as needed n Build strong collaborative relationships with business and functional partners n Communicate with transparency and clarity to internal and external clients n Earn the right to be treated as a partner! Execution Risk Management n Continue to improve performance and availability of our operating environment n Deliver project commitments on time, within budget and with no service disruption to our customers n Drive initiatives to improve our clients’ experience Productivity “Scale to Win” n Cross firm leverage (IB partnership in Prime Custody Solution, Custody Foundations, JPMAM – Davinci, TA platform) n Leverage common utilities and services – pricing, accounting services, reference data n Execute location strategies and leverage our global workforce n Transform our technology infrastructure through innovation (virtualization, linux, blade computing) n Deliver $55 million in efficiencies Risk and Controls n Manage risk, not risk aversion n Identify risks and ensure robust preventative controls are in place (csas, access to production) n Escalate issues or concerns early, contribute to a more risk conscious environment n Increased focus on audit reviews; adherence to process and controls, especially in such volatile times Talent Management n Create a culture of meritocracy n Drive a high performance culture through stretch objectives and regular, constructive feedback n Maintain a highly professional environment recognizing and rewarding people for performance n Improve technical and management effectiveness through training programs 2

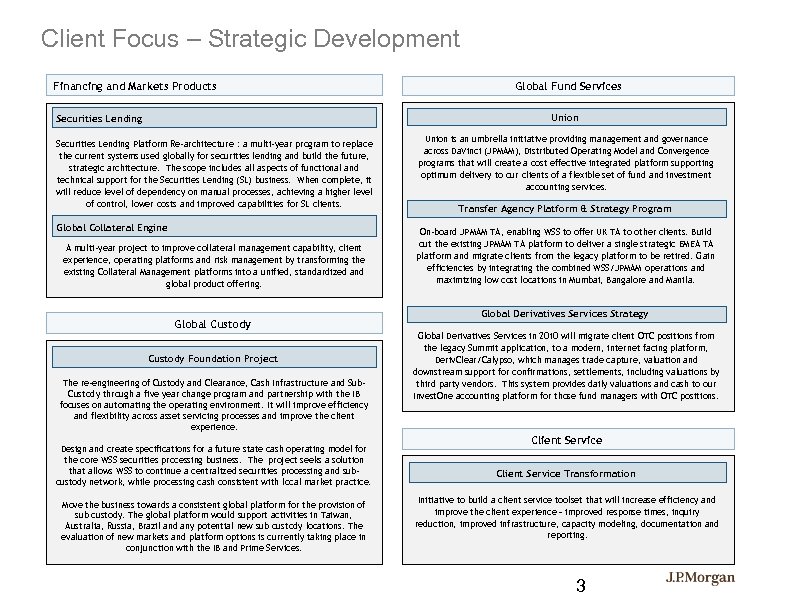

Client Focus – Strategic Development Financing and Markets Products Global Fund Services Union Securities Lending Platform Re-architecture : a multi-year program to replace the current systems used globally for securities lending and build the future, strategic architecture. The scope includes all aspects of functional and technical support for the Securities Lending (SL) business. When complete, it will reduce level of dependency on manual processes, achieving a higher level of control, lower costs and improved capabilities for SL clients. Global Collateral Engine A multi-year project to improve collateral management capability, client experience, operating platforms and risk management by transforming the existing Collateral Management platforms into a unified, standardized and global product offering. Global Custody Foundation Project The re-engineering of Custody and Clearance, Cash Infrastructure and Sub. Custody through a five year change program and partnership with the IB focuses on automating the operating environment. It will improve efficiency and flexibility across asset servicing processes and improve the client experience. Design and create specifications for a future state cash operating model for the core WSS securities processing business. The project seeks a solution that allows WSS to continue a centralized securities processing and subcustody network, while processing cash consistent with local market practice. Move the business towards a consistent global platform for the provision of sub custody. The global platform would support activities in Taiwan, Australia, Russia, Brazil and any potential new sub custody locations. The evaluation of new markets and platform options is currently taking place in conjunction with the IB and Prime Services. Union is an umbrella initiative providing management and governance across Da. Vinci (JPMAM), Distributed Operating Model and Convergence programs that will create a cost effective integrated platform supporting optimum delivery to our clients of a flexible set of fund and investment accounting services. Transfer Agency Platform & Strategy Program On-board JPMAM TA, enabling WSS to offer UK TA to other clients. Build out the existing JPMAM TA platform to deliver a single strategic EMEA TA platform and migrate clients from the legacy platform to be retired. Gain efficiencies by integrating the combined WSS/JPMAM operations and maximizing low cost locations in Mumbai, Bangalore and Manila. Global Derivatives Services Strategy Global Derivatives Services in 2010 will migrate client OTC positions from the legacy Summit application, to a modern, internet facing platform, Deriv. Clear/Calypso, which manages trade capture, valuation and downstream support for confirmations, settlements, including valuations by third party vendors. This system provides daily valuations and cash to our Invest. One accounting platform for those fund managers with OTC positions. Client Service Transformation Initiative to build a client service toolset that will increase efficiency and improve the client experience – improved response times, inquiry reduction, improved infrastructure, capacity modeling, documentation and reporting. 3

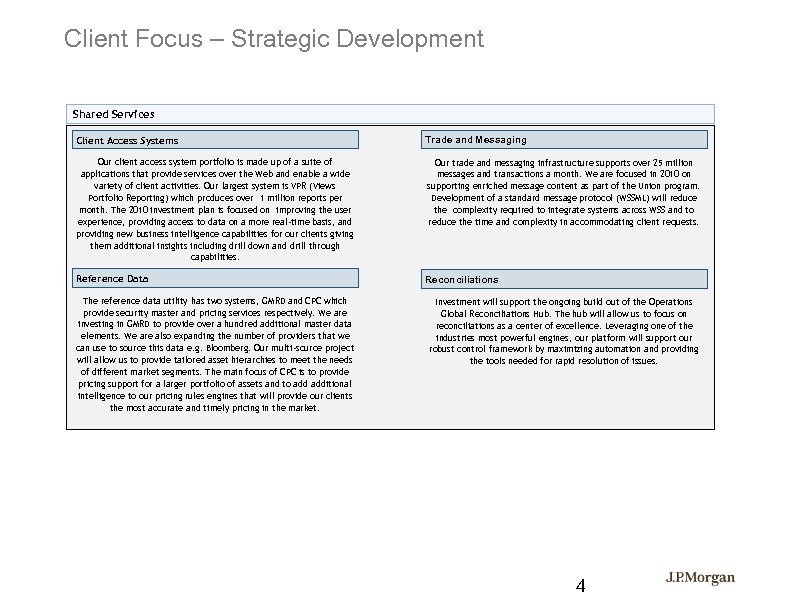

Client Focus – Strategic Development Shared Services Client Access Systems Trade and Messaging Our client access system portfolio is made up of a suite of applications that provide services over the Web and enable a wide variety of client activities. Our largest system is VPR (Views Portfolio Reporting) which produces over 1 million reports per month. The 2010 investment plan is focused on improving the user experience, providing access to data on a more real-time basis, and providing new business intelligence capabilities for our clients giving them additional insights including drill down and drill through capabilities. Our trade and messaging infrastructure supports over 25 million messages and transactions a month. We are focused in 2010 on supporting enriched message content as part of the Union program. Development of a standard message protocol (WSSML) will reduce the complexity required to integrate systems across WSS and to reduce the time and complexity in accommodating client requests. Reference Data Reconciliations The reference data utility has two systems, GMRD and CPC which provide security master and pricing services respectively. We are investing in GMRD to provide over a hundred additional master data elements. We are also expanding the number of providers that we can use to source this data e. g. Bloomberg. Our multi-source project will allow us to provide tailored asset hierarchies to meet the needs of different market segments. The main focus of CPC is to provide pricing support for a larger portfolio of assets and to additional intelligence to our pricing rules engines that will provide our clients the most accurate and timely pricing in the market. Investment will support the ongoing build out of the Operations Global Reconciliations Hub. The hub will allow us to focus on reconciliations as a center of excellence. Leveraging one of the industries most powerful engines, our platform will support our robust control framework by maximizing automation and providing the tools needed for rapid resolution of issues. 4

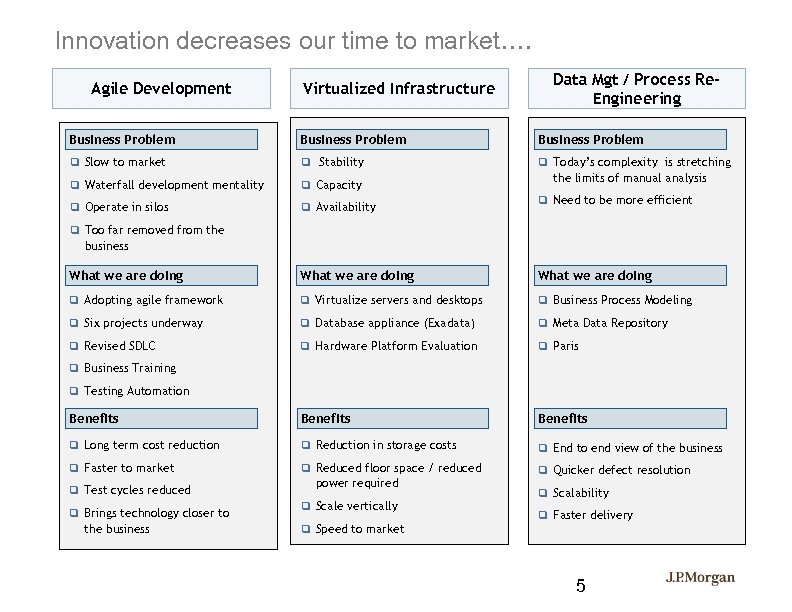

Innovation decreases our time to market…. Agile Development Virtualized Infrastructure Data Mgt / Process Re. Engineering Business Problem q Slow to market q Stability q Waterfall developmentality q Capacity q Today’s complexity is stretching the limits of manual analysis q Operate in silos q Availability q Need to be more efficient q Too far removed from the business What we are doing q Adopting agile framework q Virtualize servers and desktops q Business Process Modeling q Six projects underway q Database appliance (Exadata) q Meta Data Repository q Revised SDLC q Hardware Platform Evaluation q Paris Benefits q Long term cost reduction q Reduction in storage costs q End to end view of the business q Faster to market q Reduced floor space / reduced power required q Quicker defect resolution q Business Training q Testing Automation q Test cycles reduced q Brings technology closer to the business q Scale vertically q Speed to market q Scalability q Faster delivery 5

Industry Leadership Through Innovation…. . “Technology Service Provider of the Year” “Innovation in Banking Technology “ J. P Morgan ACCESSSM Client Dashboard “Chair’s Choice” Global Collateral Engine Re-hypothecation “Innovation in Custody and Securities Service Technology” Global Collateral Engine Re-hypothecation 6

My ask of you today…. . q Ask questions q Offer Insights q Two way conversation q Thank you! 7

ab32f1ace10eed78d94665dc847ddd80.ppt