2b78066b2f13c4f424ac9b6365837e49.ppt

- Количество слайдов: 24

Transforming Regions: From Convergence to Competitiveness Open Days 2005 Gerry Finn Director BMW Regional Assembly

Transforming Regions: From Convergence to Competitiveness Open Days 2005 Gerry Finn Director BMW Regional Assembly

Presentation Overview • Profile of the Border, Midland Western Region • Processes Undertaken – Audit of Innovation – Regional Foresight • Challenges Identified • Lessons for next round of Structural Funding

Presentation Overview • Profile of the Border, Midland Western Region • Processes Undertaken – Audit of Innovation – Regional Foresight • Challenges Identified • Lessons for next round of Structural Funding

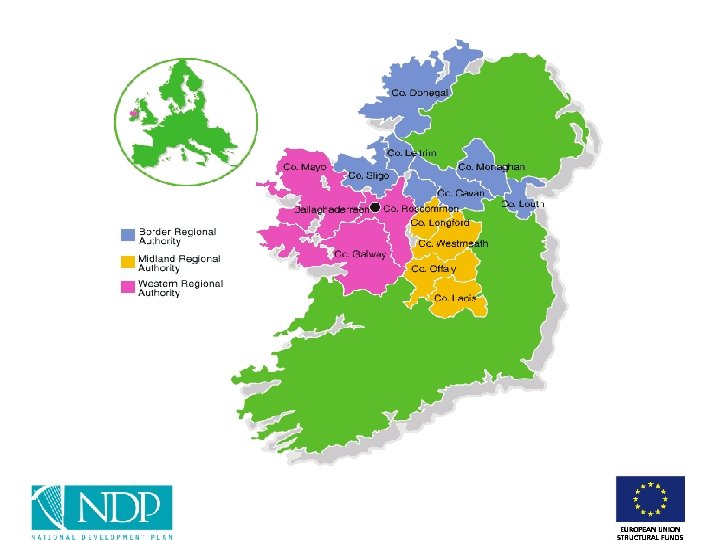

Regional Context Ø BMW Region has 47% of land area, 27% of population & 19% of national GDP Ø Growing Regional Divide in terms of GDP, unemployment, “brain drain” & infrastructure Ø Significant underspend in BMW Region at Mid-Term stage of NDP – particular underspend in roads, public transport, broadband R&D Ø Infrastructure deficit - roads, electricity, gas, ICT etc. Ø NSS sets a new framework for regional development

Regional Context Ø BMW Region has 47% of land area, 27% of population & 19% of national GDP Ø Growing Regional Divide in terms of GDP, unemployment, “brain drain” & infrastructure Ø Significant underspend in BMW Region at Mid-Term stage of NDP – particular underspend in roads, public transport, broadband R&D Ø Infrastructure deficit - roads, electricity, gas, ICT etc. Ø NSS sets a new framework for regional development

The Economy of the BMW Region • Traditional sectors (agriculture/food processing/tourism) in decline • Low level of high value added activities • Low R&D - most research funds allocated to S&E Region • Relatively low levels of innovation • Commitment of Industrial Development Authority to provide 50% of greenfield sites in the region

The Economy of the BMW Region • Traditional sectors (agriculture/food processing/tourism) in decline • Low level of high value added activities • Low R&D - most research funds allocated to S&E Region • Relatively low levels of innovation • Commitment of Industrial Development Authority to provide 50% of greenfield sites in the region

Audit of Innovation: WHY DID WE DO IT? • • To establish baseline situation in the region Identify enablors and barriers to innovation Assess the causes of low innovation activity Develop concrete proposals to improve performance • Comprehensive process involving: - Desk research - Company Surveys - Focus group discussion- Industry case studies - One to one interviews - Interim seminar

Audit of Innovation: WHY DID WE DO IT? • • To establish baseline situation in the region Identify enablors and barriers to innovation Assess the causes of low innovation activity Develop concrete proposals to improve performance • Comprehensive process involving: - Desk research - Company Surveys - Focus group discussion- Industry case studies - One to one interviews - Interim seminar

Scope of the Audit • Profiling of the BMW Region’s economy, Industry structure & employment trends • Review of entrepreneurial system, company start ups and growth rates. • Survey of 215 firms in the BMW region on innovation performance, supports & barriers. • Review of Development support system. • Assessment of role of 3 rd level sector & impact of infrastructure & entrepreneurial culture on innovation. • Recommendations & Pilot Actions

Scope of the Audit • Profiling of the BMW Region’s economy, Industry structure & employment trends • Review of entrepreneurial system, company start ups and growth rates. • Survey of 215 firms in the BMW region on innovation performance, supports & barriers. • Review of Development support system. • Assessment of role of 3 rd level sector & impact of infrastructure & entrepreneurial culture on innovation. • Recommendations & Pilot Actions

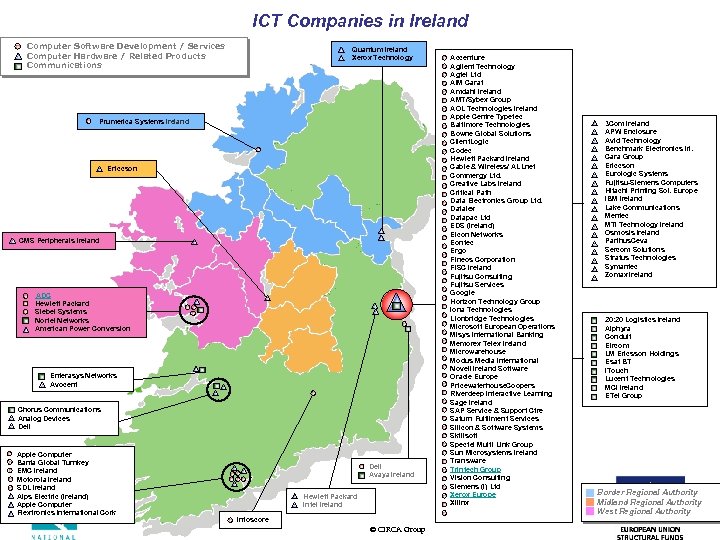

ICT Companies in Ireland Computer Software Development / Services Computer Hardware / Related Products Communications Quantum Ireland Xerox Technology Prumerica Systems Ireland Ericcson CMS Peripherals Ireland ADC Hewlett Packard Siebel Systems Nortel Networks American Power Conversion Enterasys Networks Avocent Chorus Communications Analog Devices Dell Apple Computer Banta Global Turnkey EMC Ireland Motorola Ireland SDL Ireland Alps Electric (Ireland) Apple Computer Flextronics International Cork Dell Avaya Ireland Hewlett Packard Intel Ireland Infoscore © CIRCA Group Accenture Agilent Technology Agtel Ltd AIM Carat Amdahl Ireland AMT/Sybex Group AOL Technologies Ireland Apple Centre Typetec Baltimore Technologies Bowne Global Solutions Client. Logic Codec Hewlett Packard Ireland Cable & Wireless/ ALLnet Commergy Ltd. Creative Labs Ireland Critical Path Data Electronics Group Ltd. Datalex Datapac Ltd EDS (Ireland) Eicon Networks Eontec Ergo Fineos Corporation FISC Ireland Fujitsu Consulting Fujitsu Services Google Horizon Technology Group Iona Technologies Lionbridge Technologies Microsoft European Operations Misys International Banking Memorex Telex Ireland Microwarehouse Modus Media International Novell Ireland Software Oracle Europe Pricewaterhouse. Coopers Riverdeep Interactive Learning Sage Ireland SAP Service & Support Ctre Saturn Fulfilment Services Silicon & Software Systems Skillsoft Spectel Multi Link Group Sun Microsystems Ireland Transware Trintech Group Vision Consulting Siemens (I) Ltd Xerox Europe Xilinx 3 Com Ireland APW Enclosure Avid Technology Benchmark Electronics Irl. Cara Group Ericcson Eurologic Systems Fujitsu-Siemens Computers Hitachi Printing Sol. Europe IBM Ireland Lake Communications Mentec MTI Technology Ireland Osmosis Ireland Parthus. Ceva Sercom Solutions Stratus Technologies Symantec Zomax Ireland 20: 20 Logistics Ireland Alphyra Conduit Eircom LM Ericsson Holdings Esat BT i. Touch Lucent Technologies MCI Ireland ETel Group Border Regional Authority Midland Regional Authority West Regional Authority

ICT Companies in Ireland Computer Software Development / Services Computer Hardware / Related Products Communications Quantum Ireland Xerox Technology Prumerica Systems Ireland Ericcson CMS Peripherals Ireland ADC Hewlett Packard Siebel Systems Nortel Networks American Power Conversion Enterasys Networks Avocent Chorus Communications Analog Devices Dell Apple Computer Banta Global Turnkey EMC Ireland Motorola Ireland SDL Ireland Alps Electric (Ireland) Apple Computer Flextronics International Cork Dell Avaya Ireland Hewlett Packard Intel Ireland Infoscore © CIRCA Group Accenture Agilent Technology Agtel Ltd AIM Carat Amdahl Ireland AMT/Sybex Group AOL Technologies Ireland Apple Centre Typetec Baltimore Technologies Bowne Global Solutions Client. Logic Codec Hewlett Packard Ireland Cable & Wireless/ ALLnet Commergy Ltd. Creative Labs Ireland Critical Path Data Electronics Group Ltd. Datalex Datapac Ltd EDS (Ireland) Eicon Networks Eontec Ergo Fineos Corporation FISC Ireland Fujitsu Consulting Fujitsu Services Google Horizon Technology Group Iona Technologies Lionbridge Technologies Microsoft European Operations Misys International Banking Memorex Telex Ireland Microwarehouse Modus Media International Novell Ireland Software Oracle Europe Pricewaterhouse. Coopers Riverdeep Interactive Learning Sage Ireland SAP Service & Support Ctre Saturn Fulfilment Services Silicon & Software Systems Skillsoft Spectel Multi Link Group Sun Microsystems Ireland Transware Trintech Group Vision Consulting Siemens (I) Ltd Xerox Europe Xilinx 3 Com Ireland APW Enclosure Avid Technology Benchmark Electronics Irl. Cara Group Ericcson Eurologic Systems Fujitsu-Siemens Computers Hitachi Printing Sol. Europe IBM Ireland Lake Communications Mentec MTI Technology Ireland Osmosis Ireland Parthus. Ceva Sercom Solutions Stratus Technologies Symantec Zomax Ireland 20: 20 Logistics Ireland Alphyra Conduit Eircom LM Ericsson Holdings Esat BT i. Touch Lucent Technologies MCI Ireland ETel Group Border Regional Authority Midland Regional Authority West Regional Authority

Results of Firm survey Survey of 215 firms found that in BMW region: § Levels of innovation lower than national average (53% versus 79%) § Lower rate of product development & patenting § Lower rate of linkages with research/3 rd level institutions § Absorbtive capacity for new development generally weak. § Lower rate of employment of graduates and Postgraduates

Results of Firm survey Survey of 215 firms found that in BMW region: § Levels of innovation lower than national average (53% versus 79%) § Lower rate of product development & patenting § Lower rate of linkages with research/3 rd level institutions § Absorbtive capacity for new development generally weak. § Lower rate of employment of graduates and Postgraduates

Development Support system • Low access to and uptake of venture capital • Low expenditure in the region on industrial RTDI • Level of participation in company based R & D schemes is low • Need for continued focus on Foreign Direct investment • Many schemes not sufficiently geared to the needs of companies in the region.

Development Support system • Low access to and uptake of venture capital • Low expenditure in the region on industrial RTDI • Level of participation in company based R & D schemes is low • Need for continued focus on Foreign Direct investment • Many schemes not sufficiently geared to the needs of companies in the region.

Infrastructure & Role of Third Level Sector • Infrastructure deficits add costs to doing business & acts as a disincentive to inward investment • Continued investment needed in roads, rail, air, telecommunications & energy infrastructure • New strategies required in 3 rd level sector • Additional resources for industry relevant research activities. • Knowledge drain of graduates out of the region evident • Need for greater technology transfer between research/3 rd level institutions & companies throughout the region

Infrastructure & Role of Third Level Sector • Infrastructure deficits add costs to doing business & acts as a disincentive to inward investment • Continued investment needed in roads, rail, air, telecommunications & energy infrastructure • New strategies required in 3 rd level sector • Additional resources for industry relevant research activities. • Knowledge drain of graduates out of the region evident • Need for greater technology transfer between research/3 rd level institutions & companies throughout the region

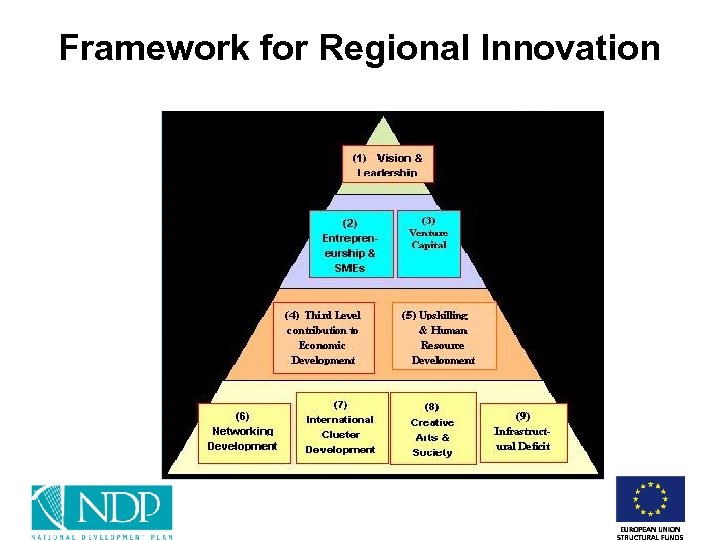

Framework for Regional Innovation

Framework for Regional Innovation

Overview of the Foresight Process • 18 month process involving wide consultation within & outside the region • Co-ordinated by BMW Regional Assembly secretariat • Facilitated by consultants CM International • Steering Committee & 4 expert panels • Wide consultation nationally & within region • Submissions invited from interested parties • Local/regional/national endorsement obtained

Overview of the Foresight Process • 18 month process involving wide consultation within & outside the region • Co-ordinated by BMW Regional Assembly secretariat • Facilitated by consultants CM International • Steering Committee & 4 expert panels • Wide consultation nationally & within region • Submissions invited from interested parties • Local/regional/national endorsement obtained

Challenges to the BMW Region as a Competitive Region • Transport and Communications Infrastructure • Supporting Business Clusters and Centres of Excellence • Increase in Knowledge-Intensive Activities • Competitive use of Natural Resources • Increasing Entrepreneurship • Industry-Relevant Support Programmes

Challenges to the BMW Region as a Competitive Region • Transport and Communications Infrastructure • Supporting Business Clusters and Centres of Excellence • Increase in Knowledge-Intensive Activities • Competitive use of Natural Resources • Increasing Entrepreneurship • Industry-Relevant Support Programmes

Challenges to the BMW Region as an Innovating Region • Greater Flexibility and Adaptive Attitudes to Respond to Change • Education and Skills Levels to Increase • Inter-Agency Colloboration and Academic. Industrial Linkages • Technology Transfer and Company Spin-Outs • Clustering and Spatial Specialisation • Building a Regional Research Base

Challenges to the BMW Region as an Innovating Region • Greater Flexibility and Adaptive Attitudes to Respond to Change • Education and Skills Levels to Increase • Inter-Agency Colloboration and Academic. Industrial Linkages • Technology Transfer and Company Spin-Outs • Clustering and Spatial Specialisation • Building a Regional Research Base

Challenges to the BMW Region as a Knowledge Region • • Identifying and Responding to Future Skills Needs Increasing the Knowledge Capacity of the Region Increasing Life-Long Learning in the Region Appropriate Delivery Mechanisms for Further Education • Flexibility and Adaptability of Skills • Graduate Retention and Attraction • Resources for all Education Levels

Challenges to the BMW Region as a Knowledge Region • • Identifying and Responding to Future Skills Needs Increasing the Knowledge Capacity of the Region Increasing Life-Long Learning in the Region Appropriate Delivery Mechanisms for Further Education • Flexibility and Adaptability of Skills • Graduate Retention and Attraction • Resources for all Education Levels

Challenges to the BMW Region as a Quality of Life Region • A Desirable Place in which to Live, Work, Visit, Invest • Social Infrastructure • Sustainability – Improved Living Environment • Spatial Development Strategies • Diversity, Access and Equality • Cultural and Social Environment

Challenges to the BMW Region as a Quality of Life Region • A Desirable Place in which to Live, Work, Visit, Invest • Social Infrastructure • Sustainability – Improved Living Environment • Spatial Development Strategies • Diversity, Access and Equality • Cultural and Social Environment

4 Themes & 4 Panels 4 expert panels selected to explore themes of: • A Knowledge Region • A Competitive Region • A Quality of Life Region • An Innovative Region

4 Themes & 4 Panels 4 expert panels selected to explore themes of: • A Knowledge Region • A Competitive Region • A Quality of Life Region • An Innovative Region

A Vision for the BMW Region in 2025 An innovative, knowledge-based and competitive region, with a high quality environment, first class infrastructure, visionary leadership and a quality of life for its citizens that is among the highest in the world

A Vision for the BMW Region in 2025 An innovative, knowledge-based and competitive region, with a high quality environment, first class infrastructure, visionary leadership and a quality of life for its citizens that is among the highest in the world

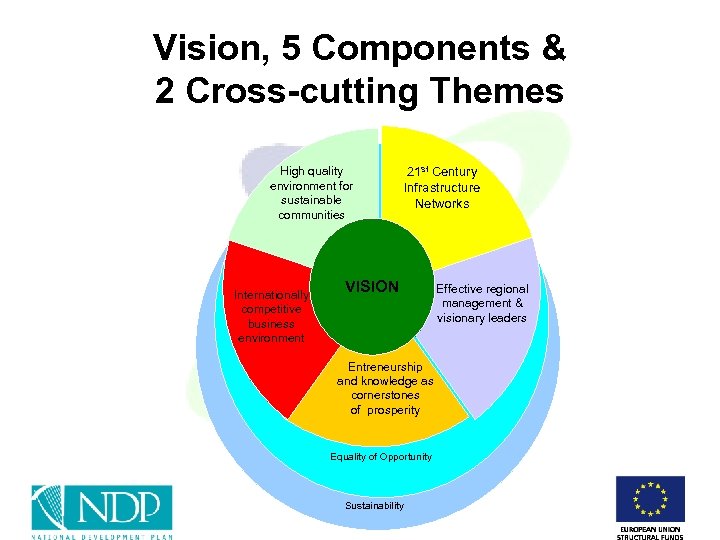

Vision, 5 Components & 2 Cross-cutting Themes High quality environment for sustainable communities Internationally competitive business environment 21 st Century Infrastructure Networks VISION ```` Entreneurship and knowledge as cornerstones of prosperity Equality of Opportunity Sustainability Effective regional management & visionary leaders

Vision, 5 Components & 2 Cross-cutting Themes High quality environment for sustainable communities Internationally competitive business environment 21 st Century Infrastructure Networks VISION ```` Entreneurship and knowledge as cornerstones of prosperity Equality of Opportunity Sustainability Effective regional management & visionary leaders

The Strategic Objectives • Place 3 rd level institutions at the heart of the region’s future prosperity • Create an innovation & entrepreneurial culture • Build on existing clusters & concentrate investment • Invest in infrastructure that builds on the NSS • Strengthen regional leadership

The Strategic Objectives • Place 3 rd level institutions at the heart of the region’s future prosperity • Create an innovation & entrepreneurial culture • Build on existing clusters & concentrate investment • Invest in infrastructure that builds on the NSS • Strengthen regional leadership

The Strategic Objectives (cntd. ) • Invest in attracting and retaining skills • Invest in leading edge business support • Invest to make the region’s high quality environment sustainable • Invest in community & social capital to ensure sustainability • Invest in physical infrastructure to maximise knowledge capital

The Strategic Objectives (cntd. ) • Invest in attracting and retaining skills • Invest in leading edge business support • Invest to make the region’s high quality environment sustainable • Invest in community & social capital to ensure sustainability • Invest in physical infrastructure to maximise knowledge capital

Lessons for Next Round of Structural Funds • New approaches to research and innovation activities required and new partnership arrangements • Greater regional differentiation in national strategies • Innovative delivery mechanisms e. g. County and Group Broadband Scheme • Greater focus on Ireland’s National Spatial Strategy as a framework for investment

Lessons for Next Round of Structural Funds • New approaches to research and innovation activities required and new partnership arrangements • Greater regional differentiation in national strategies • Innovative delivery mechanisms e. g. County and Group Broadband Scheme • Greater focus on Ireland’s National Spatial Strategy as a framework for investment

Lessons for Next Round of Structural Funds • Need for greater added value for community funds • Better co-ordination with national expenditure plans and with agriculture, fisheries, rural, research programmes and human resources • Frontloading in phasing-in regions requires a pipeline of “spend-ready” measures • Infrastructure deficiencies still prevalent – a key determinent of competitiveness

Lessons for Next Round of Structural Funds • Need for greater added value for community funds • Better co-ordination with national expenditure plans and with agriculture, fisheries, rural, research programmes and human resources • Frontloading in phasing-in regions requires a pipeline of “spend-ready” measures • Infrastructure deficiencies still prevalent – a key determinent of competitiveness