9ffc369965186a78c30e54bc356eaca3.ppt

- Количество слайдов: 20

Transaction Cost Economics

Transaction Cost Economics

Sources – http: //en. wikipedia. org/wiki/Transaction_cost – The Logic of Electronic Markets by Malone, Yates and Benjamin, Harvard Business Review, May 1989 – E-commerce and the Market Structure of Retail Industries, by Goldmanis, Hortaçsu, Syverson and Emre, Economic Journal, June 2010 – Price Dispersion in the Small and in the Large: Evidence from an Internet Price Comparison Site, by Baye, Morgan and Scholten, Journal of Industrial Economics, 52(4), 2004 – Information Rules, by Shapiro and Varian, 1999 – Bringing the Market Inside by Malone, Harvard Business Review, April 2004 – The Collective Intelligence Genome by by Malone, Laubacher and Dellarocas, MIT Technology Review, April 2010 2

Sources – http: //en. wikipedia. org/wiki/Transaction_cost – The Logic of Electronic Markets by Malone, Yates and Benjamin, Harvard Business Review, May 1989 – E-commerce and the Market Structure of Retail Industries, by Goldmanis, Hortaçsu, Syverson and Emre, Economic Journal, June 2010 – Price Dispersion in the Small and in the Large: Evidence from an Internet Price Comparison Site, by Baye, Morgan and Scholten, Journal of Industrial Economics, 52(4), 2004 – Information Rules, by Shapiro and Varian, 1999 – Bringing the Market Inside by Malone, Harvard Business Review, April 2004 – The Collective Intelligence Genome by by Malone, Laubacher and Dellarocas, MIT Technology Review, April 2010 2

Introduction • Our third and final framework to analyze the market perspective of technology is transaction cost economics • We use this area of modern Economics because it has been very useful in analyzing technology. The most striking example is the prediction, based on transaction cost economics, of the emergence of electronic commerce • It took almost a decade for the prediction to be proved true, but it demonstrated the power of theory • A transaction cost is the cost of participating in a market • For example, buying a laptop … 3

Introduction • Our third and final framework to analyze the market perspective of technology is transaction cost economics • We use this area of modern Economics because it has been very useful in analyzing technology. The most striking example is the prediction, based on transaction cost economics, of the emergence of electronic commerce • It took almost a decade for the prediction to be proved true, but it demonstrated the power of theory • A transaction cost is the cost of participating in a market • For example, buying a laptop … 3

An example: Buying a laptop … • • Your costs will include the energy and effort it requires to find out … – which of the various computers you prefer – where to get them and at what price – the cost of traveling to the store – the effort in bargaining the price – the effort of discussing and understanding the warranty and other terms and conditions of the purchase – and all other costs above and beyond the price of the computer are the transaction costs. Information Technology reduces transaction costs. – It is much easier to search for products on the Internet than in a large shopping center – Similarly, it much easier to understand the details of purchasing a specific service from a Q&A web page and reviews of current customers, than from discussing it with salesperson and looking for friends who already subscribed to this service 4

An example: Buying a laptop … • • Your costs will include the energy and effort it requires to find out … – which of the various computers you prefer – where to get them and at what price – the cost of traveling to the store – the effort in bargaining the price – the effort of discussing and understanding the warranty and other terms and conditions of the purchase – and all other costs above and beyond the price of the computer are the transaction costs. Information Technology reduces transaction costs. – It is much easier to search for products on the Internet than in a large shopping center – Similarly, it much easier to understand the details of purchasing a specific service from a Q&A web page and reviews of current customers, than from discussing it with salesperson and looking for friends who already subscribed to this service 4

Theory: Transaction Cost Economics • • • A transaction cost is incurred in making an economic (or market) exchange – Search and data collection costs – Bargaining costs and other costs of agreeing on the price and quality – Costs to ensure that the other party sticks to the agreed terms – Costs required if it does not obey it These are Not production costs The Nature of The Firm by Ronald Coase (1937) – Why firms emerge? Why hire people and not contract-out work? – Because market exchanges incur transaction costs – Nobel Prize in Economics, 1991 Markets and Hierarchies by Oliver Williamson (1975) – Make or Buy? Uncertainty, specificity, opportunism – Increase transaction costs – Potentially creates holdup – Drives toward Make and not Buy – Nobel Prize in Economics, 2009 There is a lot of empirical evidence to support theory 5

Theory: Transaction Cost Economics • • • A transaction cost is incurred in making an economic (or market) exchange – Search and data collection costs – Bargaining costs and other costs of agreeing on the price and quality – Costs to ensure that the other party sticks to the agreed terms – Costs required if it does not obey it These are Not production costs The Nature of The Firm by Ronald Coase (1937) – Why firms emerge? Why hire people and not contract-out work? – Because market exchanges incur transaction costs – Nobel Prize in Economics, 1991 Markets and Hierarchies by Oliver Williamson (1975) – Make or Buy? Uncertainty, specificity, opportunism – Increase transaction costs – Potentially creates holdup – Drives toward Make and not Buy – Nobel Prize in Economics, 2009 There is a lot of empirical evidence to support theory 5

Theory: Holdup • The idea of a hold-up, or lock-in, as suggested by Williamson is extremely important in the management of technology • Often, users of Information Technology accumulate information or data on the IT product or service they use • If they will not be able to transfer this data to a competing product/service, they will be held-up by the supplier who will be able to charge them expensively to continue using the product • The cost of moving the data to another product is called Switching Costs • If they are considerable, you will be ready to stay with your old product and pay more • Again, as with the network effect, this makes IT markets non-competitive 6

Theory: Holdup • The idea of a hold-up, or lock-in, as suggested by Williamson is extremely important in the management of technology • Often, users of Information Technology accumulate information or data on the IT product or service they use • If they will not be able to transfer this data to a competing product/service, they will be held-up by the supplier who will be able to charge them expensively to continue using the product • The cost of moving the data to another product is called Switching Costs • If they are considerable, you will be ready to stay with your old product and pay more • Again, as with the network effect, this makes IT markets non-competitive 6

An Example: Mobile number portability • After you subscribe to a mobile phone service, you start telling your friends and colleagues what is your phone number • After a while this accumulated data, with your friends and colleagues, becomes very valuable • If you wish to switch to another operator, you would like to transfer your own phone number to the new operator • If you cannot do this, the existing operator will hold you up and will be able to charge you higher prices. This was very common a few years ago • However, now mobile phone customers have the right to take their mobile number with them through a simple process called porting. • Mobile number portability was introduced by the UK government in order to reduce hold-up and make the mobile phone industry more competitive 7

An Example: Mobile number portability • After you subscribe to a mobile phone service, you start telling your friends and colleagues what is your phone number • After a while this accumulated data, with your friends and colleagues, becomes very valuable • If you wish to switch to another operator, you would like to transfer your own phone number to the new operator • If you cannot do this, the existing operator will hold you up and will be able to charge you higher prices. This was very common a few years ago • However, now mobile phone customers have the right to take their mobile number with them through a simple process called porting. • Mobile number portability was introduced by the UK government in order to reduce hold-up and make the mobile phone industry more competitive 7

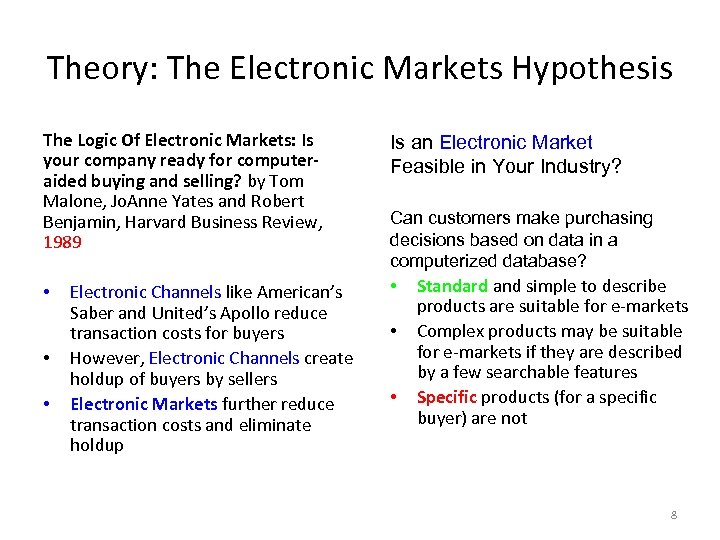

Theory: The Electronic Markets Hypothesis The Logic Of Electronic Markets: Is your company ready for computeraided buying and selling? by Tom Malone, Jo. Anne Yates and Robert Benjamin, Harvard Business Review, 1989 • • • Electronic Channels like American’s Saber and United’s Apollo reduce transaction costs for buyers However, Electronic Channels create holdup of buyers by sellers Electronic Markets further reduce transaction costs and eliminate holdup Is an Electronic Market Feasible in Your Industry? Can customers make purchasing decisions based on data in a computerized database? • • • Standard and simple to describe products are suitable for e-markets Complex products may be suitable for e-markets if they are described by a few searchable features Specific products (for a specific buyer) are not 8

Theory: The Electronic Markets Hypothesis The Logic Of Electronic Markets: Is your company ready for computeraided buying and selling? by Tom Malone, Jo. Anne Yates and Robert Benjamin, Harvard Business Review, 1989 • • • Electronic Channels like American’s Saber and United’s Apollo reduce transaction costs for buyers However, Electronic Channels create holdup of buyers by sellers Electronic Markets further reduce transaction costs and eliminate holdup Is an Electronic Market Feasible in Your Industry? Can customers make purchasing decisions based on data in a computerized database? • • • Standard and simple to describe products are suitable for e-markets Complex products may be suitable for e-markets if they are described by a few searchable features Specific products (for a specific buyer) are not 8

Practice: Twenty Years Later … 9

Practice: Twenty Years Later … 9

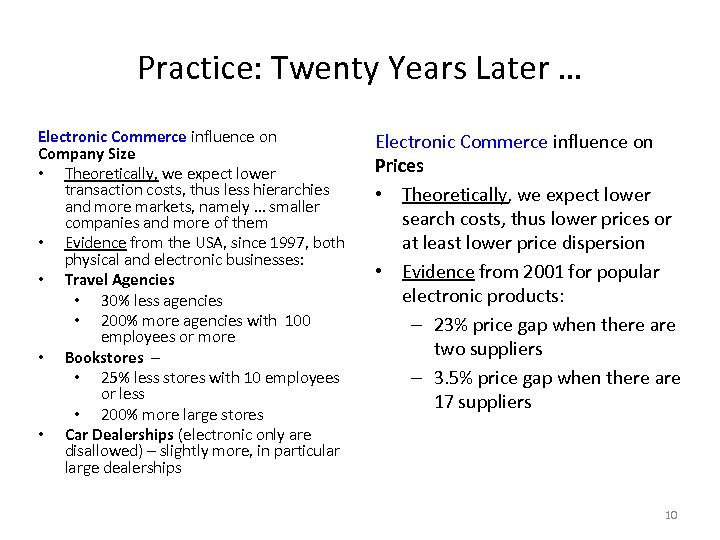

Practice: Twenty Years Later … Electronic Commerce influence on Company Size • Theoretically, we expect lower transaction costs, thus less hierarchies and more markets, namely … smaller companies and more of them • Evidence from the USA, since 1997, both physical and electronic businesses: • Travel Agencies • 30% less agencies • 200% more agencies with 100 employees or more • Bookstores – • 25% less stores with 10 employees or less • 200% more large stores • Car Dealerships (electronic only are disallowed) – slightly more, in particular large dealerships Electronic Commerce influence on Prices • Theoretically, we expect lower search costs, thus lower prices or at least lower price dispersion • Evidence from 2001 for popular electronic products: – 23% price gap when there are two suppliers – 3. 5% price gap when there are 17 suppliers 10

Practice: Twenty Years Later … Electronic Commerce influence on Company Size • Theoretically, we expect lower transaction costs, thus less hierarchies and more markets, namely … smaller companies and more of them • Evidence from the USA, since 1997, both physical and electronic businesses: • Travel Agencies • 30% less agencies • 200% more agencies with 100 employees or more • Bookstores – • 25% less stores with 10 employees or less • 200% more large stores • Car Dealerships (electronic only are disallowed) – slightly more, in particular large dealerships Electronic Commerce influence on Prices • Theoretically, we expect lower search costs, thus lower prices or at least lower price dispersion • Evidence from 2001 for popular electronic products: – 23% price gap when there are two suppliers – 3. 5% price gap when there are 17 suppliers 10

Your Project The Transaction Cost Framework 1. Are there transaction costs that the technology reduces? Explain the search, bargaining/contracting and enforcement costs. 2. How large are these transaction costs? Compare them to the value and price of the product or service. 3. Are there other ways to reduce transaction costs? 4. Is there a danger of hold-up in using this product or service? As a user, do you accumulate data that you will not be able to use with other technology? Consider also skill and habits that you develop while using the technolgy -- will you be able to transfter them to a different product or service? 5. Explain and try to assess the costs to move from this product/service to a competing one? 11

Your Project The Transaction Cost Framework 1. Are there transaction costs that the technology reduces? Explain the search, bargaining/contracting and enforcement costs. 2. How large are these transaction costs? Compare them to the value and price of the product or service. 3. Are there other ways to reduce transaction costs? 4. Is there a danger of hold-up in using this product or service? As a user, do you accumulate data that you will not be able to use with other technology? Consider also skill and habits that you develop while using the technolgy -- will you be able to transfter them to a different product or service? 5. Explain and try to assess the costs to move from this product/service to a competing one? 11

Practice: e. Bay’s holdup and economies of scale

Practice: e. Bay’s holdup and economies of scale

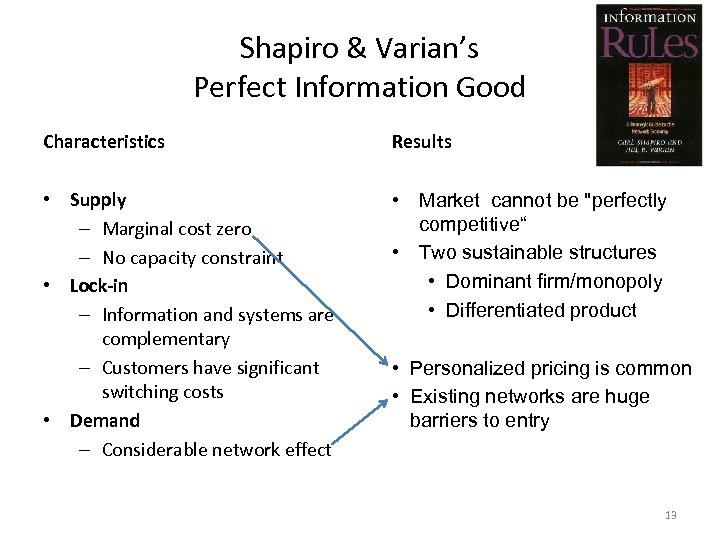

Shapiro & Varian’s Perfect Information Good Characteristics Results • Supply – Marginal cost zero – No capacity constraint • Lock-in – Information and systems are complementary – Customers have significant switching costs • Demand – Considerable network effect • Market cannot be "perfectly competitive“ • Two sustainable structures • Dominant firm/monopoly • Differentiated product • Personalized pricing is common • Existing networks are huge barriers to entry 13

Shapiro & Varian’s Perfect Information Good Characteristics Results • Supply – Marginal cost zero – No capacity constraint • Lock-in – Information and systems are complementary – Customers have significant switching costs • Demand – Considerable network effect • Market cannot be "perfectly competitive“ • Two sustainable structures • Dominant firm/monopoly • Differentiated product • Personalized pricing is common • Existing networks are huge barriers to entry 13

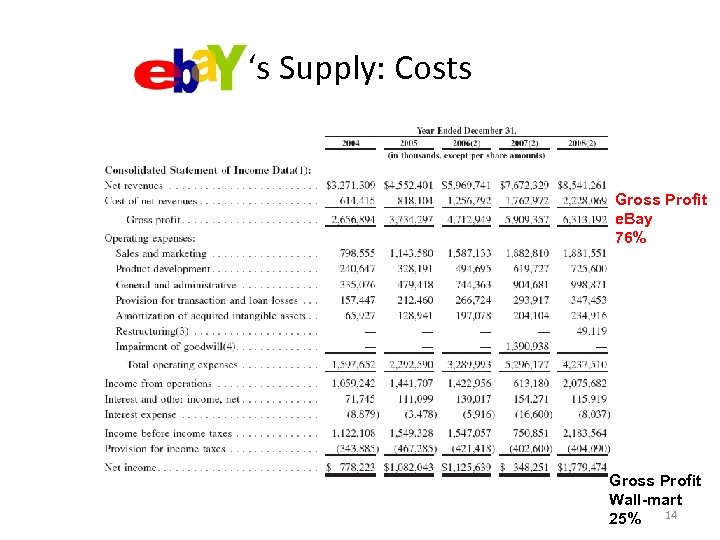

‘s Supply: Costs Gross Profit e. Bay 76% Gross Profit Wall-mart 25% 14

‘s Supply: Costs Gross Profit e. Bay 76% Gross Profit Wall-mart 25% 14

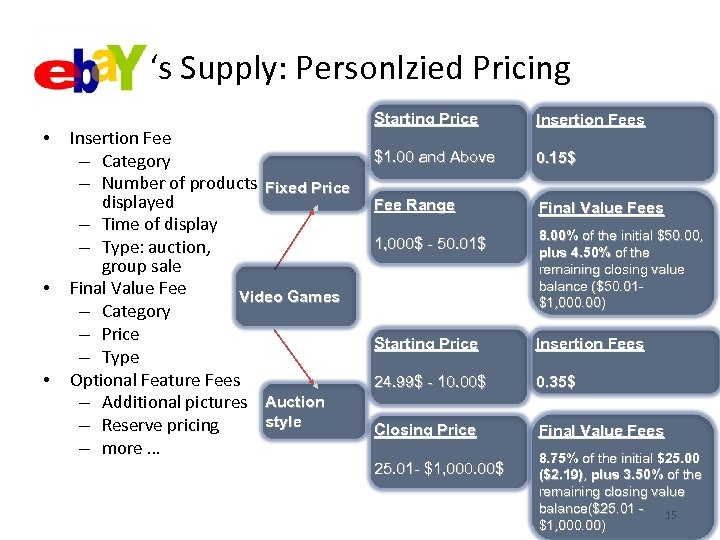

‘s Supply: Personlzied Pricing • • • Insertion Fee – Category – Number of products Fixed Price displayed – Time of display – Type: auction, group sale Final Value Fee Video Games – Category – Price – Type Optional Feature Fees – Additional pictures Auction style – Reserve pricing – more … Starting Price Insertion Fees $1. 00 and Above 0. 15$ Fee Range Final Value Fees 1, 000$ - 50. 01$ 8. 00% of the initial $50. 00, plus 4. 50% of the remaining closing value balance ($50. 01$1, 000. 00) Starting Price Insertion Fees 24. 99$ - 10. 00$ 0. 35$ Closing Price Final Value Fees 25. 01 - $1, 000. 00$ 8. 75% of the initial $25. 00 ($2. 19), plus 3. 50% of the remaining closing value balance($25. 01 - 15 $1, 000. 00)

‘s Supply: Personlzied Pricing • • • Insertion Fee – Category – Number of products Fixed Price displayed – Time of display – Type: auction, group sale Final Value Fee Video Games – Category – Price – Type Optional Feature Fees – Additional pictures Auction style – Reserve pricing – more … Starting Price Insertion Fees $1. 00 and Above 0. 15$ Fee Range Final Value Fees 1, 000$ - 50. 01$ 8. 00% of the initial $50. 00, plus 4. 50% of the remaining closing value balance ($50. 01$1, 000. 00) Starting Price Insertion Fees 24. 99$ - 10. 00$ 0. 35$ Closing Price Final Value Fees 25. 01 - $1, 000. 00$ 8. 75% of the initial $25. 00 ($2. 19), plus 3. 50% of the remaining closing value balance($25. 01 - 15 $1, 000. 00)

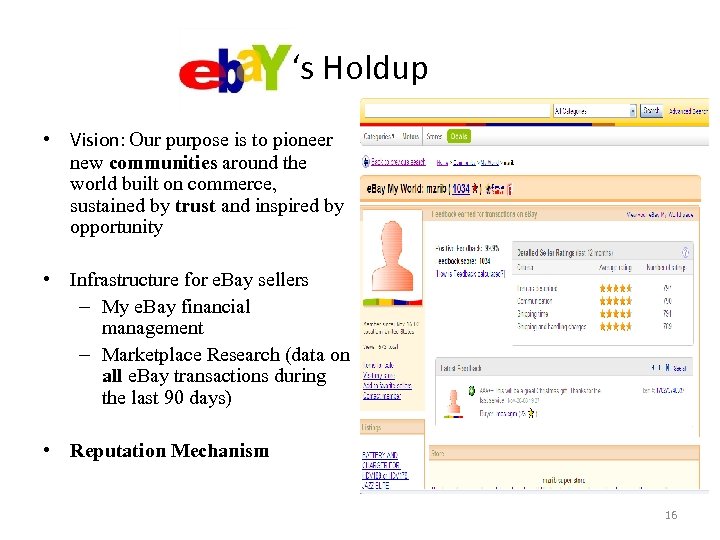

‘s Holdup • Vision: Our purpose is to pioneer new communities around the world built on commerce, sustained by trust and inspired by opportunity • Infrastructure for e. Bay sellers – My e. Bay financial management – Marketplace Research (data on all e. Bay transactions during the last 90 days) • Reputation Mechanism 16

‘s Holdup • Vision: Our purpose is to pioneer new communities around the world built on commerce, sustained by trust and inspired by opportunity • Infrastructure for e. Bay sellers – My e. Bay financial management – Marketplace Research (data on all e. Bay transactions during the last 90 days) • Reputation Mechanism 16

‘s Demand Main Network Effects • • • 39 markets in 27 languages 276 million customers 86 million of them are active 133 million items 60 billion worth of transactions 6 billion feedbacks More Network Effects • Pay. Pal • no payments are accepted from Amazon’s and Google’s checkout services • Skype … • Stub. Hub • Gmarket. kr 17

‘s Demand Main Network Effects • • • 39 markets in 27 languages 276 million customers 86 million of them are active 133 million items 60 billion worth of transactions 6 billion feedbacks More Network Effects • Pay. Pal • no payments are accepted from Amazon’s and Google’s checkout services • Skype … • Stub. Hub • Gmarket. kr 17

More Theory? Recent predictions by Tom Malone

More Theory? Recent predictions by Tom Malone

Bringing The Market Inside, 2004 • Internal electronic commerce reduces political and slow decision making Examples • BP achieved ten-year goals for greenhouse-gases reduction within a year • HP forecasted demand for printers through an internal market for demand estimates • Intel simulated Fab Asset Allocation through an internal future markets 19

Bringing The Market Inside, 2004 • Internal electronic commerce reduces political and slow decision making Examples • BP achieved ten-year goals for greenhouse-gases reduction within a year • HP forecasted demand for printers through an internal market for demand estimates • Intel simulated Fab Asset Allocation through an internal future markets 19

Collective Intelligence, 2010 • • • Google takes the judgments made • by millions of people as they create links to web pages and harnesses • that collective knowledge to produce intelligent answers to the questions we type into the Google • search bar In Wikipedia, thousands of contributors have collectively created the world’s largest • encyclopaedia, with articles of remarkably high quality MIT’s Centre for Collective Intelligence has gathered nearly 250 examples of web-enabled collective intelligence What? • Create • Decide Who? • Hierarchy • Crowd Why? • Money • Love • Glory How? • Collection • Collaboration • Voting • Consensus • Averaging • Prediction Markets • Individual Decisions (Markets & Networks) 20

Collective Intelligence, 2010 • • • Google takes the judgments made • by millions of people as they create links to web pages and harnesses • that collective knowledge to produce intelligent answers to the questions we type into the Google • search bar In Wikipedia, thousands of contributors have collectively created the world’s largest • encyclopaedia, with articles of remarkably high quality MIT’s Centre for Collective Intelligence has gathered nearly 250 examples of web-enabled collective intelligence What? • Create • Decide Who? • Hierarchy • Crowd Why? • Money • Love • Glory How? • Collection • Collaboration • Voting • Consensus • Averaging • Prediction Markets • Individual Decisions (Markets & Networks) 20