d231d3ce2d78cd44956724b136f84a19.ppt

- Количество слайдов: 44

Training for Panel Services Team: Advanced Analytics Jane Tang October 27, 2010

Training for Panel Services Team: Advanced Analytics Jane Tang October 27, 2010

Analytics • Small group: – Jane Tang (Calgary) – Rosanna Mau (Vancouver) – Tanveer Husnani (Toronto) • Handle all of the advanced analytics within VC: anything above and beyond data tables

Analytics • Small group: – Jane Tang (Calgary) – Rosanna Mau (Vancouver) – Tanveer Husnani (Toronto) • Handle all of the advanced analytics within VC: anything above and beyond data tables

How we do it - Up front quote on cost based on available information - Your project is charged for our time only - You get the mark up for analytics - Internal cost: $150/hr, external cost: $250/hr - Consultative process - We work with you and with your client to design the sample and questionnaire, and to find the statistical methods to best answer your research question - We are up front about our methods. There’s no black box. We are happy to provide details on any of the statistical methods we utilize short of giving you the actual code. - We work with you to find the best way to present the results. 3

How we do it - Up front quote on cost based on available information - Your project is charged for our time only - You get the mark up for analytics - Internal cost: $150/hr, external cost: $250/hr - Consultative process - We work with you and with your client to design the sample and questionnaire, and to find the statistical methods to best answer your research question - We are up front about our methods. There’s no black box. We are happy to provide details on any of the statistical methods we utilize short of giving you the actual code. - We work with you to find the best way to present the results. 3

Commonly used advanced analysis techniques: Simple models: - Van Westerndorp Driver analysis: Shapley Value regression Max. Diff TURF & Shapley Value Thurstone case V Segmentation: Clustering & Discriminant Analysis Conjoint Analysis: CBC

Commonly used advanced analysis techniques: Simple models: - Van Westerndorp Driver analysis: Shapley Value regression Max. Diff TURF & Shapley Value Thurstone case V Segmentation: Clustering & Discriminant Analysis Conjoint Analysis: CBC

Van Westerndorp

Van Westerndorp

Van Westerndorp - Overview • Price Sensitivity Meter. – Gauges thresholds and provides a range of acceptable prices. – There is a relationship between price and quality and that consumers are willing to pay more for a higher quality product. – Consumers have ideas about what reasonable price they are willing to pay for a product and that consumers are willing to pay more for a high quality product. – Easy to use. Good for early stage pricing model. – Not in a competitive context. – Recommend sample size: n=150 -200. Minimum: n=100

Van Westerndorp - Overview • Price Sensitivity Meter. – Gauges thresholds and provides a range of acceptable prices. – There is a relationship between price and quality and that consumers are willing to pay more for a higher quality product. – Consumers have ideas about what reasonable price they are willing to pay for a product and that consumers are willing to pay more for a high quality product. – Easy to use. Good for early stage pricing model. – Not in a competitive context. – Recommend sample size: n=150 -200. Minimum: n=100

Van Westerndorp - Questionnaire • Price Sensitivity Meter: 4 questions to the questionnaire. • By aggregating the proportion of people (at each of these prices), we can develop a series of curves that will indicate the range of acceptable prices in the market place. – At what price would you consider the product to be getting expensive, but you would still consider buying it? (EXPENSIVE) – At what price would you consider the product too expensive and you would not consider buying it? (TOO EXPENSIVE) – At what price would you consider the product to be getting inexpensive, and you would consider it to be a bargain? (BARGAIN) – At what price would you consider the product to be so inexpensive that you would doubt its quality and would not consider buying it? (TOO CHEAP)

Van Westerndorp - Questionnaire • Price Sensitivity Meter: 4 questions to the questionnaire. • By aggregating the proportion of people (at each of these prices), we can develop a series of curves that will indicate the range of acceptable prices in the market place. – At what price would you consider the product to be getting expensive, but you would still consider buying it? (EXPENSIVE) – At what price would you consider the product too expensive and you would not consider buying it? (TOO EXPENSIVE) – At what price would you consider the product to be getting inexpensive, and you would consider it to be a bargain? (BARGAIN) – At what price would you consider the product to be so inexpensive that you would doubt its quality and would not consider buying it? (TOO CHEAP)

Van Westerndorp - Questionnaire • • • Newton/Miller/Smith Extension. With the addition of two purchase probability questions (at the BARGAIN and EXPENSIVE price points), it is possible to plot trial and revenue curves. These curves will indicate the price that will stimulate maximum trial and the price that should produce maximum revenue for the company. – At the (expensive price) how likely are you to purchase this product? – At the (bargain price) how likely are you to purchase this product?

Van Westerndorp - Questionnaire • • • Newton/Miller/Smith Extension. With the addition of two purchase probability questions (at the BARGAIN and EXPENSIVE price points), it is possible to plot trial and revenue curves. These curves will indicate the price that will stimulate maximum trial and the price that should produce maximum revenue for the company. – At the (expensive price) how likely are you to purchase this product? – At the (bargain price) how likely are you to purchase this product?

van Westendorp Output - PSM

van Westendorp Output - PSM

van Westendorp Output – Trial & Revenue

van Westendorp Output – Trial & Revenue

TURF & SV

TURF & SV

TURF - Overview • TURF Analysis, (Total Unduplicated Reach & Frequency) – find the best combination of magazines to place ads to achieve the maximum audience reach and frequency of exposure. – the building or extending of product & flavor lines, finding the optimal combination of products/flavors for a fixed number of products in the line. • Typically reach can be maximized by offering all of the potential flavors or options. However, production costs, cannibalism, shelf space, and capacity often prevent this strategy. Decisions need to be made to determine which options will reach or appeal to the largest amount of customers.

TURF - Overview • TURF Analysis, (Total Unduplicated Reach & Frequency) – find the best combination of magazines to place ads to achieve the maximum audience reach and frequency of exposure. – the building or extending of product & flavor lines, finding the optimal combination of products/flavors for a fixed number of products in the line. • Typically reach can be maximized by offering all of the potential flavors or options. However, production costs, cannibalism, shelf space, and capacity often prevent this strategy. Decisions need to be made to determine which options will reach or appeal to the largest amount of customers.

TURF - Overview • Gives good indication of the optimal number of products/flavors that should be included in the line. • Provides solutions to specific marketing questions. – E. g. If I could only market 2 of the 10 new flavors, which 2 should I use? – Typically not presented in a competitive context – While answering product manager’s specific question, it does little to provide strategic information about the product/flavor – how much is this flavor worth? • Flexible data: – Top Box (or top 2 box) purchase interest levels – Sort results

TURF - Overview • Gives good indication of the optimal number of products/flavors that should be included in the line. • Provides solutions to specific marketing questions. – E. g. If I could only market 2 of the 10 new flavors, which 2 should I use? – Typically not presented in a competitive context – While answering product manager’s specific question, it does little to provide strategic information about the product/flavor – how much is this flavor worth? • Flexible data: – Top Box (or top 2 box) purchase interest levels – Sort results

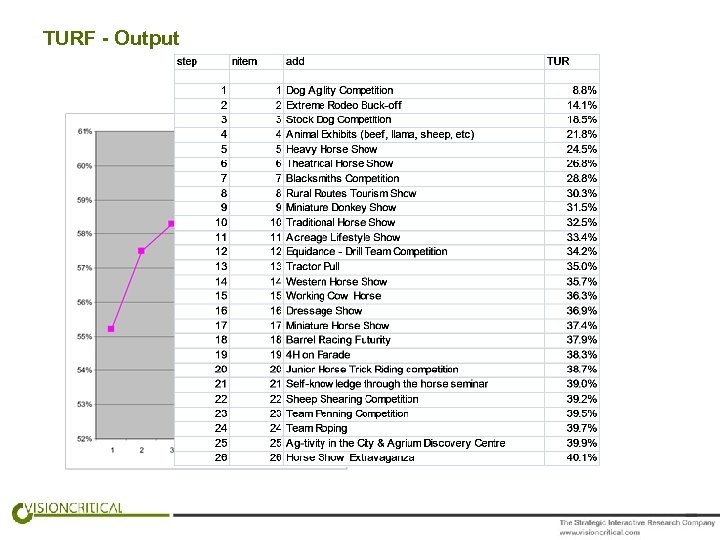

TURF - Output

TURF - Output

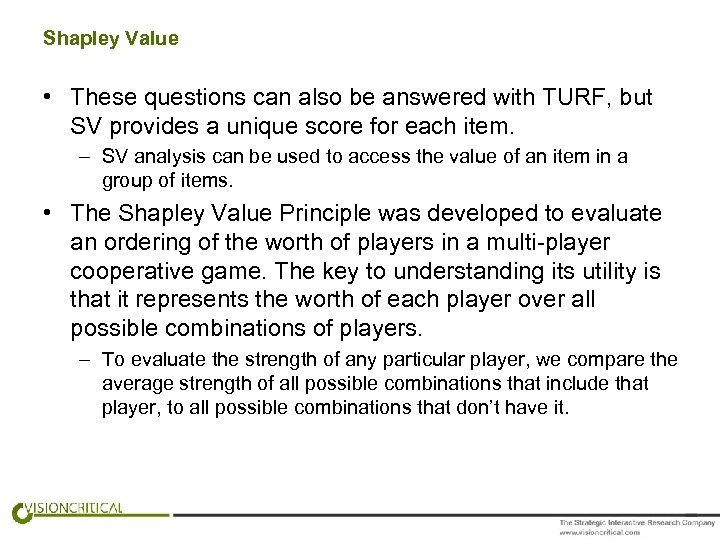

Shapley Value • These questions can also be answered with TURF, but SV provides a unique score for each item. – SV analysis can be used to access the value of an item in a group of items. • The Shapley Value Principle was developed to evaluate an ordering of the worth of players in a multi-player cooperative game. The key to understanding its utility is that it represents the worth of each player over all possible combinations of players. – To evaluate the strength of any particular player, we compare the average strength of all possible combinations that include that player, to all possible combinations that don’t have it.

Shapley Value • These questions can also be answered with TURF, but SV provides a unique score for each item. – SV analysis can be used to access the value of an item in a group of items. • The Shapley Value Principle was developed to evaluate an ordering of the worth of players in a multi-player cooperative game. The key to understanding its utility is that it represents the worth of each player over all possible combinations of players. – To evaluate the strength of any particular player, we compare the average strength of all possible combinations that include that player, to all possible combinations that don’t have it.

Thurstone

Thurstone

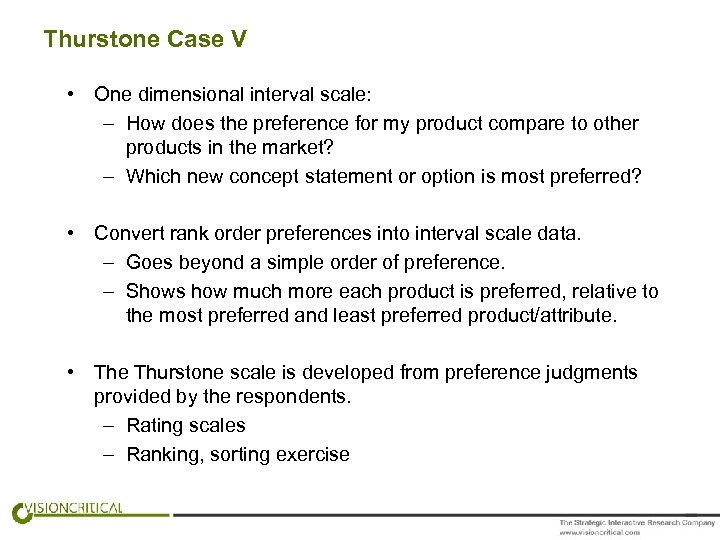

Thurstone Case V • One dimensional interval scale: – How does the preference for my product compare to other products in the market? – Which new concept statement or option is most preferred? • Convert rank order preferences into interval scale data. – Goes beyond a simple order of preference. – Shows how much more each product is preferred, relative to the most preferred and least preferred product/attribute. • The Thurstone scale is developed from preference judgments provided by the respondents. – Rating scales – Ranking, sorting exercise

Thurstone Case V • One dimensional interval scale: – How does the preference for my product compare to other products in the market? – Which new concept statement or option is most preferred? • Convert rank order preferences into interval scale data. – Goes beyond a simple order of preference. – Shows how much more each product is preferred, relative to the most preferred and least preferred product/attribute. • The Thurstone scale is developed from preference judgments provided by the respondents. – Rating scales – Ranking, sorting exercise

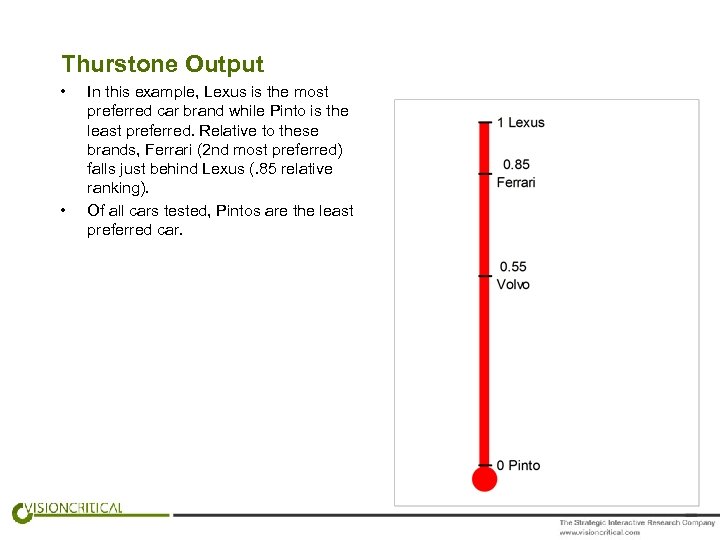

Thurstone Output • • In this example, Lexus is the most preferred car brand while Pinto is the least preferred. Relative to these brands, Ferrari (2 nd most preferred) falls just behind Lexus (. 85 relative ranking). Of all cars tested, Pintos are the least preferred car.

Thurstone Output • • In this example, Lexus is the most preferred car brand while Pinto is the least preferred. Relative to these brands, Ferrari (2 nd most preferred) falls just behind Lexus (. 85 relative ranking). Of all cars tested, Pintos are the least preferred car.

Driver Analysis

Driver Analysis

Why driver analysis? • If we want to know why consumers purchase one product, but not the other – what’s wrong with just asking why? – http: //www. visioncritical. com/blog/dont-ask-why-theanswer-is-not-what-you-think-it-is/ – Stated importance: • Gives good measure if using Max. Diff • Rating scales: – Lack of discrimination: everything is important – Scale usage bias • Cost of entry items/Pro-social biases

Why driver analysis? • If we want to know why consumers purchase one product, but not the other – what’s wrong with just asking why? – http: //www. visioncritical. com/blog/dont-ask-why-theanswer-is-not-what-you-think-it-is/ – Stated importance: • Gives good measure if using Max. Diff • Rating scales: – Lack of discrimination: everything is important – Scale usage bias • Cost of entry items/Pro-social biases

Why Shapley Value Regression? • Driver analysis is used to look for relationships between what people bought and how they feel about what they bought to understand why they bought it. • We still have the same scale usage problems • Rating scales: Scale usage bias • Multicollinearity: – attributes are often measuring the similar concepts – “Halo” effects. E. g. Apple fan boys • Shapley Value regression

Why Shapley Value Regression? • Driver analysis is used to look for relationships between what people bought and how they feel about what they bought to understand why they bought it. • We still have the same scale usage problems • Rating scales: Scale usage bias • Multicollinearity: – attributes are often measuring the similar concepts – “Halo” effects. E. g. Apple fan boys • Shapley Value regression

Why Shapley Value Regression? • The Shapley Value Principle was developed to evaluate an ordering of the worth of players in a multi-player cooperative game. • The key to understanding its utility is that it represents the worth of each player over all possible combinations of players. • In Shapely Value Regression, we extend this to the problem of comparative usefulness of possible drivers, the SV regression assigns a value for each potential drivers calculated over all possible combinations of predictors in regressions. • OLS regression for all possible combinations of explanatory variables. Contribution measured by R-square • http: //www. visioncritical. com/blog/untangling-which-attributes-drivepurchase-multicollinearity-and-the-chocolate-chip-cookie-recipe/

Why Shapley Value Regression? • The Shapley Value Principle was developed to evaluate an ordering of the worth of players in a multi-player cooperative game. • The key to understanding its utility is that it represents the worth of each player over all possible combinations of players. • In Shapely Value Regression, we extend this to the problem of comparative usefulness of possible drivers, the SV regression assigns a value for each potential drivers calculated over all possible combinations of predictors in regressions. • OLS regression for all possible combinations of explanatory variables. Contribution measured by R-square • http: //www. visioncritical. com/blog/untangling-which-attributes-drivepurchase-multicollinearity-and-the-chocolate-chip-cookie-recipe/

Segmentation

Segmentation

Segmentation Overview Background • The segmentation results enable the client to target its product development, positioning, and messaging to the most promising audience, as well as tailoring marketing strategies to enhance appeal across multiple market segments. • The criteria for assessing the practical value of a segmentation scheme include: – Statistical criteria – clear and significant quantitative differences across the segments. – Business value – clear distinctions and linkage regarding key business metrics/actions. – Clarity – segments that are easy to understand to communicate with or about. – Findable– the ability to easily identify and locate segment members.

Segmentation Overview Background • The segmentation results enable the client to target its product development, positioning, and messaging to the most promising audience, as well as tailoring marketing strategies to enhance appeal across multiple market segments. • The criteria for assessing the practical value of a segmentation scheme include: – Statistical criteria – clear and significant quantitative differences across the segments. – Business value – clear distinctions and linkage regarding key business metrics/actions. – Clarity – segments that are easy to understand to communicate with or about. – Findable– the ability to easily identify and locate segment members.

Segmentation • Many different segmentation techniques are in common use in market research, some of which are more suitable for attitudinal data than others. We let the data determine what technique(s) are appropriate for segmentation analysis. • Pre-determined (a priori) – Pre-select criterion variable and segments – Cross-tabs to profile segments on demographics, attitudes; etc. – Discriminant analysis (or CHAID / Cart) to determine the variables that predict segment membership (drive behavior) • Derived – Pre-select basis of segmentation and criterion variable, based on understanding of role product plays in consumer’s life – Factor analysis is conducted to reduce number of attitudinal predictor variables – Cluster analysis is used to group respondents into segments – Cross tabs with significance testing and discriminant function analysis to profile groups

Segmentation • Many different segmentation techniques are in common use in market research, some of which are more suitable for attitudinal data than others. We let the data determine what technique(s) are appropriate for segmentation analysis. • Pre-determined (a priori) – Pre-select criterion variable and segments – Cross-tabs to profile segments on demographics, attitudes; etc. – Discriminant analysis (or CHAID / Cart) to determine the variables that predict segment membership (drive behavior) • Derived – Pre-select basis of segmentation and criterion variable, based on understanding of role product plays in consumer’s life – Factor analysis is conducted to reduce number of attitudinal predictor variables – Cluster analysis is used to group respondents into segments – Cross tabs with significance testing and discriminant function analysis to profile groups

Segmentation • Cluster Analysis – Techniques suitable for scalar-based attitudinal data include Convergent Cluster Analysis (CCA) and hierarchical analysis. – Techniques more suitable for continuous data (e. g. conjoint utility scores, constant sum) include CCA – Technique most suitable for behavioral categorical data is Latent Class segmentation. • Respondents are divided into groups based on their scores on a set of behavioral, attitudinal, psychographic, and demographic variables. – The respondents are segmented into groups where rating differences within a group are minimized and rating differences between groups are maximized. – This results in several groups containing people who are similar in their attitudes and behaviors. Each group forms a market segment.

Segmentation • Cluster Analysis – Techniques suitable for scalar-based attitudinal data include Convergent Cluster Analysis (CCA) and hierarchical analysis. – Techniques more suitable for continuous data (e. g. conjoint utility scores, constant sum) include CCA – Technique most suitable for behavioral categorical data is Latent Class segmentation. • Respondents are divided into groups based on their scores on a set of behavioral, attitudinal, psychographic, and demographic variables. – The respondents are segmented into groups where rating differences within a group are minimized and rating differences between groups are maximized. – This results in several groups containing people who are similar in their attitudes and behaviors. Each group forms a market segment.

Segmentation • Latent class segmentation – Unlike traditional methods, latent class assigns each respondent a probability of belonging to each cluster. Segment membership can be hard coded by assigning individual to the segment with the highest probability. – The Latent class segmentation model also assigns respondents a probability from zero to one of falling into each market segment. If a respondent exhibits characteristics of more than one segment, they will have a positive probability of falling into each one. • Convergent Cluster Analysis: K-Means clustering – A CCA segmentation assigns each respondent to one segment. The probability of segment membership can be determined by using discriminant function analysis.

Segmentation • Latent class segmentation – Unlike traditional methods, latent class assigns each respondent a probability of belonging to each cluster. Segment membership can be hard coded by assigning individual to the segment with the highest probability. – The Latent class segmentation model also assigns respondents a probability from zero to one of falling into each market segment. If a respondent exhibits characteristics of more than one segment, they will have a positive probability of falling into each one. • Convergent Cluster Analysis: K-Means clustering – A CCA segmentation assigns each respondent to one segment. The probability of segment membership can be determined by using discriminant function analysis.

Segmentation Output • A Segmentation produces three types of output: – Segment characteristics (behaviors, attitudes, psychographics, and demographics), – Segment sizes expressed as a percentage of the target market, – Probabilities of each respondent being in each market segment. • There a number of ways we can represent the segmentation output. The most straightforward approach is with simple cross-tabs of the segments by other determining variables in our study. – Correspondence analysis – Discriminant analysis • These diagrams show the relationship of the segments to each other and to other behavioral, attitudinal, psychographic, and demographic variables.

Segmentation Output • A Segmentation produces three types of output: – Segment characteristics (behaviors, attitudes, psychographics, and demographics), – Segment sizes expressed as a percentage of the target market, – Probabilities of each respondent being in each market segment. • There a number of ways we can represent the segmentation output. The most straightforward approach is with simple cross-tabs of the segments by other determining variables in our study. – Correspondence analysis – Discriminant analysis • These diagrams show the relationship of the segments to each other and to other behavioral, attitudinal, psychographic, and demographic variables.

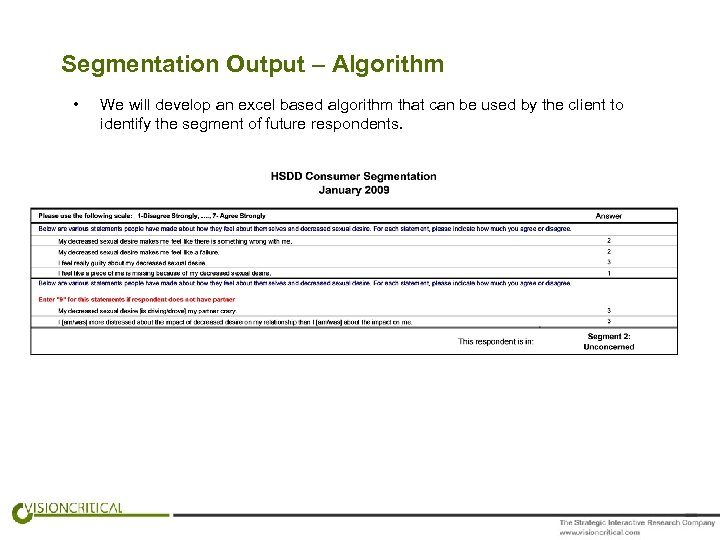

Segmentation Output – Algorithm • We will develop an excel based algorithm that can be used by the client to identify the segment of future respondents.

Segmentation Output – Algorithm • We will develop an excel based algorithm that can be used by the client to identify the segment of future respondents.

Conjoint Analysis: CBC

Conjoint Analysis: CBC

Overview of Conjoint Analysis: • Conjoint analysis is a popular marketing research technique that marketers use to determine what features a new product should have and how it should be priced. • Conjoint analysis became popular because it was a far less expensive (smaller sample size) and more flexible way to address these issues than concept testing. – When there are just too many potential product combinations for concept testing – Need to understand the tradeoff respondents make – Need to understand the competitive context http: //intranet/download/attachments/10027862/Discrete+Choic e+Modeling+vs+Concept+Tests. pdf? version=1

Overview of Conjoint Analysis: • Conjoint analysis is a popular marketing research technique that marketers use to determine what features a new product should have and how it should be priced. • Conjoint analysis became popular because it was a far less expensive (smaller sample size) and more flexible way to address these issues than concept testing. – When there are just too many potential product combinations for concept testing – Need to understand the tradeoff respondents make – Need to understand the competitive context http: //intranet/download/attachments/10027862/Discrete+Choic e+Modeling+vs+Concept+Tests. pdf? version=1

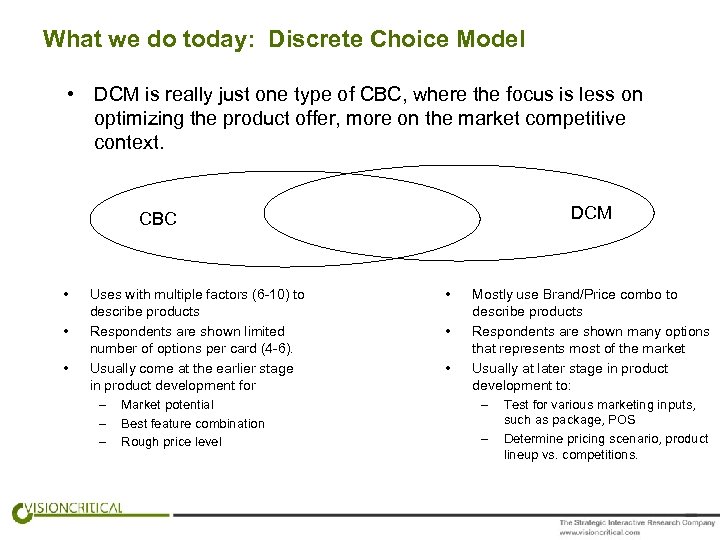

What we do today: Discrete Choice Model • DCM is really just one type of CBC, where the focus is less on optimizing the product offer, more on the market competitive context. DCM CBC • • • Uses with multiple factors (6 -10) to describe products Respondents are shown limited number of options per card (4 -6). Usually come at the earlier stage in product development for – Market potential – Best feature combination – Rough price level • • • Mostly use Brand/Price combo to describe products Respondents are shown many options that represents most of the market Usually at later stage in product development to: – Test for various marketing inputs, – such as package, POS Determine pricing scenario, product lineup vs. competitions.

What we do today: Discrete Choice Model • DCM is really just one type of CBC, where the focus is less on optimizing the product offer, more on the market competitive context. DCM CBC • • • Uses with multiple factors (6 -10) to describe products Respondents are shown limited number of options per card (4 -6). Usually come at the earlier stage in product development for – Market potential – Best feature combination – Rough price level • • • Mostly use Brand/Price combo to describe products Respondents are shown many options that represents most of the market Usually at later stage in product development to: – Test for various marketing inputs, – such as package, POS Determine pricing scenario, product lineup vs. competitions.

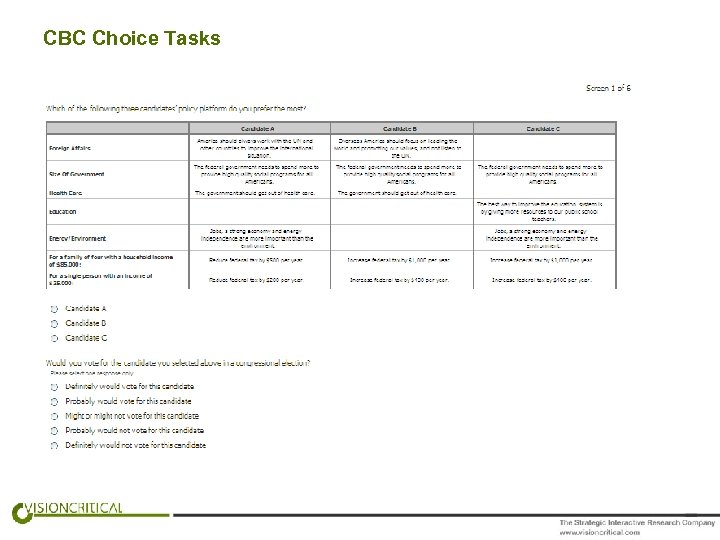

CBC Choice Tasks

CBC Choice Tasks

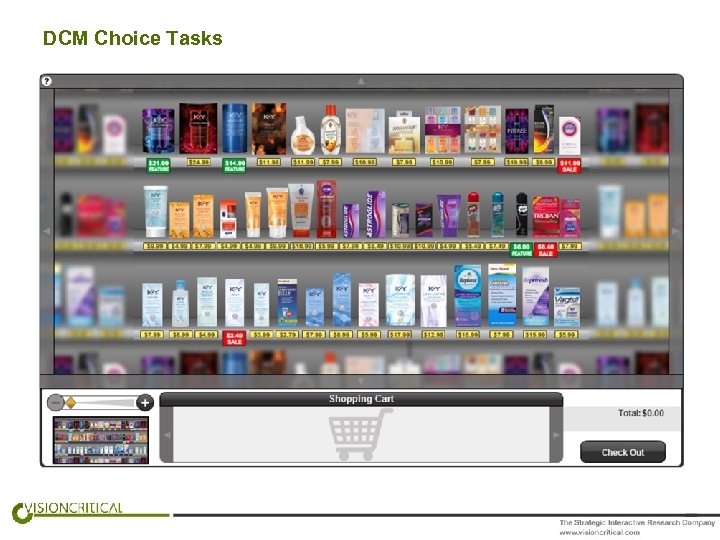

DCM Choice Tasks

DCM Choice Tasks

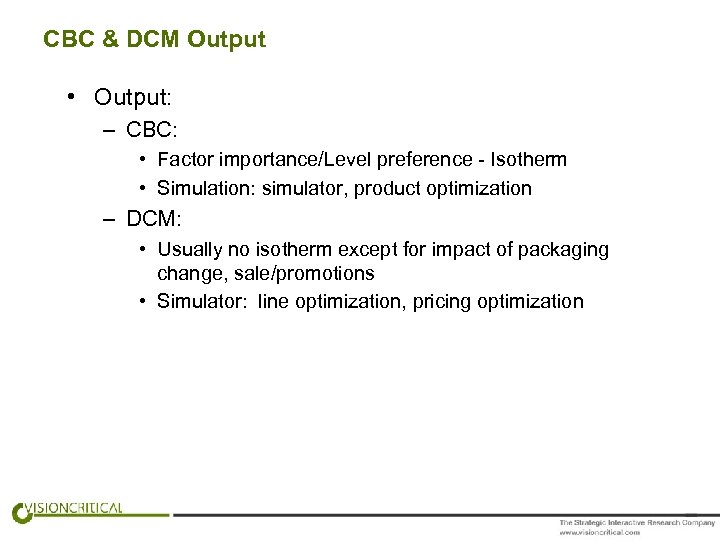

CBC & DCM Output • Output: – CBC: • Factor importance/Level preference - Isotherm • Simulation: simulator, product optimization – DCM: • Usually no isotherm except for impact of packaging change, sale/promotions • Simulator: line optimization, pricing optimization

CBC & DCM Output • Output: – CBC: • Factor importance/Level preference - Isotherm • Simulation: simulator, product optimization – DCM: • Usually no isotherm except for impact of packaging change, sale/promotions • Simulator: line optimization, pricing optimization

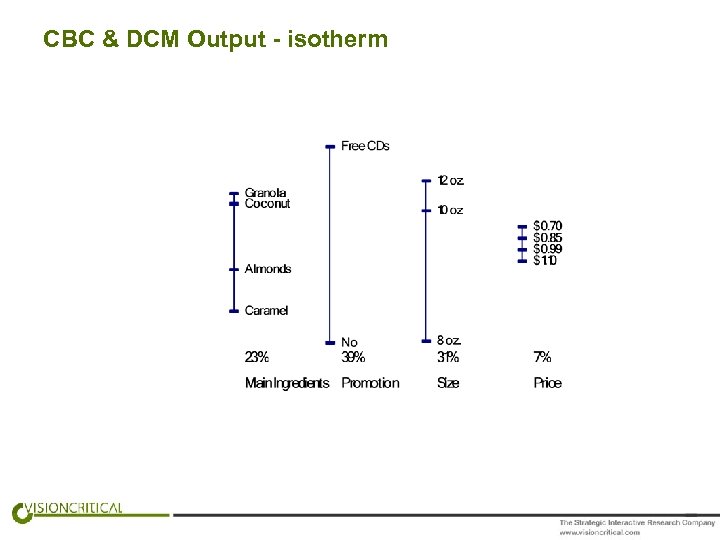

CBC & DCM Output - isotherm

CBC & DCM Output - isotherm

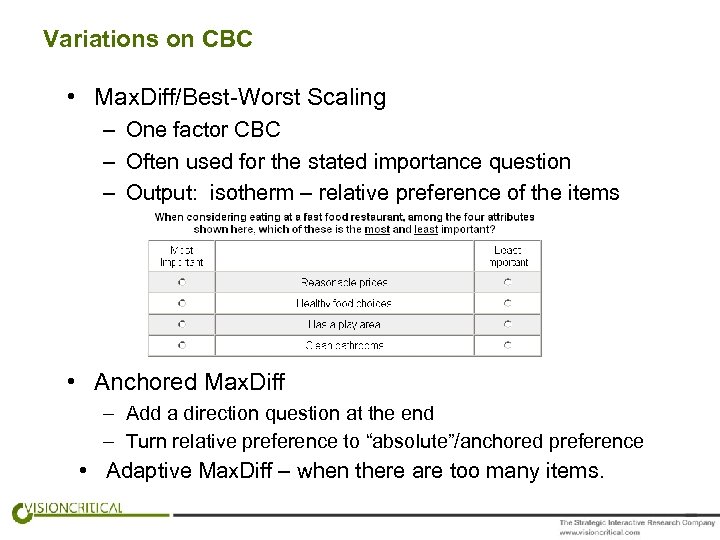

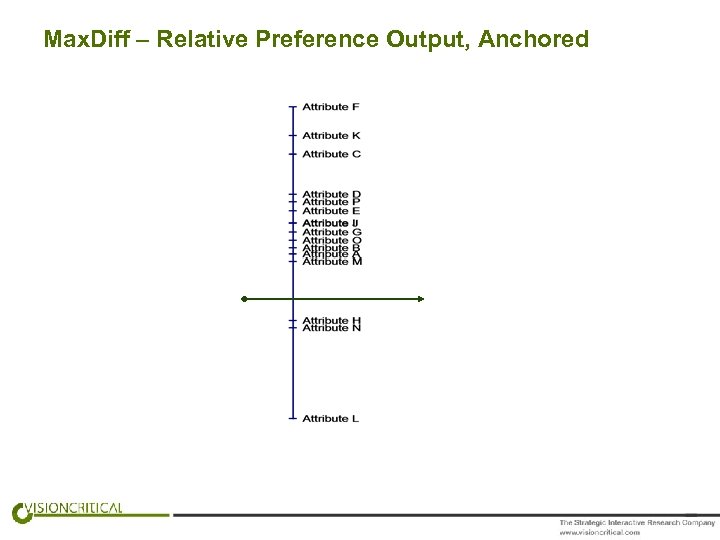

Variations on CBC • Max. Diff/Best-Worst Scaling – One factor CBC – Often used for the stated importance question – Output: isotherm – relative preference of the items • Anchored Max. Diff – Add a direction question at the end – Turn relative preference to “absolute”/anchored preference • Adaptive Max. Diff – when there are too many items.

Variations on CBC • Max. Diff/Best-Worst Scaling – One factor CBC – Often used for the stated importance question – Output: isotherm – relative preference of the items • Anchored Max. Diff – Add a direction question at the end – Turn relative preference to “absolute”/anchored preference • Adaptive Max. Diff – when there are too many items.

Max. Diff – Relative Preference Output, Anchored

Max. Diff – Relative Preference Output, Anchored

Market Share vs. Choice share • Choice shares are NOT market shares – 100% awareness, – 100% availability – “Overstatement” on the new products – “Price is no object” • In our experience, we generally under-estimate price elasticity – Other issues …. Comparison should only be made to the “BASE CASE” – not to current market share

Market Share vs. Choice share • Choice shares are NOT market shares – 100% awareness, – 100% availability – “Overstatement” on the new products – “Price is no object” • In our experience, we generally under-estimate price elasticity – Other issues …. Comparison should only be made to the “BASE CASE” – not to current market share

Forecast • Market Shares are NOT one-time measures. They reflect decisions consumers make over time. – Trial: first purchase - Would you buy it? – Repeat: subsequent purchases – Would you buy it again? • Calibrated choice shares, adjusted for media spend and marketing plans, can be used to assess “Trial”. – We have no information on “repeat”. DCM alone will not give you “forecast” • Bring in the “forecast” expert. • Dr. Lin

Forecast • Market Shares are NOT one-time measures. They reflect decisions consumers make over time. – Trial: first purchase - Would you buy it? – Repeat: subsequent purchases – Would you buy it again? • Calibrated choice shares, adjusted for media spend and marketing plans, can be used to assess “Trial”. – We have no information on “repeat”. DCM alone will not give you “forecast” • Bring in the “forecast” expert. • Dr. Lin

Pricing for CBC – Analytics cost • A standard CBC is about 60 hrs in the PPE, – $9 K internal cost • Analytics will bill you the actual hours only – If it will be more than 60 hrs, you will get notified. – Rosanna bills at a lower rate than Jane, but might take more time, so the cost will be about same in the end. – $15 K external to the client • Your SBU keeps the difference

Pricing for CBC – Analytics cost • A standard CBC is about 60 hrs in the PPE, – $9 K internal cost • Analytics will bill you the actual hours only – If it will be more than 60 hrs, you will get notified. – Rosanna bills at a lower rate than Jane, but might take more time, so the cost will be about same in the end. – $15 K external to the client • Your SBU keeps the difference

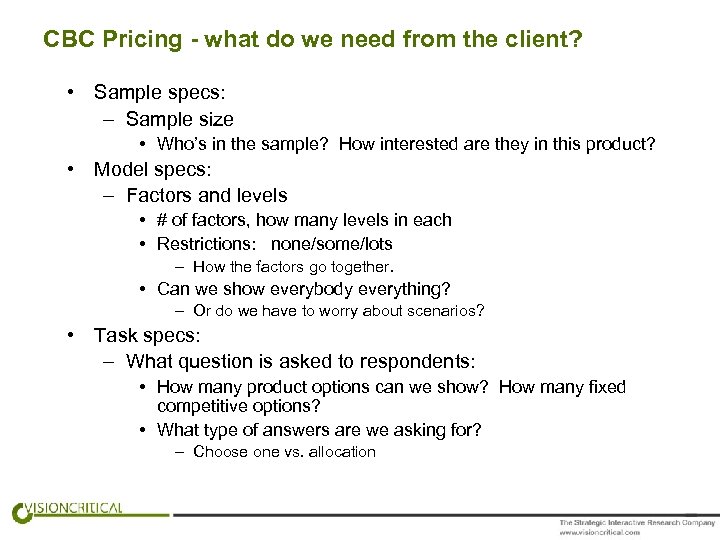

CBC Pricing - what do we need from the client? • Sample specs: – Sample size • Who’s in the sample? How interested are they in this product? • Model specs: – Factors and levels • # of factors, how many levels in each • Restrictions: none/some/lots – How the factors go together. • Can we show everybody everything? – Or do we have to worry about scenarios? • Task specs: – What question is asked to respondents: • How many product options can we show? How many fixed competitive options? • What type of answers are we asking for? – Choose one vs. allocation

CBC Pricing - what do we need from the client? • Sample specs: – Sample size • Who’s in the sample? How interested are they in this product? • Model specs: – Factors and levels • # of factors, how many levels in each • Restrictions: none/some/lots – How the factors go together. • Can we show everybody everything? – Or do we have to worry about scenarios? • Task specs: – What question is asked to respondents: • How many product options can we show? How many fixed competitive options? • What type of answers are we asking for? – Choose one vs. allocation

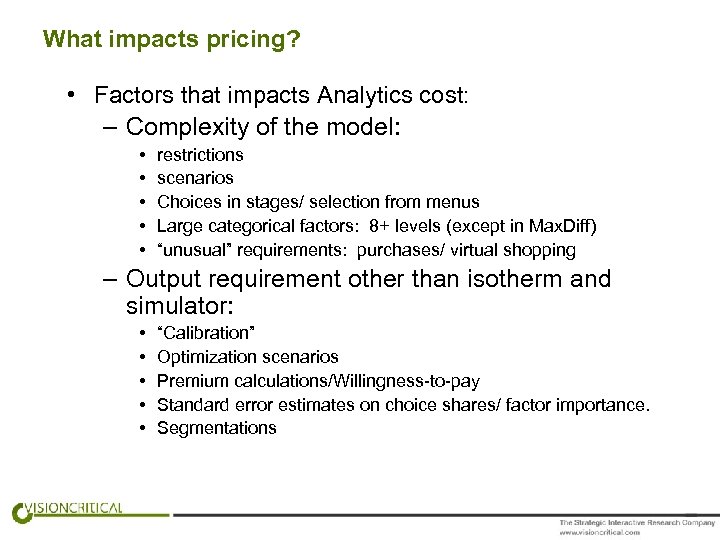

What impacts pricing? • Factors that impacts Analytics cost: – Complexity of the model: • • • restrictions scenarios Choices in stages/ selection from menus Large categorical factors: 8+ levels (except in Max. Diff) “unusual” requirements: purchases/ virtual shopping – Output requirement other than isotherm and simulator: • • • “Calibration” Optimization scenarios Premium calculations/Willingness-to-pay Standard error estimates on choice shares/ factor importance. Segmentations

What impacts pricing? • Factors that impacts Analytics cost: – Complexity of the model: • • • restrictions scenarios Choices in stages/ selection from menus Large categorical factors: 8+ levels (except in Max. Diff) “unusual” requirements: purchases/ virtual shopping – Output requirement other than isotherm and simulator: • • • “Calibration” Optimization scenarios Premium calculations/Willingness-to-pay Standard error estimates on choice shares/ factor importance. Segmentations

http: //intranet/display/research/Analytics jane. tang@visioncritical. com

http: //intranet/display/research/Analytics jane. tang@visioncritical. com