95fcab4f05d1c1d6abfe1a769c8f86c3.ppt

- Количество слайдов: 14

TRAINING AND ASSESSMENT FOR FINANCIAL ADVISERS Presentation to the PAA National Roadshow Michael Frampton Manager – Strategy and Corporate Relations March 2010

TRAINING AND ASSESSMENT FOR FINANCIAL ADVISERS Presentation to the PAA National Roadshow Michael Frampton Manager – Strategy and Corporate Relations March 2010

Getting off on the right foot: Some role clarity… § Securities Commission – Central government regulator – Responsible for the authorisation and supervision of financial advisers § Code Committee – Appointed by the Commissioner for Financial Advisers – Responsible for the development of a Code of Professional Conduct for Authorised Financial Advisers § ETITO – National standards-setting body for the financial services industry – Responsible for the development of national standards and qualifications, and the design and operation of the centrallyadministered assessment system for financial advisers

Getting off on the right foot: Some role clarity… § Securities Commission – Central government regulator – Responsible for the authorisation and supervision of financial advisers § Code Committee – Appointed by the Commissioner for Financial Advisers – Responsible for the development of a Code of Professional Conduct for Authorised Financial Advisers § ETITO – National standards-setting body for the financial services industry – Responsible for the development of national standards and qualifications, and the design and operation of the centrallyadministered assessment system for financial advisers

What qualification do advisers need The Code Committee is proposing that to offer category one financial adviser services or a financial planning service, an AFA must either have: §attained the revised version of the National Certificate in Financial Services [Financial Advice] [Level 5] or §hold one of a number of specifically identified qualifications and / or industry designation. It is proposed that if an adviser holds one of these listed qualifications / designations, only certain unit standards within the revised National Certificate will apply

What qualification do advisers need The Code Committee is proposing that to offer category one financial adviser services or a financial planning service, an AFA must either have: §attained the revised version of the National Certificate in Financial Services [Financial Advice] [Level 5] or §hold one of a number of specifically identified qualifications and / or industry designation. It is proposed that if an adviser holds one of these listed qualifications / designations, only certain unit standards within the revised National Certificate will apply

![National Certificate in Financial Services [Financial Advice] [Level 5] § Basis of Code Committee National Certificate in Financial Services [Financial Advice] [Level 5] § Basis of Code Committee](https://present5.com/presentation/95fcab4f05d1c1d6abfe1a769c8f86c3/image-4.jpg) National Certificate in Financial Services [Financial Advice] [Level 5] § Basis of Code Committee proposal for minimum competence requirement for authorised financial advisers § Is for people who: – give personalised and specific advice based on needs analysis of a wide range of data – determine appropriate methods, make recommendations for financial solutions and lead the client based on this analysis – have full responsibility for the nature, quantity and quality of outcomes – possess a broad knowledge base with substantial depth in some areas – who work for the client § These advisers may specialise in investment advice, insurance advice, and / or residential property lending advice

National Certificate in Financial Services [Financial Advice] [Level 5] § Basis of Code Committee proposal for minimum competence requirement for authorised financial advisers § Is for people who: – give personalised and specific advice based on needs analysis of a wide range of data – determine appropriate methods, make recommendations for financial solutions and lead the client based on this analysis – have full responsibility for the nature, quantity and quality of outcomes – possess a broad knowledge base with substantial depth in some areas – who work for the client § These advisers may specialise in investment advice, insurance advice, and / or residential property lending advice

![The assessment system Standard Set Capstone[1] # of unit Form of Assessment standards A The assessment system Standard Set Capstone[1] # of unit Form of Assessment standards A](https://present5.com/presentation/95fcab4f05d1c1d6abfe1a769c8f86c3/image-5.jpg) The assessment system Standard Set Capstone[1] # of unit Form of Assessment standards A Core Knowledge No 3 Supervised online examination and workplace assessment via ETITO, or training provider B Knowledge of Code and Law Yes 1 Supervised online examination via ETITO only C Professional Practice Yes 4 Presentation of a portfolio of evidence supported by a competency interview via ETITO only [ETITO or ETITO DAO] D Investment Advice, or No 2 Supervised online examination and workplace assessment via ETITO, or training provider E Insurance Advice, or No 2 of 4 Residential Property Lending No 2 2 or 3 supervised online examinations and workplace assessment via ETITO, or training provider Supervised online examination and workplace assessment via ETITO, or training provider AND ONE of the following: [1] Capstone standards are capable of assessment only by ETITO

The assessment system Standard Set Capstone[1] # of unit Form of Assessment standards A Core Knowledge No 3 Supervised online examination and workplace assessment via ETITO, or training provider B Knowledge of Code and Law Yes 1 Supervised online examination via ETITO only C Professional Practice Yes 4 Presentation of a portfolio of evidence supported by a competency interview via ETITO only [ETITO or ETITO DAO] D Investment Advice, or No 2 Supervised online examination and workplace assessment via ETITO, or training provider E Insurance Advice, or No 2 of 4 Residential Property Lending No 2 2 or 3 supervised online examinations and workplace assessment via ETITO, or training provider Supervised online examination and workplace assessment via ETITO, or training provider AND ONE of the following: [1] Capstone standards are capable of assessment only by ETITO

Delegated Assessment Organisation model § The DAO model will form part of ETITO’s centrally-administered system for workplace assessment. § DAO licensing is available to: – Employers with employees and nominated agents – Industry associations – Accredited Training providers with enrolled trainees. § DAO status permits an organisation to conduct assessment for their employees / nominated agents / members / trainees to the workplace practice standards contained within Standard Set C, AND the workplace evidence component of standards contained within Standard Sets A, D and E of the Code Committee’s proposal. § PAA is actively considering DAO status on your behalf

Delegated Assessment Organisation model § The DAO model will form part of ETITO’s centrally-administered system for workplace assessment. § DAO licensing is available to: – Employers with employees and nominated agents – Industry associations – Accredited Training providers with enrolled trainees. § DAO status permits an organisation to conduct assessment for their employees / nominated agents / members / trainees to the workplace practice standards contained within Standard Set C, AND the workplace evidence component of standards contained within Standard Sets A, D and E of the Code Committee’s proposal. § PAA is actively considering DAO status on your behalf

Training provision § The current accredited training providers for the National Certificate in Financial Services [Financial Advice] [Level 5] are: – The Open Polytechnic of New Zealand – Adviserlink Ltd – Strategi § These providers are able to provide: – training for all unit standards contained in Standard Sets A, B, C, D and E; and – assessment against Standard Sets A, D and E § A number of other organisations are working towards accreditation § ETITO is actively working to ensure a range of quality training provision is available to financial advisers in both modular and full-course form

Training provision § The current accredited training providers for the National Certificate in Financial Services [Financial Advice] [Level 5] are: – The Open Polytechnic of New Zealand – Adviserlink Ltd – Strategi § These providers are able to provide: – training for all unit standards contained in Standard Sets A, B, C, D and E; and – assessment against Standard Sets A, D and E § A number of other organisations are working towards accreditation § ETITO is actively working to ensure a range of quality training provision is available to financial advisers in both modular and full-course form

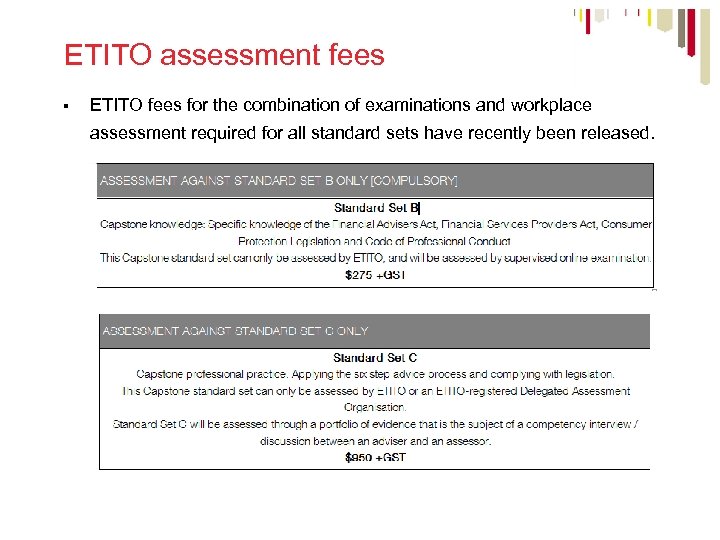

ETITO assessment fees § ETITO fees for the combination of examinations and workplace assessment required for all standard sets have recently been released.

ETITO assessment fees § ETITO fees for the combination of examinations and workplace assessment required for all standard sets have recently been released.

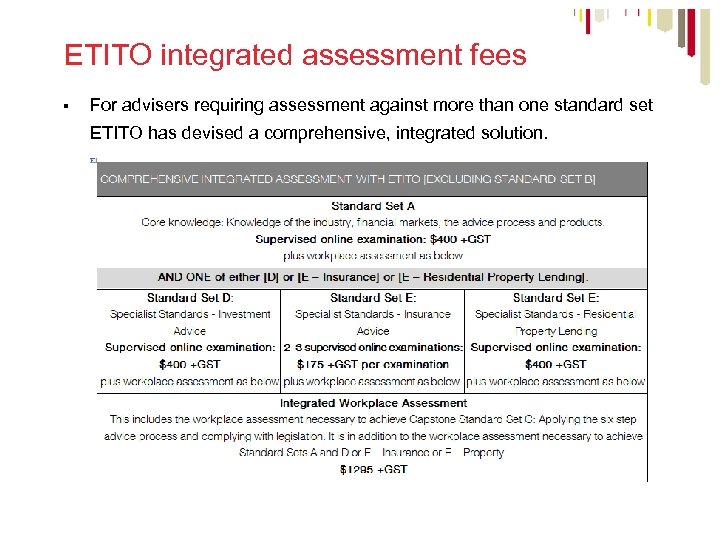

ETITO integrated assessment fees § For advisers requiring assessment against more than one standard set ETITO has devised a comprehensive, integrated solution.

ETITO integrated assessment fees § For advisers requiring assessment against more than one standard set ETITO has devised a comprehensive, integrated solution.

The self-evaluation tool § Use the self-evaluation tool at www. afacompetence. org. nz § Provides financial advisers with an indication of any current knowledge and / or skills gaps § Covers all unit standards proposed by the Code Committee [including residential property lending], excluding Standard Set B § The profile report will help determine: – whethere are unit standards for which advisers may need to undertake formal training prior to undertaking assessment; – whethere are unit standards for which advisers may consider undertaking self-directed study, reviewing their practice, and / or speaking with a practice mentor prior to undertaking assessment; or – whether the advisers' knowledge and skills place them in a good position to prepare for assessment, where they will be required to produce evidence of their competence against each of the performance outcomes contained within each of the unit standards.

The self-evaluation tool § Use the self-evaluation tool at www. afacompetence. org. nz § Provides financial advisers with an indication of any current knowledge and / or skills gaps § Covers all unit standards proposed by the Code Committee [including residential property lending], excluding Standard Set B § The profile report will help determine: – whethere are unit standards for which advisers may need to undertake formal training prior to undertaking assessment; – whethere are unit standards for which advisers may consider undertaking self-directed study, reviewing their practice, and / or speaking with a practice mentor prior to undertaking assessment; or – whether the advisers' knowledge and skills place them in a good position to prepare for assessment, where they will be required to produce evidence of their competence against each of the performance outcomes contained within each of the unit standards.

What should advisers be doing now? § Familiarise yourself with the unit standards contained within the Code Committee Competence Proposal § Use the self-evaluation tool at www. afacompetence. org. nz § Review the services of a training provider if your self-evaluation tool results suggest that you need to consider the purchase of training interventions § Review your business practice, undertake some self-directed study or speak with a practice mentor if your self-evaluation tool results suggest that you should consider doing so § Subscribe to the RSS Feed on the ETITO website to remain informed about assessment system developments § Review the draft Code when it is released by the Code Committee on 31 March. § Participate in the Code Committee’s consultation process

What should advisers be doing now? § Familiarise yourself with the unit standards contained within the Code Committee Competence Proposal § Use the self-evaluation tool at www. afacompetence. org. nz § Review the services of a training provider if your self-evaluation tool results suggest that you need to consider the purchase of training interventions § Review your business practice, undertake some self-directed study or speak with a practice mentor if your self-evaluation tool results suggest that you should consider doing so § Subscribe to the RSS Feed on the ETITO website to remain informed about assessment system developments § Review the draft Code when it is released by the Code Committee on 31 March. § Participate in the Code Committee’s consultation process

Timeline* § Today – Self-evaluation tool available for advisers to ascertain competence gaps – Accredited providers available to deliver training to close identified training gaps § Mid-April 2010** – ETITO booking engine opens for assessment reservations § 01 June 2010 – ETITO assessment regime commences [except Standard Set B] – DAO organisations commence operation * Timelines are indicative only ** Revised timeframe

Timeline* § Today – Self-evaluation tool available for advisers to ascertain competence gaps – Accredited providers available to deliver training to close identified training gaps § Mid-April 2010** – ETITO booking engine opens for assessment reservations § 01 June 2010 – ETITO assessment regime commences [except Standard Set B] – DAO organisations commence operation * Timelines are indicative only ** Revised timeframe

QUESTIONS

QUESTIONS

TRAINING AND ASSESSMENT FOR FINANCIAL ADVISERS Presentation to the PAA National Roadshow Michael Frampton Manager – Strategy and Corporate Relations March 2010

TRAINING AND ASSESSMENT FOR FINANCIAL ADVISERS Presentation to the PAA National Roadshow Michael Frampton Manager – Strategy and Corporate Relations March 2010