54fdc2173c3bc3c3f0c61ff95468804f.ppt

- Количество слайдов: 20

Trading on Margin Concepts and illustrations

Objective Understand how margin accounts operate

Outline • Glossary • On short selling • Purchasing securities on margin • Selling short securities on margin • Aggregate margin trading

Glossary Margin Account opened with a broker for the purpose of trading securities. The broker usually lends part of the funds. Street Name Securities are held in the name of the street (that is, the broker) although they really belong to the investor. Margin purchase Purchase in which part of the funds are provided through a loan by the broker. Margin Requirement The minimum percentage of equity investors have to maintain (another measure of leverage). MR = Account’s equity / Market value of securities Short Sale A sell transaction in which the seller does not own the security yet.

Margin Purchase The margin requirement for a long position MRL = Value of account's equity / Market value of long position

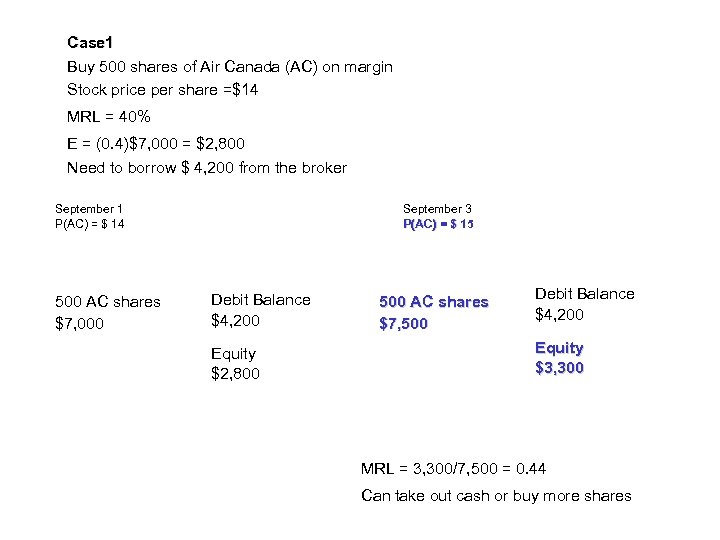

Case 1 Buy 500 shares of Air Canada (AC) on margin Stock price per share =$14 MRL = 40% E = (0. 4)$7, 000 = $2, 800 Need to borrow $ 4, 200 from the broker September 1 P(AC) = $ 14 500 AC shares $7, 000 September 3 P(AC) = $ 15 Debit Balance $4, 200 Equity $2, 800 500 AC shares $7, 500 Debit Balance $4, 200 Equity $3, 300 MRL = 3, 300/7, 500 = 0. 44 Can take out cash or buy more shares

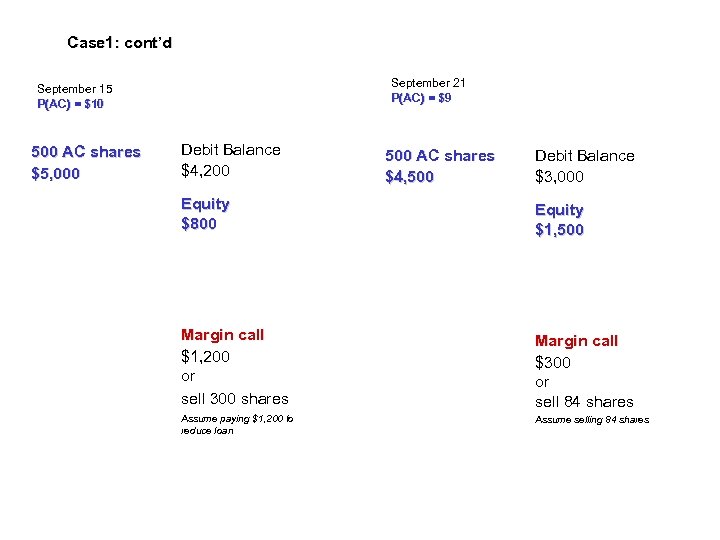

Case 1: cont’d September 21 P(AC) = $9 September 15 P(AC) = $10 500 AC shares $5, 000 Debit Balance $4, 200 500 AC shares $4, 500 Debit Balance $3, 000 Equity $800 Equity $1, 500 Margin call $1, 200 or sell 300 shares Margin call $300 or sell 84 shares Assume paying $1, 200 to reduce loan Assume selling 84 shares

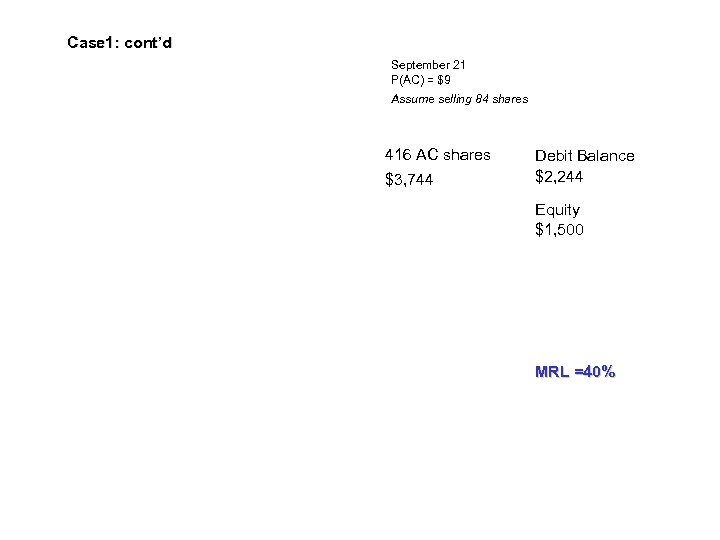

Case 1: cont’d September 21 P(AC) = $9 Assume selling 84 shares 416 AC shares $3, 744 Debit Balance $2, 244 Equity $1, 500 MRL =40%

Margin Purchase: Comments Change in market value of stock Change in the value of equity When market prices go up, the degree of leverage decreases

Short Sale on Margin The margin requirement for a short position MRS = Value of account's equity / Market value of shorted securities

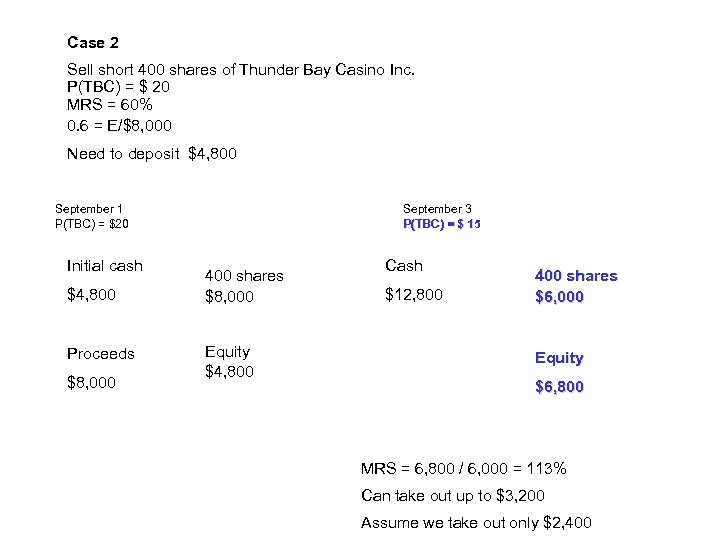

Case 2 Sell short 400 shares of Thunder Bay Casino Inc. P(TBC) = $ 20 MRS = 60% 0. 6 = E/$8, 000 Need to deposit $4, 800 September 1 P(TBC) = $20 Initial cash $4, 800 Proceeds $8, 000 September 3 P(TBC) = $ 15 400 shares $8, 000 Equity $4, 800 Cash $12, 800 400 shares $6, 000 Equity $6, 800 MRS = 6, 800 / 6, 000 = 113% Can take out up to $3, 200 Assume we take out only $2, 400

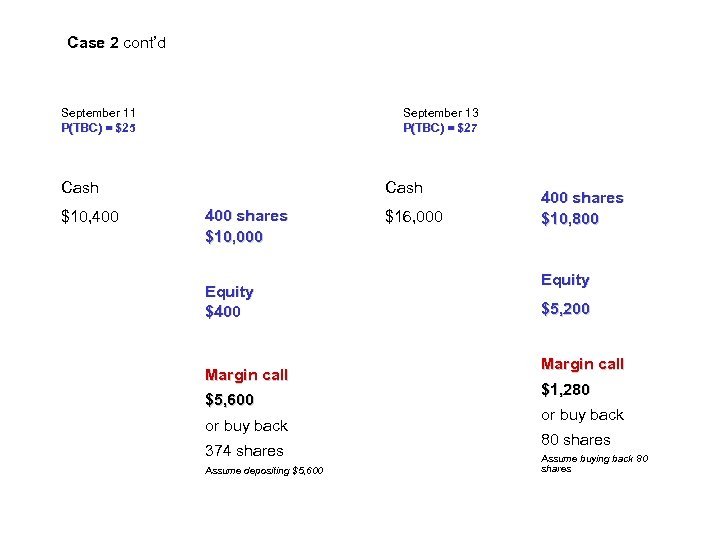

Case 2 cont’d Case 2 September 11 P(TBC) = $25 September 13 P(TBC) = $27 Cash $10, 400 Cash 400 shares $10, 000 Equity $400 Margin call $5, 600 or buy back 374 shares Assume depositing $5, 600 $16, 000 400 shares $10, 800 Equity $5, 200 Margin call $1, 280 or buy back 80 shares Assume buying back 80 shares

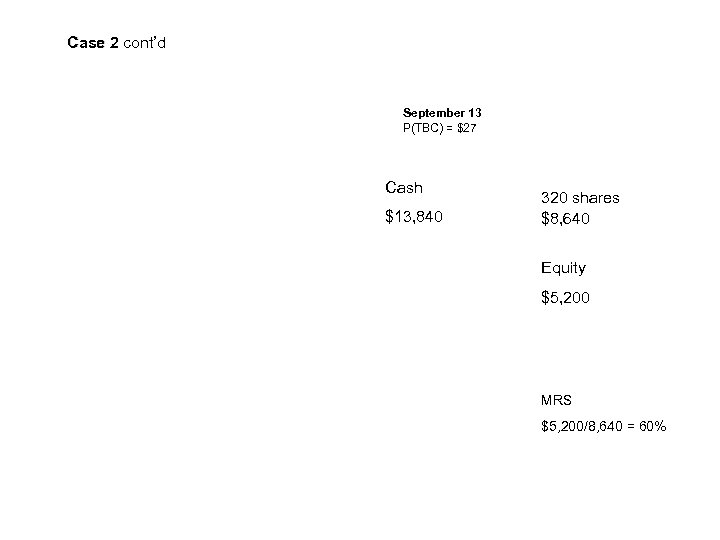

Case 2 cont’d Case 2 September 13 P(TBC) = $27 Cash $13, 840 320 shares $8, 640 Equity $5, 200 MRS $5, 200/8, 640 = 60%

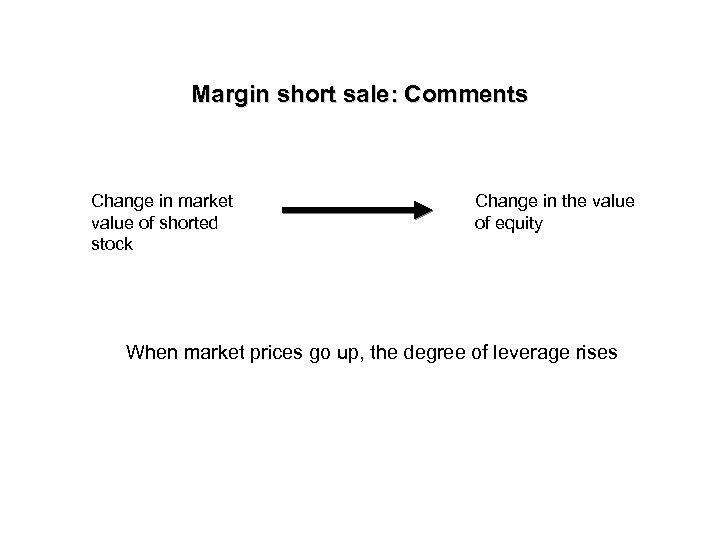

Margin short sale: Comments Change in market value of shorted stock Change in the value of equity When market prices go up, the degree of leverage rises

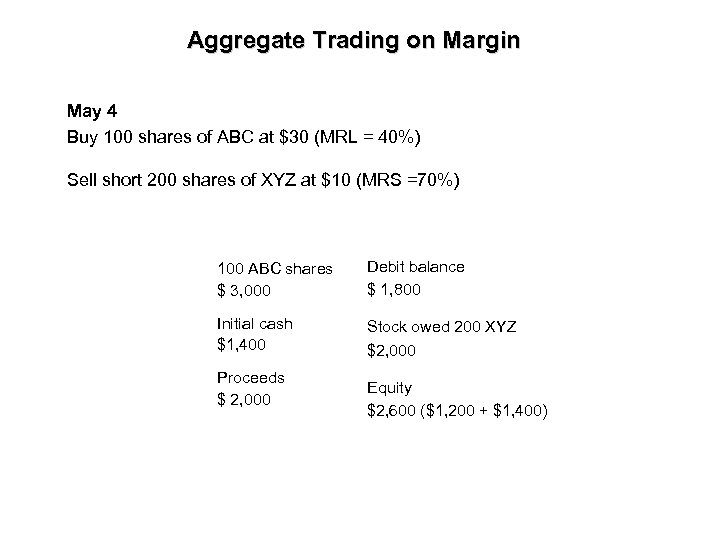

Aggregate Trading on Margin May 4 Buy 100 shares of ABC at $30 (MRL = 40%) Sell short 200 shares of XYZ at $10 (MRS =70%) 100 ABC shares $ 3, 000 Debit balance $ 1, 800 Initial cash $1, 400 Stock owed 200 XYZ $2, 000 Proceeds $ 2, 000 Equity $2, 600 ($1, 200 + $1, 400)

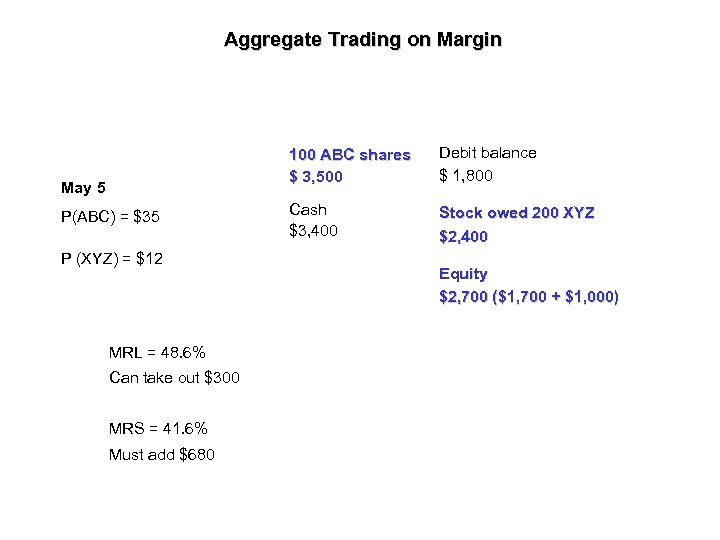

Aggregate Trading on Margin 100 ABC shares $ 3, 500 May 5 P(ABC) = $35 P (XYZ) = $12 MRL = 48. 6% Can take out $300 MRS = 41. 6% Must add $680 Debit balance $ 1, 800 Cash $3, 400 Stock owed 200 XYZ $2, 400 Equity $2, 700 ($1, 700 + $1, 000)

What to do? Add cash, or Buy back XYZ shares, or Sell ABC shares

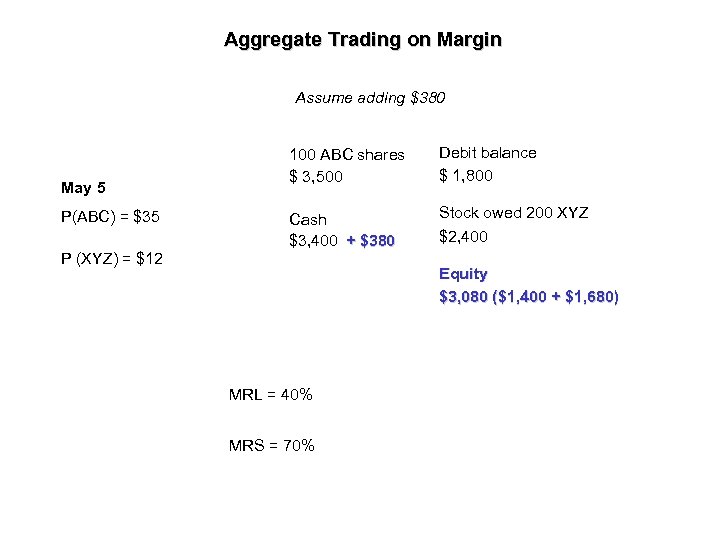

Aggregate Trading on Margin Assume adding $380 May 5 P(ABC) = $35 P (XYZ) = $12 100 ABC shares $ 3, 500 Debit balance $ 1, 800 Cash $3, 400 + $380 Stock owed 200 XYZ $2, 400 Equity $3, 080 ($1, 400 + $1, 680) MRL = 40% MRS = 70%

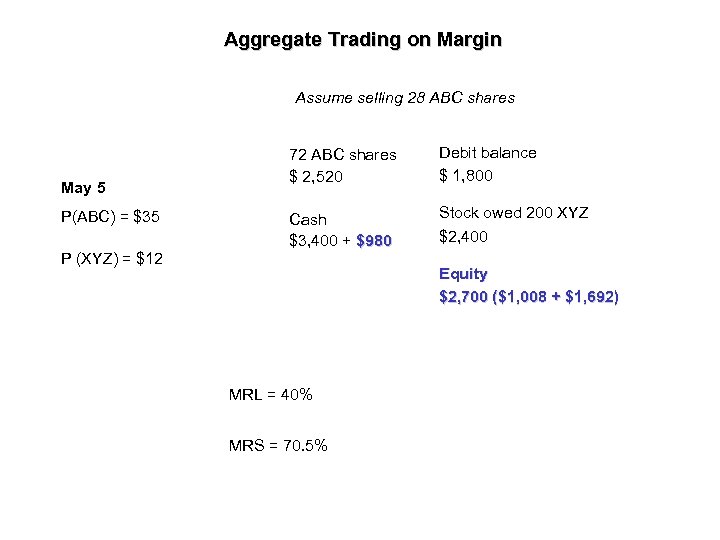

Aggregate Trading on Margin Assume selling 28 ABC shares May 5 P(ABC) = $35 P (XYZ) = $12 72 ABC shares $ 2, 520 Debit balance $ 1, 800 Cash $3, 400 + $980 Stock owed 200 XYZ $2, 400 Equity $2, 700 ($1, 008 + $1, 692) MRL = 40% MRS = 70. 5%

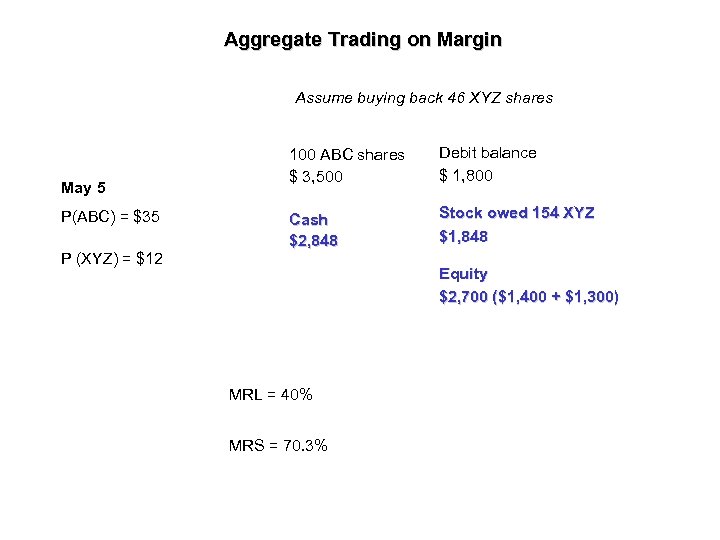

Aggregate Trading on Margin Assume buying back 46 XYZ shares May 5 P(ABC) = $35 P (XYZ) = $12 100 ABC shares $ 3, 500 Debit balance $ 1, 800 Cash $2, 848 Stock owed 154 XYZ $1, 848 Equity $2, 700 ($1, 400 + $1, 300) MRL = 40% MRS = 70. 3%

54fdc2173c3bc3c3f0c61ff95468804f.ppt