IER_Topic #3.ppt

- Количество слайдов: 35

Trade policy. Barriers. International Economic Relation Topic 3

Issues to discuss q What are the effects of various trade policy instruments? n Who will benefit and who will lose from these trade policy instruments? q What are the costs and benefits of protection? n Will q the benefits outweigh the costs? What should a nation’s trade policy be? n For example, should the United States use a tariff or an import quota to protect its automobile industry against competition from Japan and South Korea?

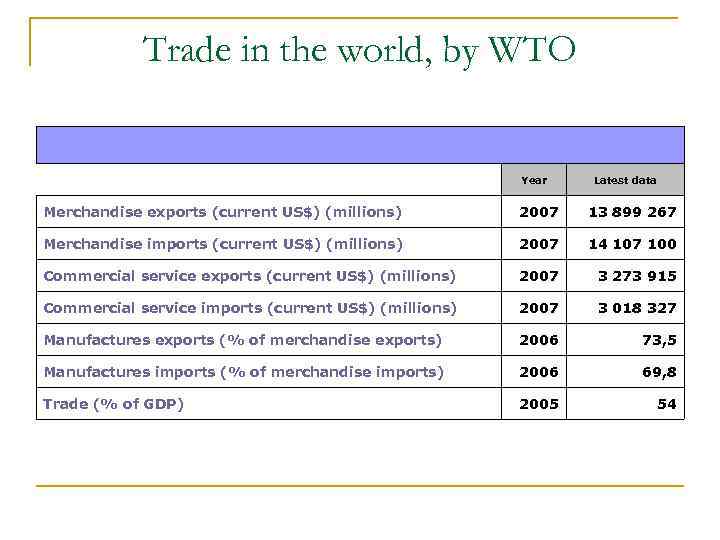

Trade in the world, by WTO Year Latest data Merchandise exports (current US$) (millions) 2007 13 899 267 Merchandise imports (current US$) (millions) 2007 14 107 100 Commercial service exports (current US$) (millions) 2007 3 273 915 Commercial service imports (current US$) (millions) 2007 3 018 327 Manufactures exports (% of merchandise exports) 2006 73, 5 Manufactures imports (% of merchandise imports) 2006 69, 8 Trade (% of GDP) 2005 54

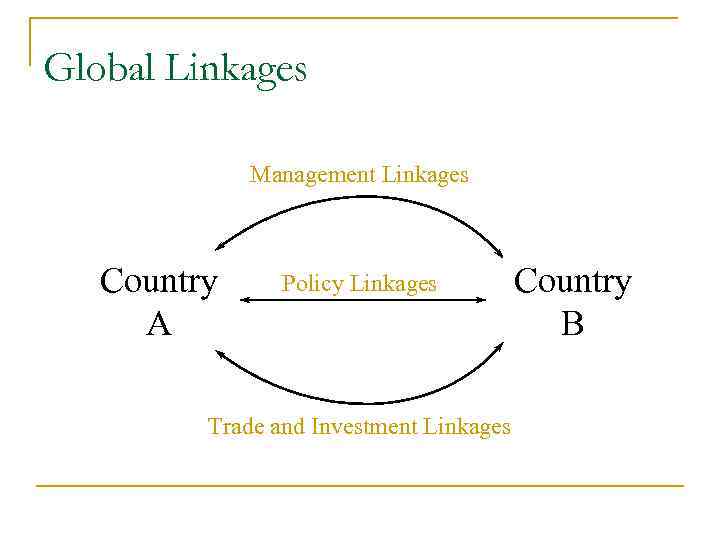

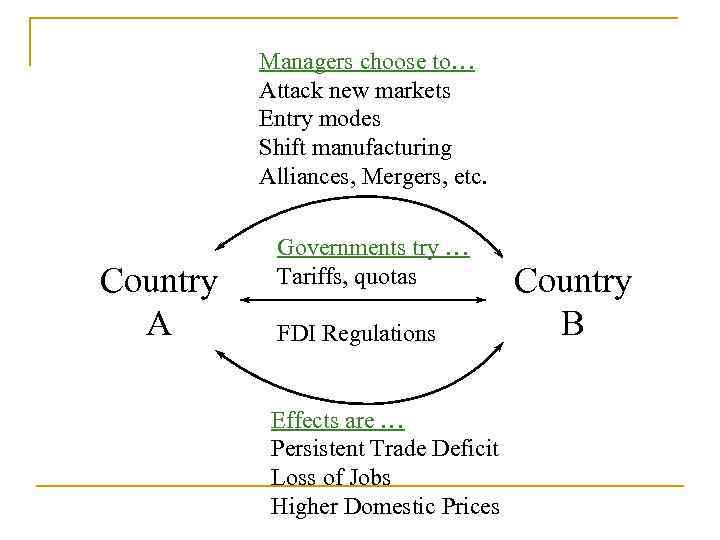

Global Linkages Management Linkages Country A Policy Linkages Trade and Investment Linkages Country B

Managers choose to… Attack new markets Entry modes Shift manufacturing Alliances, Mergers, etc. Country A Governments try … Tariffs, quotas FDI Regulations Effects are … Persistent Trade Deficit Loss of Jobs Higher Domestic Prices Country B

Definition of Trade Barriers n Government laws, policies, or practices that either: Protect domestic products from competition q Artificially stimulate exports of particular domestic products q

Protection: Instruments of Public Policy Tariff (Taxes) n Quotas (quantity restrictions) n Non-tariff barriers (Product standards, voluntary restraints). n

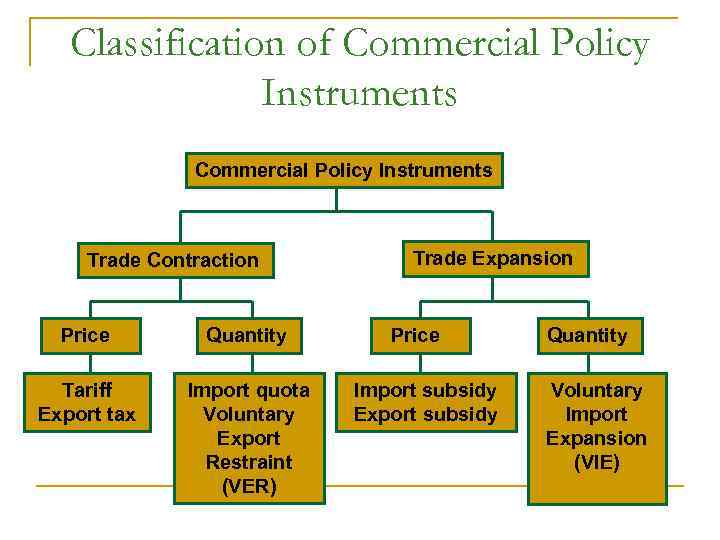

Classification of Commercial Policy Instruments Trade Contraction Price Quantity Tariff Export tax Import quota Voluntary Export Restraint (VER) Trade Expansion Price Import subsidy Export subsidy Quantity Voluntary Import Expansion (VIE)

Tariffs classification n Specific tariffs q Taxes that are levied as a fixed charge for each unit of goods imported § Example: A specific tariff of $10 on each imported bicycle with an international price of $100 means that customs officials collect the fixed sum of $10. n Ad valorem tariffs q Taxes that are levied as a fraction of the value of the imported goods § Example: A 20% ad valorem tariff on bicycles generates a $20 payment on each $100 imported bicycle. q A compound duty (tariff) is a combination of an ad valorem and a specific tariff.

Nontariff bariers q Modern governments usually prefer to protect domestic industries through a variety of nontariff barriers, such as: n Import q. Limit n Export q. Limit quotas the quantity of imports restraints the quantity of exports

Overt Policy Alternatives n n Restrict Imports (tariffs, quotas, VERs) Restrict FDI q q n n Incoming (F/X controls) Outgoing (tax code) Restrict Exports (Do. D restrictive munitions) Export Promotion (subsidies, tax credits) Import Promotion (tax credits, favors) FDI Incentives (subsidies for infrastructure, training & development, market access) n Preferential Govt. Procurement

Basic Tariff Analysis n Useful definitions: q q The terms of trade is the relative price of the exportable good expressed in units of the importable good. A small country is a country that cannot affect its terms of trade no matter how much it trades with the rest of the world. Consumer Surplus Producer Surplus

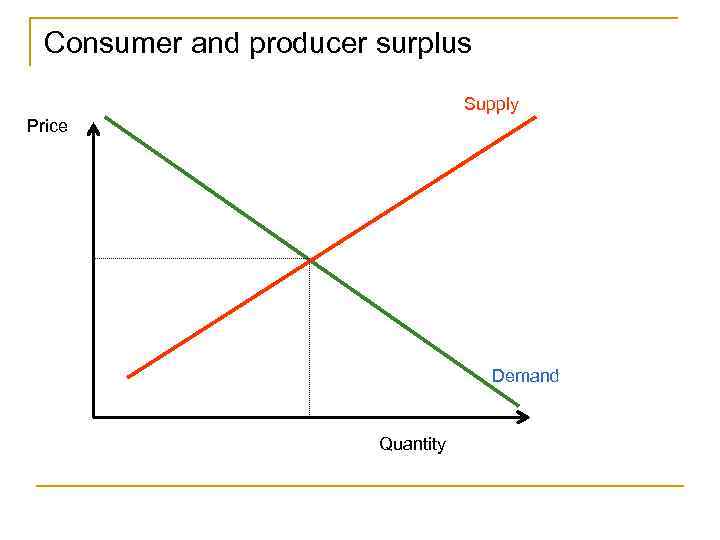

Consumer and producer surplus Supply Price Demand Quantity

Consumer and producer surplus n n Consumer surplus is the difference between what consumers are willing to pay for an additional unit of a good or service and it’s market price. Producer surplus is the difference between what producers are willing to accept for an additional unit of a good or service and its market price.

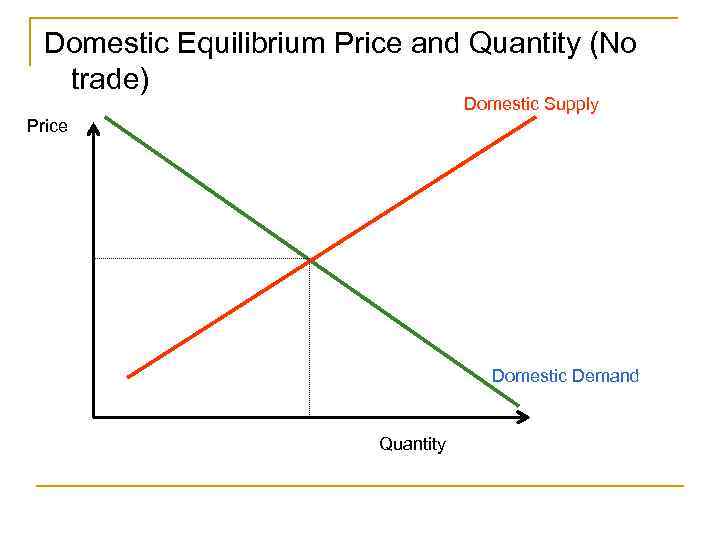

Effect of Tariff on Value We will assume the country is small relative to the rest of the world. If there was no trade the domestic supply and demand would look like:

Domestic Equilibrium Price and Quantity (No trade) Domestic Supply Price Domestic Demand Quantity

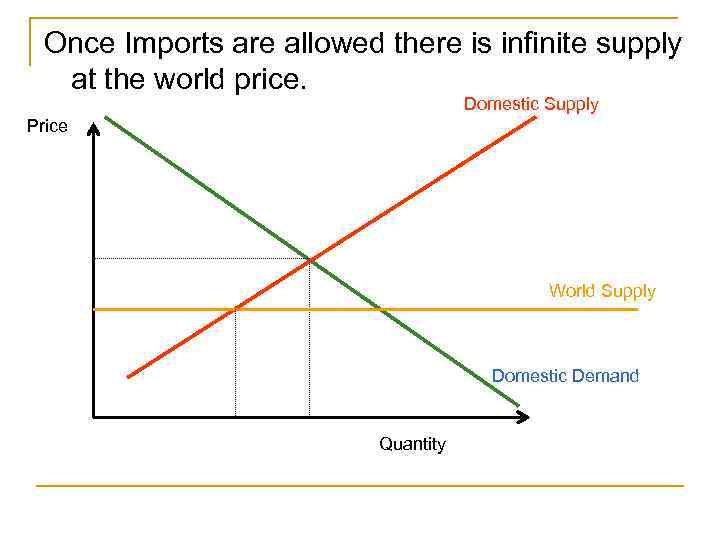

Once Imports are allowed there is infinite supply at the world price. Domestic Supply Price World Supply Domestic Demand Quantity

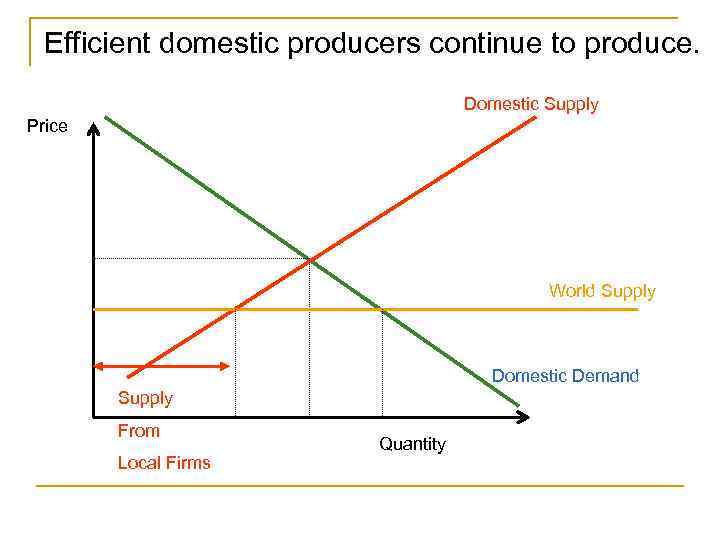

Efficient domestic producers continue to produce. Domestic Supply Price World Supply Domestic Demand Supply From Local Firms Quantity

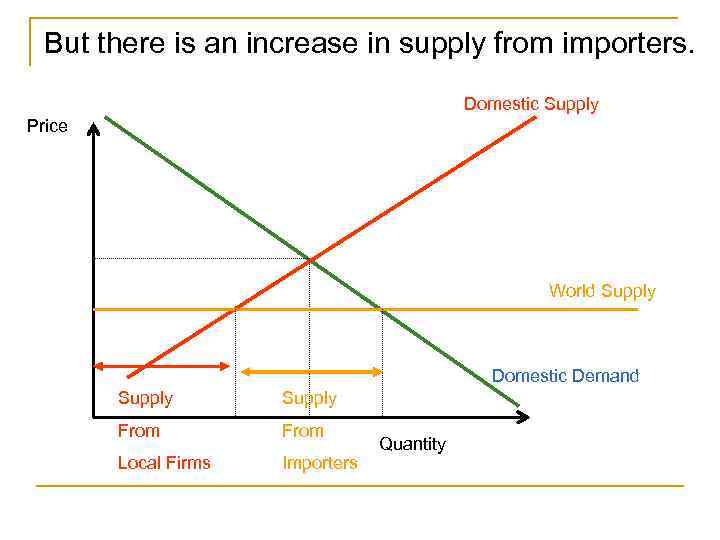

But there is an increase in supply from importers. Domestic Supply Price World Supply Domestic Demand Supply From Local Firms Importers Quantity

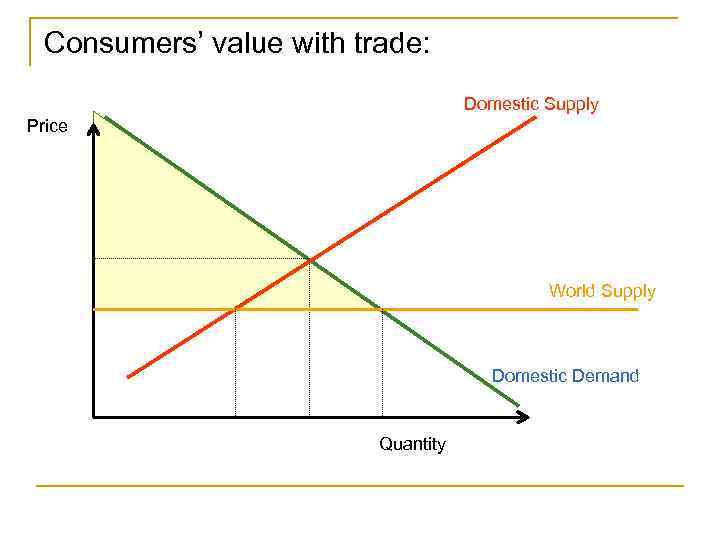

Consumers’ value with trade: Domestic Supply Price World Supply Domestic Demand Quantity

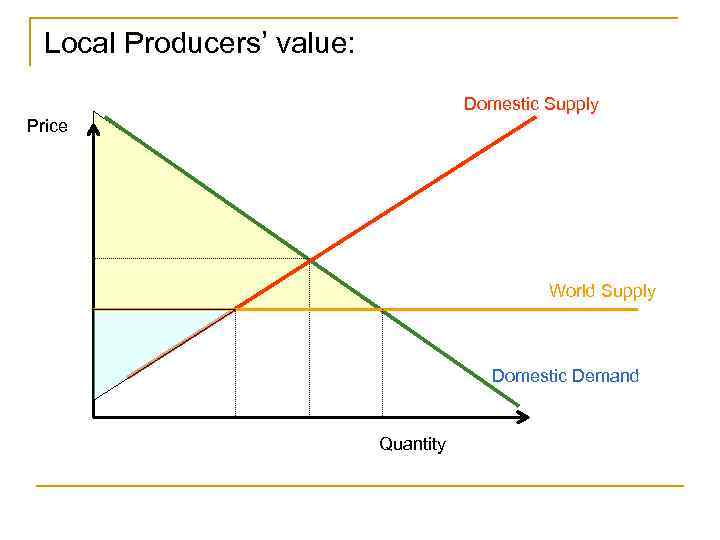

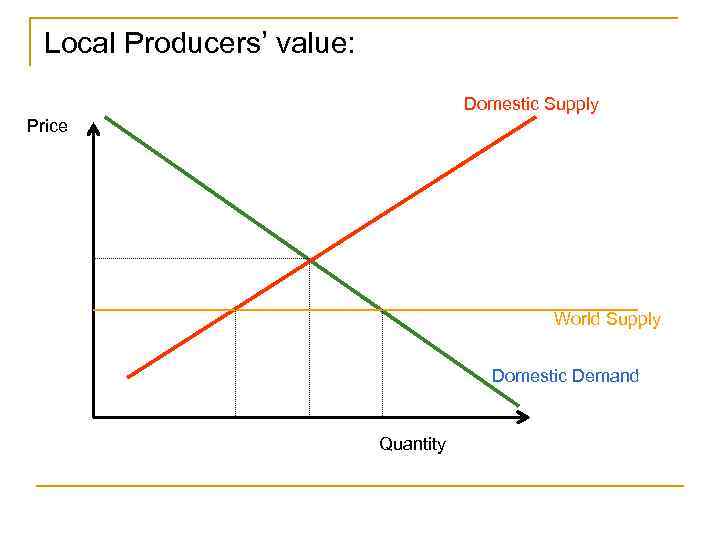

Local Producers’ value: Domestic Supply Price World Supply Domestic Demand Quantity

The Government Imposes a Tax/Tariff We could describe this as a shift in the demand function. Or We could think of this as an increase in the price of imports

Local Producers’ value: Domestic Supply Price World Supply Domestic Demand Quantity

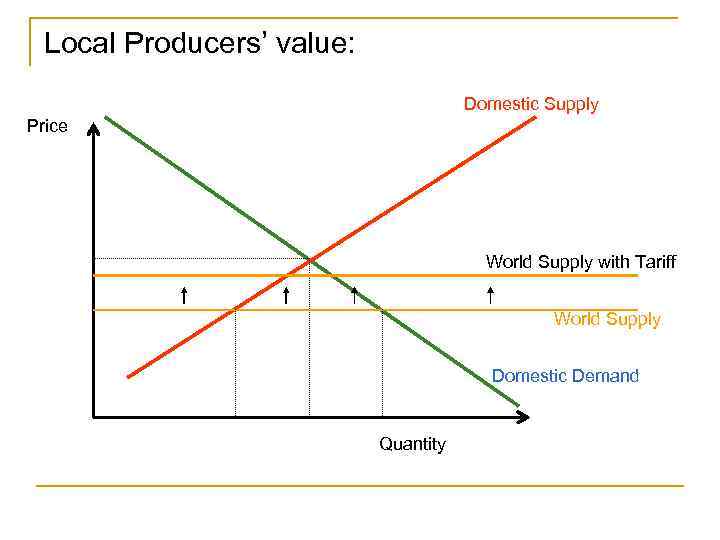

Local Producers’ value: Domestic Supply Price World Supply with Tariff World Supply Domestic Demand Quantity

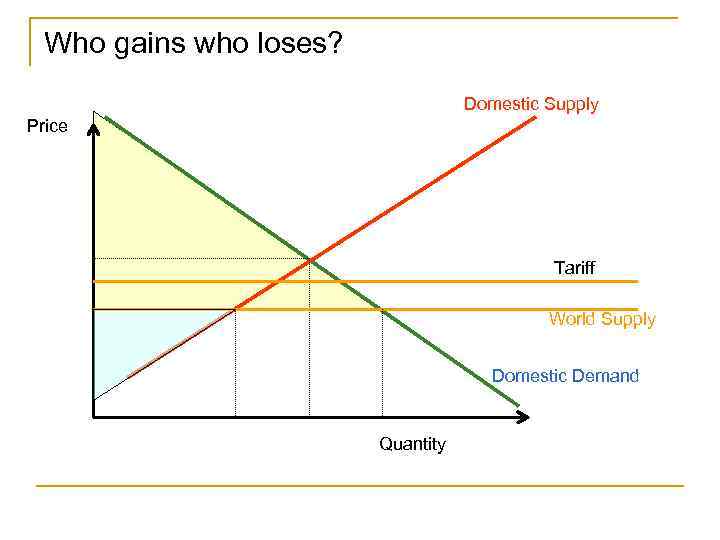

Who gains who loses? Domestic Supply Price Tariff World Supply Domestic Demand Quantity

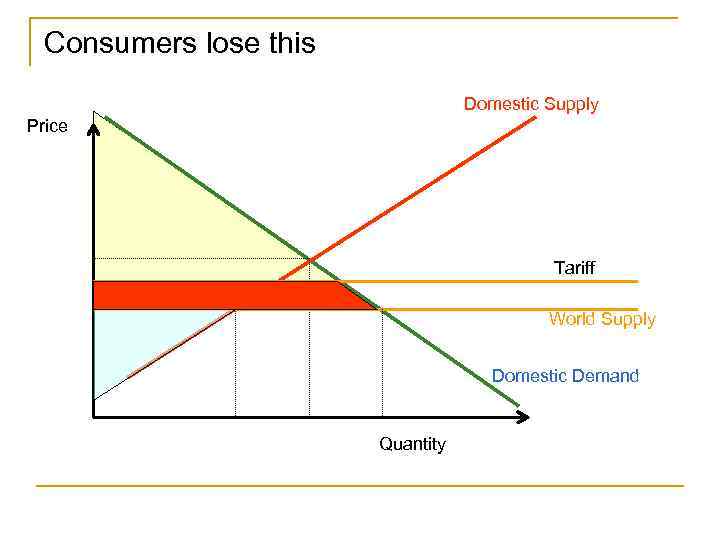

Consumers lose this Domestic Supply Price Tariff World Supply Domestic Demand Quantity

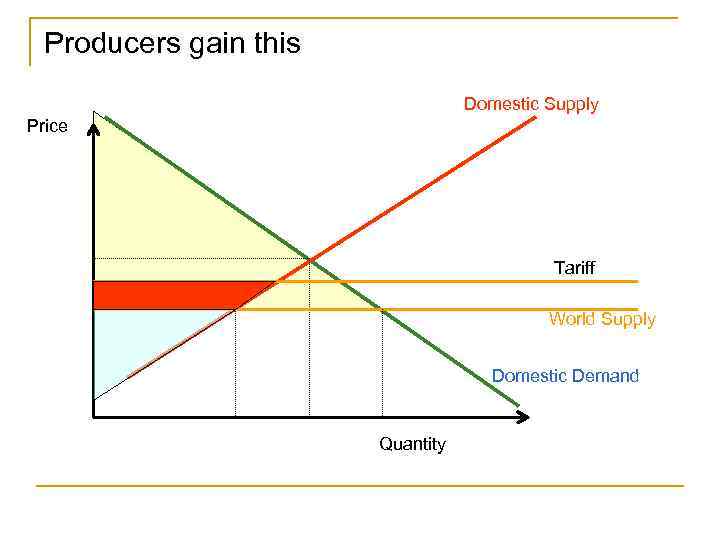

Producers gain this Domestic Supply Price Tariff World Supply Domestic Demand Quantity

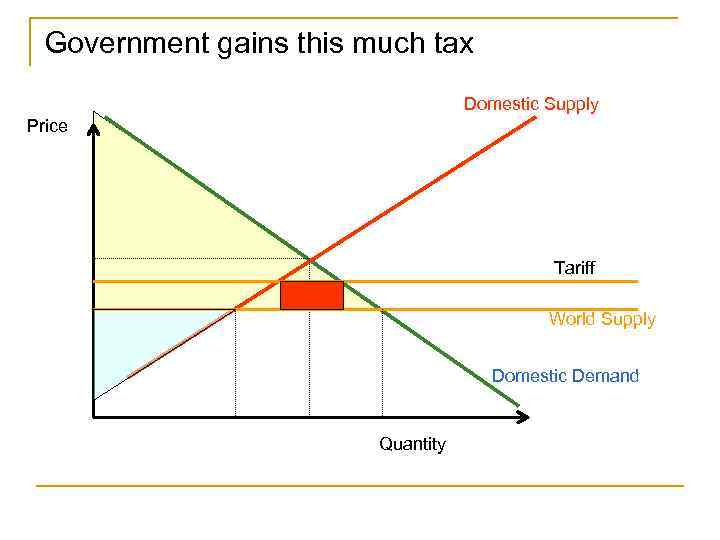

Government gains this much tax Domestic Supply Price Tariff World Supply Domestic Demand Quantity

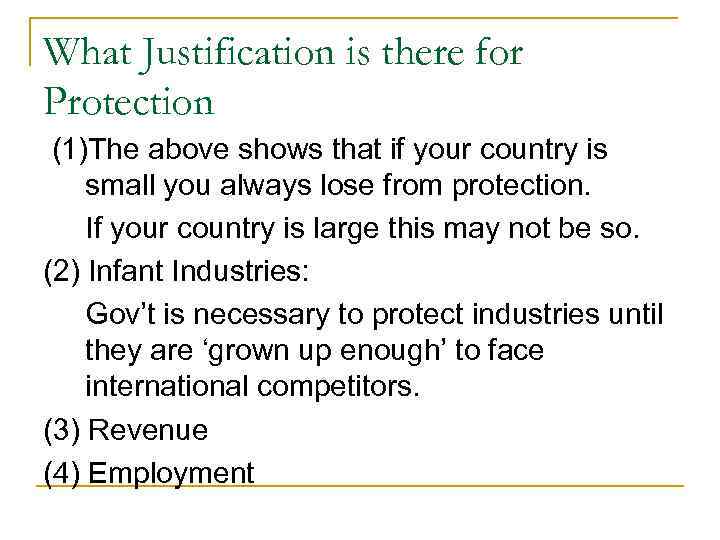

What Justification is there for Protection (1)The above shows that if your country is small you always lose from protection. If your country is large this may not be so. (2) Infant Industries: Gov’t is necessary to protect industries until they are ‘grown up enough’ to face international competitors. (3) Revenue (4) Employment

Patterns of Trade Liberalisation n Tariffs and non tariffs barriers have been declining steadily in last 20 years, but… q n n n use of antidumping actions has been increasing Tariffs on agricultural products are higher than on industrial ones Industrialised countries have average lower tariffs than developing ones Industrialised countries’ tariffs are higher towards developing than other industrialised countries.

Ukraine at WTO, 2008 n Ukraine’s average tariff bindings are 10. 66% for agricultural products and 4. 95% for industrial goods. n The highest tariffs Ukraine may apply are on items such as sugar (50%) and sunflower seed oil (30%). Other products with tariff ceilings of 25% include certain radiobroadcast receivers, catgut, and certain conveyor/transmission belts.

Ukraine at WTO, 2008 n n n Ukraine has agreed not to apply any “other duties and charges” — beyond its ordinary customs duties. In agriculture, Ukraine has agreed not to. subsidize exports. Read further the information http: //www. wto. org/english/news_e/pres 08_e/ pr 511_e. htm

Rise in Preferences and Regionalism n n Preferential and Regional Trade Arrangements (RTAs) keep increasing 250 RTAs so far are in effect (170 only notified to WTO); 20 RTAs await ratification; 70 RTAs are under negotiation 1/3 of global trade takes place under RTAs need to carefully designed to maximize development benefits

Strategic “Supporting” Policies: n n n n Free trade and FDI Infrastructure Education Antitrust and competition Intellectual Property Protection Tax Incentives on R&D Technical Standards Many others…

TO DO AT HOME: n n n Analyze the information used in the tables, be ready for the discussion in class. Pay attention to the influence of barriers to economy. The mid-term exam will have similar assignment with numbers. Add to your selected country presentation the information on its’ TRADE POLICY. Analyze if there were changes introduced recently. Find out more about Ukrainian trade policy. Watch the international economic news!!!! Enjoy studying International Economics.

IER_Topic #3.ppt