d2c9030c7ed383c91dfdb96628e64bf9.ppt

- Количество слайдов: 18

Trade mission Hungarian construction sector 19 April 2012

Trade mission Hungarian construction sector 19 April 2012

Agenda § Mazars in a nutshell § Attention points doing business in the Netherlands § Opportunities doing business in the Netherlands § How can we help you? ! 2

Agenda § Mazars in a nutshell § Attention points doing business in the Netherlands § Opportunities doing business in the Netherlands § How can we help you? ! 2

Mazars

Mazars

Mazars the Netherlands § International, integrated and independent professional services organisation. § Specialised in audit, accountancy, legal, tax and advisory services. § In the top ten of the Dutch audit and advisory firms. § In the Netherlands: 10 offices - 800 staff. § Experienced partner in advising companies to set up their business in the Netherlands in a tax efficient manner.

Mazars the Netherlands § International, integrated and independent professional services organisation. § Specialised in audit, accountancy, legal, tax and advisory services. § In the top ten of the Dutch audit and advisory firms. § In the Netherlands: 10 offices - 800 staff. § Experienced partner in advising companies to set up their business in the Netherlands in a tax efficient manner.

Attention points

Attention points

Attention points: General § Open labour market ► regulated by EU regulations ► Hungarian citizens can travel, live and work without a permit in the Netherlands. § General employment matters ► ► ► Hungarian employees are in principal entitled to a similar salary and reimbursement as Dutch employees; Regulations of Dutch Labour Law applicable: minimum wage (over 23 years EUR 1, 424 gross per month), working hours (40 hours per week), safety rules and so on; Collective Labour Agreements: declared generally binding for all companies in that branch. Amongst others: salary, working hours, holiday, reimbursements. 6

Attention points: General § Open labour market ► regulated by EU regulations ► Hungarian citizens can travel, live and work without a permit in the Netherlands. § General employment matters ► ► ► Hungarian employees are in principal entitled to a similar salary and reimbursement as Dutch employees; Regulations of Dutch Labour Law applicable: minimum wage (over 23 years EUR 1, 424 gross per month), working hours (40 hours per week), safety rules and so on; Collective Labour Agreements: declared generally binding for all companies in that branch. Amongst others: salary, working hours, holiday, reimbursements. 6

Attention points: Subcontractor Hungarian subcontractor conducting business in the Netherlands § Permanent establishment for tax purposes? Most relevant criteria based on the Tax treaty between Hungary – the Netherlands for subcontractors in the construction sector: “A building site or construction or assembly project constitutes a permanent establishment only if it lasts more than 12 months” § In case of a permanent establishment then consequences for e. g. the Dutch corporate income tax and wage tax. § Applying for Dutch tax numbers, filing tax returns, administration requirements, withholding wage tax and so on (see next slides). § Advise: determine the start and expected ending date of the project. Make sure that all Dutch fiscal obligations are met in case of a (expected) permanent establishment. 7

Attention points: Subcontractor Hungarian subcontractor conducting business in the Netherlands § Permanent establishment for tax purposes? Most relevant criteria based on the Tax treaty between Hungary – the Netherlands for subcontractors in the construction sector: “A building site or construction or assembly project constitutes a permanent establishment only if it lasts more than 12 months” § In case of a permanent establishment then consequences for e. g. the Dutch corporate income tax and wage tax. § Applying for Dutch tax numbers, filing tax returns, administration requirements, withholding wage tax and so on (see next slides). § Advise: determine the start and expected ending date of the project. Make sure that all Dutch fiscal obligations are met in case of a (expected) permanent establishment. 7

Attention points: Hungarian company which employs staff in the Netherlands (1) § (Fictitious) permanent establishment for wage tax purposes! § The Hungarian company is the formal employer and liable in Dutch law to make: • salary deductions; • withhold wage tax and possibly national insurance contributions • submit wage tax declarations; • possibly submit social security declarations. • Dutch obligations depend on the tax law of the Netherlands, the tax treaty between the Netherlands and Hungary and on various international social security treaties (see next slides) § If the Hungarian company refuses to make the payments, the Dutch tax authorities holds the recipient of the workers liable. 8

Attention points: Hungarian company which employs staff in the Netherlands (1) § (Fictitious) permanent establishment for wage tax purposes! § The Hungarian company is the formal employer and liable in Dutch law to make: • salary deductions; • withhold wage tax and possibly national insurance contributions • submit wage tax declarations; • possibly submit social security declarations. • Dutch obligations depend on the tax law of the Netherlands, the tax treaty between the Netherlands and Hungary and on various international social security treaties (see next slides) § If the Hungarian company refuses to make the payments, the Dutch tax authorities holds the recipient of the workers liable. 8

Attention points: Hungarian company which employs staff in the Netherlands (2) § Advise: it is important to determine whether you, as a foreign supplier, must pay (wage) tax/national insurance contributions, care insurance contributions and employed persons’ insurance scheme contributions in the Netherlands. § The recipient will most likely wish to reduce his/her liability to a minimum. For example, by the following: • screening you as a foreign supplier • paying the expected amount of payroll taxes into a G account • paying the expected amount of payroll taxes directly to the Tax and Customs Administration • NEN certificate 4400 -2 Be aware of a proposed change in the Dutch legislation: obligation to register at the Dutch chamber of commerce for (foreign) companies that employs staff in the Netherlands. A fine of EUR 12, 000 per employee which increases! 9

Attention points: Hungarian company which employs staff in the Netherlands (2) § Advise: it is important to determine whether you, as a foreign supplier, must pay (wage) tax/national insurance contributions, care insurance contributions and employed persons’ insurance scheme contributions in the Netherlands. § The recipient will most likely wish to reduce his/her liability to a minimum. For example, by the following: • screening you as a foreign supplier • paying the expected amount of payroll taxes into a G account • paying the expected amount of payroll taxes directly to the Tax and Customs Administration • NEN certificate 4400 -2 Be aware of a proposed change in the Dutch legislation: obligation to register at the Dutch chamber of commerce for (foreign) companies that employs staff in the Netherlands. A fine of EUR 12, 000 per employee which increases! 9

Attention points: Hungarian company which employs staff Hungarian employee § Tax treaty between Hungary – the Netherlands applicable § Dependent personal services (article 15): Salaries, wages and other similar remuneration derived by a Hungarian in respect of employment shall be taxable in the Netherlands in case the employment is exercised in the Netherlands; ► This will not be the case if: the Hungarian employee is present in the Netherlands for a period(s) not exceeding the aggregate 183 days a year; the remuneration is paid by an employer who is not a resident of the Netherlands; the remuneration is not borne by a PE or a fixed base of the Hungarian employer in the Netherlands. ► § The exception does not apply in the situation of a Hungarian company which employs staff in the Netherlands. As of the first day the remuneration will be subject to Dutch wage tax! 10

Attention points: Hungarian company which employs staff Hungarian employee § Tax treaty between Hungary – the Netherlands applicable § Dependent personal services (article 15): Salaries, wages and other similar remuneration derived by a Hungarian in respect of employment shall be taxable in the Netherlands in case the employment is exercised in the Netherlands; ► This will not be the case if: the Hungarian employee is present in the Netherlands for a period(s) not exceeding the aggregate 183 days a year; the remuneration is paid by an employer who is not a resident of the Netherlands; the remuneration is not borne by a PE or a fixed base of the Hungarian employer in the Netherlands. ► § The exception does not apply in the situation of a Hungarian company which employs staff in the Netherlands. As of the first day the remuneration will be subject to Dutch wage tax! 10

Attention points § In case of a permanent establishment the follow actions should be taken: § Wage tax the Hungarian employee should obtain a Dutch tax identification number; ► the Hungarian employer should obtain a wage tax number; ► inform future principals about the registration; ► set up a wage tax administration; ► monthly pay slip for the employees; ► monthly wage tax returns; ► annual review for income tax return (for employees) ► § Corporate income tax administration ► annual corporate income tax return ► 11

Attention points § In case of a permanent establishment the follow actions should be taken: § Wage tax the Hungarian employee should obtain a Dutch tax identification number; ► the Hungarian employer should obtain a wage tax number; ► inform future principals about the registration; ► set up a wage tax administration; ► monthly pay slip for the employees; ► monthly wage tax returns; ► annual review for income tax return (for employees) ► § Corporate income tax administration ► annual corporate income tax return ► 11

Opportunities

Opportunities

Opportunities § Dutch favourable tax climate: wide tax treaty network reducing withholding taxes on dividends, interest and royalties; ► no statutory withholding tax on outgoing interest and royalty payments; ► favourable participation exemption regime; ► relatively low statutory corporate income tax rate of 25% (20% over the first EUR 200, 000); ► favourable tax treatment foreign employees with specific expertise (30% tax ruling); ► possibility of obtaining advance tax rulings from the Dutch tax authorities. ► IN SPECIAL: in certain circumstances the employer does not have to withhold social security contributions in the Netherlands! The Hungarian employee will be insured in Hungary if: - the employee has a contract of employment with the Hungarian employer; the term of the posting does not exceed 24 months; and the employer conducts business in Hungary as well (substance) A-1 certificate! 13

Opportunities § Dutch favourable tax climate: wide tax treaty network reducing withholding taxes on dividends, interest and royalties; ► no statutory withholding tax on outgoing interest and royalty payments; ► favourable participation exemption regime; ► relatively low statutory corporate income tax rate of 25% (20% over the first EUR 200, 000); ► favourable tax treatment foreign employees with specific expertise (30% tax ruling); ► possibility of obtaining advance tax rulings from the Dutch tax authorities. ► IN SPECIAL: in certain circumstances the employer does not have to withhold social security contributions in the Netherlands! The Hungarian employee will be insured in Hungary if: - the employee has a contract of employment with the Hungarian employer; the term of the posting does not exceed 24 months; and the employer conducts business in Hungary as well (substance) A-1 certificate! 13

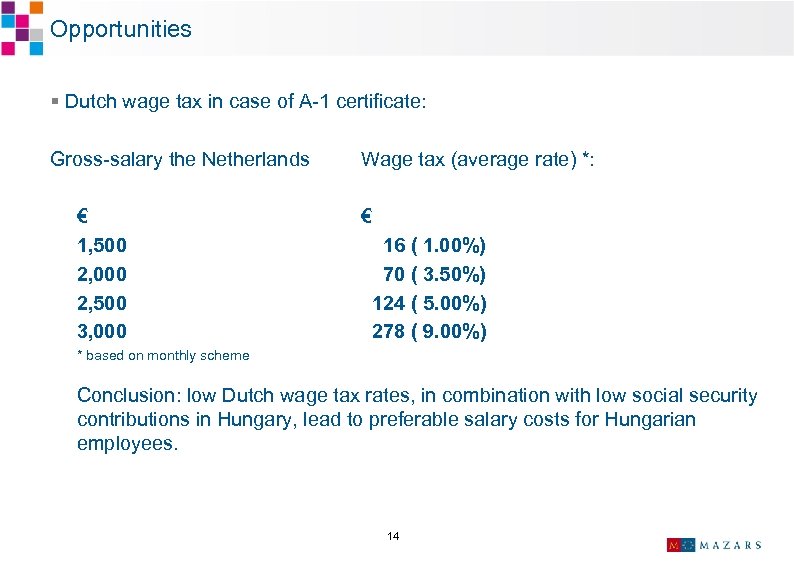

Opportunities § Dutch wage tax in case of A-1 certificate: Gross-salary the Netherlands € 1, 500 2, 000 2, 500 3, 000 Wage tax (average rate) *: € 16 ( 1. 00%) 70 ( 3. 50%) 124 ( 5. 00%) 278 ( 9. 00%) * based on monthly scheme Conclusion: low Dutch wage tax rates, in combination with low social security contributions in Hungary, lead to preferable salary costs for Hungarian employees. 14

Opportunities § Dutch wage tax in case of A-1 certificate: Gross-salary the Netherlands € 1, 500 2, 000 2, 500 3, 000 Wage tax (average rate) *: € 16 ( 1. 00%) 70 ( 3. 50%) 124 ( 5. 00%) 278 ( 9. 00%) * based on monthly scheme Conclusion: low Dutch wage tax rates, in combination with low social security contributions in Hungary, lead to preferable salary costs for Hungarian employees. 14

How can we help you? !

How can we help you? !

How can we help you? ! § Support you with setting up your business in the Netherlands; § Advise you on a tax efficient market entrance in the Netherlands; § Take care of the necessary registrations (chamber of commerce, tax authorities); § Provide bookkeeping services, preparing separate annual figures (balance sheet and profit & loss statement) § Prepare and file the annual corporate income tax return, VAT-returns etc. § Pay rolling (wage tax administration, pay slips, filing wage tax returns etc. ) 16

How can we help you? ! § Support you with setting up your business in the Netherlands; § Advise you on a tax efficient market entrance in the Netherlands; § Take care of the necessary registrations (chamber of commerce, tax authorities); § Provide bookkeeping services, preparing separate annual figures (balance sheet and profit & loss statement) § Prepare and file the annual corporate income tax return, VAT-returns etc. § Pay rolling (wage tax administration, pay slips, filing wage tax returns etc. ) 16

Questions Doing business in the Netherlands mr. drs. E-J. (Ernst-Jan) de Roest tax manager Mobile : +31 (0) 6 11 88 10 41 Office : +31 (0) 88 277 2100 Ernst-Jan. de. Roest@mazars. nl Druivenstraat 1 4816 KB Breda The Netherlands 17

Questions Doing business in the Netherlands mr. drs. E-J. (Ernst-Jan) de Roest tax manager Mobile : +31 (0) 6 11 88 10 41 Office : +31 (0) 88 277 2100 Ernst-Jan. de. Roest@mazars. nl Druivenstraat 1 4816 KB Breda The Netherlands 17

18

18