0e8b217c0a44080eac399951d8525bf5.ppt

- Количество слайдов: 48

Trade in Services: Some Lessons from South Africa Matthew Stern www. dnafrica. com

Trade in Services: Some Lessons from South Africa Matthew Stern www. dnafrica. com

Outline • Trade in services – facts and theory • Case studies – Health services – Construction services • The gains from trade • Trade policy implications 2

Outline • Trade in services – facts and theory • Case studies – Health services – Construction services • The gains from trade • Trade policy implications 2

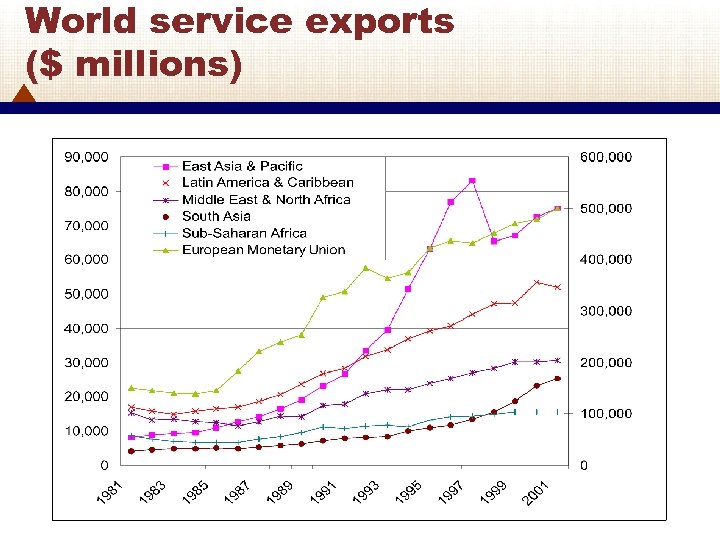

Trade in services • 25% of global trade • Fastest growing sector (trade & FDI) • Dominated by OECD (70%) • Highly regulated • Critical determinant of competitiveness 3

Trade in services • 25% of global trade • Fastest growing sector (trade & FDI) • Dominated by OECD (70%) • Highly regulated • Critical determinant of competitiveness 3

World service exports ($ millions) 4

World service exports ($ millions) 4

Application of trade theory • Trade in services, in general, display the same characteristics as trade in goods • The theory of comparative advantage does apply to services trade • Given high levels of regulation (protection) in the service sector, economic factors alone cannot explain the pattern of trade in services • The removal or reduction of barriers to trade in services would contribute to major increases in global welfare 5

Application of trade theory • Trade in services, in general, display the same characteristics as trade in goods • The theory of comparative advantage does apply to services trade • Given high levels of regulation (protection) in the service sector, economic factors alone cannot explain the pattern of trade in services • The removal or reduction of barriers to trade in services would contribute to major increases in global welfare 5

Developing countries • 50% of GDP • Fourfold increase in trade over last 15 years • Important contributor to economy-wide efficiency and development • Labour intensive • More dependent on trade in services than industrialised countries 6

Developing countries • 50% of GDP • Fourfold increase in trade over last 15 years • Important contributor to economy-wide efficiency and development • Labour intensive • More dependent on trade in services than industrialised countries 6

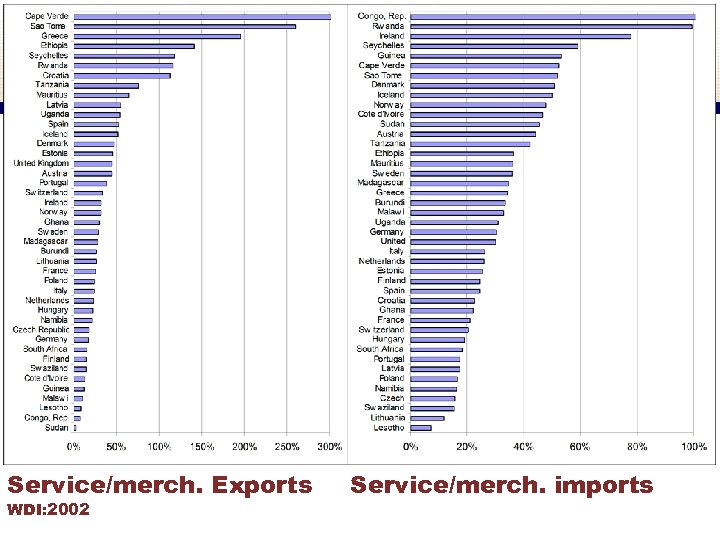

Service/merch. Exports WDI: 2002 Service/merch. imports 7

Service/merch. Exports WDI: 2002 Service/merch. imports 7

Constraints on liberalization • Domestic opposition • Lack of expertise and resources • Unable to improve access for domestic exporters • Cannot fully address anti-competitive practices of foreign firms • Inadequate stability or international credibility 8

Constraints on liberalization • Domestic opposition • Lack of expertise and resources • Unable to improve access for domestic exporters • Cannot fully address anti-competitive practices of foreign firms • Inadequate stability or international credibility 8

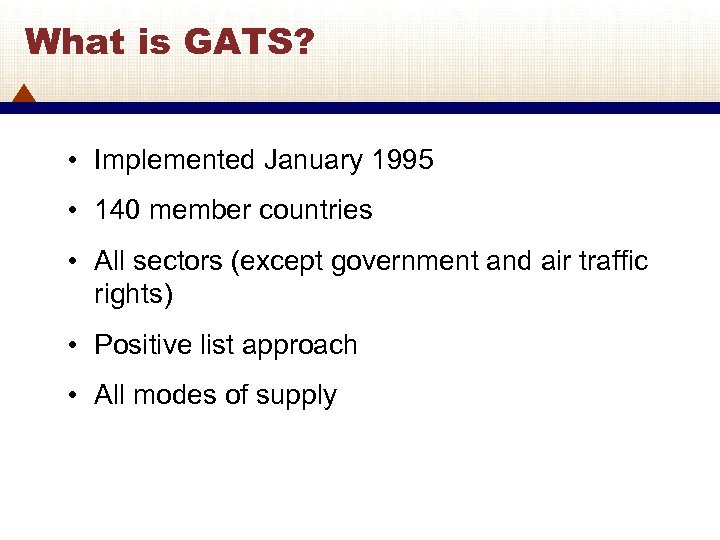

What is GATS? • Implemented January 1995 • 140 member countries • All sectors (except government and air traffic rights) • Positive list approach • All modes of supply 9

What is GATS? • Implemented January 1995 • 140 member countries • All sectors (except government and air traffic rights) • Positive list approach • All modes of supply 9

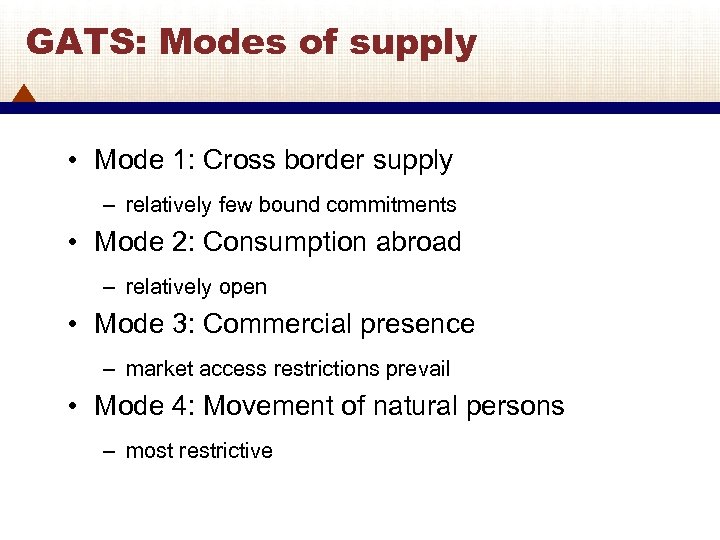

GATS: Modes of supply • Mode 1: Cross border supply – relatively few bound commitments • Mode 2: Consumption abroad – relatively open • Mode 3: Commercial presence – market access restrictions prevail • Mode 4: Movement of natural persons – most restrictive 10

GATS: Modes of supply • Mode 1: Cross border supply – relatively few bound commitments • Mode 2: Consumption abroad – relatively open • Mode 3: Commercial presence – market access restrictions prevail • Mode 4: Movement of natural persons – most restrictive 10

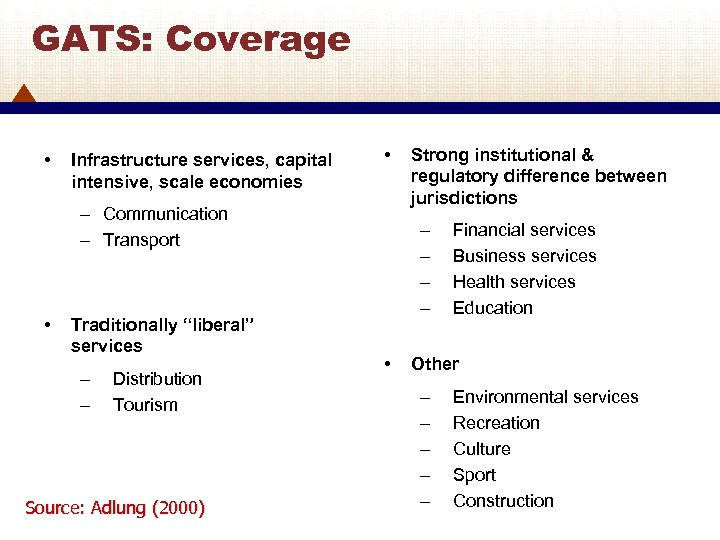

GATS: Coverage • Infrastructure services, capital intensive, scale economies • – Communication – Transport • Traditionally “liberal” services – – Distribution Tourism Source: Adlung (2000) Strong institutional & regulatory difference between jurisdictions – – • Financial services Business services Health services Education Other – – – Environmental services Recreation Culture Sport Construction 11

GATS: Coverage • Infrastructure services, capital intensive, scale economies • – Communication – Transport • Traditionally “liberal” services – – Distribution Tourism Source: Adlung (2000) Strong institutional & regulatory difference between jurisdictions – – • Financial services Business services Health services Education Other – – – Environmental services Recreation Culture Sport Construction 11

GATS: Obligations • General – MFN treatment – Transparency • Specific – Market access – National treatment 12

GATS: Obligations • General – MFN treatment – Transparency • Specific – Market access – National treatment 12

Case Studies 13

Case Studies 13

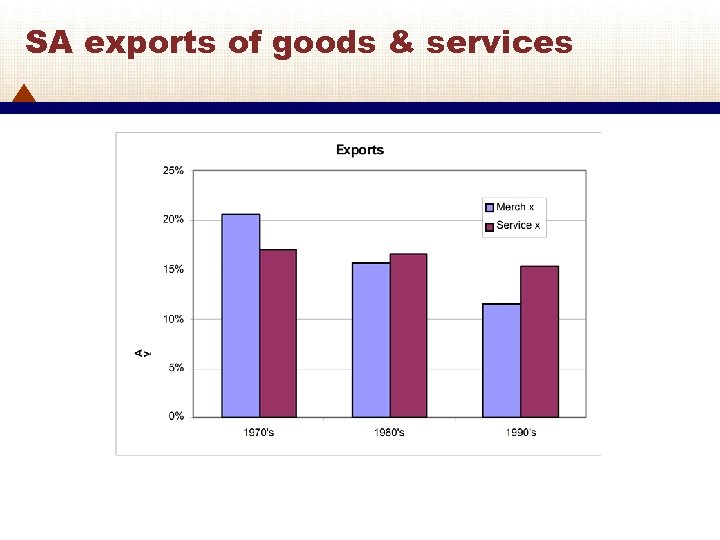

SA exports of goods & services 14

SA exports of goods & services 14

GATS: South Africa • Scheduled 9 out of 12 major sectors (education, health and recreational services excluded) • Relatively liberal commitments in retail, computer, construction, tourism and business services • Relatively few commitments in transport, life insurance, communications and education services 15

GATS: South Africa • Scheduled 9 out of 12 major sectors (education, health and recreational services excluded) • Relatively liberal commitments in retail, computer, construction, tourism and business services • Relatively few commitments in transport, life insurance, communications and education services 15

SA Health Sector • Well developed private sector – 55% of total health care expenditure – 20% of all patients – High cost and specialised care • Embattled public sector – 80% all patients – 30% all doctors – HIV/AIDS • Migration 16

SA Health Sector • Well developed private sector – 55% of total health care expenditure – 20% of all patients – High cost and specialised care • Embattled public sector – 80% all patients – 30% all doctors – HIV/AIDS • Migration 16

Exports of health services • Cross border – Call and claim centers 17

Exports of health services • Cross border – Call and claim centers 17

Exports of health services • Cross border – Call and claim centers • Consumption abroad – Health tourism 18

Exports of health services • Cross border – Call and claim centers • Consumption abroad – Health tourism 18

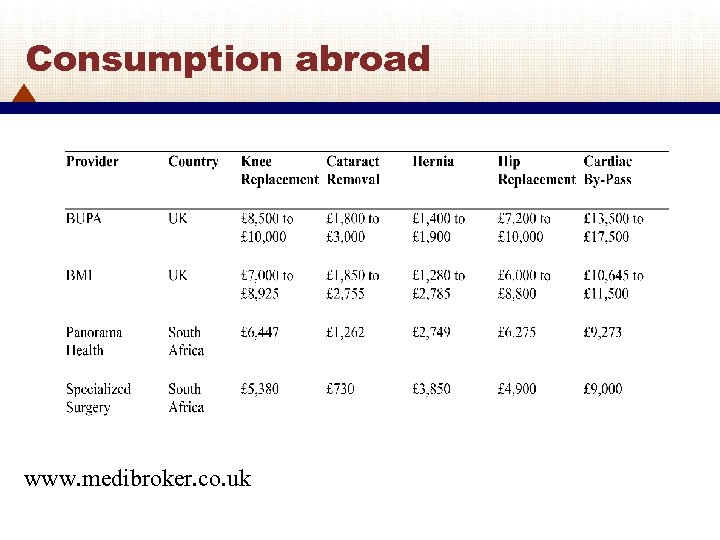

Consumption abroad www. medibroker. co. uk 19

Consumption abroad www. medibroker. co. uk 19

Exports of health services • Cross border – Call and claim centers • Consumption abroad – Health tourism • Commercial presence – NHS contracts 20

Exports of health services • Cross border – Call and claim centers • Consumption abroad – Health tourism • Commercial presence – NHS contracts 20

NHS health care contracts • 900 cataracts in Lancaster – R 10 million – 45 personnel • 12 000 ENT in Middlesex • 300 hips and knees in Southport • 1 000 orthopedics in Gosport 21

NHS health care contracts • 900 cataracts in Lancaster – R 10 million – 45 personnel • 12 000 ENT in Middlesex • 300 hips and knees in Southport • 1 000 orthopedics in Gosport 21

Exports of health services • Cross border – Call and claim centers • Consumption abroad – Health tourism • Commercial presence – NHS contracts • Movement of natural persons – Nurses 22

Exports of health services • Cross border – Call and claim centers • Consumption abroad – Health tourism • Commercial presence – NHS contracts • Movement of natural persons – Nurses 22

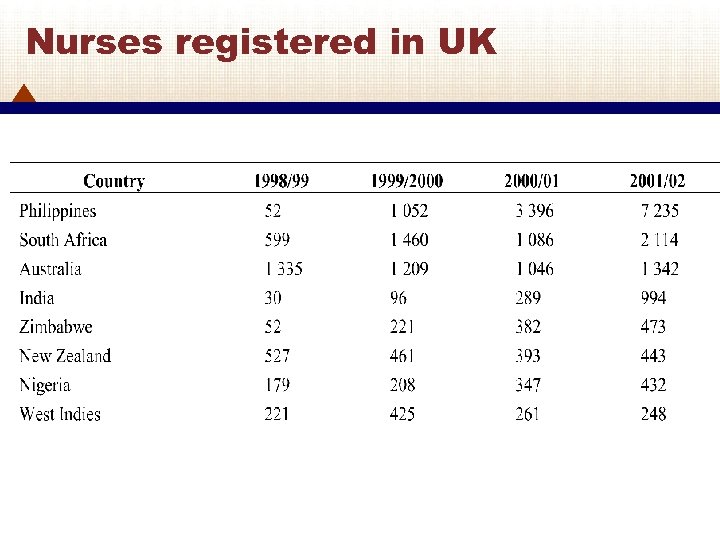

Nurses registered in UK 23

Nurses registered in UK 23

Constraints—international • Portability of national health insurance • Recognition/registration of medical professionals 24

Constraints—international • Portability of national health insurance • Recognition/registration of medical professionals 24

Constraints—domestic • National Health Bill – Certificate of need • Immigration – Moratorium on foreign health professionals • Community service – 45% plan to emigrate • Technology/telecommunications 25

Constraints—domestic • National Health Bill – Certificate of need • Immigration – Moratorium on foreign health professionals • Community service – 45% plan to emigrate • Technology/telecommunications 25

SA Construction Sector • Large and extremely competent construction firms • Highly skilled engineers • Dominated by government expenditure • Long-term decline in domestic activity 26

SA Construction Sector • Large and extremely competent construction firms • Highly skilled engineers • Dominated by government expenditure • Long-term decline in domestic activity 26

Construction works 27

Construction works 27

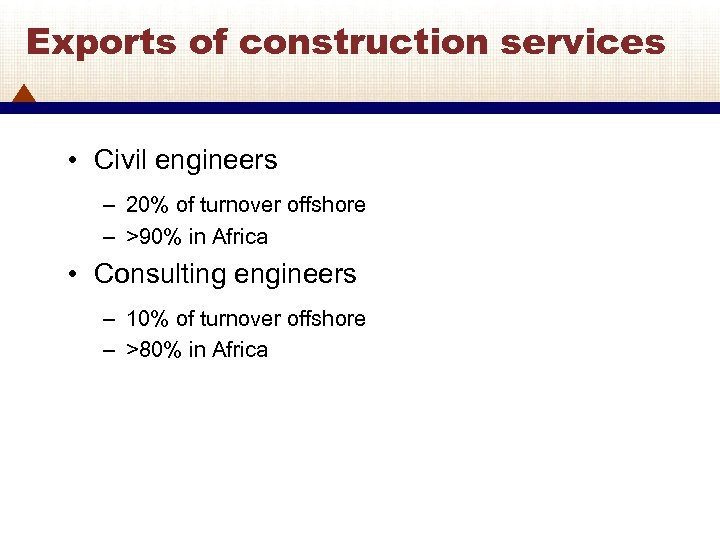

Exports of construction services • Civil engineers – 20% of turnover offshore – >90% in Africa • Consulting engineers – 10% of turnover offshore – >80% in Africa 28

Exports of construction services • Civil engineers – 20% of turnover offshore – >90% in Africa • Consulting engineers – 10% of turnover offshore – >80% in Africa 28

Exports and investment • Grinaker-LTA – 50 th largest international contractor* – 5 th largest contractor in Africa* – Operations: Australia, United Arab Emirates (UAE), Angola, Nigeria and Mauritius • Murray and Roberts – 54 th largest international contractor* – 7 th largest contractor in Africa* – Operations: Australia, UAE, UK, Botswana, Namibia, Nigeria, Tanzania, Zimbabwe and Indonesia * Engineering News Record 29

Exports and investment • Grinaker-LTA – 50 th largest international contractor* – 5 th largest contractor in Africa* – Operations: Australia, United Arab Emirates (UAE), Angola, Nigeria and Mauritius • Murray and Roberts – 54 th largest international contractor* – 7 th largest contractor in Africa* – Operations: Australia, UAE, UK, Botswana, Namibia, Nigeria, Tanzania, Zimbabwe and Indonesia * Engineering News Record 29

Constraints - international • Technical standards and regulations • Nationality & residency requirements • Ownership restrictions • Government procurement – Tied-AID – Export credit agencies 30

Constraints - international • Technical standards and regulations • Nationality & residency requirements • Ownership restrictions • Government procurement – Tied-AID – Export credit agencies 30

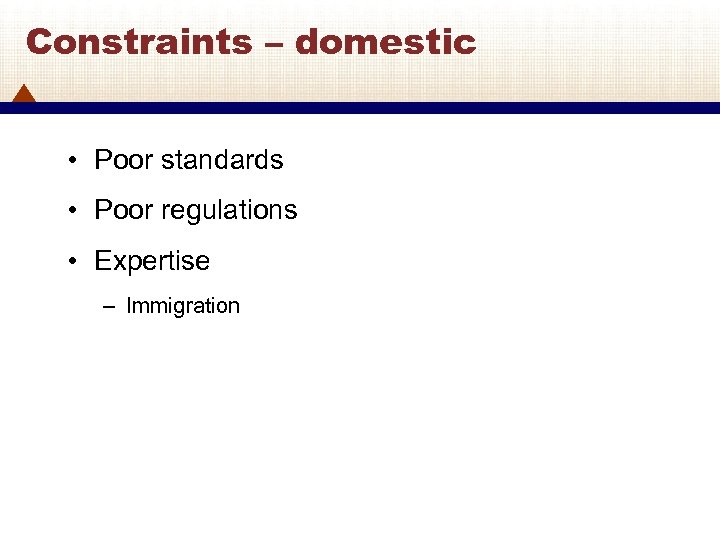

Constraints – domestic • Poor standards • Poor regulations • Expertise – Immigration 31

Constraints – domestic • Poor standards • Poor regulations • Expertise – Immigration 31

Gains From Trade 32

Gains From Trade 32

Gains from exports • Employment • Complementary exports • Foreign exchange • Knowledge and skills • Economies of scale 33

Gains from exports • Employment • Complementary exports • Foreign exchange • Knowledge and skills • Economies of scale 33

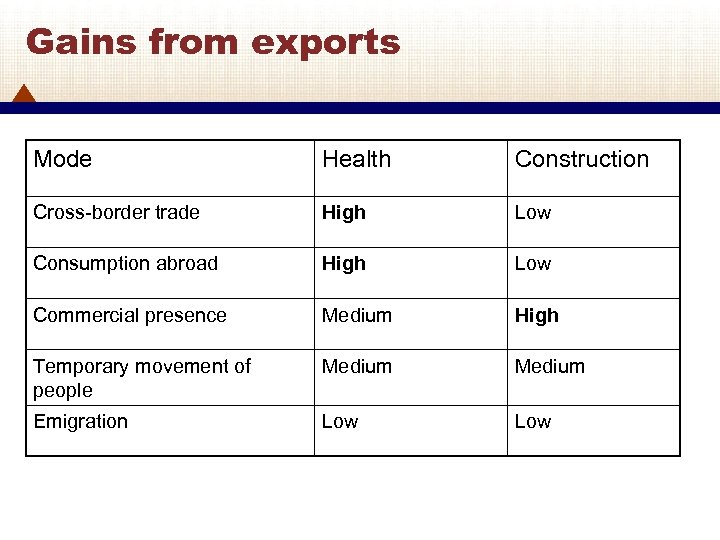

Gains from exports Mode Health Construction Cross-border trade High Low Consumption abroad High Low Commercial presence Medium High Temporary movement of people Medium Emigration Low 34

Gains from exports Mode Health Construction Cross-border trade High Low Consumption abroad High Low Commercial presence Medium High Temporary movement of people Medium Emigration Low 34

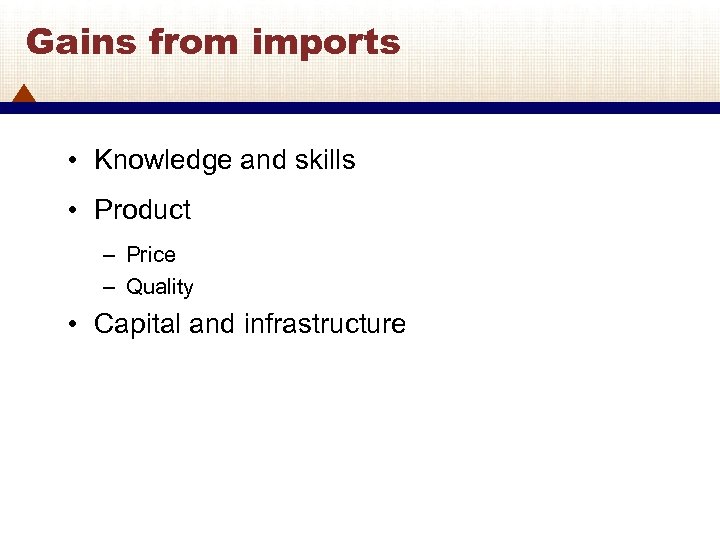

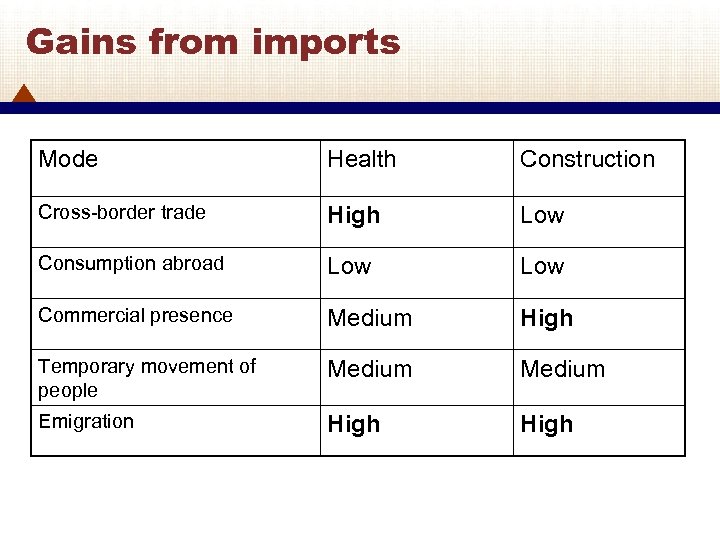

Gains from imports • Knowledge and skills • Product – Price – Quality • Capital and infrastructure 35

Gains from imports • Knowledge and skills • Product – Price – Quality • Capital and infrastructure 35

Gains from imports Mode Health Construction Cross-border trade High Low Consumption abroad Low Commercial presence Medium High Temporary movement of people Medium Emigration High 36

Gains from imports Mode Health Construction Cross-border trade High Low Consumption abroad Low Commercial presence Medium High Temporary movement of people Medium Emigration High 36

Trade Policy Implications 37

Trade Policy Implications 37

Health services - WTO • 40% of member countries have made some commitments – 25% hospital services – 33% medical and dental services 38

Health services - WTO • 40% of member countries have made some commitments – 25% hospital services – 33% medical and dental services 38

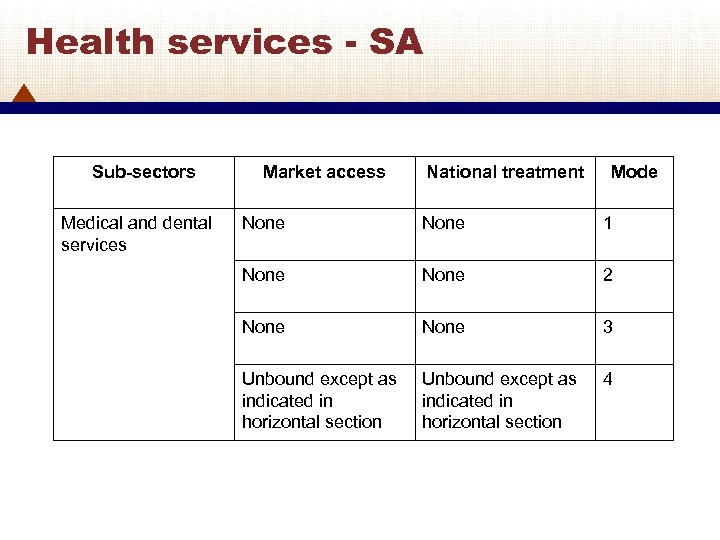

Health services - SA Sub-sectors Medical and dental services Market access National treatment Mode None 1 None 2 None 3 Unbound except as indicated in horizontal section 4 39

Health services - SA Sub-sectors Medical and dental services Market access National treatment Mode None 1 None 2 None 3 Unbound except as indicated in horizontal section 4 39

Health service strategy • Remove domestic restrictions on investment and professionals • Target foreign barriers to health tourism and electronic trade • Access to the national health systems of importing countries is critical 40

Health service strategy • Remove domestic restrictions on investment and professionals • Target foreign barriers to health tourism and electronic trade • Access to the national health systems of importing countries is critical 40

But first … • Compulsory community service • New National Health Bill (certificate of need) • Restrictive immigration laws • Poor working conditions in the public sector 41

But first … • Compulsory community service • New National Health Bill (certificate of need) • Restrictive immigration laws • Poor working conditions in the public sector 41

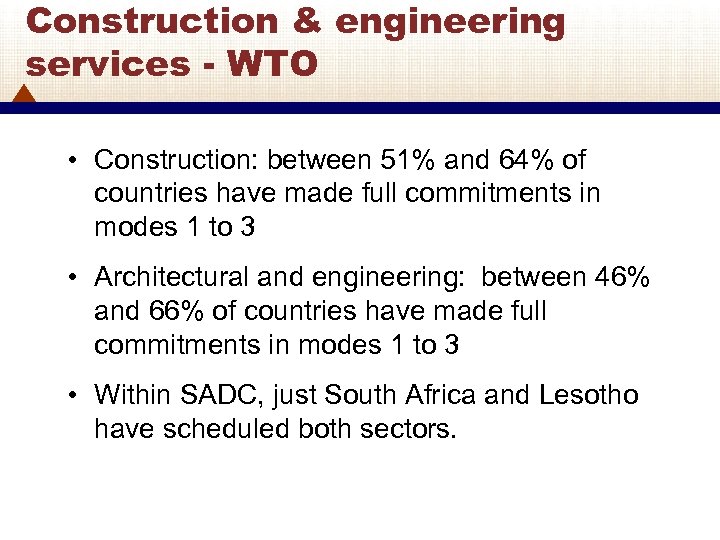

Construction & engineering services - WTO • Construction: between 51% and 64% of countries have made full commitments in modes 1 to 3 • Architectural and engineering: between 46% and 66% of countries have made full commitments in modes 1 to 3 • Within SADC, just South Africa and Lesotho have scheduled both sectors. 42

Construction & engineering services - WTO • Construction: between 51% and 64% of countries have made full commitments in modes 1 to 3 • Architectural and engineering: between 46% and 66% of countries have made full commitments in modes 1 to 3 • Within SADC, just South Africa and Lesotho have scheduled both sectors. 42

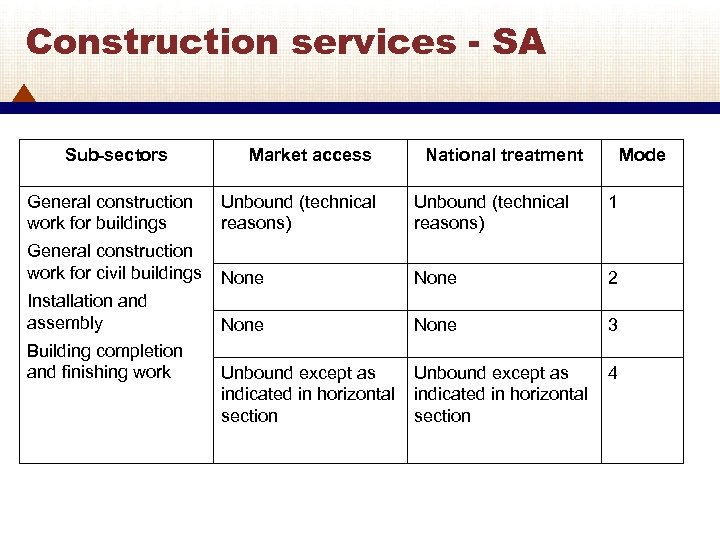

Construction services - SA Sub-sectors Market access National treatment Mode General construction work for buildings Unbound (technical reasons) 1 General construction work for civil buildings None 2 Installation and assembly None 3 Unbound except as indicated in horizontal section 4 Building completion and finishing work 43

Construction services - SA Sub-sectors Market access National treatment Mode General construction work for buildings Unbound (technical reasons) 1 General construction work for civil buildings None 2 Installation and assembly None 3 Unbound except as indicated in horizontal section 4 Building completion and finishing work 43

Engineering services - SA Sub-sectors Market access National treatment Mode Engineering services None 1 None 2 None 3 Unbound except as indicated in horizontal section 4 44

Engineering services - SA Sub-sectors Market access National treatment Mode Engineering services None 1 None 2 None 3 Unbound except as indicated in horizontal section 4 44

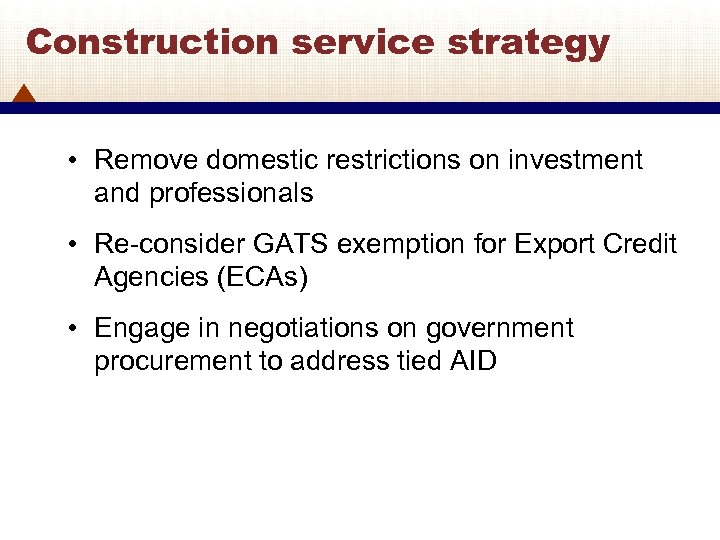

Construction service strategy • Remove domestic restrictions on investment and professionals • Re-consider GATS exemption for Export Credit Agencies (ECAs) • Engage in negotiations on government procurement to address tied AID 45

Construction service strategy • Remove domestic restrictions on investment and professionals • Re-consider GATS exemption for Export Credit Agencies (ECAs) • Engage in negotiations on government procurement to address tied AID 45

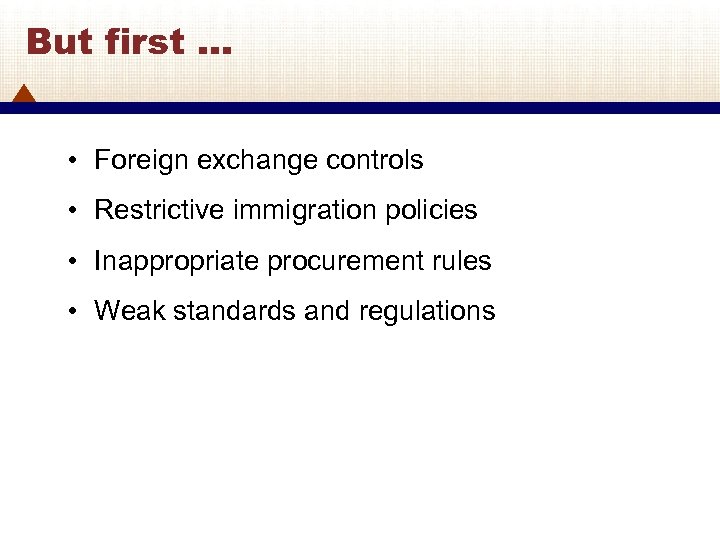

But first … • Foreign exchange controls • Restrictive immigration policies • Inappropriate procurement rules • Weak standards and regulations 46

But first … • Foreign exchange controls • Restrictive immigration policies • Inappropriate procurement rules • Weak standards and regulations 46

Conclusion 47

Conclusion 47

Conclusion • Need to understand the economic gains from service liberalisation • Need to understand the social costs of service liberalisation and protection • Need to identify actual constraints to trade – Foreign barriers – Domestic regulations (or the lack thereof) 48

Conclusion • Need to understand the economic gains from service liberalisation • Need to understand the social costs of service liberalisation and protection • Need to identify actual constraints to trade – Foreign barriers – Domestic regulations (or the lack thereof) 48