760f8f477741208c48d82b600d6d490c.ppt

- Количество слайдов: 28

TRADE AND INVESTMENT OPPORTUNITIES IN MALAYSIA 7 June 2011

TRADE AND INVESTMENT OPPORTUNITIES IN MALAYSIA 7 June 2011

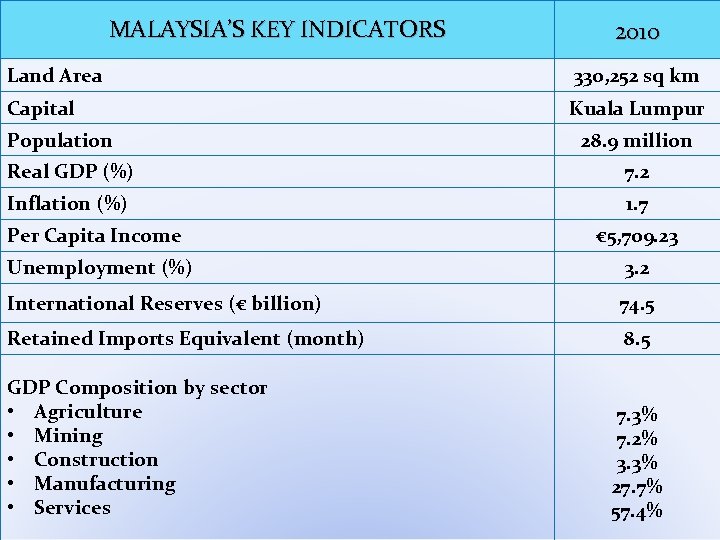

MALAYSIA’S KEY INDICATORS 2010 Land Area 330, 252 sq km Capital Kuala Lumpur Population 28. 9 million Real GDP (%) 7. 2 Inflation (%) 1. 7 Per Capita Income € 5, 709. 23 Unemployment (%) 3. 2 International Reserves (€ billion) 74. 5 Retained Imports Equivalent (month) 8. 5 GDP Composition by sector • Agriculture • Mining • Construction • Manufacturing • Services 7. 3% 7. 2% 3. 3% 27. 7% 57. 4% 1

MALAYSIA’S KEY INDICATORS 2010 Land Area 330, 252 sq km Capital Kuala Lumpur Population 28. 9 million Real GDP (%) 7. 2 Inflation (%) 1. 7 Per Capita Income € 5, 709. 23 Unemployment (%) 3. 2 International Reserves (€ billion) 74. 5 Retained Imports Equivalent (month) 8. 5 GDP Composition by sector • Agriculture • Mining • Construction • Manufacturing • Services 7. 3% 7. 2% 3. 3% 27. 7% 57. 4% 1

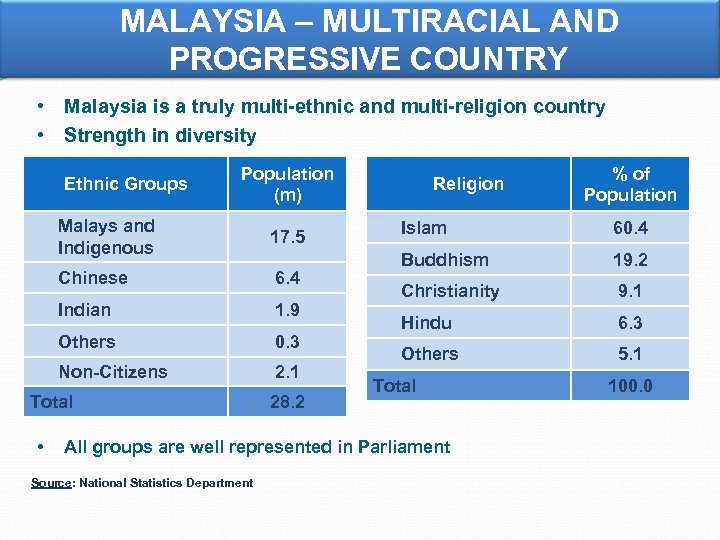

MALAYSIA – MULTIRACIAL AND PROGRESSIVE COUNTRY • Malaysia is a truly multi-ethnic and multi-religion country • Strength in diversity Ethnic Groups Population (m) Malays and Indigenous 17. 5 Chinese 6. 4 Indian 1. 9 Others 0. 3 Non-Citizens 2. 1 Total • 28. 2 Religion Islam 60. 4 Buddhism 19. 2 Christianity 9. 1 Hindu 6. 3 Others 5. 1 Total All groups are well represented in Parliament Source: National Statistics Department % of Population 100. 0

MALAYSIA – MULTIRACIAL AND PROGRESSIVE COUNTRY • Malaysia is a truly multi-ethnic and multi-religion country • Strength in diversity Ethnic Groups Population (m) Malays and Indigenous 17. 5 Chinese 6. 4 Indian 1. 9 Others 0. 3 Non-Citizens 2. 1 Total • 28. 2 Religion Islam 60. 4 Buddhism 19. 2 Christianity 9. 1 Hindu 6. 3 Others 5. 1 Total All groups are well represented in Parliament Source: National Statistics Department % of Population 100. 0

Why Malaysia is Special? Year-long warm and sunny climate offers plenty of opportunities for sports, leisure and family activities Excellent health infrastructure with many modern hospitals, clinics and medical facilities Welldeveloped transport and telecommunic ation system Variety of food, 300 malls, deepest reefs, Natural rainforest Over 30 international schools registered with the Ministry of Education Peace and harmony

Why Malaysia is Special? Year-long warm and sunny climate offers plenty of opportunities for sports, leisure and family activities Excellent health infrastructure with many modern hospitals, clinics and medical facilities Welldeveloped transport and telecommunic ation system Variety of food, 300 malls, deepest reefs, Natural rainforest Over 30 international schools registered with the Ministry of Education Peace and harmony

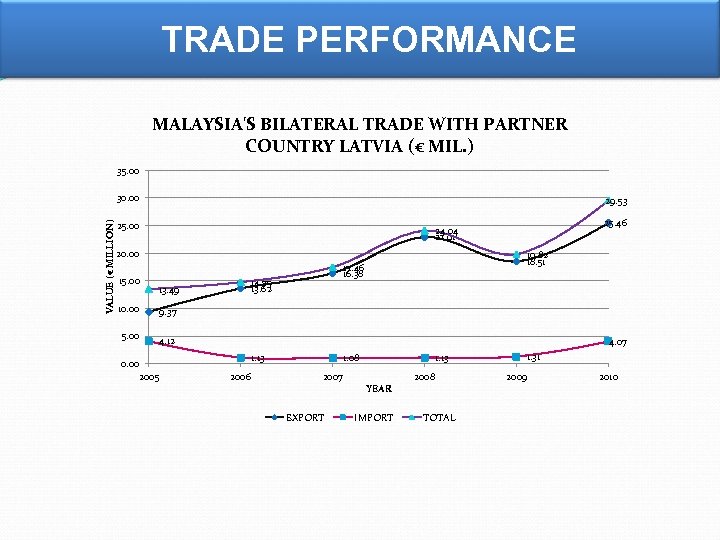

TRADE PERFORMANCE MALAYSIA'S BILATERAL TRADE WITH PARTNER COUNTRY LATVIA (€ MIL. ) 35. 00 VALUE (€ MILLION) 30. 00 29. 53 25. 00 20. 00 15. 00 25. 46 24. 04 22. 91 13. 49 10. 00 14. 75 13. 62 9. 37 5. 00 19. 82 18. 51 17. 46 16. 38 4. 12 0. 00 2005 4. 07 1. 13 2006 1. 13 1. 08 2007 EXPORT YEAR IMPORT 2008 TOTAL 1. 31 2009 2010

TRADE PERFORMANCE MALAYSIA'S BILATERAL TRADE WITH PARTNER COUNTRY LATVIA (€ MIL. ) 35. 00 VALUE (€ MILLION) 30. 00 29. 53 25. 00 20. 00 15. 00 25. 46 24. 04 22. 91 13. 49 10. 00 14. 75 13. 62 9. 37 5. 00 19. 82 18. 51 17. 46 16. 38 4. 12 0. 00 2005 4. 07 1. 13 2006 1. 13 1. 08 2007 EXPORT YEAR IMPORT 2008 TOTAL 1. 31 2009 2010

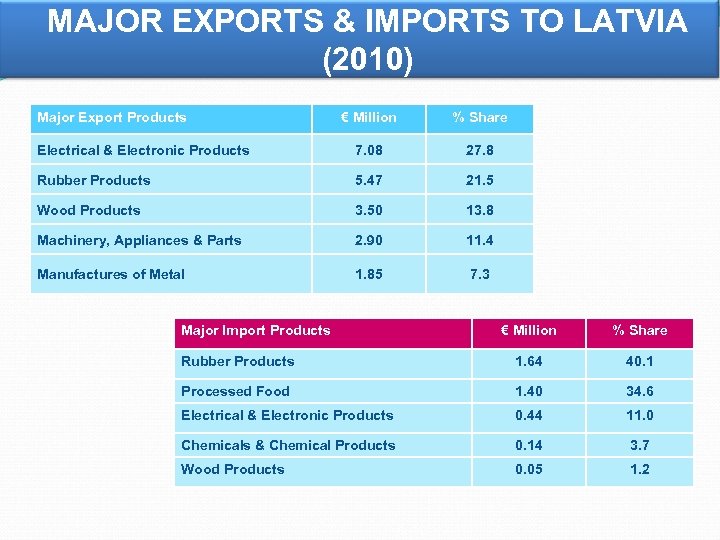

MAJOR EXPORTS & IMPORTS TO LATVIA (2010) Major Export Products € Million % Share Electrical & Electronic Products 7. 08 27. 8 Rubber Products 5. 47 21. 5 Wood Products 3. 50 13. 8 Machinery, Appliances & Parts 2. 90 11. 4 Manufactures of Metal 1. 85 7. 3 Major Import Products € Million % Share Rubber Products 1. 64 40. 1 Processed Food 1. 40 34. 6 Electrical & Electronic Products 0. 44 11. 0 Chemicals & Chemical Products 0. 14 3. 7 Wood Products 0. 05 1. 2

MAJOR EXPORTS & IMPORTS TO LATVIA (2010) Major Export Products € Million % Share Electrical & Electronic Products 7. 08 27. 8 Rubber Products 5. 47 21. 5 Wood Products 3. 50 13. 8 Machinery, Appliances & Parts 2. 90 11. 4 Manufactures of Metal 1. 85 7. 3 Major Import Products € Million % Share Rubber Products 1. 64 40. 1 Processed Food 1. 40 34. 6 Electrical & Electronic Products 0. 44 11. 0 Chemicals & Chemical Products 0. 14 3. 7 Wood Products 0. 05 1. 2

GOVERNMENTINITIATIVES GOVERNMENT INITIATIVES Government Transformation Programme (GTP) Economic Transformation Programme (ETP) 10 th Malaysia Plan 2011 -2015 Effective delivery of government services Private sector leads, Government facilitates. Specific initiatives and projects driving economic transformation. 12 NKEAs to received prioritized policy and investment focus. . . As at date, 60 EPP projects has been announced with an estimated amount of € 23. 1 million value of investment & offering about 230, 000 job opportunities. Source: Economic Planning Unit, Malaysia

GOVERNMENTINITIATIVES GOVERNMENT INITIATIVES Government Transformation Programme (GTP) Economic Transformation Programme (ETP) 10 th Malaysia Plan 2011 -2015 Effective delivery of government services Private sector leads, Government facilitates. Specific initiatives and projects driving economic transformation. 12 NKEAs to received prioritized policy and investment focus. . . As at date, 60 EPP projects has been announced with an estimated amount of € 23. 1 million value of investment & offering about 230, 000 job opportunities. Source: Economic Planning Unit, Malaysia

APPROVED INVESTMENT IN MANUFACTURING SECTOR BY MAJOR COUNTRIES (2008 – 2010) 1. USA € 5. 0 billion 2. JAPAN € 3. 6 billion 3. AUSTRALIA € 2. 8 billion 4. HONG KONG 5. GERMANY € 1. 8 billion € 1. 4 billion IMPLEMENTED MANUFACTURING PROJECTS (as at 2010) 1. JAPAN 2. USA 3. SINGAPORE 4. GERMANY 5. NETHERLANDS € 13. 6 billion € 12. 7 billion € 5. 4 billion € 4. 4 billion € 3. 3 billion

APPROVED INVESTMENT IN MANUFACTURING SECTOR BY MAJOR COUNTRIES (2008 – 2010) 1. USA € 5. 0 billion 2. JAPAN € 3. 6 billion 3. AUSTRALIA € 2. 8 billion 4. HONG KONG 5. GERMANY € 1. 8 billion € 1. 4 billion IMPLEMENTED MANUFACTURING PROJECTS (as at 2010) 1. JAPAN 2. USA 3. SINGAPORE 4. GERMANY 5. NETHERLANDS € 13. 6 billion € 12. 7 billion € 5. 4 billion € 4. 4 billion € 3. 3 billion

NOTABLE GERMAN COMPANIES IN MALAYSIA

NOTABLE GERMAN COMPANIES IN MALAYSIA

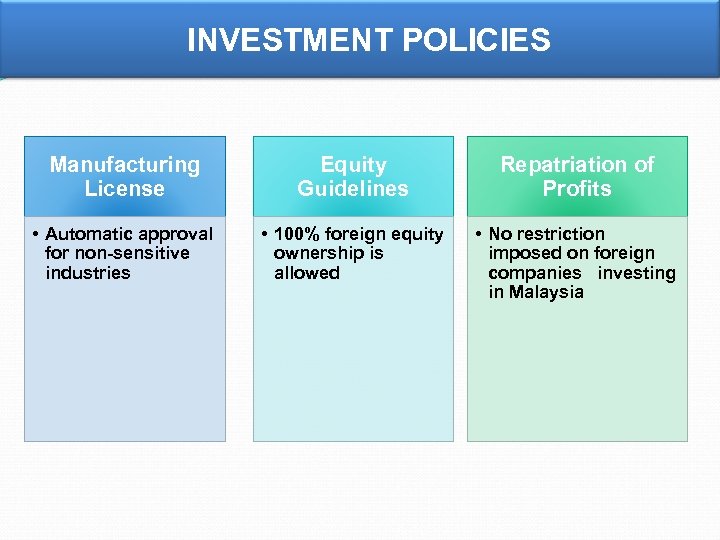

INVESTMENT POLICIES Manufacturing License Equity Guidelines Repatriation of Profits • Automatic approval for non-sensitive industries • 100% foreign equity ownership is allowed • No restriction imposed on foreign companies investing in Malaysia

INVESTMENT POLICIES Manufacturing License Equity Guidelines Repatriation of Profits • Automatic approval for non-sensitive industries • 100% foreign equity ownership is allowed • No restriction imposed on foreign companies investing in Malaysia

INCENTIVES Pioneer Status Income tax exemption ranging from 70%-100%; 510 years Investment Tax Allowance 60%-100% on qualifying capital expenditure; 5 -10 years Incentives Reinvestment Allowance 60% on qualifying capital expenditure Import Duty & Sales Tax Exemption For raw materials and machinery and Equipment

INCENTIVES Pioneer Status Income tax exemption ranging from 70%-100%; 510 years Investment Tax Allowance 60%-100% on qualifying capital expenditure; 5 -10 years Incentives Reinvestment Allowance 60% on qualifying capital expenditure Import Duty & Sales Tax Exemption For raw materials and machinery and Equipment

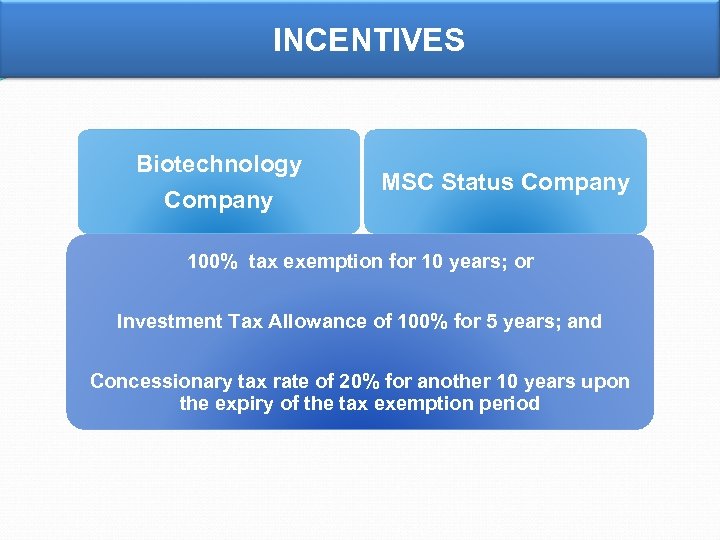

INCENTIVES Biotechnology Company MSC Status Company 100% tax exemption for 10 years; or Investment Tax Allowance of 100% for 5 years; and Concessionary tax rate of 20% for another 10 years upon the expiry of the tax exemption period

INCENTIVES Biotechnology Company MSC Status Company 100% tax exemption for 10 years; or Investment Tax Allowance of 100% for 5 years; and Concessionary tax rate of 20% for another 10 years upon the expiry of the tax exemption period

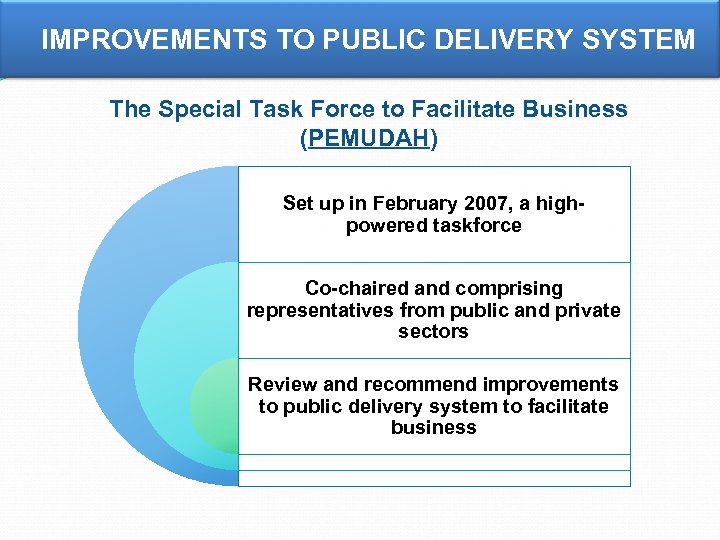

IMPROVEMENTS TO PUBLIC DELIVERY SYSTEM The Special Task Force to Facilitate Business (PEMUDAH) Set up in February 2007, a highpowered taskforce Co-chaired and comprising representatives from public and private sectors Review and recommend improvements to public delivery system to facilitate business

IMPROVEMENTS TO PUBLIC DELIVERY SYSTEM The Special Task Force to Facilitate Business (PEMUDAH) Set up in February 2007, a highpowered taskforce Co-chaired and comprising representatives from public and private sectors Review and recommend improvements to public delivery system to facilitate business

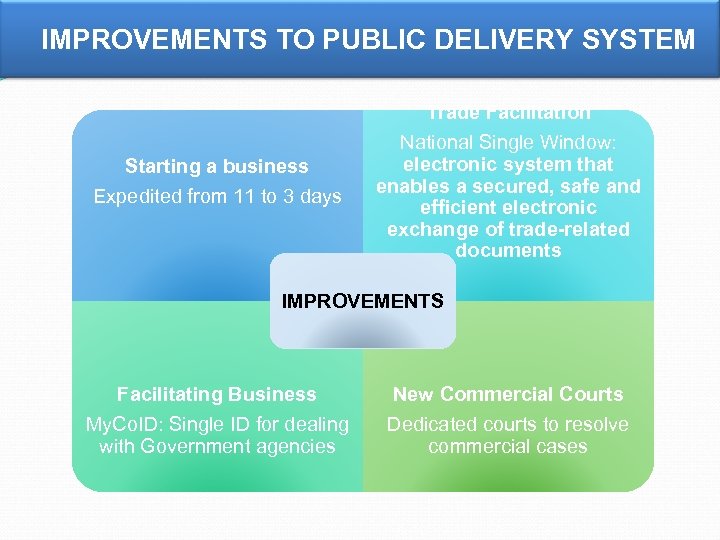

IMPROVEMENTS TO PUBLIC DELIVERY SYSTEM Starting a business Expedited from 11 to 3 days Trade Facilitation National Single Window: electronic system that enables a secured, safe and efficient electronic exchange of trade-related documents IMPROVEMENTS Facilitating Business My. Co. ID: Single ID for dealing with Government agencies New Commercial Courts Dedicated courts to resolve commercial cases

IMPROVEMENTS TO PUBLIC DELIVERY SYSTEM Starting a business Expedited from 11 to 3 days Trade Facilitation National Single Window: electronic system that enables a secured, safe and efficient electronic exchange of trade-related documents IMPROVEMENTS Facilitating Business My. Co. ID: Single ID for dealing with Government agencies New Commercial Courts Dedicated courts to resolve commercial cases

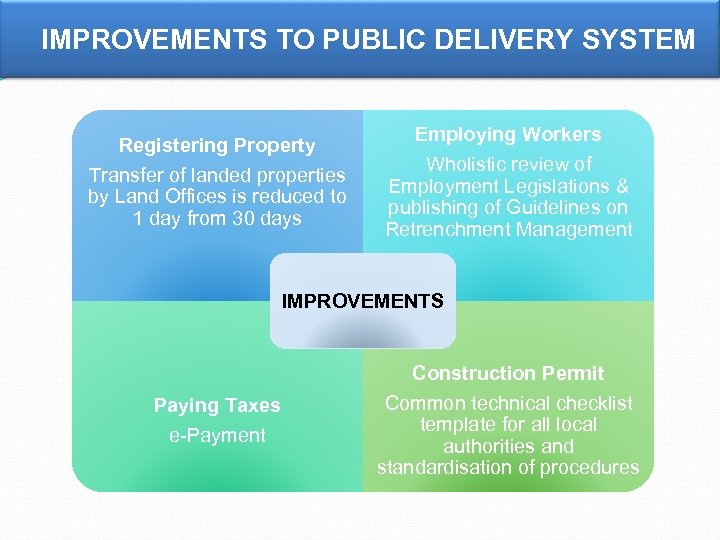

IMPROVEMENTS TO PUBLIC DELIVERY SYSTEM Registering Property Transfer of landed properties by Land Offices is reduced to 1 day from 30 days Employing Workers Wholistic review of Employment Legislations & publishing of Guidelines on Retrenchment Management IMPROVEMENTS Paying Taxes e-Payment Construction Permit Common technical checklist template for all local authorities and standardisation of procedures

IMPROVEMENTS TO PUBLIC DELIVERY SYSTEM Registering Property Transfer of landed properties by Land Offices is reduced to 1 day from 30 days Employing Workers Wholistic review of Employment Legislations & publishing of Guidelines on Retrenchment Management IMPROVEMENTS Paying Taxes e-Payment Construction Permit Common technical checklist template for all local authorities and standardisation of procedures

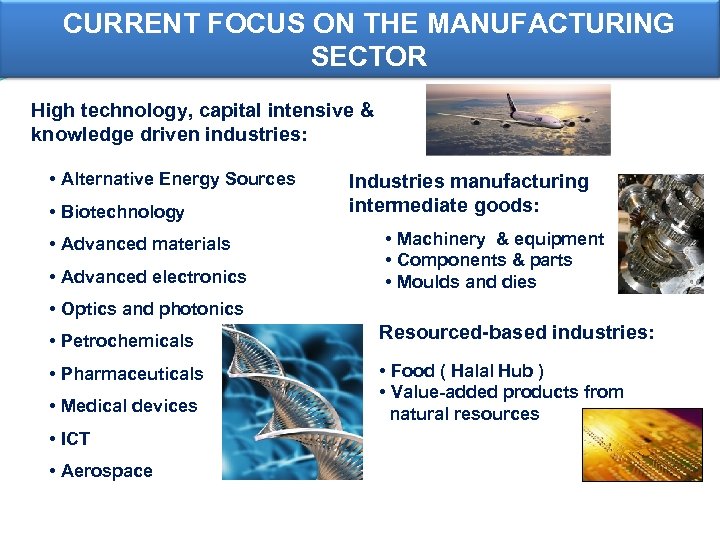

CURRENT FOCUS ON THE MANUFACTURING SECTOR High technology, capital intensive & knowledge driven industries: • Alternative Energy Sources • Biotechnology • Advanced materials • Advanced electronics Industries manufacturing intermediate goods: • Machinery & equipment • Components & parts • Moulds and dies • Optics and photonics • Petrochemicals • Pharmaceuticals • Medical devices • ICT • Aerospace Resourced-based industries: • Food ( Halal Hub ) • Value-added products from natural resources

CURRENT FOCUS ON THE MANUFACTURING SECTOR High technology, capital intensive & knowledge driven industries: • Alternative Energy Sources • Biotechnology • Advanced materials • Advanced electronics Industries manufacturing intermediate goods: • Machinery & equipment • Components & parts • Moulds and dies • Optics and photonics • Petrochemicals • Pharmaceuticals • Medical devices • ICT • Aerospace Resourced-based industries: • Food ( Halal Hub ) • Value-added products from natural resources

TARGETED SERVICES SECTORS Ø Regional Establishments § Operational Headquarters (OHQ) § International Procurement Centre (IPC) § Regional Distribution Centre (RDC) Ø Logistics § Integrated Logistics Services § Cold Chain Facilities Ø Tourism §Hotel §Tourist project §Recreational camp §Convention centre

TARGETED SERVICES SECTORS Ø Regional Establishments § Operational Headquarters (OHQ) § International Procurement Centre (IPC) § Regional Distribution Centre (RDC) Ø Logistics § Integrated Logistics Services § Cold Chain Facilities Ø Tourism §Hotel §Tourist project §Recreational camp §Convention centre

TARGETED SERVICES SECTORS Ø Environmental Management § Energy conservation/efficiency § Energy generation, using renewable energy sources § Storage, treatment and disposal of hazardous waste § Recycling of agricultural waste and agricultural byproducts Ø Business Services § Shared services outsourcing § Research & Development (R&D) § ICT Services § Market Support Services § Film & Video Production & Post Production

TARGETED SERVICES SECTORS Ø Environmental Management § Energy conservation/efficiency § Energy generation, using renewable energy sources § Storage, treatment and disposal of hazardous waste § Recycling of agricultural waste and agricultural byproducts Ø Business Services § Shared services outsourcing § Research & Development (R&D) § ICT Services § Market Support Services § Film & Video Production & Post Production

TARGETED SERVICES SECTORS Ø Education § Technical, Vocational & Science Training Ø Healthcare Travel (Medical Tourism) § Private hospitals § Wellness Zone (Port Dickson)

TARGETED SERVICES SECTORS Ø Education § Technical, Vocational & Science Training Ø Healthcare Travel (Medical Tourism) § Private hospitals § Wellness Zone (Port Dickson)

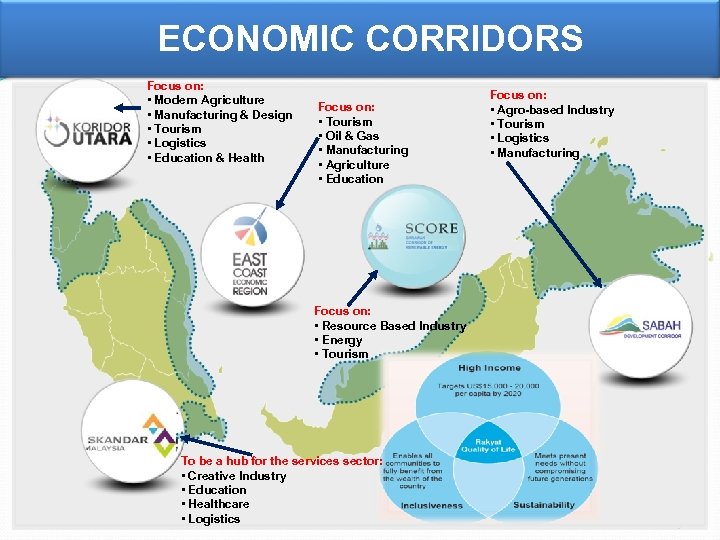

ECONOMIC CORRIDORS Focus on: • Modern Agriculture • Manufacturing & Design • Tourism • Logistics • Education & Health Focus on: • Tourism • Oil & Gas • Manufacturing • Agriculture • Education Focus on: • Agro-based Industry • Tourism • Logistics • Manufacturing Focus on: • Resource Based Industry • Energy • Tourism To be a hub for the services sector: • Creative Industry • Education • Healthcare • Logistics 19

ECONOMIC CORRIDORS Focus on: • Modern Agriculture • Manufacturing & Design • Tourism • Logistics • Education & Health Focus on: • Tourism • Oil & Gas • Manufacturing • Agriculture • Education Focus on: • Agro-based Industry • Tourism • Logistics • Manufacturing Focus on: • Resource Based Industry • Energy • Tourism To be a hub for the services sector: • Creative Industry • Education • Healthcare • Logistics 19

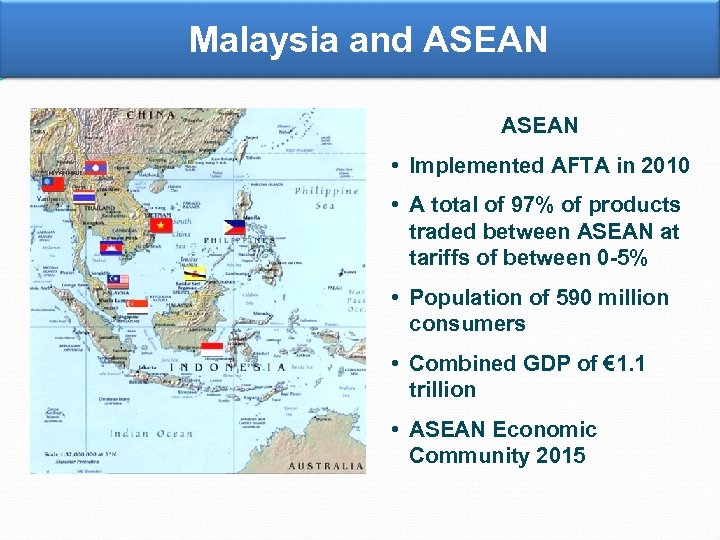

Malaysia and ASEAN • Implemented AFTA in 2010 • A total of 97% of products traded between ASEAN at tariffs of between 0 -5% • Population of 590 million consumers • Combined GDP of € 1. 1 trillion • ASEAN Economic Community 2015

Malaysia and ASEAN • Implemented AFTA in 2010 • A total of 97% of products traded between ASEAN at tariffs of between 0 -5% • Population of 590 million consumers • Combined GDP of € 1. 1 trillion • ASEAN Economic Community 2015

STRATEGIC MARKET ACCESS Foreign companies based in Malaysia can enjoy preferential market access via Free Trade Agreements concluded by Malaysia: ASEAN Bilateral AFTA China Korea Japan Australia-New Zealand Japan Pakistan New Zealand Chile India Under Negotiations EU Australia Turkey TPP GCC

STRATEGIC MARKET ACCESS Foreign companies based in Malaysia can enjoy preferential market access via Free Trade Agreements concluded by Malaysia: ASEAN Bilateral AFTA China Korea Japan Australia-New Zealand Japan Pakistan New Zealand Chile India Under Negotiations EU Australia Turkey TPP GCC

MALAYSIA –EU FTA Coverage: üCoverage broad spectrum i. e. Goods, Services, Investment and others • So far, 2 rounds of negotiation held • Targeted to be completed within 18 months from December 2010 • Expected to bring benefits both EU and Malaysia in all economic areas.

MALAYSIA –EU FTA Coverage: üCoverage broad spectrum i. e. Goods, Services, Investment and others • So far, 2 rounds of negotiation held • Targeted to be completed within 18 months from December 2010 • Expected to bring benefits both EU and Malaysia in all economic areas.

MALAYSIA’S INTERNATIONAL RANKINGS 3 rd Attractive Location for Outsourcing Destinations – A. T. Kearney Global Services Location Index 2010 4 th For Investor Protection – Forbes Report 2010 10 th Most Competitive Economy In 2010 – IMD 23 rd For Ease Of Doing Business In 2010 – The World Bank Group

MALAYSIA’S INTERNATIONAL RANKINGS 3 rd Attractive Location for Outsourcing Destinations – A. T. Kearney Global Services Location Index 2010 4 th For Investor Protection – Forbes Report 2010 10 th Most Competitive Economy In 2010 – IMD 23 rd For Ease Of Doing Business In 2010 – The World Bank Group

WHY MALAYSIA ? • • • Political & Economic Stability Pro-business Government Liberal Investment Policies Transparent Policies Policy of Welcome Well Developed Infrastructure Sound Banking System Harmonious Industrial Relations Trainable & Educated Labour Force Quality of Life Good Track Record

WHY MALAYSIA ? • • • Political & Economic Stability Pro-business Government Liberal Investment Policies Transparent Policies Policy of Welcome Well Developed Infrastructure Sound Banking System Harmonious Industrial Relations Trainable & Educated Labour Force Quality of Life Good Track Record

CONCLUSION MALAYSIA YOUR STRATEGIC PARTNER IN ASIA PACIFIC YOU CAN COUNT ON!

CONCLUSION MALAYSIA YOUR STRATEGIC PARTNER IN ASIA PACIFIC YOU CAN COUNT ON!