5a5dfa857a2fc2b13e74fd443aa7ffd1.ppt

- Количество слайдов: 26

Towards the future: What next for Telecom Businesses? Dr Tim Kelly, ITU Wednesday Session 1 CTO Senior management seminar: Telecoms restructuring and business change Malta, 17 -21 May, 1999 The views expressed in this paper are those of the author and do not necessarily reflect the opinions of the ITU or its membership. Dr Kelly can be contacted at Tim. Kelly@itu. int.

Agenda l The current international telecoms market l Forecasting by projection of current trends ð Market trends ð Price trends ð Infrastructure trends l Forecasting by identifying discontinuities ð Rise of the Internet ð Mobile / Fixed substitution ð Erosion of the accounting rate system l The international telecoms market in 2005

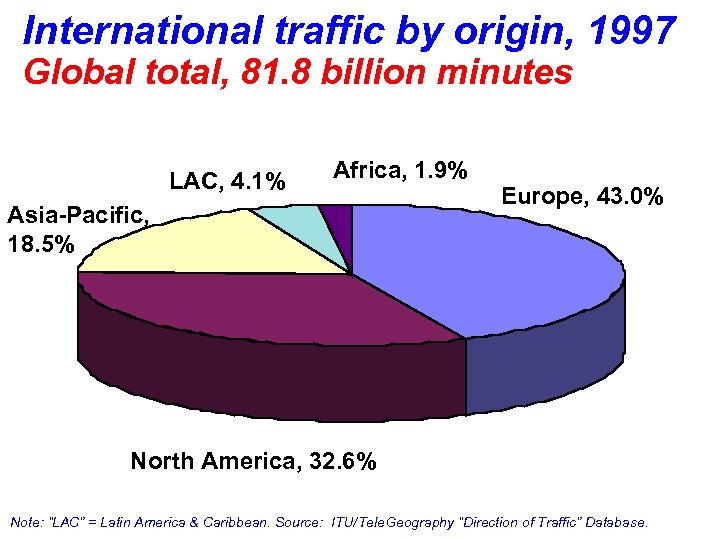

International traffic by origin, 1997 Global total, 81. 8 billion minutes LAC, 4. 1% Africa, 1. 9% Asia-Pacific, 18. 5% Europe, 43. 0% North America, 32. 6% Note: “LAC” = Latin America & Caribbean. Source: ITU/Tele. Geography “Direction of Traffic” Database.

Top ten international telecom carriers, 1997 (billions of minutes) Source: ITU/Tele. Geography Inc.

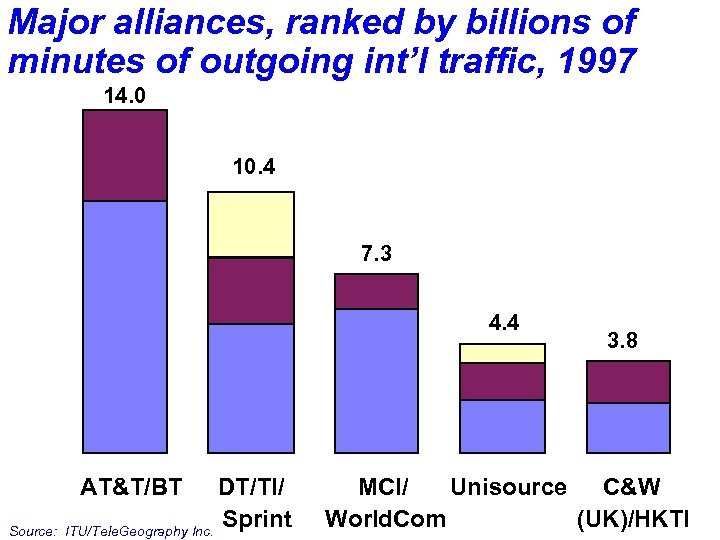

Major alliances, ranked by billions of minutes of outgoing int’l traffic, 1997 14. 0 10. 4 7. 3 4. 4 AT&T/BT Source: DT/TI/ Sprint ITU/Tele. Geography Inc. 3. 8 MCI/ Unisource C&W World. Com (UK)/HKTI

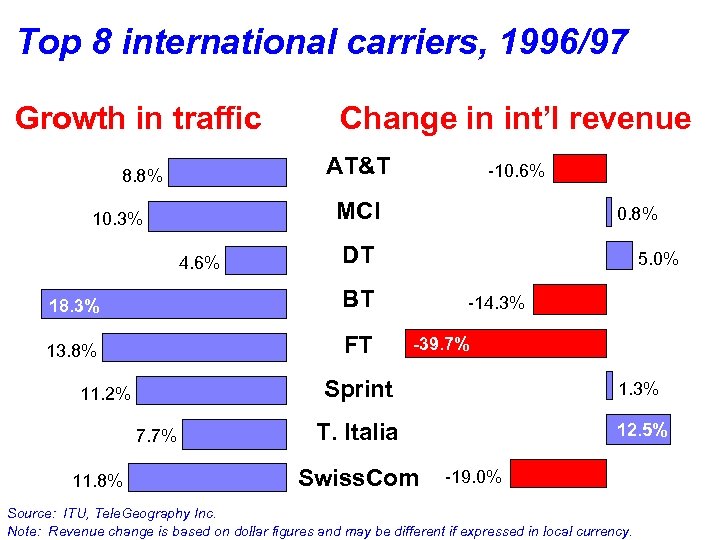

Top 8 international carriers, 1996/97 Growth in traffic Change in int’l revenue AT&T 8. 8% -10. 6% MCI 10. 3% 4. 6% 0. 8% DT 18. 3% BT 13. 8% FT 5. 0% -39. 7% Sprint 11. 2% 7. 7% 11. 8% -14. 3% 1. 3% T. Italia 12. 5% Swiss. Com -19. 0% Source: ITU, Tele. Geography Inc. Note: Revenue change is based on dollar figures and may be different if expressed in local currency.

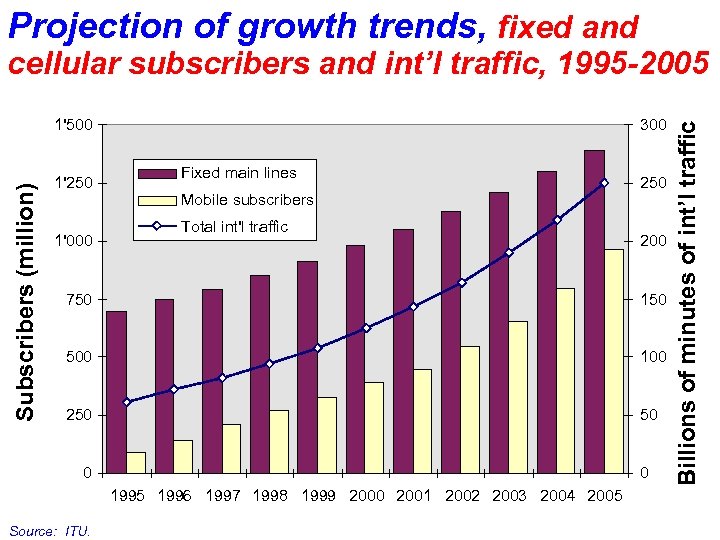

Projection of growth trends, fixed and Subscribers (million) 1'500 1'250 1'000 300 Fixed main lines Mobile subscribers Total int'l traffic 250 200 750 150 500 100 250 50 0 0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Source: ITU. Billions of minutes of int’l traffic cellular subscribers and int’l traffic, 1995 -2005

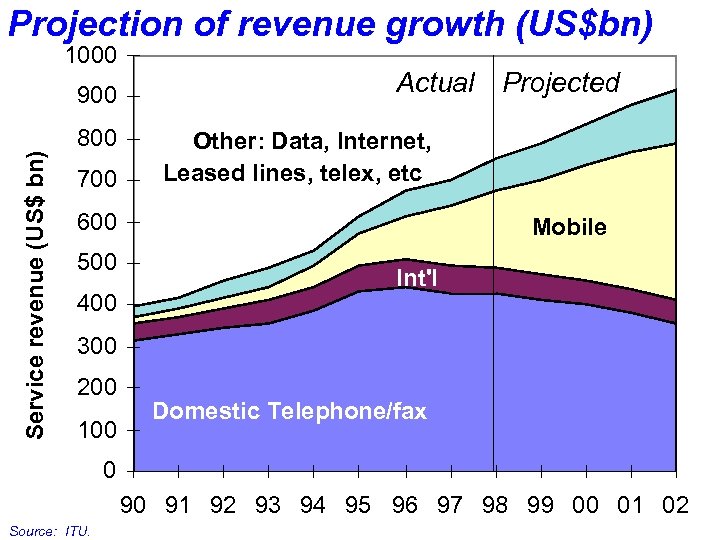

Projection of revenue growth (US$bn) 1000 Service revenue (US$ bn) 900 800 700 Actual Projected Other: Data, Internet, Leased lines, telex, etc 600 500 400 Mobile Int'l 300 200 100 Domestic Telephone/fax 0 90 91 92 93 94 95 96 97 98 99 00 01 02 Source: ITU.

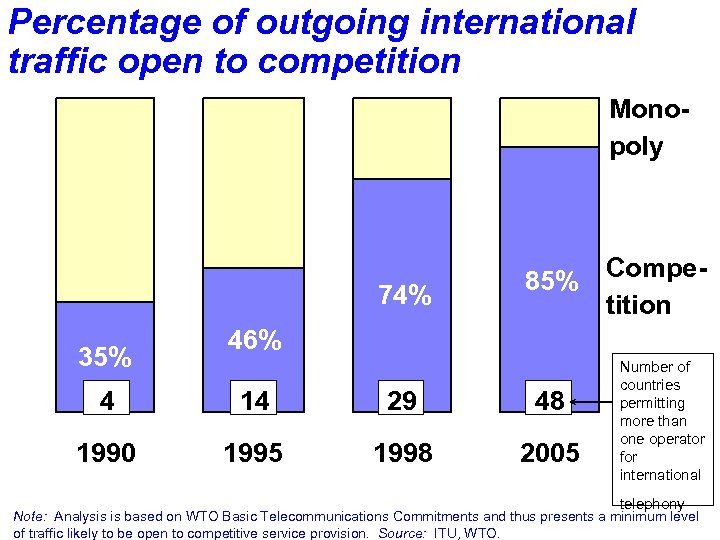

Percentage of outgoing international traffic open to competition Monopoly 74% 35% 85% Competition 46% 4 14 29 48 1990 1995 1998 2005 Number of countries permitting more than one operator for international telephony Note: Analysis is based on WTO Basic Telecommunications Commitments and thus presents a minimum level of traffic likely to be open to competitive service provision. Source: ITU, WTO.

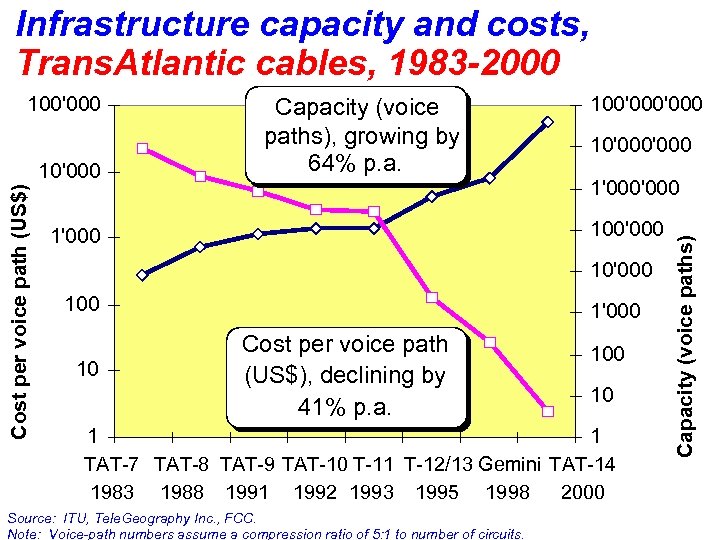

Infrastructure capacity and costs, Trans. Atlantic cables, 1983 -2000 Cost per voice path (US$) 10'000 Capacity (voice paths), growing by 64% p. a. 100'000 10'000 1'000 100'000 10'000 10 1'000 Cost per voice path (US$), declining by 41% p. a. 100 10 1 1 TAT-7 TAT-8 TAT-9 TAT-10 T-11 T-12/13 Gemini TAT-14 1983 1988 1991 1992 1993 1995 1998 2000 Source: ITU, Tele. Geography Inc. , FCC. Note: Voice-path numbers assume a compression ratio of 5: 1 to number of circuits. Capacity (voice paths) 100'000

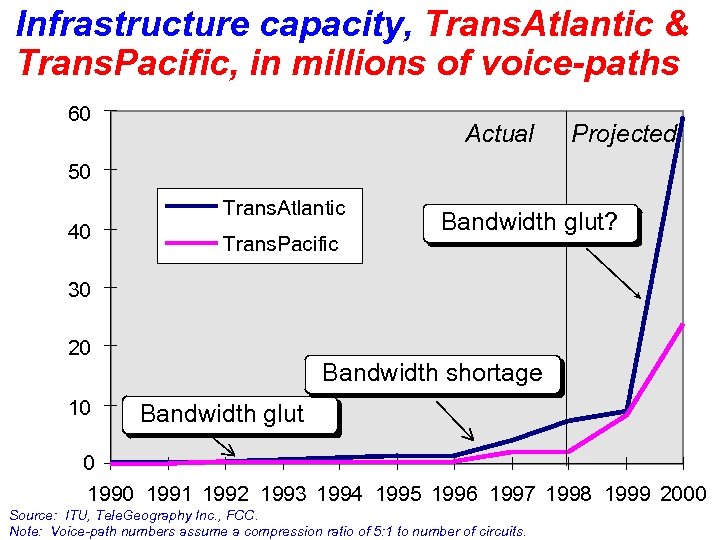

Infrastructure capacity, Trans. Atlantic & Trans. Pacific, in millions of voice-paths 60 Actual Projected 50 Trans. Atlantic 40 Trans. Pacific Bandwidth glut? 30 20 10 Bandwidth shortage Bandwidth glut 0 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 Source: ITU, Tele. Geography Inc. , FCC. Note: Voice-path numbers assume a compression ratio of 5: 1 to number of circuits.

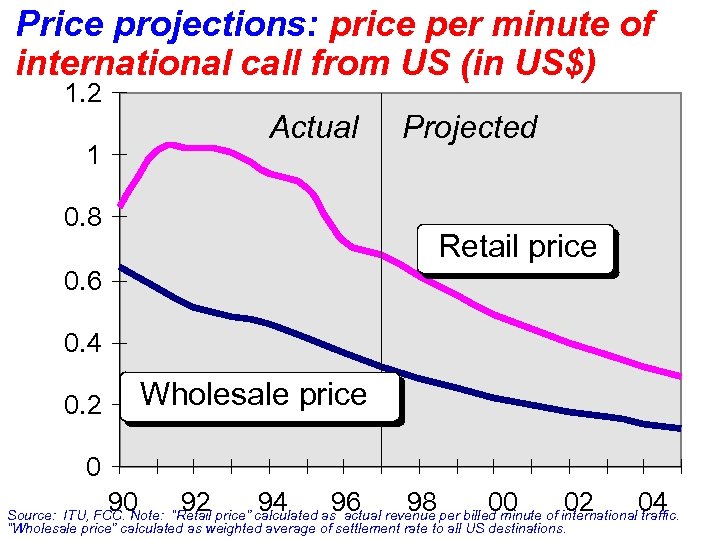

Price projections: price per minute of international call from US (in US$) 1. 2 Actual 1 Projected 0. 8 Retail price 0. 6 0. 4 Wholesale price 0. 2 0 90 92 94 96 98 00 02 04 Source: ITU, FCC. Note: “Retail price” calculated as actual revenue per billed minute of international traffic. “Wholesale price” calculated as weighted average of settlement rate to all US destinations.

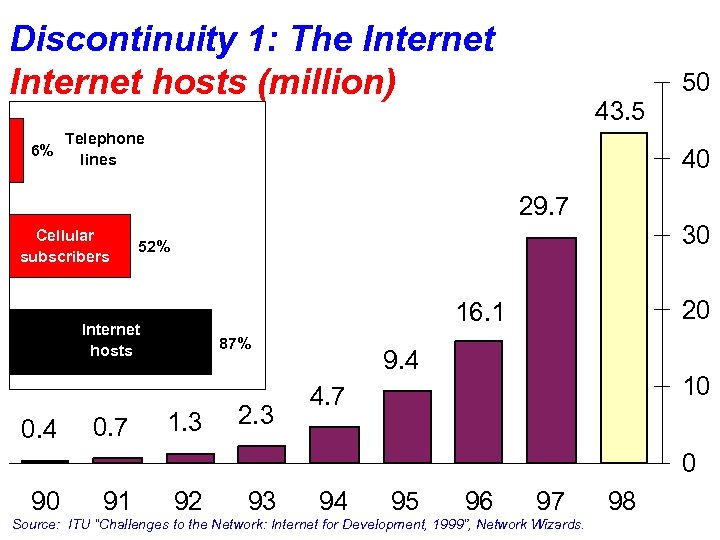

Discontinuity 1: The Internet hosts (million) 43. 5 Telephone 6% lines 40 29. 7 Cellular subscribers 0. 4 30 52% 20 16. 1 Internet hosts 0. 7 50 87% 1. 3 2. 3 9. 4 10 4. 7 0 90 91 92 93 94 95 96 97 Source: ITU “Challenges to the Network: Internet for Development, 1999”, Network Wizards. 98

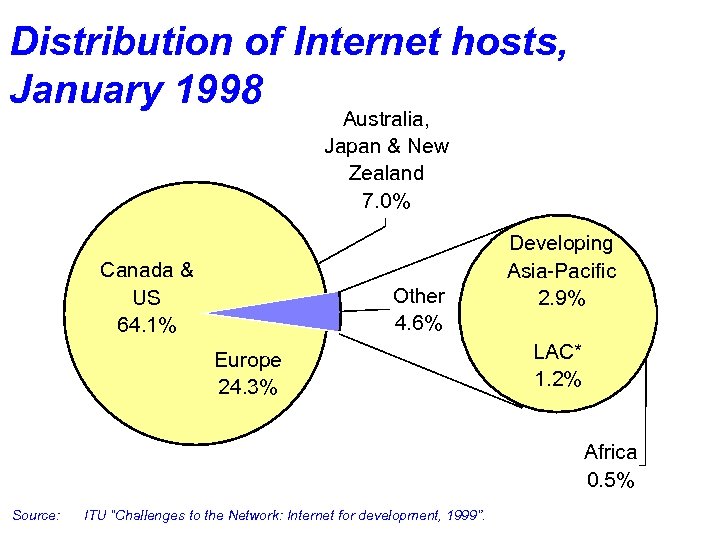

Distribution of Internet hosts, January 1998 Australia, Japan & New Zealand 7. 0% Canada & US 64. 1% Other 4. 6% Europe 24. 3% Developing Asia-Pacific 2. 9% LAC* 1. 2% Africa 0. 5% Source: ITU “Challenges to the Network: Internet for development, 1999”.

“IP is to communications what the PC was to computing … it’s that fundamental a shift” Dan Schulman, AT&T World. Net Services, Quoted in Tele. Com, May 1998 The Economist May 2 nd 1998

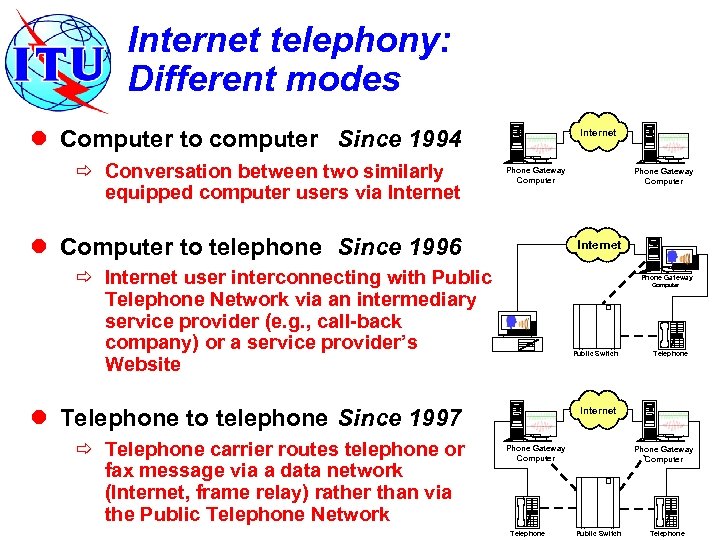

Internet telephony: Different modes l Computer to computer Since 1994 ð Conversation between two similarly equipped computer users via Internet Phone Gateway Computer l Computer to telephone Since 1996 Internet ð Internet user interconnecting with Public Telephone Network via an intermediary service provider (e. g. , call-back company) or a service provider’s Website Phone Gateway Computer Public Switch l Telephone to telephone Since 1997 ð Telephone carrier routes telephone or fax message via a data network (Internet, frame relay) rather than via the Public Telephone Network Phone Gateway Computer Telephone Internet Phone Gateway Computer Telephone Phone Gateway Computer Public Switch Telephone

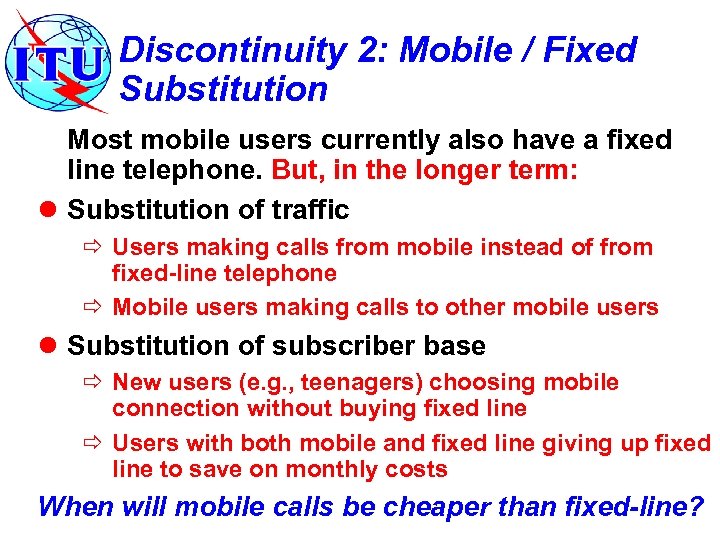

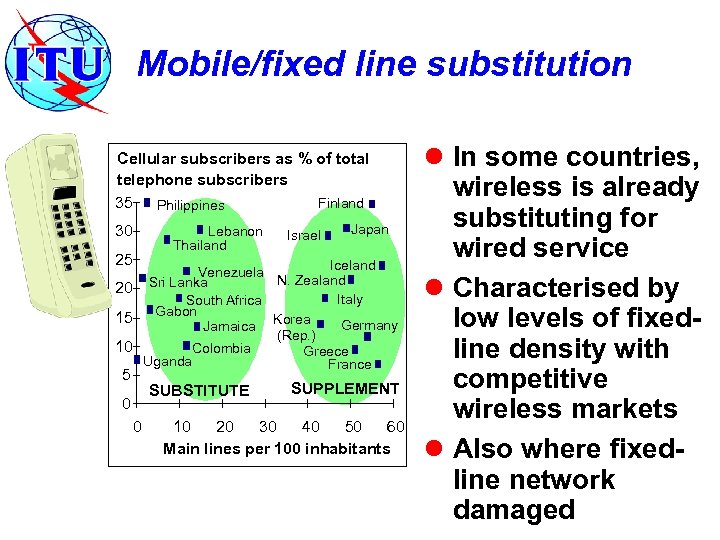

Discontinuity 2: Mobile / Fixed Substitution Most mobile users currently also have a fixed line telephone. But, in the longer term: l Substitution of traffic ð Users making calls from mobile instead of from fixed-line telephone ð Mobile users making calls to other mobile users l Substitution of subscriber base ð New users (e. g. , teenagers) choosing mobile connection without buying fixed line ð Users with both mobile and fixed line giving up fixed line to save on monthly costs When will mobile calls be cheaper than fixed-line?

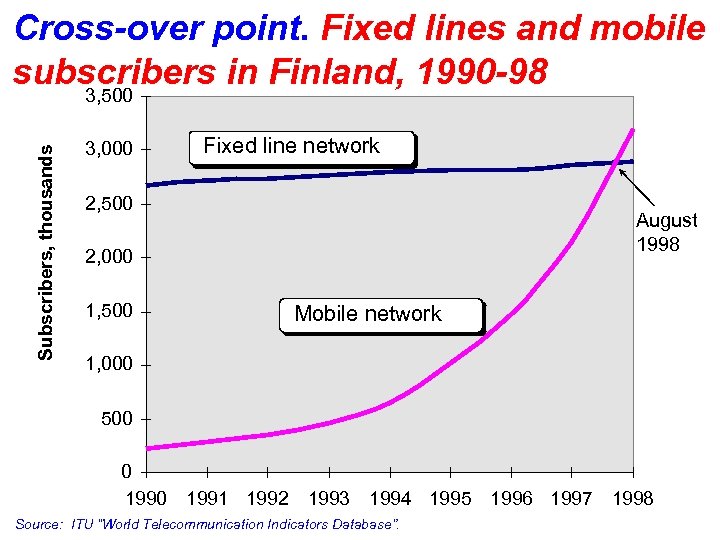

Subscribers, thousands Cross-over point. Fixed lines and mobile subscribers in Finland, 1990 -98 3, 500 3, 000 Fixed line network 2, 500 August 1998 2, 000 1, 500 Mobile network 1, 000 500 0 1991 1992 1993 1994 1995 Source: ITU “World Telecommunication Indicators Database”. 1996 1997 1998

Mobile/fixed line substitution Cellular subscribers as % of total telephone subscribers 35 Philippines Finland 30 25 Lebanon Thailand Israel Japan Iceland Venezuela N. Zealand 20 Sri Lanka Italy South Africa 15 Gabon Korea Germany Jamaica (Rep. ) 10 Colombia Greece Uganda France 5 SUBSTITUTE 0 0 SUPPLEMENT 10 20 30 40 50 60 Main lines per 100 inhabitants l In some countries, wireless is already substituting for wired service l Characterised by low levels of fixedline density with competitive wireless markets l Also where fixedline network damaged

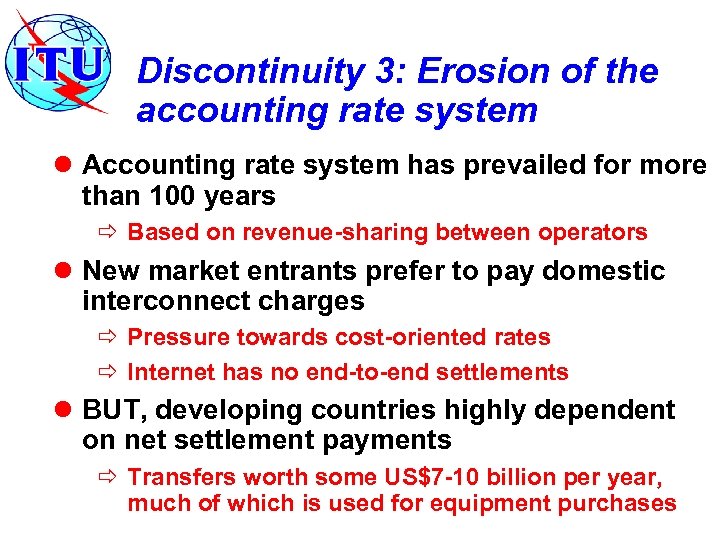

Discontinuity 3: Erosion of the accounting rate system l Accounting rate system has prevailed for more than 100 years ð Based on revenue-sharing between operators l New market entrants prefer to pay domestic interconnect charges ð Pressure towards cost-oriented rates ð Internet has no end-to-end settlements l BUT, developing countries highly dependent on net settlement payments ð Transfers worth some US$7 -10 billion per year, much of which is used for equipment purchases

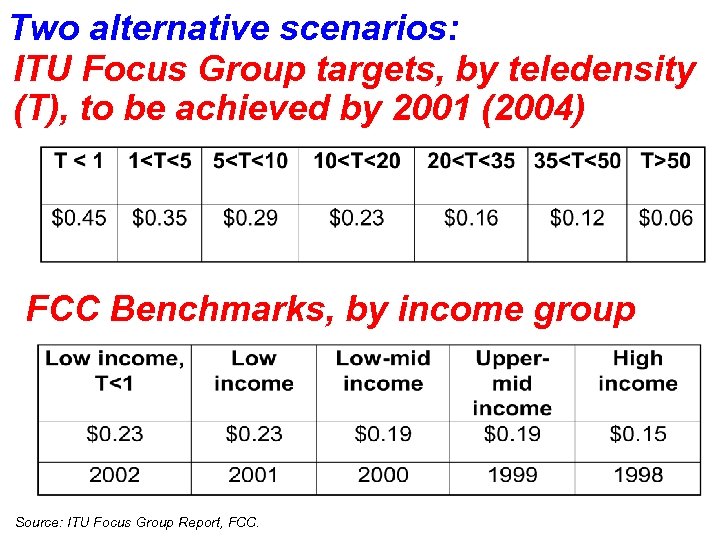

Two alternative scenarios: ITU Focus Group targets, by teledensity (T), to be achieved by 2001 (2004) FCC Benchmarks, by income group Source: ITU Focus Group Report, FCC.

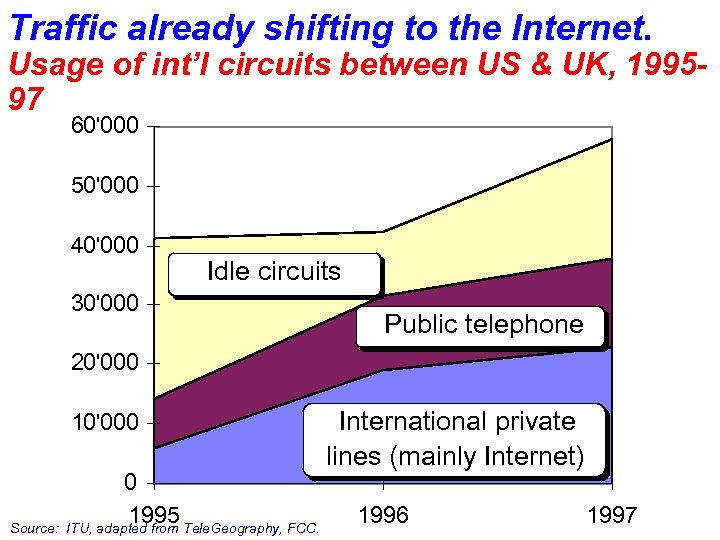

Traffic already shifting to the Internet. Usage of int’l circuits between US & UK, 199597 60'000 50'000 40'000 Idle circuits 30'000 Public telephone 20'000 10'000 Source: 0 1995 ITU, adapted from Tele. Geography, FCC. International private lines (mainly Internet) 1996 1997

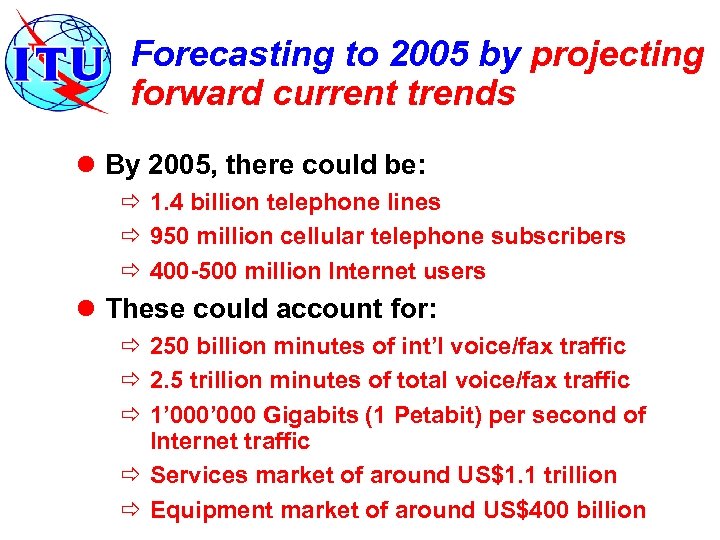

Forecasting to 2005 by projecting forward current trends l By 2005, there could be: ð 1. 4 billion telephone lines ð 950 million cellular telephone subscribers ð 400 -500 million Internet users l These could account for: ð 250 billion minutes of int’l voice/fax traffic ð 2. 5 trillion minutes of total voice/fax traffic ð 1’ 000 Gigabits (1 Petabit) per second of Internet traffic ð Services market of around US$1. 1 trillion ð Equipment market of around US$400 billion

“The death of distance as a determinant of the cost of communicating will probably be the single most important factor shaping society in the first half of the next century. ” Frances Cairncross, “The Death of Distance”, 1997

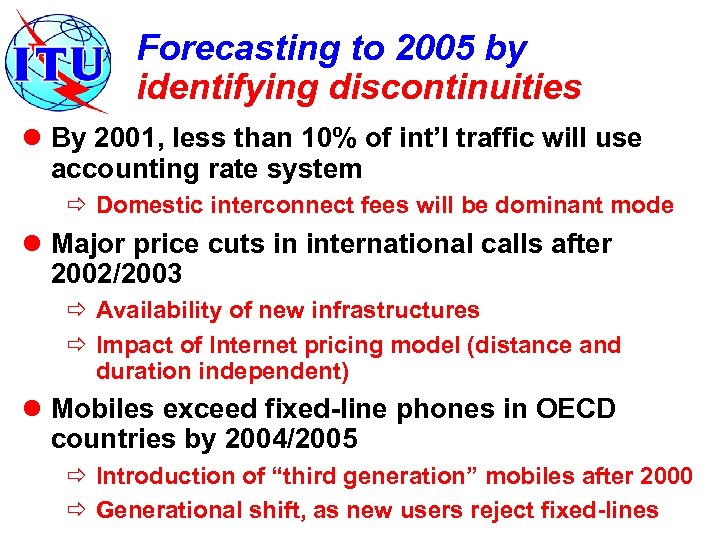

Forecasting to 2005 by identifying discontinuities l By 2001, less than 10% of int’l traffic will use accounting rate system ð Domestic interconnect fees will be dominant mode l Major price cuts in international calls after 2002/2003 ð Availability of new infrastructures ð Impact of Internet pricing model (distance and duration independent) l Mobiles exceed fixed-line phones in OECD countries by 2004/2005 ð Introduction of “third generation” mobiles after 2000 ð Generational shift, as new users reject fixed-lines

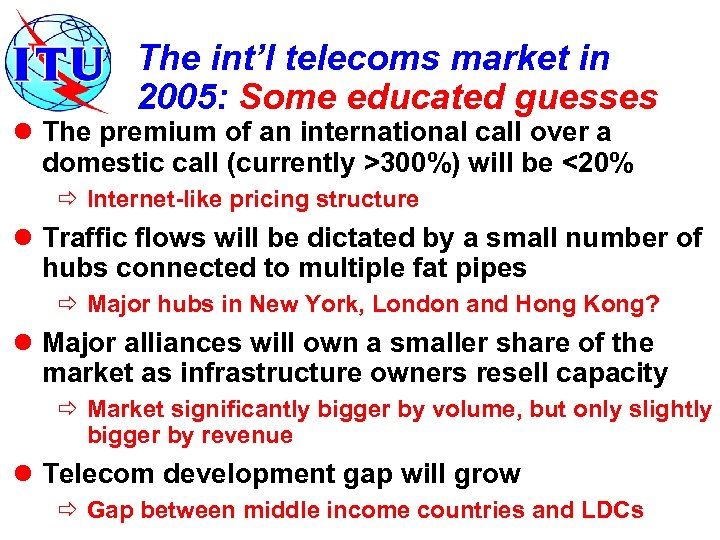

The int’l telecoms market in 2005: Some educated guesses l The premium of an international call over a domestic call (currently >300%) will be <20% ð Internet-like pricing structure l Traffic flows will be dictated by a small number of hubs connected to multiple fat pipes ð Major hubs in New York, London and Hong Kong? l Major alliances will own a smaller share of the market as infrastructure owners resell capacity ð Market significantly bigger by volume, but only slightly bigger by revenue l Telecom development gap will grow ð Gap between middle income countries and LDCs

5a5dfa857a2fc2b13e74fd443aa7ffd1.ppt