e01278a8c53cbae48d5ce60e131790ca.ppt

- Количество слайдов: 17

Towards Innovative Healthcare Financing Ghana NHIS 10 th Anniversary Conference WHO Consultant Sheila O’Dougherty November 2013

Towards Innovative Healthcare Financing Ghana NHIS 10 th Anniversary Conference WHO Consultant Sheila O’Dougherty November 2013

Outline of Presentation • International trend: from opposing camps to disappearing dichotomies • Innovation and efficiency gains: the relationship between three health financing functions of revenue collection, pooling of funds and health purchasing

Outline of Presentation • International trend: from opposing camps to disappearing dichotomies • Innovation and efficiency gains: the relationship between three health financing functions of revenue collection, pooling of funds and health purchasing

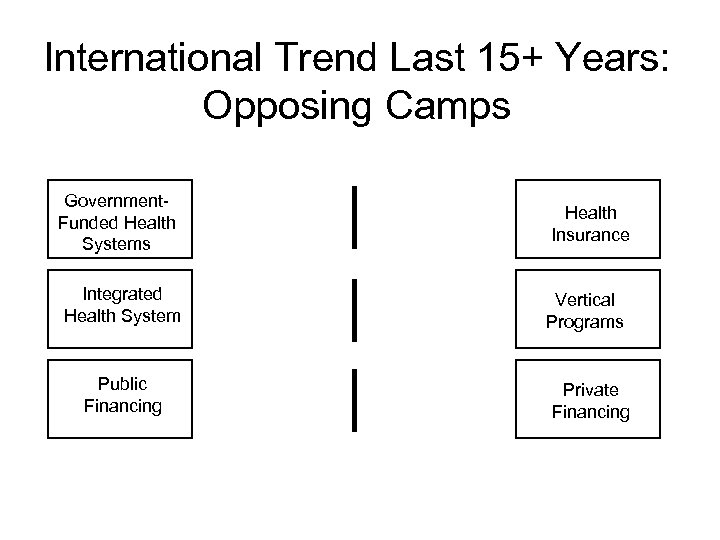

International Trend Last 15+ Years: Opposing Camps Government. Funded Health Systems Integrated Health System Public Financing Health Insurance Vertical Programs Private Financing

International Trend Last 15+ Years: Opposing Camps Government. Funded Health Systems Integrated Health System Public Financing Health Insurance Vertical Programs Private Financing

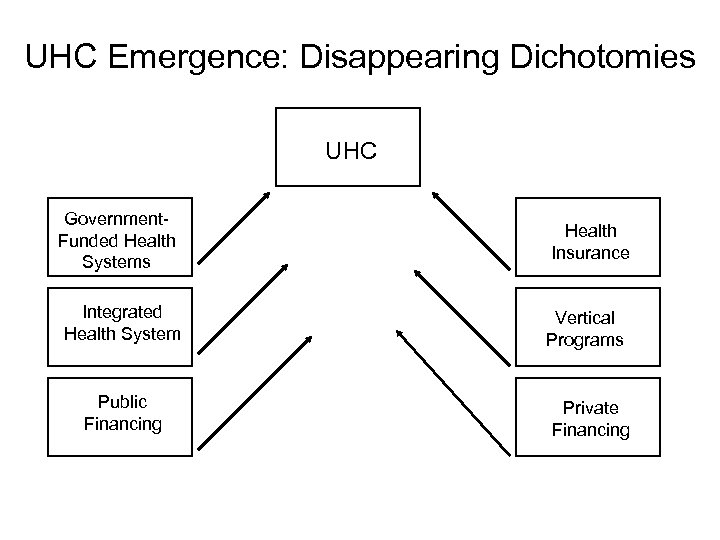

UHC Emergence: Disappearing Dichotomies UHC Government. Funded Health Systems Integrated Health System Public Financing Health Insurance Vertical Programs Private Financing

UHC Emergence: Disappearing Dichotomies UHC Government. Funded Health Systems Integrated Health System Public Financing Health Insurance Vertical Programs Private Financing

Universal Health Coverage • "Financing systems need to be specifically designed to: – Provide all people with access to needed health services (including prevention, promotion, treatment and rehabilitation) of sufficient quality to be effective; – Ensure that the use of these services does not expose the user to financial hardship“ – World Health Report 2010, p. 6 – More a journey than a destination

Universal Health Coverage • "Financing systems need to be specifically designed to: – Provide all people with access to needed health services (including prevention, promotion, treatment and rehabilitation) of sufficient quality to be effective; – Ensure that the use of these services does not expose the user to financial hardship“ – World Health Report 2010, p. 6 – More a journey than a destination

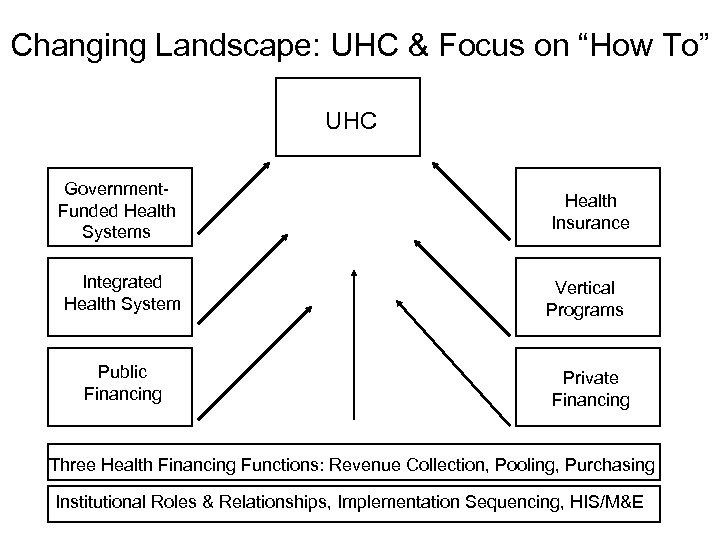

Changing Landscape: UHC & Focus on “How To” UHC Government. Funded Health Systems Integrated Health System Public Financing Health Insurance Vertical Programs Private Financing Three Health Financing Functions: Revenue Collection, Pooling, Purchasing Institutional Roles & Relationships, Implementation Sequencing, HIS/M&E

Changing Landscape: UHC & Focus on “How To” UHC Government. Funded Health Systems Integrated Health System Public Financing Health Insurance Vertical Programs Private Financing Three Health Financing Functions: Revenue Collection, Pooling, Purchasing Institutional Roles & Relationships, Implementation Sequencing, HIS/M&E

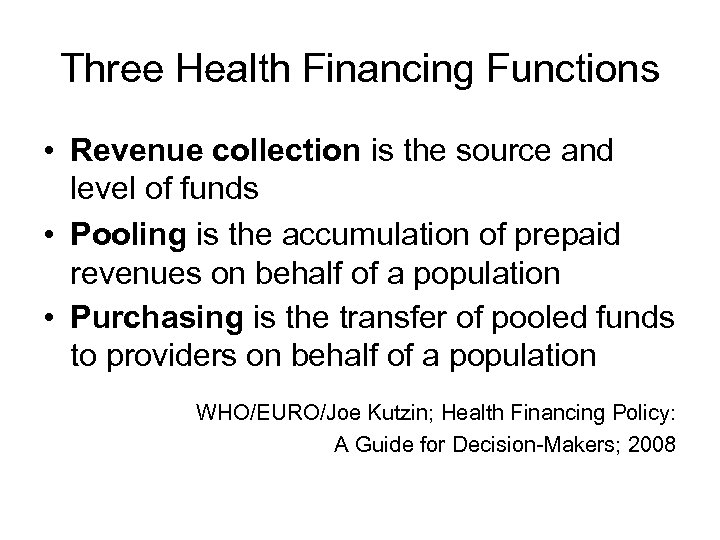

Three Health Financing Functions • Revenue collection is the source and level of funds • Pooling is the accumulation of prepaid revenues on behalf of a population • Purchasing is the transfer of pooled funds to providers on behalf of a population WHO/EURO/Joe Kutzin; Health Financing Policy: A Guide for Decision-Makers; 2008

Three Health Financing Functions • Revenue collection is the source and level of funds • Pooling is the accumulation of prepaid revenues on behalf of a population • Purchasing is the transfer of pooled funds to providers on behalf of a population WHO/EURO/Joe Kutzin; Health Financing Policy: A Guide for Decision-Makers; 2008

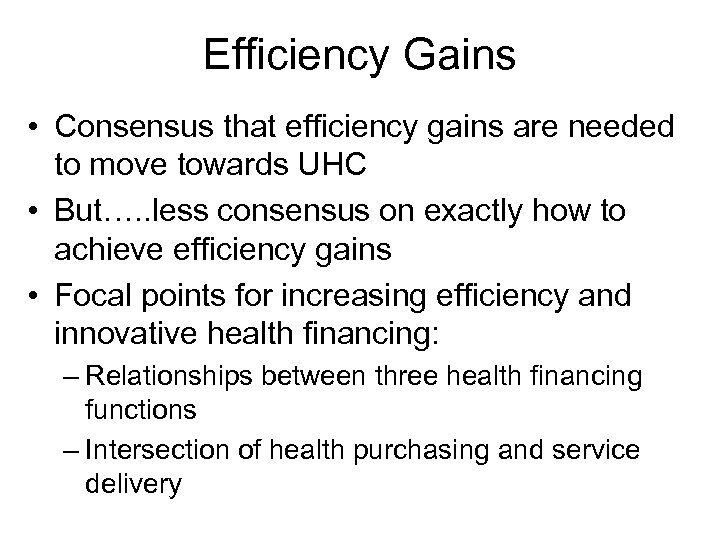

Efficiency Gains • Consensus that efficiency gains are needed to move towards UHC • But…. . less consensus on exactly how to achieve efficiency gains • Focal points for increasing efficiency and innovative health financing: – Relationships between three health financing functions – Intersection of health purchasing and service delivery

Efficiency Gains • Consensus that efficiency gains are needed to move towards UHC • But…. . less consensus on exactly how to achieve efficiency gains • Focal points for increasing efficiency and innovative health financing: – Relationships between three health financing functions – Intersection of health purchasing and service delivery

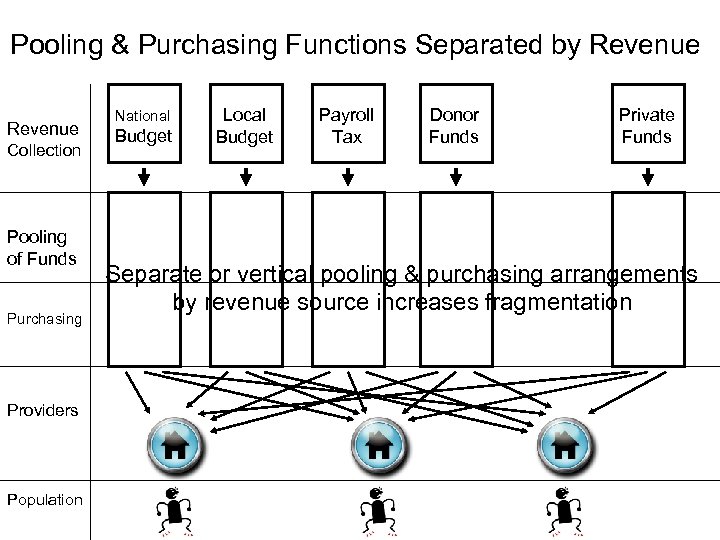

Pooling & Purchasing Functions Separated by Revenue Collection Pooling of Funds Purchasing Providers Population National Budget Local Budget Payroll Tax Donor Funds Private Funds Separate or vertical pooling & purchasing arrangements by revenue source increases fragmentation

Pooling & Purchasing Functions Separated by Revenue Collection Pooling of Funds Purchasing Providers Population National Budget Local Budget Payroll Tax Donor Funds Private Funds Separate or vertical pooling & purchasing arrangements by revenue source increases fragmentation

Summary (Chart 1) • Common perception that each revenue source is standalone or requires it’s own separate pooling and purchasing arrangements – National budget, local government budget, payroll tax (SHI), other types of taxes, donors, private, etc. • Can lead to health financing fragmentation and inefficiencies: – Less than optimal pooling of funds – Less than optimal service or benefit package and provider payment system specification – At provider level, conflicting financial incentives in payment systems (mess of arrows in payment to providers) – Not achieving service delivery improvement objectives – Not level playing field across types of providers – Harder for people to access covered & appropriate services

Summary (Chart 1) • Common perception that each revenue source is standalone or requires it’s own separate pooling and purchasing arrangements – National budget, local government budget, payroll tax (SHI), other types of taxes, donors, private, etc. • Can lead to health financing fragmentation and inefficiencies: – Less than optimal pooling of funds – Less than optimal service or benefit package and provider payment system specification – At provider level, conflicting financial incentives in payment systems (mess of arrows in payment to providers) – Not achieving service delivery improvement objectives – Not level playing field across types of providers – Harder for people to access covered & appropriate services

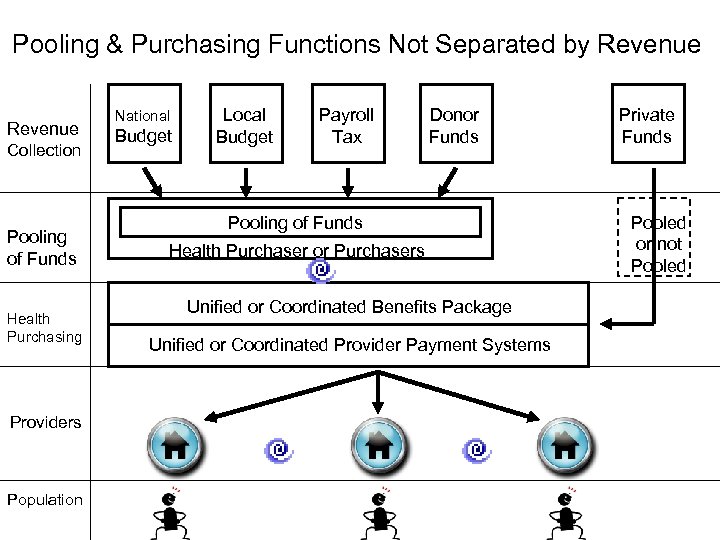

Pooling & Purchasing Functions Not Separated by Revenue Collection Pooling of Funds Health Purchasing Providers Population National Budget Local Budget Payroll Tax Donor Funds Pooling of Funds Health Purchaser or Purchasers Unified or Coordinated Benefits Package Unified or Coordinated Provider Payment Systems Private Funds Pooled or not Pooled

Pooling & Purchasing Functions Not Separated by Revenue Collection Pooling of Funds Health Purchasing Providers Population National Budget Local Budget Payroll Tax Donor Funds Pooling of Funds Health Purchaser or Purchasers Unified or Coordinated Benefits Package Unified or Coordinated Provider Payment Systems Private Funds Pooled or not Pooled

Purchasing with Health Budget Funds • Input-based line item budgets funding public facilities can be problematic if low budget level doesn’t fund all services provided in health facility – Not clear to provider what services funded and what not funded • Health budget purchasing better targeting or matching priority services & poor populations – Output-based provider payment systems • Key is unit of service—not building but services for people – Financial incentives for desired service delivery improvements – Align rather than fragment health purchasing – Better targeting budget funds to priority services opens space or clear role for private funds

Purchasing with Health Budget Funds • Input-based line item budgets funding public facilities can be problematic if low budget level doesn’t fund all services provided in health facility – Not clear to provider what services funded and what not funded • Health budget purchasing better targeting or matching priority services & poor populations – Output-based provider payment systems • Key is unit of service—not building but services for people – Financial incentives for desired service delivery improvements – Align rather than fragment health purchasing – Better targeting budget funds to priority services opens space or clear role for private funds

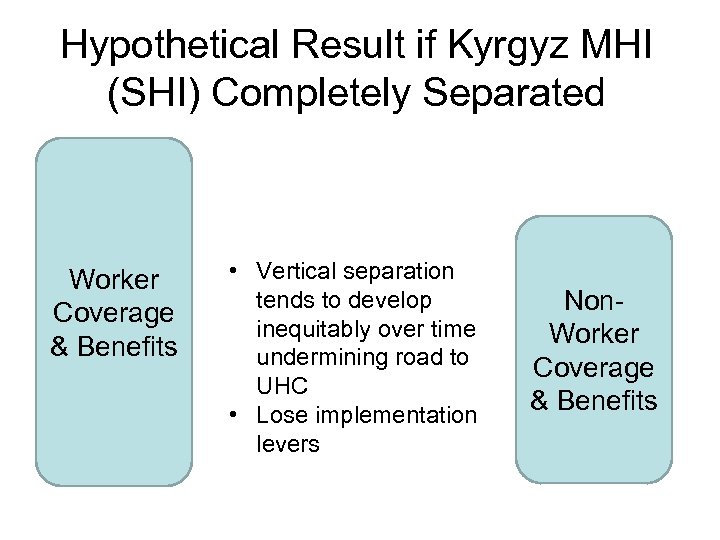

Hypothetical Result if Kyrgyz MHI (SHI) Completely Separated Worker Coverage & Benefits • Vertical separation tends to develop inequitably over time undermining road to UHC • Lose implementation levers Non. Worker Coverage & Benefits

Hypothetical Result if Kyrgyz MHI (SHI) Completely Separated Worker Coverage & Benefits • Vertical separation tends to develop inequitably over time undermining road to UHC • Lose implementation levers Non. Worker Coverage & Benefits

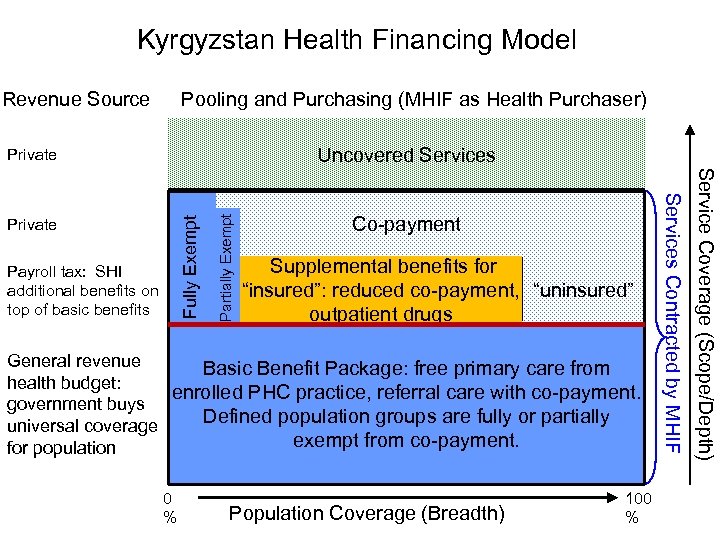

Kyrgyzstan Health Financing Model Revenue Source Pooling and Purchasing (MHIF as Health Purchaser) Payroll tax: SHI additional benefits on top of basic benefits Partially Exempt Co-payment Fully Exempt Private Supplemental benefits for “insured”: reduced co-payment, “uninsured” outpatient drugs General revenue Basic Benefit Package: free primary care from health budget: enrolled PHC practice, referral care with co-payment. government buys Defined population groups are fully or partially universal coverage exempt from co-payment. for population 0 % Population Coverage (Breadth) 100 % Service Coverage (Scope/Depth) Uncovered Services Contracted by MHIF Private

Kyrgyzstan Health Financing Model Revenue Source Pooling and Purchasing (MHIF as Health Purchaser) Payroll tax: SHI additional benefits on top of basic benefits Partially Exempt Co-payment Fully Exempt Private Supplemental benefits for “insured”: reduced co-payment, “uninsured” outpatient drugs General revenue Basic Benefit Package: free primary care from health budget: enrolled PHC practice, referral care with co-payment. government buys Defined population groups are fully or partially universal coverage exempt from co-payment. for population 0 % Population Coverage (Breadth) 100 % Service Coverage (Scope/Depth) Uncovered Services Contracted by MHIF Private

Summary (Chart 2) • More rather than less pooling of funds • Clear health purchaser institutional structure, roles and relationships • Unified or coordinated benefits package • Private OOP (user fees, copayments, etc. ) directly linked to benefits package • Unified or coordinated provider payment systems across revenue sources • Reduces conflicting financial incentives at provider level (clear arrows to providers) • Stimulates desired health system structure and service delivery improvements • Easier for people to access covered & appropriate services

Summary (Chart 2) • More rather than less pooling of funds • Clear health purchaser institutional structure, roles and relationships • Unified or coordinated benefits package • Private OOP (user fees, copayments, etc. ) directly linked to benefits package • Unified or coordinated provider payment systems across revenue sources • Reduces conflicting financial incentives at provider level (clear arrows to providers) • Stimulates desired health system structure and service delivery improvements • Easier for people to access covered & appropriate services

Possible Relevance to Ghana • Ghana doing excellent job moving toward UHC • Innovations could consider: – More unification or coordination of MOH services/programs and NHIS benefit package • Tied together by health worker salaries – Potential for efficiency gains and reducing conflicting financial incentives in payment systems for variable costs of direct patient care (input-based line item budget, fee-for-service, DRGs, per capita, donor mechanisms) – Ensure health purchasing and financial incentives drive desired service delivery improvements

Possible Relevance to Ghana • Ghana doing excellent job moving toward UHC • Innovations could consider: – More unification or coordination of MOH services/programs and NHIS benefit package • Tied together by health worker salaries – Potential for efficiency gains and reducing conflicting financial incentives in payment systems for variable costs of direct patient care (input-based line item budget, fee-for-service, DRGs, per capita, donor mechanisms) – Ensure health purchasing and financial incentives drive desired service delivery improvements

Conclusions • Emergence of UHC as goal can be: – Problem: creates unrealistic expectations – Opportunity: disappearing dichotomies open avenues for innovation • Relationships between three health financing functions and link to service delivery can drive innovation and efficiency gains • Health purchasing for health budget funds better targeting priority services and poor populations – Maximize impact of health budget – Align pooling & purchasing for all revenue sources – Create clarity and space for private financing

Conclusions • Emergence of UHC as goal can be: – Problem: creates unrealistic expectations – Opportunity: disappearing dichotomies open avenues for innovation • Relationships between three health financing functions and link to service delivery can drive innovation and efficiency gains • Health purchasing for health budget funds better targeting priority services and poor populations – Maximize impact of health budget – Align pooling & purchasing for all revenue sources – Create clarity and space for private financing