cc823074d8f800b71d0079faf07f4dfc.ppt

- Количество слайдов: 29

Tourism Value Chain Analysis Dr. Frederic Thomas thomas-frederic@voila. fr A framework for tourism stakeholders to assess and maximize the development impact of public/private investments in the tourism sector, especially the pro poor impact The data in this presentation come from a research’s project co-funded by the IFC/MPDF and the Prosperity initiative in Cambodia and Lao PDR

Tourism Value Chain Analysis Dr. Frederic Thomas thomas-frederic@voila. fr A framework for tourism stakeholders to assess and maximize the development impact of public/private investments in the tourism sector, especially the pro poor impact The data in this presentation come from a research’s project co-funded by the IFC/MPDF and the Prosperity initiative in Cambodia and Lao PDR

Objectives A major objective of the IFC/PI project was to develop a framework for tourism stakeholders to assess and maximize the development impact of public/private investments in the tourism sector, especially the pro poor impact The objectives of a value chain analysis are first and foremost to better understand: n n How a specific economic sector impacts on a local economy (range of activities, phases of production, number of hired people (direct, indirect, induced))? Which opportunities exist for increasing the linkages and benefits between this economic sector and the local economy? What is the feasibility or plausibility of each potential interventions for having an economic, local or pro-poor impact? Finally, what would be the best strategies to increase either the global economic impact, Local Expenditures Impact or the Pro-poor Impact*? (*This implies to take into account the return on investment!)

Objectives A major objective of the IFC/PI project was to develop a framework for tourism stakeholders to assess and maximize the development impact of public/private investments in the tourism sector, especially the pro poor impact The objectives of a value chain analysis are first and foremost to better understand: n n How a specific economic sector impacts on a local economy (range of activities, phases of production, number of hired people (direct, indirect, induced))? Which opportunities exist for increasing the linkages and benefits between this economic sector and the local economy? What is the feasibility or plausibility of each potential interventions for having an economic, local or pro-poor impact? Finally, what would be the best strategies to increase either the global economic impact, Local Expenditures Impact or the Pro-poor Impact*? (*This implies to take into account the return on investment!)

Introduction to Cambodian and Lao Tourism The 2007 Travel and tourism economic research - WTTC world market share of tourism GDP growth 2007/2006 Travel and tourism industry contribution to GDP Travel and tourism contribution to the economy Travel and tourism economy employment (direct/ indirect / induced) Travel and tourism industry employment (direct/indirect) Cambodia 0. 0% 6. 5% 9. 3% 20. 3% 1, 108, 235 500, 103 Vietnam 0. 2% 10. 5% 3. 1% 11. 2% 3, 519, 630 932, 110 Lao PDR 0. 0% 7. 1% 4. 2% 8. 5% 148, 532 72, 248 Malaysia 0. 5% 4. 4% 13. 3% 1, 217, 080 476, 438 Indonesia 0. 6% 3. 6% 2. 4% 7. 5% 6, 056, 156 1, 980, 658 Thailand 0. 7% 3. 3% 6. 7% 14. 9% 4, 109, 502 1, 945, 544 Philippines 0. 2% 7. 0% 4. 1% 9. 1% 3, 542, 908 1, 388, 229

Introduction to Cambodian and Lao Tourism The 2007 Travel and tourism economic research - WTTC world market share of tourism GDP growth 2007/2006 Travel and tourism industry contribution to GDP Travel and tourism contribution to the economy Travel and tourism economy employment (direct/ indirect / induced) Travel and tourism industry employment (direct/indirect) Cambodia 0. 0% 6. 5% 9. 3% 20. 3% 1, 108, 235 500, 103 Vietnam 0. 2% 10. 5% 3. 1% 11. 2% 3, 519, 630 932, 110 Lao PDR 0. 0% 7. 1% 4. 2% 8. 5% 148, 532 72, 248 Malaysia 0. 5% 4. 4% 13. 3% 1, 217, 080 476, 438 Indonesia 0. 6% 3. 6% 2. 4% 7. 5% 6, 056, 156 1, 980, 658 Thailand 0. 7% 3. 3% 6. 7% 14. 9% 4, 109, 502 1, 945, 544 Philippines 0. 2% 7. 0% 4. 1% 9. 1% 3, 542, 908 1, 388, 229

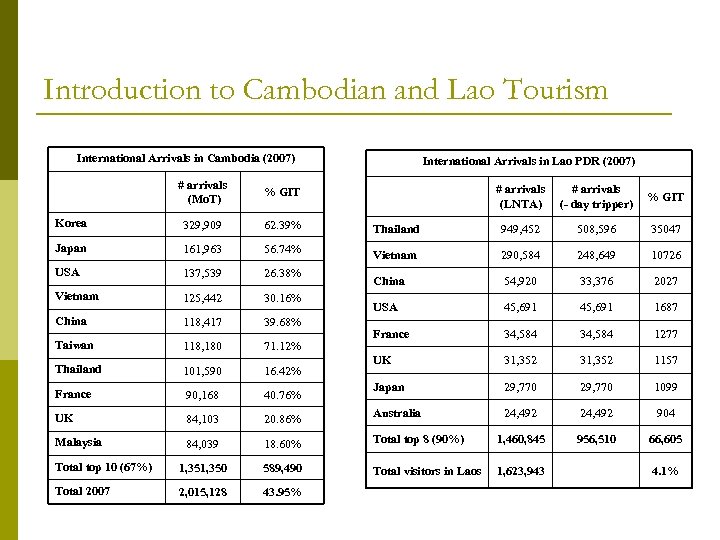

Introduction to Cambodian and Lao Tourism International Arrivals in Cambodia (2007) International Arrivals in Lao PDR (2007) # arrivals (Mo. T) % GIT Korea 329, 909 62. 39% Japan 161, 963 56. 74% USA 137, 539 26. 38% Vietnam 125, 442 30. 16% China 118, 417 39. 68% Taiwan 118, 180 71. 12% Thailand 101, 590 16. 42% France 90, 168 40. 76% UK 84, 103 20. 86% Malaysia 84, 039 18. 60% Total top 10 (67%) 1, 350 589, 490 Total 2007 2, 015, 128 43. 95% # arrivals (LNTA) # arrivals (- day tripper) % GIT Thailand 949, 452 508, 596 35047 Vietnam 290, 584 248, 649 10726 China 54, 920 33, 376 2027 USA 45, 691 1687 France 34, 584 1277 UK 31, 352 1157 Japan 29, 770 1099 Australia 24, 492 904 Total top 8 (90%) 1, 460, 845 956, 510 66, 605 Total visitors in Laos 1, 623, 943 4. 1%

Introduction to Cambodian and Lao Tourism International Arrivals in Cambodia (2007) International Arrivals in Lao PDR (2007) # arrivals (Mo. T) % GIT Korea 329, 909 62. 39% Japan 161, 963 56. 74% USA 137, 539 26. 38% Vietnam 125, 442 30. 16% China 118, 417 39. 68% Taiwan 118, 180 71. 12% Thailand 101, 590 16. 42% France 90, 168 40. 76% UK 84, 103 20. 86% Malaysia 84, 039 18. 60% Total top 10 (67%) 1, 350 589, 490 Total 2007 2, 015, 128 43. 95% # arrivals (LNTA) # arrivals (- day tripper) % GIT Thailand 949, 452 508, 596 35047 Vietnam 290, 584 248, 649 10726 China 54, 920 33, 376 2027 USA 45, 691 1687 France 34, 584 1277 UK 31, 352 1157 Japan 29, 770 1099 Australia 24, 492 904 Total top 8 (90%) 1, 460, 845 956, 510 66, 605 Total visitors in Laos 1, 623, 943 4. 1%

The IFC/PI Approach Cambodia and Lao PDR The data collected (demand supply side surveys) allow the following expenditure measures of yield to be estimated: n n n Total trip expenditure, nationally and in destinations Average expenditure per night (total tourism) nationally and by destination Expenditure per night by market (by origin, demographic, travel motive) nationally and by destination Expenditure in each tourism supply chain (accommodation, F+B, shopping, transportation) , nationally, by destination and by type of tourist Employment in tourism, nationally and by destination, by type of tourist and by tourism sub-sector/supply chain

The IFC/PI Approach Cambodia and Lao PDR The data collected (demand supply side surveys) allow the following expenditure measures of yield to be estimated: n n n Total trip expenditure, nationally and in destinations Average expenditure per night (total tourism) nationally and by destination Expenditure per night by market (by origin, demographic, travel motive) nationally and by destination Expenditure in each tourism supply chain (accommodation, F+B, shopping, transportation) , nationally, by destination and by type of tourist Employment in tourism, nationally and by destination, by type of tourist and by tourism sub-sector/supply chain

Review of different methodological issues observed in Cambodia and Lao PDR p Expenditures person vs. per interviewee p FIT vs. GIT p Definition of poverty: Unskilled workers (ODI/SNV) vs. poor background’s workers p Expenditures per day and expenditures for the last 24 h p Are products bought at the local market obviously locals?

Review of different methodological issues observed in Cambodia and Lao PDR p Expenditures person vs. per interviewee p FIT vs. GIT p Definition of poverty: Unskilled workers (ODI/SNV) vs. poor background’s workers p Expenditures per day and expenditures for the last 24 h p Are products bought at the local market obviously locals?

Step one (Larry Dwyer: Tourism Yield definition) 1. Total in-country expenditures 2. Converting Expenditure Measures of Yield into local expenditure yield measures (Local Expenditure Impact) 3. Estimating pro-poor employee income (PPEDI) yield measures 4. Estimating tourism supplier pro-poor impact: Propoor Indirect employment income (PPEII) 5. Estimating direct seller pro-poor impact 6. Estimating Employment Measures of Yield (direct, indirect)

Step one (Larry Dwyer: Tourism Yield definition) 1. Total in-country expenditures 2. Converting Expenditure Measures of Yield into local expenditure yield measures (Local Expenditure Impact) 3. Estimating pro-poor employee income (PPEDI) yield measures 4. Estimating tourism supplier pro-poor impact: Propoor Indirect employment income (PPEII) 5. Estimating direct seller pro-poor impact 6. Estimating Employment Measures of Yield (direct, indirect)

Tourism Yield Analysis - Approach Due to a lack of maturity of the market (difficulties in getting sensitive data), the approach did not include profitability measures and particularly the analysis of the yield as rate on return of capital.

Tourism Yield Analysis - Approach Due to a lack of maturity of the market (difficulties in getting sensitive data), the approach did not include profitability measures and particularly the analysis of the yield as rate on return of capital.

Tourism Yield Analysis - Approach There is no consistent definition of Tourism Yield. We have essentially looked at 4 dimensions: p Economic p Local Economic Impact p Pro-poor employee direct incomes $ $ Economic ) $Expenditure / Revenues( Jobs LEI Local Economic Impact )what stays in Cambodia(? PPI Pro-Poor Impact LEI PPEDI Pro-Poor Employee direct Incomes

Tourism Yield Analysis - Approach There is no consistent definition of Tourism Yield. We have essentially looked at 4 dimensions: p Economic p Local Economic Impact p Pro-poor employee direct incomes $ $ Economic ) $Expenditure / Revenues( Jobs LEI Local Economic Impact )what stays in Cambodia(? PPI Pro-Poor Impact LEI PPEDI Pro-Poor Employee direct Incomes

Tourism Yield Analysis - Approach p Economic impact of tourism Total in country trip expenditure = (ALOS * ADE * Number of tourists) ALOS = Average Length of Stay ADE = Average Daily expenditures person (and not per interviewee)

Tourism Yield Analysis - Approach p Economic impact of tourism Total in country trip expenditure = (ALOS * ADE * Number of tourists) ALOS = Average Length of Stay ADE = Average Daily expenditures person (and not per interviewee)

Tourism Yield Analysis - Approach Expenditure - IVA / trip Cambodia

Tourism Yield Analysis - Approach Expenditure - IVA / trip Cambodia

Tourism Yield Analysis - Approach Expenditure - IVA / trip LAO PDR Opportunities for increasing the number of GIT and the amount of GIT itself are limited (low average number of rooms per hotel). Therefore the analysis focused mainly on FIT.

Tourism Yield Analysis - Approach Expenditure - IVA / trip LAO PDR Opportunities for increasing the number of GIT and the amount of GIT itself are limited (low average number of rooms per hotel). Therefore the analysis focused mainly on FIT.

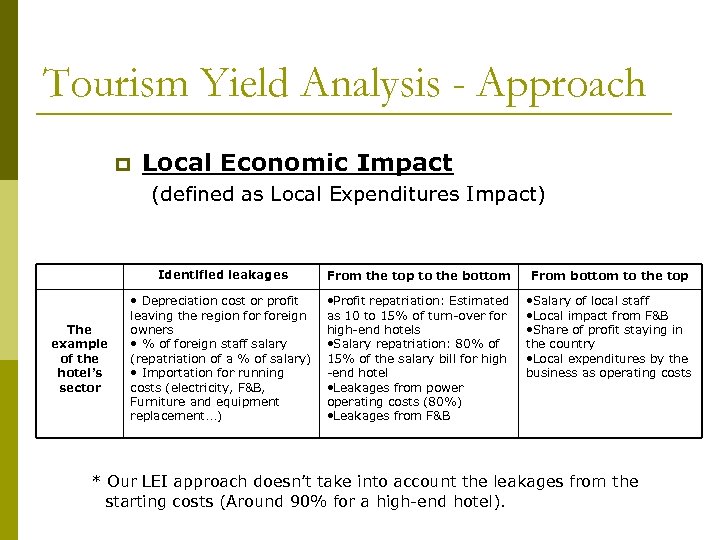

Tourism Yield Analysis - Approach p Local Economic Impact (defined as Local Expenditures Impact) Identified leakages The example of the hotel’s sector From the top to the bottom From bottom to the top • Depreciation cost or profit leaving the region foreign owners • % of foreign staff salary (repatriation of a % of salary) • Importation for running costs (electricity, F&B, Furniture and equipment replacement…) • Profit repatriation: Estimated as 10 to 15% of turn-over for high-end hotels • Salary repatriation: 80% of 15% of the salary bill for high -end hotel • Leakages from power operating costs (80%) • Leakages from F&B • Salary of local staff • Local impact from F&B • Share of profit staying in the country • Local expenditures by the business as operating costs * Our LEI approach doesn’t take into account the leakages from the starting costs (Around 90% for a high-end hotel).

Tourism Yield Analysis - Approach p Local Economic Impact (defined as Local Expenditures Impact) Identified leakages The example of the hotel’s sector From the top to the bottom From bottom to the top • Depreciation cost or profit leaving the region foreign owners • % of foreign staff salary (repatriation of a % of salary) • Importation for running costs (electricity, F&B, Furniture and equipment replacement…) • Profit repatriation: Estimated as 10 to 15% of turn-over for high-end hotels • Salary repatriation: 80% of 15% of the salary bill for high -end hotel • Leakages from power operating costs (80%) • Leakages from F&B • Salary of local staff • Local impact from F&B • Share of profit staying in the country • Local expenditures by the business as operating costs * Our LEI approach doesn’t take into account the leakages from the starting costs (Around 90% for a high-end hotel).

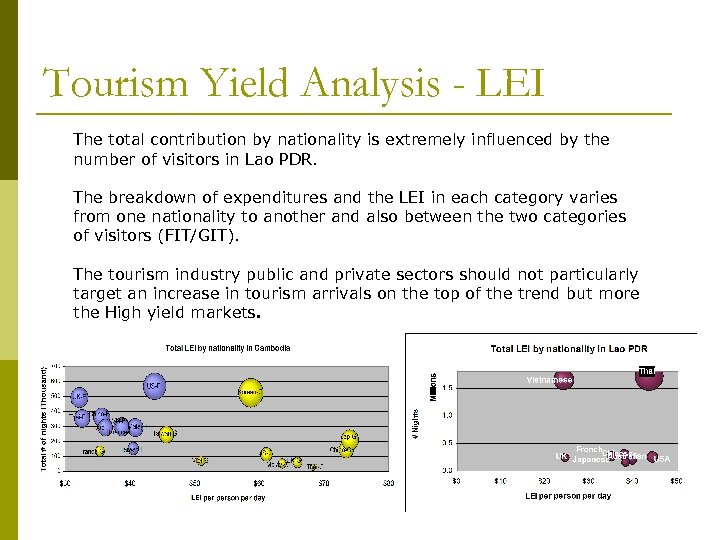

Tourism Yield Analysis - LEI The total contribution by nationality is extremely influenced by the number of visitors in Lao PDR. The breakdown of expenditures and the LEI in each category varies from one nationality to another and also between the two categories of visitors (FIT/GIT). The tourism industry public and private sectors should not particularly target an increase in tourism arrivals on the top of the trend but more the High yield markets.

Tourism Yield Analysis - LEI The total contribution by nationality is extremely influenced by the number of visitors in Lao PDR. The breakdown of expenditures and the LEI in each category varies from one nationality to another and also between the two categories of visitors (FIT/GIT). The tourism industry public and private sectors should not particularly target an increase in tourism arrivals on the top of the trend but more the High yield markets.

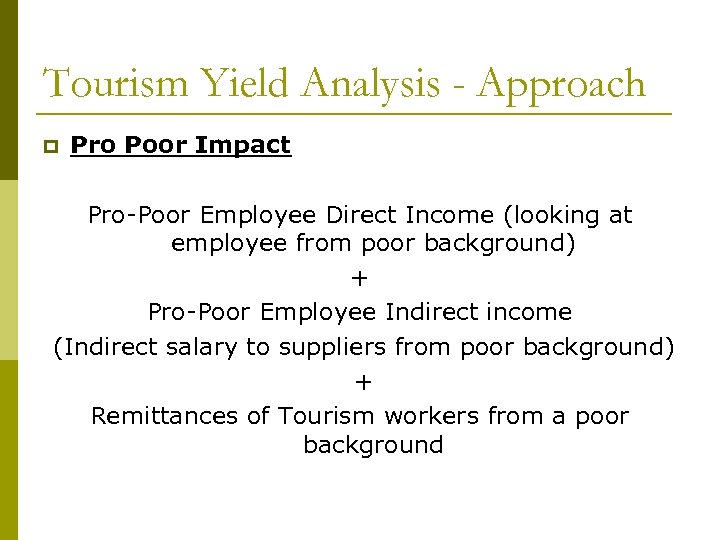

Tourism Yield Analysis - Approach p Pro Poor Impact Pro-Poor Employee Direct Income (looking at employee from poor background) + Pro-Poor Employee Indirect income (Indirect salary to suppliers from poor background) + Remittances of Tourism workers from a poor background

Tourism Yield Analysis - Approach p Pro Poor Impact Pro-Poor Employee Direct Income (looking at employee from poor background) + Pro-Poor Employee Indirect income (Indirect salary to suppliers from poor background) + Remittances of Tourism workers from a poor background

Tourism Yield Analysis - PPI The total contribution by nationality is extremely influenced by the number of visitors in Lao PDR. In Cambodia, the level or importance of the Pro poor impact for each nationality is relatively different than their LEI

Tourism Yield Analysis - PPI The total contribution by nationality is extremely influenced by the number of visitors in Lao PDR. In Cambodia, the level or importance of the Pro poor impact for each nationality is relatively different than their LEI

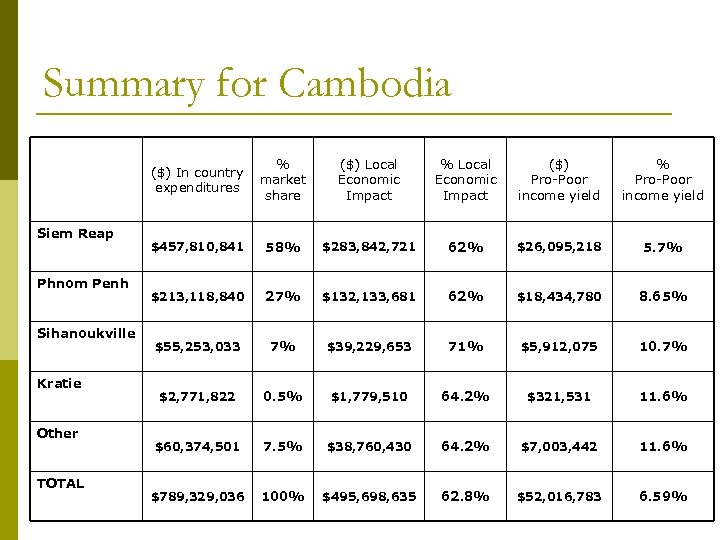

Summary for Cambodia Siem Reap Phnom Penh Sihanoukville Kratie Other TOTAL % ($) In country market expenditures share ($) Local Economic Impact % Local Economic Impact ($) Pro-Poor income yield % Pro-Poor income yield $457, 810, 841 58% $283, 842, 721 62% $26, 095, 218 5. 7% $213, 118, 840 27% $132, 133, 681 62% $18, 434, 780 8. 65% $55, 253, 033 7% $39, 229, 653 71% $5, 912, 075 10. 7% $2, 771, 822 0. 5% $1, 779, 510 64. 2% $321, 531 11. 6% $60, 374, 501 7. 5% $38, 760, 430 64. 2% $7, 003, 442 11. 6% $789, 329, 036 100% $495, 698, 635 62. 8% $52, 016, 783 6. 59%

Summary for Cambodia Siem Reap Phnom Penh Sihanoukville Kratie Other TOTAL % ($) In country market expenditures share ($) Local Economic Impact % Local Economic Impact ($) Pro-Poor income yield % Pro-Poor income yield $457, 810, 841 58% $283, 842, 721 62% $26, 095, 218 5. 7% $213, 118, 840 27% $132, 133, 681 62% $18, 434, 780 8. 65% $55, 253, 033 7% $39, 229, 653 71% $5, 912, 075 10. 7% $2, 771, 822 0. 5% $1, 779, 510 64. 2% $321, 531 11. 6% $60, 374, 501 7. 5% $38, 760, 430 64. 2% $7, 003, 442 11. 6% $789, 329, 036 100% $495, 698, 635 62. 8% $52, 016, 783 6. 59%

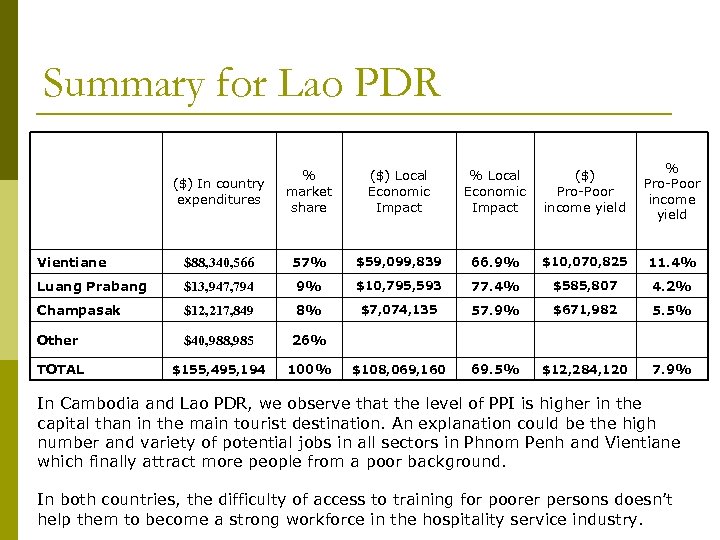

Summary for Lao PDR ($) In country expenditures % market share ($) Local Economic Impact % Local Economic Impact ($) Pro-Poor income yield % Pro-Poor income yield Vientiane $88, 340, 566 57% $59, 099, 839 66. 9% $10, 070, 825 11. 4% Luang Prabang $13, 947, 794 9% $10, 795, 593 77. 4% $585, 807 4. 2% Champasak $12, 217, 849 8% $7, 074, 135 57. 9% $671, 982 5. 5% Other $40, 988, 985 26% TOTAL $155, 495, 194 100% $108, 069, 160 69. 5% $12, 284, 120 7. 9% In Cambodia and Lao PDR, we observe that the level of PPI is higher in the capital than in the main tourist destination. An explanation could be the high number and variety of potential jobs in all sectors in Phnom Penh and Vientiane which finally attract more people from a poor background. In both countries, the difficulty of access to training for poorer persons doesn’t help them to become a strong workforce in the hospitality service industry.

Summary for Lao PDR ($) In country expenditures % market share ($) Local Economic Impact % Local Economic Impact ($) Pro-Poor income yield % Pro-Poor income yield Vientiane $88, 340, 566 57% $59, 099, 839 66. 9% $10, 070, 825 11. 4% Luang Prabang $13, 947, 794 9% $10, 795, 593 77. 4% $585, 807 4. 2% Champasak $12, 217, 849 8% $7, 074, 135 57. 9% $671, 982 5. 5% Other $40, 988, 985 26% TOTAL $155, 495, 194 100% $108, 069, 160 69. 5% $12, 284, 120 7. 9% In Cambodia and Lao PDR, we observe that the level of PPI is higher in the capital than in the main tourist destination. An explanation could be the high number and variety of potential jobs in all sectors in Phnom Penh and Vientiane which finally attract more people from a poor background. In both countries, the difficulty of access to training for poorer persons doesn’t help them to become a strong workforce in the hospitality service industry.

Major interventions to increase the % of LEI and /or PPI Major interventions on changing the % of PPI should be based on - Main leakages by supply chain and feasibility to fill the gap/increase linkages and particularly with projects having a high LEI/PPI - Main sectors able to highly contribute to the global LEI/PPI - Main markets able to highly contribute to the global LEI/PPI - Making jobs more accessible for the poor Main areas usually targeted to help the poor - Importation (F&B, handicrafts, miscellaneous products…) Main opportunities become: - Substitution to importation strategies are often considered as the only area where an increase of LEI/PPI is feasible. Now, these strategies should be - Able to differentiate between absolute value and percentage of LEI/PPI; Able to compete with existing products in terms of costs, quality and just-intime production/distribution all the year long (With a ROI concern) and not only job creation and/or increase of incomes; - Marketing strategies to attract high-yield market, to increase ALOS, to increase # of high yield visitors in low season

Major interventions to increase the % of LEI and /or PPI Major interventions on changing the % of PPI should be based on - Main leakages by supply chain and feasibility to fill the gap/increase linkages and particularly with projects having a high LEI/PPI - Main sectors able to highly contribute to the global LEI/PPI - Main markets able to highly contribute to the global LEI/PPI - Making jobs more accessible for the poor Main areas usually targeted to help the poor - Importation (F&B, handicrafts, miscellaneous products…) Main opportunities become: - Substitution to importation strategies are often considered as the only area where an increase of LEI/PPI is feasible. Now, these strategies should be - Able to differentiate between absolute value and percentage of LEI/PPI; Able to compete with existing products in terms of costs, quality and just-intime production/distribution all the year long (With a ROI concern) and not only job creation and/or increase of incomes; - Marketing strategies to attract high-yield market, to increase ALOS, to increase # of high yield visitors in low season

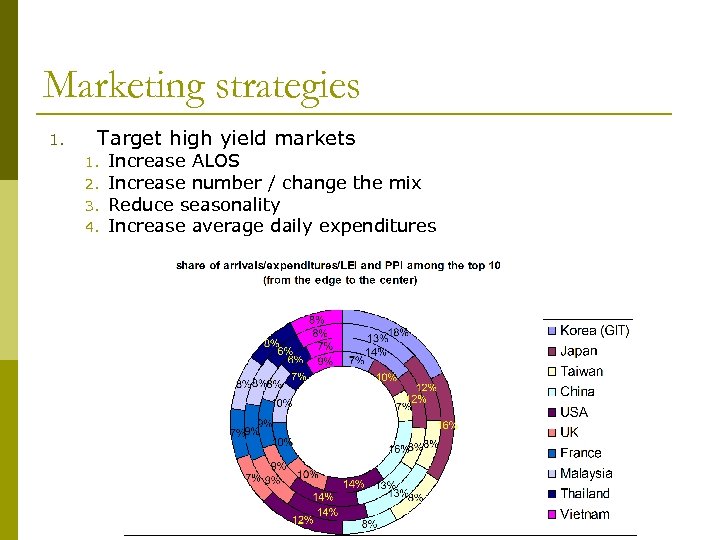

Marketing strategies 1. Target high yield markets 1. 2. 3. 4. Increase ALOS Increase number / change the mix Reduce seasonality Increase average daily expenditures

Marketing strategies 1. Target high yield markets 1. 2. 3. 4. Increase ALOS Increase number / change the mix Reduce seasonality Increase average daily expenditures

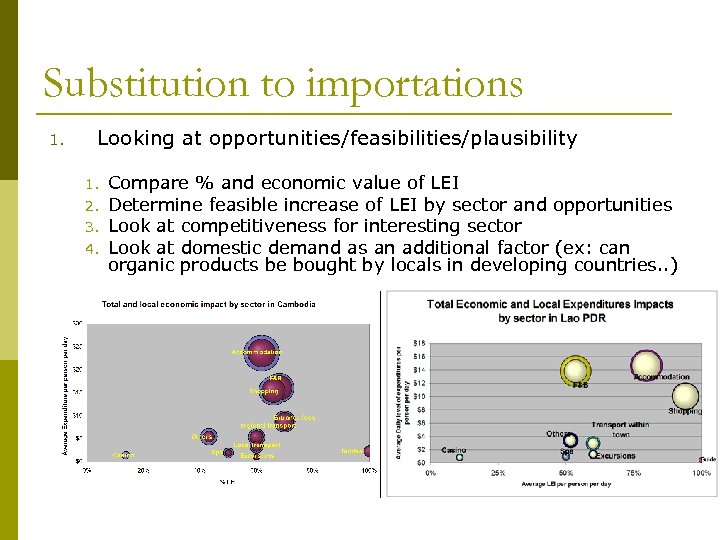

Substitution to importations 1. Looking at opportunities/feasibilities/plausibility 1. 2. 3. 4. Compare % and economic value of LEI Determine feasible increase of LEI by sector and opportunities Look at competitiveness for interesting sector Look at domestic demand as an additional factor (ex: can organic products be bought by locals in developing countries. . )

Substitution to importations 1. Looking at opportunities/feasibilities/plausibility 1. 2. 3. 4. Compare % and economic value of LEI Determine feasible increase of LEI by sector and opportunities Look at competitiveness for interesting sector Look at domestic demand as an additional factor (ex: can organic products be bought by locals in developing countries. . )

Step two – Study the feasibility/plausibility of interventions 1. Breaking down the value chain 2. Looking at supply chain’s specificities (competitiveness, opportunities, linkages and leakages) 3. Studying the feasibility of interventions based on understanding of context 4. Breaking down the supply chain for any plausible intervention 5. Studying the Return on investment for each plausible intervention

Step two – Study the feasibility/plausibility of interventions 1. Breaking down the value chain 2. Looking at supply chain’s specificities (competitiveness, opportunities, linkages and leakages) 3. Studying the feasibility of interventions based on understanding of context 4. Breaking down the supply chain for any plausible intervention 5. Studying the Return on investment for each plausible intervention

Feasibility / potential to change the LEI/PPI by supply chain: The example of the accommodation sector (1)

Feasibility / potential to change the LEI/PPI by supply chain: The example of the accommodation sector (1)

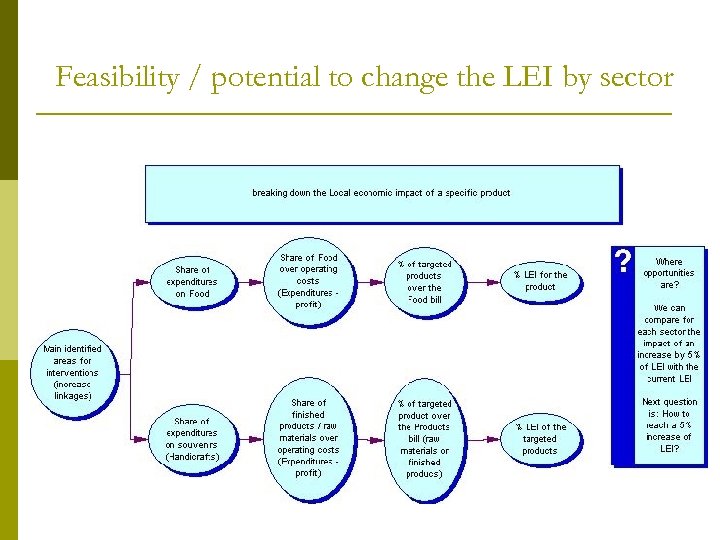

Feasibility / potential to change the LEI by sector

Feasibility / potential to change the LEI by sector

Changing the % of LEI Example: encourage the production of fruits by local farmers Cambodia Average Daily expenditures person Share of expenditures on food and beverages % Fruits over % LEI for F&B fruits Hotel US$ 20 31. 5% 5% 60% $0. 082 Restaurants US$ 17 55. 2% 5% 60% $0. 122 Opportunities exist but they remains limited in terms of yields. US$ final LEI for fruits person

Changing the % of LEI Example: encourage the production of fruits by local farmers Cambodia Average Daily expenditures person Share of expenditures on food and beverages % Fruits over % LEI for F&B fruits Hotel US$ 20 31. 5% 5% 60% $0. 082 Restaurants US$ 17 55. 2% 5% 60% $0. 122 Opportunities exist but they remains limited in terms of yields. US$ final LEI for fruits person

Feasibility / potential to change the PPI by sector

Feasibility / potential to change the PPI by sector

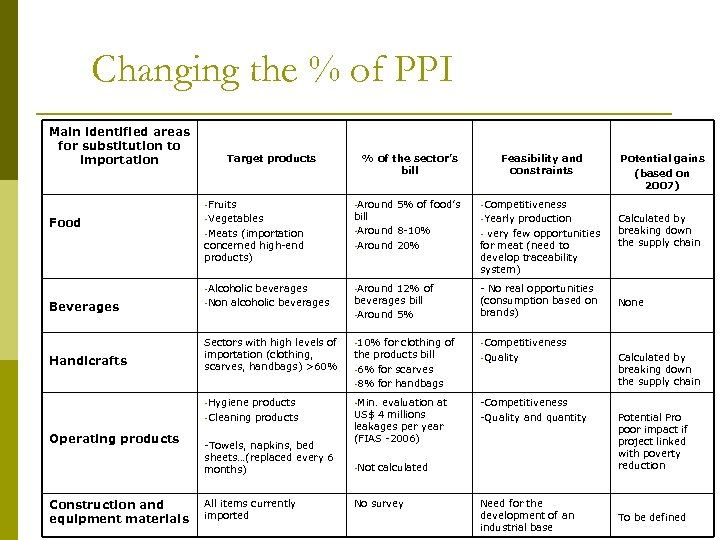

Changing the % of PPI Main identified areas for substitution to importation Target products -Fruits % of the sector’s bill -Around 5% of food’s -Meats (importation bill -Around 8 -10% -Around 20% -Alcoholic beverages -Around 12% of Potential gains (based on 2007) -Competitiveness - very few opportunities Calculated by breaking down the supply chain -Non alcoholic beverages bill -Around 5% - No real opportunities (consumption based on brands) None Sectors with high levels of importation (clothing, scarves, handbags) >60% -10% for clothing of -Competitiveness -Hygiene products Food -Vegetables Feasibility and constraints -Min. evaluation at concerned high-end products) Beverages Handicrafts -Cleaning products Operating products Construction and equipment materials -Towels, napkins, bed sheets…(replaced every 6 months) All items currently imported the products bill -6% for scarves -8% for handbags US$ 4 millions leakages per year (FIAS -2006) -Yearly production for meat (need to develop traceability system) -Quality -Competitiveness -Quality and quantity -Not calculated No survey Need for the development of an industrial base Calculated by breaking down the supply chain Potential Pro poor impact if project linked with poverty reduction To be defined

Changing the % of PPI Main identified areas for substitution to importation Target products -Fruits % of the sector’s bill -Around 5% of food’s -Meats (importation bill -Around 8 -10% -Around 20% -Alcoholic beverages -Around 12% of Potential gains (based on 2007) -Competitiveness - very few opportunities Calculated by breaking down the supply chain -Non alcoholic beverages bill -Around 5% - No real opportunities (consumption based on brands) None Sectors with high levels of importation (clothing, scarves, handbags) >60% -10% for clothing of -Competitiveness -Hygiene products Food -Vegetables Feasibility and constraints -Min. evaluation at concerned high-end products) Beverages Handicrafts -Cleaning products Operating products Construction and equipment materials -Towels, napkins, bed sheets…(replaced every 6 months) All items currently imported the products bill -6% for scarves -8% for handbags US$ 4 millions leakages per year (FIAS -2006) -Yearly production for meat (need to develop traceability system) -Quality -Competitiveness -Quality and quantity -Not calculated No survey Need for the development of an industrial base Calculated by breaking down the supply chain Potential Pro poor impact if project linked with poverty reduction To be defined

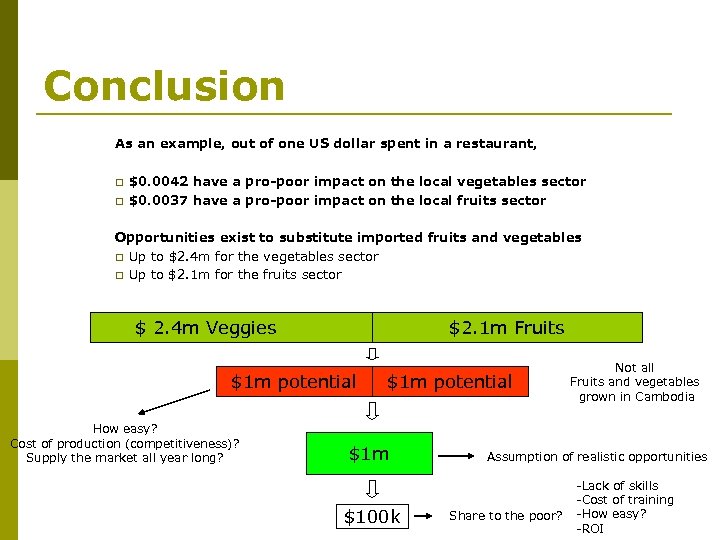

Conclusion As an example, out of one US dollar spent in a restaurant, p $0. 0042 have a pro-poor impact on the local vegetables sector p $0. 0037 have a pro-poor impact on the local fruits sector Opportunities exist to substitute imported fruits and vegetables p Up to $2. 4 m for the vegetables sector p Up to $2. 1 m for the fruits sector $ 2. 4 m Veggies $2. 1 m Fruits $1 m potential How easy? Cost of production (competitiveness)? Supply the market all year long? $1 m potential $1 m $100 k Not all Fruits and vegetables grown in Cambodia Assumption of realistic opportunities Share to the poor? -Lack of skills -Cost of training -How easy? -ROI

Conclusion As an example, out of one US dollar spent in a restaurant, p $0. 0042 have a pro-poor impact on the local vegetables sector p $0. 0037 have a pro-poor impact on the local fruits sector Opportunities exist to substitute imported fruits and vegetables p Up to $2. 4 m for the vegetables sector p Up to $2. 1 m for the fruits sector $ 2. 4 m Veggies $2. 1 m Fruits $1 m potential How easy? Cost of production (competitiveness)? Supply the market all year long? $1 m potential $1 m $100 k Not all Fruits and vegetables grown in Cambodia Assumption of realistic opportunities Share to the poor? -Lack of skills -Cost of training -How easy? -ROI

Summary p Can’t assume, details matters p Evidence based conclusion (potential) p With good understanding of context to maximize ROI and development

Summary p Can’t assume, details matters p Evidence based conclusion (potential) p With good understanding of context to maximize ROI and development