invest.ppt

- Количество слайдов: 20

Topic: INVESTMENT ACTIVITY OF ENTERPRISE 1. Definition and classification investments 2. Investment projects of enterprise of 3. Estimation of economic efficiency of investments

Topic: INVESTMENT ACTIVITY OF ENTERPRISE 1. Definition and classification investments 2. Investment projects of enterprise of 3. Estimation of economic efficiency of investments

-1 According to Ukrainian law investments – it is all types of material and intellectual values, what are invested in objects of entrepreneurial or other kinds of activity. And as results of what profit or social effect is received. According to accounting standards investment – it is the asset, which enterprise hold for gaining of capital by distribution of profit, received from this asset.

-1 According to Ukrainian law investments – it is all types of material and intellectual values, what are invested in objects of entrepreneurial or other kinds of activity. And as results of what profit or social effect is received. According to accounting standards investment – it is the asset, which enterprise hold for gaining of capital by distribution of profit, received from this asset.

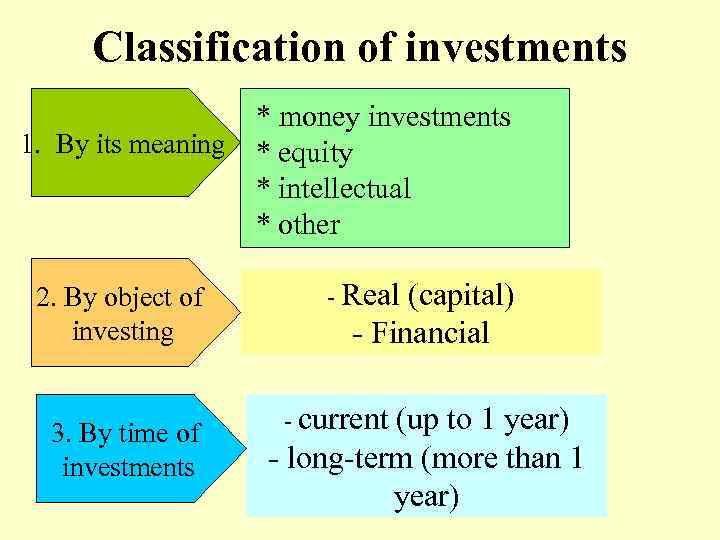

Classification of investments * money investments 1. By its meaning * equity * intellectual * other 2. By object of investing 3. By time of investments - Real (capital) - Financial - current (up to 1 year) - long-term (more than 1 year)

Classification of investments * money investments 1. By its meaning * equity * intellectual * other 2. By object of investing 3. By time of investments - Real (capital) - Financial - current (up to 1 year) - long-term (more than 1 year)

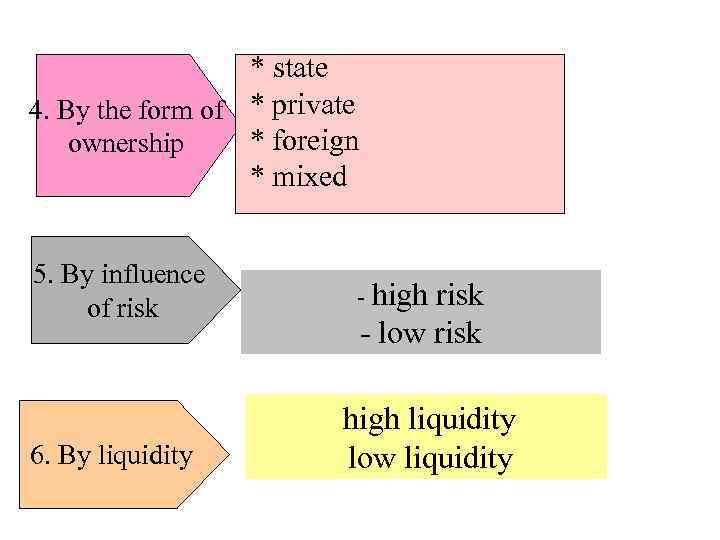

* state 4. By the form of * private * foreign ownership * mixed 5. By influence of risk - high risk - low risk high liquidity 6. By liquidity low liquidity

* state 4. By the form of * private * foreign ownership * mixed 5. By influence of risk - high risk - low risk high liquidity 6. By liquidity low liquidity

Investment activity could be organized from such sources: · own financial resources · borrowed financial resources · donated capital

Investment activity could be organized from such sources: · own financial resources · borrowed financial resources · donated capital

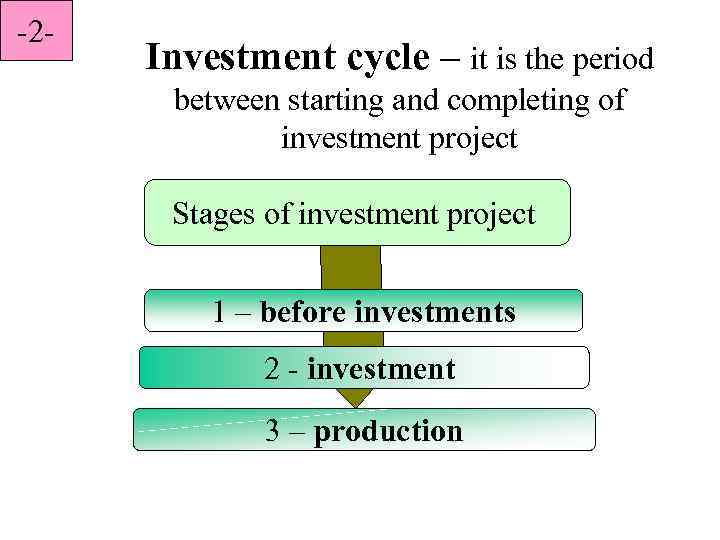

-2 - Investment cycle – it is the period between starting and completing of investment project Stages of investment project 1 – before investments 2 - investment 3 – production

-2 - Investment cycle – it is the period between starting and completing of investment project Stages of investment project 1 – before investments 2 - investment 3 – production

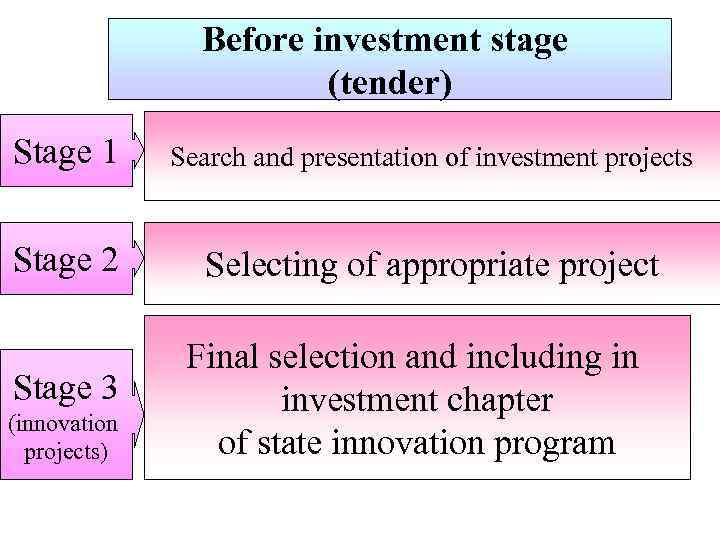

Before investment stage (tender) Stage 1 Search and presentation of investment projects Stage 2 Selecting of appropriate project Stage 3 (innovation projects) Final selection and including in investment chapter of state innovation program

Before investment stage (tender) Stage 1 Search and presentation of investment projects Stage 2 Selecting of appropriate project Stage 3 (innovation projects) Final selection and including in investment chapter of state innovation program

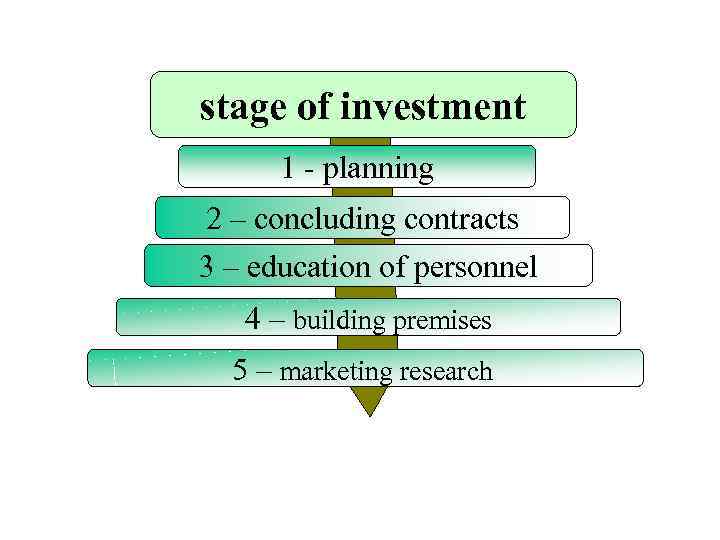

stage of investment 1 - planning 2 – concluding contracts 3 – education of personnel 4 – building premises 5 – marketing research

stage of investment 1 - planning 2 – concluding contracts 3 – education of personnel 4 – building premises 5 – marketing research

Production stage – assume starting of production powers exploitation (realization of investment project) Capital investments – it is the investments, directed on creating and renewal of capital assets

Production stage – assume starting of production powers exploitation (realization of investment project) Capital investments – it is the investments, directed on creating and renewal of capital assets

Sources of financing of capital investments · from state funds · from local budgets ; · from own funds; · from foreign investors funds.

Sources of financing of capital investments · from state funds · from local budgets ; · from own funds; · from foreign investors funds.

-3 - Effectiveness of investment calculated by the indexes: 1) NPV – net present value. 2) PI – profitability index. 3) IRR– internal rate of return. 4) Т – time of payback.

-3 - Effectiveness of investment calculated by the indexes: 1) NPV – net present value. 2) PI – profitability index. 3) IRR– internal rate of return. 4) Т – time of payback.

Additional indexes: 5) Coefficient of economic efficiency 6) Index of discounted costs 7) Coefficient of discount 8) Coefficient of economical efficiency of reconstruction 9) Annual economic efficiency of investments

Additional indexes: 5) Coefficient of economic efficiency 6) Index of discounted costs 7) Coefficient of discount 8) Coefficient of economical efficiency of reconstruction 9) Annual economic efficiency of investments

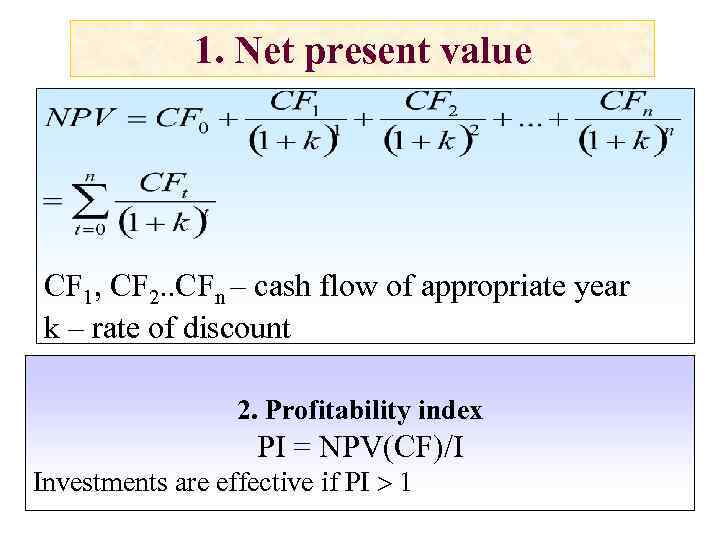

1. Net present value CF 1, CF 2. . CFn – cash flow of appropriate year k – rate of discount 2. Profitability index PI = NPV(CF)/I Investments are effective if PI 1

1. Net present value CF 1, CF 2. . CFn – cash flow of appropriate year k – rate of discount 2. Profitability index PI = NPV(CF)/I Investments are effective if PI 1

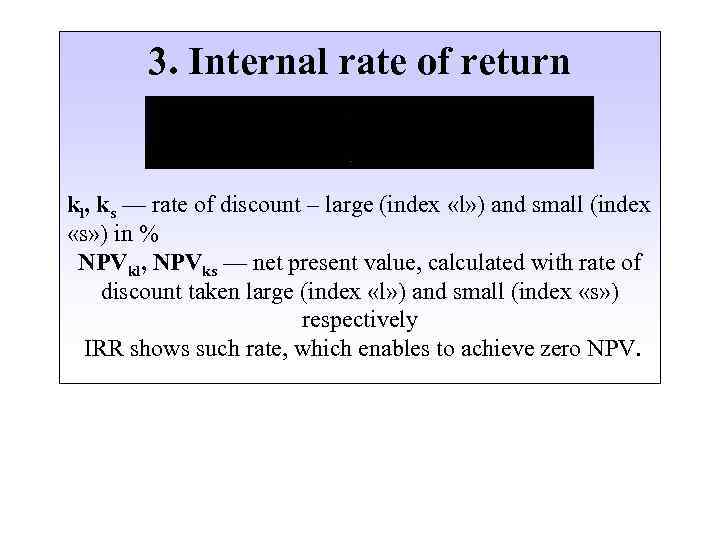

3. Internal rate of return kl, ks — rate of discount – large (index «l» ) and small (index «s» ) in % NPVkl, NPVks — net present value, calculated with rate of discount taken large (index «l» ) and small (index «s» ) respectively IRR shows such rate, which enables to achieve zero NPV.

3. Internal rate of return kl, ks — rate of discount – large (index «l» ) and small (index «s» ) in % NPVkl, NPVks — net present value, calculated with rate of discount taken large (index «l» ) and small (index «s» ) respectively IRR shows such rate, which enables to achieve zero NPV.

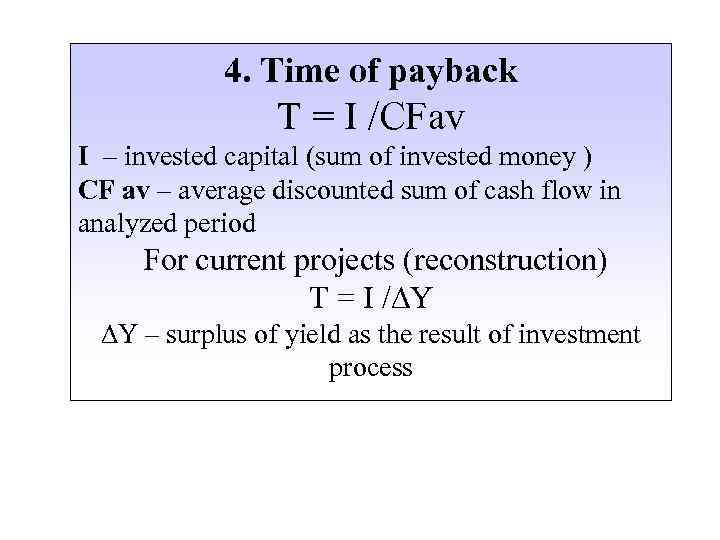

4. Time of payback Т = І /CFav І – invested capital (sum of invested money ) CF av – average discounted sum of cash flow in analyzed period For current projects (reconstruction) Т = І /∆Y ∆Y – surplus of yield as the result of investment process

4. Time of payback Т = І /CFav І – invested capital (sum of invested money ) CF av – average discounted sum of cash flow in analyzed period For current projects (reconstruction) Т = І /∆Y ∆Y – surplus of yield as the result of investment process

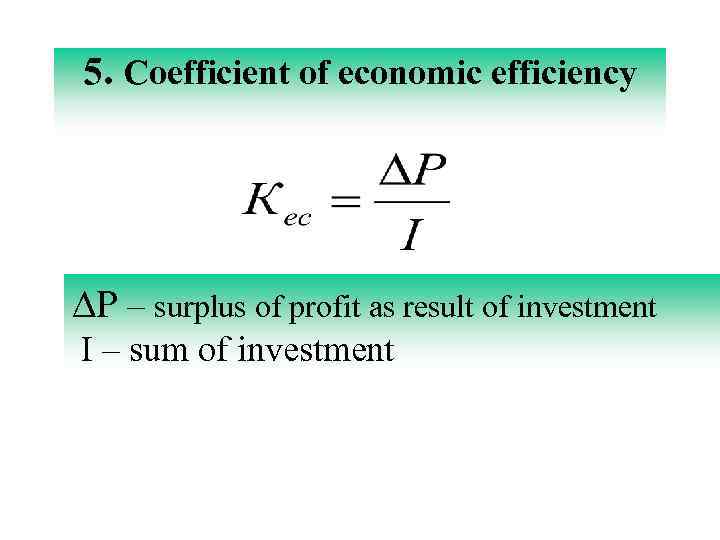

5. Coefficient of economic efficiency ∆P – surplus of profit as result of investment I – sum of investment

5. Coefficient of economic efficiency ∆P – surplus of profit as result of investment I – sum of investment

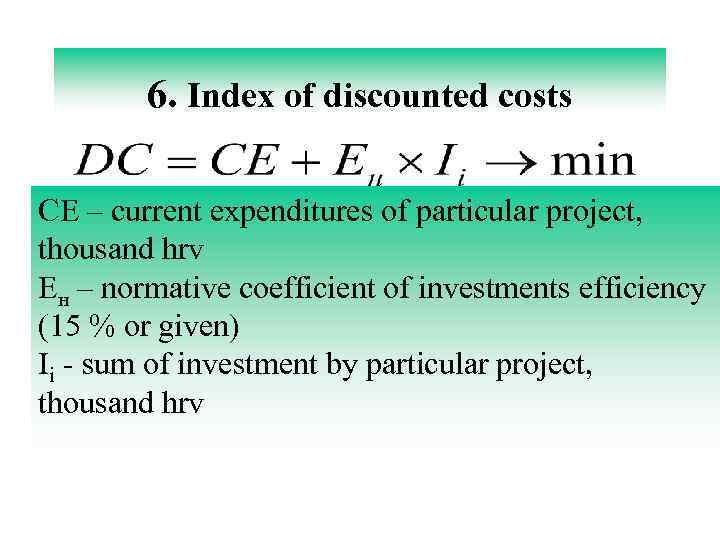

6. Index of discounted costs CE – current expenditures of particular project, thousand hrv Ен – normative coefficient of investments efficiency (15 % or given) Iі - sum of investment by particular project, thousand hrv

6. Index of discounted costs CE – current expenditures of particular project, thousand hrv Ен – normative coefficient of investments efficiency (15 % or given) Iі - sum of investment by particular project, thousand hrv

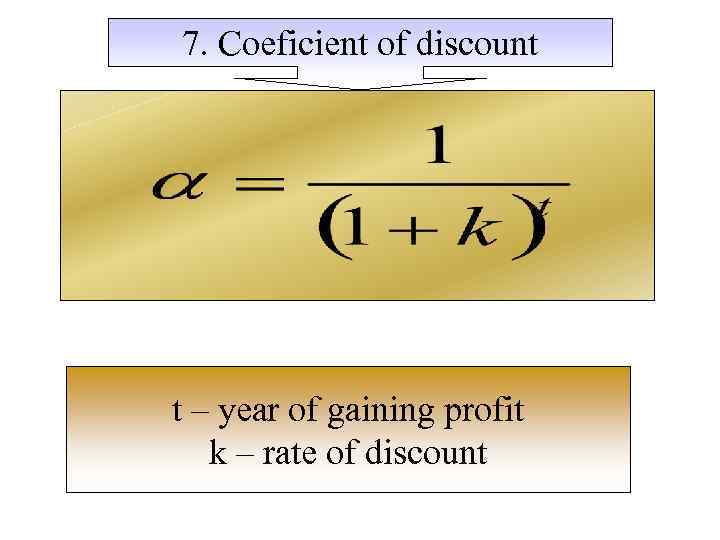

7. Coeficient of discount t – year of gaining profit k – rate of discount

7. Coeficient of discount t – year of gaining profit k – rate of discount

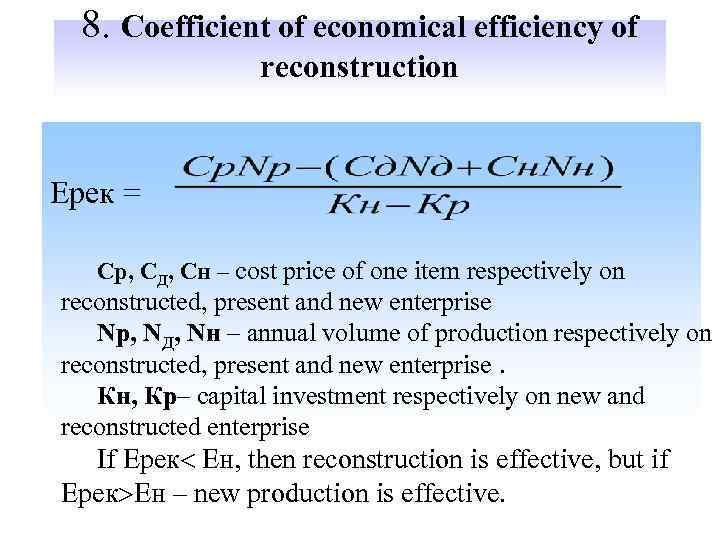

8. Coefficient of economical efficiency of reconstruction Ерек = Cр, CД, Cн – cost price of one item respectively on reconstructed, present and new enterprise Nр, NД, Nн – annual volume of production respectively on reconstructed, present and new enterprise. Кн, Кр– capital investment respectively on new and reconstructed enterprise If Ерек Ен, then reconstruction is effective, but if Ерек Ен – new production is effective.

8. Coefficient of economical efficiency of reconstruction Ерек = Cр, CД, Cн – cost price of one item respectively on reconstructed, present and new enterprise Nр, NД, Nн – annual volume of production respectively on reconstructed, present and new enterprise. Кн, Кр– capital investment respectively on new and reconstructed enterprise If Ерек Ен, then reconstruction is effective, but if Ерек Ен – new production is effective.

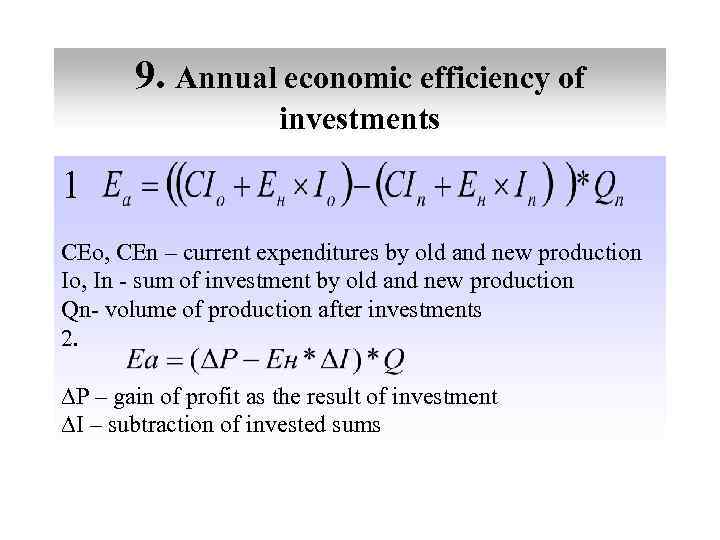

9. Annual economic efficiency of investments 1 CEo, CEn – current expenditures by old and new production Io, In - sum of investment by old and new production Qn- volume of production after investments 2. ∆P – gain of profit as the result of investment ∆I – subtraction of invested sums

9. Annual economic efficiency of investments 1 CEo, CEn – current expenditures by old and new production Io, In - sum of investment by old and new production Qn- volume of production after investments 2. ∆P – gain of profit as the result of investment ∆I – subtraction of invested sums