29a2545a4fc85dd7dd44021ba29785e3.ppt

- Количество слайдов: 85

Topic H Risk management

Topic H Risk management

PART H-19 Foreign currency risk

PART H-19 Foreign currency risk

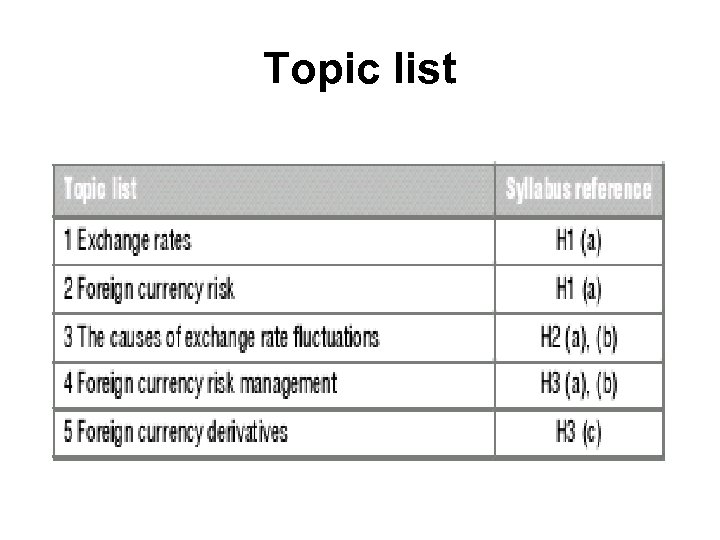

Topic list

Topic list

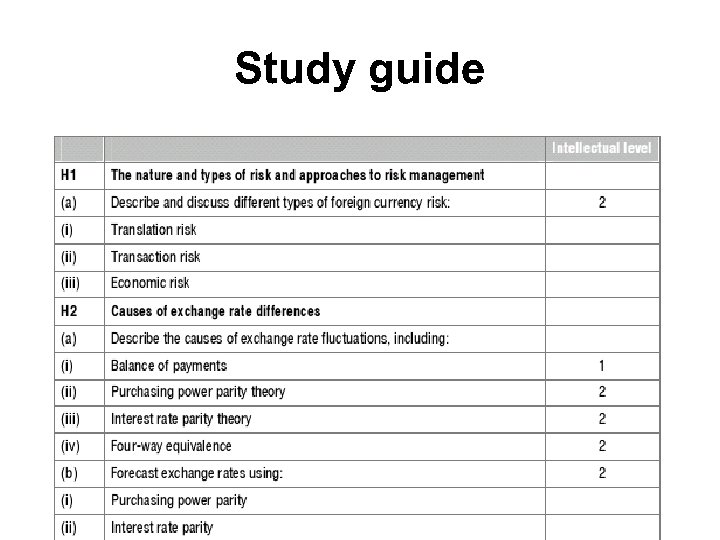

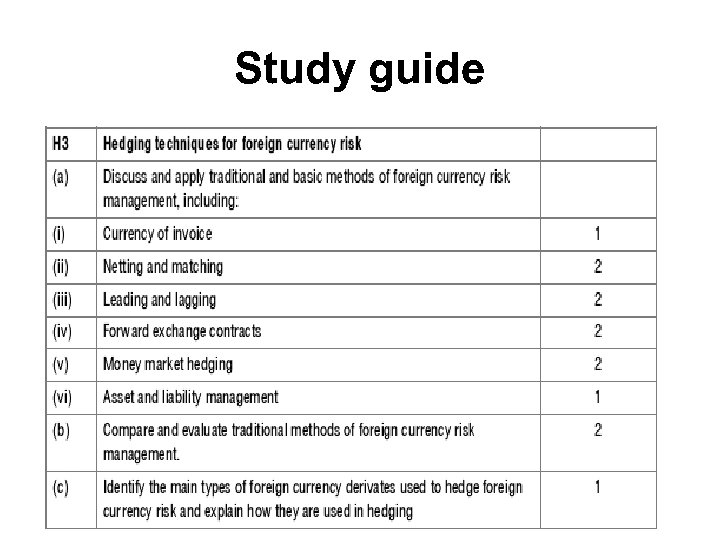

Study guide

Study guide

Study guide

Study guide

Exam guide • This is an important chapter. You need to have a good understanding of various hedging methods, and be able to determine in a given situation what exposure needs hedging and how best to do it. • Pilot Paper question 2 requires a good working knowledge of exchange rate topics.

Exam guide • This is an important chapter. You need to have a good understanding of various hedging methods, and be able to determine in a given situation what exposure needs hedging and how best to do it. • Pilot Paper question 2 requires a good working knowledge of exchange rate topics.

Foreign currency risk • • Foreign currency risk Causes of exchange rate fluctuations Foreign currency risk management Derivatives

Foreign currency risk • • Foreign currency risk Causes of exchange rate fluctuations Foreign currency risk management Derivatives

Exchange rates Key terms • An exchange rate is the rate at which one country's currency can be traded in exchange for another country's currency. • The spot rate is the exchange or interest rate currently offered on a particular currency or security. The spot rate is the rate of exchange in currency for immediate delivery. • The forward rate is an exchange rate set now for currencies to be exchanged at a future date.

Exchange rates Key terms • An exchange rate is the rate at which one country's currency can be traded in exchange for another country's currency. • The spot rate is the exchange or interest rate currently offered on a particular currency or security. The spot rate is the rate of exchange in currency for immediate delivery. • The forward rate is an exchange rate set now for currencies to be exchanged at a future date.

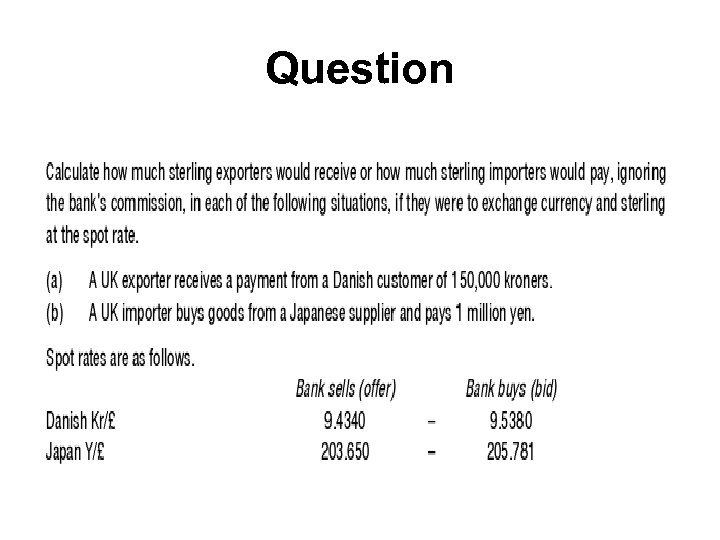

Question

Question

Foreign currency risk Fast forward Currency risk occurs in three forms: transaction exposure (short-term), economic exposure (effect on present value of longer term cash flows) and translation exposure (book gains or losses).

Foreign currency risk Fast forward Currency risk occurs in three forms: transaction exposure (short-term), economic exposure (effect on present value of longer term cash flows) and translation exposure (book gains or losses).

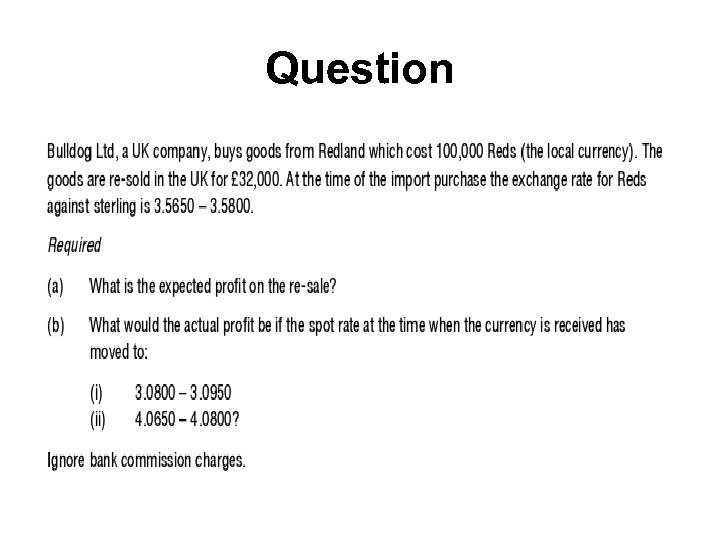

Question

Question

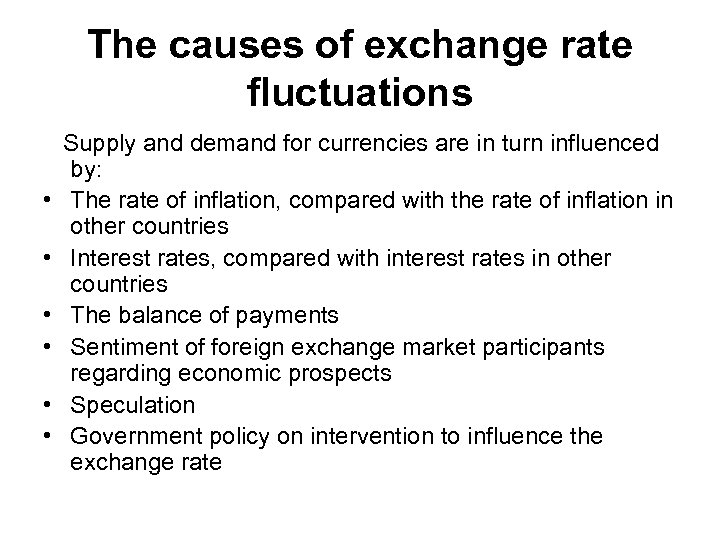

The causes of exchange rate fluctuations Fast forward Factors influencing the exchange rate include the comparative rates of inflation in different countries (purchasing power parity), comparative interest rates in different countries (interest rate parity), the underlying balance of payments, speculation and government policy on managing or fixing exchange rates.

The causes of exchange rate fluctuations Fast forward Factors influencing the exchange rate include the comparative rates of inflation in different countries (purchasing power parity), comparative interest rates in different countries (interest rate parity), the underlying balance of payments, speculation and government policy on managing or fixing exchange rates.

The causes of exchange rate fluctuations • • • Supply and demand for currencies are in turn influenced by: The rate of inflation, compared with the rate of inflation in other countries Interest rates, compared with interest rates in other countries The balance of payments Sentiment of foreign exchange market participants regarding economic prospects Speculation Government policy on intervention to influence the exchange rate

The causes of exchange rate fluctuations • • • Supply and demand for currencies are in turn influenced by: The rate of inflation, compared with the rate of inflation in other countries Interest rates, compared with interest rates in other countries The balance of payments Sentiment of foreign exchange market participants regarding economic prospects Speculation Government policy on intervention to influence the exchange rate

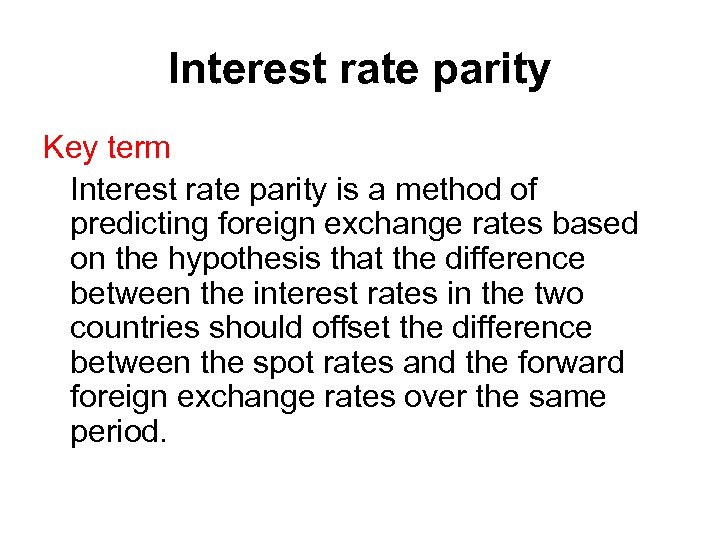

Interest rate parity Key term Interest rate parity is a method of predicting foreign exchange rates based on the hypothesis that the difference between the interest rates in the two countries should offset the difference between the spot rates and the forward foreign exchange rates over the same period.

Interest rate parity Key term Interest rate parity is a method of predicting foreign exchange rates based on the hypothesis that the difference between the interest rates in the two countries should offset the difference between the spot rates and the forward foreign exchange rates over the same period.

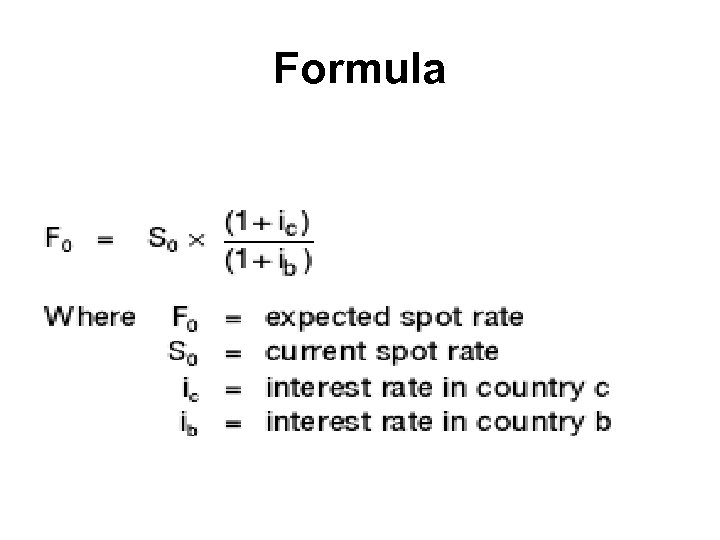

Formula

Formula

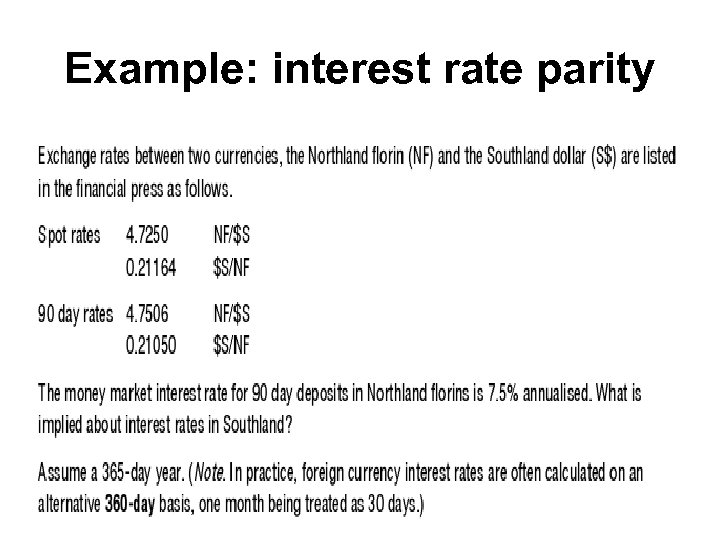

Example: interest rate parity

Example: interest rate parity

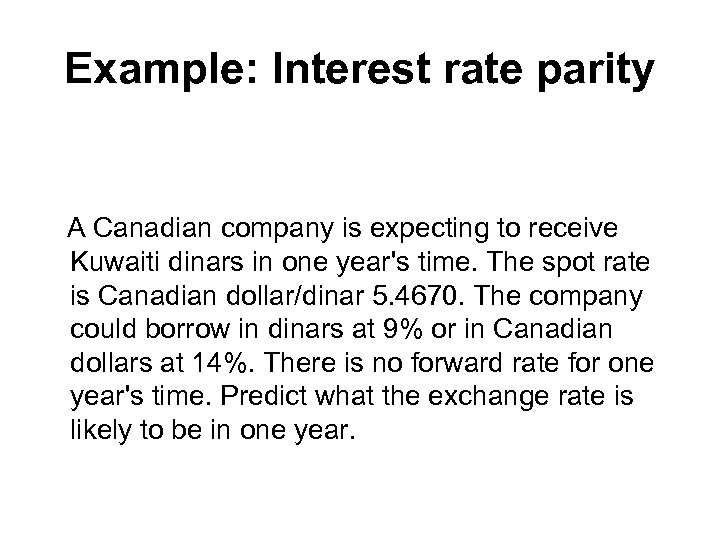

Example: Interest rate parity A Canadian company is expecting to receive Kuwaiti dinars in one year's time. The spot rate is Canadian dollar/dinar 5. 4670. The company could borrow in dinars at 9% or in Canadian dollars at 14%. There is no forward rate for one year's time. Predict what the exchange rate is likely to be in one year.

Example: Interest rate parity A Canadian company is expecting to receive Kuwaiti dinars in one year's time. The spot rate is Canadian dollar/dinar 5. 4670. The company could borrow in dinars at 9% or in Canadian dollars at 14%. There is no forward rate for one year's time. Predict what the exchange rate is likely to be in one year.

Purchasing power parity Key term Purchasing power parity theory states that the exchange rate between two currencies is the same in equilibrium when the purchasing power of currency is the same in each country.

Purchasing power parity Key term Purchasing power parity theory states that the exchange rate between two currencies is the same in equilibrium when the purchasing power of currency is the same in each country.

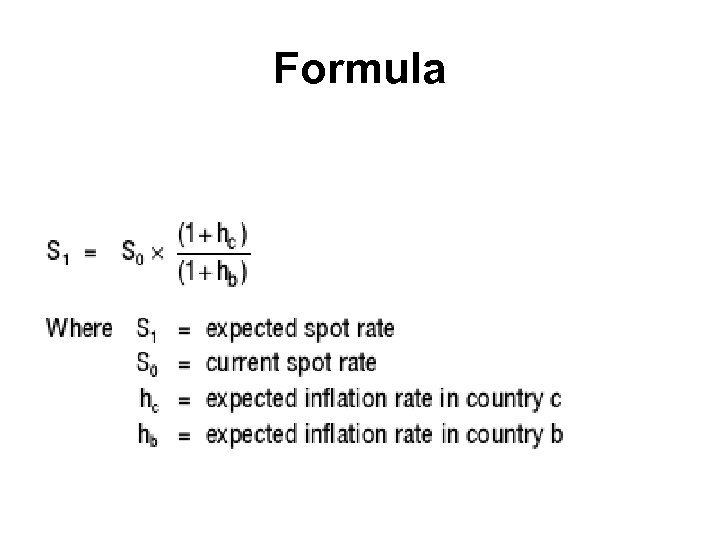

Formula

Formula

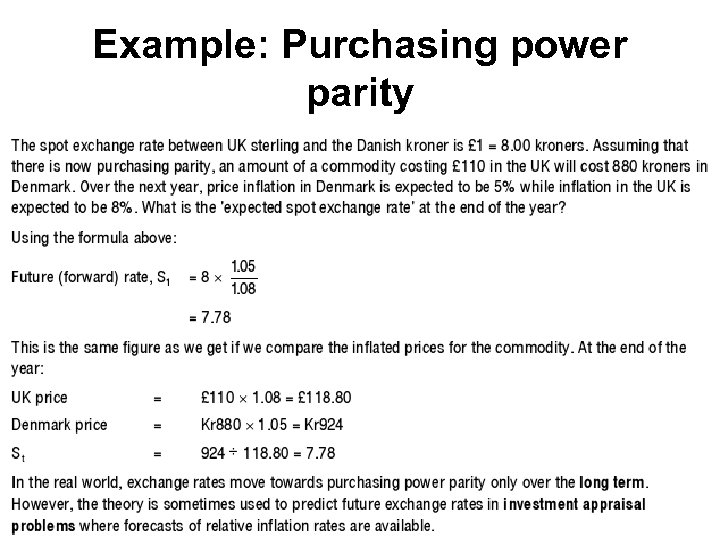

Example: Purchasing power parity

Example: Purchasing power parity

Case study • An amusing example of purchasing power parity is the Economist's Big Mac index. Under PPP movements in countries' exchange rates should in the long-term mean that the prices of an identical basket of goods or services are equalized. The Mc. Donalds Big Mac represents this basket. • The index compares local Big Mac prices with the price of Big Macs in America. This comparison is used to forecast what exchange rates should be, and this is then compared with the actual exchange rates to decide which currencies are over and under-valued.

Case study • An amusing example of purchasing power parity is the Economist's Big Mac index. Under PPP movements in countries' exchange rates should in the long-term mean that the prices of an identical basket of goods or services are equalized. The Mc. Donalds Big Mac represents this basket. • The index compares local Big Mac prices with the price of Big Macs in America. This comparison is used to forecast what exchange rates should be, and this is then compared with the actual exchange rates to decide which currencies are over and under-valued.

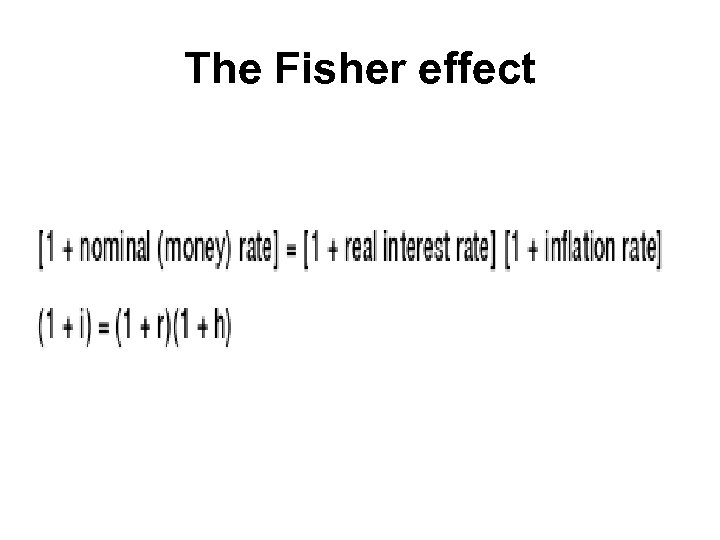

The Fisher effect

The Fisher effect

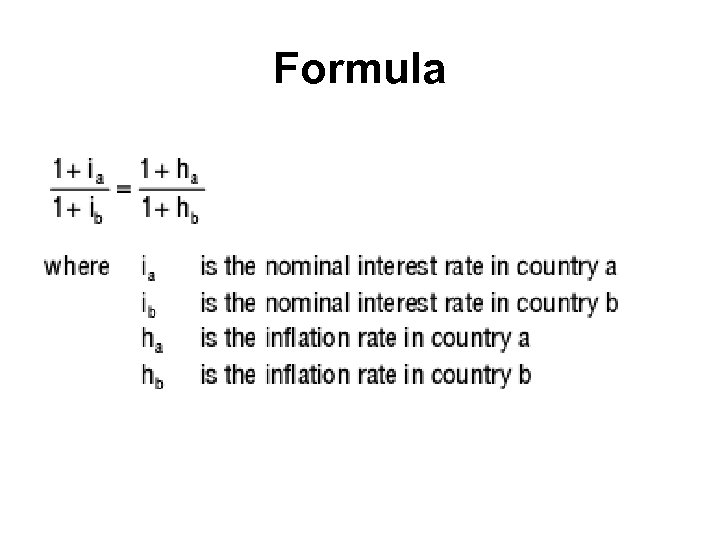

Formula

Formula

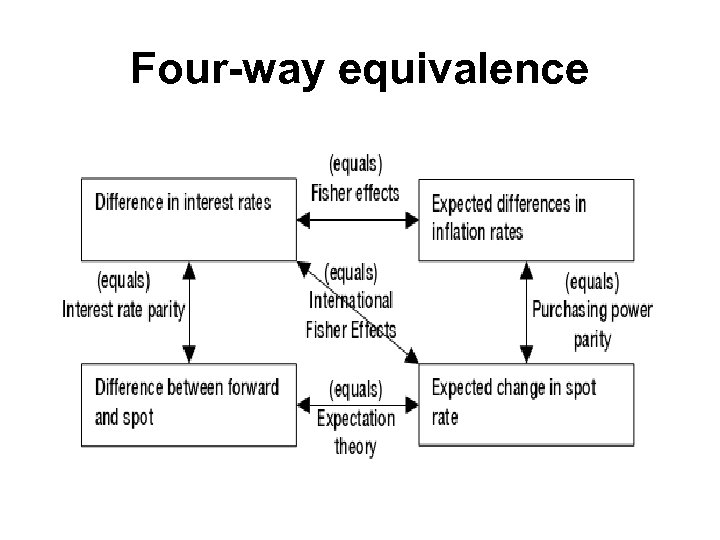

Four-way equivalence

Four-way equivalence

Foreign currency risk management Fast forward Basic methods of hedging risk include matching receipts and payments, invoicing in own currency, and leading and lagging the times that cash is received and paid.

Foreign currency risk management Fast forward Basic methods of hedging risk include matching receipts and payments, invoicing in own currency, and leading and lagging the times that cash is received and paid.

Foreign currency risk management • (a) Firstly, a business may wish to reduce risks to which it is exposed to acceptable levels. What is an acceptable level of risk may depend upon various factors, including the scale of operations of the business and the degree to which its proprietors or shareholders are risk-averse. • (b) Secondly, a business may wish to avoid particular kinds of risks. For example, a business may be averse to taking risks with exchange rates. The reasons may include the fact that the risks are simply too great for the business to bear, for example if exchange rate movements could easily bankrupt the business.

Foreign currency risk management • (a) Firstly, a business may wish to reduce risks to which it is exposed to acceptable levels. What is an acceptable level of risk may depend upon various factors, including the scale of operations of the business and the degree to which its proprietors or shareholders are risk-averse. • (b) Secondly, a business may wish to avoid particular kinds of risks. For example, a business may be averse to taking risks with exchange rates. The reasons may include the fact that the risks are simply too great for the business to bear, for example if exchange rate movements could easily bankrupt the business.

Currency of invoice • (a) There is the possible marketing advantage by proposing to invoice in the buyer's own currency, when there is competition for the sales contract. • (b) The exporter may also be able to offset payments to his own suppliers in a particular foreign currency against receipts in that currency. • (c) By arranging to sell goods to customers in a foreign currency, a UK exporter might be able to obtain a loan in that currency at a lower rate of interest than in the UK, and at the same time obtain cover against exchange risks by arranging to repay the loan out of the proceeds from the sales in that currency.

Currency of invoice • (a) There is the possible marketing advantage by proposing to invoice in the buyer's own currency, when there is competition for the sales contract. • (b) The exporter may also be able to offset payments to his own suppliers in a particular foreign currency against receipts in that currency. • (c) By arranging to sell goods to customers in a foreign currency, a UK exporter might be able to obtain a loan in that currency at a lower rate of interest than in the UK, and at the same time obtain cover against exchange risks by arranging to repay the loan out of the proceeds from the sales in that currency.

Leading and lagging • Lead payments (payments in advance) • Lagged payments (delaying payments beyond their due date)

Leading and lagging • Lead payments (payments in advance) • Lagged payments (delaying payments beyond their due date)

Netting Key term Netting is a process in which credit balances are netted off against debit balances so that only the reduced net amounts remain due to be paid by actual currency flows.

Netting Key term Netting is a process in which credit balances are netted off against debit balances so that only the reduced net amounts remain due to be paid by actual currency flows.

Example: Netting A and B are respectively UK and US based subsidiaries of a Swiss based holding company. At 31 March 20 X 5, A owed B SFr 300, 000 and B owed A SFr 220, 000. Netting can reduce the value of the intercompany debts: the two intercompany balances are set against each other, leaving a net debt owed by A to B of SFr 80, 000 (SFr 300, 000 - 220, 000).

Example: Netting A and B are respectively UK and US based subsidiaries of a Swiss based holding company. At 31 March 20 X 5, A owed B SFr 300, 000 and B owed A SFr 220, 000. Netting can reduce the value of the intercompany debts: the two intercompany balances are set against each other, leaving a net debt owed by A to B of SFr 80, 000 (SFr 300, 000 - 220, 000).

Forward exchange contracts Fast forward A forward contract specifies in advance the rate at which a specified quantity of currency will be bought and sold.

Forward exchange contracts Fast forward A forward contract specifies in advance the rate at which a specified quantity of currency will be bought and sold.

Forward exchange contracts Key term A forward exchange contract is: • (a) An immediately firm and binding contract, eg between a bank and its customer • (b) For the purchase or sale of a specified quantity of a stated foreign currency • (c) At a rate of exchange fixed at the time the contract is made • (d) For performance (delivery of the currency and payment for it) at a future time which is agreed when making the contract (This future time will be either a specified date, or any time between two specified dates. )

Forward exchange contracts Key term A forward exchange contract is: • (a) An immediately firm and binding contract, eg between a bank and its customer • (b) For the purchase or sale of a specified quantity of a stated foreign currency • (c) At a rate of exchange fixed at the time the contract is made • (d) For performance (delivery of the currency and payment for it) at a future time which is agreed when making the contract (This future time will be either a specified date, or any time between two specified dates. )

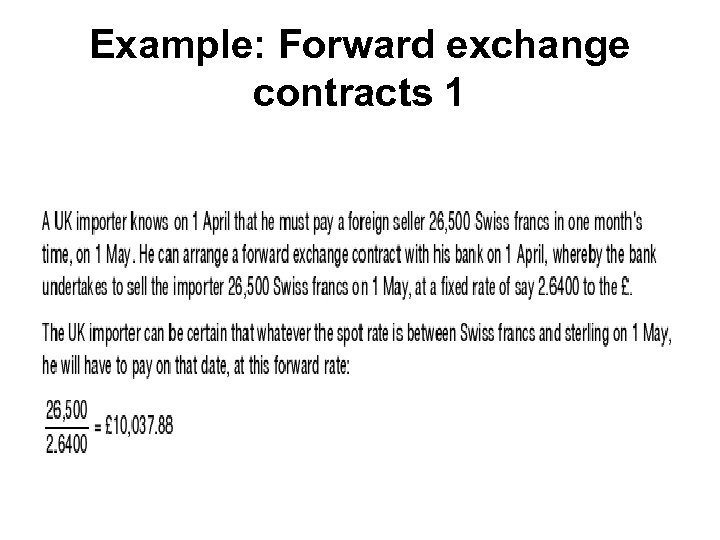

Example: Forward exchange contracts 1

Example: Forward exchange contracts 1

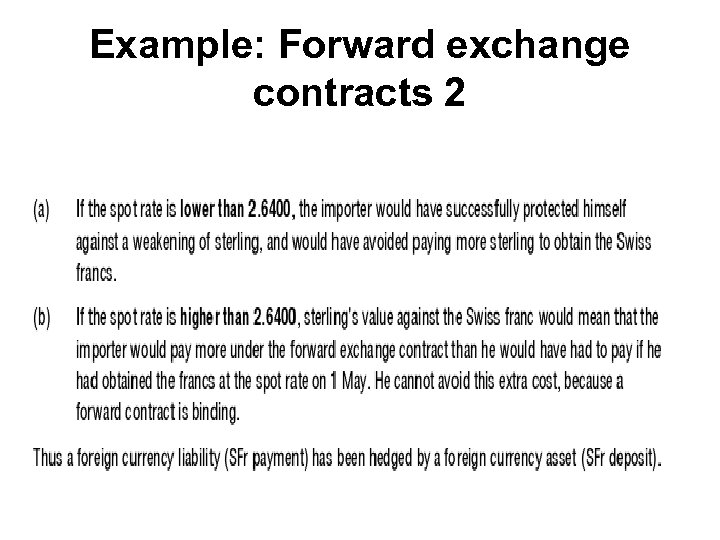

Example: Forward exchange contracts 2

Example: Forward exchange contracts 2

Money market hedging Fast forward Money market hedging involves borrowing in one currency, converting the money borrowed into another currency and putting the money on deposit until the time the transaction is completed, hoping to take advantage of favorable interest rate movements.

Money market hedging Fast forward Money market hedging involves borrowing in one currency, converting the money borrowed into another currency and putting the money on deposit until the time the transaction is completed, hoping to take advantage of favorable interest rate movements.

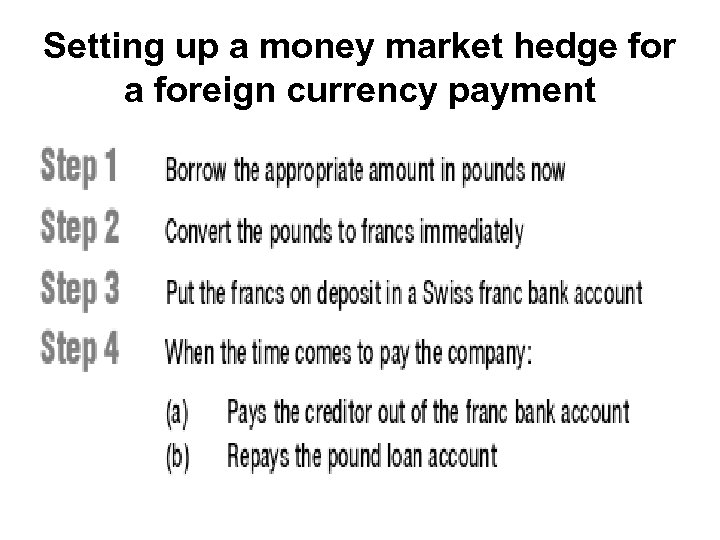

Setting up a money market hedge for a foreign currency payment

Setting up a money market hedge for a foreign currency payment

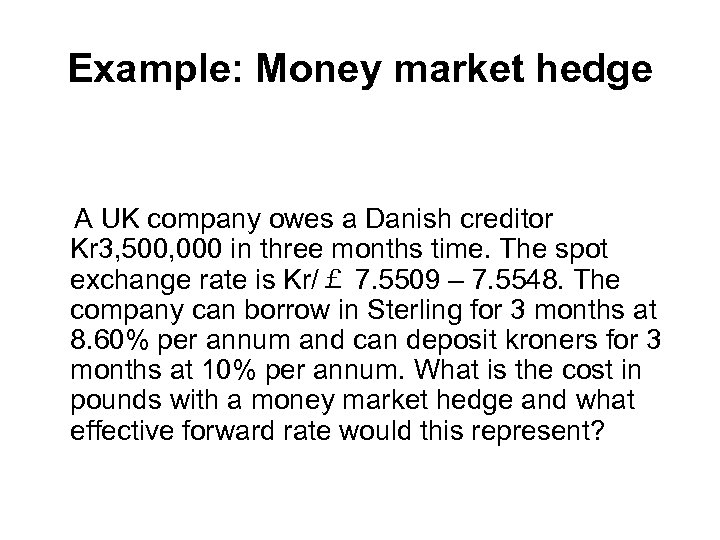

Example: Money market hedge A UK company owes a Danish creditor Kr 3, 500, 000 in three months time. The spot exchange rate is Kr/£ 7. 5509 – 7. 5548. The company can borrow in Sterling for 3 months at 8. 60% per annum and can deposit kroners for 3 months at 10% per annum. What is the cost in pounds with a money market hedge and what effective forward rate would this represent?

Example: Money market hedge A UK company owes a Danish creditor Kr 3, 500, 000 in three months time. The spot exchange rate is Kr/£ 7. 5509 – 7. 5548. The company can borrow in Sterling for 3 months at 8. 60% per annum and can deposit kroners for 3 months at 10% per annum. What is the cost in pounds with a money market hedge and what effective forward rate would this represent?

Choosing between a forward contract and a money market hedge Fast forward The choice between forward and money markets is generally made on the basis of which method is cheaper, with other factors being of limited significance.

Choosing between a forward contract and a money market hedge Fast forward The choice between forward and money markets is generally made on the basis of which method is cheaper, with other factors being of limited significance.

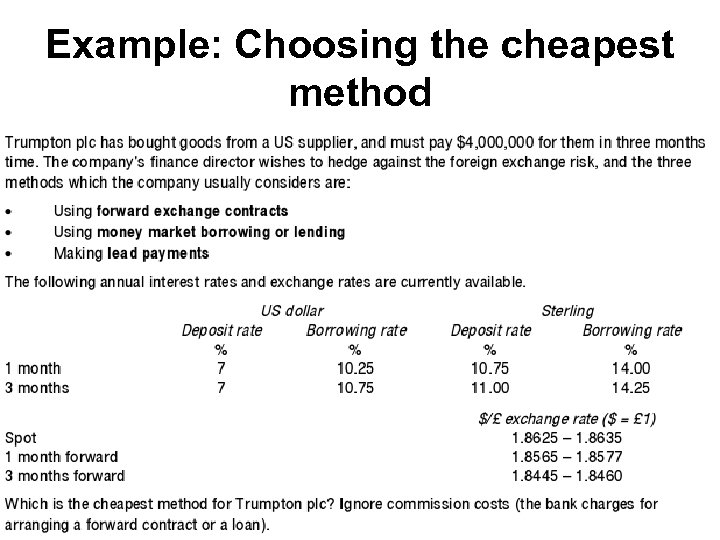

Example: Choosing the cheapest method

Example: Choosing the cheapest method

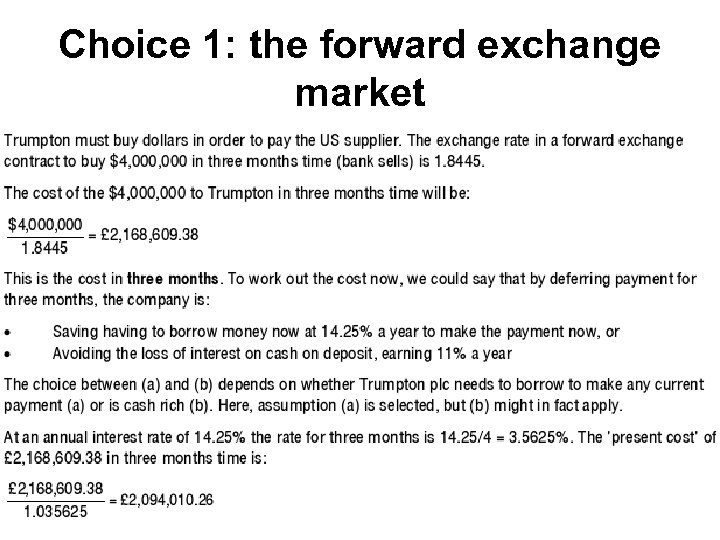

Choice 1: the forward exchange market

Choice 1: the forward exchange market

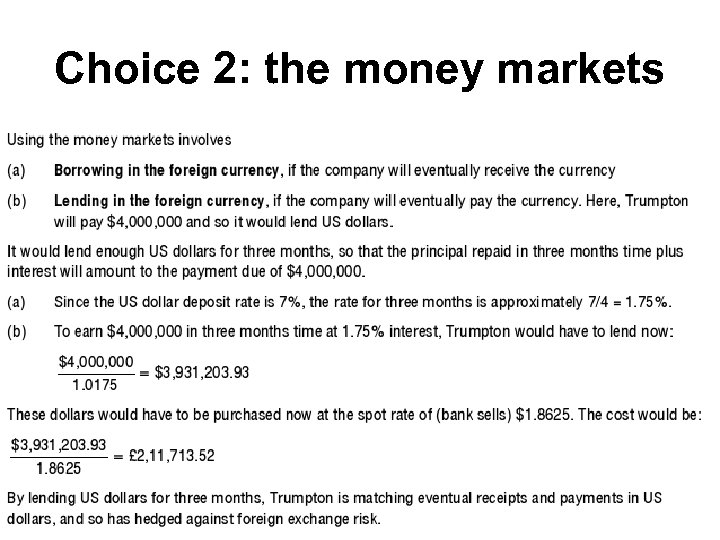

Choice 2: the money markets

Choice 2: the money markets

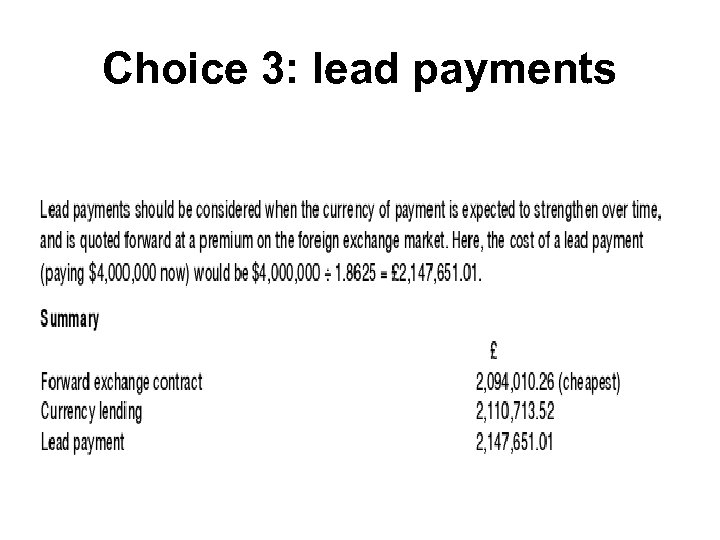

Choice 3: lead payments

Choice 3: lead payments

Foreign currency derivatives Fast forward Foreign currency derivatives can be used to hedge foreign currency risk. Futures contracts, options and swaps are types of derivative.

Foreign currency derivatives Fast forward Foreign currency derivatives can be used to hedge foreign currency risk. Futures contracts, options and swaps are types of derivative.

Currency futures Fast forward A currency future is a standardized contract to buy or sell a specified quantity of foreign currency.

Currency futures Fast forward A currency future is a standardized contract to buy or sell a specified quantity of foreign currency.

Currency futures Key term A currency future is a standardised contract to buy or sell a specified quantity of foreign currency.

Currency futures Key term A currency future is a standardised contract to buy or sell a specified quantity of foreign currency.

futures contract Exam focus point You will not be expected to do futures calculations in the exam but the following example will help you to understand how they work.

futures contract Exam focus point You will not be expected to do futures calculations in the exam but the following example will help you to understand how they work.

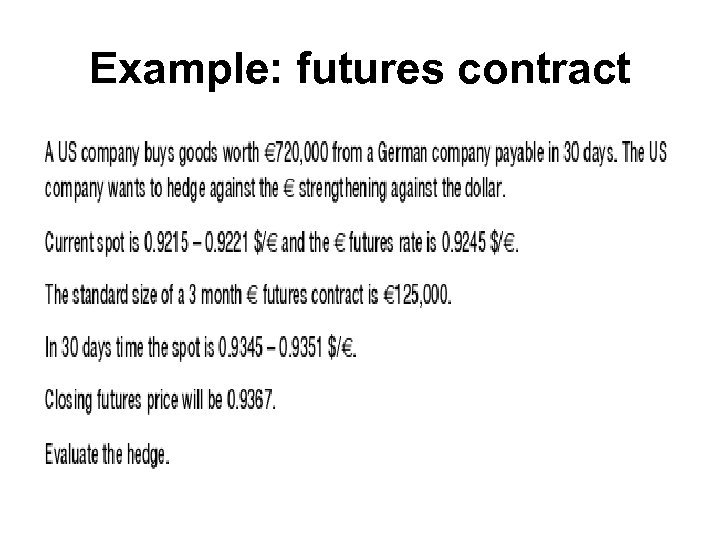

Example: futures contract

Example: futures contract

Currency options Fast forward Currency options protect against adverse exchange rate movements while allowing the investor to take advantage of favourable exchange rate movements. They are particularly useful in situations where the cash flow is not certain to occur (eg when tendering for overseas contracts).

Currency options Fast forward Currency options protect against adverse exchange rate movements while allowing the investor to take advantage of favourable exchange rate movements. They are particularly useful in situations where the cash flow is not certain to occur (eg when tendering for overseas contracts).

Currency options Key term A currency option is a right of an option holder to buy (call) or sell (put) foreign currency at a specific exchange rate at a future date.

Currency options Key term A currency option is a right of an option holder to buy (call) or sell (put) foreign currency at a specific exchange rate at a future date.

Currency swaps Fast forward Currency swaps effectively involve the exchange of debt from one currency to another. Currency swaps can provide a hedge against exchange rate movements for longer periods than the forward market, and can be a means of obtaining finance from new countries.

Currency swaps Fast forward Currency swaps effectively involve the exchange of debt from one currency to another. Currency swaps can provide a hedge against exchange rate movements for longer periods than the forward market, and can be a means of obtaining finance from new countries.

Currency swaps Key term A swap is a formal agreement whereby two organisations contractually agree to exchange payments on different terms, eg in different currencies, or one at a fixed rate and the other at a floating rate'.

Currency swaps Key term A swap is a formal agreement whereby two organisations contractually agree to exchange payments on different terms, eg in different currencies, or one at a fixed rate and the other at a floating rate'.

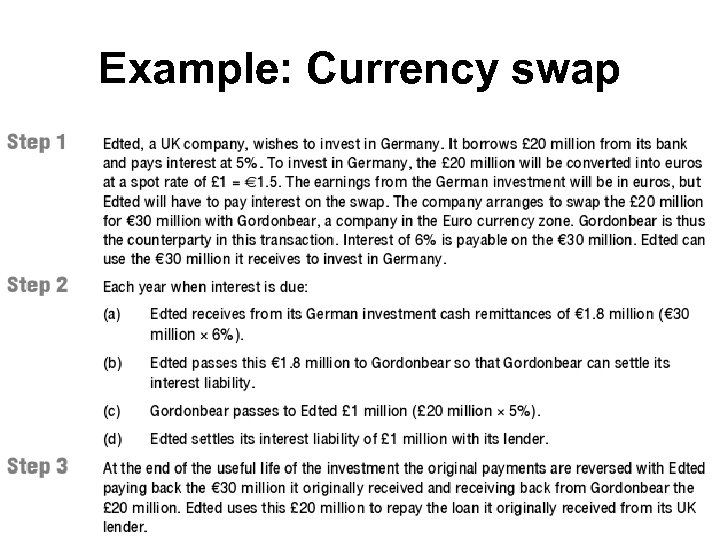

Example: Currency swap

Example: Currency swap

Chapter roundup Text book : P 346

Chapter roundup Text book : P 346

Quick Quiz

Quick Quiz

Answers to Quick Quiz

Answers to Quick Quiz

PART H-20 Interest rate risk

PART H-20 Interest rate risk

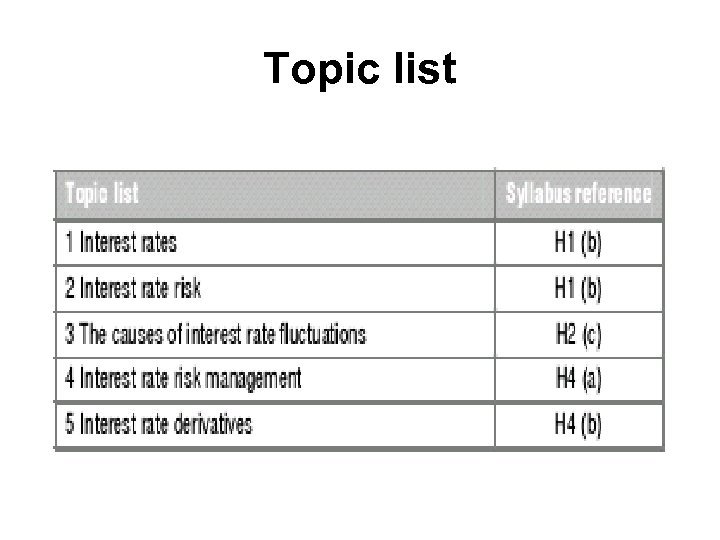

Topic list

Topic list

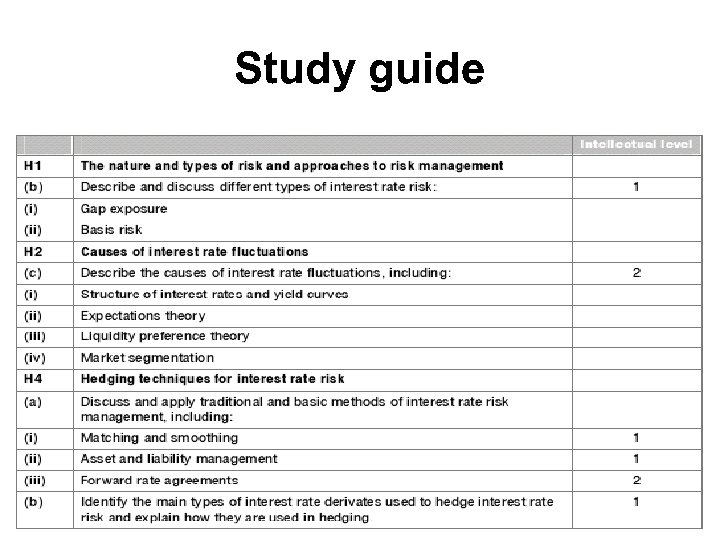

Study guide

Study guide

Exam guide The material in this chapter will be examined almost entirely as a discussion question and it is important you understand can explain the terminology.

Exam guide The material in this chapter will be examined almost entirely as a discussion question and it is important you understand can explain the terminology.

Interest rate risk • Interest rate risk • Risk management

Interest rate risk • Interest rate risk • Risk management

Interest rates Fast forward • The pattern of interest rates on financial assets is influenced by the risk of the assets, the duration of the lending, and the size of the loan. • There is a trade-off between risk and return. Investors in riskier assets expect to be compensated for the risk

Interest rates Fast forward • The pattern of interest rates on financial assets is influenced by the risk of the assets, the duration of the lending, and the size of the loan. • There is a trade-off between risk and return. Investors in riskier assets expect to be compensated for the risk

Interest rate risk Fast forward Interest rate risk is faced by companies with floating and fixed rate debt. It can arise from gap exposure and basis risk.

Interest rate risk Fast forward Interest rate risk is faced by companies with floating and fixed rate debt. It can arise from gap exposure and basis risk.

Basis risk Key term LIBOR or the London Inter-Bank Offered Rate is the rate of interest applying to wholesale money market lending between London banks.

Basis risk Key term LIBOR or the London Inter-Bank Offered Rate is the rate of interest applying to wholesale money market lending between London banks.

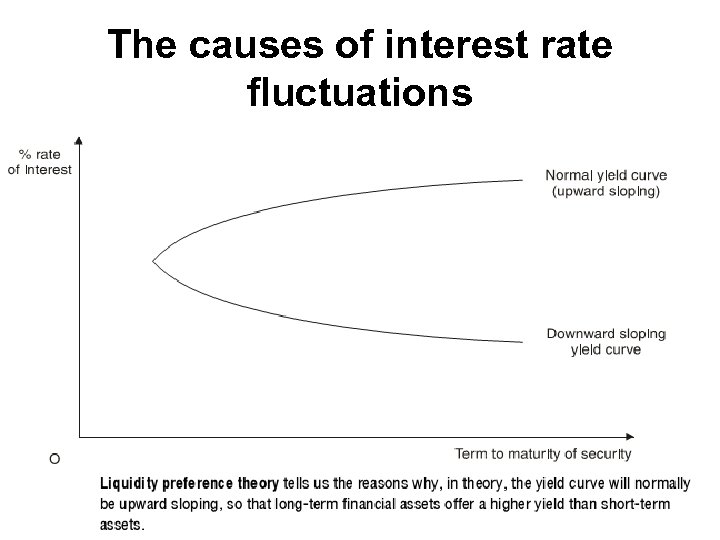

The causes of interest rate fluctuations Fast forward The causes of interest rate fluctuations include the structure of interest rates and yield curves and changing economic factors.

The causes of interest rate fluctuations Fast forward The causes of interest rate fluctuations include the structure of interest rates and yield curves and changing economic factors.

The causes of interest rate fluctuations • (a) Risk • (b) The need to make a profit on re-lending • (c) The size of the loan • (d) Different types of financial asset • (e) The duration of the lending

The causes of interest rate fluctuations • (a) Risk • (b) The need to make a profit on re-lending • (c) The size of the loan • (d) Different types of financial asset • (e) The duration of the lending

The causes of interest rate fluctuations

The causes of interest rate fluctuations

The causes of interest rate fluctuations • (f) Expectations theory • (g) The market segmentation theory • (h) Government policy

The causes of interest rate fluctuations • (f) Expectations theory • (g) The market segmentation theory • (h) Government policy

The general level of interest rates • (a) Need for a real return • (b) Inflation • (c) Uncertainty about future rates of inflation • (d) Liquidity preference of investors and the demand for borrowing • (e) Balance of payments

The general level of interest rates • (a) Need for a real return • (b) Inflation • (c) Uncertainty about future rates of inflation • (d) Liquidity preference of investors and the demand for borrowing • (e) Balance of payments

The general level of interest rates • (f) Monetary policy • (g) Interest rates abroad

The general level of interest rates • (f) Monetary policy • (g) Interest rates abroad

Interest rate risk management Fast forward Interest rate risk can be managed using internal hedging in the form of asset and liability management, matching and smoothing or using external hedging instruments such as forward rate agreements and derivatives.

Interest rate risk management Fast forward Interest rate risk can be managed using internal hedging in the form of asset and liability management, matching and smoothing or using external hedging instruments such as forward rate agreements and derivatives.

Interest rate risk management Key term • Matching is where liabilities and assets with a common interest rate are matched. • Smoothing is where a company keeps a balance between its fixed rate and floating rate borrowing.

Interest rate risk management Key term • Matching is where liabilities and assets with a common interest rate are matched. • Smoothing is where a company keeps a balance between its fixed rate and floating rate borrowing.

Forward rate agreements (FRAs) Fast forward Forward rate agreements hedge risk by fixing the interest rate on future borrowing.

Forward rate agreements (FRAs) Fast forward Forward rate agreements hedge risk by fixing the interest rate on future borrowing.

Example: Forward rate agreement It is 30 June. Lynn plc will need a £ 10 million 6 month fixed rate loan from 1 October. Lynn wants to hedge using an FRA. The relevant FRA rate is 6% on 30 June. • (a) State what FRA is required. • (b) What is the result of the FRA and the effective loan rate if the 6 month FRA benchmark rate has moved to (i) 5% (ii) 9%

Example: Forward rate agreement It is 30 June. Lynn plc will need a £ 10 million 6 month fixed rate loan from 1 October. Lynn wants to hedge using an FRA. The relevant FRA rate is 6% on 30 June. • (a) State what FRA is required. • (b) What is the result of the FRA and the effective loan rate if the 6 month FRA benchmark rate has moved to (i) 5% (ii) 9%

Interest rate derivatives Fast forward Interest rate futures can be used to hedge against interest rate changes between the current date and the date at which the interest rate on the lending or borrowing is set. Borrowers sell futures to hedge against interest rate rises; lenders buy futures to hedge against interest rate falls.

Interest rate derivatives Fast forward Interest rate futures can be used to hedge against interest rate changes between the current date and the date at which the interest rate on the lending or borrowing is set. Borrowers sell futures to hedge against interest rate rises; lenders buy futures to hedge against interest rate falls.

Interest rate options Fast forward Interest rate options allow an organisation to limit its exposure to adverse interest rate movements, while allowing it to take advantage of favourable interest rate movements.

Interest rate options Fast forward Interest rate options allow an organisation to limit its exposure to adverse interest rate movements, while allowing it to take advantage of favourable interest rate movements.

Interest rate options Key term An interest rate option grants the buyer of it the right, but not the obligation, to deal at an agreed interest rate (strike rate) at a future maturity date. On the date of expiry of the option, the buyer must decide whether or not to exercise the right.

Interest rate options Key term An interest rate option grants the buyer of it the right, but not the obligation, to deal at an agreed interest rate (strike rate) at a future maturity date. On the date of expiry of the option, the buyer must decide whether or not to exercise the right.

Interest rate caps, collars and floors Fast forward Caps set a ceiling to the interest rate; a floor sets a lower limit. A collar is the simultaneous purchase of a cap and floor.

Interest rate caps, collars and floors Fast forward Caps set a ceiling to the interest rate; a floor sets a lower limit. A collar is the simultaneous purchase of a cap and floor.

Interest rate caps, collars and floors Key term • (a) An interest rate cap is an option which sets an interest rate ceiling. • (b) A floor is an option which sets a lower limit to interest rates. • (c) Using a 'collar' arrangement, the borrower can buy an interest rate cap and at the same time sell an interest rate floor. This limits the cost for the company as it receives a premium for the option it's sold.

Interest rate caps, collars and floors Key term • (a) An interest rate cap is an option which sets an interest rate ceiling. • (b) A floor is an option which sets a lower limit to interest rates. • (c) Using a 'collar' arrangement, the borrower can buy an interest rate cap and at the same time sell an interest rate floor. This limits the cost for the company as it receives a premium for the option it's sold.

Interest rate swaps Fast forward Interest rate swaps are where two parties agree to exchange interest rate payments. Interest rate swaps can act as a means of switching from paying one type of interest to another, raising less expensive loans and securing better deposit rates. A fixed to floating rate currency swap is a combination of a currency and interest rate swap.

Interest rate swaps Fast forward Interest rate swaps are where two parties agree to exchange interest rate payments. Interest rate swaps can act as a means of switching from paying one type of interest to another, raising less expensive loans and securing better deposit rates. A fixed to floating rate currency swap is a combination of a currency and interest rate swap.

Interest rate swaps Key term Interest rate swap is an agreement whereby the parties to the agreement exchange interest rate commitments.

Interest rate swaps Key term Interest rate swap is an agreement whereby the parties to the agreement exchange interest rate commitments.

Interest rate swaps Exam focus point If you have to discuss which instrument should be used to hedge interest rate risk, consider cost, flexibility, expectations and ability to benefit from favourable interest rate movements.

Interest rate swaps Exam focus point If you have to discuss which instrument should be used to hedge interest rate risk, consider cost, flexibility, expectations and ability to benefit from favourable interest rate movements.

Chapter Roundup Text book : P 358

Chapter Roundup Text book : P 358

Quick Quiz

Quick Quiz

Answers to Quick Quiz

Answers to Quick Quiz

Revision P 52 -57 Risk management 51 -57

Revision P 52 -57 Risk management 51 -57