b189e40b5cc2fcdce05c9f2761c63d61.ppt

- Количество слайдов: 21

Topic 9 ©Schwartz, Sipress, Weber Fall 2008 1

Performance Measurement in Trading 1. Beyond P&L 2. Risk measures in trading 3. Transactions cost analysis (TCA) • Useful for How to trade-Where to trade. When to trade decisions • Role of Alternative trading systems (ATS) • Achieving Best Execution ©Schwartz, Sipress, Weber Fall 2008 2

Measures 1. Profits (P&L) 2. Trading “surplus” vs. target price 3. Benchmarks (VWAP, TWAP, …) ©Schwartz, Sipress, Weber Fall 2008 3

Transaction Cost Analysis (TCA) See SFW text: Pages 327 - 331 ©Schwartz, Sipress, Weber Fall 2008 4

Risk Management 1. Operational and Transfer Risk • Technical and human failure 2. Counterparty Risk • Who is your trading counterparty? • A Central Counterparty (CCP) 3. Market Risk • Volatility • Pages 332 – 337 ©Schwartz, Sipress, Weber Fall 2008 5

Best Execution Text: Pages 337 - 345 ©Schwartz, Sipress, Weber Fall 2008 6

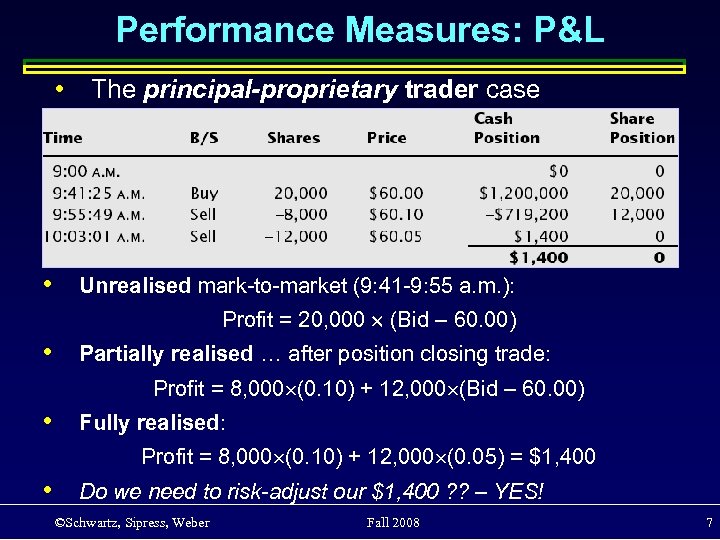

Performance Measures: P&L • • The principal-proprietary trader case Unrealised mark-to-market (9: 41 -9: 55 a. m. ): Profit = 20, 000 (Bid – 60. 00) • Partially realised … after position closing trade: Profit = 8, 000 (0. 10) + 12, 000 (Bid – 60. 00) • Fully realised: Profit = 8, 000 (0. 10) + 12, 000 (0. 05) = $1, 400 • Do we need to risk-adjust our $1, 400 ? ? – YES! ©Schwartz, Sipress, Weber Fall 2008 7

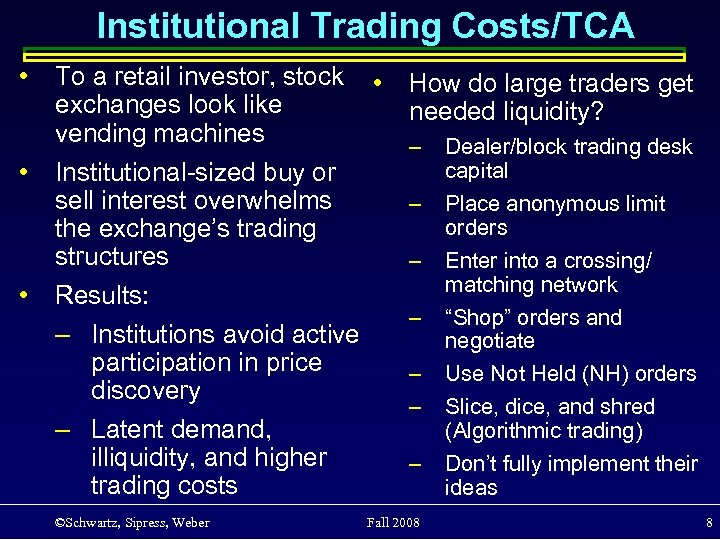

Institutional Trading Costs/TCA • • • To a retail investor, stock exchanges look like vending machines Institutional-sized buy or sell interest overwhelms the exchange’s trading structures Results: – Institutions avoid active participation in price discovery – Latent demand, illiquidity, and higher trading costs ©Schwartz, Sipress, Weber • How do large traders get needed liquidity? – Dealer/block trading desk capital – Place anonymous limit orders – Enter into a crossing/ matching network – “Shop” orders and negotiate Use Not Held (NH) orders Slice, dice, and shred (Algorithmic trading) Don’t fully implement their ideas – – – Fall 2008 8

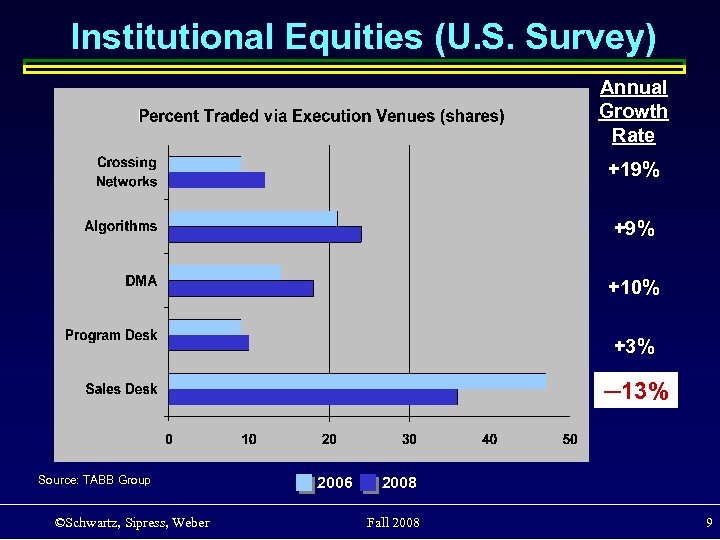

Institutional Equities (U. S. Survey) Annual Growth Rate +19% +10% +3% ─13% Source: TABB Group ©Schwartz, Sipress, Weber 2006 2008 Fall 2008 9

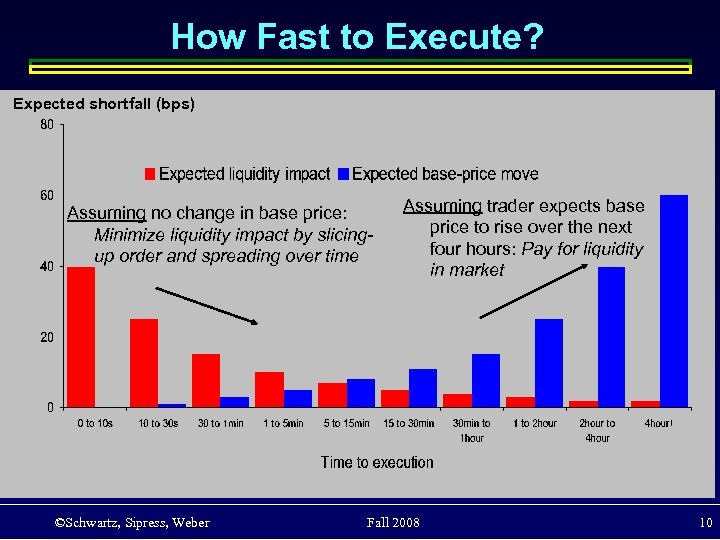

How Fast to Execute? Expected shortfall (bps) Assuming no change in base price: Minimize liquidity impact by slicingup order and spreading over time ©Schwartz, Sipress, Weber Assuming trader expects base price to rise over the next four hours: Pay for liquidity in market Fall 2008 10

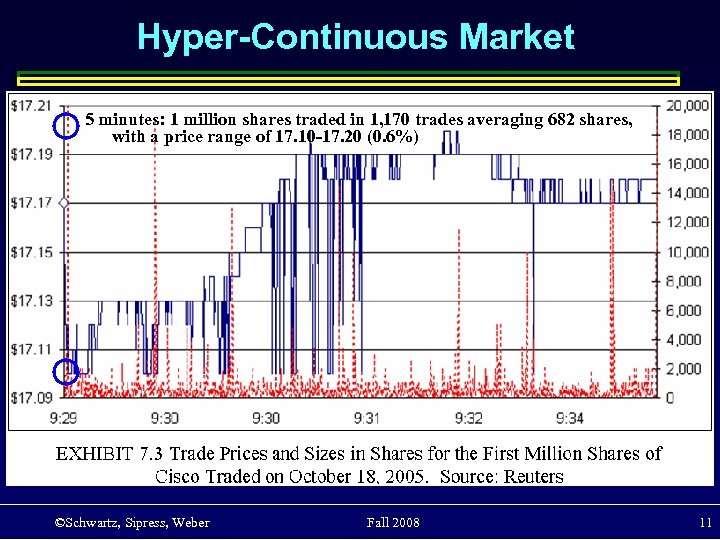

Hyper-Continuous Market 5 minutes: 1 million shares traded in 1, 170 trades averaging 682 shares, with a price range of 17. 10 -17. 20 (0. 6%) ©Schwartz, Sipress, Weber Fall 2008 11

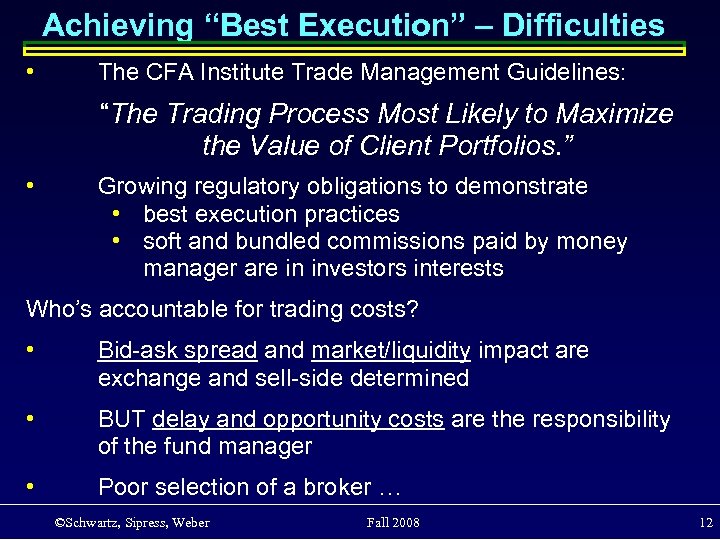

Achieving “Best Execution” – Difficulties • The CFA Institute Trade Management Guidelines: “The Trading Process Most Likely to Maximize the Value of Client Portfolios. ” • Growing regulatory obligations to demonstrate • best execution practices • soft and bundled commissions paid by money manager are in investors interests Who’s accountable for trading costs? • Bid-ask spread and market/liquidity impact are exchange and sell-side determined • BUT delay and opportunity costs are the responsibility of the fund manager • Poor selection of a broker … ©Schwartz, Sipress, Weber Fall 2008 12

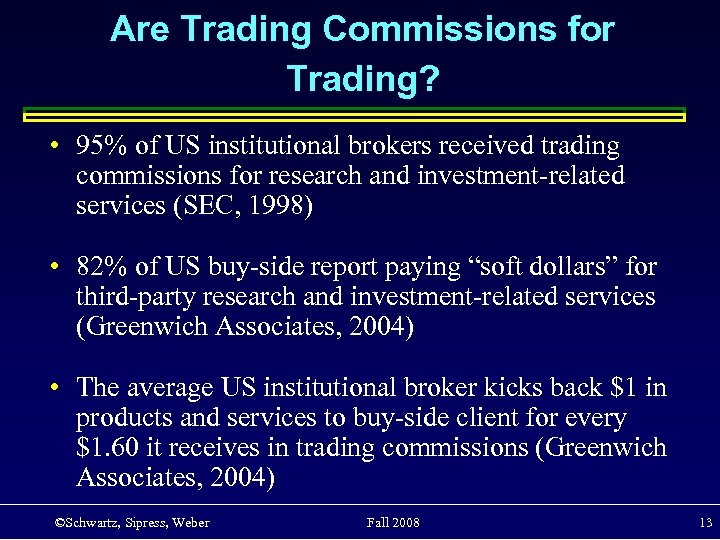

Are Trading Commissions for Trading? • 95% of US institutional brokers received trading commissions for research and investment-related services (SEC, 1998) • 82% of US buy-side report paying “soft dollars” for third-party research and investment-related services (Greenwich Associates, 2004) • The average US institutional broker kicks back $1 in products and services to buy-side client for every $1. 60 it receives in trading commissions (Greenwich Associates, 2004) ©Schwartz, Sipress, Weber Fall 2008 13

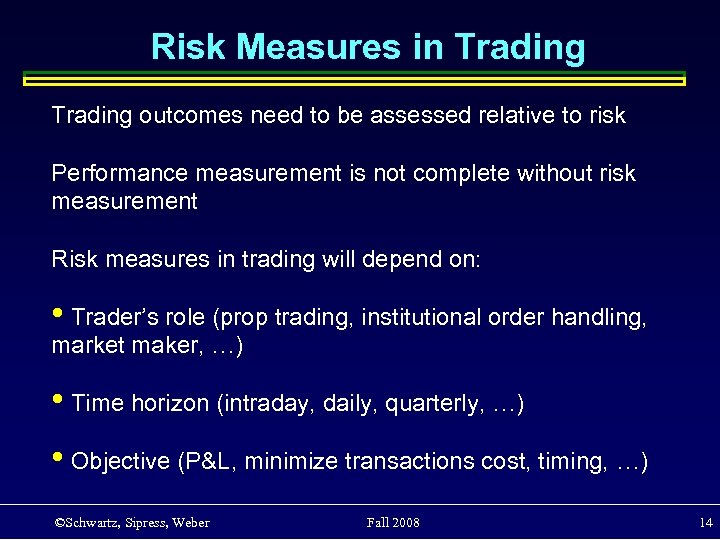

Risk Measures in Trading outcomes need to be assessed relative to risk Performance measurement is not complete without risk measurement Risk measures in trading will depend on: • Trader’s role (prop trading, institutional order handling, market maker, …) • Time horizon (intraday, daily, quarterly, …) • Objective (P&L, minimize transactions cost, timing, …) ©Schwartz, Sipress, Weber Fall 2008 14

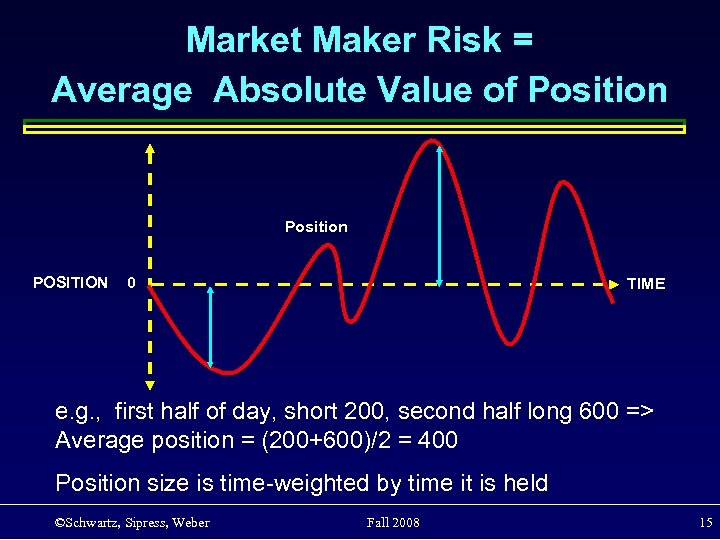

Market Maker Risk = Average Absolute Value of Position POSITION 0 TIME e. g. , first half of day, short 200, second half long 600 => Average position = (200+600)/2 = 400 Position size is time-weighted by time it is held ©Schwartz, Sipress, Weber Fall 2008 15

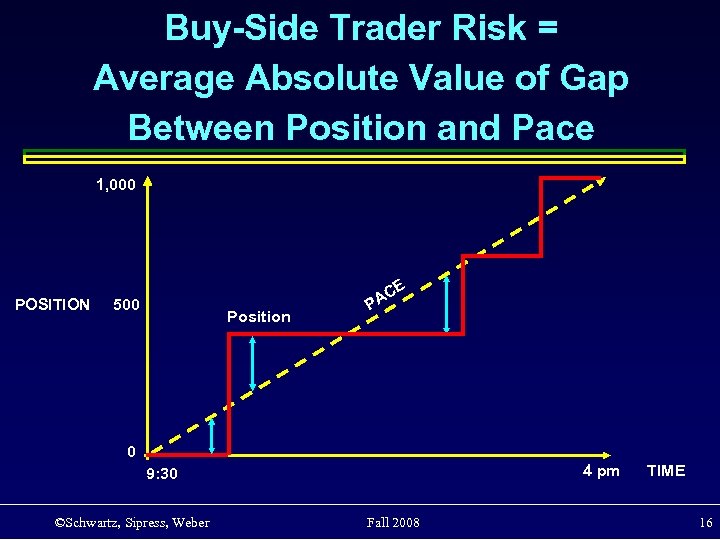

Buy-Side Trader Risk = Average Absolute Value of Gap Between Position and Pace 1, 000 POSITION E 500 Position C PA 0 4 pm 9: 30 ©Schwartz, Sipress, Weber Fall 2008 TIME 16

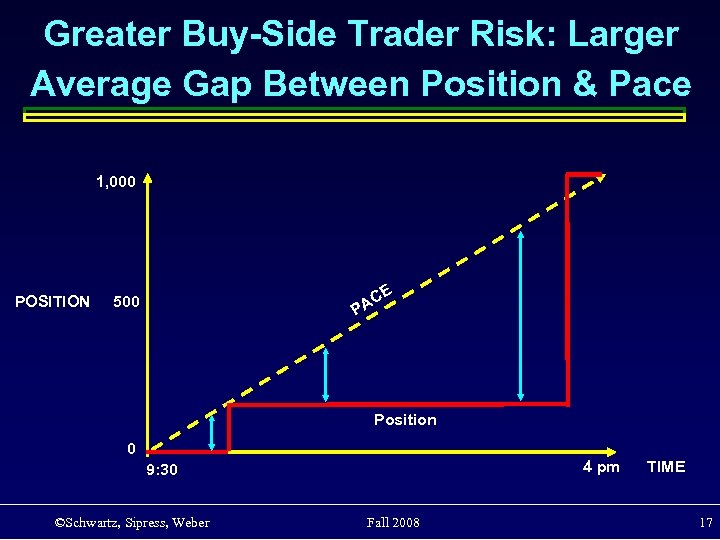

Greater Buy-Side Trader Risk: Larger Average Gap Between Position & Pace 1, 000 POSITION E C PA 500 Position 0 4 pm 9: 30 ©Schwartz, Sipress, Weber Fall 2008 TIME 17

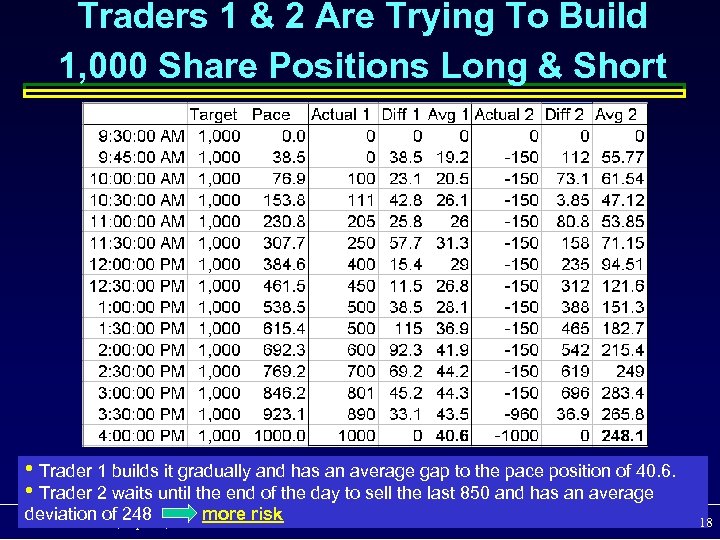

Traders 1 & 2 Are Trying To Build 1, 000 Share Positions Long & Short • Trader 1 builds it gradually and has an average gap to the pace position of 40. 6. • Trader 2 waits until the end of the day to sell the last 850 and has an average deviation of 248 Weber more risk ©Schwartz, Sipress, Fall 2008 18

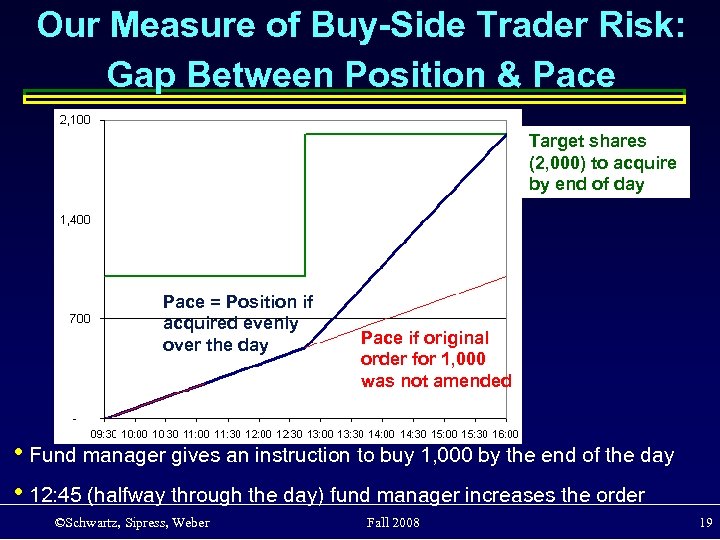

Our Measure of Buy-Side Trader Risk: Gap Between Position & Pace Target shares (2, 000) to acquire by end of day Pace = Position if acquired evenly over the day Pace if original order for 1, 000 was not amended • Fund manager gives an instruction to buy 1, 000 by the end of the day • 12: 45 (halfway through the day) fund manager increases the order ©Schwartz, Sipress, Weber Fall 2008 19

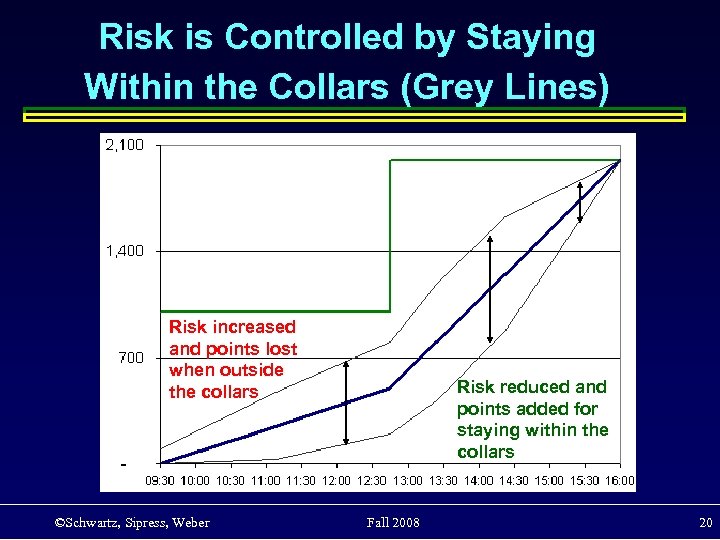

Risk is Controlled by Staying Within the Collars (Grey Lines) Risk increased and points lost when outside the collars ©Schwartz, Sipress, Weber Risk reduced and points added for staying within the collars Fall 2008 20

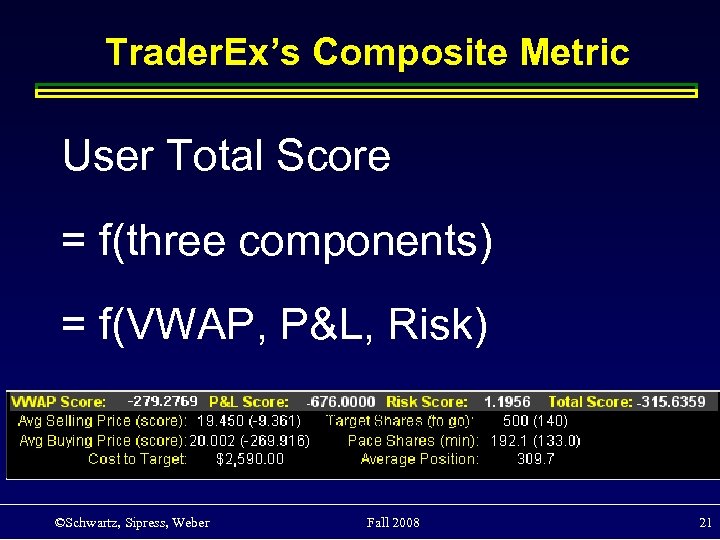

Trader. Ex’s Composite Metric User Total Score = f(three components) = f(VWAP, P&L, Risk) ©Schwartz, Sipress, Weber Fall 2008 21

b189e40b5cc2fcdce05c9f2761c63d61.ppt